CryptoCurrency

Age-Verified Stablecoin Remittance for Regulated Enterprises

The rise of stablecoin remittance has transformed the way regulated digital businesses transfer money across borders. However, as payment speed improves, a new challenge emerges: ensuring that every transaction originates from an eligible user. In age-restricted sectors like iGaming, digital entertainment, and interactive virtual worlds, a single underage transaction can trigger costly penalties and damage brand trust instantly.

Stablecoin development solutions transform age verification into a seamless advantage. Enterprises gain faster approvals, higher conversion, and compliance that operates automatically in the background. Consumers now expect privacy and instant approvals. Regulators demand safety and verified access. Enterprises must deliver both at the same time. The brands winning this new market reality are those building trust directly into their payment flows. Age verification is no longer friction. It is a revenue unlock. And companies that adopt this trust-driven payment layer now will own the future of compliant digital commerce worldwide.

This blog is your blueprint for leading responsibly in regulated digital commerce. If you are ready to transform age verification from a compliance burden into a global growth advantage, your next move starts here.

The Urgent Challenge With Age-Restricted Digital Payments

Enterprises in regulated digital sectors face a critical dilemma. Regulators are tightening enforcement to protect minors. Users expect instant and private checkout experiences. Enterprises require global scalability without legal exposure. Current identity verification tools add friction, store excessive data, and still fail to prevent unauthorized underage transactions. As digital entertainment and online wagering become mainstream worldwide, the consequences of non-compliance have become severe. In 2024, online age verification technologies accounted for nearly USD 2.5 billion in global revenue. With regulatory pressure rising worldwide, the market is forecast to surge to USD 7.1 billion by 2033, accelerating at a CAGR of 15.7% from 2026 onward. Many enterprises are transitioning toward stablecoin remittance models, but without integrated age controls, the regulatory risk remains unresolved.

Age-verified stablecoin payments solve this escalating challenge. By validating user eligibility at the transaction layer itself, enterprises can confidently operate in complex markets such as iGaming, sports betting, digital collectibles, and more. Only qualified users are authorized, and minors are systematically excluded. This creates a secure revenue environment backed by automation rather than human-dependent screening.

Stablecoin Remittance: Enabling Safe and Scalable Market Expansion

Stablecoin remittance introduces a faster, cheaper, and more reliable payment infrastructure for digital businesses. Traditional banking rails often block high-risk industries, delay settlement, or drive fees higher. Stablecoins remove these barriers through:

- Instant cross-border settlement

- Reduced processing fees

- No dependence on local acquiring banks

- Frictionless payout capabilities

Source: Financial Times

This rapid expansion reinforces why enterprises are increasingly deploying white-label stablecoin remittance software to enter new jurisdictions swiftly, while maintaining compliance and operational control. As regulated digital entertainment explodes internationally, enterprises must adopt payment options that are fast, compliant, and user-centric. Stablecoin allows companies to enter new regulated regions quickly while remaining compliant and profitable. Age eligibility verified upfront keeps minors out and revenue flows in.

What Age-Verified Payments Solve (The Before vs After Comparison)

Today’s regulated digital enterprises face problems that directly threaten revenue, licensing, and long-term survival. Age-verified stablecoin payments transform those vulnerabilities into measurable business advantages.

| Enterprise Struggle Today | Impact | With Age-Verified Stablecoin Payments |

|---|---|---|

| Minors bypass KYC | Legal risk + chargebacks | Eligibility is checked inside every transaction |

| Payment failures in regulated markets | Lost revenue | Stablecoins guarantee access + approval |

| Data-heavy onboarding | User abandonment | Zero knowledge keeps it instant |

| Banking gatekeeping | Market restrictions | Global commerce unlocked |

Once the payment flow only allows verified adults, compliance becomes proactive instead of reactive. Enterprises gain continuous protection because age eligibility is enforced before funds ever move, not after a violation has already occurred. Risk teams spend less time on remediation and more on optimizing growth. Regulatory audits become smoother because every transaction already aligns with jurisdiction requirements.

This helps brands strengthen trust with users, investors, and partners who expect responsible innovation, especially in high-restriction digital markets. By adopting white-label stablecoin remittance software, enterprises deploy this compliance transformation quickly and cost-efficiently, creating a future where digital payments remain fast, secure, and always aligned with global safety standards.

Talk to an Age-Verified Payments Architect

The Tech Breakthrough: Zero-Knowledge Age Verification

Users want privacy. Enterprises want compliance. Zero-knowledge proofs deliver both with mathematically guaranteed trust.

How it works:

- A user verifies “over X age” a single time through a secure identity check

- A cryptographic proof is generated instead of storing personal data

- Every future transaction automatically validates age eligibility in milliseconds

- Sensitive identity attributes are never exposed or stored in large databases

This design eliminates repeated onboarding, reduces friction, and prevents data breaches that could harm both users and the enterprise’s reputation. According to industry analysis, zero-knowledge proof adoption is growing rapidly because it enables verification without exposing sensitive attributes. It aligns perfectly with the principles driving regulated digital commerce growth, especially in markets scaling stablecoin remittance for faster, global payments.

This is why Switzerland, a global leader in data-protection standards and regulated digital finance, is advancing privacy-first verification throughout financial infrastructure. Enterprises can now ensure age compliance without breaching user confidentiality.

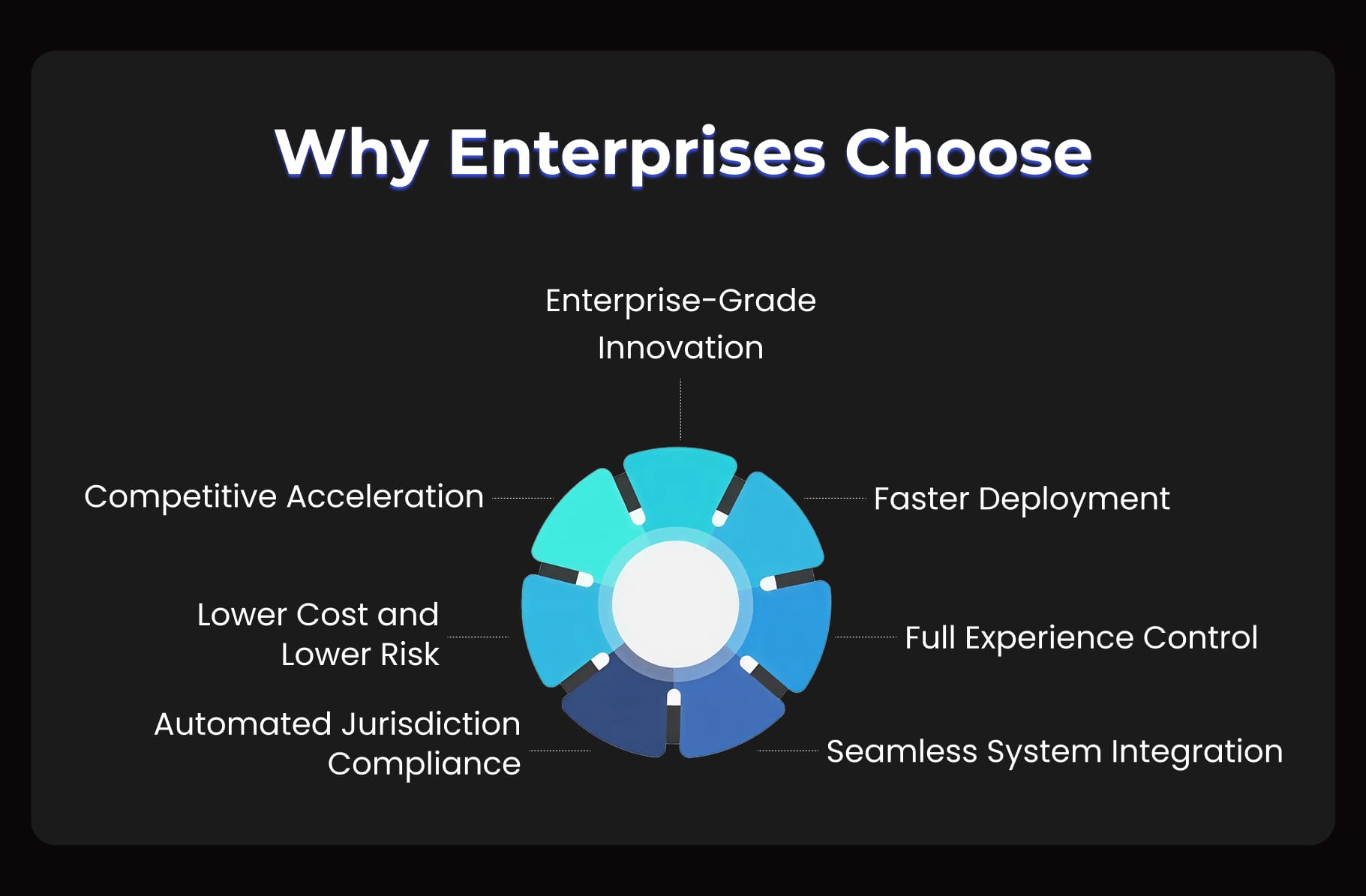

Why Enterprises Choose White-Label Stablecoin Remittance Software for Speed

Enterprises need a compliant digital payment infrastructure that can launch fast without engineering delays. White-label stablecoin remittance software provides a ready-to-deploy solution that balances operational control, speed, and regulatory assurance.

- Faster Deployment: Enterprises accelerate go-to-market by launching compliance-ready payment systems without lengthy development. Operational delays diminish, and digital commerce expansion happens on the timelines business leaders expect.

- Full Experience Control: Your branding, user journeys, and product policies remain fully intact. Age-based access and permission structures adapt automatically to your commercial standards and pricing strategies without friction for verified users, while stablecoin remittance ensures every transaction remains fast, compliant, and globally accessible.

- Seamless System Integration: Compliance workflows remain unified because the platform connects easily with existing KYC, AML, identity verification, and payment service providers. Users complete onboarding quickly without repeating verification tasks.

- Automated Jurisdiction Compliance: Regional age and spending rules are enforced before each transaction takes place. This allows enterprises to scale into regulated digital markets, including the UAE, with confidence that every approval aligns with legal expectations.

- Lower Cost and Lower Risk: By leveraging proven infrastructure, enterprises avoid massive development costs and reduce ongoing technical overhead. Continuous updates ensure regulatory alignment without requiring constant internal intervention, allowing leadership teams to focus on growth instead of system maintenance.

- Competitive Acceleration: Stablecoin remittance enables rapid cross-border payout cycles and unlocks regions that banks hesitate to support. Leaders capture early advantage while slower competitors remain stuck in development or compliance review.

- Enterprise-Grade Innovation: Growth-focused businesses rely on white label solutions to ensure age restriction, auditability, and revenue scalability stay embedded at the core of their payment infrastructure.

By choosing a white-label solution that prioritizes compliance from day one, enterprises secure speed to market and lasting operational stability with less complexity.

Book Your Compliance Strategy Consultation

Enterprise Value: The ROI Executives Actually Care About

| Business Outcome | Benefit Delivered |

|---|---|

| Faster onboarding | Fewer user drop-offs → higher revenue |

| Zero chargebacks from minors | Lower operational cost |

| Safer risk profile | Increased institutional investment |

| Quicker licensing approvals | Faster go-to-market |

| Responsible brand positioning | Long-term customer trust |

This is why enterprises increasingly partner with a stablecoin remittance development company that embeds compliance into transaction logic from day one. Instead of reacting to risk, enterprises move forward with confidence, knowing that every approved transaction strengthens their competitive position and long-term valuation.

Final Thought for Decision Makers

Consumer protection has become a core business requirement, not an add-on. Enterprises that adopt age-verified stablecoin payment rails now secure long-term advantages in trust, approvals, and global reach. Growth in regulated digital commerce belongs to innovators who safeguard users and stay ahead of compliance expectations. Advanced stablecoin development solutions that automate eligibility and privacy controls enable enterprises to scale compliance securely and confidently.

Antier, a renowned White-label stablecoin remittance software development company, helps forward-thinking enterprises align compliance and revenue from day one. We design systems where every transaction builds trust and every approval accelerates market entry.

The future of responsible digital payments is already here.

Let us help you lead it.

Frequently Asked Questions

01. What is the significance of stablecoin remittance in regulated digital businesses?

Stablecoin remittance has transformed cross-border money transfers for regulated digital businesses by improving payment speed, but it also raises the challenge of ensuring transactions originate from eligible users, particularly in age-restricted sectors.

02. How does age verification impact enterprises in regulated digital sectors?

Age verification is crucial for enterprises in regulated sectors like iGaming and digital entertainment, as a single underage transaction can lead to severe penalties and damage brand trust, making compliance essential for sustainable operations.

03. What are the benefits of integrating age verification into stablecoin payments?

Integrating age verification into stablecoin payments allows enterprises to validate user eligibility seamlessly, enhancing compliance, speeding up approvals, and ultimately transforming age verification from a burden into a growth advantage in the digital commerce landscape.