CryptoCurrency

InQubeta: Pioneering Innovations in Crypto Crowdfunding

In the sphere of crypto crowdfunding, InQubeta emerges as a notable contender, poised to revolutionize traditional investment paradigms with its AI-driven platform.

As the crypto landscape continues to evolve, the advancements brought forth by InQubeta prompt a reevaluation of how investors engage with digital assets.

The potential for innovation, disruption, and financial gain within InQubeta’s ecosystem beckons a closer examination of the intricacies that underpin this burgeoning platform.

By exploring the nuances of InQubeta’s approach to crypto crowdfunding, a deeper understanding of the opportunities and challenges inherent in this dynamic space can be gleaned.

Market Data and Token Information

As a key player in this niche, InQubeta offers investors exposure to the rapidly evolving intersection of artificial intelligence and cryptocurrency. The token’s market data reflects its growing presence and potential within the sector, attracting traders and enthusiasts alike.

With a market cap indicative of its valuation and a notable trading volume demonstrating active interest, QUBE presents an intriguing investment opportunity for those looking to participate in the innovative landscape of AI-driven crowdfunding projects. Monitoring these metrics can provide valuable insights into the token’s performance and market sentiment.

Price Predictions and Analysis

With a focus on forecasting the value trajectory of InQubeta’s token QUBE, market analysts project a range of price fluctuations in the coming months and years. Short-term predictions suggest a varying price range from $0.002021 to $0.002309, with potential dips in December and peaks in October and November.

Looking ahead, long-term projections indicate a possible price range of $0.06134 to $0.1155 by 2026, showcasing a steady growth pattern. Investors in InQubeta should consider the high-risk nature of this investment, conducting thorough research and aligning their decisions with their risk tolerance.

Market conditions, project updates, and competition will continue to influence QUBE’s price, emphasizing the importance of staying informed for strategic investment decisions.

Investment Strategies and Considerations

Investors evaluating involvement with InQubeta should carefully assess their risk tolerance and conduct thorough research before making any financial commitments. Due to the high-risk nature and significant volatility associated with investing in InQubeta, it is crucial for potential investors to consider their risk tolerance and financial position before deciding to invest.

Conducting in-depth research into the project, its technology, team, market potential, and competition is essential to make informed investment decisions. It is advised to invest within one’s comfort zone, considering the growth potential and enduring value of InQubeta.

Long-Term Potential and Growth Outlook

Amidst the evolving landscape of crypto crowdfunding platforms, InQubeta stands out as an AI-focused innovation poised for long-term growth and potential. With its emphasis on artificial intelligence, InQubeta is positioned to capitalize on the increasing demand for advanced technologies in the crypto space.

As the platform continues to refine its AI algorithms and enhance user experience, it is likely to attract a broader user base and solidify its market position.

Additionally, the platform’s innovative approach to crowdfunding and its commitment to transparency and security bode well for sustained growth in the long run.

Factors Affecting Investor Decisions

Navigating the dynamic landscape of crypto crowdfunding platforms requires careful consideration of various factors that can influence investor decisions.

Investor decisions are significantly impacted by the level of transparency and credibility maintained by the crowdfunding platform. Factors such as the project’s whitepaper quality, team expertise, and roadmap clarity play a crucial role in attracting potential investors.

Additionally, market demand, user adoption rates, and competitive landscape influence investor sentiment towards a project. Investors also assess the tokenomics structure, utility of the native token, and potential for long-term value appreciation.

Embracing Innovation and Volatility

Given the dynamic nature of the crypto crowdfunding landscape and the pivotal role of transparency and credibility in investor decisions, embracing innovation and volatility becomes a strategic imperative for stakeholders in the InQubeta ecosystem.

Innovation serves as the lifeblood of progress within the crypto space, driving advancements in technology, user experience, and market adaptability. InQubeta, as an AI-focused crowdfunding platform, must continuously evolve to meet changing investor demands, regulatory requirements, and technological trends.

Moreover, volatility, inherent in the cryptocurrency market, demands a proactive approach in risk management and strategic decision-making.

Embracing this volatility entails a thorough understanding of market dynamics, risk assessment, and timely responses to market fluctuations.

Conclusion

InQubeta’s AI-focused crypto crowdfunding platform presents a high-risk, high-reward investment opportunity in the ever-changing landscape of digital assets.

With a focus on market data, price predictions, and long-term potential, investors must carefully consider factors such as volatility, regulatory impacts, and project updates.

Angel Marinov is the Managing Editor at Coinlabz. With extensive knowledge of crypto payments and blockchain use cases, Angel is a trusted source of accurate and timely information

CryptoCurrency

Trump-Linked Crypto Platform’s $33M Ether (ETH) Transfer Spurs ETF Staking Hopes

Sentiment towards Ethereum’s ether (ETH) has sunk to depressed levels in recent times, but the latest maneuver of President Donald Trump-related crypto platform could spur hope for a reversal.

World Liberty Financial (WLFI), the decentralized finance (DeFi) platform linked to the Trump family, this week deposited a total of 10,000 ether (ETH) worth $33 million to liquid staking platform Lido Finance (LDO) to stake and earn rewards, blockchain data by Arkham Intelligence showed. Lido is the largest ether staking platform with $31 billion of assets posted on the platform.

The transactions came after World Liberty Finance acquired more than $110 million worth of crypto assets including ETH, wrapped bitcoin (wBTC), Tron’s TRX, AAVE, LINK and Ethena’s ENA, as CoinDesk reported.

The maneuver raises hopes that regulators will soon allow staking for spot ETH exchange-traded funds. SEC Commissioner Hester Pierce, who now leads the agency’s crypto task force, said last month in an interview with Coinage that she was open to considering staking for ETFs. Former SEC Chair Gary Gensler, known for his anti-crypto stance in the industry, stepped down on January 20 with Trump entering office.

Staking would boost appeal for the investment products, letting investors earn a steady stream of yield on their holdings and reducing product fees. U.S. spot ETH ETFs combined hold $12 billion of assets, according to SoSoValue data.

The potential regulatory approval also could jolt ETH’s price and adjacent ecosystem tokens like Lido’s LDO. Ethereum’s future has been under the microscope recently, amid sagging prices relative to competitors, leadership disputes and worries over the project’s development roadmap. ETH recently dropped to a 4-year low price against bitcoin (BTC) and ceded market share in trading activity to rapidly growing blockchains like Solana.

“I will never trade ETH again after, but watch how quickly the sentiment changes when the staked ETH ETFs come through in the next few weeks,” well-followed crypto trader Pentoshi said.

“ETH will have a multi-week giga pump at some point in 2025, around staking ETF news… If [you’re] too long ETH, that’s when you dump and switch to better performing assets,” said Alex Krüger, partner at Asgard Markets, in an X post.

CryptoCurrency

Crypto Market Reacts to Trump’s Executive Orders- Lightchain AI Gains Investor Focus

The cryptocurrency market is buzzing as Trump’s executive orders send ripples across the financial landscape, prompting investors to seek resilient opportunities.

Amid this dynamic shift, Lightchain AI has captured significant investor focus with its innovative approach to blockchain and AI integration. Currently in its presale phase at $0.005625 per token, Lightchain AI has already raised $12.3 million, reflecting strong market confidence.

With groundbreaking features like its Proof of Intelligence (PoI) consensus mechanism, Lightchain AI is positioning itself as a leader in the evolving decentralized intelligence space.

Understanding Ripple Effect of Trump’s Executive Orders on Crypto Market

President Donald Trump recent orders have greatly changed the crypto market. His team support for crypto, with ideas to create a government Bitcoin store and pick pro-crypto people, has raised investor trust. This cheer is seen in the rise of Bitcoin value, going over $100,000 for first time.

Also, the start of the $TRUMP meme coin caused a fast rise in its worth but it saw ups and downs later. While these changes have excited the market, experts warn that less oversight can make the market more wild and may cause money troubles. So, wh͏ile the short-time effects of Trump’s plans have been good for crypto items, the lasting effects need close thought.

Why Lightchain AI is Emerging as Safe Haven for Investors Amid Market Shifts

The crypto market is no stranger to volatility, and recent shifts following Trump’s executive orders have left investors seeking stability. Amid this uncertainty, Lightchain AI is emerging as a safe haven.

With its presale offering tokens at $0.005625 and raising millions, it’s clear investors recognize its potential. Unlike speculative assets, Lightchain AI’s robust foundation lies in its groundbreaking innovations like Proof of Intelligence (PoI) and the Artificial Intelligence Virtual Machine (AIVM).

These features ensure scalability, security, and practical use cases, appealing to long-term investors. Furthermore, its transparent governance and community-driven model position it as a stable investment opportunity in turbulent times. As traditional markets react, Lightchain AI is gaining traction as a beacon of confidence.

Rising Star- How Lightchain AI is Capturing Investor Focus During Uncertain Times

During uncertain market conditions, Lightchain AI is becoming a beacon for investors seeking innovation and stability. Its cutting-edge platform combines advanced blockchain technology with artificial intelligence, offering solutions tailored to modern challenges. With a presale price of $0.005625 and a remarkable $12.3 million raised, Lightchain AI demonstrates strong market confidence.

Investors are drawn to its unique blend of decentralized governance and innovative consensus mechanisms, which ensure security and transparency. In a volatile market, Lightchain AI stands out as a forward-thinking opportunity. Grab Lightchain AI opportunity now to be a part of this rising star in the crypto market!

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Why Dogecoin price is still running toward $2

DOGE price is down 5% today in the past 24 hours but several technical and onchain metrics suggest that Dogecoin could soon tag new all-time highs.

CryptoCurrency

‘We’re sitting ducks for their stupidity’

SAS veteran Phil Campion has launched a blistering attack on Labour’s plans to impose inheritance tax on military death-in-service payments, calling the move “despicable” and bordering on “cowardice”.

Speaking on GB News, Campion said armed forces personnel were “sitting ducks for their stupidity” because they lack union representation and cannot strike.

“It’s another easy target for them – armed forces, we don’t have unions,” the former special forces soldier said.

“We can’t go on strike. They couldn’t put us further back in the queue when it comes to absolutely everything that they do.”

Campion tore into the Labour Government in a brutal rant

GB NEWS / PA

Labour MPs have voted to impose inheritance tax on death-in-service payments for military families from April 2027.

The changes mean children or partners of unmarried servicemen and women will face death duties on the lump sum payments.

LATEST DEVELOPMENTS

Rachel Reeves backed the controversial taxPA

Rachel Reeves backed the controversial taxPADeath-in-service payments, which typically amount to four times the late individual’s salary, are currently tax-free.

Under the new rules, military personnel who die while off duty – such as from sudden illness or accident – will see their payments subject to inheritance tax of up to 40 percent.

The payments will go into probate if not left to a spouse or civil partner, and cannot be protected through trusts as they are part of the Armed Forces pension scheme.

In a passionate statement, Campion highlighted the constant demands placed on military personnel.

Phil Campion joined Martin Daubney on GB News

GB NEWS

“When you sign that dotted line, you don’t just sign it to go to war, you’re on duty 24/7. You’re on call 24/7. You can be plucked out of the sky any time they choose,” he said.

The veteran referenced his recent work with Scotty’s Little Soldiers, a charity supporting bereaved military children.

“Members from the charity are absolutely appalled that they would start taking from people like that. It’s ridiculous,” Campion added.

“It’s just an absolute shock across everybody’s bowels. It’s despicable and borders on cowardice.”

Major General Neil Marshall, chief executive of the Forces Pension Society, has written to HMRC urging them to reverse the decision.

In his letter, he warned the policy “poses a serious threat to morale, team cohesion and ultimately operational effectiveness” given the high-risk nature of military service.

A Treasury spokesman responded: “We value the immense sacrifice made by our brave Armed Forces.”

The spokesman confirmed existing inheritance tax exemptions will continue to apply “if a member of the Armed Forces dies from a wound inflicted, accident occurring or disease contracted on active service.”

Any pension funds left to a spouse or civil partner in such cases will also remain exempt.

CryptoCurrency

Coinbase CEO Suggests Possible USDT Delisting Under Regulatory Pressure

Coinbase CEO Brian Armstrong has revealed that the exchange could be forced to delist USDT to comply with potential new regulations.

Armstrong was discussing the possible impact of new rules that could require stablecoin issuers to back their tokens entirely with U.S. Treasury bonds and undergo periodic audits to ensure transparency and financial integrity.

Shifting Regulatory Landscape

The executive was speaking to the Wall Street Journal on the sidelines of the World Economic Forum in Davos, where he stressed that it would be essential for his company to comply with the anticipated regulations even if it meant removing Tether from its platform.

Armstrong was also keen to point out that Coinbase would continue providing USDT services to customers to facilitate their off-ramping to other compliant assets. “We want to help them transition to a system that we think is more secure,” he said.

The exchange has already delisted several crypto assets from its European operations to comply with the Markets in Crypto Assets (MiCA) regulations. However, it has left the door open for possible relistings if the tokens meet the requirements at a “later date.”

One of the biggest criticisms leveled against Tether is that its quarterly attestations, published through BDO Italia, fall short of full audits. Additionally, observers argue that the reports may not meet the rigorous standards likely to be set by new U.S. legislation.

USDT currently dominates the stablecoin market, making up about 65% of the sector’s nearly $213 billion valuation. Its issuer holds about 80% of its reserves in Treasury bills, supplemented by assets such as gold and Bitcoin.

Towards the end of 2024, it added an extra $700 million worth of BTC to its reserves, bringing its total holdings of the cryptocurrency to $7.8 billion. This came even as its closest competitor, Circle, announced a partnership with Binance to help push the global adoption of USDC and whittle down USDT’s oversized market share.

Tether Finds a New Home

In April last year, Wyoming Senator Cynthia Lummis, together with her New York counterpart Kirsten Gillibrand, introduced the Payment Stablecoin Act, a bipartisan bill meant to create a framework for fiat-pegged cryptocurrencies.

If such legislation were to pass, it could force Tether to change its reserve policies and reporting methods to remain in the United States.

Interestingly, the crypto firm has already started shifting its focus away from the U.S. and European markets, positioning itself more in emerging economies. It recently announced plans to move operations to Bitcoin-friendly El Salvador, in what some see as a strategy to stay outside major regulatory zones.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Eric Trump’s Deleted Tweet Raises Eyebrows

While the Bitcoin price is hovering just below the old all-time high of December 17, US Senator Cynthia Lummis and Eric Trump reportedly convened at the Capitol yesterday to discuss the notion of creating an American Strategic Bitcoin Reserve (SBR). Bloomberg’s Steven Dennis broke the news, while Swan, a crypto-focused platform, spotlighted Eric Trump’s now-deleted retweet about the meeting.

Almost as soon as Eric Trump retweeted Swan’s post referencing talks with Senator Lummis on the SBR, he pulled it down without explanation. “What’s brewing behind the scenes?” Swan queried in a subsequent tweet, suggesting the swift deletion could indicate high-level caution, possibly to avoid front-running an official announcement.

DEVELOPING: Eric Trump RT’d @Swan’s post about his meeting with Senator Lummis on the American Strategic #Bitcoin Reserve—then quickly deleted it.

What’s brewing behind the scenes? 🤔 pic.twitter.com/E7nqbieNIQ

— Swan (@Swan) January 22, 2025

This latest buzz follows Senator Lummis’ unveiling of The Bitcoin Act of 2024 last year, a legislative proposal to formally establish a US strategic Bitcoin reserve. Known officially as the Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act, the bill outlines a plan for the U.S. Treasury to acquire 1 million BTC over five years, funded by reallocating existing resources within the Federal Reserve System and the Treasury Department.

Related Reading

While details remain scarce regarding the progress of the legislation, sources indicate Lummis’ office is working diligently to navigate the political and logistical complexities involved. Notably, Senator Lummis also met with former President Donald Trump over the weekend. Senator John Barrasso revealed via X: “Senator Lummis and I had a great time talking with President Donald Trump this morning. Wyoming is ready for Inauguration Day tomorrow!”

Bitcoin Reserve Rumors Intensify With Ulbricht Pardon

The notion of an SBR has gained renewed momentum following yesterday’s pardon of Ross Ulbricht by President Trump. Analysts note that during the 2024 conference, Trump had floated the idea of transferring BTC seized by law enforcement into a national stockpile. Now, with the pardon promise fulfilled, many in the community are wondering if the SBR plan could be next on the administration’s agenda.

On prediction platform Polymarket, the odds of an imminent SBR soared from 28% to 44% after news of the pardon broke. Those odds had once reached as high as 59% around Inauguration Day. As of late, they had dipped back to around 28%—only to bounce upward again following Ulbricht’s release.

Related Reading

Crypto analyst known as Byzantine General voiced optimism, posting on X: “The fact that he kept his promise with Ross is a good sign IMO that he’s going to follow through with supporting crypto.”

David Bailey, CEO of BTC Inc who was instrumental in turning Trump pro-BTC, added to the speculation, remarking: “Tonight is about Ross but I’ll share this since I’m getting a ton of questions: I’m still expecting dedicated bitcoin+crypto EOs in coming days. I don’t know what they say or exactly when they drop. I also fully expect the President to deliver on the SBR in his first 100 days.”

Anthony Pompliano, Founder & CEO of Professional Capital Management, posted a similarly confident take: “If Ross Ulbricht got the pardon, we are definitely getting the Strategic Bitcoin Reserve. Trump will create history with the stroke of his pen.”

In a separate discussion at the World Economic Forum, Coinbase CEO Brian Armstrong was asked about President Trump’s stance on establishing a US Bitcoin reserve. Armstrong said:

“Well, I didn’t talk to him about that specifically, but I think he is excited about it. I mean, he really wants to be the first Bitcoin president. Cynthia Lummis in the Senate is actually, I think, the one driving this legislation around a strategic Bitcoin reserve. And I think it’s a good idea. The US actually has reserves in lots of things, gold, oil, I think like 27 different rare minerals like palladium and all these things. And so, you know, I think the world is moving to a Bitcoin standard for money. They absolutely should hold. Any government who holds gold should also hold Bitcoin as a reserve.”

At press time, BTC traded at $105,382.

Featured image from YouTube, chart from TradingView.com

CryptoCurrency

House Dems Warn of Corruption in President Donald Trump’s Crypto Business Moves

The crypto industry is waiting for President Donald Trump to issue an executive order that will steer the federal government toward a new, more welcoming era for digital assets oversight. That’ll be good for Trump’s own business, and that’s one of the reasons Democrats in the House of Representatives are already shouting about ethical lapses in the administration.

A Trump executive order on crypto stands to increase the value of at least two components of Trump’s family business: crypto venture World Liberty Financial and the eponymous token (TRUMP) launched right before he returned to the White House. Gerry Connolly, the top Democrat on the House Oversight Committee, requested an investigation of the president’s business relationships in a letter sent to the committee’s Republican chairman one day into Trump’s new term.

“This committee must take immediate action to investigate the grave conflicts of interest

Donald Trump carries with him to the Office of the President,” he wrote in the request, which is unlikely to lead to formal scrutiny on the leader of the Republican Party, who demands loyalty from senior GOP officials. “The expanding scope of President Trump — and by extension The Trump Organization’s — financial entanglements and quid pro quo promises are troubling.”

Earlier, as Trump’s oath still echoed through the Capitol Rotunda, Representative Maxine Waters, the ranking Democrat on the House Financial Services Committee, expressed alarm about Trump’s coin.

“Through his meme coin, Trump has created a way to circumvent national security and anti-corruption laws, allowing interested parties to anonymously transfer money to him and his inner circle,” Waters said in a January 20 statement. “Buyers could include large corporations, allied nations who are pressed to show their ‘respect’ for the president, and our adversaries, like Russia and China, which have much to gain from influencing a Trump presidency.”

Waters argued that the token doesn’t just compromise Trump, but she said it taints the wider industry, “which has long fought for legitimacy and a level playing field with other financial institutions.”

The California Democrat worked for months with former committee Chairman Patrick McHenry on a stablecoin regulation bill, but they failed to reach a bipartisan compromise. Waters will still be in a position to weigh in on crypto bills during this session.

Though Trump had promised fast action on cryptocurrency when he returned to the White House, the crypto industry isn’t yet among those benefiting from the extensive array of executive orders the president has already signed. So far, the most significant action from the overhauled U.S. government is the establishment of a crypto task force by the acting chair of the Securities and Exchange Commission, Mark Uyeda.

Read More: SEC Forms New Crypto Task Force Spearheaded by Hester Peirce

CryptoCurrency

bitcoin++ Hacking Edition 2025: Brazil

The next edition of bitcoin++ will be taking place February 19-22, 2025 at the ACATE Centro de Inovação in Florianópolis, Brazil. This edition of the conference is breaking from the usual narrowly focused topical structure(the last conference in Berlin focused exclusively on the subject of ecash), and is essentially going to be one big hackathon.

Catering to developers, engineers, and innovators, the event promises to be a valuable experience both for veteran contributors in the space as well as developers looking to dip their toes into the Bitcoin ecosystem.

What to Expect:

- Workshops and Technical Sessions: Learn from top-tier professionals in the Bitcoin space. Sessions will cover a range of topics including advanced cryptography, wallet development, Layer 2 solutions, and the latest Bitcoin protocol improvements.

- Live Hacking Challenges: Developers will be able to participate in live coding challenges, contributing to innovative Bitcoin-related projects and protocols.

- Networking Opportunities: Meet and exchange ideas with like-minded individuals, including developers, engineers, and industry leaders working at the forefront of Bitcoin’s evolution.

If you are a developer building in the Bitcoin space, or interested in getting started, this event is a must attend. More information can be found, and tickets purchased, here.

Don’t miss out on your chance for a valuable in person learning experience with some of the smartest developers in the ecosystem.

CryptoCurrency

Trump meme craze pushes new Solana addresses to all-time high: Report

The TRUMP memecoin shattered records before Inauguration Day, eventually reaching a total market cap of more than $12 billion.

CryptoCurrency

Reeves’ back against the wall as OBR delivers hammer blow to her farm inheritance tax plan

Chancellor Reeves’ plan to tax farmers to plug the ‘black hole’ has been dealt a hammer blow by Britain’s independent financial watchdog today.

Reeves slapped previously exempt farmers with 20 per cent tax on assets over £1million in her October budget, sparking outcry from asset-rich but cash-poor farmers.

The Chancellor argued it was a ‘fair and balanced’ way to raise money to fill the £22billion black hole, but farmers, rural lobby groups and tax experts have said it will wipe out farmers’ profits for a decade.

Rural folk also warned the tax would lead to many farmers simply selling up, damaging the UK’s food security and inviting faceless foreign companies to buy up British land as they won’t pay massive IHT bills every forty or so years and can use the land for bogus offsetting schemes.

‘Nothing short of betrayal’: The farming community reacted with fury and despair to Reeves’ devastating budget

Olly Harrison / PA

Defra Secretary Steve Reed has been defending the government’s policy, repeatedly stating it will only affect 500 or so farms a year.

That number has been heavily contested with several experts dismantling the Treasury’s calculations.

While arguments about numbers played out in meeting rooms, two huge tractor protests gridlocked central London, farmers cancelled machinery orders and paused investment plans, harming rural economies.

With the best tax advice for the last 30 years being to keep the farm until death, Reeves’ tax- which came with no prior warning- left many elderly farmers scrambling to transfer their farm to their children under the seven-year gifting rule, a deeply troubling and stressful time for older farmers who are worrying they may die and penalise their kids.

Defra Secretary Steve Reed has doubled down on the farm tax, refusing to apologise for any concern it may caused

Getty/HoC

In a fresh blow to the Chancellor, the independent Office for Budget Responsibility (OBR) has branded the Treasury’s ‘costing’ of the policy as ‘highly uncertain’, casting sever doubt on whether it will raise any money at all.

“The main driver of uncertainty is the behavioural response to the measure, given the range of options potentially available,” said the report.

Since Reeves’ tax sparked such outrage, the government have been busy advising farmers on how not to pay their new tax, for which options include gifting it to their spouse/children over seven years.

Critics have pointed out this is not an option for many farmers who are widows, do not have children or do not have children interested in farming or are old enough to farm.

Moreover, once the farm is gifted, the giver is no longer allowed to enjoy its benefits, meaning widowed farmers who have transferred their farm would not be allowed to live on it anymore.

This is just one element of a possible behavioural reaction to the tax. With so many moving parts, it is no doubt the OBR has found the Treasury’s costing to be highly uncertain.

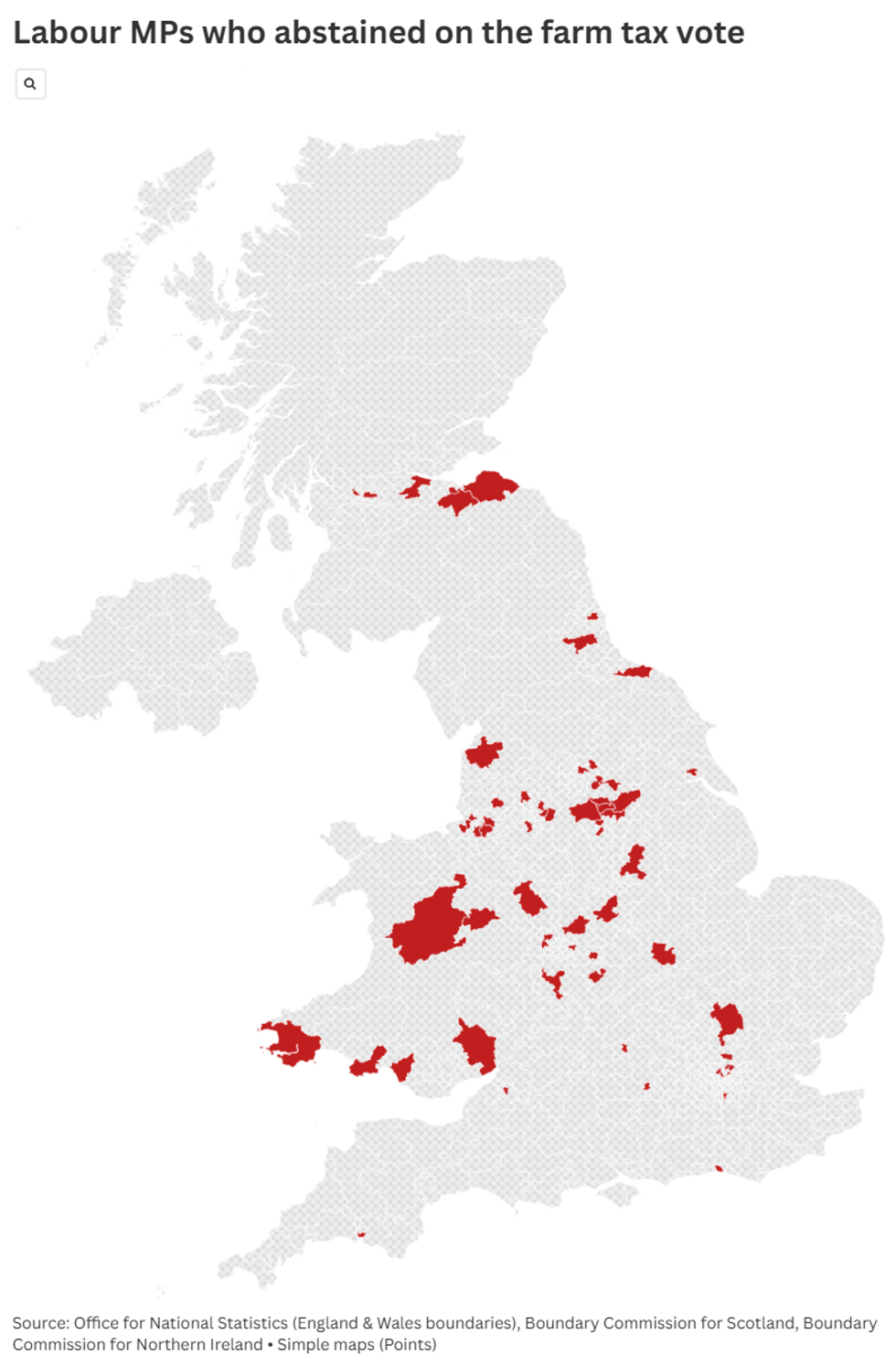

When it came to voting on the farm tax, scores of rural Labour MPs abstained to save face with constituents

GB News/Flourish

This is a huge blow as the policy was (by the Treasury’s estimation) set to raise just £520million a year by 2030, enough to fund the NHS for one day.

This number is fifty times less than the amount Reeves will rake in via her hike to Employers’ NI hike but has generated severe criticism and seen Labour’s polling in rural areas crash.

The watchdog also found ‘moderate uncertainty’ around the data used in the Treasury’s costing.

Critics have said this because the Treasury’s analysis was based on one year’s worth of farmers’ inheritance tax relief claims, too short a period to reveal the full effect, and failed to look at farms across Britain.

They have also pointed out the Treasury only analysed relief claims made under Agricultural Property Relief (APR) scheme.

Farmers also use the Business Property Relief (BPR) to shield assets from inheritance tax like combine harvesters that can cost up to £750,000. Reeves plans to cap BPR relief at £1million.

LATEST FROM MEMBERSHIP:

Farage attending the farm protestGetty

Farage attending the farm protestGettyReacting to the OBR’s report, Victoria Vyvyan, President of the Country Land and Business Association, said:“It is clear that neither the Treasury nor the Office of Budget Responsibility (OBR) has fully considered the impact on the economy of these tax reforms.

“Ministers have repeatedly said that the OBR had certified their claims, but the truth is that the OBR themselves say there is a high degree of uncertainty as to how much money will be raised, if any at all.

“But we do know that farmers and small business owners are pulling investment, cancelling machinery orders and considering whether their businesses are viable for the long-term.

“This means fewer jobs, less food security, less growth and less money going into the Exchequer to pay for public services. Government must put these reforms out to a meaningful consultation, so that Treasury can truly understand the damage they are doing.”

Victoria Atkins, shadow Defra Secretary, said: “The OBR has demonstrated that the Chancellor’s reasoning is completely flawed; Labour must now axe the family farm tax.”

The Treasury and Defra have been approached for comment.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login