Business

Catch Up on This Week’s Central-Bank Bonanza

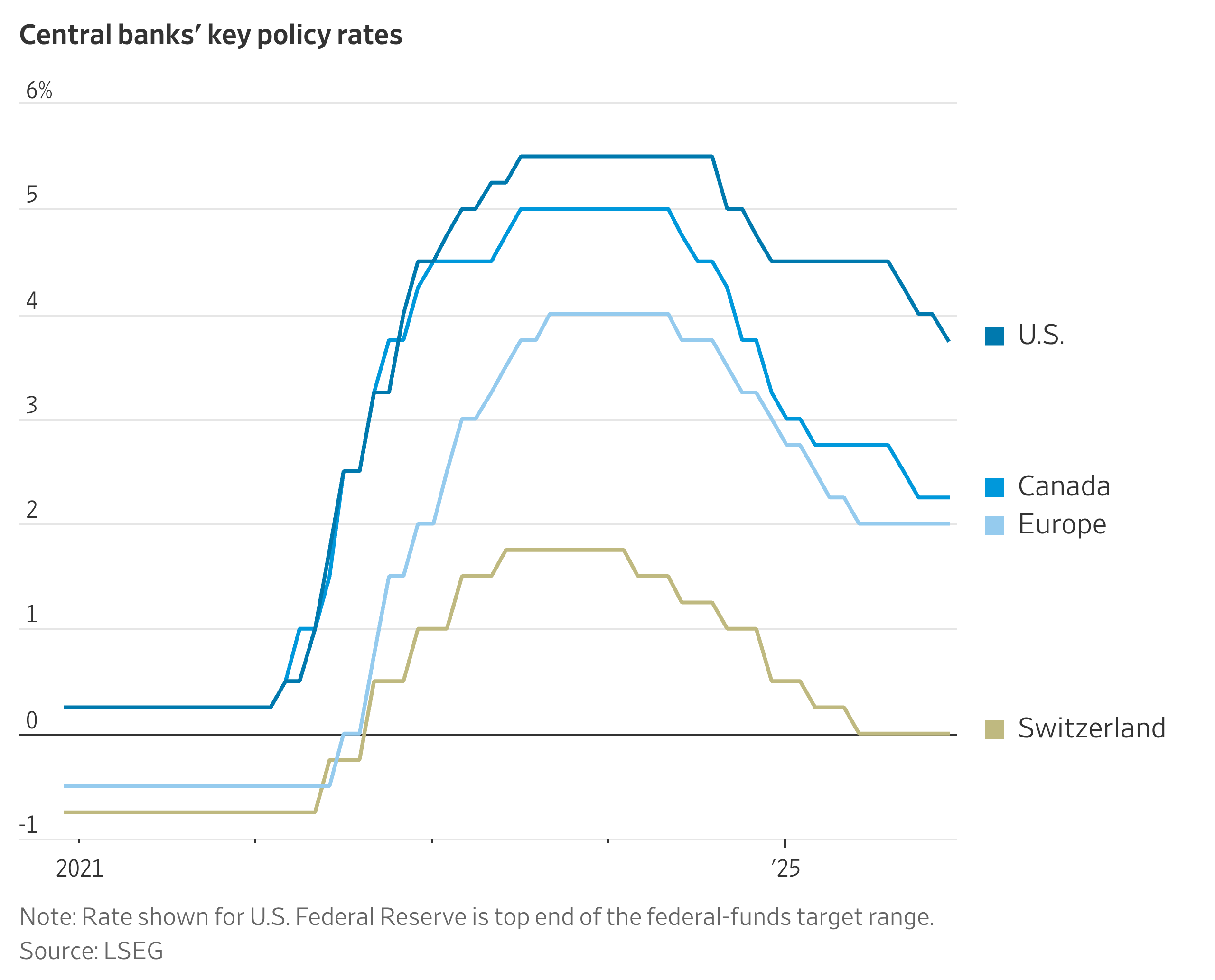

The European Central Bank kept its deposit rate at 2%. Inflation has fallen back toward the ECB’s 2% target and is expected to drop further in 2026 and 2027.

The Bank of England cut by 0.25 percentage point, or 25 basis points, moving in step with the Fed. U.K. inflation slowed to an eight-month low in November.

Norway’s Norges Bank held its key rate at 4%. It said inflation remains too high, but signaled plans to slowly ease policy in the coming years.

Sweden’s Riksbank kept its key rate at 1.75% and said inflation was falling in line with forecasts. It said its next move will be a hike, but not for some time.

Taiwan’s central bank held its benchmark rate at 2%. Inflation has cooled in recent months, and the island’s economy is being boosted by global AI demand.

Mexico’s central bank, as expected, delivered another 25-basis-point cut, but signaled a possible pause from its easing streak. Last week, the country approved potentially inflationary tariff hikes.