Money

Trainline issues huge warning to passengers that must be followed or risk £100 fine

TRAINLINE has issued a huge warning to passengers that must be followed or could risk being hit with £100 fine.

The digital platform, which allows customers to book travel online, is reminding users they can not use their Railcard on every train journey.

A railcard is a discount card for young and retired people which helps them shave around a third off their travel costs.

However, Trainline said some Railcards can only be used on fares that are above a certain price, at a certain time.

While others have specific restrictions on the times you can travel.

For example, if you’re travelling between 4:30am and 10am, some Railcards can only be used on fares that cost £12 or more.

If you do not adhere to these rules you could face a £100 fine for not complying with the ticket rules.

A Trainline spokesperson told The Sun it is changing how it presents information to make the rules more easy for customers to understand.

They said: “While we have always applied railcards correctly and presented the right fees to our customers, recent events highlighted a sense of confusion for passengers around rail industry terms and conditions.

“And so, we have changed how we present this information in the booking flow, as well as adding information to our website, to give customers clarity when buying their tickets”

Travel cards have been in the spotlight recently after it was reported that Northern Rail passengers could be entitled to compensation.

The travel giant said it was dropping cases of people accused of wrongly using a 16-25 railcard to get discounted travel at the wrong time of the day, The Telegraph reported.

It was said that Northen was breaking a rule whereby passengers with a railcard travelling on the wrong train must be offered the chance to pay back the difference “on the spot”.

Instead, the travel giant was accused of whacking travellers with a find on the spot

A Northern Rail spokesperson told the outlet: “We are withdrawing any live cases and will also look to review anyone who has been prosecuted previously on this specific issue”.

The Sun has contacted Northern Rail for a comment,

How to avoid a fine when using your Railcard

Railcards are available to a number of different age groups, including students, young professionals and the elderly.

You have to pay for the card with the price usually working out at around £30 for a year or £70 for three years.

A number of different companies issue Railcards, such as Trainline which is the official retailer of Railcards by National Rail.

Trainpal is another option but the price remains the same.

Using the discount can help you save around a third on your travel costs.

However, it is important to note that you could be fined if you travel during peak time or pay a certain amount for your ticket.

This is especially important when you buy Anytime tickets or other flexible tickets.

For example, if you travel on a train before 10am and have used your Railcard to buy your ticket, make sure you didn’t pay less than £12.

This is because the ticket won’t be valid before 10am – even though it’s an Anytime ticket.

To avoid fines make sure that if you end up travelling on an earlier train, make sure to double-check any restrictions.

You can read about the restrictions surrounding Railcards by visiting, https://www.railcard.co.uk/help/railcard-terms-and-conditions//

Different types of Railcard

- 16-25 Railcard:

- Eligibility: Available to anyone aged 16-25, or mature students aged 26 and over who are in full-time education.

- 26-30 Railcard:

- Eligibility: Available to anyone aged 26-30.

- Senior Railcard:

- Eligibility: For those aged 60 and over.

- Two Together Railcard:

- Eligibility: For two named individuals aged 16 or over who travel together.

- Family & Friends Railcard:

- Eligibility: Up to four adults and four children (aged 5-15) can travel on one card.

- Disabled Persons Railcard:

- Eligibility: Available to those with a disability that makes travelling by train difficult.

- Network Railcard:

- Eligibility: For anyone, but only valid for travel in the Network Railcard area (South East of England)..

- HM Forces Railcard:

- Eligibility: For members of the armed forces and their families.

- 16-17 Saver:

- Eligibility: Available to anyone aged 16-17.

Money

Planners urged to ‘believe and articulate’ their value

Financial planners need to get better at articulating their value to clients, Attivo regional director Louise Barraclough has insisted.

At Money Marketing Interactive in Leeds today (24 October), she said advisers should think about where the value of their advice is for clients.

“As planners, we absolutely need to believe our value,” she said, suggesting this is the “biggest thing in this profession that we lack”.

“It’s not just enough to believe value,” she added. “We need to articulate value way before the client asks us to demonstrate it.”

