In today’s increasingly connected world, the need for reliable, high-speed internet connectivity is no longer a luxury, but a necessity for both organizations and consumers alike. As more individuals and businesses continue to rely more heavily on digital platforms and technologies, the demand for seamless, secure and robust connectivity has never been so important. For many businesses, connectivity is not just about operational efficiency, it is at heart of business operations, innovation, and security in an age where even minor outages can cause significant disruptions.

This landscape highlights the important role vendors play in ensuring businesses have access to the necessary IT infrastructure and tools needed to succeed. Through focusing on inclusive policies, implementing advanced technologies, and offering tailored solutions, vendors can empower businesses to meet the challenges today’s digital world brings.

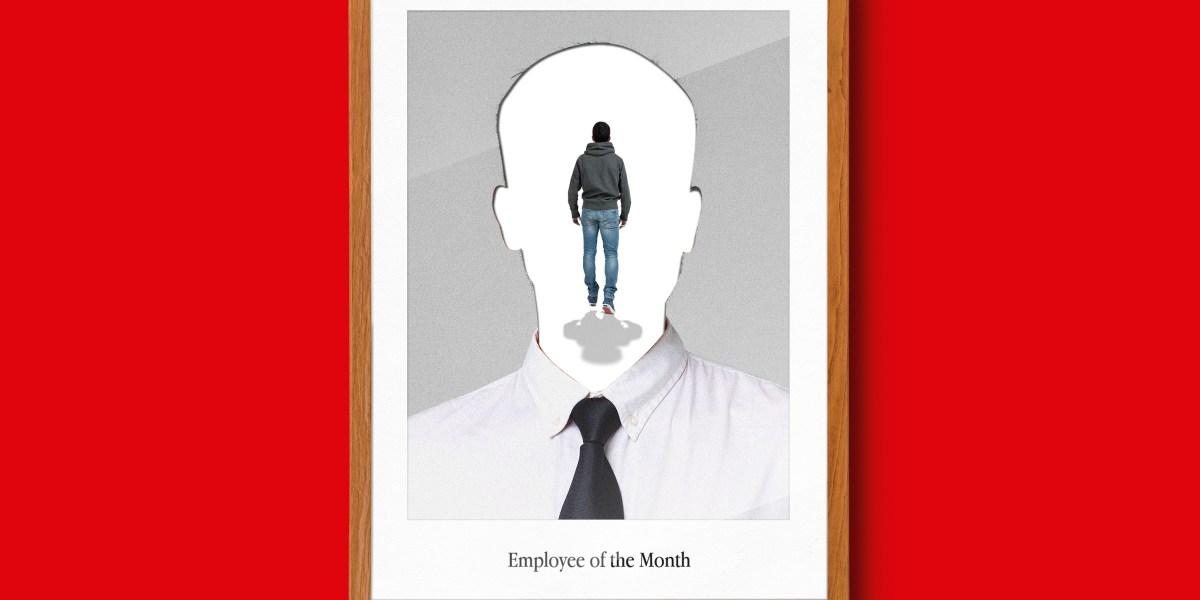

ISP Presales Director at TP-Link UK.

Bridging the digital divide for a more inclusive society

Delivering good connectivity for all is vital for fostering a more inclusive and safer digital society. The digital divide – the gap between those with access to reliable internet and those without – still remains a pressing issue globally. For organizations, this divide can translate into unequal opportunities, limited innovation, and reduced competitiveness in underserved regions. Addressing this issue requires a united effort among governments, industries, and internet service providers (ISPs).

Governments play a key role in facilitating widespread connectivity through funding infrastructure projects in underserved regions and establishing policies that incentivize private sector participation. Programs aimed at rural broadband expansion and low-cost internet services ensure that businesses in remote areas can compete on an equal footing with their urban counterparts.

Beyond access, connectivity must be affordable and environmentally sustainable. Vendors and ISPs need to have a bigger focus on low-cost, energy-efficient technologies, providing technology that can stand the test of time as networking continues to get more advanced, whether that’s through utilizing scalable solutions that doesn’t require costly replacements. These collective efforts foster a more inclusive digital society, ensuring businesses across the UK have the tools needed to succeed in today’s modern digital landscape.

Unlocking opportunities for ISPs and vendors

With increased innovation and advanced technology across a number of sectors, this presents a number of opportunities for ISPs and vendors to delivery comprehensive and advanced solutions that are tailored for the evolving needs of many businesses. Through adopting and implementing emerging technologies and enhancing service offerings, ISPs can strengthen their role in enabling businesses to succeed. ISPs and vendors can offer a number of benefits for businesses, including:

Premium services and tiered packages: Businesses often have varying and evolving needs when it comes to connectivity. Large organizations may require ultra-fast speeds and robust cybersecurity, while smaller businesses may prioritize affordability and reliability. ISPs can offer tiered service packages ensuring that businesses of all sizes can access the right level of support.

Enhanced network management: Advanced tools for network monitoring, optimization and management allow ISPs to adjust performance in real-time. For businesses, this translates to offering minimal downtime and consistent performance, which is essential for organizations to stay competitive.

Scalable solutions for growth: ISPs and vendors can provide businesses with flexible and scalable connectivity options that grow alongside their needs. Whether expanding to new locations, onboarding more users, or adopting cloud applications, these solutions ensure businesses maintain optimal performance and seamless connectivity as they evolve.

These tailored offerings not only benefit businesses but also enhance the ISP’s reputation and customer loyalty. By positioning themselves as reliable partners, vendors and ISPs can secure long-term relationships which helps to drive mutual growth.

Transformative power of advanced technologies

The rise of technologies like Wi-Fi 7 represents a dramatic shift in the way businesses operate. These advancements go beyond offering fast connections, but address critical needs for stability, security, and scalability in a rapidly evolving digital landscape.

Wi-Fi 7 introduces groundbreaking features such as multi-gig connectivity and improved latency. For businesses, this offers a range of benefits, from uninterrupted video conferencing, smoother data transfers, to enhanced support for IoT devices. These capabilities are particularly important for verticals like education and hospitality, where unstable connectivity can cause significant disruption and financial loss.

Having reliable and seamless connectivity has never been more important. Next-generation technologies enable fast and efficient communication through advanced networks and optimized access points, empowering businesses to stay connected and operating. By leveraging these innovations, organizations can enhance collaboration, streamline operations, and adapt more effectively to today’s demands.

A collaborative path forward

For businesses to thrive in a digitally driven economy, robust and reliable connectivity is vital. The role of vendors and ISPs in delivering this connectivity is at the centre, but success requires a collaborative approach. Governments, industries, and technology providers must work together to bridge the digital divide, unlock the potential of emerging technologies, and create a sustainable and secure digital ecosystem.

By focusing on inclusivity, innovation, and tailored solutions, vendors can empower businesses to achieve their full potential. In turn, businesses can leverage these robust solutions to drive growth, foster innovation, and navigate the complexities of an ever-evolving digital world. The future of connectivity is not just about speed or reliability; it is about creating opportunities, ensuring equity, and building resilience in a world where technology is at the heart of business operations.

We’ve compiled a list of the best Wi-Fi extenders.

This article was produced as part of TechRadarPro’s Expert Insights channel where we feature the best and brightest minds in the technology industry today. The views expressed here are those of the author and are not necessarily those of TechRadarPro or Future plc. If you are interested in contributing find out more here: https://www.techradar.com/news/submit-your-story-to-techradar-pro

You must be logged in to post a comment Login