Video

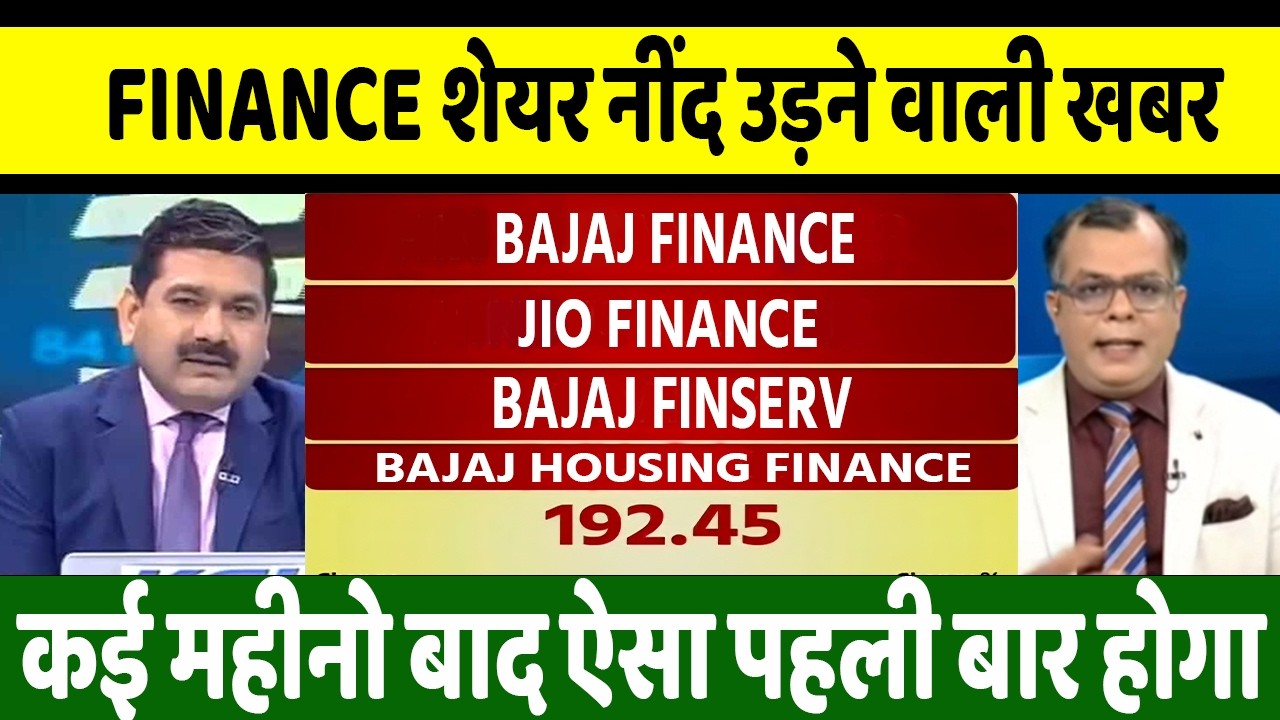

bajaj finance, bajaj housing finance, jio finance share latest news, bajaj finserv, share anelysis

bajaj finance, bajaj housing finance, jio finance share latest news, bajaj finserv, share anelysis

Topics Covered

jio finance

jio finance share

jio finance stock

jio finance stock latest news

jio finance share latest news

jio finance news

jio finance latest news

jio finance share latest news today

jio finance share news

jio finance share today news

jio finance today news

jio finance news today

jio finance share news today

jio finance share analysis

jio finance share review

jio finance share price

jio finance ipo

jio finance hold or sell

jio finance share hold or sell

jio finance ipo hold or sell

jio finance target

jio finance target price

jio finance next target

jio finance results

jio finance results today

bajaj housing finance

bajaj housing finance share

bajaj housing finance stock

bajaj housing finance stock latest news

bajaj housing finance share latest news

bajaj housing finance news

bajaj housing finance latest news

bajaj housing finance share latest news today

bajaj housing finance share news

bajaj housing finance share today news

bajaj housing finance today news

bajaj housing finance news today

bajaj housing finance share news today

bajaj housing finance share analysis

bajaj housing finance share review

bajaj housing finance share price

bajaj housing finance ipo

bajaj housing finance hold or sell

bajaj housing finance share hold or sell

bajaj housing finance ipo hold or sell

bajaj housing finance target

bajaj housing finance target price

bajaj housing finance next target

bajaj housing finance results

bajaj housing finance results today

bajaj finserv share latest news

bajaj finserv share

bajaj finserv share news today

bajaj finserv share latest news today

bajaj finserv share news

bajaj finserv share analysis

bajaj finserv share price target tomorrow

bajaj finserv share result

bajaj finserv share target

bajaj finserv share price

bajaj finserv share target tomorrow

bajaj finserv share tomorrow prediction

bajaj finserv share latest news tamil

bajaj finserv share monday target

bajaj finance share news today

bajaj finance share

bajaj finance share latest news

bajaj finance share split news

bajaj finance share analysis

bajaj finance share price

bajaj finance share target

bajaj finance share news today live

bajaj finance share target 2030

bajaj finance share bonus news

bajaj finance share split and bonus

bajaj finance share news today tamil

bajaj finance share news today result

bajaj finance share news today telugu

bajaj finance

bajaj finserv share latest news

bajaj finserv share

bajaj finserv share news today

bajaj finserv share latest news today

bajaj finserv share news

bajaj finserv share analysis

bajaj finserv share price target tomorrow

bajaj finserv share result

bajaj finserv share target

bajaj finserv share price

bajaj finserv share target tomorrow

bajaj finserv share tomorrow prediction

bajaj finserv share latest news tamil

bajaj finserv share monday target

tata capital

tata capital share news today

tata capital share price

tata capital share

tata capital shareholder quota

tata capital share hold or sell

tata capital share latest news

tata capital share news

tata capital share analysis

tata capital share review

tata capital share target

tata capital share price target

tata capital share buy or not

tata capital share latest news today

tata capital share news today tamil

hdb financial services

hdb financial services ipo hold or sell

hdb financial services latest news

hdb financial services share latest news

hdb financial services share hold or sell

hdb financial services share price

hdb financial services share latest news today

hdb financial services share news

hdb financial services share price target

hdb financial services share target

hdb financial services share analysis

hdb financial services share buy or not

shriram finance share news

shriram finance news

shriram finance news today

shriram finance share

shriram finance share target tomorrow

shriram finance share analysis

shriram finance share latest news today

shriram finance share news latest

shriram finance share results

shriram finance share price

shriram finance share target

shriram finance share prediction tomorrow

shriram finance share price target

shriram finance share monday target

bajaj finance

bajaj finance share news today

bajaj finserv share latest news

jio finance share latest news

jio finance

jio finance share

jio finance latest news

bajaj housing finance share news today

bajaj housing finance buy or sell

bajaj housing finance share

bajaj housing finance latest news

shriram finance

shriram finance share news

tata capital share news today

hdb financial services latest news

hdb financial services share latest news

source

Video

Why Companies Like JP Morgan And Visa Are Creating Crypto Tokens

Mainstream financial companies from JP Morgan to Visa are creating their own crypto currencies, known as stablecoins. Market analysts predict they could disrupt the credit card industry. Watch the video to learn why corporate giants are racing to launch their own crypto tokens.

Chapters:

0:00 Introduction

1:48 The corporate embrace

7:06 Crypto risks

8:53 Regulation pushes ahead

Hosted by MacKenzie Sigalos

Reporting by Tanaya Macheel, Kaan Oguz

Senior Managing Producer Jordan Smith

Edited by Nora Rappaport

Animation by Mithra Krishnan

Senior Director of Video Lindsey Jacobson

Additional Footage Getty Images

Additional Sources Circle, Tether, CoinMarketCap, Fact Set

» Subscribe to CNBC: https://cnb.cx/SubscribeCNBC

» Subscribe to CNBC TV: https://cnb.cx/SubscribeCNBCtelevision

» Watch CNBC on the go with CNBC+: https://www.cnbc.com/WatchCNBCPlus

About CNBC: From ‘Wall Street’ to ‘Main Street’ to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.

Do you want to buy a home but don’t know where to begin? Take CNBC’s new online course How to Buy Your First Home. Register today and use coupon code EARLYBIRD for an introductory discount of 30% off $97 (+taxes and fees) through July 15, 2025: https://cnb.cx/3STNNhr

Connect with CNBC News Online

Get the latest news: https://www.cnbc.com/

Follow CNBC on LinkedIn: https://cnb.cx/LinkedInCNBC

Follow CNBC News on Instagram: https://cnb.cx/InstagramCNBC

Follow CNBC News on Facebook: https://cnb.cx/LikeCNBC

Follow CNBC on Threads: https://cnb.cx/threads

Follow CNBC News on X: https://cnb.cx/FollowCNBC

Follow CNBC on WhatsApp: https://cnb.cx/WhatsAppCNBC

#CNBC

Why Companies Like JP Morgan And Visa Are Creating Crypto Tokens

source

Video

Financial Literacy for All Bridging the Education Gap

Video

Bitcoin Insider Reveals Institutions Are Buying The Dip In Mass!

#Bitcoin #Crypto #Finance

Bitcoin is under pressure again as crypto diverges from stocks, ETF flows shift, and derivatives activity intensifies. In this livestream LIVE from NYC! we break down what’s really driving the latest selloff, whether this is structural stress or short-term noise, and what the next few weeks could mean for Bitcoin’s trend. With macro uncertainty, policy risk, and liquidity dynamics all colliding, this moment may be more important than the price level itself.

🎙 Guests

Andrew Parish: https://x.com/AP_Abacus

Tillman Holloway: https://x.com/texasol61

Discover Bitcoin Yield: https://archpublic.com/

🚀 Connect & Learn

Join The Wolf Pack Community Channel (Free Telegram) – Daily crypto market updates + direct chat with Scott: https://t.me/+34ihhgJnZYRlOWU8

Join The Wolf Pack News Channel (Free Telegram) – Daily crypto news & technical analysis with Scott: https://t.me/+Jzsrl5Xp9NJmMDk0

Free Wolf Den Newsletter – Crypto news & market analysis every weekday: https://thewolfden.substack.com/

📊 Featured Trading Tools

Arch Public – Hedge-fund-level algorithmic trading tools: https://archpublic.com/

Trading Alpha – Pro-grade crypto indicators (Code: 10OFF): https://tradingalpha.io/?via=scottmelker

📲 Follow Scott Melker

Twitter/X: https://x.com/scottmelker

Website: https://www.thewolfofallstreets.io/

Spotify: https://spoti.fi/30N5FDe

Apple Podcasts: https://apple.co/3FASB2c

📩Promote your brand with The Wolf of All Streets. For sponsorship & partnership opportunities, contact info@thewolfofallstreets.io

⚠️ Disclaimer

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. This video was created for entertainment. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this video constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to “Buy,” “Sell,” or “Hold” an investment.

source

Video

Bitcoin Just Flashed a Rare Signal Not Seen in Years…

🎯 Predict Crypto, Sports, Politics & More on *ClashPicks* ► https://www.clashpicks.com/

🐤 Follow ClashPicks’ X ► https://x.com/ClashPicks

**Exchange Partners**

🟩Bitunix Exchange ► *$100,000 Deposit Bonus* ► https://bit.ly/3Tmp1Hq

🟦BTCC Exchange ► *10% Deposit Bonus* ► https://bit.ly/4kk20Qa

**Crypto Pulse**

🟧CryptoPulse Trading Discord ► https://discord.com/invite/georgeplaysclash

🐤Follow CryptoPulse’s X For Trade Setups ► https://x.com/CryptoPulse_CRU

**Clash**

🖥️Check Out *Clash’s Website* ► https://georgeplaysclashroyale.com/

💜Join *Clash Discord* ► https://discord.com/invite/georgeplaysclash

🕹️Join *Clash’s Weekly Tournaments* ► https://georgeplaysclashroyale.com/tournament

📱GeorgePlaysClashRoyale YouTube ► https://www.youtube.com/@Georgeplaysclashroyale

📱GeorgePlaysClashRoyale TikTok ► http://tiktok.com/@georgeplaysclashroyale

🐤GeorgePlaysClashRoyale (For Clash) ► https://x.com/GeorgePlayClash

✅Buy $Clash Here ► https://georgeplaysclashroyale.com/buy

✅Clash CA: 6nR8wBnfsmXfcdDr1hovJKjvFQxNSidN6XFyfAFZpump

0:00 Intro

0:35 Market Overview

2:30 Inflation Data

4:10 US Taiwan

6:00 Coinbase

7:22 ETF Flow

7:55 Blackrock

10:25 Van Eck

14:35 Options

16:10 Bitcoin Accumulators

17:55 BTC RSI

19:30 Bitmine

20:55 CFTC

22:30 ClashPicks

25:05 Q&A

🔴Full Disclaimer: This video and its contents are for informational purposes only and do not constitute an offer to sell or trade, a solicitation to buy, or recommendation for any security, cryptocurrency, or related product, nor does it constitute an offer to provide investment advice or other related services by CryptosRUs. CryptosRus may have a financial investment with the cryptocurrencies discussed in this video. In preparing this video, no individual financial or investment needs of the viewer have been taken into account nor is any financial or investment advice being offered. Any views expressed in this video were prepared based upon the information available at the time such views were written. Changed or additional information could cause such views to change.