Barraclough said that, to some degree, she can understand why advisers tend to “hide behind regulations” because “sometimes that’s an easy thing to do”.

However, those in financial-planning roles have a great deal of power over clients’ lives.

“The decisions that you help your clients make today don’t just impact the next year, they don’t just impact the next 10 years,” she said. “The impact extends to the next generation.”

Barraclough also suggested people often do not fully understand the difference between financial advice and financial planning.

“One of the questions I’m frequently asked is, ‘Which is best?’ The truth is, both are important, and both have a place in today’s world.

“You will all act as coaches, mentors and planners for your clients, but at some point, you’ll also need to give them advice on their investments

“This is the foundation of any financial plan.”

She said the challenge arises when a client approaches a planner for a purely transactional relationship and they try to shift that client straight into a financial planning relationship. “That’s where friction can occur.”

“Demonstrating value is often about recognising where your client is on their journey, meeting them at that point, and then guiding them through financial planning done well.”

She said the planner essentially becomes the “flight attendant” in a client’s financial life, “ensuring their comfort and safety”.

“The past few weeks have proven this,” she said. “And the next few will prove it even more. With the Budget being a hot topic, you’ll be dealing with that for sure.”

During her presentation, Barraclough urged advisers to “treat every client as a human being”.

“But,” she added, “you can take it a step further and treat each one as though they are your only client.”

Money

Supermarket giant slashes Christmas tubs to just £2.50 – it’s the cheapest around and it’s not Aldi or Tesco

A MAJOR supermarket has slashed its Christmas tub prices to just £2.50.

Cheaper than Aldi or Tesco – the offer makes this the most cost-efficient place to purchase Christmas chocolate boxes.

From October 25 to October 27, Asda customers can bag this sweet deal – but there is a catch.

Customers have to be signed up for the Asda rewards programme.

The offer is part of Asda’s Rewards Mega Event weekend, where shoppers can save more than 50% on festive favourites like Quality Street, Cadbury Heroes, Cadbury Roses, Celebrations, and Swizzels.

Normally priced at 2 for £9, Asda has cut the cost to just 2 for £5 – meaning each tub costs just £2.50, making it the best price around for stocking up on festive treats.

Read more on festive deals

Shoppers will need to download the Asda Rewards app to take advantage of this offer.

Coupons for the discount will appear in the app’s ‘wallet’ section from Friday, October 25.

To claim the deal, simply scan the coupon at the till, and your discount will be applied.

But be quick – once the weekend ends on October 27, so does this massive discount.

Asda’s Rewards Mega Event isn’t just about chocolates.

Its loyalty program allows shoppers to earn “Asda Pounds” on their everyday purchases, which can be converted into vouchers for money off future buys.

Deals on household products and cosmetics also earn Asda Pounds, boosting savings even further.

How to get the best deal

While this weekend’s deal on Christmas tubs is unbeatable, it’s always worth comparing prices to make sure you’re getting the best deal.

Ocado is currently selling the same 600g tubs for £5, while Tesco and Sainsbury’s are listing them at £6.

Morrisons is offering 2 tubs for £6, and Aldi has dropped prices to £3.89 per tub.

However, Asda’s 2 for £5 offer blows all competitors out of the water so for those wanting to get ahead of the festive rush, now’s the perfect time to stock up and save money.

Prices listed above reflect today’s prices, October 24, and are subject to change all the time.

Just because something is on offer, or is part of a sale, it doesn’t mean it’s always a good deal.

How to save money on chocolate

We all love a bit of chocolate from now and then, but you don’t have to break the bank buying your favourite bar.

Consumer reporter Sam Walker reveals how to cut costs…

Go own brand – if you’re not too fussed about flavour and just want to supplant your chocolate cravings, you’ll save by going for the supermarket’s own brand bars.

Shop around – if you’ve spotted your favourite variety at the supermarket, make sure you check if it’s cheaper elsewhere.

Websites like Trolley.co.uk let you compare prices on products across all the major chains to see if you’re getting the best deal.

Look out for yellow stickers – supermarket staff put yellow, and sometimes orange and red, stickers on to products to show they’ve been reduced.

They usually do this if the product is coming to the end of its best-before date or the packaging is slightly damaged.

Buy bigger bars – most of the time, but not always, chocolate is cheaper per 100g the larger the bar.

So if you’ve got the appetite, and you were going to buy a hefty amount of chocolate anyway, you might as well go bigger.

There are plenty of comparison websites out there that’ll check prices for you – so don’t be left paying more than you have to.

Most of them work by comparing the prices across hundreds of retailers.

For example, Google Shopping is a tool that lets users search for and compare prices for products across the web. Simply type in keywords, or a product number, to bring up search results.

Another tool is Price Spy, which logs the history of how much something costs from over 3,000 different retailers, including Argos, Amazon, eBay and supermarkets.

Once you select an individual product you can quickly compare which stores have the best price and which have it in stock.

Idealo is another website that lets you compare prices between retailers.

All shoppers need to do is search for the item they need and the website will rank them from the cheapest to the most expensive one.

How to save at Asda

Shop the budget range

Savvy shopper Eilish Stout-Cairns recommends that shoppers grab items from Asda’s Just Essentials range.

She said: “Asda’s budget range is easy to spot as it’s bright yellow! Keep your eyes peeled for yellow and you’ll find their Just Essentials range.

“It’s great value and I’ve found it has a much wider selection of budget items compared to other supermarkets.

Sign up to Asda Rewards

The savvy-saver also presses on the importance of signing up to Asda’s reward scheme.

She said: “Asda Rewards is free to join and if you shop at Asda you should absolutely sign up.

“As an Asda Rewards member, you’ll get exclusive discounts and offers, and you’ll also be able to earn 10% cashback on Star Products.

“This will go straight into your cashpot, and once you’ve earned at least £1, you can transfer the money in your cashpot into ASDA vouchers.

We’ve previously rounded up the best supermarket loyalty schemes – including the ones that will save you the most money.

Look out for booze deals

Eilish always suggests that shoppers looking to buy booze look out for bargain deals.

She said: “Asda often has an alcohol offer on: buy six bottles and save 25%.

“The offer includes selected bottles with red, white and rose options, as well as prosecco. There are usually lots of popular bottles included, for example, Oyster Bay Hawkes Bay Merlot, Oyster Bay Hawkes Bay Merlot and Freixenet Prosecco D.O.C.

“Obviously, the more expensive the bottles you choose, the more you save.”

Join Facebook groups

The savvy saver also recommends that fans of Asda join Facebook groups to keep in the know about the latest bargains in-store.

Eilish said: “I recommend joining the Latest Deals Facebook Group to find out about the latest deals and new launches in store.

“Every day, more than 250,000 deal hunters share their latest bargain finds and new releases.

“For example, recently a member shared a picture of Asda’s new Barbie range spotted in store.

“Another member shared the bargain outdoor plants she picked up, including roses for 47p, blackcurrant bushes for 14p and topiary trees for 14p.”

Money

Abrdn boosts real estate investment view for first time since 2022

REITs are currently focusing on capital raising for growth rather than balance sheet repair – a “sign of renewed confidence”.

The post Abrdn boosts real estate investment view for first time since 2022 appeared first on Property Week.

Money

Upcoming Budget ‘more than ever highlights the importance of advice’

Chancellor Rachel Reeves’ first Budget on 30 October “more than ever highlights the importance of financial advice”.

This is what Triple Point regional business development manager Lucy Dolan said on a panel at the Money Marketing Interactive conference in Leeds today (24 October).

Speaking on the same panel Moran Wealth Management founder Nicola Crosbie added that there has been a lot of “panic and hysteria” surrounding the Budget.

“The need for tax planning advice will increase” as a result, Crosbie added.

She said that at the moment it is all speculation, but “we need to have a plan in place to help clients quickly following the Budget”.

Dolan, on a more positive note, said: “We have been through a lot of change before and come out of it on the other side”.

Still, her diary is packed with post budget sessions and webinars.

Syndaxi Financial Planning managing director Robert Reid also asked the audience how many had been asked about tax-free cash in the run-up to the Budget.

The majority of those attendance raised their hands.

Dolan also spoke about venture capital trusts (VCTs) and enterprise investment schemes (EIS).

EIS and VCTs enable businesses to secure equity investment and grow rapidly, with tax reliefs helping reduce investors risk, she said.

In regards to the abolition of the lifetime allowance (LTA), Crosbie said she does not believe it will be reintroduced.

Reeves initially indicated that Labour would reverse this move, which was originally announced by then chancellor Jeremy Hunt.

However, Labour dropped plans to reintroduce the pension LTA, saying it would be “too complex”.

This move was widely welcomed by the financial services industry.

Money

Major energy firm with 5.6million customers is giving thousands FREE electricity on Halloween – but you need to be quick

A MAJOR energy firm is giving thousands of customers free electricity this Halloween.

E.ON Next, which serves 5.6 million customers in the UK, is offering selected customers free electricity this Halloween.

The energy firm has begun emailing chosen customers, encouraging them to take advantage of this special offer.

Customers who download the E.ON Next app can receive a £5 credit on their electricity bill for Halloween.

The email sent to participants reads: “No tricks this Halloween, just a treat on us.

“Here’s a scarily good deal! Get a day’s worth of free electricity on us, just by following three simple steps.”

To claim the reward, customers who receive the email must first download the E.ON Next app, available on both the Apple App Store and Google Play Store.

After downloading the app, they need to log in to their E.ON Next account within 48 hours.

Once these steps are completed, customers can claim a free £5 energy credit, which will be applied to their electricity bill on October 31.

E.ON Next states that the £5 credit is equivalent to the average daily cost of electricity in the UK, meaning it will cover a full day’s electricity usage for most customers.

However, customers with a prepayment meter will not be eligible for this offer.

Reacting to the news of the offer on Facebook, one customer said: “Decent, that’ll cover boiling the kettle.”

Another said: “This can be really helpful for those who are struggling!”

“I downloaded their app, and it’s the first thing that pops up once signed in,” said a third.

Eligible customers have until 10am tomorrow (October 25) to redeem the offer before it closes for good.

E.ON Next said that the £5 credit will appear as ‘Free energy credit’ on online accounts, paper statements, and bills.

Customers who aren’t with E.ON Next can still get access to free bill credits by taking part in a number of energy-saving schemes.

OTHER WAYS TO GET FREE ENERGY CREDITS

A number of energy suppliers reward customers with discounts or credit when they change the way they use their gas and electricity usage.

These schemes, offered by the likes of British Gas, EDF, Octopus and Ovo Energy, can help customers save money this winter.

Here’s everything you need to know.

British Gas

British Gas‘ Peak Save Sundays scheme offers millions of customers half-price electricity for using their energy during certain hours.

It offers qualifying customers half price electricity between 11am and 4pm every Sunday.

The energy firm said over 650,000 customers had already signed up to the scheme, saving a combined £13million between them.

You can sign up to the scheme by visiting britishgas.co.uk/energy/peak-save.html.

The supplier will then be in touch with you if your application is successful.

After that, your savings will appear as “PeakSave Credit” on your next energy bill or online statement.

Be aware that you can only sign up to the scheme if you have a smart credit or prepayment meter that can send half-hourly meter readings.

If you don’t have a smart meter, don’t worry, British Gas will install one for free in your home.

EDF Energy

EDF offers customers the opportunity to run their homes for no cost if they take part in a new challenge.

To get the hours of free electricity, customers must cut down on using electrical devices during “peak hours”, which tend to be between 4pm-7pm Monday to Friday.

In return, EDF will give customers free electricity on Sundays when demand to the energy grid tends to be lower.

The more electricity customers shift to off-peak times, the more free electricity they can earn.

Customers who manage to cut back their usage by 40% during the week can earn up to 16 hours of free electricity to use on a Sunday.

To take part, customers need a smart meter.

To find out more, visit edfenergy.com/energy-efficiency/sunday-saver-challenge.

Octopus Energy

Octopus Energy customers who are signed up to the “Octoplus” can take part in free electricity sessions when wholesale prices fall below zero.

The sessions last an hour, and customers can use electricity for free and receive credits for using more than they typically would.

All customers with a smart meter, including smart prepay meters, receive an alert the day before each session.

When the session begins, they can ramp up their electricity usage – whether it’s charging gadgets, running a laundry marathon, or any other household activity.

Any extra electricity consumed beyond their normal usage will be credited back to their account.

Find out more by visiting octopus.energy/free-electricity/.

Ovo Energy

Ovo Energy also offers a scheme which rewards customers for reducing their energy consumption during peak times.

Power Move offers customers up to £10 a month if they use 8.50% or less of their home’s total electricity between 6-9pm, Monday to Friday.

For example, by using the dishwasher in the morning or waiting until after 9pm in the evening to catch up on TV.

You can sign up by visiting ovoenergy.com/power-move.

What energy bill help is available?

There’s a number of different ways to get help paying your energy bills if you’re struggling to get by.

If you fall into debt, you can always approach your supplier to see if they can put you on a repayment plan before putting you on a prepayment meter.

This involves paying off what you owe in instalments over a set period.

If your supplier offers you a repayment plan you don’t think you can afford, speak to them again to see if you can negotiate a better deal.

Several energy firms have grant schemes available to customers struggling to cover their bills.

But eligibility criteria vary depending on the supplier and the amount you can get depends on your financial circumstances.

For example, British Gas or Scottish Gas customers struggling to pay their energy bills can get grants worth up to £2,000.

British Gas also offers help via its British Gas Energy Trust and Individuals Family Fund.

You don’t need to be a British Gas customer to apply for the second fund.

EDF, E.ON, Octopus Energy and Scottish Power all offer grants to struggling customers too.

Thousands of vulnerable households are missing out on extra help and protections by not signing up to the Priority Services Register (PSR).

The service helps support vulnerable households, such as those who are elderly or ill, and some of the perks include being given advance warning of blackouts, free gas safety checks and extra support if you’re struggling.

Get in touch with your energy firm to see if you can apply.

Money

Assura sells 12 assets for £25m as it accelerates disposal programme

Assura said it was currently in discussions on further tranches of asset disposals with an aggregate value of approximately £110m.

The post Assura sells 12 assets for £25m as it accelerates disposal programme appeared first on Property Week.

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

MMA3 weeks ago

MMA3 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

MMA3 weeks ago

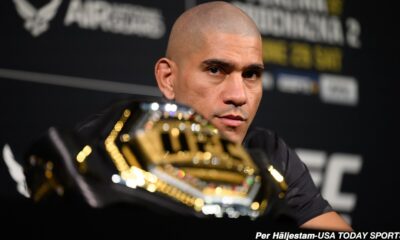

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology4 weeks ago

Technology4 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Technology4 weeks ago

Technology4 weeks agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

Technology3 weeks ago

Technology3 weeks agoGmail gets redesigned summary cards with more data & features

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

Sport3 weeks ago

Sport3 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Football3 weeks ago

Football3 weeks agoWhy does Prince William support Aston Villa?

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

MMA3 weeks ago

MMA3 weeks ago‘I was fighting on automatic pilot’ at UFC 306

-

News3 weeks ago

News3 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

TV3 weeks ago

TV3 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Money3 weeks ago

Money3 weeks agoPub selling Britain’s ‘CHEAPEST’ pints for just £2.60 – but you’ll have to follow super-strict rules to get in

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

News3 weeks ago

News3 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

-

Politics3 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

Technology3 weeks ago

Technology3 weeks agoHow to disable Google Assistant on your Pixel Watch 3

-

Business3 weeks ago

Can liberals be trusted with liberalism?

-

Entertainment3 weeks ago

Entertainment3 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment1 month ago

Science & Environment1 month agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

You must be logged in to post a comment Login