Politics

Berlinale furore explodes with open letter

Hollywood actors Tilda Swinton, Javier Bardem and Brian Cox are among more than 80 leading film industry figures to sign an open letter, titled “We Are Dismayed”, condemning the silence of the Berlin Film Festival (Berlinale) on Israel’s genocide in Gaza and its censoring of artists who speak out.

The letter comes on the same day as Booker Prize winning author Arundhati Roy announced her withdrawal from the festival over the same issue amidst comments by German director Wim Wenders against artists bringing up Gaza.

Berliale maintain silence

Other notable signatories include actors Angeliki Papoulia, Saleh Bakri, Tatiana Maslany, Peter Mullan and Tobias Menzies, and directors Mike Leigh, Lukas Dhont, Nan Goldin, Miguel Gomes, Adam McKay and Avi Mograbi. They say that they “expect the institutions in our industry to refuse complicity” in Israel’s slaughter of the Palestinian people.

The 2026 festival is currently underway. Festival head Tricia Tuttle put out a statement in which she backed Wenders:

Artists should not be expected to comment on all broader debates about a festival’s previous or current practices over which they have no control.

The signatories of the open letter “fervently disagree” and insist that the “tide is changing across the international film world”. They also point out that the Berlinale has commented strongly about earlier “atrocities” in Iran and Ukraine and call for the festival to “fulfil its moral duty” to oppose Israel’s genocide and other crimes against the Palestinians. The full text reads:

Open Letter to the Berlinale — Feb. 17, 2026

We write as film workers, all of us past and current Berlinale participants, who expect the institutions in our industry to refuse complicity in the terrible violence that continues to be waged against Palestinians. We are dismayed at the Berlinale’s involvement in censoring artists who oppose Israel’s ongoing genocide against Palestinians in Gaza and the German state’s key role in enabling it. As the Palestine Film Institute has stated, the festival has been “policing filmmakers alongside a continued commitment to collaborate with Federal Police on their investigations”.

Last year, filmmakers who spoke out for Palestinian life and liberty from the Berlinale stage reported being aggressively reprimanded by senior festival programmers. One filmmaker was reported to have been investigated by police, and Berlinale leadership falsely implied that the filmmaker’s moving speech – rooted in international law and solidarity – was “discriminatory”. As another filmmaker told Film Workers for Palestine about last year’s festival: “there was a feeling of paranoia in the air, of not being protected and of being persecuted, which I had never felt before at a film festival”. We stand with our colleagues in rejecting this institutional repression and anti-Palestinian racism.

We fervently disagree with the statement made by Berlinale 2026 jury president Wim Wenders that filmmaking is “the opposite of politics”. You cannot separate one from the other. We are deeply concerned that the German state-funded Berlinale is helping put into practice what Irene Khan, the UN Special Rapporteur on Freedom of Expression and Opinion recently condemned as Germany’s misuse of draconian legislation “to restrict advocacy for Palestinian rights, chilling public participation and shrinking discourse in academia and the arts”. This is also what Ai Weiwei recently described as Germany “doing what they did in the 1930s” (agreeing with his interviewer who suggested to him that “it’s the same fascist impulse, just a different target”).

All of this at a time when we are learning horrifying new details about the 2,842 Palestinians “evaporated” by Israeli forces using internationally prohibited, U.S.-made thermal and thermobaric weapons. Despite abundant evidence of Israel’s genocidal intent, systematic atrocity crimes and ethnic cleansing, Germany continues to supply Israel with weapons used to exterminate Palestinians in Gaza.

In September 2025, more than 5,000 film workers, including major Hollywood stars, refused to work with industry organisations “implicated in genocide and apartheid against the Palestinian people”.

Featured image via the Canary

Politics

Starmer Labels Reform’s Child Benefit U-Turn ‘Shameful’

Reform UK has been slammed by Keir Starmer after Robert Jenrick announced the party would bring back the two-child benefit cap.

Implemented by the former Conservative government, the two-child benefit cap has been a major sticking point in this parliament.

The cost-saving measure prevents families from claiming any further expenses from the state after their second child, contributing to child poverty levels.

MPs voted with the government to lift it earlier this month.

But Jenrick, Reform’s new Treasury spokesperson and former Tory minister, announced on Wednesday that a government led by his party would “restore the cap in full”.

