Pioneers sometimes get undue credit for simply being the first of many trying to reach the promised land. Even if they had never been born, their discovery would have happened around the same time anyway.

Other times they become the figurehead of what was really a collective breakthrough. But if there was a true father of passive investing then it was John “Mac” McQuown, who FT Alphaville has learned sadly passed away yesterday, aged 90.

Index funds certainly had many intellectual parents — giants like Louis Bachelier, Harry Markowitz, William Sharpe and Eugene Fama. Vanguard’s Jack Bogle was a powerhouse behind their growth into an industry-shaking phenomenon. McQuown had many able colleagues who played important roles in the genesis of passive investing.

But it was McQuown’s combination of bullheadedness and brilliance that proved the crucial driver of the first entirely passive, index-tracking investment fund’s birth in 1971. As Dimensional Fund Advisors’ David Booth, a friend and former Wells Fargo colleague of McQuown, once told Bloomberg Businessweek:

To bring about fundamental change, you need great thinkers and researchers, but you also need implementers. People like Mac don’t win Nobel Prizes; they implement the ideas of the guys who do. He’s a catalyst.

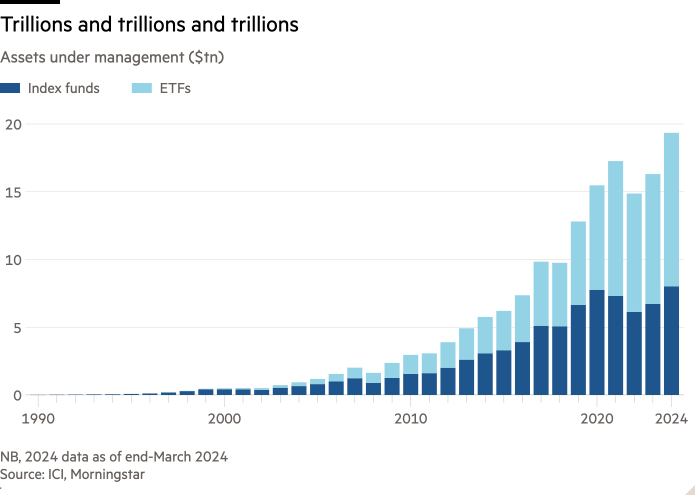

Today, the oddball Wells Fargo unit McQuown helped create is the crown jewel of BlackRock’s $11tn investment empire, and his baby has now grown into an even larger $20tn-plus universe of index-tracking funds (and that’s just the public funds, the true size of passive investing is much larger).

The true story of index funds arguably starts in 1964 — more than a decade before Jack Bogle founded Vanguard, and far away from the ferment of Wall Street — when McQuown gave a presentation to a bunch of IBM clients in San Jose.

McQuown was hardly a gripping speaker. Born on 17 July 1934, he grew up on his family’s farm in rural Illinois. When all the men went to fight in WWII, young “Mac” — aged just eight — had start working as a farmhand.

The machinery of agriculture fascinated him, and he went on to study for a degree in mechanical engineering at Northwestern University, becoming the first in his family to get a higher education.

Here’s a photo from around those days that McQuown once shared with the author.

He graduated in 1957. As a member of the Reserve Officers’ Training Corps, he was immediately commissioned as an ensign in the Navy and served two years as an engineer aboard the destroyer USS Wiltsie. Afterwards, he got an MBA from Harvard, and ended up at Smith Barney, a New York investment bank.

At Northwestern, McQuown had first fallen in love with a fantastical contraption called “the computer” — an IBM 305 RAMAC that ran on giant magnetic discs and punch cards. At Harvard, he learned how to programme on nearby MIT’s mainframe.

But Smith Barney, his new employer, had zero interest in what computers could do. This was an era when there were very few engineers on Wall Street, and virtually none that had much expertise in the burgeoning field of computer science.

So on the side of his day job as a budding banker, McQuown and a former professor periodically rented the massive IBM 7090 mainframe computer in the basement of the Time–Life building in New York. They used it to find out whether stock prices could be predicted from past patterns.

McQuown was the self-described “data dog” that had to corral the information and wait for the hulking computer to crunch the calculations. This often took so long that he brought a sleeping bag (renting the computer was cheaper in the evening and at night).

Here’s what the then-cutting-edge IBM 7090 looked like:

Unfortunately, no matter what he did, no matter how much data he collected, McQuown just couldn’t find any way to accurately predict what stocks would do.

However, the local IBM sales manager became intrigued by the young mop-haired banker and his attempts to use computers in high finance.

As it happened, IBM was at the time desperate to show off the versatility of its machines, and their uses outside of the military-industrial complex. The IBM manager didn’t really care that McQuown couldn’t find anything usable, inviting the young man to present his work at a conference in San Jose in January 1964.

By pure chance, one of the attendees at the conference was Ransom Cook, then the chair of Wells Fargo.

This was not the Wells Fargo of today. Regulations still severely limited cross-state banking. As a result Wells was a storied-but-small, sleepy regional bank of little consequence. But Cook wanted it to be something more, and thought the computer could be the key. So he invited McQuown to a meeting at the bank the very next day.

Here’s how it played out, according to the financial historian Peter Bernstein’s Capital Ideas:

“Can you really run money with this stuff?” Cook asked McQuown. McQuown was confident that he could; in fact, he was convinced that there was no other way. He explained to Cook the vacuousness of the traditional methods of portfolio management, which, he pointed out, were little more than “ . . . a variation of the Great Man theory. A Great Man picks stocks that go up. You keep him until his picks don’t work any more and you search for another Great Man. The whole thing is a chance-driven process. It’s not systematic and there is lots we still don’t know about it and that needs study.”

McQuown recalls that Cook “made me an incredibly attractive offer right on the spot.” In March 1964, McQuown went to work in the Wells Fargo Management Sciences division to develop a project plan that came to be known as “Investment Decision Making.” The goal was to make Wells Fargo a leader rather than a follower in the trust investment business.

Armed with a practically unlimited budget from Cook, McQuown hired an all-star cast of economists to do research for Management Sciences, Wells Fargo’s new skunk works.

This was the Manhattan Project of finance, with several future Nobel laureates among them, including Harry Markowitz, Bill Sharpe, Eugene Fama, Merton Miller, Myron Scholes and Fischer Black.

At the time, many in the finance industry scoffed at how these geeks tried to turn the art of investing into a science. “With computers, you now have a whole army of analysts hard at work solving non-existent problems”, one anonymous financier snidely observed to Institutional Investor.

To her credit, the magazine’s senior editor Heidi Fiske saw through this and realised what lay ahead. In her April 1968 cover story on the arrival of computers on Wall Street, she wrote:

Not all revolutions are bloody takeovers on a day in May. Some creep up slowly. At first the guerilllas roam ineffectually on the hills. Then there are a few leaders disturbingly different from those of the past. At the end their friends begin to appear everywhere in government, and you know you have to change your tune to stay alive.

Investment departments are in the midst of such a silent struggle, and it is clear that the revolutionaries are going to win. Their names: the Quantifiers. Their weapon: the computer.

Among some of the things that Management Sciences helped birth was the FICO credit scores, what would eventually become Mastercard, and several cutting-edge valuation tools and performance measurement systems. But of all the things that Wells Fargo Management Sciences churned out, the greatest and most consequential was the index fund.

McQuown was immersed in all the cutting-edge research coming from the likes of Markowitz, Sharpe and Fama. They showed how diversification could help lower overall portfolio risks, why the “market portfolio” was the optimal trade-off between risks and returns, and how most stockpickers did an abysmal job.

In 1968 McQuown therefore asked Black and Scholes to research what something like a passive investment fund might look like (though no one called it that at the time). The problem was that few wanted anything to do with it.

McQuown’s efforts were met with antagonism. The head of Well Fargo’s trust department described Management Sciences as “guys in white smocks with computers whirring”. This was a problem, as McQuown needed someone with actual money to bring to life the zany idea of a fund that bought the entire stock market.

As McQuown later recalled to the FT:

It felt like shovelling shit against the tide. We weren’t very popular, even at Wells Fargo initially.

McQuown had allies though, such as William Fouse, another pioneering “quant” he had poached from Mellon Bank. Jim Vertin, the head of the trust department, was also eventually won over by the reams of data that McQuown produced, and became a zealot for a new approach to investing. And then serendipity stuck.

In 1970, a young University of Chicago graduate called Keith Shwayder returned to his family business, the luggage maker Samsonite. There he discovered that its pension fund was invested in lots of poorly-performing, expensive mutual funds.

This was abhorrent to someone who had drunk heavily from the efficient-markets waters of Chicago. Shwayder asked his old teachers if anyone was investing in a more rigorous way, and was quickly introduced to McQuown.

Having someone finally willing to back its research, Wells Fargo enthusiastically set up an entirely passive strategy funded with $6mn from Samsonite’s pension fund, which would invest in all of the New York Stock Exchange’s 1,500 stocks.

At first it was a disaster. Holding an equal dollar amount of each of the NYSE stocks was a logistical nightmare, as Wells Fargo had to constantly rebalance the fund. In 1973 it instead set up a fund that simply tracked the S&P 500, and folded the Samsonite account into it.

Here’s what FTAV thinks is the very first advertisement for an “index fund”, from Institutional Investor in April 1974:

As the cliché goes, success has many parents. There’s still disagreement over who really set up the first “true” index fund. In 1973, another young zealous Fama protégé called Rex Sinquefield launched an S&P 500 index fund at the American National Bank of Chicago. In Boston, around the same time, Dean LeBaron also launched an S&P 500 index product at his firm Batterymarch.

Both LeBaron and Sinquefield are rightly considered pioneers of the passive investing industry, and went on to glittering later careers as well. And in 1976, Bogle’s Vanguard launched the first index mutual fund. Unlike other index fund progenitors, this still exists today, and manages a whopping $1.3tn.

However, setting aside nitty-gritty semantics about separately managed accounts and institutional money versus retail money, the intellectual forefather for the index fund industry is clearly Wells Fargo’s Samsonite account, orchestrated mostly by McQuown. This was the tiny acorn from which a mighty oak eventually grew.

McQuown left Wells Fargo in 1974, exhausted by all the battles with the bank’s new management. Wells Fargo Investment Advisors — the unit set up to house the new quantitative investment strategies — later became Barclays Global Investors once it was acquired by the British bank.

And in 2009, BlackRock swallowed BGI, where what was once WFIA now accounts for almost $8tn of the investment group’s $11.4tn of assets under management.

McQuown didn’t stop working, however. In the subsequent years he had a hand in many more financial projects, including the founding of Dimensional Fund Advisors and Diversified Credit Investments, a quantitative bond investing house acquired by Blackstone in 2020.

However, of all these post-Wells Fargo adventures, the one closest to his heart was a return to his agricultural roots: the purchase of swaths of land in California’s Sonoma Valley.

There, McQuown and his wife established a 16-acre organic farm that produces wine, olive oil and vegetables, all now powered by solar energy — to the delight of an engineer who never stopped trying to solve difficult problems.

McQuown is survived by his wife, Leslie, his son, Morgan, and his daughter-in-law, Alexa.

Further reading (disclaimer):

— Trillions (Amazon)

You must be logged in to post a comment Login