Crypto World

Ethereum 50% staking figure by Santiment draws criticism from researchers

Ethereum has crossed a symbolic threshold, with more than half the total ether (ETH) issued now held in its proof-of-stake (PoS) contract for the first time in the network’s 11-year history, Santiment said in a post on X that has been met with criticism.

The onchain analytics firm on Tuesday said that 50.18% of all ETH issued historically is now sitting in the staking deposit contract. The figure reflects cumulative ETH that has flowed into the contract since staking was introduced ahead of the network’s 2022 transition from proof-of-work to PoS.

According to CoinDesk data, the total supply of ether is 120.69 million tokens. Bitmine, the world’s largest ether-focused treasury firm, has 4.29 million ETH, of which 2.9 million is staked. According to Arkham data, the largest holder is the Eth2 Beacon Deposit Contract with 77.1 million or over 60% of the total supply. It holds the most because it serves as the central, mandatory gateway for staking to secure the blockchain. Beacon is followed by Binance with 4.1 million ETH, BlackRock with 3.4 million and Coinbase with 2.9 million.

While the tokens are staked, they cannot be transferred or traded. Withdrawals have been enabled since the Shanghai upgrade in 2023, allowing validators to exit and return ETH to circulation.

That distinction prompted some analysts to caution against interpreting the 50% figure as a permanent supply lock.

‘Inaccurate and materially misleading’

“The post is inaccurate, or at least materially misleading,” Luke Nolan, senior research associate at CoinShares, told CoinDesk. “It references the one-way deposit contract used for ETH staking, but does not account for withdrawals. While ETH is sent into that contract when validators stake, it is not a permanent sink.”

Since withdrawals were enabled, ETH can exit the validator set and re-enter circulation, meaning that looking at the deposit contract balance alone can overstate the amount effectively staked, Nolan said.

“There is also an important nuance around the numbers being cited,” he added. “It is not correct to suggest that over 80 million ETH are currently staked. Roughly 80 million ETH have passed through the staking contract historically, but the amount actively staked today is closer to 37 million ETH, which is around 30% of the current circulating supply. That distinction materially changes the narrative.”

Aleksandr Vat, BizDev at Ethplorer.io, agreed with Nolan and provided CoinDesk with supporting data reinforcing that distinction.

The Beacon deposit contract balance on the Etherscan tracker, currently around 80.97 million ETH, reflects cumulative deposits since launch and does not decrease when validators exit. Withdrawals are processed by minting ETH back to execution-layer addresses rather than subtracting from the deposit contract itself, Vat said.

According to active staking metrics, approximately 37,253,430 ETH are presently staked, based on data from Ethplorer and CryptoQuant, implying that staking represents 30.8% of the total supply.

Santiment’s 50% figure appears to compare the cumulative Beacon contract balance to historically issued supply prior to EIP-1559 burns, Vat said. While that may be mathematically consistent depending on the denominator used, it does not represent the amount of ETH currently locked or removed from circulation, he noted.

Ethereum matures into ‘digital bond’

Even so, the milestone highlights how central staking has become to Ethereum’s economic design, Vineet Budki, partner and CEO at Sigma Capital, told CoinDesk. As participation rises, a larger share of ETH earns yield through validator rewards, reinforcing its positioning as a yield-bearing crypto asset, he said, adding he sees the development as evidence of Ethereum’s maturation into what he called a “digital bond.”

“Ethereum’s milestone of 50% staked supply marks its evolution into a digital bond, where the network’s security is fueled by long-term conviction rather than short-term speculation,” Budki said. “By locking half the total issuance in a one-way vault, the protocol has engineered a structural supply crunch.”

Budki also pointed to accelerating network activity, including a 125% year-over-year increase in daily transactions, a doubling of daily active addresses and an increase in tokenized real-world assets, much of it occurring on layer-2 networks that settle back to Ethereum’s base layer.

Nolan noted, however, that recent validator growth has been concentrated among large participants.

“A significant portion of recent validator entries has been driven by large entities such as Bitmine and U.S.-listed ETFs, which have taken up a notable share of the entry queue,” he noted.

With staking levels continuing to climb, the debate shows just how Ethereum’s supply metrics, and how they are presented, can significantly shape market narratives, Budki concluded.

Crypto World

Moonwell’s AI-coded oracle glitch misprices cbETH at $1, drains $1.78M

Moonwell’s lending pools racked up about $1.78M in bad debt after a cbETH oracle mispriced the token at nearly $1 instead of around $2.2k, enabling bots and liquidators to drain collateral within hours of a misconfigured Chainlink-based update reportedly using AI-generated logic.

Summary

- Misconfigured cbETH oracle set price near $1 vs roughly $2.2k, triggering a ~99% valuation gap that broke Moonwell’s collateral math.

- Liquidators repaid around $1 per position to seize over 1,096 cbETH, leaving Moonwell with roughly $1.78M in protocol-level bad debt.

- Faulty formula and scaling logic were reportedly co-authored by AI model Claude Opus 4.6, spotlighting new DeFi risk around AI-written oracle and pricing code.

Decentralized finance lending protocol Moonwell suffered a $1.78 million exploit due to a pricing oracle bug that misvalued Coinbase-wrapped ETH (cbETH), according to reports from the platform.

The vulnerability originated in oracle calculation logic reportedly generated by the AI model Claude Opus 4.6, which introduced an incorrect scaling factor in the asset price feed, according to the protocol’s disclosure. Attackers borrowed against severely underpriced collateral, extracting funds before the error was detected and corrected.

The cbETH mispricing effectively collapsed the collateral requirement for borrowing within affected pools. Because lending systems rely on accurate collateral ratios, the incorrect price allowed attackers to extract assets with minimal backing value, according to the protocol’s technical analysis.

Price oracles represent critical security components in DeFi lending systems. Incorrect asset valuation can enable under-collateralized borrowing or liquidation failures. Many major DeFi exploits have historically involved oracle manipulation or pricing errors rather than core protocol flaws, according to industry security reports.

The Moonwell incident differs from traditional oracle exploits in that the faulty logic appears linked to automated AI code generation rather than malicious oracle data feeds, according to the protocol’s preliminary investigation.

The exploit highlights risks associated with AI-assisted smart-contract development in financial applications. Language models can accelerate coding workflows, but financial protocols require precise numerical correctness, unit handling and edge-case validation, according to blockchain security experts.

In DeFi systems, small arithmetic or scaling mistakes can translate into systemic vulnerabilities affecting collateral valuation and solvency. The incident raises questions about whether AI-generated contract components may require stricter auditing standards than manually written code, according to security researchers.

AI-assisted development is increasingly used across Web3 engineering workflows, from contract templates to integration logic. Security models and audit frameworks have not yet fully adapted to AI-generated contract code, according to industry observers.

The broader implications center on how automated code generation errors in financial logic represent a new category of DeFi risk. Oracle math, scaling factors and unit conversions remain high-precision domains where automation failures can propagate into protocol-level vulnerabilities, according to technical analysis of the incident.

As AI-assisted smart-contract development expands, audit methodologies will likely need to evolve toward verifying not only code correctness but generation provenance and numerical invariants, according to blockchain security firms.

Crypto World

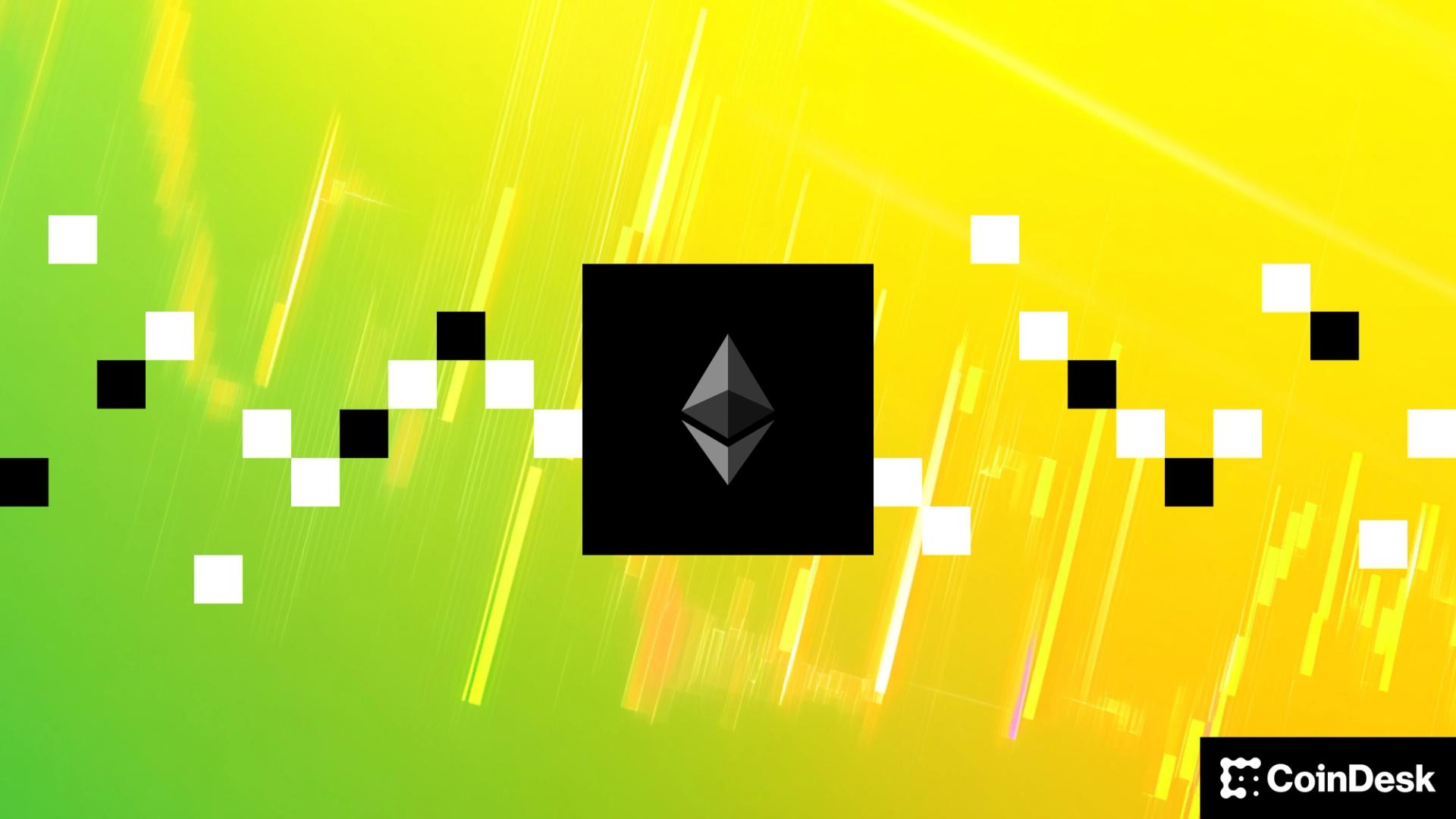

Kalshi Data Could Inform Fed Reserve Policy, Say Researchers

Three researchers at the US Federal Reserve argue that prediction market Kalshi can better measure macroeconomic expectations in real time than existing solutions and thus should be incorporated into the Fed’s decision-making process.

The “Kalshi and the Rise of Macro Markets” paper was released on Feb. 12 by Federal Reserve Board principal economist Anthony Diercks, Federal Reserve research assistant Jared Dean Katz and Johns Hopkins research associate Jonathan Wright.

Kalshi data was compared with traditional surveys and market-implied forecasts to examine how beliefs about future economic outcomes change in response to macroeconomic news and statements from policymakers.

“Managing expectations is central to modern macroeconomic policy. Yet the tools that are often relied upon—surveys and financial derivatives—have many drawbacks,” the researchers said, adding that Kalshi can capture the market’s “beliefs directly and in real time.”

“Kalshi markets provide a high-frequency, continuously updated, distributionally rich benchmark that is valuable to both researchers and policymakers.”

Kalshi traders can bet on a range of markets tied to the Federal Reserve’s decision-making, including consumer price index inflation and payroll, in addition to other macroeconomic outcomes such as gross domestic product growth and gas prices.

The Fed researchers said Kalshi data should be used to provide a risk-neutral probability density function, which shows all possible outcomes of Fed interest rate decisions and how likely each one is.

“Overall, we argue that Kalshi should be used to provide risk-neutral [probability density functions] concerning FOMC decisions at specific meetings” arguing that the current benchmark is “too far removed from the monetary policy interest rate decision.”

However, Fed research papers are only “preliminary materials circulated to stimulate discussion” and do not impact the central bank’s decision-making.

Prediction markets became one of the hottest use cases in crypto last year and have consistently surpassed $10 billion in monthly trading volume. Kalshi and competitor platform Polymarket have been aggressively marketing their products to retail users in recent months despite some state regulators seeking to restrict the industry.

Kalshi is more reactive than existing expectations tools

The Federal Reserve noted one advantage Kalshi has in examining macroeconomic expectations is its “rich intraday dynamics.”

Related: Treasury bills seen as primary driver of Bitcoin’s price: Report

“These probabilities respond sharply and sensibly to major developments,” the researchers said, pointing out an example where the implied probability of a rate cut in July rose to 25% following remarks from Federal Reserve Governors Christopher Waller and Michelle Bowman before falling after a stronger-than-expected June employment report.

“Kalshi provides the fastest-updating distributions currently available for many key macroeconomic indicators,” the researchers added.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

Crypto World

Institutions Favor Crypto Rails Over Tokens, Experts Say

Institutional capital is flowing into digital markets. But it is not chasing speculative altcoins. Instead, it is targeting tokenization, custody, and on-chain infrastructure.

That was the clear message from a recent BeInCrypto Digital Summit panel, where executives from across exchanges, infrastructure, and tokenization platforms discussed how traditional finance is approaching crypto.

The discussion featured Federico Variola, CEO of Phemex; Maria Adamjee, Global Head of Investor Relations and Market Structure at Polygon; Jeremy Ng, Founder and CEO of OpenEden; and Gideon Greaves, Head of Investment at Lisk.

Sponsored

Operating Exposure, Not Speculation

Maria Adamjee, Global Head of Investor Relations and Market Structure at Polygon, said institutions are no longer debating whether crypto belongs in portfolios. The question now is how to size it.

“Institutions aren’t debating if crypto belongs anymore,” said Maria Adamjee from Polygon . “They’re figuring out how to size it as a new asset class.”

However, she stressed that most large asset managers are not taking outright balance sheet risk on volatile tokens. Instead, they are seeking “operating exposure” through tokenization, custody, and on-chain settlement.

In other words, they are buying access to the infrastructure rather than speculating on price swings.

Conviction Still Being Tested

Federico Variola, CEO of Phemex, struck a more cautious tone. He questioned whether institutions have truly committed for the long term.

“Not many companies have gone really full crypto,” the Phemex CEO said. Many institutions, he added, structure partnerships in ways that do not disrupt their core business lines.

He warned that current enthusiasm may not survive a prolonged downturn. “If we enter a longer bear period, maybe we wouldn’t see as much interest as we are seeing today,” he said.

Sponsored

Sponsored

That raises a critical question. Are institutions building strategic allocations, or are they hedging against disruption while limiting risk?

Tokenization as the Bridge

Jeremy Ng, founder and CEO of OpenEden, argued that the strongest institutional case lies in tokenized real-world assets.

He pointed to growing hedge fund participation in crypto and rising plans to increase exposure in 2026. At the same time, he emphasized that tokenization solves a practical problem: cost.

“When large asset managers put products on-chain, it reduces costs,” Ng said. Blockchain can replace transfer agents and fund administrators by acting as a proof-of-record layer.

For institutions, this is less about ideology and more about efficiency.

Sponsored

Sponsored

The Market Structure Gap

Still, structural barriers remain.

Polygon’s Adamjee noted that institutions struggle to price most crypto tokens. “Are they priced based off revenues, or network value?” she asked. “There’s no real P/E ratio associated with them.”

As a result, institutional allocations skew heavily toward Bitcoin, Ethereum, and infrastructure plays. The broader altcoin market lacks the valuation frameworks traditional finance relies on.

Ng echoed that concern. “90% of these tokens that have been launched don’t really have a real business,” he said. “They are not really generating fees.”

Without revenue models and clear value accrual, many tokens fail institutional due diligence.

Fewer Tokens, More Real Businesses?

Variola acknowledged that the industry itself bears responsibility. Exchanges, he said, have often pushed new listings aggressively.

Sponsored

Sponsored

“As an industry we should be policing a little bit better,” Ng said, adding that there should likely be fewer tokens overall.

Polygon’s Adamjee agreed that current incentives reward token proliferation. Exchanges earn fees from listings, creating tension between growth and quality control.

That dynamic complicates institutional adoption. Large asset managers require transparency, durable revenue, and predictable market structure.

Infrastructure First

Taken together, the panel’s message was clear. Institutions are not embracing crypto culture wholesale. They are integrating blockchain, which improves efficiency.

They favor low-volatility assets, regulated wrappers, and tokenized versions of traditional products. They are building exposure to the rails.

For now, infrastructure and tokenization lead. Speculative tokens follow at a distance.

The next phase of institutional adoption may depend less on price cycles and more on whether crypto can build businesses that look familiar to traditional capital — with revenue, structure, and accountability to match.

Crypto World

BTC, ETH eyed as Kiyosaki calls giant stock crash near

BTC holds near support as Kiyosaki flags imminent stock crash, boosting demand for scarce assets.

Summary

- Kiyosaki warns of the “biggest stock market crash” approaching, citing his 2013 book and framing it as a wealth transfer for prepared investors.

- He is accumulating BTC, ETH, gold, and silver on dips, highlighting BTC’s fixed 21m cap and viewing panic selloffs as long-term entry opportunities.

- BTC recently traded near $68.4k after a drop from the $90k–$95k zone, with key support around $64k and $60k–$62k as markets stay fragile.

Financial author Robert Kiyosaki has issued a renewed warning of a major market crash, stating that the “biggest stock market crash in history” is imminent, according to his recent public statements.

Kiyosaki referenced his 2013 book “Rich Dad’s Prophecy,” in which he predicted a massive financial downturn. The author stated that the moment he warned about is now approaching and characterized the potential event as an opportunity for prepared investors.

The “Rich Dad Poor Dad” author described the anticipated downturn as a wealth transfer event. Those who prepared could become “richer beyond your wildest dreams,” while those who did not may face severe losses, according to his statements.

“In Rich Dad’s Prophecy published 2013 I warned of the biggest stock market crash in history still coming. That giant crash is now imminent,” Kiyosaki stated, adding that those who followed his warning and prepared would benefit from the coming crash.

Kiyosaki stated he is holding gold, silver, Ethereum, and Bitcoin, which he described as “real” assets, while avoiding what he characterized as “fake” versions of those instruments. The author said he is actively purchasing additional Bitcoin (BTC) as prices decline.

The financial educator emphasized Bitcoin’s fixed supply, noting that only 21 million Bitcoin will ever exist and that nearly the full supply is already in circulation. Kiyosaki argued that panic-driven selloffs create accumulation opportunities for long-term investors, stating he plans to purchase more Bitcoin if markets decline further.

Kiyosaki’s message aligns with his long-standing investment philosophy that economic crises present buying opportunities for hard assets. The author views falling markets as a chance to accumulate Bitcoin and other scarce assets at lower prices, according to his statements.

Crypto World

BTC climbs to $67,000 as Trump says U.S. deficit cut by 78%

Bitcoin trading remained volatile on Thursday, rising to around $67,000 after briefly dipping near $65,900, as traders weighed a new message from U.S. President Donald Trump claiming the nation’s trade deficit has been cut by 78% thanks to tariffs and could turn positive later this year.

“The United States trade deficit has been reduced by 78% because of the tariffs being charged to other companies and countries,” Trump said in a Truth Social post late Wednesday. “Ot will go into positive territory during this year, for the first time in many decades.”

The claim matters for crypto less because of the math in any single post and more because it pulls the market back to a familiar pressure point.

Tariffs can act like a tax on imports, which can lift prices in the real economy and complicate the path for interest rates. When markets start pricing “rates higher for longer,” the dollar tends to firm and risk assets tend to lose oxygen.

Bitcoin has spent the past two weeks trading like a macro proxy again, reacting to shifts in liquidity and rate expectations rather than any crypto specific catalyst.

There is also a real data backdrop that makes trade a live topic. In early January, the U.S. trade deficit narrowed sharply to about $29.4 billion, the lowest since 2009, with analysts pointing to a drop in imports, a jump in exports and the knock on effects of tariff threats.

But economists also noted that a big part of the swing came from non monetary gold flows, which can make month to month numbers look cleaner than the underlying trend.

If the tariffs story hardens into a stronger dollar and tighter financial conditions, rallies can struggle to stick. If it fades into political noise, crypto goes back to watching flows, leverage and whether buyers can reclaim lost levels.

Crypto World

Arthur Hayes predicts AI credit crisis as Bitcoin sounds liquidity alarm

Arthur Hayes believes Bitcoin is signaling that markets are underestimating a coming credit shock.

Summary

- Arthur Hayes argues Bitcoin is signaling a looming credit shock, citing its sharp drop from $126,000 to $60,000 while the Nasdaq remained relatively stable.

- He estimates AI-driven job losses among knowledge workers could trigger over $500 billion in consumer and mortgage defaults, potentially hitting U.S. bank equity by 13%.

- Hayes expects a deflationary phase first, followed by aggressive Federal Reserve money printing, which he believes would ultimately push Bitcoin higher.

In his latest Substack essay, “This Is Fine,” the BitMEX co-founder argues that Bitcoin (BTC) acts as a “global fiat liquidity fire alarm.” Its sharp drop from $126,000 to around $60,000, while the Nasdaq 100 remained relatively stable, reflects tightening dollar liquidity and rising deflation risk.

AI job losses may trigger $500B bank losses, Arthur Hayes says

Hayes links that risk to artificial intelligence. He estimates there are 72.1 million knowledge workers in the U.S., many of whom carry significant consumer debt and mortgages. If AI tools rapidly replace even 20% of those workers, he projects major stress for the banking system.

Using Federal Reserve data, Hayes calculates roughly $3.76 trillion in bank-held consumer credit, excluding student loans. He also estimates knowledge workers carry an average mortgage balance of about $250,000.

If widespread layoffs occur, he projects $330 billion in consumer credit losses and $227 billion in mortgage losses. After accounting for reserves, that would translate to roughly a 13% hit to U.S. commercial bank equity.

Hayes argues that while the largest “too big to fail” banks may withstand the shock, smaller regional lenders could face severe stress. Lending would tighten, credit would contract, and economic demand would weaken. Markets would first price in deflation before policymakers intervene.

He points to several early warning signs. Software and SaaS stocks have underperformed broader tech indices. Consumer staples are outperforming discretionary stocks, suggesting households are cutting back. Credit card delinquencies are rising. Meanwhile, gold has strengthened relative to Bitcoin, another sign of defensive positioning.

Despite the near-term risk, Hayes remains structurally bullish on Bitcoin. He argues that deflationary shocks eventually force the Federal Reserve to restart aggressive liquidity programs. Political tensions may delay action, but once banking stress intensifies, he expects policymakers to “print” on a large scale.

Hayes outlines two scenarios. Either Bitcoin’s drop to $60,000 marked the bottom and equities will follow lower before liquidity returns, or Bitcoin could fall further if credit conditions worsen. In both cases, he believes renewed monetary expansion would ultimately push Bitcoin to new highs.

For now, Hayes advises caution and limited leverage. The alarm may be ringing, but he argues the real opportunity comes when the money printer starts again.

Crypto World

American Bitcoin Corp Joins Top 20 Bitcoin Holders With 6,039 BTC

TLDR

- American Bitcoin Corp has reached 6,039 BTC in its corporate treasury.

- The company is now the 17th largest corporate holder of Bitcoin globally.

- ABTC uses a “mining-to-treasury” strategy to retain the Bitcoin it mines.

- Since going public in September 2025, ABTC has achieved a 116% Bitcoin yield.

- Despite the Bitcoin reserve growth, ABTC’s stock has fallen by 86%.

American Bitcoin Corp (ABTC), a company backed by the Trump family, has reached a major milestone in the cryptocurrency market. After just six months of going public, the company now holds 6,039 Bitcoin (BTC), valued at approximately $409 million. This achievement positions ABTC as the 17th largest corporate holder of Bitcoin globally.

ABTC’s Bitcoin Reserves and Mining-to-Treasury Strategy

American Bitcoin Corp’s Bitcoin reserves have quickly grown due to its “mining-to-treasury” approach. Instead of selling the Bitcoin it mines, ABTC retains the coins, which has contributed to the company’s swift growth. In January alone, it added 217 BTC to its holdings, showing continued success in this strategy.

The company has combined both mining operations and market purchases to fuel its treasury growth. This hybrid strategy has led to a 116% yield in Bitcoin since ABTC’s debut on the Nasdaq in September 2025. By keeping its mined Bitcoin instead of selling, ABTC has steadily built its reserve, distinguishing itself from traditional miners.

Stock Performance and Market Volatility

Despite growing its Bitcoin treasury, ABTC’s stock has faced significant challenges in the market. Since going public, the company’s shares have dropped by 86%, affected by Bitcoin’s volatility and the expiration of the lock-up period for early investors. This sharp decline in stock price is a reflection of the broader market trends impacting both ABTC and the cryptocurrency space.

Despite the stock downturn, analysts remain confident about ABTC’s prospects. Both Roth Capital and H.C. Wainwright & Co. have maintained Buy ratings with a $4 price target. These ratings reflect optimism about the company’s long-term potential, even with short-term market volatility.

Bitcoin’s Influence on ABTC’s Growth

American Bitcoin Corp’s treasury growth highlights its effective use of Bitcoin mining and market participation. The company’s strategy has enabled it to quickly accumulate a significant amount of Bitcoin, surpassing other firms like GameStop and Gemini Space Station in corporate holdings. However, the broader market conditions continue to affect the company’s stock performance.

ABTC’s current position in the global ranking of Bitcoin corporate treasuries signals its ambition in the cryptocurrency space. Despite the challenges, the company’s approach of retaining its mined Bitcoin continues to prove effective in growing its reserve. As Bitcoin prices remain volatile, ABTC’s future strategy will be crucial in maintaining its position in the market.

Crypto World

Aptos Foundation to Propose New Deflationary Tokenomics

The Aptos Foundation is looking to propose a significant shakeup to the dynamics of the Aptos token, announcing a host of potential policy changes designed to spur greater APT deflation.

In an X post on Wednesday, the Aptos Foundation said it would submit several governance proposals to help transition the ecosystem away from its current subsidy-based emission format to something focused more on “performance-driven mechanisms” and decreasing APT supply.

“The Aptos network is transitioning to performance-driven tokenomics designed to align supply mechanics with network utilization,” the Aptos Foundation said, adding:

“This update replaces bootstrap-era subsidy with mechanisms tied to transaction activity, establishing a framework where burns can exceed emissions as high-throughput applications scale.”

One of the foundation’s proposals is to set a hard cap at 2.1 billion tokens, as APT currently does not have a maximum cap on the total supply. The team said there are currently 1.196 billion APT in circulation.

Under the current emission structure, new tokens are continuously minted to support the ecosystem by funding things like development, grants, and staking rewards.

Meanwhile, significant token unlocks have been hanging over the ecosystem.

However, the Aptos Foundation said that this specific pressure has been easing and will continue to decline after the next major four-year token unlock cycle ends in October, stating that it will result in a 60% reduction in annualized supply unlocks.

The team said that as the ecosystem has matured to the point where big institutions such as BlackRock, Franklin Templeton, and Apollo are now deploying “hundreds of millions onchain,” APT tokenomics need to become more sustainable.

“Without reform, emissions continue indefinitely with no hard ceiling, no performance requirements, and no connection between issuance and network activity,” the team said.

Key proposals and policy changes afoot

Alongside the hard 2.1 billion supply cap, the proposed policy changes include a reduction of the annual staking rewards rate from 5.19% to 2.6%, alongside increasing rewards for “longer staking commitments.”

The Aptos Foundation said this would result in reduced overall staking emissions while also rewarding long-term participants.

Elsewhere, the team is pushing for a 10-fold increase in gas fees, arguing that there is room to do this given how cheap it is to use the network. As gas fees paid in APT are burned, this would also help reduce emissions.

Related: Coinbase’s Base transitions to its own architecture with eye on streamlining

“Even with a 10X increase, stablecoin transfers would still be the lowest in the world at around $0.00014, making it the ideal blockchain for stablecoins, payments, and any other similar high-volume transactions,” the team said.

The Aptos Foundation also proposed permanently locking 210 million APT tokens for staking on the network. The team said this would be “functionally equivalent to a token burn” and will use the rewards to fund foundation operations.

The team also said it will change its grants policy and enact stricter KPIs to ensure greater performance before issuing tokens. Finally, the foundation will also explore a token buyback program or APT reserve to help balance supply.

The Aptos Foundation is not alone in seeking major shakeups to native token dynamics. In January, the Optimism governance community approved a proposal from its foundation to initiate a buyback program using 50% of Superchain revenue.

Meanwhile, decentralized exchange Uniswap saw a significant token burn approved in December, and PancakeSwap’s community also approved a supply-reducing proposal last month.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

El Salvador bets on $100m tokenized SME equity via Stakiny

LatAm splits: El Salvador tokenizes SMEs, Brazil eyes BTC reserves, Argentina curbs wallet wages.

Summary

- El Salvador targets $100m in tokenized SME funding via COIN–Stakiny, using EVM tech, biometric wallets, and CNAD oversight for equity tokens.

- Brazil’s RESBit bill would let the state buy BTC up to 5% of FX reserves, store in cold wallets, and accept BTC for taxes with income-tax breaks on digital assets.

- Argentina’s Senate dropped digital wallet salary deposits after banking lobbying, keeping wages in bank accounts despite strong wallet usage amid inflation and past freezes.

Three Latin American countries have adopted contrasting approaches to cryptocurrency regulation and adoption in recent months, according to legislative and government actions across the region.

Latin American countries pivoting towards crypto

El Salvador announced plans to launch a $100 million investment project using digital tokens to support local small and medium-sized businesses. The initiative represents a strategic alliance between Corporación Infinito and Stakiny, designed to connect domestic enterprises with international financial markets through tokenized equity instruments.

Stakiny, a platform seeking approval from the National Commission on Digital Assets, will provide the technical infrastructure to tokenize shares of private companies. The system combines traditional shareholder agreements with blockchain-recorded digital tokens, enabling real-time management of capitalization tables, dividend distribution, governance events, and secondary trading. The platform operates on an EVM-compatible network and is accessible through a biometric mobile wallet.

In Brazil, lawmakers are considering legislation that would establish a Sovereign Strategic Bitcoin Reserve, known as RESBit, and eliminate taxes on Bitcoin earnings. Congressman Luiz Gastão presented the proposal, Bill 4,501/2024, to the Economic Development Committee of the Chamber of Deputies.

The legislation would allow the government to gradually acquire Bitcoin up to five percent of the nation’s foreign exchange reserves. Management of the assets would be shared between the Central Bank and the Ministry of Finance, with storage in cold wallets. The bill would permit the use of Bitcoin to settle federal taxes and remove current requirements for brokers and investors to document all Bitcoin transactions. The proposal includes a 100% income-tax exemption on revenues from Bitcoin and other digital assets.

Argentina took a different path when lawmakers removed provisions that would have allowed workers to receive wages through direct deposit into digital wallets. The clause was eliminated from a labor reform proposal after President Javier Milei’s party agreed to drop the section to secure broader support for the legislation.

The decision followed opposition from Argentina’s traditional financial institutions, which contacted senators to voice concerns about the digital wallet payment option. A survey conducted by the central bank several years ago showed that 47% of the population holds a bank account.

Digital wallet platforms including Mercado Pago, Modo, Ualá, and Lemon have gained users in Argentina amid currency instability and dollar shortages. The country has experienced recurring inflation and periodic restrictions on accessing funds from bank accounts, including the 2001 “corralito” banking freeze.

The three nations‘ varying approaches reflect broader experimentation across Latin America with cryptocurrency regulation, reserve management, and financial inclusion policies.

Crypto World

Altcoin Sell Pressure Reaches 5-Year Extreme After 13 Months of Continuous Distribution

TLDR:

-

- Altcoin sell pressure on CEX spot markets has reached its highest extreme in over five years of data.

- Cumulative buy and sell volume for altcoins has trended negative for 13 consecutive months without relief.

- No institutional accumulation patterns are visible in current altcoin spot flow data across exchanges.

- Capital appears to be rotating into Bitcoin or cash, leaving altcoin order books thin and highly vulnerable.

- Altcoin sell pressure on CEX spot markets has reached its highest extreme in over five years of data.

Altcoin sell pressure has reached a five-year extreme, according to recent on-chain and exchange flow data.

For over 13 consecutive months, altcoins excluding Bitcoin and Ethereum have recorded net selling on centralized exchange spot markets.

Analysts warn this is not a routine correction. The data points to a structural shift in how capital is moving across the crypto market, raising serious questions about the timeline for any altcoin recovery.

Cumulative Sell Volume Signals No Signs of Absorption

The cumulative buy and sell volume difference for altcoins has collapsed to levels last seen five years ago.

This metric, which tracks net buying versus selling activity on spot markets, has moved in one direction throughout the period.

There has been no meaningful flattening or stabilization in the data. Bounces have been consistently sold into, and breakout attempts have lacked any real follow-through from buyers.

Market analyst account Our Crypto Talk flagged the chart on X noting that even the 2022 bear market did not produce this kind of sustained one-sided pressure. The account wrote that sellers are “overwhelming buyers month after month” with no base forming.

That context makes the current situation historically unusual, not just uncomfortable for bag holders. The absence of any accumulation curve is what separates this period from prior downturns.

Tokens such as LINK, KAS, ONDO, RENDER, TAO, SUI, and SEI have all lost substantial value from their cycle highs.

Holders of these assets are down significantly, with some tokens trading more than 90% below peak prices.

A kind of drawdown, sustained over more than a year, reflects broader structural selling rather than temporary volatility. It also suggests that retail participants have largely stepped back from active buying.

Order books across major altcoins have thinned considerably during this period. Liquidity has dried up, making price movements more volatile in both directions. However, the net effect remains persistently negative. Until measurable buying pressure returns, each rally attempt remains vulnerable to selling.

Capital Rotation Away From Altcoins Raises Questions on Altseason Timing

Capital currently appears to be rotating toward Bitcoin, cash positions, or assets outside the crypto market entirely. No observable data suggests quiet institutional accumulation in altcoin spot markets at this time.

When serious capital enters a market, volume patterns shift, and cumulative flows stabilize. That pattern is absent here.

Our Crypto Talk stated directly that “the idea that alts will randomly explode any day now without flow confirmation is just hope.” That framing reflects what the flow data currently shows.

Watching cumulative delta and waiting for absorption is the approach the data supports. Premature calls for altseason are not grounded in the present market structure.

Risk management during a confirmed distribution phase looks different from positioning during accumulation. Traders anchored to previous cycle highs may be misreading current conditions.

The data, not sentiment, should guide positioning decisions right now. Until flows reverse, the distribution narrative remains the one the market is telling.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment15 hours ago

Entertainment15 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech20 hours ago

Tech20 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Entertainment7 hours ago

Entertainment7 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business21 hours ago

Business21 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World10 hours ago

Crypto World10 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show