It comes after party leader Nigel Farage previously said he would lift the cap, before deciding it would stay – with some exceptions for families with two British parents who work full-time.

But Jenrick said: “As a signal of intent, today, Reform is changing our policy on the two-child cap for Universal Credit.

“The policy was well-meaning.

We want to help working families have more children. But right now, we just cannot afford to do so with welfare. So it has to go.

“And, as Reform’s shadow chancellor, I’m ending it. A Reform government will restore the cap in full. We are the party of alarm clock Britain — a party for workers and not welfare.”

Prime minister Starmer tore into the announcement on X, writing: “Shameful. I’m incredibly proud that this government has scrapped the cruel two child limit. Reform wants to push hundreds of thousands of children into poverty.”

The PM then told Wales Online: “I think it’s shameful because Reform’s decision to reverse on this means that if they ever got into power they would drag hundreds of thousands of children back into poverty.

“We tried that experiment under the Tory government and thousands – hundreds of thousands – of children grew up in poverty and their life chances are affected. And for Reform to say ‘we’re going to punish children back into poverty’ means they are destroying the life chances of those children.”

He added that growing up in poverty makes it “so much harder to get the job you need, to have the economic worth that you deserve, to go as far as your talent and ability will take you”.

He accused Reform of a “total disregard for the lives of young people and I hope that they absolutely never get to be in power, because this is an indication of the sort of Britain they want to see, a Britain which plunges people back into poverty.”

It’s worth noting Starmer also chose to keep the cap for the first year of his premiership before U-turning amid backlash from his backbenchers.

Anna Turley, Chair of the Labour Party, also hit out at Reform, saying: “Robert Jenrick has united the right behind a cruel child poverty pact that would see nearly half a million kids pushed into poverty.

“Farage’s party is stuffed full of former failed Tories who are now hell bent on continuing their damaging legacy, with working people and their children set to pay the price.

“Labour chooses the other road – lifting almost half a million kids out of child poverty – and that’s what we’re doing this year.

“It’s the right thing to do for them, their families and our economy. It’s appalling that Reform and the Tories would undo that change and leave a lost generation of kids in every corner of Britain.”

Jenrick’s announcement comes only two weeks after his fellow ex-Tory Suella Braverman accidentally voted to scrap the cap, too.

The five other Reform MPs who took part voted against scrapping it, in line with their party policy.

The motion to end the cap, introduced by the last Tory government in an attempt to slash the welfare bill, was passed by 458 votes to 104.

Jenrick also announced that he would restrict access to health or disability benefits on what he called “spurious” grounds.

He said: “The number claiming disability benefits for an attention disorder has more than doubled since Covid. We all know a significant number of these claims are spurious.

“We will stop those with mild anxiety, depression, and similar conditions from claiming disability benefits and instead encourage them into the dignity of work.”

Jenrick announced plans to restrict benefits to British nationals only, and to reduce access to the Motability scheme which allows people on benefits to use a car.

Politics

Reeves Urges Andrew Mountbatten Windsor To Speak Out About Epstein

Rachel Reeves has added to the growing political pressure on Andrew Mountbatten-Windsor to speak out about his friendship with Jeffrey Epstein.

US Congress released more than three million files on Epstein, the convicted sex offender who died in 2019, on January 30.

It revealed the disgraced financier’s extensive contact with the global elite, including Andrew.

The former prince is now facing fresh calls from some US officials – and the family of his prominent accuser Virginia Giuffre – to testify before the Oversight Committee about Epstein.

Andrew previously denied any wrongdoing in relation to Epstein and appearing in the files is not an indication of wrongdoing.

He reached an out-of-court settlement with Giuffre four years ago, with no admission of liability. Giuffre died by suicide in 2025.

The former royal is yet to respond directly to the new claims.

Separately, the UK police are now reviewing some of the information from the dossier as part of a series of probes.

The chancellor joined in with the mounting political pressure on Andrew on Wednesday.

“The former prince has got a lot of questions to answer on a whole range of issues,” the chancellor told reporters in south-east London.

“I think he owes it to the victims of Epstein and his associates to come forward and give much more information about what he knew about the treatment of young women and girls.”

Essex Police announced on Tuesday it was looking at the information about private flights to and from Stansted Airport.

