Sports

Ilia Malinin admits Olympics pressure led to figure skating struggles

NEWYou can now listen to Fox News articles!

United States figure skater Ilia Malinin may have been favorited to take home medals entering the 2026 Milan Cortina Games, but he admitted not being well prepared to do so.

Malinin, nicknamed the “Quad God” for his special quadruple axel that he could perform in his routine, shockingly fell multiple times in the men’s free skate final, finishing eighth in the event. The result was surprising to fans and pundits alike, but this Malinin has since had time to reflect on what went wrong in Milan.

During an appearance on the “Today” show on Tuesday, he was candid with his response. It wasn’t that he wasn’t technically prepared to perform in Milan — it was the pressure from the fans in the stands and the millions watching around the world.

CLICK HERE FOR MORE SPORTS COVERAGE ON FOXNEWS.COM

Ilia Malinin of the United States reacts to his disastrous routine, in which he fell twice, during the Figure Skating, Men’s Singles Skating-Free Skating competition at the Milano Ice Skating Arena at the Milano Cortina Winter Olympic Games 2026 on Feb. 13, 2026, in Milan, Italy. (Tim Clayton/Getty Images)

“Honestly, it’s not a pleasant feeling,” Malinin said about the free skate blunders. “The most honest way to say it is it’s just a lot of on you, just so many eyes, so much attention. It really can get to you if you’re not ready to fully embrace it, so I think that might be one of the mistakes I made going into that free skate was I was not ready to handle that to a full extent.”

Heading into the Olympics, it was expected that Malinin would be on the podium in some capacity after the men’s free skate came to close. He had four competitions leading up to the Games, where his scores ranged between 209-238.

ILIA MALININ POSTPONES PRESS CONFERENCE A DAY AFTER EIGHTH-PLACE OLYMPIC FINISH

However, the falls led to a final score of 156.33, and Malinin hung his head after the event knowing that he wasn’t going to be securing an Olympic medal this time around.

Ilia Malinin of Team United States falls during the Men Single Skating on day seven of the Milano Cortina 2026 Winter Olympic games at Milano Ice Skating Arena on Feb. 13, 2026 in Milan, Italy. (Jamie Squire/Getty Images)

“Of course, it didn’t go the way I wanted it to. … All I have to do is just learn from my mistakes there and push to see how I can improve in the future. I can take a different approach leading up to the next Games, hopefully,” he said.

But it hasn’t been all bad for Malinin in Milan, as he helped the United States achieve team gold earlier in the Games with a 200.03 free skate.

Ilia Malinin of Team United States leaves the ice after competing in the Men Single Skating on day seven of the Milano Cortina 2026 Winter Olympic games at Milano Ice Skating Arena on Feb. 13, 2026 in Milan, Italy. (Jamie Squire/Getty Images)

CLICK HERE TO GET THE FOX NEWS APP

Malinin will be 25 at the next Winter Olympics in 2030, which will be held in the French Alps.

Follow Fox News Digital’s sports coverage on X and subscribe to the Fox News Sports Huddle newsletter.

Sports

Ukraine officials to boycott Winter Paralympics in protest over Russia’s participation

Ukrainian officials are poised to boycott the upcoming Milano Cortina Paralympics next month, protesting the participation of Russian and Belarusian athletes competing under their national flags.

Ukraine‘s Sports Minister Matvii Bidnyi confirmed on Wednesday that while Ukrainian athletes will still take part in the 6-15 March games, no official representatives from Ukraine will attend the opening ceremony or any other event.

It comes after the International Paralympic Committee’s (IPC) decision on Tuesday, which cleared a combined total of 10 para-athletes from Russia and Belarus to compete. Six slots have been handed to Russia and four to Belarus.

It will mark the first time a Russian flag has been flown at the Paralympics since the 2014 games in Sochi, Russia. The country’s athletes were initially banned because of a state-sponsored doping program, and the sanctions against Russia have continued since its invasion of Ukraine in 2022.

Should a Paralympic athlete win gold, it will be the first time the Russian anthem has been played on the stage of a major global sporting event since the invasion.

The IPC statement reads: “The IPC can confirm that NPC Russia has been awarded a total of six slots: two in Para alpine skiing (one male, one female), two in Para cross-country skiing (one male, one female), and two in Para snowboard (both male).

“NPC Belarus, has been awarded four slots in total, all in cross-country skiing (one male and three female).”

IPC President Andrew Parsons claimed in November that there would be no athletes from those countries at the Milan Cortina Games because the sports’ governing bodies had maintained their bans.

