Related: Missing 4-Year-Old Boy Found Dead After He Disappeared on New Year’s Eve

Advertisement

Robert Downey Jr. and Chris Evans, the two pillars of Earth’s Mightiest Heroes, are set to make their return to the MCU in Avengers: Doomsday — and it’s going to be a tremendous mistake. As the sprawling cinematic universe moves forward into uncharted territory, the instinct to rely on familiar faces for stability makes sense, but it lacks the spirit that the characters, or the franchise as a whole, always represented. Among the expansive roster of performers in the MCU, Downey and Evans stood out as the two figureheads of the cinematic franchise.

Both actors had the most prominent roles in the entire cinematic universe; as Iron Man and Captain America, they not only starred in completed standalone trilogies but came together to lead the Avengers whenever they would assemble for their shared films. Among a cast full of stars, they were the two brightest. However, returning to Evans and Downey so soon after their intended finale exemplifies the current lack of trust between fans and the MCU, representing a lack of faith in the new actors, characters, and storylines in favor of maximizing nostalgia and familiarity.

The importance of Downey and Evans to the MCU is supported by how the actors’ own professional journeys ideologically represented what the studio was trying to accomplish. The MCU was a crazy experiment— such a large and interconnected film franchise had never been made before— and so, it needed actors that were capable of fulfilling those lofty ambitions. Downey, now considered the godfather of the MCU, was just returning to Hollywood stardom after years of personal issues kept him from working at his true potential. Downey was in search of a second chance— just like Tony Stark. While it’s important to separate the art from the artist, it’s hard to fully untangle RDJ from Stark when the narrative parallels are so apparent, and the results are so effective. When audiences first saw Iron Man, they didn’t see a controversial actor or a B-list comic book hero; they saw Downey at his most captivating, embodying Tony Stark with such charm and vitality that no other actor could dare encroach on the character. Downey’s performance was so charismatic that it launched an entire cinematic universe.

I’m Sorry, but It’s True — ‘Avengers: Endgame’ Ruined the MCU, and Here Are 8 Reasons Why

Avengers, disassemble.

While Chris Evans had an altogether distinct path to becoming Captain America, he, too, seemed to represent a similar story to his fictional role. Evans wasn’t new to Hollywood, nor was he new to playing a superhero, but the actor had yet to truly establish himself as a leading man. Better known for more classic jock roles, like the Human Torch or Lucas Lee from Scott Pilgrim vs. The World, Evans clearly displayed the potential to be super, but did he have the heart to be a leader? The answer was a resounding yes, as Evans’ performance as Steve Rogers proved to be exactly what the MCU needed. Serving as the perfect accompaniment to Tony Stark’s sass and snark, Evans highlighted Captain America’s resilience and loyalty, the exact traits that made him the necessary leader of the superhero team. Both Evan and Downey had feel-good stories that reflected the underdog nature of the MCU and its characters, making the entire experience exciting for audiences on multiple fronts. We weren’t just watching characters overcome the odds, we were seeing artists and performers defy expectations. However, their return to the MCU, especially under these circumstances, dismantles everything.

A common criticism of comic book storytelling is the lack of sufficient stakes. Between fake deaths, resurrections, and other narrative hijinks, characters in comic books often get stuck in revolving journeys with little actual progress. Just think about how many Spider-Man stories still see the web-slinger stuck in high school and with no money? However, that issue is directly what Avengers: Endgame successfuly overcame. Endgame was a love letter to the original Avengers cast; it was a farewell tour that gave their characters conclusive narrative endings that thematically aligned with their arcs that spanned several films.

In this chapter, the MCU gave these comic book characters bittersweet but earned endings to their stories. Tony Stark, once a selfish and cavalier weapons manufacturer, proved that his humanity and selflessness were essential to the world’s survival. His destined path of becoming Iron Man wasn’t just to save his own life, but for the entire universe. In complementary juxtaposition, Steve Rogers, the man who couldn’t help but volunteer his own life at every opportunity, finally chooses to prioritize himself after years of fighting. To get to this point in their journeys, both characters went through entire trilogies and four Avengers movies, each with character development and growth to get to this point. Unlike in comic books, the MCU built off each installment and made sure that each addition had lasting influence and consequences. It’s that accumulation of audience time and commitment, one that spanned an entire decade that made Endgame such a unique movie, complete with one of cinema’s most satisfying endings.

It’s no secret that the MCU has been going through a rough patch in the past few years, as reception to Phase Four paled in comparison to the near-universal positive hype surrounding the franchise during the previous two Avengers movies. The return of Downey and Evans in Avengers: Doomsday feels like a response to this waning interest, but it also feels like waving the white flag. Kevin Feige‘s ingenious marketing strategy of outlining different phases in the MCU was one of the premier reasons why fans kept returning to the franchise, as each year brought new movies and new excitement. But it was that daring and experimentation that made this cycle feel innovative rather than repetitive. Back in 2019, Endgame was meant to serve as a closing chapter to the first three phases, but rather than end the MCU as a whole, it was also meant to be the symbolic passing of the torch from one Avengers cast to the next. Steve Rogers passed down his shield to Sam Wilson (Anthony Mackie) and Tony Stark’s sacrifice ensured that future generations of heroes would live on. Yelena Belova found her own team to lead in Thunderbolts* and they’ve taken on the moniker of the New Avengers.

The following few movies even introduced new characters poised to take the spotlight, such as Shang-Chi (Simu Liu), but the MCU has failed to maximize these fresh faces. In reality, Shang-Chi hasn’t been seen in years, and he’s supposed to be one of the main members of the new Avengers roster. The MCU did something no other movie franchise could have accomplished, but its own fear is now leading to its self-imposed implosion. After years of anticipation and narrative development, the return of Evans and Downey is emblematic of how the MCU might have lost the audacious spirit that made it so beloved in the first place.

December 18, 2026

Stephen McFeely, Michael Waldron, Jack Kirby, Stan Lee

Netflix has to have a hit legal drama at all times at this point. It’s almost as if the streamer offers the same audience a fresh adjacent fix: something paced for bingeing, built on case-of-the-week momentum, and easy to drop into without homework. That’s what’s happening right now with a newly surging 10-episode crime thriller starring Melissa Roxburgh, Nick Wechsler, Patrick Sabongui, Josh McKenzie, and Sara Garcia, and it’s sliding into the exact viewing lane that The Lincoln Lawyer has owned for a while.

The show’s hook is engineered for quick addiction. It’s a manhunt procedural with an escalation engine baked in: a small, specialized team is assembled after the country’s most dangerous killers escape from a prison that isn’t supposed to exist, turning each episode into a capture mission that feeds a larger conspiracy. That structure matters on Netflix because it creates “one more episode” gravity the same way courtroom dramas do — problem introduced, pressure applied, resolution delivered, and a breadcrumb dropped for the bigger season arc.

The show in question, titled The Hunting Party, has climbed to #2 on Netflix’s U.S. Top 10 TV list as of February 18, 2026, while The Lincoln Lawyer sits at #6 on the same daily chart — a clean picture of how the audience is being redistributed in real time. That rise tracks with what you’d expect from a newly activated catalog add: the title hits the list, gets surfaced harder, and then gains momentum as more viewers sample it. And it’s not just a Netflix-only story either: the series is also charting on Prime Video at the #4 spot in Turkey this week.

The Hunting Party, originally aired in January 2025, is now spiking because Netflix has made it newly accessible to viewers who didn’t watch it on NBC during its original run, which changes the viewing context. The other reason is that the show’s second installment recently started airing, so it’s currently being discussed more, too. Therefore, while a weekly network procedural can feel routine, a fully available Netflix season plays like a new binge drop, especially with a recognizable lead like Melissa Roxburgh anchoring the hook.

The new season, however, isn’t yet available to stream on Netflix and will only be available once the complete season has premiered. This is exactly how Netflix treated the lead of legal drama Suits, and it worked out well.

The Hunting Party Season 2 airs new episodes weekly. The first season is available to watch on Netflix. Stay tuned to Collider for more updates.

January 19, 2025

Thor Freudenthal, Glen Winter, James Bamford, Nicole Rubio, Rod Hardy, Shana Stein, Blackhorse Lowe, Marcus Stokes, Kristin Windell

David Loong, JJ Bailey, Jake Coburn, Keto Shimizu, Michael Jones-Morales, Paula Sabbaga, Rebecca Bellotto, Vinny Ferris

Melissa Roxburgh

Rebecca ‘Bex’ Henderson

Editor’s note: The below contains spoilers for Love Story Episodes 1-3.

Ryan Murphy is a producer linked to never-ending controversies courtesy of his ongoing Monster anthology series, but Love Story: John F. Kennedy Jr. & Carolyn Bessette represents a far more thoughtful approach to a ripped-from-the-headlines celebrity story. There have been many films and shows centered around the Kennedy family, but Love Story explores the passionate, tempestuous marriage between John F. Kennedy Jr. (Paul Anthony Kelly) and Carolyn Bessette (Sarah Pidgeon) before their tragic deaths in a 1999 plane crash. The Kennedys were involved with many powerful figures in both Washington, D.C. and Hollywood, and Love Story depicts the brief romance between JFK Jr. and the actress Daryl Hannah, portrayed in the show by Dree Hemingway.

Due to his family’s influence and political legacy, Kennedy was encouraged to pursue a career in service of his country and completed the bar exam in New York after two unsuccessful attempts. At the same time, Kennedy was also involved in lifestyle and popular culture institutions, and began dating Hannah in the late 1980s before they split up in 1994. Hemingway admitted that the actors were encouraged not to contact the subjects they portrayed, which has remained consistent on all the anthology shows that Murphy has produced except American Crime Story: Impeachment, in which Monica Lewinsky was involved. This may have been a noble attempt to ensure that the depiction of these figures was unbiased, but it’s more problematic when the series also invents plot elements that skew the way that events are perceived.

Love Story is only focused on a condensed period of time within Kennedy’s life, meaning that it only shows the end portion of his relationship with Hannah. Despite reports that they had been happily dating within the first few years of meeting, Love Story doesn’t explore any of the affection that Kennedy and Hannah had for each other, since the series begins when their relationship is already in a downward spiral. Even when ignoring the fact that Love Story only depicts Hannah in a negative light, implying she was completely oblivious to the media attention that Kennedy had inflicted upon him, the series doesn’t grant her the depth provided to other supporting characters like Calvin Klein (Alessandro Nivola).

Murphy should consider returning to the anthology series that brought him the most prestige.

Love Story‘s most glaring invention so far is the implied tension between Hannah and Kennedy’s mother, Jackie Onassis (Naomi Watts). There are conflicting reports about whether there was any friction between the two women, but Love Story assumes the worst by suggesting that Jackie’s objections prevented Kennedy from marrying Hannah. It’s also not a particularly even-sided conflict, as the series is far more sympathetic to Jackie, who is portrayed as a helpful and supportive maternal figure before her death in the third episode, “America’s Widow.”

Interpreting historical ambiguities may have been inevitable for Love Story, but the show’s characterization of Hannah is especially unfortunate given how over-the-top and obnoxious her portrayal is. In addition to implying that Hannah’s involvement with drug users caused stress within Kennedy’s life, the series also includes a strange moment in which she equates the death of her dog to the loss of Jackie. Beyond a larger unwillingness to contact Hannah, Love Story’s producers didn’t follow any accounts that were slightly sympathetic to her position; the show was inspired by the non-fiction novel Once Upon a Time by Elizabeth Beller and also draws from The Other Man, a memoir by Bessette’s former lover, Michael Berman (Michael Nathanson). Considering that Love Story is otherwise a very well-crafted drama show that is thoughtful in its approach to an unfortunate situation, Hannah’s highly negative portrayal feels more glaring in contrast.

Although Hannah has yet to make any public statements about the series, the real actress might not be able to change the narrative, given that Murphy has largely ignored criticisms from the subjects of his other shows. There’s no case for libel when the series states outright that some events are fictionalized, but given the frequent allusions to very specific events and dates, Love Story may give many viewers the impression that its version is mostly accurate. It’s worth noting that in the aftermath of the crash, Hannah did not show any ill will towards Kennedy or Bessette and has been praised in recent years for her advocacy on behalf of environmentalist groups. It’s a shame that her essence was reduced to a stereotype of an out-of-touch actress.

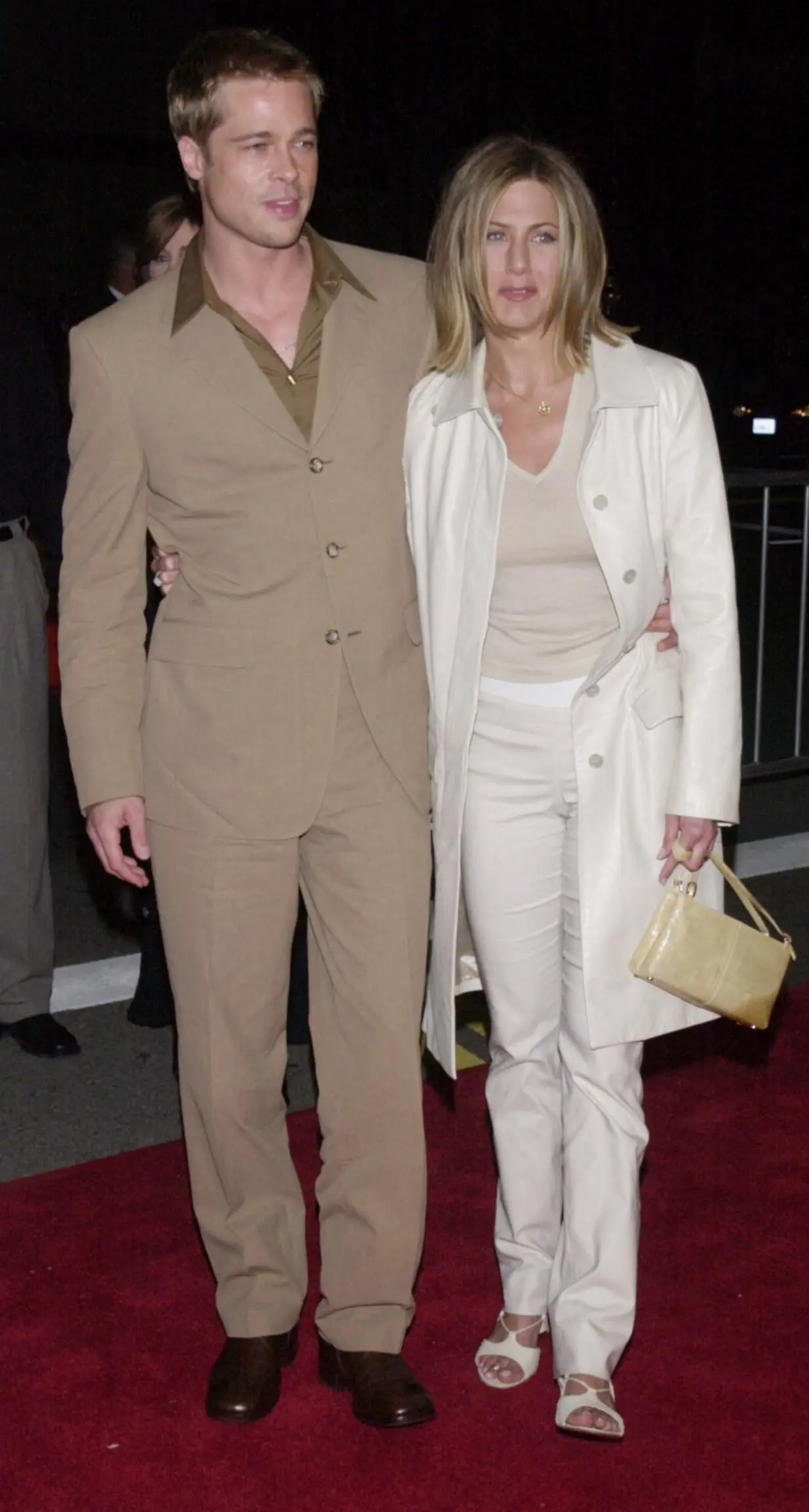

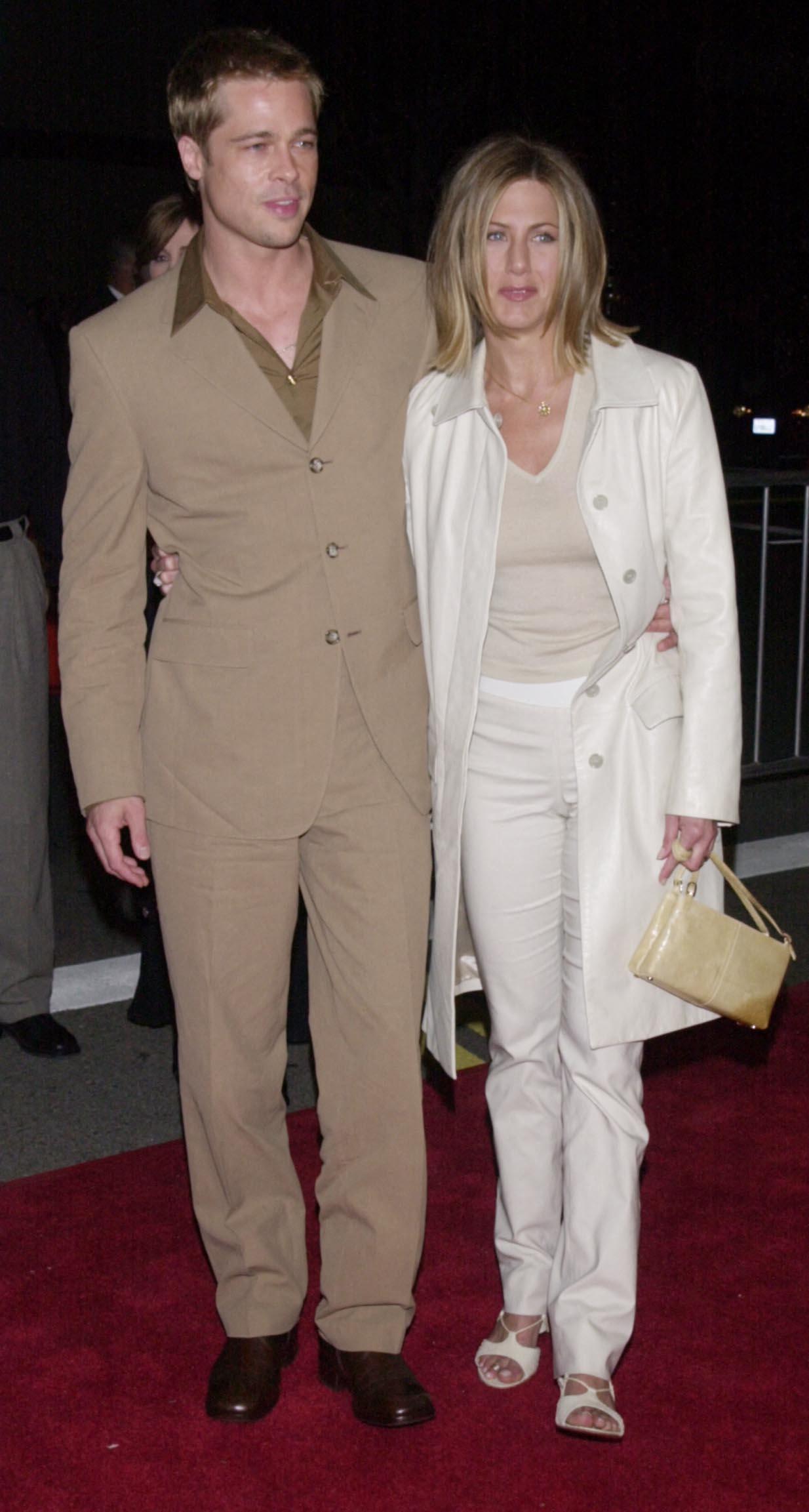

The actress is currently dating Hypnotist Jim Curtis, but reports claim he is “deeply intimidated” by her past high-profile relationship with Hollywood star Brad Pitt, whom she married in 2000, before their divorce five years later.

In recent years, the former lovers have seemingly rekindled a friendly relationship, with Brad Pitt even attending Jennifer Aniston’s 50th birthday celebration in 2019.

Article continues below advertisement

After hard launching their relationship last November, Aniston reminded the public of her blossoming romance with Curtis when she shared a sweet snapshot with the hypnotist visible in the background on Valentine’s Day.

However, despite the subtle but clear stamp of love, it appears that Curtis is still troubled by her past, particularly her former romance with Hollywood veteran Brad Pitt.

Pitt and Aniston were married for five years, and despite their 2005 split, their relationship still resonates within industry circles.

They have also seemingly remained amicable, as evidenced by Pitt’s appearance at Aniston’s 50th birthday celebration in 2019.

All of these have allegedly left Curtis feeling he is not up to par, especially given Pitt’s glittering Hollywood career.

Article continues below advertisement

“Jim is deeply intimidated,” one insider said, per a report. “Brad Pitt isn’t just an ex-husband. He’s a cultural icon — one of the sexiest men to ever live. That body alone became part of pop history.”

Article continues below advertisement

According to other sources who spoke to Rob Shuter’s #Shuterscoop, Curtis is aware that conversations about Brad Pitt and Aniston’s past relationship persist, even as his own relationship with the actress continues to flourish.

This has at times made things feel overwhelming for him, even though he is not actively trying to compete with Aniston’s past.

“The Brad-and-Jen narrative never really died,” said an insider. “It’s not that Jim thinks he’s competing — it’s that he’s stepping into something the public still romanticizes.”

“He’s confident, but he’s human. When your girlfriend’s former marriage is still treated like unfinished business by fans, that’s a lot to carry,” a second source echoed.

Article continues below advertisement

For her part, Aniston appears focused on the here and now, even as Hollywood continues to fixate on her past.

Article continues below advertisement

Rumors that Aniston and Curtis were romantically involved surfaced in mid-2025 and were officially confirmed by US Weekly in July.

At the time, the outlet claimed that the duo “are being super private but have been spending a lot of time together.”

The claim was later confirmed by the Daily Mail, which also noted how excited Aniston’s friends were about the relationship.

“Jennifer is dating Jim and is very happy, but she’s still taking things slowly for now. Her friends have been buzzing with excitement over the new romance, and those who have met him think they are a perfect match,” a source shared.

“Jen feels very connected to Jim, as they have the same level of emotional intelligence, unlike some of her previous suitors,” they added.

That same month, People Magazine revealed that the duo was introduced by friends and that Aniston feels Curtis is “very different from anyone she’s dated before.”

Article continues below advertisement

Last November, Aniston took to Instagram to show off their romance by sharing a loved-up photo of the two of them to celebrate Curtis turning 50.

“Happy birthday, my love,” captioned the black-and-white photo, which marked her first public acknowledgement of her romance with Curtis. She also added the word “Cherished,” alongside a heart emoji.

At the time, Curtis reciprocated the show of love with pictures of them on his page. He added the caption, “If this is a dream, I don’t want to wake up.”

More recently, he gave back the same birthday energy with a tribute to Aniston when she turned 57 earlier in the month.

He shared a monochrome picture of himself with Aniston sharing an intimate kiss and another of them laughing intensely while posing for the camera aboard what appeared to be a yacht.

Curtis also added a “HBD my [heart],” captioned alongside a funky birthday song playing in the background.

The media personality, who previously shared that she was offered $12 Million attached with a condition that she signs a non-disclosure agreement, spills more on what her life would have been if she accepted the terms.

Brianna LaPaglia has been vocal about the downsides of her relationship with Zach Bryan, which lasted for almost a year. She previously noted that the mishaps in her relationship with men may steer her towards having a taste of the other side.

Article continues below advertisement

LaPaglia sat down with the hosts on a recent episode of “Impaulsive,” where she spilled the tea on the non-disclosure agreement she was presented with after her split from Bryan. She told Logan Paul and Mike Majlak that the agreement would have prohibited her from being on social media.

Explaining further, she said that she would not have the liberty of posting on the internet, doing her job, or speaking about her ex unless it was in a positive light.

She vehemently insisted that, contrary to popular opinion, even if she could go back and take the money, she would not, as that would put her life under surveillance. “It was out of the question. It was so controlling,” the podcaster added.

Article continues below advertisement

LaPaglia also noted that the “insane” offer included “all of Barstool [Sports],” also covering and controlling her then-“BFFs” podcast co-hosts, Josh Richards and Dave Portnoy’s activities.

She further shared that the contract, which was supposed to span for five years before the $12 million was completely paid, will demand regular check-ins with her ex’s manager.

This revelation prompted one of the hosts to interject and state that said manager would have been “like a probation officer.”

Article continues below advertisement

Continuing the conversation, LaPaglia shared that Bryan often made fun of her career as a podcast host, calling it embarrassing. In her words, “He hated everything to do with podcasting… he thinks it’s like the worst thing ever.”

After she disclosed the details of the agreement, Paul could not come to terms with the fact that Bryan wanted that amount of control over her even after their relationship had ended. He said:

“I am failing to understand why he wanted that level of control over you post-relationship,” to which she immediately responded, “because he is a psychopath, a narcissist, and a very scary person.”

Article continues below advertisement

The 26-year-old stated that she wanted that chapter of her life to be over, adding that she shared her story publicly for herself and other girls who are probably going through a similar situation. Paul and Majlak applauded her stance to reject the multi-million dollar deal, tagging it a noble act.

Article continues below advertisement

Shortly after their breakup in 2024, LaPaglia went public with the details of their split on her podcast, where she announced that she was offered a large sum of money to stay completely silent about her experiences with the singer.

LaPaglia’s co-host, Dave Portnoy, noted she went back and forth over accepting the deal before she ultimately decided that she did not want the “blood money.” The Blast shared that she admitted that it was a moral battle for her at the time, considering the financial and economic status of her family.

Furthermore, she disclosed that another thing that sealed the deal on her decision was her experience with Bryan emotionally abusing her. She claimed that taking the money would have cost her peace of mind, as she would lose sleep in fear of what emotional abuse tactic he would resort to.

Article continues below advertisement

After her messy breakup with the “Pink Skies” singer, LaPaglia got candid about the possibilities of her dating life taking a turn. She shared her intentions of testing the waters in same-sex relationships.

The Blast reported that her preference in the dating pool was already tilting towards women, owing to the way things turned out with men in the past. She also revealed that it would not be a first for her because she had engaged in same sex dating before.

“I think that they’re better, so maybe I really am fully a lesbian, so maybe that’s why none of my relationships with men have worked out,” the podcaster told her co-host Josh Richards. However, LaPaglia noted that at the time, she was content with remaining single and enjoying life on her own.

The estranged lovers first met in May 2023 at the Academy of Country Music Awards. A month later, they shared the stage during Bryan’s concert at Forest Hills Stadium in New York City. By July of the same year, they confirmed the status of their romantic relationship.

The duo had their red carpet debut at the 2024 Grammys, where Bryan bagged his first Grammy, stepping out together hand in hand as they made points to highlight their love for each other publicly.

The content creator was head over heels for Bryans and had no issues admitting it. She often voiced her feelings on her podcast and showed great support for her then-boyfriend’s music career.

Article continues below advertisement

As shared by The Blast, the former lovebirds celebrated their first anniversary together in July 2024 with sweet social media posts, and three months later, the relationship hit rock bottom. Bryan announced the split online in October.

Will the heat between Brianna LaPaglia and Zach Bryan eventually settle?

Published

Cops were called out to Shia LaBeouf‘s Los Angeles area home more than once prior to his breakup with Mia Goth … according to police records obtained by TMZ.

Docs show that authorities showed up to the home belonging to Shia for calls involving a disturbance of the peace and an alleged stalking incident.

According to the records, in November 2024, a call was logged for a “husband and wife” disturbance of the peace, where an “uncooperative female” was repeatedly heard on the 911 call saying “just go” — stating she was trying to get her husband to leave.

The docs describe a male being heard in the background cursing … before the call was eventually cleared. The Pasadena City PIO confirms the incident did involve the residents of the home … however, no full police report was required.

In another call from August 2025, a caller told cops an “old friend” was mentally ill and she thinks she is married to Shia LaBeouf … stating she is “murderously angry with him, appears to be stalking him and is going to his home.”

According to the docs, the caller — who appears to be a fan of Shia and did not live in his neighborhood — told cops they saw the individual obsessing over Shia via their Instagram profile.

The caller said they were simply concerned when seeing these posts online and claimed the person believed they were married to Shia. It is unknown if Shia was even aware of this incident, but the docs mention Shia’s home address.

TMZ.com

As we first reported … Shia was arrested Monday night in New Orleans after allegedly punching a bar employee, sparking a brawl before cops arrived. He was later charged with two counts of simple battery.

The arrest came months after his split from Mia Goth. We broke the story … following the breakup, Shia relocated from Los Angeles to New Orleans in December, purchasing a 3-bedroom, 3.5-bath Uptown cottage for just over $1 million.

Police in Alabama have identified human remains discovered in a coal bin as a man who vanished 38 years ago and was the subject of a long-lingering cold case.

DNA testing on the remains — which were first found in late 2004 — finally returned a hit for 21-year-old Bryant Keith Bates.

Us Weekly confirmed Bates was last seen alive on November 15, 1988, after he had left his family’s home in North East Lake for a funeral.

When he failed to return from his friend’s funeral, Bates’ relatives grew suspicious and reported him missing to the Birmingham Police Department.

Early on in the missing persons probe, his family expressed grave concerns the young man was killed intentionally.

Back on November 22, 2004, police were contacted by an exterminator, who told them he had discovered human skeletal remains buried inside a coal bin while working in the crawl space of a South East Lake rental property.

The skeletal remains were brought to the Jefferson County Coroner/Medical Examiner’s Office for examination, and it was determined the victim was male and likely of African descent. They estimated his age to be between 17- and 30-years-old and said that he stood 5-foot-10.

Officials say that Bates was last seen wearing a pair of plaid pants with a white shirt that had blue trim — the same clothing that was found along with the skeletal remains.

A Coca-Cola brand watch and a chain necklace were also recovered, and both belonged to Bates.

An autopsy determined that Bates was shot in the head. His manner of death was deemed a homicide, and now, investigators are trying to bring his killer to justice.

Police do not have an idea at the moment how long ago Bates was killed. They also have failed to discuss any possible suspects they may have in mind.

Information about the unidentified remains was entered into the National Missing and Unidentified Persons System in 2015, but no match was found.

Three years later, a bone sample was submitted to the University of Texas Center for Human Identification (UNTCHI) for analysis, and the results confirmed the remains were those of a man. A profile was entered into the Combined DNA Index System, however, there still was no match.

Then, in March 2025, officials took a bone sample and submitted it to Othram, Inc., for further analysis. The DNA profile developed from that specific analysis confirmed that the remains were of African descent and aided genealogists in developing new leads about who the man might be.

Officials claim those fresh leads were sent to the Jefferson County Coroner/Medical Examiner’s Office and allowed them to locate immediate family members of the deceased.

In Feb. 2026, officials say UNTCHI performed DNA testing of Bates and confirmed that the missing remains that were found were those of Bates.

The Jefferson County Coroner’s Office says the identification was made possible by utilizing forensic genetic genealogy analysis (FGG) and is the second positive ID using the process. Officials say they currently have 26 cases being analyzed by the FGG process.

:max_bytes(150000):strip_icc():format(jpeg)/dog-olympics-course-021826-1-03c3f3b12d2941c581e7982fd5cdb421.jpg)

Watch the pet cross the finish line in Milan Cortina.

The late actor Carl Weathers is being honored in the new “Star Wars” movie, “The Mandalorian & Grogu.” After three seasons on Disney+, the titular Mandalorian, played by Pedro Pascal, is finally heading to the big screen. Although Weathers has sadly passed away, Lucasfilm honored the late actor by sneaking his name into The Mandalorian’s latest adventure.

Article continues below advertisement

In the first few seasons of “The Mandalorian,” which are currently available to stream on Disney+, Carl Weathers plays the role of Greef Karga. The character became an agent of the Bounty Hunters’ Guild and Guild Master of the Nevarro Hunters following the collapse of the Galactic Empire. He later became the High Magistrate of Nevarro and became someone the Mandalorian could trust.

However, that wasn’t Weathers’ only contribution to a galaxy far, far away. He also directed two episodes of the show. He directed “Chapter 12: The Siege” (Season 2, Episode 4) and “Chapter 20: The Foundling” (Season 3, Episode 4). Fans loved his character, but also praised the work that he did behind the camera.

Article continues below advertisement

“When we finally had the meeting about [#TheMandalorian], you walk into this conference room and all of this [concept] art is on the walls… And it’s all magnificent. It’s some of the most beautiful artwork you could ever see.” – Carl Weathers (Greef Carga) #StarWars pic.twitter.com/e0Sv7vq7Zf

— Phil Szostak (@PhilSzostak) October 24, 2019

Eagle-eyed fans who watched the trailer that dropped on February 17 noticed a nod to Carl Weathers when a creature smashes through a door that is marked with the name “WEATHERS APOLLO” written across the top.

“Weathers” is clearly a reference to the late actor, while the name “Apollo” is clearly a nod to one of his best-known roles. Weathers portrayed Apollo Creed in the first four “Rocky” films, from 1976 to 1985. Although he began as the primary antagonist to Rocky Balboa, he eventually became Rocky’s close friend and mentor.

Article continues below advertisement

RIP Carl Weathers

Greef Carga was a character I loved in this new Star Wars story. Your acting and directing was a treasure. Glad me and my son got to watch you on screen. pic.twitter.com/QZE30cga90

— Elderpug (@Elderpug27) February 2, 2024

According to a death certificate obtained exclusively by The Blast, Weathers passed away on February 2 at 12:18 AM at 76 years old. His death certificate listed “atherosclerotic cardiovascular disease” as his official cause of death.

His family confirmed the news in a statement, saying, “He died peacefully in his sleep on Thursday, February 1st, 2024. We are deeply saddened to announce the passing of Carl Weathers.”

They praised him as an “exceptional human being who lived an extraordinary life. Through his contributions to film, television, the arts, and sports, he has left an indelible mark and is recognized worldwide and across generations. He was a beloved brother, father, grandfather, partner, and friend.”

Article continues below advertisement

In addition to Weathers, acclaimed director Martin Scorsese will also appear in a galaxy far, far away. Polygon confirmed that the Ardennian shopkeeper seen at the beginning of the trailer is voiced by none other than Martin Scorsese.

The film is also bringing some serious star power with “Alien” actress Sigourney Weaver, playing Ward, a colonel and leader of the New Republic’s Adelphi Rangers who previously served as a pilot for the Rebel Alliance. “The Bear” star Jeremy Allen White is also voicing Rotta the Hutt, the son of deceased crime lord Jabba the Hutt.

Article continues below advertisement

“This trailer makes it feel more like a movie and not just an episode of the show,” one fan commented.

“This is the way you do a real trailer,” another user agreed.

“Hope there’s a longer version of the Star Wars theme music at the beginning of the trailer on the soundtrack,” a third fan chimed in. “I love it!”

Others expressed shock to hear Scorsese’s voice in the trailer, with one fan writing, “Martin Scorsese in Star Wars wasn’t on my 2026 Bingo card, but I’m happy.”

“The Mandalorian & Grogu” hits theaters on May 22, 2026. Seasons 1-3 of “The Mandalorian” are currently available to stream on Disney+.

Guy Ritchie has had quite the comeback in the 2020s, and has become more productive than at any other point in his career. While the late 2010s featured him as the director behind poorly received blockbusters like King Arthur: Legend of the Sword and Aladdin, Ritchie kicked off the new decade with six new mid-budget genre films, and he has three more on the way. It feels as if Ritchie is returning to his roots by making smart, snarky gangster stories with his trademark non-linear sensibilities, and he’s even managed to extend that style into television. The Gentlemen isn’t just one of the most entertaining projects that Ritchie has ever been involved with, but it’s a distillation of what makes him such a unique storyteller.

The first film in this third wave of Ritchie’s career was The Gentlemen, a fun heist thriller with a collection of handsome dudes, blackly funny ultra-violence, and an overcomplicated plot involving illegal drug smuggling. While it was great to see Ritchie make something that felt like a deliberate throwback to his work on Snatch, The Gentlemen series is more than just a retelling of the film, as it is set in the same universe and goes far more in-depth with its analysis of family dysfunction. Given that Ritchie likes to sneak in bite-sized escapades and jokes into his stories, The Gentlemen has proven that he just might be better fit to make prestige television than to continue doing feature films.

While the film featured Matthew McConaughey as an Oklahoma drug kingpin, The Gentlemen introduces a new family empire with the Horniman, a British dynasty that controls a powerful cannabis farm. After the death of the family’s patriarch, Archibald (Edward Fox), the fortune is passed down to his youngest son, Eddie (Theo James), bypassing his older heir, Freddie (Daniel Ings), altogether. Eddie is a former veteran of the British Army who knows a thing or two about maintaining relationships with dangerous organizations, but he’s shocked to find that his father owes a massive debt to the Scouse drug dealer Tommy Dixon (Peter Serafinowicz).

As he enters the illicit world of underground drug smuggling, Eddie finds both allies and adversaries; while the rival drug kingpin Bobby Glass (Ray Winstone) wants to take back the land that Eddie has now used to curate his farms, the incarcerated gangster’s daughter Susan (Kaya Scodelario) might be able to provide the Hornimans with a truce. However, both families are threatened by the encroaching danger of Stanley Johnson (Giancarlo Esposito), an American billionaire who is desperate to buy them out by any means necessary.

Guy Ritchie Had Already Found His Style With His First Crime Thriller Short Film

The roots of Ritchie’s career can be traced back to these 20 minutes.

The Gentlemen succeeds because the series paints a colorful portrayal of the different parties involved in the illegal trade, which is treated as a prestige family business. While Eddie has worked for the good of his country through both the Army and the United Nations’ peacekeeping force, he surprisingly finds that handling his father’s business requires the same set of skills. He is trying to protect the family fortune, and is also attempting to soothe tensions and avoid any violent conflict.

This aspect of the story allowed Ritchie to expand the material beyond the action that would need to be included within a single film, and allowed for a greater exploration of the interconnected world. Some of the most compelling parts of The Gentlemen are simply observations about the various gamekeepers, distributors, security forces, and corrupt law enforcement officials involved in any of Eddie’s business moves. The series moves like a chess game, which makes it all the more exciting when Ritchie breaks out into his trademark slapstick humor.

Even in his worst films, Ritchie has always had an eye for casting, and The Gentlemen benefits from a cast who elevates their characters beyond stereotypes. James has always been a more dynamic actor than the generic heartthrob that he was pigeonholed as early on in his career, and he turns Eddie into a fascinating character filled with contradictions. Eddie is ruthless in cutting out those who are disloyal to him, but he also considers that he has the potential to change his family legacy and redefine what a “gentleman” can be. Scodelario’s performance is perfectly matched to his because Susie is also trying to break out from under the shadow of a highly powerful father, and was ironically able to emulate his qualities after he was trapped in prison. The return of Bobby into Susie’s life doesn’t just make her loyalties ambiguous, but drives a wedge against the more positive influence that Eddie had on her.

The Gentlemen has just as many twists and turns as any of Ritchie’s films, and the series is straight up hilarious, willing to go far for the sake of an absurdist joke. He may be currently stealing scenes on A Knight of the Seven Kingdoms, but Ings is just as great on The Gentlemen because Freddie seems to always find a way to undercut his brother’s strategies — even if his intentions are pure. While the first season of The Gentlemen proved that Ritchie has the capability of building an entire universe, the impending second season might ensure that the series goes down in history as his greatest achievement.

:max_bytes(150000):strip_icc():format(jpeg)/donny-osmond-las-vegas-2-021826-9e9fd10b6d5443e08a14b4d9a672ae84.jpg)

Joanne Julkowski alleges that she suffered physical and mental issues.

Bitcoin: We’re Entering The Most Dangerous Phase

Luxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

Can XRP Price Successfully Register a 33% Breakout Past $2?

GB's semi-final hopes hang by thread after loss to Switzerland

The Final Warning: XRP Is Entering The Chaos Zone

The Music Industry Enters Its Less-Is-More Era

Infosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

Kunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

Financial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

Bhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

Retro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

Clearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

Dolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

The strange Cambridgeshire cemetery that forbade church rectors from entering

Barbeques Galore Enters Voluntary Administration

Tesla avoids California suspension after ending ‘autopilot’ marketing

Kalshi enters $9B sports insurance market with new brokerage deal

WLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

Ethereum Price Struggles Below $2,000 Despite Entering Buy Zone

Man dies after entering floodwater during police pursuit