It came after former prime minister Gordon Brown claimed last week that the files showed “in graphic detail” how Epstein used the airport to “fly in girls from Latvia, Lithuania and Russia”.

A representative from Stansted Airport said the airport “does not manage or have any visibility of passenger arrangements on privately-operated aircraft”.

Surrey Police are also looking into a claim from a 2020 FBI report related to a child abuse claim against Andrew and convicted sex trafficker, Epstein’s friend Ghislaine Maxwell.

Norfolk Police are looking into various documents which have been flagged to them, but say they have not received any allegations and are not currently investigating any probes.

Thames Valley Police are looking into claims Andrew shared confidential information with Epstein when the then-prince was the UK’s trade envoy.

The National Police Chiefs’ Council (NPCC) have confirmed a national group has been set up to support UK forces that are “assessing allegations” related to file drop.

Reeves’ words come after prime minister Keir Starmer urged Andrew to give evidence before a US congressional committee which first asked for his testimony in November, saying the victims must be “first priority”.

The prime minister had previously said it would be a decision for Andrew to testify.

The US congress committee does not have the power to compel Andrew to appear in front of them.

Meanwhile, former US secretary of state Hillary Clinton told the BBC: “I think everybody should testify who is asked to testify.”

Clinton and her husband former US president Bill Clinton will appear before Congress over Epstein at the end of this month.

There is no indication either of them are guilty of wrongdoing.

Politics

Best Acne-Fighting Buys, From Serums To Cleansers

We hope you love the products we recommend! All of them were independently selected by our editors. Just so you know, HuffPost UK may collect a share of sales or other compensation from the links on this page if you decide to shop from them. Oh, and FYI – prices are accurate and items in stock as of time of publication.

Acne is far from uncommon, but there’s somehow still so much stigma around it. The skin condition can also have a massive impact on self-esteem.

“Many adults experiencing acne feel lost and unsupported, simply because skincare advice and marketing often don’t reflect the reality of acne at different life stages,” she added.

According to new research from Face The Future, just 39% of adults are aware that acne can pop up during menopause and pregnancy.

Meanwhile, 66% worry their acne will never clear up, and 79% feel overwhelmed by the number of products that claim to “fix” their breakouts.

If you count yourself among the overwhelmed, here’s a list of acne-fighting buys that have scores of great reviews under their belts.

Politics

BAE Systems announce record profits through warmongering

Arms giant BAE Systems has posted record profits for 2025. In short, it’ll be yachts and third homes for the elites while the world burns. Yay! The Independent reported:

Europe’s biggest defence contractor reported better-than-expected underlying earnings before interest and taxes of £3.32 billion for 2025, up 12% on the previous year, as sales jumped 10% to a record high of £30.66 billion.

Recent global instability means the firm has a massive backlog of orders as nation states scramble to arm themselves:

The aerospace and weapons manufacturer said its order backlog also hit a record £83.6 billion as of the end of December while its order intake stood at £36.8 billion.

The This is Money website was extra jovial about the news:

Analysts at broker AJ Bell also point to conflict in the Middle East and heightened geopolitical tensions for BAE’s ‘stunning run’.

The shares have trebled since Russian tanks rolled across the Ukrainian border four years ago.

‘Stunning run’… okay fellas.

BAE Systems have a record breaking backlog?

BAE boss Charles Woodburn said:

Our results highlight another year of strong operational and financial performance, thanks to the outstanding dedication of our employees.

In a new era of defence spending, driven by escalating security challenges, we’re well positioned to provide both the advanced conventional systems and disruptive technologies needed to protect the nations we serve now and into the future.

He added:

With a record order backlog and continuing investment in our business to enhance agility, efficiency and capacity, we’re confident in our ability to keep delivering growth over the coming years.

BAE Systems reported sales to many countries across Europe and beyond. This included kit sold to authoritarian governments like Qatar.

Starmer’s big spend

This could even increase over the next year as the UK’s Keir Starmer promised to ramp up defence spending. His pledge followed demands by US president Donald Trump that Europe do more.

Stop the War Coalition were having none of it:

This is part of a massive European arms drive aimed at appeasing Trump as he demands Europe pay more for its own defence.

The additional cost comes at a time when we are told to accept cuts to pensions, to wages and to public services, while much of what is spent will go directly into the coffers of US arms manufacturers.

Arms firms thrive in conditions of chaos and war. In fact instability is self-evidently in their interest. And nobody understands this better than they do… It’s on the rest of us to defy and challenge the kind of militarist, profit seeking logic which is running rampant in these febrile times.

Featured image via the Canary

Politics

Wuthering Heights Director Explains What The Outrageous Opening Scene Is All About

This article contains spoilers for Wuthering Heights.

The Oscar winner packs in outrageous scenes from the get-go, with her adaptation of Emily Brontë’s gothic novel opening with a public hanging, in which a rabble of people grow increasingly frenzied at the scene in front of them.

As the fast-paced sequence unfolds, a delighted youth in the throng of people points out the hanged man’s “stiffie”, while other members of the crowd are seen celebrating, dancing and kissing.

Speaking to USA Today, Emerald explained that she chose this as the opener of her film to “set the tone and say what it is”.

“This is a deeply felt romance,” she continued. “But I also wanted people to understand that it would be surprising and darkly funny and perhaps stranger than they would expect.”

Emerald added that it was crucial for her to “acknowledge early on that arousal and danger are kind of the same thing”.

“That is what the Gothic is,” she insisted. “And it was important that the first thing we see is Cathy, this young girl, seemingly frightened but then actually delighted. It tells us so much about who she is, but so much about Brontë, too.

“We have this idea that the world of period dramas was fragrant and beautiful and pastel and lovely. It wasn’t at all. It was a dangerous place to live in, so it was crucial for me to show that right at the beginning.”

Over the summer, it was revealed that Wuthering Heights had been screened for test audiences for the first time, with much being made of this hanging sequence at the time.

At first, it was reported by World Of Reel that the scene would have seen the man ejaculating “mid-execution”, and “sending the onlooking crowd into a kind of orgiastic frenzy”, with a nun in the crowd even being seen “fondling the corpse’s visible erection”.

It’s not clear whether this scene was eventually toned down in the finished version, or whether the original reporting was mistaken about certain details.

Emerald has previously spoken out in defence of the changes she’s made to the source material for her new Wuthering Heights film – including one scene in particular that’s garnered a lot of controversy since the movie hit cinemas last week.

Of course, before filming was even underway, Emerald faced backlash over her casting of Jacob Elordi as Heathcliff, a character who is heavily implied in the book to be a person of colour.

Responding to these “whitewashing” accusations, the filmmaker said: “The thing is, everyone who loves this book has such a personal connection to it, and so, you can only ever kind of make the movie that you sort of imagined yourself when you read it.

“That’s the great thing about this movie is that it could be made every year and it would still be so moving and so interesting.”

Prior to this, she had claimed she was first inspired to cast Jacob as Heathcliff after noticing while working with him on Saltburn that he “looked exactly like the illustration of Heathcliff” on the first copy of Wuthering Heights that she read.

Wuthering Heights is in cinemas now.

Politics

Zia Yusuf just embarrassed himself on live tv

Reform UK’s Zia Yusuf has just had his arse handed to him on Newsnight. Couldn’t have happened to a nicer fella.

Zia Yusuf interrogated on Reform wanting to scrap quality act

The newly named (supposed) Reform Shadow Home Secretary appeared on Newsnight to talk about his new role. But he was met with a sharp interrogation from Victoria Derbyshire about Suella Braverman’s announcement that she would “rip up” the Equality Act.

In her speech, Braverman said she would get rid of the “divisive notion of protected characteristics”. That “divisive notion”, for anyone who needs a reminder, is that you can’t be discriminated against because of your sex, pregnancy, race, religion, disability, age, sexuality, gender reassignment, marriage, or belief.

However, Reform hasn’t actually been able to answer what would “rip up” and how discrimination would be policed, which is where Yusuf fell foul.

What would they actually scrap?

After confusingly saying that millionaires would go to the top of the list (as if they didn’t already), Yusuf was stopped by Derbyshire, who pulled him up on who exactly would be affected.

If I may go through the protected characteristics and what you want to get rid of, because that’s not clear to me.

So Amnesty say the Equality Act is the legal guarantee that you can’t be sacked for being pregnant, you can’t be refused housing because of your race and you can’t be harassed at work because you are disabled or gay. So how are you going to protect those people?

Yusuf, of course, didn’t answer this

We will make sure that there are measures to ensure those things do not happen

He was cut off by Derbyshire asking, “How?” To which he replied that this will be done through legislation, which is what the Equality Act is:

Yusuf: Through legislation that’s exactly the sort of thing we will do

Derbyshire: right so you’re going to scrap the Equality Act, but you’re still going to protect for example pregnant women from being sacked because they’re pregnant in a new act?

Yusuf: yes that’s exactly what we’re going to do

Yusuf attempts to bluster about what “the problem” with the Equality Act is, but Derbyshire cuts him off, asking:

so will it be the same act with a different label?

Yusuf goes on to say that there are

so many parts of the equality act which are so unfit for purpose.

Let’s be honest, from Reform’s track record, it’s probably going to be the parts of the Act that stop you being bastards to trans people and immigrants isn’t it?

Still no answer?

He does, however, come back to a big Reform talking point, which is that young white working-class boys are the ones really struggling. This is actually something he comes back to many times. Because Reform knows while they may not have the young vote, they do have their grandparents’ votes.

Instead, Derbyshire pulled him back to who actually would be affected and brilliantly championed disabled people:

There are 17 million people in this country with disabilities, that’s 25% of the population. This act means if you have a disability you’ve got an equal right to a job, equal access to public transport or really practical stuff like, most people don’t even think about this, that doorframes have to be a particular size so that people using a wheelchair can literally get in and out of a building.

Do you not want to protect those people?

You could see the contempt on Yusuf’s face as she reads that out, because he and Reform couldn’t give a fuck. Instead, it seemed like he found the whole thing tedious.

When pushed, he said:

You can expect those things to be protected

Still, Derbyshire carried on:

So which of the protected characteristics do you not want to protect anymore? Because I’m not clear?

It’s clear who Reform actually wants to protect

In the end, Derbyshire listed every single protected characteristic, and Yusuf said Reform would protect every single one. But if this is true, what’s the fucking point of claiming you want to rip up the Equality Act?

Instead, what he closed with was:

We’ve got to ask ourselves why white working class boys are doing so badly, and why this act in its current form industrialises discrimination against them

This, by the way, is completely fucking untrue. It’s not equality to blame for working-class boys having a lack of opportunity.

Equality didn’t close the mines and shipyards without giving working-class communities another way to thrive. It didn’t prioritise the privately educated whilst locking poorer kids in low-paid apprenticeships. Equality doesn’t give the higher-paid jobs to their useless sons over hardworking, less wealthy young men.

It’s clear as day that this is just Reform using working-class people to get votes.

Scrapping the Equality Act isn’t about giving everyone an equal chance, it’s about point scoring and using working-class boys as cannon fodder – as usual. Zia Yusuf’s disastrous appearance on Newsnight showed that.

Featured image via the Canary

Politics

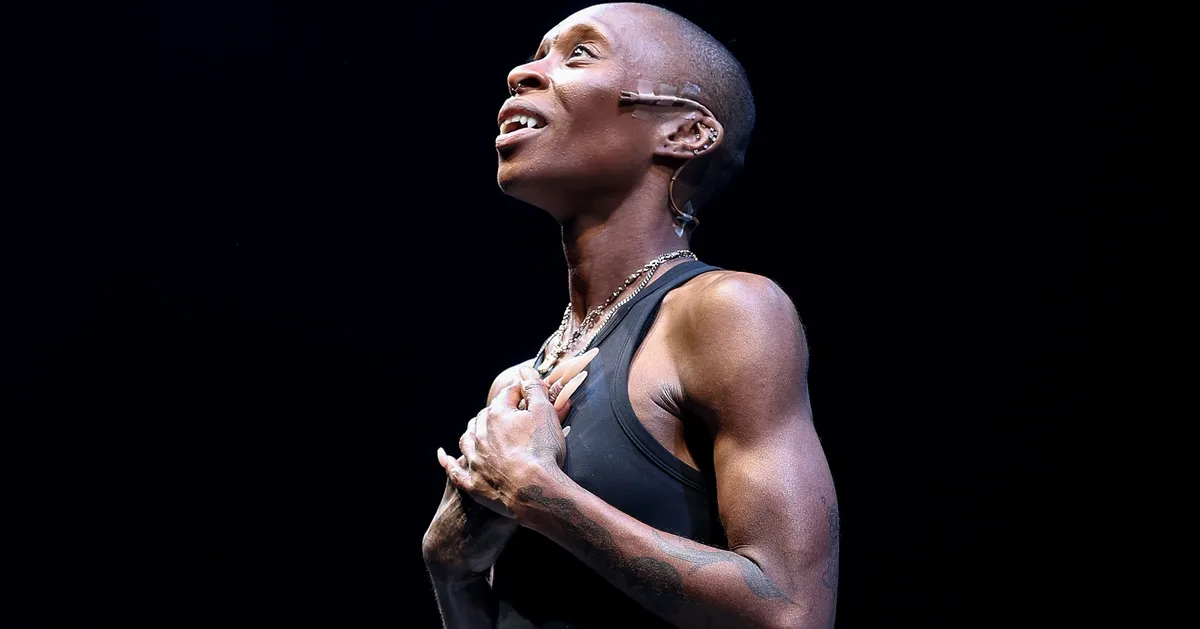

Dracula Reviews: Cynthia Erivo’s New Play Divides Critics

Following her acclaimed performances as Elphaba in the movie musical Wicked and its sequel, Cynthia Erivo is currently starring in a new West End production of Dracula.

Remarkably, the Oscar nominee plays all 23 characters in the ambitious play, thanks to a combination of pre-recorded screen work and Cynthia’s in-person stage acting.

In the run-up to the official opening, much was made in the press of the fact some audience members were unimpressed with the supposed use of an autocue during preview performances, though in newly-released reviews, there’s no indication that this has taken away from her conviction or credibility in the 23 roles the British star inhabits.

Unfortunately, critics seem more lukewarm on the show itself, with many reviews indicating that the production team may have bitten off more than they could chew with the project.

Here’s a selection of what critics have said about the new adaptation of Dracula…

“During early previews at the Noël Coward, word of mouth suggested that the Wicked star – who plays all 23 characters, some live, some pre-recorded – was struggling to negotiate the dense tangle of dialogue and cues. Some audience members were said to be unhappy at seeing teleprompters on stage. Those problems seem to have been ironed out.

“At the press preview I saw, Erivo fumbled a few lines but otherwise gave a commanding display in a Kip Williams production that is part theatre, part cinema.”

“Erivo’s excellence is the least surprising element of the evening. She is magnetic, meticulous, and emotionally lucid throughout, finding flashes of humour and menace even while juggling an almost unmanageable technical load […] At the same time, the feat has inevitable limits.

“There are moments that could be deeply resonant in the hands of an actor of Erivo’s ability, that instead seemed rushed or surface-level.”

“At previews, Erivo was reportedly reliant on an auto-cue; there’s still one on hand but she seems word-perfect now. My only cavil is that her rendition can incline to flatness.

“Still, she’s climbing a mountain, really, and deserves cheering on. It’s feats of stamina like this that keep British theatre un-dead.”

“Cynthia Erivo gives an extraordinary, shape shifting performance […] The Wicked star juggles costumes and accents, interacting with onscreen versions of herself in a hectic 120-minute canter through the Gothic tale. Her performance triumphantly walks a knife edge between virtuosity and absurdity.”

“Truly this is a mind–bogglingly complex show, which goes beyond the kitchen sink in its attempts to create an audio-visual hallucination.

“Yet what’s missing is old-fashioned suspense. We all know, roughly speaking, what’s coming. But I still find myself tipping my pointy hat to Erivo.”

“Erivo is tiny and the screen is massive, and the pre-recorded stuff is so dominant – as many as four gigantic versions of her on-screen versions of her – that it overshadows the technically impressive work happening on stage.”

″[Cynthia Erivo] deserves praise for tackling such a relentless and challenging part, which requires her to constantly switch between personas, interact with pre-recorded versions of herself, and hit all her marks for the camera operators […] but in a production that demands so much of its performer, you can’t shake the feeling it’s about to run away from her.

“She wades through the dense script, which would have benefited from another round with the dramaturg, rushing out vast passages and occasionally stumbling over her words. Perhaps some of these issues will be ironed out over the course of the run, but for now there is too much jeopardy that she won’t get there.”