The following month, an appeal from Russia saw the Court of Arbitration for Sport overturn a blanket ban imposed by the International Ski and Snowboard Federation – paving the way for Russians to compete as neutral athletes at the 2026 Olympics, and with their own flag and anthem at the Paralympics.

Tuesday’s announcement stands as another indicator that Russia and its national identity will be fully restored in Olympic circles well ahead of the 2028 Summer Games in Los Angeles.

Sports

LaMelo Ball crashes custom Hummer in Charlotte, walks away uninjured

NEWYou can now listen to Fox News articles!

The NBA All-Star break did not end well for Charlotte Hornets star guard LaMelo Ball. He crashed his custom Hummer in the city Wednesday.

Video footage obtained by WSOC-TV captured the moment when Ball’s vehicle smashed into a gray sedan heading straight while he was attempting to make a left turn.

Ball’s Hummer, which was wrapped in a camouflage pattern, continued to roll slowly as the sedan remained in the video’s frame. There was clear damage to both vehicles.

CLICK HERE FOR MORE SPORTS COVERAGE ON FOXNEWS.COM

LaMelo Ball of the Charlotte Hornets drives by Paul Reed of the Detroit Pistons during the second half of a basketball game at Spectrum Center on Feb. 9, 2026, in Charlotte, N.C. (David Jensen/Getty Images)

The Hummer lost its driver’s front side wheel in the accident, and the Kia had considerable front-end damage.

Ball exited his vehicle with no apparent injuries, while the status of the sedan driver is unknown.

Ball stayed at the site of the crash while both vehicles were getting towed. WSOC-TV reported that he left when someone in a Lamborghini picked him up.

Ball’s custom Hummer isn’t going to be cheap to fix.

LaMelo Ball of the Charlotte Hornets, right, drives by Nickeil Alexander-Walker of the Atlanta Hawks during the second half at Spectrum Center Feb. 11, 2026, in Charlotte, N.C. (David Jensen/Getty Images)

Dreamworks Motorsports worked hard on Ball’s 2022 Hummer EV Edition 1, adding large custom wheels with orange rims that said “1 of 1” on the inside.

The design replicated his signature Puma basketball shoe.

It’s been a vehicle Ball has used frequently in Charlotte since Dreamworks Motorsports finished it for him.

It will need to be back in the body shop for some work after the accident.

LaMelo Ball of the Charlotte Hornets reacts during the first half against the Detroit Pistons at Spectrum Center Feb. 9, 2026, in Charlotte, N.C. (David Jensen/Getty Images)

CLICK HERE TO GET THE FOX NEWS APP

The Hornets return to play the second half of the NBA season Thursday, taking on the Houston Rockets at home.

Follow Fox News Digital’s sports coverage on X and subscribe to the Fox News Sports Huddle newsletter.

Sports

Trial for Guardians’ Clase, Ortiz likely to be pushed to October

NEW YORK — A scheduled spring fraud trial for two Cleveland Guardians pitchers accused of colluding with sports bettors to rig bets and betray “America’s pastime” will likely be postponed until October, a federal judge said Wednesday as the men pleaded not guilty to a rewritten indictment.

Judge Kiyo A. Matsumoto left a May 4 trial date on the books for now, but indicated she’ll probably move it to the fall in the coming weeks.

Pitchers Emmanuel Clase and Luis Ortiz, speaking Spanish, entered not guilty pleas through a translator to a rewritten indictment in Brooklyn federal court.

No new charges were in the superseding indictment unsealed on Friday, as prosecutors charged a third individual with serving as a middleman between bettors and Clase. That person also pleaded not guilty Wednesday.

The pitchers were first charged in November with accepting several thousand dollars in payoffs to help two gamblers from their native Dominican Republic win at least $460,000 by placing more than 100 in-game prop bets and parlays on the speed and the outcome of certain pitches. Charges include wire fraud conspiracy and conspiracy to influence sporting contests.

The rewritten indictment released Friday added allegations that Clase used code words like “rooster” and “chicken” in communications about pitches to be thrown.

Prior to a May 18, 2025, game against the Cincinnati Reds, Clase received a message to “throw a rock at the first rooster in today’s fight” and responded with: “Yes, of course, that’s an easy toss to that rooster,” the indictment said. However, Clase never entered the game and could not fulfill the plan to throw outside the strike zone to the first batter he faced, it added.

A day earlier, though, Clase broke Major League Baseball rules by using his cellphone in the middle of a game against the Reds to signal to gamblers that a pitch would be outside the strike zone, enabling them to win about $27,000, the indictment said.

Clase, the Guardians’ former closer, and Ortiz, a starter, have been on non-disciplinary paid leave since July. Their teammates are just starting training camp for the new season. The team’s home opener is April 3.

Clase and Ortiz, who are free on bail, left the courthouse separately after Wednesday’s hearing. Neither commented. Lawyers for both men have insisted their clients never colluded with gamblers.

Lawyers for Ortiz have asked that he be tried separately, saying in court papers that if Clase passed along Ortiz’s pitching strategy to gamblers, he did so without Ortiz’s knowledge. They also noted that Ortiz is accused of throwing only two pitches that drew scrutiny over a 12-day span, while Clase is charged with colluding with gamblers on numerous pitches since 2023.

“Mr. Clase may have abused his relationship with Mr. Ortiz as friends and teammates by convincing Mr. Ortiz to throw certain pitches at certain times — ostensibly for baseball reasons as far as Mr. Ortiz was aware,” the lawyers wrote.

They said they might present a defence to the jury that would cast “Ortiz as a victim of Mr. Clase’s scheme, rather than a knowing and willing participant.”

Clase, a three-time All-Star, had a $4.5 million salary in 2025, the fourth season of a $20 million, five-year contract. Prosecutors say he started providing bettors with information about his pitches in 2023 but didn’t seek payoffs until last year.

Prosecutors have said that Ortiz, who had a $782,600 salary last season, joined the scheme last June.

The Guardians and Major League Baseball have said they are cooperating with the investigation. MLB said it contacted federal law enforcement when it began investigating unusual betting activity.

Sports

Playoff positioning already in mind as streaking Spurs face Suns

Feb 11, 2026; San Francisco, California, USA; San Antonio Spurs forward Victor Wembanyama (1), forward Keldon Johnson (3), and guard De’Aaron Fox (4) celebrate as the clock expires against the Golden State Warriors in the fourth quarter at Chase Center. Mandatory Credit: Eakin Howard-Imagn Images

Feb 11, 2026; San Francisco, California, USA; San Antonio Spurs forward Victor Wembanyama (1), forward Keldon Johnson (3), and guard De’Aaron Fox (4) celebrate as the clock expires against the Golden State Warriors in the fourth quarter at Chase Center. Mandatory Credit: Eakin Howard-Imagn Images The San Antonio Spurs and Phoenix Suns will have differing goals when they square off Thursday in Austin, Texas, in the teams’ return to action after the weeklong All-Star break.

San Antonio has a Western Conference title in its sights, while the Suns are looking to secure stronger playoff positioning.

The Spurs head to the final third of the season in second place in the West, three games behind the Oklahoma City Thunder with 28 games left. San Antonio has won six straight, which is the longest current streak in the league, including five in a row by double digits.

Victor Wembanyama leads San Antonio’s balanced attack in scoring (24.4 points per game) and rebounding (11.1), and seven teammates score in double digits.

San Antonio has already exceeded its win total from last year (34) and has thrived as it has adapted to the personality of coach Mitch Johnson.

Johnson is in his first full year at the helm after taking over from Gregg Popovich last season when the venerable Hall of Fame coach suffered a stroke and eventually retired.

“It’s my job to set my vision and expectations for the players,” Johnson said. “And it’s their job to bring that to life. When you go through things, you’re able to learn from them and take away all the good and the bad. You add it to your mental bank and Rolodex. Hopefully it helps you moving forward.”

One of Johnson’s strengths is finding the right combination of players to put on the court at crucial times in a game. The Spurs employ a freewheeling style on the offensive end but can also stifle opponents with Wembanyama always a presence in the lane. “He does a good job of putting us in the right spots to succeed,” guard Stephon Castle said about Johnson. “His main thing is defense, (but) offensively, he gives us a lot of freedom to … play free.”

The Suns have also been a surprise but have struggled of late. They dropped four of the past six games and return from the break on the heels of a 136-109 loss at home to shorthanded Oklahoma City.

With 32 wins, Phoenix has surpassed preseason projections and sits in seventh place in the West, 1 1/2 games behind the Minnesota Timberwolves for the final guaranteed playoff spot.

“What we’re playing for the next 27 games, that’s exciting,” Suns coach Jordan Ott said. “Every night is going to feel like one of those playoff games when you start fighting for it, so that continues our growth. We’re right there, and these guys have put themselves in a position that makes these next handful of games meaningful.” The Suns’ success is even more impressive considering three top players have rarely been healthy at the same time. They have endured a mix of injuries to star guard Devin Booker and key cogs Grayson Allen and Jalen Green.

“We play our own style of basketball,” Ott said. “We’re building something that is going to hopefully lead to success down the road. That’s where it feels good. It feels good that we’re on the right path, but we know how quickly this thing can change.”

The Suns beat the Spurs twice at home in November and will conclude the season series March 19 in the Alamo City.

–Field Level Media

Sports

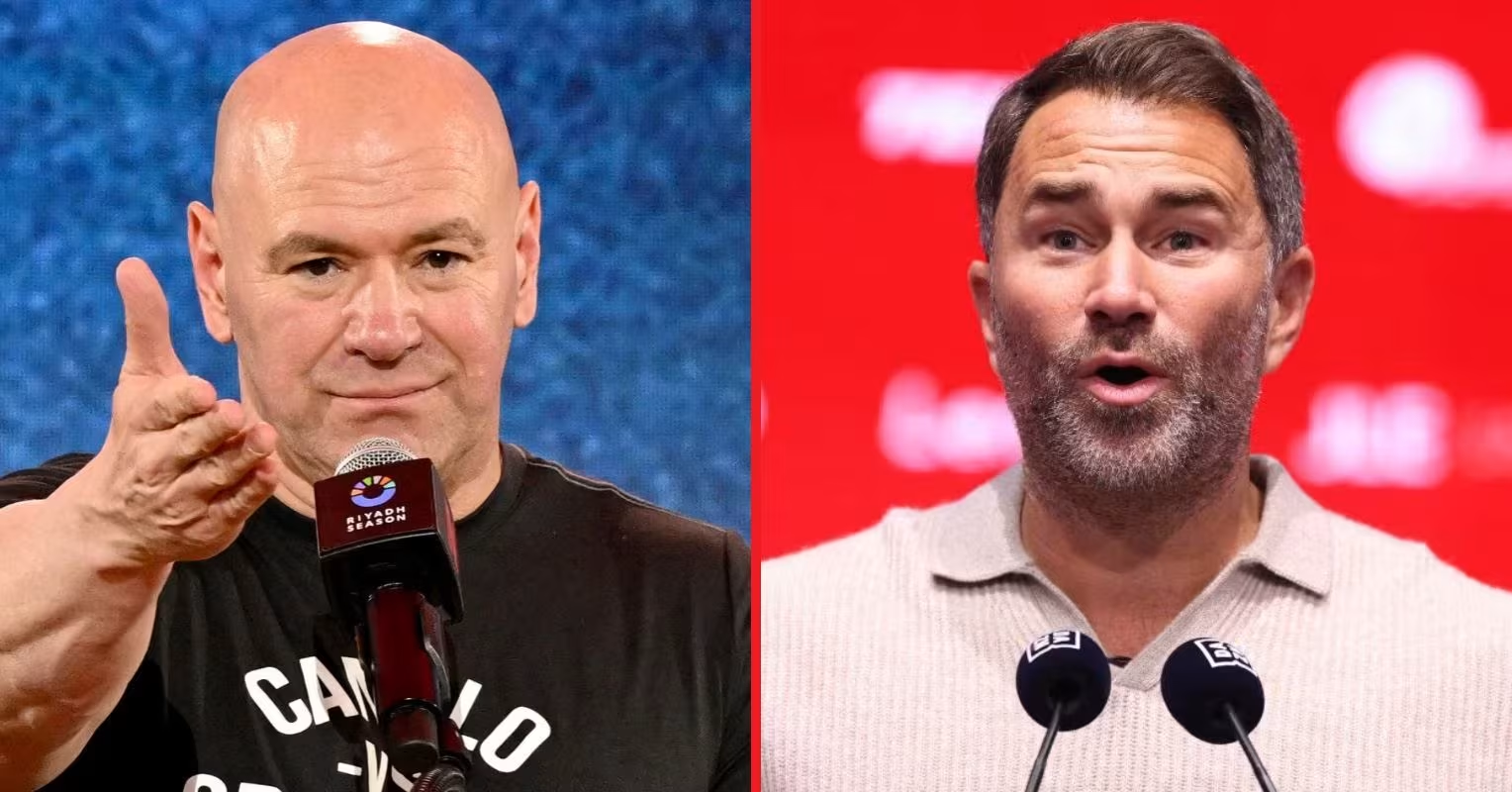

Eddie Hearn responds to Dana White’s recent criticism as rivalry intensifies

Eddie Hearn has hit back at Dana White’s most recent dig as the war of words between the two men continues.

Matchroom chief Hearn and UFC CEO White had been on good terms prior to White’s entry into boxing, but the pair have gone back and forth in recent weeks after Zuffa began staging their own events.

During a press conference on Sunday following his third fight night, White claimed the Matchroom chairman has no vision and was simply just working for his father, Barry Hearn, who started the company back in 1982.

Whilst speaking to The Stomping Ground, Eddie has now had his say, first responding to White’s suggestion that he lacks foresight.

“It’s very strange because I’ve got to be honest with you, I wouldn’t say up my ar**, but Dana has always been so complimentary about us a company and me as a promoter, but to say I don’t have any vision is really quite strange.

“Right now when you talk about Zuffa or whatever it’s called, when you talk about their vision, what’s their vision? Getting Max Kellerman to tell everyone that Callum Walsh is the next Roy Jones or putting Charles Martin on a headline show on a Sunday night in front of 126 people in your garage on a ring that looks like you’ve just got it out of a local club show. I mean, what sort of f**king vision is that?

“Or better still, here’s a belt and it’s Zuffa, look at the vision. That’s not vision, that’s control. The reality is, when he says we can’t compete, they can’t compete in this cut throat world of boxing because it’s a horrible world and they don’t want to compete. They want to create their own world.”

Hearn then compared his own events to that of Zuffa’s, delivering a damning verdict on what White has produced so far.

“At the moment, when you compare Matchroom shows to Zuffa show, quite frankly, Zuffa shows are absolute complete dogs**t. They’re going to get better and they’re going to sign some big fighters and spunk some money and waste some money.

“I’ve said it before, they’re clever people, but right now they’re trying to manipulate fight fans and they don’t understand how intelligent fight fans are when it comes to boxing. You can’t create these cards and tell everyone it’s the best vs the best because quite frankly it’s not.”

The British promoter, who promoted his first major card in 2011, finished by addressing the comments made by White earlier in the week about Eddie just working for his father, Barry.

“The reality is yes, I do work for my dad. But guess what? Dana White has worked for his daddy for a long time, the Fertitta Brothers. That’s who he worked for, and right now, Dana White has got a new daddy, and his name is Turki Alalshikh. He is Dana White’s papi.

“It took him a nanosecond to get personal, and that’s because right now he’s at the bottom of the pile in terms of quality as a boxing promoter but as I keep saying, they’re a good operation and they will get better.”

It certainly appears that any hopes of seeing the two men reconcile are quickly fading, and it shouldn’t take White long to respond to the latest comments from Hearn.

Sports

Warriors’ Stephen Curry, Kristaps Porzingis may return vs. Celtics

Jan 30, 2026; San Francisco, California, USA; Golden State Warriors guard Stephen Curry (30) reacts after committing a turnover against the Detroit Pistons in the first quarter at the Chase Center. Mandatory Credit: Cary Edmondson-Imagn Images

Jan 30, 2026; San Francisco, California, USA; Golden State Warriors guard Stephen Curry (30) reacts after committing a turnover against the Detroit Pistons in the first quarter at the Chase Center. Mandatory Credit: Cary Edmondson-Imagn Images Former Celtics center Kristaps Porzingis could make his debut with the Golden State Warriors when they host Boston on Thursday night.

Warriors coach Steve Kerr said he’s hoping two-time MVP Stephen Curry will also be on the court. Curry, who leads Golden State with 27.2 points per game, has missed the last five games because of a sore knee.

Porzingis was acquired by the Warriors from Atlanta at the trade deadline but hasn’t played since Jan. 7 due to issues with his left Achilles tendon. He said at the time of the trade that Thursday’s game was his target date for returning to the court.

“I look forward to really having a surprisingly good post All-Star break,” he said.

Porzingis has played in 17 games this season (12 starts). He’s averaging 17.1 points, 5.1 rebounds and 1.3 blocked shots per contest.

Porzingis played for Boston last season, but was limited to 42 games with Postural Orthostatic Tachycardia Syndrome. The Celtics traded him to the Hawks in July. He did not play against Boston while with Atlanta.

“He’s an easy fit,” Kerr said. “You don’t have to change a whole lot. The biggest difference I guess that he provides is post-ups. He’s a pretty good post-up player, especially against switches. You throw him the ball at the foul line, the elbows, even the low block, he can score in those spots. That was one of the things we did today, we worked on our spacing.”

Kerr said he wanted to watch Porzingis in a scrimmage Wednesday before deciding whether he will play Thursday night. “Kristaps has been here the last handful of days and practiced today with the team,” Kerr said. “Looked good. He’s feeling good. We won’t make a determination until after (Wednesday). When we practice (Wednesday) afternoon we’ll get up and down the floor and scrimmage, which we didn’t do (Tuesday). We did more skill work and went over some things.”

The Warriors, who lost four of their last six games before the All-Star break, occupy eighth place in the Western Conference standings. Boston will enter Thursday’s game as the No. 2 team in the Eastern Conference, 5 1/2 games behind Detroit.

Speculation has ramped up regarding the possibility of injured forward Jayson Tatum suiting up for the Celtics in the second half of the season. Tatum, who is recovering from a torn Achilles, began practicing with some of his teammates this week. He had surgery in May.

“He looked like Jayson Tatum, I’ll say that much,” Ron Harper Jr. said. “We’re really excited for the potential of him coming back. We don’t know for sure if he’s going to come back. We’re just really excited to see him progress during his rehab.” Tatum averaged 26.8 points, 8.7 rebounds and a career-high 6.0 assists per game in 2024-25. The six-time All-Star has averaged 23.6 points, 7.3 rebounds and 3.8 assists during his 585-game NBA career.

Thursday night’s matchup will be the first of two for these teams this season and should feature plenty of perimeter scoring. The Warriors lead the NBA in made 3-point field goals (897), while Boston is third (831).

–Field Level Media

Sports

How cricket found Saad Bin Zafar: Left Pakistan for studies, became hero for Canada | Exclusive | Cricket News

NEW DELHI: In 2004, T20 cricket was still an idea waiting to happen. The shortest format, which today commands prime-time slots, billions in franchise cricket, biennial World Cup events, and the ICC’s most-reliable route to globalise the game, had not yet been played at the international level.That same year, a 17-year-old Saad Bin Zafar moved from Gujranwala in Pakistan to Canada. Cricket was not the reason for the move. Education was.“When we moved to Canada in the beginning, the sole reason was for me to get a good education,” Saad told TimesofIndia.com during an exclusive interaction. “My parents, especially my dad, used to tell me to focus on my studies, ‘play cricket but don’t let your studies affect you. That’s the sole reason we decided to move you to Canada.’ So, there was some pressure from my family.”

Two decades later, Saad is Canada’s most experienced campaigner in the ongoing T20 World Cup 2026 and their leading wicket-taker with four wickets.And as his team prepares to play Afghanistan in their final match of the tournament on Thursday at the MA Chidambaram Stadium in Chennai, the 39-year-old has just one ambition: “To give our best and show our potential.”A late start to ‘serious’ cricketFor the 1989-born, cricket was a pastime in Pakistan, rather than a serious pursuit.“I didn’t play a lot of club cricket in Pakistan. I played school cricket. I didn’t have in mind that I would take up cricket as a career,” he said.After moving to Canada, he joined the University of Toronto and completed a Bachelor’s degree in Business Administration there.

Canada’s Saad Bin Zafar, left, celebrates the wicket of New Zealand’s Tim Seifert (AP Photo/Mahesh Kumar A.)

Cricket initially fit around his studies. He would play club cricket in Toronto’s Super 9 league before making his debut for Canada in 2008.However, the early years were filled with inconsistency.“From 2008 to 2015, I was on and off in the team. I used to be picked and then dropped,” he added. “I was a youngster. I was new in the team. I was trying to make my place.”That changed in 2015. He gradually made his mark as a regular in the national side and became one of the team’s most trusted assets.A leader in the roomSaad played an integral part in leading Canada through the qualifiers into the T20 World Cup, later becoming the country’s first captain in the tournament’s history. Under his leadership, Canada regained ODI status in 2023.Although he doesn’t hold the captain’s armband anymore, the responsibilities have only got bigger.“I play my role as a bowling all-rounder, left-arm spinner, left-hand batsman, lower-middle order. I want to win matches for Canada through good performances. And I want to share my experience with the youngsters and groom them,” he said.

Canada’s Saad Bin Zafar, smiling, and Shreyas Movva celebrate the wicket of United Arab Emirates’ Mayank Kumar (AP Photo/Manish Swarup)

He has also had experience of playing foreign franchise cricket, including the Caribbean Premier League for St Lucia Zouks.In November 2021, he recorded a rare feat in T20Is: becoming the first man to concede no runs in a four-over spell and finishing with figures of 4-4-0-2 against Panama.Cricket became full-time over timeFor most of his career, cricket was not a full-time profession in Canada. Saad worked as a procurement analyst in an insurance company while playing international cricket.“It was very difficult at the start. After all, cricket was not a full-time profession in Canada,” he revealed. “Even when you play for Canada, you have to work together.”He negotiated leave for tours and sometimes worked remotely while travelling. But employers were not always welcoming. “There was a point when they said that we can’t accommodate you that much. So, you have to either work or play cricket,” he recalled.“When a company would start bothering me, I used to find another job. But I didn’t leave cricket.”In 2018, after becoming Player of the Match in the GT20 final and receiving opportunities in other franchise leagues, he made the decision to quit his job and focus fully on cricket.‘My parents started believing that I am talented’Saad moved to Canada with his family as the eldest son. The move was primarily for his university education. After three years, his family returned to Pakistan while he stayed back to complete his studies. However, eventually, his other four siblings also moved to Canada. Also, his father’s stance changed.ALSO READ: From ice hockey to T20 World Cup 2026’s youngest talents: Ajayveer Hundal finds ‘great feeling’ in Delhi“Eventually, when I got a call-up in the national team and started playing for Canada, my parents started believing that I am talented enough to represent Canada. After that, my dad started supporting me,” he added with a smile.“He then stopped telling me to give up cricket and focus on my studies. They now feel proud.”

Sports

Teddy Atlas goes out on a limb with Barrios vs Ryan Garcia prediction: “That’s my guess”

Teddy Atlas has delivered his verdict on Mario Barrios vs Ryan Garcia, insisting that the outcome should ultimately be determined by Garcia’s psychological state.

The pair will square off this Saturday at Las Vegas’s T-Mobile Arena, with Barrios gearing up for the third defence of his WBC world title.

His last two outings both resulted in a draw, against Abel Ramos and a 46-year-old Manny Pacquiao, though the 30-year-old is nonetheless considered a solid test for Garcia.

Entering his second world title challenge, Garcia has had just one outing at 147lbs, a unanimous decision defeat to Rolando Romero in May, since moving up from super-lightweight.

Prior to that, the American claimed a majority decision victory over Devin Haney in April 2024 which, due to him testing positive for banned substance ostarine, was later over-turned to a no-contest.

Not only that, but Garcia was also handed a year-long ban by the New York State Athletic Commission, during which time he has openly admitted to ‘drinking and partying’.

As a result of such antics, many have questioned the 27-year-old’s dedication to the sport, which appeared particularly problematic throughout the build-up to his showdown with Haney.

During that time, Garcia’s erratic behaviour led many to express concern over his psychological state in general, let alone any perceived lack of application to his craft.

And those same questions, it seems, are still lingering ahead of his clash with Barrios, though Hall of Fame trainer Atlas has opined on his YouTube channel that Garcia’s relative silence could be taken as an encouraging sign.

“At this point in Barrios’ career – Garcia being younger; Garcia being faster with his hands, a little more explosive – I think that you’d favour Garcia.

“But again… is he okay, mentally? Where is he at? You’ve got to take a gamble: Is he right, mentally?

“It’s been quiet on the western front [and], if it’s quiet on the western front with Garcia, that’s good news. If there’s no noise, then maybe things are good … And if I’m going to go with that, I’m gonna say I favour Garcia. Where you’ve got to favour Barrios is you know what you’re gonna get. With Garcia, you don’t know for sure what you’re gonna get.

“At the end of the day, I’ll guess that Garcia will be together.”

Many others would likely agree with Atlas’ assessment of the situation, believing that a mentally-focused Garcia has the beating of Barrios.

Sports

Revived Clippers take on Nuggets after All-Star interlude

Feb 11, 2026; Houston, Texas, USA; Los Angeles Clippers forward Kawhi Leonard (2) reacts to his winning basket against the Houston Rockets in the fourth quarter at Toyota Center. Mandatory Credit: Thomas Shea-Imagn Images

Feb 11, 2026; Houston, Texas, USA; Los Angeles Clippers forward Kawhi Leonard (2) reacts to his winning basket against the Houston Rockets in the fourth quarter at Toyota Center. Mandatory Credit: Thomas Shea-Imagn Images While the All-Star Game infrastructure figures to be gone by the time the Los Angeles Clippers play host to the Denver Nuggets on Thursday, much of the momentum is expected to remain.

Both teams will resume the post-break portion of their schedule when they meet at Inglewood, Calif., the site of last weekend’s All-Star festivities.

While the Nuggets’ Nikola Jokic and Jamal Murray started for Team World, the Clippers’ hometown hero Kawhi Leonard stole some of the spotlight as a starter for USA Stripes.

Leonard scored 31 points against Team World during a 12-minute “game” that allowed USA Stripes to play for the title in the three-team tournament against USA Stars. In the title game, USA Stripes fizzled as a tired Leonard missed all four of his shots from the floor while scoring one point.

“I was happy for him, just to be in our arena, in our building and play the way he did. It was good,” Clippers head coach Tyronn Lue said. “The crowd was really into it. They were going crazy. Even his teammates were going crazy about it. It was good to see.”

Leonard’s scoring burst looked similar to what he has shown while leading the Clippers to a revival since just before Christmas. Los Angeles started the season 6-21, but since Lue turned Leonard loose, they are 20-7.

The Clippers are 10th in the Western Conference and hold the last play-in spot with two months left in the regular season. However, they will proceed without James Harden, who was traded to the Cleveland Cavaliers at the deadline for Darius Garland, whose toe injury has delayed his team debut.

So how can Los Angeles continue its surge?

“Just the same thing we have been doing, with the effort, staying competitive, wanting to compete every night, pushing the pace, rebounding,” Leonard said. “That has been what we have been doing the last couple of weeks.”

Jokic only saw five minutes of action in the All-Star Game and didn’t score a point. Murray shot 0-for-6 without scoring in one 12-minute game and had eight points in another.

Denver resumes play in third place in the Western Conference, 3 1/2 games behind the second-place San Antonio Spurs and 6 1/2 games behind the first-place Oklahoma City Thunder.

The Nuggets were just 2-4 heading into All-Star weekend in a stumble that started after a 122-109 home victory over the Clippers.

Jokic might not have much love for the All-Star Game, but he showed just how much the regular season matters to him with four consecutive triple-doubles before the break. He has 184 in his career, second most all-time behind former teammate Russell Westbrook.

Aaron Gordon (hamstring) has missed the last nine games, while Peyton Watson (hamstring) missed the past three. Denver still put together a 122-116 victory over the Memphis Grizzlies before the break started.

“I’m not concerned,” Nuggets head coach David Adelman said of the team’s recent form. “We had some guys that were exhausted.

“We wanted to get a win going into the break. And that’s what they did. The guys toughed it out. … All these guys need a break, not just from basketball but from each other (and) from me.”

–Field Level Media

Sports

Riviera shut down Viktor Hovland’s sneaky shortcut. He’s not amused

To the list of famous trees in golf — the Eisenhower Tree, the Lone Cypress, the Ghost Tree — we can now add two more: the Hovland Trees.

A pair of sycamores, to be precise, now planted hard along the right side of Riviera’s 487-yard dogleg-right par-4 15th, a hole that ranks second-toughest on the scorecard and typically rates among the nastiest in the Genesis Invitational, too.

The trees weren’t added for aesthetics. They were installed as a defense against their namesake, Viktor Hovland, who in past Genesis starts has attacked the 15th unconventionally, launching his drive to the right, up the neighboring 17th fairway. It’s not the route Riviera’s designer, George Thomas, had in mind, but it opens up a wider landing area and a clean view of the 15th green. (Several other players have taken the same alternate route, but none has done so as frequently as Hovland).

Last year, of course, Riviera never got the chance to defend itself. Wildfires forced the Genesis to Torrey Pines. But in Hovland’s last appearance in the event at Riviera, he played the 15th in even par for the week — two pars, a birdie and a bogey. How much of an advantage that detour provided is impossible to say without having access to the alternate reality where he played the hole conventionally.

Regardless, this year, Riviera closed the loophole. In practice rounds, the trees appear to have served their purpose.

But if they’ve stymied Hovland, they haven’t silenced him. On Instagram, Hovland posted photos (above) of the new look with a caption that required no translation: SMH.

Hovland is hardly the first Tour pro to take a creative line in search of a competitive edge. At the Sony Open in Hawaii, Charley Hoffman has taken his drive on the par-5 18th down the 11th fairway. At the now-defunct Dell Technologies Championship, Justin Thomas and several others played the par-4 12th up the adjacent 13th.

Just as players get creative, so do courses and tournament committees, whether by planting trees or installing internal out-of-bounds. In 2023, Riviera tried a different kind of deterrent, positioning a tournament scoreboard in Hovland’s alternate line.

Hovland simply hit over it.

Good luck trying that this week.

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment14 hours ago

Entertainment14 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech19 hours ago

Tech19 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Entertainment6 hours ago

Entertainment6 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business20 hours ago

Business20 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World9 hours ago

Crypto World9 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit