[matched_con]

Source link

Carrie Underwood Sings “America The Beautiful’ At Inauguration: Watch

Estimated read time

1 min read

You May Also Like

Ivanka Trump Sparks Calls for Boycott of Historic Fashion Brand

January 21, 2025

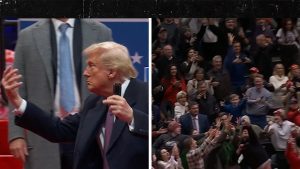

Donald Trump Signs Executive Orders, Tosses Pens Into Giddy Crowd

January 21, 2025

More From Author

Ivanka Trump Sparks Calls for Boycott of Historic Fashion Brand

January 21, 2025

President Trump: 'TikTok Is Worthless if I Don’t Approve It'

January 21, 2025

Crypto ally Mark Uyeda to serve as interim SEC chair

January 21, 2025

+ There are no comments

Add yours