“It’s slick, soulless and all about appearances. There’s no jeopardy or really any true drama. On the night I attended, the audience loved it, but what are we applauding? Erivo deserves it, but she also deserves far better – a Dracula with a bit of red meat rather than this bloodless, soul-sapping affair.”

“It’s testament to Erivo’s skill that her performance still packed a punch throughout. However, by the law of averages a five-star performance and one-star production must equal three.

“Sadly like Dracula himself, this production sits stranded in the middle, not dead, not alive, but somewhere in between.”

“Despite the speed, the atmosphere stays sedate, with none of the fever required, and no peril whatsoever. And characters seem so simplistic that they verge on the comical […] Erivo’s feat of narration also seems to distract her from the actual acting, too neutral in her physical and facial expressions.”

Dracula plays at the Noël Coward Theatre in London’s West End until Saturday 30 May.

Politics

Rafe Fletcher: Broad-church Conservatism can’t handle AI

Rafe Fletcher is the founder of CWG.

Dario Amodei kickstarted the recent peak in AI hype with a 20,000-word essay on the technology’s imminent dangers.

Released just as his company Anthropic (which counts Rishi Sunak amongst its advisers) embarked on a new US$30 billion funding round, cynics may infer ulterior motives in Amodei’s elucidation of AI’s awesome powers. Nevertheless, its renewed prominence leaves governments responding to an age-old question: how to harness technological revolutions while limiting societal disruption?

The subject was top of the agenda in Singapore as Prime Minister Lawrence Wong presented the country’s budget last Thursday. New policies include generous tax deductions for businesses’ AI expenditures and free access to premium AI tools for Singaporeans who take up certain AI training courses. “AI is a powerful tool”, said Wong, but “it must serve our national interests and our people.”

In Singapore, capitalism and its innovations have always been a means, not an end. Something that was sometimes misunderstood by British Brexiteers imagining Singapore-on-Thames as bastion of laissez-faire economics. The better analogy is Vote Leave’s own Take Back Control when it comes to market forces. Use them but steer them.

The problem is that Britain lacks this same autonomy. The Conservatives share the blame for that. Tension between its strands of economic liberalism and paternalism manifest in strategic incoherence. That split was always present but more easily reconciled when Britain was a leading power. Perhaps the closest historical parallel to AI disruption, the Industrial Revolution, illustrates this.

Karl Polanyi’s 1944 book The Great Transformation is an account of Britain’s pioneering capitalism in the 19th Century. Polanyi was a Hungarian Jew who first fled from Budapest in 1919, then Vienna in 1933, following the respective ascension of fascist regimes. He argues free markets underpinned this terror, a result of trying to square the subsequent disorder. Polanyi’s own moderate socialism looks a tad naïve given the authoritarianism he witnessed first-hand. Particularly his belief that we can trust an interventionist government if it is “true to its task of creating more abundant freedom for all.”

But an errant prognosis does not diminish what Polanyi gets right. Chiefly that the market forces guiding the Industrial Revolution and Britain’s economic supremacy were not entirely organic. Britain’s rise rested not only on technology but government decisions about trade, finance and property. Empire and global reserve currency status meant Britain naturally absorbed the advantages of a new free-market structure.

Domestic politics then debated the balance between accelerationism and gradualism. Polanyi’s own belief that the “rate of change is no less important than direction itself” was articulated by 19th Century Conservatives. Figures like Richard Oastler jostled with Whig Prime Minister Early Grey over the 1834 Poor Law, which denied the rights of the poor to subsistence. The former believed unemployment was a manifestation of the social dislocation wrought by sudden change. The latter that it was simply an unwillingness to work for the wages available in the labour market.

The same Whig-Conservative divide shows up in earlier views of Napoleon Bonaparte. Whigs like Charles James Fox were sympathetic to the Corsican General. Firstly, because his European reforms offered trading benefits, with newly liberalised and legalised economies. Secondly, because they resented the costs of fighting such a drawn-out war. It was the Conservatives, under Pitt the Younger, who were far more obstinate in enduring heavy taxation and economic blockades to keep fighting. Trade and sovereignty pulled in different directions, but Britain was strong enough to manage the tension.

Disparity was manageable because Britain held such sway over market mechanisms. It could repeal the mercantilist Navigation Acts in 1849, giving up privileged shipping rights because naval supremacy allowed it to row back if necessary. Paternalistic public health reforms and workplace safety legislation were possible because Britain had the fiscal means to do so. Its economic pre-eminence entitled it to indulge both factions.

Today’s Conservative Party is an amalgamation of these differing proclivities. The Whigs, and its subsequent Liberal iteration, were subsumed into this new broad church in 1912. We recognise these different strands in the form of Disraeli’s one-nation conservatism and Gladstone’s classical liberalism. But as Britain’s influence has diminished, so these result in contradictions. It does not have the economic might to sustain both visions. It has to offer a transparent choice – going for growth or a more paternalistic state-directed gradualism.

The lesson from Singapore is that it is too late to have both. Its autonomy to handle AI comes from years of consistent government and strategic planning. It has built huge domestic savings, enshrined balanced budgets in law and maintained a strong industrial base (manufacturing still represents 25 percent of GDP). Britain has none of these things.

But it has many other advantages. It is a talent hub. Americans rave about the opportunity to hire top-tier talent at a third of the price. And (for now) it is free of the EU regulation that threatens to stifle AI development. What it lacks in infrastructure it can incentivise the Anthropics of this world to build through de-regulation and tax incentives if accompanied by liberal energy and planning reform.

Offering such perks would require a drastic overhaul of the state. And proponents may be buoyed by recent evidence that the British public is feeling a little less statist. Recent research reported an all-time high of Brits saying tax and spending should be reduced. But it still pales in comparison to the number calling for more or the same.

The alternative is to be upfront about trade-offs. Britain is unlikely to be a leader in any AI revolution. But it will do its best to manage it. It will protect jobs, regulate where necessary and guard social cohesion. It’s a perfectly reasonable Oastlerian conservative position when delivered with clarity. And perhaps, if Amodei’s claims prove overblown, it will look prescient.

The Conservatives need to define what they stand for as they go up against Reform as the party of the right. They can be guardians of paternalism or engineers of growth. But it is dishonest to pretend both are possible. Unlike the Industrial Revolution, Britain does not have the luxury of leading this one. Control only comes from informed choice.

And the Conservatives must decide what tradition they stand for.

Politics

WATCH: Reeves Refuses to Rule Out 15th U-Turn on Minimum Wage

Rachel Reeves was asked this morning whether she was still committed to Labour’s manifesto pledge to pay young workers the same national minimum wage as older workers. She refused to do so twice. 15th U-turn on the way…

Politics

Yellow Weather Warnings For Rain, Snow And Ice Issued In UK

In what has been an impressively dreary winter so far, the Met Office has issued yet more weather warnings for England, Northern Ireland and Wales across today (18 Feb) and tomorrow (19 Feb).

It shared that rain, ice and snow yellow weather warnings have been issued for South West England, Wales and Northern Ireland, with conditions set to continue into tomorrow.

Yellow weather warnings for England, Wales and Northern Ireland

Steven Keates, Met Office deputy chief forecaster, explained the outlook: “On Wednesday, weather fronts are expected to move in from the Atlantic into some western, southern and central areas of the UK.

“As they bump into the cold air already in place, we are likely to see some snow developing, although there is still some uncertainty around the details.

“Initially, we may see some snow over the highest parts of southern England, such as Dartmoor, but the main chance of snow will be across higher parts of the Midlands and mid and southeast Wales. Above 150 to 200 metres, 2-5 cm of snow may accumulate, with a few places – most likely above 300 metres –possibly seeing 10cm or more.”

What do yellow weather warnings mean?

These are issued by The Met Office National Severe Weather Warning Service (NSWWS) and they warn of both human and building risks of harm due to extreme weather conditions.

Yellow weather warnings indicate ‘low-level’ risks, such as problems with travel, which can impact people’s daily routines, but there is often no other risk to life or property.

Fortunately, this weather warning is short-lived and forecasters have not shared concerns for wellbeing.

Should you drive when there is a yellow weather warning?

According to Traffic Scotland: “If possible, you should avoid driving no matter the warning level.

“Driving in a yellow warning may not pose a likely risk, but there is likely to be increased congestion and disruption on the road. Driving in amber and red warnings pose a greater risk, therefore travel should be avoided unless absolutely essential.”

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business13 hours ago

Business13 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech4 hours ago

Tech4 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business6 hours ago

Business6 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show