source

Video

Money View Loan Kaise Milega – Personal Loan App Full Review in Hindi | Moneyview personal loan app

Money View Loan Kaise Milega – Personal Loan App Full Review in Hindi | Moneyview personal loan app

TrueBalance APP ⬇️

https://truebalance.onelink.me/bMoN/d7kim1g5

Is video me hum detail me batayenge Moneyview personal loan kaise milta hai, eligibility kya hoti hai aur Moneyview app ka full honest review

🔹 Is Video Me Aap Janenge:

Moneyview personal loan kaise apply kare

Eligibility, CIBIL score & income requirement

Interest rate, processing fees & tenure details

Approval process & documents needed

Moneyview loan ke pros & cons

📲Join Telegram ⬇️

https://telegram.me/wtydk

Disclaimer: – Disclaimer: This video is for educational purposes only. We are not a financial advisor or loan provider. Please verify all details on the official MoneyView website before applying.

Note: – Full Credit to Owners.

All Images, Picture, Music show in the video belongs to the respected owners.

Copyright Disclaimer: – Under section 107 of the copyright Act 1976, allowance is mad for FAIR USE for purpose such a as criticism, comment, news reporting, teaching, scholarship and research.

Fair use is a use permitted by copyright statues that might otherwise be infringing. Non- Profit, educational or personal use tips the balance in favor of FAIR USE.

For Sponsorship & Business

Inquiries:-arifsiddiqui40408@gmail.com

Your queries –

Money View Loan Kaise Milega

money view loan kaise kare

money view loan kaise lete hain

money view personal loan

money view personal loan kaise le

money view personal loan interest rate

money view personal loan review

money view personal loan app fake or real

money view loan kaise milega

money view loan kaise milega 2026

money view loan kaise lete hain

money view personal loan

money view personal loan kaise le

money view loan

money view loan app

moneyview personal loan

money view loan kaise le

money view app se loan kaise le

money view se loan kaise le

money view loan 2026

money view

money view personal loan app

personal loan

📲Follow Us On Instagram ⬇️

https://instagram.com/arif.technical?igshid=MzMyNGUyNmU2YQ==

source

Video

1.5B XRP Gone: The Math 99% Missed

The amount of XRP available on centralized exchanges is at its lowest since 2019, suggesting a systemic supply vacuum that most retail investors are unaware of. This investigative report digs into the latest xrp news today, analyzing why institutional investors explained this market condition. We examine the current xrp price trends and the broader ripple news impacting digital assets.

#ripple #xrp #crypto

—————————————————————–

📚 Learn:

👉 https://cheekyschool.com/

👉 Grab 50% OFF with this Code: YT50OFF

Educational resource only – no guarantees of financial outcome.

🔗 Free Educational 𝗗𝗶𝘀𝗰𝗼𝗿𝗱:

👉 https://discord.gg/cheekycrypto

🧠 This is a community for educational discussion only.

🚫 No financial advice is provided.

👨💼 Admins and moderators are not licensed financial professionals.

📱 Learn More About UNITY

👉 https://unitynodes.io/

🔗 Kraken XRP DEAL

👉 Special Link: https://kraken.pxf.io/c/6189776/3300403/10583

👉 Full T&Cs: https://www.kraken.com/en-de/legal/affiliate-incentive-25-xrp-terms

—————————————————————–

🎥 OUR YOUTUBE CHANNELS

🔹 Follow Cheeky Crypto 𝗼𝗻 YouTube: / @CheekyCrypto

🔹 Follow Cheeky Crypto Trading 𝗼𝗻 YouTube: / @CheekyCryptoPlus

🔹 Follow Cheeky Crypto News 𝗼𝗻 YouTube: / @CheekyCryptoNews

🔹 Follow Cheeky Crypto Education 𝗼𝗻 YouTube: / @CheekyCryptoEducation

🔹 Follow Cheeky Crypto Unfiltered 𝗼𝗻 YouTube: / @Cheeky_Crypto_Unfiltered

—————————————————————–

📱 FOLLOW US ON SOCIAL MEDIA

🐦 Follow us 𝗼𝗻 𝗫: / cheekycrypto

📘 Follow us 𝗼𝗻 𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: / cheekycrypto

—————————————————————–

Check out our Affiliate Offers:

We may earn a commission if you sign up through the link below.

👉 https://portal.cheekycrypto.io/cheeky-crypto-affiliate-links/

—————————————————————–

⚠️ 𝗕𝗘𝗪𝗔𝗥𝗘 𝗢𝗙 𝗦𝗖𝗔𝗠𝗠𝗘𝗥𝗦 𝗜𝗡 𝗢𝗨𝗥 𝗖𝗢𝗠𝗠𝗘𝗡𝗧𝗦 𝗔𝗡𝗗 𝗖𝗢𝗠𝗠𝗨𝗡𝗜𝗧𝗬 𝗖𝗛𝗔𝗡𝗡𝗘𝗟𝗦 ⚠️

🛑 DISCLAIMER:

This is a channel for entertainment purposes only. All opinions expressed by the hosts and guests should not be construed as financial advice.The views of guests and hosts do not necessarily reflect those of the channel.

We do not promote any get-rich-quick schemes, trading strategies that guarantee returns, or risky financial behavior.

All trading decisions are your own responsibility. Viewers are strongly encouraged to do their own research.

Trading cryptocurrencies carries a significant risk of loss, and no outcome is guaranteed. This Channel does not offer financial services or securities and does not guarantee any results.

Affiliate offers are intended only for non-UK residents.

This content complies with YouTube’s Harmful and Dangerous Content policies and is intended for mature audiences interested in learning about blockchain technology. Some links are affiliate offers.

We may earn a commission if you sign up through them, at no additional cost to you.

These platforms are not recommendations and are shared for informational purposes only.

Offers vary and may not be available in all regions. Please consult your local laws and financial advisor before participating.

—————————————————————–

Timestamps

source

Video

How Govinda and Karishma Kapoor Overcame Financial Struggles #shorts #viral #facts #new #bollywood

From struggling newcomers to Bollywood royalty! ✨ Discover the incredible journey of Govinda and Karishma Kapoor as they battled financial hardships to conquer the Hindi film industry. Learn how they navigated the challenges, built empires, and became two of the most beloved stars of their generation.

In this video, we delve deep into the untold stories behind their meteoric rise. You’ll uncover:

* The early days of financial insecurity and the sacrifices they made.

* The pivotal moments that changed their careers forever.

* Their strategies for overcoming obstacles and staying resilient.

* The secrets to their enduring popularity and successful partnerships.

* Inspiring lessons on perseverance, hard work, and achieving dreams against all odds.

Whether you’re a Bollywood enthusiast, an aspiring actor, or simply looking for a dose of inspiration, this video offers valuable insights into the lives of two legendary actors. Understand the grit and determination it took to reach the pinnacle of success in a competitive industry.

Don’t miss out on this fascinating look at the financial struggles and triumphs of Govinda and Karishma Kapoor! It’s a story of hope, resilience, and the power of never giving up.

👍 If you enjoyed this video, please give it a thumbs up!

💬 Share your thoughts in the comments below – what’s your favorite Govinda or Karishma Kapoor movie?

🔔 Subscribe to our channel for more inspiring Bollywood stories and industry insights!

🔗 Watch next: [Link to another relevant video]

🔗 Follow us on [Social Media Platform]: [Link to your social media]

#Govinda #KarishmaKapoor #BollywoodFinance #BollywoodStruggles #IndianCinema #ActorJourney #Inspiration #BollywoodSuccess

source

Video

Here are 3 financial moves most people skip but regret later

Here are 3 financial moves most people skip but regret later. Get these right early, and everything else becomes easier. #fyp #booktok #financialliteracy #wealthplanning #moneytips

#livingtrusts 👈 Click Link in Channel Bio!

source

Video

Crypto Trading LIVE: BTC Live Trading Bitcoin Analysis | 17 FEB #crypto #bitcoin #btc

TELEGRAM : https://t.me/TradeForProfitx

✅ NON KYC FOREX BROKER- Markets4You-https://account.markets4you.online/en/user-registration/?affid=pwfrktk%3ATFP

✅BEST REWARDS BROKER-BINGX-

https://bingx.pro/en/activity/contest/4543940715?ref=TFP

(PARTNER CODE- TFP )

✅BEST CFD BROKER(FOREX+CRYPTO) -PRIMEXBT- https://go.primexbt.direct/visit/?bta=45475&brand=primexbt

(20% DEPOSIT BONUS CODE-TFP20)

✅ NON KYC CRYPTO EXCHANG- KCEX- https://www.kcex.com/landingpage/TradeForProfit2?handleDefaultLocale=keep&inviteCode=14R1VP

(PARTNER CODE- 14R1VP)

✅BEST FOREX BROKER (XM)- https://affs.click/KvJnF

(PARTNER CODE- TFP100)

🚨Disclaimer – – – –

The information provided during this stream is for educational and informational purposes only. it does not constitute financial advice, investment recommendation involves high risk, and you should not trade with money you cannot afford to loss. Always conduct your own research, consult with a financial advisor, and make decisions bases on your personal circumstances. the content shared in this stream reflects my personal opinions and may not be suitable for everyone.

🚨”Disclaimer: Forex and CFD trading involve significant risk and may not be suitable for all investors. Exness is an offshore broker and is not regulated by SEBI (Securities and Exchange Board of India). Indian laws allow forex trading only on SEBI-approved exchanges and INR-based currency pairs. Trading with an offshore broker may lead to legal and financial risks, including potential issues with fund withdrawals or regulatory actions by RBI or SEBI. Please do your own research and consult a financial advisor before investing.”

————————————————————————————————————————————————————–

#bitcoin

#live

source

Video

XRP NEWS TODAY : Ripple’s CTO Just Revealed What’s Happening Next

#XRP #XRPNews #XRPToday

Ripple CTO David Schwartz has just delivered the most important timeline in XRP history: mass adoption is only months away. In this final breakdown, The Calm Analyst decodes the ‘Invisible Blockchain’ theory, why 6-10 major banks are about to change everything, and how the falling interest rate environment is forcing institutions into the XRP Ledger.

Welcome to The Calm Analyst — your clear, rational space for understanding financial markets, cryptocurrency, and the global economy without noise or hype.

At The Calm Analyst, we focus on breaking down complex market movements and financial concepts into calm, structured, and data-driven insights that help you see the bigger picture and think independently.

On this channel, you’ll find content covering:

✔️ Cryptocurrency markets, blockchain, and digital assets

✔️ XRP, Bitcoin, and major crypto trends & analysis

✔️ Global economy, inflation, and monetary policy

✔️ Market cycles, risk management, and investor psychology

✔️ Long-term investing perspectives and macroeconomic trends

What to expect:

📊 Clear technical & fundamental analysis

📚 Fact-based discussions backed by data and logic

🧠 Calm explanations designed to reduce emotional decision-making

🌍 Connections between global events and financial markets

Our mission is to help you analyze markets with clarity, patience, and discipline — empowering you to make informed decisions in a fast-moving financial world.

👉 Subscribe and turn on notifications 🔔 to stay updated with consistent, thoughtful market analysis.

For advertising, sponsorships, or collaborations, please contact us via email.

We partner only with projects that align with transparency and long-term value.

business.thecalmanalyst@gmail.com

⚠️ Disclaimer:

This channel is for educational and informational purposes only. Nothing shared here constitutes financial, investment, or legal advice. Markets involve risk, and losses are possible. Always conduct your own research and consult a licensed financial advisor before making investment decisions.

Keywords:

David Schwartz XRP months not years, XRP institutional adoption 2026, Ripple invisible blockchain, XRP domino effect banking, XRP liquidity infrastructure, TradFi vs DeFi Ripple. ⏸️

Hashtags:

#XRP #Ripple #TheCalmAnalyst #FinancialUtility #CryptoNews #GlobalSettlement

#XRP #XRPNews #XRPToday #XRPPrice #XRPPrediction #Ripple #RippleXRP #XRPAnalysis #XRPLive #XRPArmy #Crypto #CryptoNews #CryptoNewsToday #Cryptocurrency #Bitcoin #Altcoins #XRPCoin #XRPLawsuit #XRPUpdate #RippleNews

source

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment18 hours ago

Entertainment18 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech22 hours ago

Tech22 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports3 hours ago

Sports3 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment9 hours ago

Entertainment9 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business24 hours ago

Business24 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World12 hours ago

Crypto World12 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit