Business

What Founders Need to Know About Preparing Their Business for Digital Tax Rules

Digital transformation has altered almost every aspect of modern business, and tax is no exception. Across the UK, businesses must now adopt digital record-keeping and reporting practices.

While this was previously optional, it is now mandatory. For founders, this represents a structural change that’s likely to influence financial processes, digital infrastructure, decision-making, and long-term planning, among other areas.

Why Digital Tax Rules Should Be on Every Founder’s Radar

From 6th April 2026, digital tax systems will become a mandatory part of the standard business infrastructure. The ultimate aim of this modernisation is to boost accuracy and transparency across the UK tax system, but for businesses, it means implementing stringent digital financial compliance systems and processes (if you haven’t already).

As such, founders can no longer treat compliance as something that they simply hand over to an accountant. The shift toward digital record-keeping involves quarterly rather than annual reporting, which in turn means that underlying data must be closely and consistently tracked through business systems in real time (or near real time). You can no longer rely on end-of-year reconciliation to clear all financial loose ends; they need to be tracked and addressed immediately.

Founders should be aware that non-compliance with these new digital record requirements and submission obligations will, at best, lead to administrative disruption and, at worst, result in financial penalties or even a fraud investigation. For example, organisations that fail to maintain appropriate digital records or meet reporting deadlines are likely to face daily fines until the deadlines are met.

A Founder-Friendly Overview of Digital Tax in the UK

Let’s start with a founder-focused overview of the new MTD system:

What HMRC means by digital record-keeping and reporting

When they refer to ‘digital record-keeping and reporting’, HMRC means creating and storing financial records using approved digital software and submitting information to it electronically. Typically, a digital financial record uses electronic systems to capture income and expense details, such as amounts, dates sent/received, transaction categories, and more.

For VAT-registered entities, digital records should also include core information like identification data and VAT account records. Just as you would with analogue financial records, you will need to preserve these records digitally for several years in order to maintain an audit trail.

One very important aspect of MTD is digital linking. It is no longer sufficient to manually copy data from platform to platform. Instead, platforms should communicate with one another and link seamlessly for data sharing. This automated connection and data transfer ultimately benefits everyone involved by improving consistency and reducing the risk of human error.

Which businesses are affected

From April 2026, all businesses (including unincorporated businesses) and landlords with income exceeding £50,000 PA will be required to comply with digital record-keeping requirements. The income thresholds are set to get progressively lower over subsequent years. As such, even founders whose businesses don’t currently meet the threshold should start preparing and aligning their processes for Making Tax Digital.

How Digital Tax Rules Impact Day-to-Day Business Operations

Digital tax rules are likely to impact day-to-day business operations in a variety of ways:

Changes to internal finance processes

Businesses will feel immediate effects on internal finance processes once the digital rules come into force. For a start, finance teams will need to ensure that all records are captured in a structured digital format from the outset. This includes transaction categorisation, system integration, installation and maintenance of compatible software environments, and more.

Similarly, reporting cycles and processes will have to shift from retrospective compilation and analysis to continuous monitoring. Teams must start treating financial data as a live operational asset rather than as a once-yearly obligation.

The knock-on effects for cash flow and forecasting

Digital reporting also brings indirect advantages and pressures. For example, real-time financial visibility should enable more accurate forecasting and tax estimation, helping founders anticipate liabilities earlier. Similarly, software environments often display projected tax positions based on current records, which can significantly improve planning capacity.

At the same time, increased reporting frequency can expose gaps in data quality and process discipline that might otherwise go unnoticed. This can create friction in the short term as teams work to plug gaps and fix issues, but it will ultimately lead to smoother, more accurate financial workflows.

Common Mistakes Founders Make When Preparing for Digital Tax

Here are some common mistakes to be aware of and to avoid when preparing for digital tax:

Treating digital tax as a last-minute project

If you possibly can, treat tax as an ongoing process. Leaving things until deadlines are looming has always been a bad idea – but with the new quarterly reporting schedule, it could plunge you into a continuous cycle of chasing your tax backlog.

Remember that your staff will likely need training on the new system, and some processes will need to be redesigned. As such, start preparing as early as possible to avoid delays when the first reporting deadlines arise.

Over-relying on spreadsheets and manual workarounds

Spreadsheets are useful analytical tools, but on their own, they often fail to meet integration and compliance requirements. For example, if you are relying on manually transferring data from spreadsheet to platform to spreadsheet, etc., you’re at risk of submission errors or compatibility issues.

How Founders Can Prepare Their Business in Practical Terms

Let’s take a look at some practical ways business founders can prepare for MTD:

Reviewing existing finance systems and processes

Start by evaluating your existing systems and processes. Assess exactly how financial data enters your organisation, how it is processed, and whether or not your systems support digital linking and structured record retention.

Ideally, use this review as an opportunity to think about software compatibility, staff capability, and documentation practices. Identifying weaknesses early will save you from costly retrofitting later.

Choosing tools that support compliance and growth

The right tools can make a huge difference to your MTD preparation and ongoing financial processes. Look for Making Tax Digital software that aligns with HMRC requirements and allows businesses to maintain records, automate submissions, and integrate accounting workflows.

Working More Effectively With Accountants and Advisors

Accountants and advisors can play a more efficient, more proactive role in a post-MTD world. Here’s how:

Why digital records improve collaboration

Digital systems boost visibility between founders and advisors. For example, if they have the right access and permissions, accountants can access structured data directly. This makes things a lot more efficient and means that no time (or accuracy) is wasted with manual transfers.

This kind of speed and transparency ultimately promotes efficiency, shortens reporting cycles, and supports higher-quality decision support.

Shifting accountants from compliance to strategy

When routine compliance is streamlined with digital tools, professional advisors can focus more on planning and optimisation. This means more time spent working on things like strategic insight on tax positioning, cash flow management, and investment decisions.

Preparing Early as a Competitive Advantage

Early adoption of digital tax processes will reduce operational disruption and position your business to realise the benefits of MTD sooner. For example, the earlier you go digital, the earlier you can benefit from clearer financial oversight and more efficient reporting structures.

Digital readiness also signals organisational maturity. Investors, lenders, and partners frequently view structured data governance as evidence of reliable management capability. This reputational factor can influence your access to funding and boost your credibility in potential partnership situations.

Building a Business That’s Ready for the Future

Digital tax rules aren’t an isolated compliance exercise – they represent a broader shift toward data-centric governance in the UK. As such, founders who treat the transition as an opportunity to refine financial infrastructure will derive greater long-term value than those who focus solely on regulatory adherence.

Embedding digital record discipline, selecting integrated tools, and collaborating strategically with advisors will lay the foundation for scalability and resilience. By approaching preparation as part of organisational development, founders can position their businesses to operate confidently within evolving regulatory and technological environments.

Business

Deadly Avalanche Kills 8 Backcountry Skiers

Eight backcountry skiers were confirmed dead and a ninth remained missing and presumed dead Wednesday after a massive avalanche swept through their guided group in the Sierra Nevada mountains northwest of Lake Tahoe, marking the deadliest avalanche in modern California history and one of the worst in the United States in nearly half a century.

The tragedy unfolded Tuesday morning when a football-field-sized slide buried nine members of a 15-person party — 11 clients and four guides from Blackbird Mountain Guides — near Castle Peak and Frog Lake in Nevada County, about 10 miles north of Lake Tahoe. The group was on the final day of a three-day trek, having stayed at the Frog Lake huts since Sunday and heading back to the trailhead when the avalanche struck around 11:30 a.m.

Nevada County Sheriff Shannan Moon said rescuers located the bodies of eight victims — seven women and one man, ranging in age from 30 to 55 — clustered relatively close together amid “pretty horrific” conditions of heavy snowfall, gale-force winds and low visibility. The ninth skier, whose identity and gender were not released, was presumed to have perished given the extreme weather, unstable snowpack and prolonged burial time.

Six survivors — five women and one man, also aged 30 to 55 — were rescued about six hours later, around 5:30 p.m. Tuesday. They had built a makeshift shelter and were found with various injuries; two required hospital treatment, one released Tuesday night and the other expected to be discharged Wednesday.

The operation involved nearly 100 first responders from multiple agencies, who navigated treacherous terrain on skis and used avalanche beacons and cellphone signals to locate the group. Recovery efforts were hampered by ongoing blizzard conditions, with bodies still trapped under snow and additional avalanche risks preventing immediate extraction.

The Sierra Avalanche Center had issued a warning for the Central Sierra Nevada effective Tuesday through 5 a.m. Thursday, citing heavy new snow — up to 40 inches in nearby Soda Springs since Monday — combined with strong winds and unstable layers. The slide occurred on a north-facing slope at about 8,300 feet elevation, classified as D2.5 destructive size, capable of burying or killing people.

This incident surpasses previous deadly California avalanches, including the 1982 Alpine Meadows resort slide that killed seven and a 1911 event in Mono County that claimed eight lives. Nationally, it ranks as the deadliest since 1981, when 11 climbers died on Washington’s Mount Rainier, and the fourth-worst in U.S. history per records from the Colorado Avalanche Information Center.

The Castle Peak area, popular for backcountry recreation in the Tahoe National Forest, has seen frequent slides; the Sierra Avalanche Center documented at least 50 avalanches in the broader Lake Tahoe region since September 2025. A January 2026 slide nearby killed a snowmobiler.

Authorities have not released victim names pending family notifications. Blackbird Mountain Guides, a respected outfitter, has not commented publicly. The group was experienced, equipped with standard safety gear including beacons, probes and shovels, but officials emphasized that backcountry travel in high-risk conditions carries inherent dangers even with preparation.

Search efforts shifted to recovery mode Wednesday as weather remained severe, with forecasters warning of continued instability and potential for more slides. Nearby resorts like Sierra-at-Tahoe closed for the day due to the storm, which dumped over 5.5 feet of snow in recent days.

The incident highlights ongoing avalanche hazards amid a powerful West Coast winter storm system. Experts urge backcountry users to check forecasts, carry gear and travel in groups with communication plans. The National Avalanche Center reports 25-30 U.S. avalanche deaths annually on average, with California ranking eighth in fatalities since 1950.

As recovery continues under challenging conditions, officials expressed deep sorrow for the victims and support for survivors and families. The Nevada County Sheriff’s Office leads the investigation, with assistance from the U.S. Forest Service and other agencies.

Business

APA Group Stapled Securities (APAJF) Q2 2026 Earnings Call Transcript

Operator

Thank you for standing by, and welcome to the APA Group 2026 Half Year Results. [Operator Instructions] I would now like to hand the conference over to Mr. Adam Watson, Managing Director and CEO. Please go ahead.

Adam Watson

CEO, MD & Director

Thank you, and good morning, everyone. Thank you for joining us for today’s first half FY ’26 results presentation. I’m joined by Garrick Rollason, our CFO, as well as our Investor Relations team.

Let me start by acknowledging the Gadigal people of the Eora Nation, traditional custodians of the land on which I’m speaking. First Nations people have taken care of our lands and waterways for the past 60,000 years. We acknowledge and pay our respects to their elders, past and present.

As always, I’ll start today’s presentation with a safety share on Slide 4. To prepare for extreme weather conditions, we conduct a summer readiness program, including activities such as site clearing and weed prevention. I’m pleased to say that we haven’t had any weather-related customer impact so far this summer. I’d like to thank the APA operations team for the fantastic work they do to keep our people and our assets safe and to keep our customers’ operations going 24/7.

Suffice to say, we are very

Business

NRW posts bumper 40pc profit increase

Civil contractor and mining services firm NRW has posted a 40 per cent increase in profit for the first half of the year, buoyed by acquisitions, the Olympics and data centres.

Business

Cashed up Gold Fields eyes WA mines

South African-headquartered Gold Fields is closely watching Western Australian gold sector’s consolidation, with $2.5 billion in the bank.

Business

Form DEF 14A Inogen Inc For: 19 February

Form DEF 14A Inogen Inc For: 19 February

Business

Did Meta Target Teens? Mark Zuckerberg Grilled Over Instagram’s Alleged Addictive Design

Social media addiction is highly subjective since it depends on a person’s experience and emotional state. While this is true, the platform we use also contributes to the addiction that we feel, like in the case of Meta apps.

Earlier this week, Mark Zuckerberg testified before a Los Angeles jury, defending Meta Platforms against allegations that its social media platforms deliberately targeted young users and fostered addictive behavior.

The high-profile lawsuit, which also names YouTube as a defendant, could influence thousands of similar cases pending across the United States.

Meta is Allegedly Targeting Young Users Intentionally

At the center of the case are claims that Instagram and Facebook prioritized teen engagement despite internal research identifying potential mental health risks.

According to CNN, plaintiffs argue the company knowingly implemented strategies designed to increase time spent on its platforms, even as studies suggested negative effects on younger users.

Internal Research and Email Evidence

During cross-examination, attorneys presented internal emails and research reports indicating that company leaders closely monitored teen activity and explored ways to boost engagement.

A 2019 email questioned whether Meta’s enforcement of age restrictions was sufficiently rigorous, suggesting that weak oversight undermined claims that the company was doing everything possible to protect minors.

Another internal study reportedly found that some teens described feeling “hooked” on Instagram, with usage patterns resembling behavioral addiction.

Zuckerberg disputed the plaintiffs’ interpretation of the documents, arguing that the materials were taken out of context. He emphasized that certain internal findings also reflected positive user experiences and maintained that Meta has consistently invested in safety improvements.

The business tycoon reiterated that children under 13 are prohibited from using the platforms and account for only a minimal portion of advertising revenue.

Teen Growth Strategy and Engagement Metrics

BBC reported in another article that additional emails from 2015 and 2017 revealed discussions about prioritizing teen growth and increasing time spent on Meta’s platforms.

Zuckerberg acknowledged that earlier corporate goals emphasized engagement metrics but stated that the company has since shifted toward promoting healthier digital habits.

He highlighted safety tools introduced in 2018, including daily usage limits, notification controls, and parental supervision features. However, internal data presented in court suggested that adoption of these tools among teens remained relatively low.

Originally published on Tech Times

Business

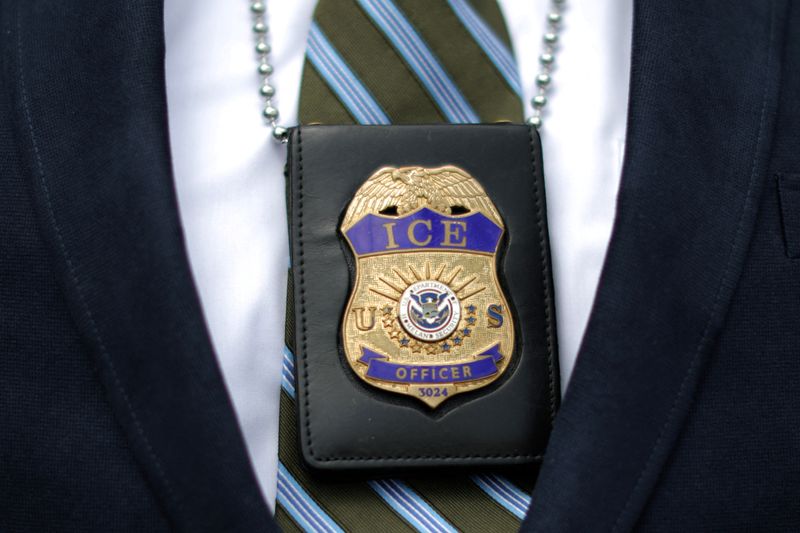

Trump administration expands ICE authority to detain refugees

Trump administration expands ICE authority to detain refugees

Business

Stock picking key as markets navigate AI uncertainty: Amit Khurana

Sharing his view on the quarter in an interview to ET Now, Amit Khurana from Dolat Capital said earnings largely held up against expectations and operating performance appears to be stabilising. He noted, “There were broadly three key trends that we observed for the current quarter. One, earnings held on pretty well in terms of the estimates versus actual delivery… Second, the operating performance has started finding bottoms… And finally, we are trending now towards mid-teens aggregate earnings… So, positive take on the earnings and as we go along the next few quarters this will only rebound further and give the much needed confidence and support to the valuations.”

On stock-specific developments, he said the ₹2,000-crore capex plan by Hindustan Unilever signals confidence in long-term demand, particularly in premium segments. “Capex from FMCG companies… reflects the structural demand that they are seeing over the next few years… HUL expansion especially given the size seems pretty meaningful and we stay positive on that… India is premiumizing fast and franchises which are able to position their products accordingly will probably have a market share sustenance or gains,” he said.

Khurana cautioned against reading too much into intermittent foreign inflows, saying concerns around India’s positioning in the AI wave and valuations remain. “AI wave everybody seems to be talking about it… But to your point on the FII buying… I am not very enthused with a few days of buying… And second, the valuations while they have turned relatively better are not outright cheap even now… one needs to be stock specific,” he said.

He added that domestic consumption continues to be a preferred theme, with a bottom-up approach guiding stock selection. He highlighted Marico as a preferred name, saying, “We have been pro-domestic consumption… We also are beginning to like staples… we have liked Marico… This is a market wherein you will have to do a real hard work of identifying the names… domestic consumption has been our favourite.”

On infrastructure, including developments around NCC Limited, Khurana said the sector has corrected due to slower order flows but fundamentals remain intact. “Infra stocks have taken a big beating… probably because of the slowdown of the NHAI order book… our channel checks are suggesting that this should eventually play out… Specific to NCC, we need to wait for the specific details,” he said.

Discussing the IT sector and developments at Infosys and Tata Consultancy Services, he said investors are awaiting clarity on disruption timelines and growth visibility. “The market will look for very strong evidence on two counts… how far is this disruption going to continue… and secondly, is the kind of opportunities which will come… In the interim… they will broadly be in the range,” he said.

Business

Should Investors Centralize Indonesia Operations Within a Holding Company?

Consolidation with a holding company enhances control, tax planning, and efficiency, but sector restrictions and dividend taxes influence foreign ownership limits and repatriation strategies in Indonesia.

Capital Requirements for Consolidation

Consolidation becomes essential when expansion increases a company’s exposure across multiple entities. In Indonesia, a PT PMA typically requires a minimum investment of IDR 10 billion (US$637,000) per business classification. Establishing three subsidiaries in different sectors would demand at least IDR 30 billion (US$1.91 million) in committed capital before operational expenses are considered. This substantial funding highlights the need for careful planning in capital allocation and investment management to support growth and diversification efforts.

Impact of Holding Companies on Tax and Profit Management

Introducing a holding company alters the landscape of equity distribution and profit accumulation. The holding can be either Indonesian or offshore, influencing tax residency, treaty benefits, and dividend routing. The optimal choice depends on the investor’s long-term capital strategy, especially regarding cross-border profit repatriation. Jurisdiction selection is critical, as it directly affects net returns, with tax treaties playing a vital role in reducing withholding taxes on dividends.

Ownership, Control, and Sector Regulations

Ownership placement significantly impacts tax obligations and control rights. Indonesia’s Positive Investment List restricts foreign ownership in specific sectors, meaning a holding company cannot bypass sector-specific limits. Additionally, dividends paid abroad typically face a 20% withholding tax unless reduced by tax treaties. Planning for dividend flows exceeding this threshold makes treaty positioning and jurisdiction choice economically crucial to optimize after-tax returns.

Read the original article : Should Investors Consolidate Indonesia Operations Under a Holding Company?

Other People are Reading

Business

Oak Garden Apartments, 400 Garden Lane on Raising Housing Standards

Oak Garden Apartments 400 Garden Lane is a community-focused housing complex based in Chickasaw, Alabama.

Since acquiring the property in 2019, the leadership team has taken a long-term approach to ownership. Their work centers on raising standards in rental housing through steady investment and consistent management.

When they purchased the apartment complex, they saw both potential and responsibility. Significant capital was invested to modernize interiors and improve shared spaces. Mature trees and lush grounds were preserved. Outdoor areas were made more usable. The goal was clear from the beginning.

“We purchased this property with a long-term view,” they explain. “Our goal was simple. Make it a great community to raise a family.”

Oak Garden Apartments 400 Garden Lane offers spacious interiors, a pet-friendly setting, on-site laundry, a dog park, picnic area, and 24-hour maintenance. Yet leadership believes amenities alone do not define quality housing.

“Anyone can list features,” they say. “What matters is how the place feels day to day.”

Their philosophy focuses on improving community standards across resident relations, maintenance, and quality living spaces. They see property management as stewardship rather than simple oversight.

“You are not just managing buildings,” they note. “You are managing people’s homes.”

Through discipline and consistent attention to detail, Oak Garden Apartments 400 Garden Lane has positioned itself as a steady leader in community-based housing in the Chickasaw area.

A Conversation with Oak Garden Apartments

Q: Take us back to 2019. What led to the purchase of Oak Garden Apartments 400 Garden Lane?

A: In 2019, we saw an opportunity in Chickasaw. The property had solid foundations. It also had room to improve. We believed in the location and in the long-term potential. We did not see it as a short project. We saw it as a responsibility.

Q: What was your immediate priority after the purchase?

A: Investment. We put significant capital into the property. We focused on modernising the interiors and improving the grounds. We wanted residents to feel the change. Not just see it.

“Improvements to the property send a message that we are here for the community,” we often say. “We wanted residents to notice the difference.”

Q: Why focus so heavily on standards?

A: Standards shape daily life. When maintenance slips, small issues grow. When communication fails, trust breaks down. We define our mission as improving community standards across resident relations, maintenance, and quality living spaces.

“We hold ourselves accountable,” we say. “If something needs attention, we address it.”

Q: What makes Oak Garden Apartments 400 Garden Lane distinct in your view?

A: Consistency. The community offers modern and spacious interiors. It is pet-friendly. There is on-site laundry, a dog park, picnic area, and 24-hour maintenance. But features alone are not enough.

“Anyone can list amenities,” we explain. “What matters is how the place feels when you live there.”

We focus on clean spaces, reliable service, and steady upkeep.

Q: How important is location in your strategy?

A: Very important. The property sits near major interstates and is minutes from downtown Mobile. That balance matters. Chickasaw offers a quieter setting while staying connected to work and services.

“Comfort and convenience affect everyday life. Location supports that.”

Q: How would you describe your leadership philosophy?

A: Long-term thinking. We think in years, not months. We do not chase trends. We focus on fundamentals. Safe units. Functional layouts. Well-kept grounds.

“You are not just managing buildings,” we often remind ourselves. “You are managing people’s homes.”

That mindset shapes how we operate every day.

Q: What lessons have you learned since 2019?

A: Patience and discipline matter. Real improvement takes time. Quick fixes do not build strong communities. Consistent effort does.

We have also learned that residents value reliability. When maintenance is responsive and communication is clear, trust grows.

Q: How do you define success in this industry?

A: Success is stability. It is a property that runs well. It is residents who feel comfortable. It is standards that are maintained year after year.

“Our job is to raise the standard. Not just once. Every day.”

Q: Looking ahead, what remains your core focus?

A: The same as it was in 2019. Improve the property. Strengthen the community. Maintain the standard. Leadership in housing is not loud. It is consistent.

At Oak Garden Apartments 400 Garden Lane, that consistency defines our career and our approach to the industry.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment18 hours ago

Entertainment18 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech22 hours ago

Tech22 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports3 hours ago

Sports3 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment9 hours ago

Entertainment9 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business24 hours ago

Business24 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World12 hours ago

Crypto World12 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit