CryptoCurrency

Analog Announces Fair Launch as Fjord Foundry LBP to Maximize Access to $ANLOG Token

Web3 interoperability protocol Analog has announced that it’s hosting a liquidity event on Fjord Foundry’s token issuance platform. On January 21, Analog will kick off the launch of its $ANLOG token through a Liquidity Bootstrapping Pool (LBP) on Fjord Foundry. The event marks a significant step in Analog’s journey to establish a fully interoperable blockchain ecosystem.

Running for 48 hours, the LBP aims to foster community-driven price discovery and equitable token access, reflecting Analog’s commitment to building open and decentralized infrastructure. Tokens purchased via the LBP will be fully unlocked in time for the forthcoming Token Generation Event (TGE). The $ANLOG LBP will be live on Fjord Foundry from January 21, 2025, 06:00 AM CET and run until January 23, 2025, 05:59 AM CET.

$ANLOG Equal Access Through LBP

LBPs, which have gained traction as a fair token distribution mechanism, utilize a dynamic pricing structure that adjusts based on participant demand. This approach contrasts with traditional token launches, where fixed prices often benefit larger, early participants at the expense of smaller contributors. By leveraging Fjord Foundry’s infrastructure, Analog will ensure that $ANLOG’s distribution is as broad as possible, which is ideal when launching a new token or network.

For Analog, the choice to host its $ANLOG sale via an LBP on Fjord Foundry was an obvious one. LBPs are uniquely designed to democratize access to tokens by enabling prices to start high and decrease gradually over time until they stabilize based on market demand. This model ensures that contributors set the token’s valuation, avoiding the speculative surges often associated with conventional launches.

Fjord Foundry’s community-focused token sale platform has supported a string of successful projects through its LBP framework. Its infrastructure aligns seamlessly with Analog’s goal of building an ecosystem that prioritizes accessibility and fairness for developers and end-users alike. Having recently closed a $5M seed round, taking its total funding to $21M, Analog is now well on course to achieve its goal of providing the interoperable layer to connect all major blockchains.

$ANLOG in Action

The $ANLOG token is central to Analog’s Layer 0 protocol that facilitates seamless cross-chain data and transaction flows. Analog’s flagship innovation, Timechain, enables decentralized applications to securely operate across multiple blockchains. This ensures developers are not siloed within a single network but can build solutions that transcend traditional boundaries.

$ANLOG acts as the utility token within this ecosystem, empowering developers to interact with Analog’s cross-chain infrastructure. From paying transaction fees to incentivizing validator participation, $ANLOG is a cornerstone of Analog’s drive to create a scalable, interconnected web3 landscape. As Analog’s network grows, so too does the significance of $ANLOG in fostering cross-chain dapps that allow data and assets to flow freely.

It can be hard to visualize what amorphous concepts such as interoperability look like in reality, but there’s already a taster of what the Analog community can expect in the form of Zenswap. Developed using Analog’s tech stack, the cross-chain DEX enables assets to be swapped across such chains as TON, Solana, and Bitcoin, using USDC-based routing. Once Analog’s mainnet deploys, it will be joined by a host of other omnichain dapps from over 50 partners that are already under development.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice

CryptoCurrency

5 cryptos for 2025

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Analyzing 5 cryptos for 2025, led by new contender Rexas Finance.

2025 is giving bullish sentiment with Donald Trump as the new U.S. president. Investors are looking to position themselves in order to capitalize on this bullish trend, and top analysts have identified some of the coins with the potential to drive riches.

Rexas Finance, Nodle, Bifrost, Shiden Network, and KILT Protocol have stood out. Of the five, Rexas Finance is making waves with its transformative approach to real-world asset (RWA) tokenization and its selling out presale.

Rexas Finance

Rexas Finance has caught the eye of both investors and analysts due to its focus on RWA tokenization. This is a new way of tokenizing physical and digital assets, offering fractional ownership and greater liquidity.

RXS is in Stage 11 of its presale, which is currently priced at $0.175, having already raised $36,381,133 out of its $41 million funding target. The presale has been on a lot of people’s radar, with 399 million tokens already bought out of a total of 425 million.

Rexas Finance is listed on CoinMarketCap and CoinGecko, further boosting confidence. The project also has a Certik audit, showing that it takes its security and transparency seriously. As the presale continues, RXS could soar to incredible price heights in 2025.

Nodle

Another cryptocurrency that is picking up speed is Nodle, which is worth about $0.00247. Nodle has gotten investors looking for potential growth, witnessing a price increase of almost 8% in the past 24 hours.

Analysts believe that Nodle could offer an ROI of about 320%. Therefore, as a decentralized wireless network, it is well-placed to take advantage of the steadily increasing demand.

Bifrost

Built on Bifrost’s proprietary technology, which aims to bridge different blockchain ecosystems, the token is currently trading at $0.2162, with minor growth of 1.62% over the past week.

It is anticipated that it will scale to the all-time high (ATH) of $0.81, around 300% growth. As more projects try to operate across blockchains, Bifrost could be at the center of making these connections possible.

Shiden Network

Shiden Network also hits the headlines, trading at around $0.1425, up 3.03% in the 24 hours. Analysts believe that Shiden will gain 350% and reach $0.47.

Shiden Network is a multi-chain decentralized application platform that seeks to improve scalability and usability for developers and users.

KILT Protocol

KILT Protocol currently trades at $0.1417. The KILT token has also been the subject of bullish analysis, with a price target of $0.51 or about 400% ROI.

With privacy and security of digital interactions remaining an issue, KILT’s decentralized identity solutions come at the right time.

Conclusion

2025 presents a unique opportunity, with analysts listing coins with the potential for significant gains. Among the five, Rexas Finance stands out as a beacon with a potential ROI of o 12,740%.

For more information on Rexas Finance, visit their website, X, or Telegram.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Trump-Backed Crypto Venture To Extend Token Sales

The Financial Times reported on Monday that World Liberty Financial (WLF), the digital asset venture associated with President Donald Trump, has successfully raised $1 billion through its token sales.

Initially launched in October with a goal of selling only 20 billion WLF tokens, the decentralized finance’s (DeFi) venture token surpassed this target by selling 21 billion tokens, demonstrating robust demand despite a rocky start.

Eric Trump Champions World Liberty Financial At ‘High-Profile Event’

Per the report, this surge in interest comes as WLF announces the release of an additional 5 billion tokens from its total supply of 100 billion, citing “massive demand and overwhelming interest.”

The Trump family’s foray into the cryptocurrency space has been marked by a blend of enthusiasm and controversy. Over the weekend, both Donald Trump and his wife, Melania, launched their own memecoins, which experienced rapid spikes in value.

Related Reading

Eric Trump, actively promoting World Liberty Financial, also attended a “high-profile crypto event” in Washington, celebrating the intersection of politics and digital assets as his father prepares for a new administration.

Trump’s embrace of the crypto sector during his election campaign has resonated with industry executives, many of whom anticipate a more favorable regulatory environment compared to the policies of the outgoing Biden administration.

The appointment of crypto-friendly figures, such as Paul Atkins to lead the Securities and Exchange Commission (SEC) and David Sacks as the newly created artificial intelligence (AI) and Crypto Czar, further underscores this potential shift. However, the venture has not been without its critics.

Trump’s Memecoins Spark Controversy

Concerns arise over the limited rights associated with WLF tokens, which provide holders with only minimal voting rights and no economic entitlements. Furthermore, the tokens cannot be traded or sold back to WLF, leading to questions about their long-term value and utility.

Compounding the intrigue surrounding WLF, notable crypto entrepreneur and TRON blockchain founder Justin Sun recently revealed a significant investment of $45 million into the venture, raising his total stake to $75 million.

The market’s reaction has been volatile, exemplified by Bitcoin’s brief spike to a record high of over $109,000 on Monday, followed by a retraction toward $102,000 after Trump’s inauguration speech.

Analysts now speculate that upcoming executive orders from Trump could bolster the crypto industry’s fortunes in the US, although skepticism lingers among some industry veterans.

Nic Carter, a venture capitalist, articulated concerns about the “ethical implications” of a sitting president engaging in business ventures that could be perceived as “conflicts of interest.”

Related Reading

The launch of Trump’s memecoins has also stirred controversy, with the Donald Trump memecoin experiencing a sharp decline from a weekend high of $75 to $52.

Meanwhile, the Melania Trump memecoin, which disrupted the market dynamics of the Donald coin, saw its value fluctuate significantly from a high of $13.64 to $8.43.

Bernstein analysts have noted that this “chaotic crypto era” marks a critical juncture, suggesting that government engagement with cryptocurrencies may redefine the relationship between leadership and emerging technologies.

The analysts assert that the launch of Trump and Melania’s memecoins signifies a potential regulatory shift in the country, where digital assets could serve as a direct connection to a mass audience.

Featured image from DALL-E, chart from TradingView.com

CryptoCurrency

MicroStrategy Bitcoin (BTC) Holdings Rise to 461K

Disclaimer: The analyst who wrote this piece owns shares of MicroStrategy (MSTR).

Led by Executive Chairman Michael Saylor, MicroStrategy (MSTR) has again added to its massive bitcoin (BTC) stack.

In the week ending Jan 19, the company purchased 11,000 BTC for $1.1 billion, taking its total holdings to 461,000 BTC. This latest bitcoin average purchase price was $101,191, increasing MicroStrategy’s overall average purchase price to $63,610.

Once again, Michael Saylor teased the announcement on X on Sunday with the caption, “Things will be different tomorrow.” Since the tweet, Saylor has posted multiple photos of himself with Eric Trump, crypto czar David Sacks and Robert Kennedy Jr.

MSTR shares are down modestly in premarket action, with bitcoin trading at $104,500, lower by a hair from late Friday afternoon. U.S. stocks were closed on Monday due to the MLK holiday.

CryptoCurrency

Dogwifhat and Pepe Price Predictions Now Trump's Meme Coin Has Hit The Market; Remittix Could Rally 5000% In 2025

Although cryptocurrency has always been an unpredictable journey, 2025 may be the year that it takes things to the next level. Remittix, still in its presale phase, is receiving a lot of interest among the new competitors. Having raised around $4 million to date, some analysts estimate a 100x spike in 2024, making Remittix’s 2025 price rally one of the largest in the meme currency field.

You’re not the only one who is unsure if now is the right moment to join in on the fun. When compared to other up-and-coming stars like Dogwifhat and Pepe coin, investors are closely monitoring Remittix. However, why the hype? In the upcoming year, will Remittix surpass Dogwifhat, or are both tokens set for a huge surge?

Why Are Investors Flocking to Meme Coins in 2025?

Although meme coins have always been popular, the industry appears to be expanding to unprecedented levels in 2025. Meme coins are still very much in use because of the hype around tokens like Dogwifhat and Pepe coin. Coins like Dogwifhat and Pepe coin are becoming popular as both investors and cryptocurrency fans get on the meme coin bandwagon. If you know where to search, meme coins may yield enormous rewards for both novice and experienced cryptocurrency investors.

Remittix is also making headlines for all the right reasons. Investors looking for the next great thing have taken notice of Remittix, whether it is because of its success in the presale or the community it fosters. On the other hand, Dogwifhat price prediction is also showing potential, although it hasn’t generated as much excitement as Remittix yet.

It is important to remember that meme coins are more than just trends or jokes. They are a developing area of the cryptocurrency industry where early investors stand to gain significantly. Remittix’s 2025 price surge may provide huge profits, but only for investors who act quickly.

Why Is Remittix Getting So Much Attention?

Despite Remittix still being in its presale phase, it is already showing signs of huge potential. The excitement around the Remittix 2025 price surge is rapidly growing, with over $3.7million raised. With predictions that this coin will increase 100 times in the next year alone, early investors are thrilled. More people are joining the presale in an attempt to reserve their seats as it becomes more popular.

Many experts think that Remittix will surpass Dogwifhat and Pepe in no time. They see it as a new contender that is bound to take over the market in 2025.

How Do Dogwifhat and Pepe Coin Compare to Remittix?

Dogwifhat price analysis makes it evident that the meme coin market is expanding and changing. Investors want to know if Remittix will seize the lead or if Dogwifhat can keep beating forecasts. Many people think that Remittix may be the next big thing in 2025, even if Pepe and Dogwifhathave had their share of fame.

Remittix is now one of the most talked-about tokens due to its success during the presale, and the hype around it has already surpassed that of many others. The Remittix 2025 price rally could be one of the most significant events in the crypto space. Remittix offers a fresh, exciting opportunity for those looking to get in on a token with significant upside potential; Remittix’spotential is enough to get more people on board.

But what if Dogwifhat is still in the game? Though the future is still very much up in the air, many predict that the battle between Dogwifhat and Remittix might heat up.

Don’t Miss Out On Remittix

With the 2025 price rally approaching, now is the ideal moment to invest in Remittix, which has already demonstrated that it is a competitor in the meme coin space. Remittix is proving to be a must-watch token in the coming year, regardless of whether you’re a fan of Dogwifhat, Pepe coin, or other meme coins like Pepe. Don’t pass up this fantastic chance to get on the winning team.

Find out more about Remittix and be a part of its future by checking its presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Trump pardons Silk Road creator Ross Ulbricht

US President Donald Trump has followed through on his promise to pardon Ross Ulbricht, the founder of the online drug market Silk Road, who was imprisoned for over a decade.

CryptoCurrency

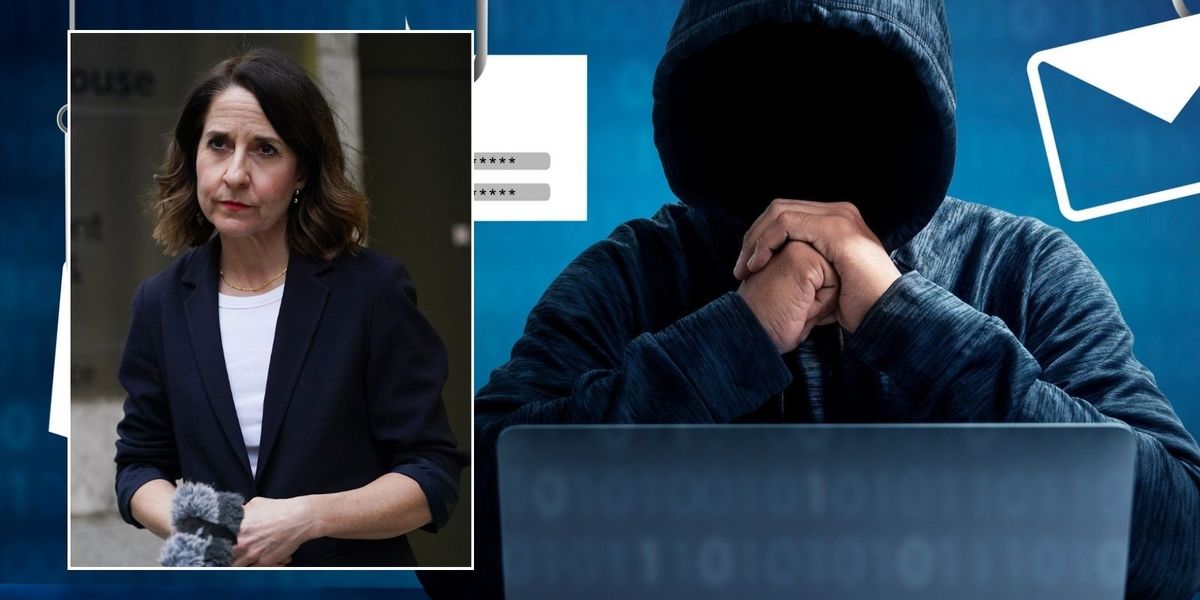

DWP launches ‘biggest benefit fraud crackdown’ as Labour unveils new controversial tough measure

Benefit fraudsters who cheated taxpayers out of £7billion last year could face driving bans under sweeping new powers announced by the Department for Work and Pensions (DWP).

The legislation, introduced in Parliament today, represents the biggest fraud clampdown in a generation. Repeat offenders who refuse to repay their debts could be disqualified from driving for up to two years.

The new measures will give DWP investigators the power to apply for search warrants, allowing them to work alongside police to search premises and seize evidence like computers and smartphones.

The crackdown comes as part of wider plans from the Labour Government to save £8.6billion over five years through tackling welfare fraud and error. Officials say the current system is costing taxpayers around £10billion annually, with £35billion incorrectly paid out since the pandemic.

The new legislation will target fraudsters who owe £1,000 or more and have repeatedly ignored requests to repay their debts. DWP officials will need to apply to courts to justify suspending driving privileges in these cases.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The Government has unveiled new rules to clampdown on benefit fraudsters

GETTY

The Bill is expected to save the Department £1.5billion over the next five years. The measures will be based on principles of fairness and proportionality, with driving bans used only as a last resort.

Officials will prioritise negotiating affordable and sustainable repayment plans with offenders before pursuing more severe penalties. The legislation forms part of the government’s Plan for Change, which aims to reform the health and disability welfare system.

New proposals for reforming health and disability benefits are expected in the Spring. Work and Pensions Secretary Liz Kendall said: “We are turning off the tap to criminals who cheat the system and steal law-abiding taxpayers money.”

She emphasised the serious consequences for fraudsters, including the potential loss of driving privileges in extreme cases. “Backed up by new and important safeguards including reporting mechanisms and independent oversight to ensure the powers are used proportionately and safely,” Kendall added.

DWP Minister Liz Kendall is promising to tackle benefit fraud

PA

“People need to have confidence the Government is opening all available doors to tackle fraud and eliminate waste, as we continue the most ambitious programme for government in a generation – with a laser-like focus on outcomes which will make the biggest difference to their lives as part of our Plan for Change.”

Under the new powers, DWP will be able to recover money directly from bank accounts of those who owe money and refuse to pay, despite having the means to do so.

However, the Department will not have direct access to people’s bank accounts. The legislation will allow DWP to request bank statements to prove debtors have sufficient funds to repay what they owe.

These measures are part of a modernised approach to catching fraudsters and preventing overpayments. The new system aims to keep pace with sophisticated fraud while ensuring legitimate claimants receive the correct benefits.

Officials say this will help prevent vulnerable customers from falling further into debt. The powers will apply to individuals who are not on benefits or in PAYE employment but still owe money to the Department. The legislation includes comprehensive safeguarding measures to protect vulnerable customers.

LATEST DEVELOPMENTS:

Benefit fraudsters could be banned from driving under Government plans

GETTY

Staff will receive high-level training on the appropriate use of new powers. New oversight and reporting mechanisms will be introduced to monitor how these powers are used.

Furthermore, Government will develop Codes of Practice, which will be subject to consultation during the Bill’s passage. All powers will have clearly defined scope and limitations, including the right to appeal decisions.

The Cabinet Office’s Public Sector Fraud Authority will receive additional powers under the new legislation. Georgia Gould, Minister in the Cabinet Office, said: “During the pandemic, when people and businesses needed government support the most, some people stole public money for their own personal gain.”

The time limit for civil claims against Covid fraud will be doubled from six to twelve years. This extension will give investigators more time to examine complex cases and apply new powers retrospectively. These powers include the ability to raid properties and retrieve money from Covid fraudsters’ bank accounts.

CryptoCurrency

PEPE and Fartcoin target gains, PropiChain could rise from $0.01 to $3

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

While PEPE and Solana’s Fartcoin target gains, PropiChain is set to steal the spotlight with its potential rise from $0.01 to $3.

The crypto market is dynamic as ever, with meme coins like PEPE and Solana’s Fartcoin capturing the spotlight with their price surges. Often rooted in humor and online culture, these projects have gained traction among retail investors seeking quick profits.

While PEPE aims to use its established meme status, Fartcoin capitalizes on Solana’s high-performance blockchain to drive interest. Both PEPE and Fartcoin have set ambitious targets, drawing attention to their potential. However, their speculative nature raises questions about long-term sustainability.

Amid the hype surrounding these meme coins, PropiChain (PCHAIN) is emerging as a serious contender for the top gainer position in the crypto space in Q2 2025. Market experts say PCHAIN is poised to rally from $0.01 to $3.

Focused on transforming the real estate industry, estimated to be worth $600 trillion, through blockchain technology, PropiChain offers a utility-driven narrative.

PEPE and Solana’s Fartcoin

PEPE has become a standout player in the memecoin ecosystem. While the memecoin has evolved into a symbol of community-driven crypto success, the volatile nature of meme-based assets still poses a big concern for investors.

The Solana ecosystem has birthed many projects, but few are as notable as Fartcoin. Combining humor with innovation, Solana’s Fartcoin has captured attention with its playful branding and unique tokenomics. Fartcoin’s rise is attributed to its viral marketing campaigns and a strong push from influencers.

PropiChain

While PEPE and Fartcoin thrive on humor and virality, PCHAIN is carving a niche in the rapidly growing tokenized real estate market. Launched to democratize property ownership, PCHAIN enables users to invest in fractional shares of real estate assets through blockchain technology.

The emphasis on tangible utility and real-world application sets PCHAIN apart from meme-based assets. The platform is thus poised to capture a percentage of the $600 trillion real estate market.

By deploying blockchain’s transparency and efficiency, PCHAIN aims to lower barriers to entry for real estate investment while providing liquidity to a traditionally illiquid market.

Why PropiChain could rise from $0.01 to $3

PCHAIN is positioned for a massive rally that could see early presale investors enjoy over 29,000% ROI.

- Growing demand for tokenized assets

The tokenization of real-world assets is gaining significant traction, with the market projected to hit $16 trillion. PropiChain is well-positioned to capitalize on this shift, offering an easy-to-use platform for both retail and institutional investors.

PropiChain’s collaborations with established players in the real estate industry add credibility to its model. These partnerships are expected to drive adoption and increase the value of its native token, PCHAIN.

As the broader crypto market looks for projects with real-world utility, PCHAIN’s value proposition stands out.

PropiChain’s unique features

PropiChain aims to reshape the real estate industry by using advanced technology to redefine property transactions. The platform will set new standards for buying, selling, and investing in real estate globally with four transformative features:

- Immersive virtual property exploration

The platform will transform how investors and buyers scout properties using cutting-edge Metaverse technology. It will facilitate remote property exploration through immersive 3D virtual tours, overcoming geographical limitations and making real estate investment accessible to a wider audience.

By enabling real-time property assessments without physical visits, investors can save time and money.

- Smart contracts for automated and secure transactions

The platform will utilize blockchain-based smart contracts to automate critical real estate processes. These self-executing digital agreements can handle tasks such as ownership transfers, lease management & agreement, and rental payments, significantly reducing the need for intermediaries like brokers and agents.

- AI-driven investment insights

The platform will incorporate artificial intelligence to optimize real estate investment strategies. Its AI-powered virtual assistants and chatbots will provide round-the-clock support, helping investors navigate the real estate market seamlessly.

Additionally, its predictive AI system will analyze market trends, predict property value changes, and deliver data-driven recommendations. These insights empower investors to make informed decisions, boosting profitability while minimizing risks.

- Real estate tokenization for broader investment opportunities

PCHAIN will enable the tokenization of real-world assets (RWA), turning physical properties into digital tokens. This approach will allow for fractional ownership of high-value real estate, increasing market liquidity and democratizing access to property investments.

The PropiChain presale

PropiChain’s focus on real-world utility combined and its potential rally from $0.011 to $3 positions it for the top-gamer position in 2025.

The project raised over $1.3 million in the first presale round and has already crossed the $970,000 mark in the ongoing second presale round. This underscores the high confidence of investors in the project’s potential. After this presale round, the token price will rise by over 109% for the third and final presale round.

The token is listed on CoinMarketCap, a statement of the project’s readiness to do bigger things in the crypto space. Additionally, BlockAudit, a top blockchain security company, audited the project’s smart contract and certified that it has no vulnerability.

For more information on PropiChain, visit their website or online community.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Vivek Ramaswamy Resigns as D.O.G.E Co-Lead to Run for Ohio Governor: Report

Biotech entrepreneur and prominent crypto supporter Vivek Ramaswamy has reportedly stepped down from his role as co-lead of the Department of Government Efficiency (DOGE).

His decision is said to stem from a desire to run for governor of Ohio next year, with the current occupant of the seat, Mike DeWine, ineligible for reelection in 2026 since he is serving his second four-year term in office.

A Political Pivot for Ramaswamy

It is not the first time Ramaswamy has shown interest in high-profile political roles, having sought the Republican nomination for president in 2024. He had also shown interest in succeeding Vice President JD Vance as the senator for Ohio before Governor DeWine selected his deputy, Jon Husted, to fill the vacancy.

His departure from D.O.G.E, first reported by The Associated Press, is in line with the department’s new structural guidelines, which require members to step back from active roles if pursuing elected office.

The Cincinnati native has been a vocal advocate for crypto, criticizing the regulatory approach to the assets in the U.S. and even accusing the Biden administration and Wall Street of trying to “suppress” the industry.

He praised Grayscale’s victory against the Securities and Exchange Commission (SEC) when it wanted to convert its Bitcoin Trust into a spot exchange-traded fund (ETF), saying the win made it possible to keep BTC and blockchain innovations in the U.S. instead of pushing them overseas.

Towards the end of last year, his company, Strive Asset Management, filed for a BTC bond ETF with the SEC that would provide institutional investors and everyday Americans easy access to financial instruments based on the number one cryptocurrency.

Musk Left as Sole Leader

President Donald Trump appointed the 38-year-old to lead DOGE alongside Tesla and SpaceX CEO Elon Musk soon after winning the elections in late 2024.

Launched under his “Save America” agenda, Trump formally established the task force via an executive order on the day of his inauguration. It aims to modernize the federal government’s operations by slashing inefficiencies, reducing regulatory red tape, and streamlining government spending.

Alongside its bold goals, the initiative drew attention due to its playful acronym, which is similar to the ticker of the largest meme coin by market capitalization, Dogecoin. Incidentally, Musk, who is now its sole leader, is a long-term supporter of Dogecoin, even earning the nickname “Dogefather” for his endorsement of the token.

The billionaire businessman recently proposed a public “leaderboard” that would highlight the most egregious examples of government inefficiency, an idea he described as “tragic” and “entertaining.”

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Bitstamp to Roll Out Regulated Derivatives Trading in Europe: Sources

Bitstamp, the longest running cryptocurrency exchange, plans to roll out regulated crypto derivatives trading in Europe, according to two people with knowledge of the matter.

With its long-standing focus on compliance, Bitstamp is one of a select group of crypto trading platforms to hold a Markets in Financial Instruments (MiFID) license, a pan-European regulatory framework for trading securities and derivatives, which was amended in 2022 to encompass crypto assets.

“With its MiFID license in Europe, Bitstamp plans to launch a fully regulated perpetual swap offering,” one of the people said.

The arrival of regulatory clarity in Europe, when it comes to crypto and tokens, has prompted the planned introduction of crypto derivatives trading from firms holding MiFID II licenses, such as Point72 Ventures-backed D2X, and Backpack Exchange, which is in the process of acquiring the remains of FTX EU and its licenses.

The vast majority of crypto derivatives volume is offshore and the aim of these new entrants is to shift market dominance away from the likes of Panama-based centralized exchange Deribit.

In June of last year, it was announced that fintech giant Robinhood would be acquiring Bitstamp, whose future looks bright, not only in Europe but also in the U.S. where it holds multiple state licenses, including a coveted New York State BitLicense.

Bitstamp declined to comment because the plans are not yet public.

CryptoCurrency

BlockDAG x HackerEarth Plan Global Hackathons for 7.6M Developers — Fantom (FTM) Price & Cardano News

As we step into 2025, the blockchain scene is buzzing with innovation, led by major players like Cardano, Fantom, and BlockDAG. Recent Cardano news highlights its collaboration with FC Barcelona under the “Barça Vision” initiative, showcasing how blockchain technology is enhancing fan engagement through ADA rewards and NFT offerings. On the other hand, Fantom price remains under scrutiny as the platform works to regain stability following significant sell-offs by major holders, raising concerns about its future price trajectory.

Amid these developments, BlockDAG (BDAG) is coming out ahead, with a bold vision that includes fostering over 200 Web3 projects and launching global hackathons in partnership with HackerEarth. By tapping into HackerEarth’s network of 7.6 million developers, BlockDAG is dedicating itself to laying down the infrastructure for large-scale decentralized innovation. Having already raised over $182.5 million in its presale, with BDAG coins priced attractively at $0.0248, it’s carving out a promising niche for buyers looking for significant returns.

Cardano News: FC Barcelona Partnership Aims to Reshape Fan Experience

In recent Cardano news, the cryptocurrency has stepped into the sports arena through a significant partnership with FC Barcelona, unveiled under the club’s “Barça Vision” project on January 10, 2025. This collaboration seeks to revolutionize fan interaction by integrating blockchain tech to offer new job prospects, blockchain education, and a rewards system packed with ADA tokens and NFTs.

This announcement gave Cardano’s ADA token a nice 4% bump to $0.95, despite a tough market week that saw it slide down 11%. Cardano continues to hold strong as the world’s 9th largest cryptocurrency by market cap, which currently stands at $33.5 billion, signaling a robust and expanding ecosystem.

This venture highlights the transformative potential of blockchain in professional sports, showcasing ADA’s critical role. The growing use cases and adoption rates offer exciting opportunities for those investing in innovative digital assets.

Fantom (FTM) Price Faces Challenges Amid Whale Activity

The Fantom price has seen a modest 3% recovery in the last 24 hours, but it’s still down by 20% over the past week, struggling to reverse a bearish trend. The Average Directional Index (ADX), a tool for measuring trend strength, points to a weakening downtrend at 31.4, suggesting the market could be moving towards stabilization.

Compounding the issue, there’s been a notable decline in activity from large holders, increasing selling pressure. The count of wallets holding between 1 million and 10 million FTM dropped from 84 to 69 in just one week, impacting the coin’s liquidity.

Currently, Fantom’s price is wavering around $0.618 at a crucial support point. Falling below this could push prices down to test $0.50, while any recovery effort could send it climbing towards the $0.879 resistance level. Fantom continues to be a coin worth watching as it aims to regain stability and momentum.

BlockDAG’s Bold Strategy: 200+ Web3 Projects & Worldwide Hackathons

Looking ahead, BlockDAG is prepping for a groundbreaking year with extensive plans, including a significant alliance with HackerEarth. This partnership will facilitate four global hackathons aimed at engaging between 10,000 to 15,000 developers from HackerEarth’s comprehensive network of 7.6 million tech experts.

These hackathons are crafted to spur innovation and foster a vibrant global community of developers. BlockDAG’s overarching ambition is to stimulate the development of more than 200 Web3 projects within its ecosystem, giving developers the tools to innovate, test, and deploy cutting-edge decentralized applications (dApps), while showcasing what the BlockDAG Network can do.

With a detailed roadmap and a visionary outlook for the future, BlockDAG is positioning itself as an increasingly appealing buying option. Market analysts estimate that BDAG, currently priced at $0.0248, could potentially soar to $1 by 2025. Its sophisticated technology, burgeoning ecosystem, and practical utility are catching the eyes of buyers eager for top-tier opportunities in today’s crypto market.

And the momentum is only building. BlockDAG’s presale has already netted over $182.5 million and is quickly advancing toward its $600 million target. As more developers join the ecosystem and drive its expansion, BlockDAG is affirming its role as a pivotal player in the Web3 domain. The outlook is bright for both developers and users venturing into the decentralized opportunities that BlockDAG offers.

Best Altcoins For 2025

As Cardano and Fantom each navigate their unique challenges and opportunities, BlockDAG emerges as the standout blockchain platform for growth and innovation. Its ambitious initiatives, including organizing hackathons and expanding its Web3 project ecosystem, demonstrate its dedication to scalability and practical utility.

Market experts forecast that BDAG could hit $1 by 2025, buoyed by its solid presale results and a strategy centered around developer engagement. For buyers poised to ride the next big wave in the crypto landscape, BlockDAG presents the most compelling case, blending immediate potential with a long-term strategy that solidifies its standing as a frontrunner in the Web3 revolution.

Secure Your BDAG Today:

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login