Crypto World

US CLARITY Act Could Pass by April, Says Senator Bernie Moreno

The US CLARITY Act, a long-awaited framework intended to clarify how the United States will regulate the burgeoning crypto sector, could be on track for a congressional pass in the coming weeks, according to crypto-friendly policymakers. Senator Bernie Moreno suggested a potential April milestone as he spoke to CNBC in Florida, where he was touring President Donald Trump’s Mar-a-Lago resort. The remarks came as Coinbase CEO Brian Armstrong joined Moreno for a discussion that touched on market structure and the regulatory path forward at a gathering organized by the World Liberty Financial crypto forum.

Armstrong described the current climate as offering a “path forward” that might yield a balanced outcome for the industry, traditional banks, and American consumers. He noted that earlier iterations of the draft included provisions that would ban interest-bearing stablecoins and would place the U.S. Securities and Exchange Commission in a central regulatory role over crypto markets. Those elements proved problematic for the exchange and had contributed to a pause in its public backing for the bill. At the same time, members of the crypto community have emphasized the need for a predictable regulatory framework that can spur investment and innovation while protecting consumers and the broader financial system.

Moreno, who co-authored or championed the legislation’s bipartisan path, signaled that the sticking point on stablecoins—particularly the idea of rewarding users with yield—has shifted toward a more workable compromise. In his view, the debate over stablecoin rewards “shouldn’t be part of this equation,” and he indicated that lawmakers were looking to refine the language so it could pass with broad support. The discussion has not been simple, given the various interests involved, from traditional banking to fintech platforms and consumer advocates. But with executives from the crypto industry at the table alongside bankers and lawmakers, the atmosphere has become more conducive to finding a compromise that can be signed into law.

From the trading floor to the Capitol, the conversation has also been about market structure and consumer protections. Armstrong invoked a vision of a “win-win-win” scenario where the bill would advance the interests of the crypto industry, safeguard banks, and benefit American consumers by consolidating a coherent national framework. The idea is to harmonize the fast-moving crypto markets with existing financial regulations, reducing uncertainty for businesses and investors alike. The discussions have taken place against a backdrop of broader regulatory activity, including ongoing policy reviews at the White House and within Congress, and amid an intensifying push from both parties to deliver tangible crypto reforms.

The regulatory conversation has not occurred in a vacuum. Polymarket, a prediction market for crypto policy, offered a glimpse into market sentiment by showing the odds of the CLARITY Act passing in 2026 swing between 90% and roughly 72% around the time of the interview. The volatility in these odds underscores the uncertainty that still surrounds the drafting process and the political dynamics at play in a year marked by competing priorities for lawmakers. While Moreno suggested a constructive path forward, he also acknowledged that the timetable is influenced by technical details that still require resolution, particularly around stablecoins and the precise allocation of regulatory authority among federal agencies.

Key takeaways

- The CLARITY Act is gaining momentum in Congress, with a potential passage window cited as “April” by Senator Bernie Moreno in a CNBC interview conducted at Mar-a-Lago.

- Coinbase previously withdrew support over provisions that would ban interest-bearing stablecoins and centralize crypto regulation under the SEC, complicating the bill’s path; the White House reportedly viewed the move as a unilateral action.

- Armstrong and Moreno signaled a renewed effort to achieve a balanced compromise that would advance crypto market structure while addressing concerns from the banking sector.

- Market-facing sentiment on the bill has fluctuated, with Polymarket showing odds of passage in 2026 ranging from 90% to 72% around the talks.

- The discussions emphasize restoring clarity for market participants, investors, and consumers, potentially shaping the United States’ stance on crypto policy for years to come.

Sentiment: Bullish

Market context: The rhetoric around the CLARITY Act reflects a broader push for regulatory clarity in a volatile asset class, as lawmakers seek a stable framework to accommodate innovation while safeguarding financial stability and consumer protections in a rapidly evolving market.

Why it matters

The CLARITY Act represents more than a regulatory tweak; it signals a concerted attempt to establish a nationwide standard for crypto assets, a move that could significantly influence how exchanges, wallet providers, and fintech firms operate in the United States. By aiming to clarify which activities trigger regulatory oversight and which agencies oversee them, the bill seeks to reduce the current fragmentation that has left many market participants navigating a patchwork of state and federal rules. If enacted, the act could provide a predictable environment for investment, product development, and institutional participation, potentially attracting capital that has been cautious due to regulatory ambiguity.

However, the path to passage remains contingent on reconciling divergent priorities. The debate over stablecoins—whether to treat certain yields as permissible rewards or to prohibit certain yield-bearing mechanisms—highlights the trade-offs lawmakers face between fostering innovation and protecting financial stability. The White House’s reaction to Coinbase’s withdrawal illustrates the delicate political optics involved in crypto legislation, with officials wary of any moves that could cast the administration as unfavorably aligned with industry players or skeptical of robust consumer protections. As talks continue, stakeholders on all sides are watching for a clearer set of draft language that can win broad bipartisan support and withstand evolving regulatory scrutiny.

For investors and users, the potential passage of the CLARITY Act could usher in a period of relative regulatory certainty, enabling more precise risk assessment and potentially more defined product offerings. The balance being sought is delicate: too lenient a regime could invite operational risk, while overly restrictive provisions might stifle innovation and push activity offshore or into less regulated ecosystems. The ongoing discussions at the WLF crypto forum, coupled with public comments from industry leaders, show a sector eager for governance that protects consumers without quashing growth.

What to watch next

- Upcoming committee hearings or markup sessions in Congress that could reveal the final language of the CLARITY Act.

- Any revisions to stablecoin treatment within the bill, particularly around yield-bearing arrangements and consumer protections.

- White House statements or official remarks that signal shifting positions or tailored guidance on crypto regulation.

- Respective statements or filings from Coinbase and other major players to gauge industry alignment with the revised draft.

- Follow-up coverage on the World Liberty Financial crypto forum and any subsequent policy pledges or compromises announced by lawmakers.

Sources & verification

- CNBC interview at Mar-a-Lago featuring Senator Bernie Moreno and Coinbase CEO Brian Armstrong.

- World Liberty Financial crypto forum discussions on market structure and regulatory pathways.

- Coinbase withdrawal of support for the CLARITY Act and White House reaction documenting the administration’s stance.

- Polymarket odds page tracking the CLARITY Act’s passage probability in 2026.

- David Sacks statements cited by Cointelegraph regarding confidence in the bill’s trajectory.

US CLARITY Act gains momentum as lawmakers edge toward April passage

The ongoing dialogue around the CLARITY Act underscores a broader shift in how the United States intends to regulate crypto markets. As policymakers seek a cohesive and comprehensive framework, industry leaders are pushing for a balance that preserves innovation while ensuring consumer protection and financial stability. The discussions at the Mar-a-Lago event and the WLF crypto forum point to a willingness to negotiate, even if core points—from stablecoin policy to the SEC’s regulatory role—remain contested. If April proves to be a viable milestone, as Moreno suggested, lawmakers may be positioned to deliver a bill that could redefine the U.S. market structure for years to come. The unfolding narrative will likely influence investor sentiment, the trajectory of exchange policies, and the pace at which traditional financial institutions engage with crypto products in a regulated environment.

As the sector awaits more precise legislative language, participants will be closely watching for any signals that the political calculus has shifted enough to secure bipartisan support. The balance of risk and opportunity in the year ahead will hinge on how effectively the bill reconciles the industry’s demand for clarity with the banking sector’s emphasis on safety and soundness. The next few weeks could prove pivotal for a piece of legislation that many view as a potential turning point for mainstream crypto adoption in the United States.

Crypto World

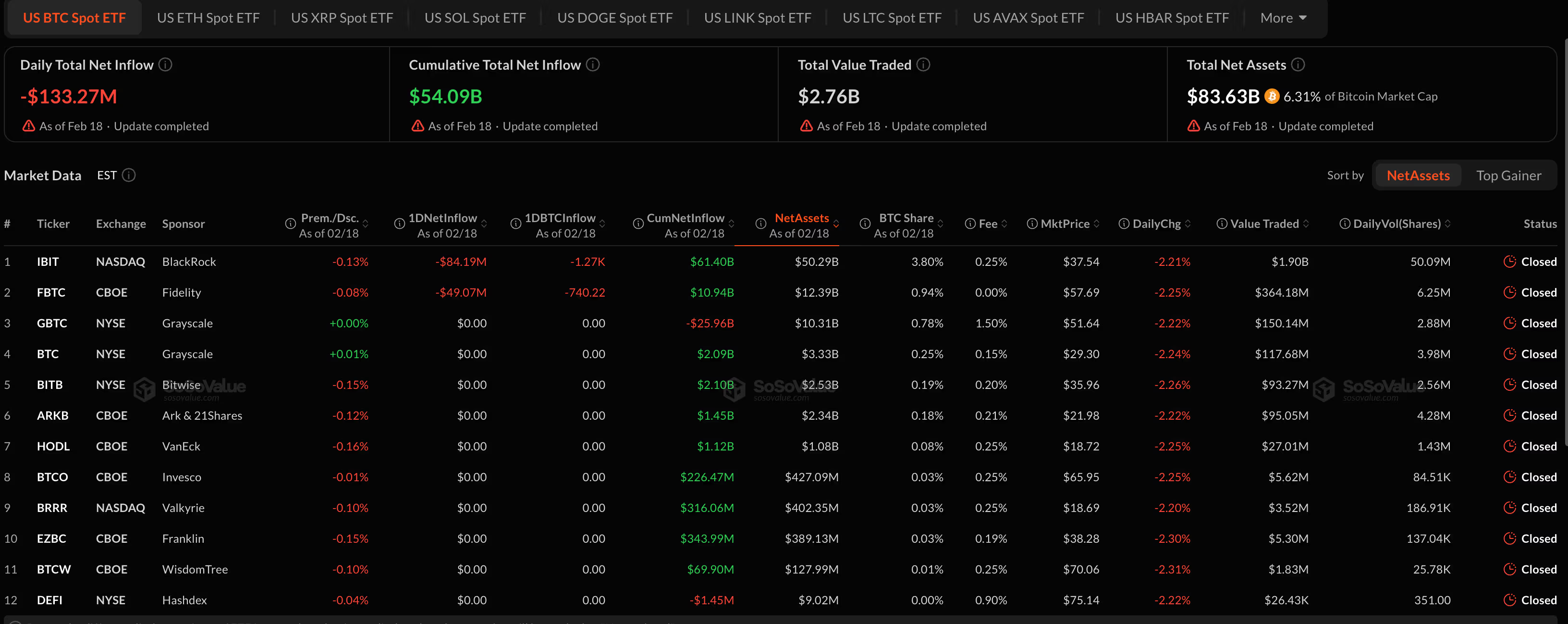

Bitcoin, ether, xrp ETFs bleed while Solana bucks outflow trend

U.S.-listed crypto ETFs are flashing red across the board, with one notable exception.

Bitcoin spot ETFs saw $133.3 million in daily net outflows as of Feb. 18, led by BlackRock’s IBIT, which shed $84.2 million, and Fidelity’s FBTC, which lost $49 million. Total net assets across bitcoin funds stand at $83.6 billion, roughly 6.3% of bitcoin’s market cap, but recent flows suggest institutions are trimming exposure rather than adding on dips.

Ethereum products followed a similar pattern. U.S. ETH spot ETFs recorded $41.8 million in net outflows on the day, with BlackRock’s ETHA losing nearly $30 million. Total net assets across ether funds sit at $11.1 billion, about 4.8% of ETH’s market cap.

The steady bleed comes as ether trades below $2,000 and struggles to build momentum despite broader expectations of rate cuts later this year.

XRP ETFs also slipped into negative territory, posting $2.2 million in daily outflows. Total net assets across XRP funds are just over $1 billion, or roughly 1.2% of XRP’s market cap. Price action in XRP has mirrored the cautious tone, with the token down over 4% on the day.

Solana, however, stood out.

U.S. SOL spot ETFs recorded $2.4 million in net inflows, pushing cumulative inflows to nearly $880 million. Bitwise’s BSOL led with $1.5 million in fresh capital. While modest in absolute terms, the inflow contrasts sharply with the broader risk-off positioning across bitcoin and ether products.

Elsewhere, smaller altcoin ETFs such as LINK saw marginal inflows, but the overall picture remains one of selective exposure rather than broad-based accumulation.

The divergence suggests investors are rotating within crypto rather than exiting entirely. With macroeconomic uncertainty lingering and the dollar firming, ETF flows offer a real-time read on where institutional conviction remains and where it is fading.

Crypto World

Warren Urges Fed And Treasury To Reject Crypto Bailout

Senate Banking Committee ranking member Elizabeth Warren has reportedly sent a letter to Treasury Secretary Scott Bessent and Federal Reserve chair Jerome Powell, urging them not to bail out “cryptocurrency billionaires” with taxpayer dollars.

Warren warned that any potential bailout “would be deeply unpopular to transfer wealth from American taxpayers to cryptocurrency billionaires,” adding that it could also “directly enrich President Trump and his family’s cryptocurrency company, World Liberty Financial, according to CNBC.

The letter comes as Bitcoin (BTC) prices have fallen more than 50% from their all-time high in October, hitting a local low of $60,000 on Feb. 6.

The letter also came on the same day that World Liberty Financial hosted its first “World Liberty Forum” for crypto executives and pro-industry policymakers at the President’s private Mar-a-Lago club in Palm Beach, Florida.

The US government is retaining seized Bitcoin

Senator Warren also referenced the Financial Stability Oversight Council’s Annual Report hearing on Feb. 4, during which Secretary Bessent was asked about his authority to bail out the crypto industry.

During the hearing, Congressman Brad Sherman asked Bessent if the Treasury Department “has the authority to bail out Bitcoin?” or instruct banks to buy Bitcoin or Trumpcoin (TRUMP).

A bemused Bessent asked for clarification on the question, stating that “within the context of asset diversification within banks, they could hold many assets.”

Related: Senators ask Bessent to probe $500M UAE stake in Trump-linked WLFI

Sherman also expressed concern that US tax dollars might be invested in crypto assets. “Why would a private bank be your tax dollars?” asked the Treasury secretary.

Bessent confirmed that “we are retaining seized Bitcoin,” which is not tax money, but an “asset of the US government.”

Senator Warren claims response was deflection

Warren saw the exchange differently, stating in her letter that Bessent “deflected.”

“It’s deeply unclear what, if any, plans the US government currently has to intervene in the current Bitcoin selloff,” she wrote.

“Ultimately, any government intervention to stabilize Bitcoin would disproportionately benefit crypto billionaires.”

“Your agencies must refrain from propping up Bitcoin and transferring wealth from taxpayers to crypto billionaires through direct purchases, guarantees, or liquidity facilities,” the letter reportedly stated.

Cointelegraph reached out to Warren and the Treasury for comment, but did not receive an immediate response. A Federal Reserve spokesman confirmed they had received the letter but declined to comment.

Magazine: Chinese New Year boosts interest, TradFi buying crypto exchanges: Asia Express

Crypto World

Is BTC About to Drop Below $60K?

Analysts are expecting a volatile near-term future for BTC, with some questioning whether new lows are on their way.

Bitcoin went through some intense trading sessions at the end of January and the beginning of February, plunging from over $90,000 to a 15-month low at $60,000 in under ten days. However, it has been rather sluggish since then, mostly trading below $70,000, with little sign of a breakout.

Founder and CIO of MN Fund, Michaël van de Poppe, outlined the recent stagnation, indicating that BTC’s volatility is “the lowest it has been since the crash.” Consequently, he determined that “there’s a big move on the horizon” and outlined his plan for buying or selling.

Sub-$60K or Above $80K?

The volatility on #Bitcoin is the lowest it has been since the crash.

That means; there’s a big move on the horizon.

If we dip, I’ll be a big buyer, for sure.

If we go back upwards, I’ll start taking some profits on a test at $80-85K to be trading the trend.

Volatility is… pic.twitter.com/7Irp4iTzT9

— Michaël van de Poppe (@CryptoMichNL) February 18, 2026

The popular analyst said he would be a “big buyer for sure” if bitcoin dips again. In contrast, he would “start taking some profits” if the cryptocurrency tests the $80,000-$85,000 range.

Merlijn The Trader also weighed in on BTC’s recent performance, highlighting the significance of the current $67,000 level. If lost, the analyst believes $60,000 will come into focus again. His worst-case scenario envisions a massive drop below $50,000 if the February 6 bottom gives in.

BITCOIN IS AT THE CRUX: $67K.

Reclaim $73K the trend repair begins.

Lose $60K liquidity vacuum opens below.Next real demand zone:

$48K–$49K (0.618 retrace)This isn’t volatility.

It’s the market choosing a direction. pic.twitter.com/FQfrBNYrTe— Merlijn The Trader (@MerlijnTrader) February 18, 2026

Glassnode was slightly less bearish, predicting that bitcoin could drop to as low as $55,000 if the landscape worsens again soon.

You may also like:

Year of the Metals

Doctor Profit, who has been among the few analysts to predict BTC’s crash below $100,000 at the end of 2025, said the cryptocurrency now trades around 50% lower than its October all-time high. He noted that “it’s bad to lose money, but it’s even worse to lose it in terms of USD.”

The analyst predicted that 2026 will be the year of precious metals, such as gold and silver. Both assets experienced intense volatility in 2026 as well. Gold, for example, skyrocketed to a new all-time high of $5,600/oz in late January before it crumbled to $4,400 days later. It has managed to rebound to $5,000 as of press time.

Silver, on the other hand, exploded to over $120, dumped to $64, and now sits close to $80. Both metals are slightly in the green on a year-to-date scale, while BTC is deep in the red.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

XRP price prediction ahead of December PCE Inflation report

XRP price is trading in a tight range as investors await the December Personal Consumption Expenditures (PCE) inflation report, due Friday, Feb. 20. The token’s next move could hinge not just on crypto-specific catalysts, but on broader macroeconomic data that shapes Federal Reserve policy expectations.

Summary

- XRP is consolidating near $1.43 ahead of the December PCE inflation report, a key macro event that could influence Federal Reserve policy expectations.

- November’s PCE came in hot at 2.8%, but Truflation data shows cooling trends, with estimates at 1.54% headline and 1.94% core, raising hopes of a softer official print.

- Technically, XRP remains in a broader downtrend but is stabilizing between $1.35 and $1.50, with resistance at $1.47 and support at $1.35 and $1.20.

The PCE index is the Fed’s preferred inflation gauge, particularly core PCE, which excludes food and energy and tracks persistent price pressures. November’s PCE and core PCE both came in at 2.8%, surprising to the upside and reinforcing concerns that inflation progress had stalled.

However, fresh data from Truflation suggests cooling pressures.

Its real-time estimates currently place headline PCE at 1.54% and core PCE at 1.94%, well below the official November print. Traders are now watching to see whether the U.S. Bureau of Economic Analysis reflects that cooling trend.

As inflation data directly impacts rate expectations, it also influences risk-sensitive assets like XRP. A softer reading could revive hopes of future rate cuts and support crypto prices, while a hotter print may pressure the market through a stronger dollar and tighter financial conditions.

XRP price analysis: Consolidation after sharp drop

XRP is trading around $1.43 at press time, stabilizing after a steep decline from the early-January high near $2.40. The daily chart shows a clear downtrend marked by lower highs and lower lows.

The recent capitulation candle near $1.20 triggered a strong bounce, but the Ripple token (XRP) has since entered a tight consolidation range between roughly $1.35 and $1.50.

The 9-day moving average (~$1.43) is attempting to flatten, while the 21-day moving average (~$1.47) remains above price and continues sloping downward. This suggests short-term stabilization but a broader bearish structure remains intact.

The Balance of Power (BBP) indicator sits slightly negative at -0.09, indicating sellers still have a marginal edge, though bearish momentum has eased compared to early February’s sharp selloff.

Immediate resistance lies at $1.47, aligning with the 21-day MA. A break above that could open a move toward $1.60. On the downside, key support rests near $1.35, followed by stronger support around $1.20.

With XRP coiling ahead of the PCE release, Friday’s inflation data could act as the catalyst for the next decisive move.

Crypto World

Moonwell Proposes $2.68M Recovery Plan After cbETH Liquidation Incident Harms 181 Borrowers on Base

TLDR:

- Roughly 181 Moonwell borrowers on Base lost ~$2.68M due to oracle-driven cbETH liquidations from Feb 14–18, 2026.

- Moonwell will allocate ~$310,000 from its Apollo Treasury as an immediate pro-rata repayment to all affected borrowers.

- The remaining ~$2.37M will be repaid gradually through future protocol fees and OEV revenue via Sablier over 12 months.

- MFAM holders will convert their tokens into stkWELL at a 1:1.5 ratio, consolidating Apollo DAO into Moonwell’s primary governance.

Moonwell has released a recovery proposal addressing unfair liquidations of cbETH collateral between February 14 and 18, 2026.

The incident affected roughly 181 borrowers on Base, resulting in approximately $2.68M in net losses. Protocol behavior tied to MIP-X43, not user error, drove the liquidations.

The plan combines treasury funds with future revenue and includes a transition for MFAM holders into the WELL ecosystem.

cbETH Liquidation Recovery Targets 181 Affected Borrowers

The Moonwell team conducted a full onchain review of all liquidation activity during the incident window. Each borrower’s loss was calculated on a net basis, meaning only realized economic harm qualifies for remediation.

The methodology accounts for all cbETH collateral seized, minus the USD value of debt repaid at the time of liquidation.

The proposal was direct about what caused the harm. “These users trusted Moonwell with their assets and were harmed through no fault of their own,” the post stated.

Crucially, cbETH was repriced at $2,200 per token to correct erroneous oracle values that contributed to the problem. This adjustment ensures that repayments reflect actual market conditions rather than distorted price data.

To begin repayments promptly, approximately $310,000 will be drawn from the Moonwell Apollo Treasury. This amount will be distributed pro-rata to affected borrowers based on their individual calculated losses.

The proposal described this allocation as “an immediate good-faith remediation without jeopardizing protocol stability.”

The remaining balance of roughly $2.37M will be repaid over time through future protocol revenue. This includes net protocol fees and OEV revenue under the current fee split structure.

All repayments will be claimable through Sablier over a 12-month window, after which unclaimed rewards expire.

MFAM Wind-Down Consolidates Apollo DAO Into Moonwell’s Primary Governance

The proposal also addresses the full deprecation of Moonwell on Moonriver, which was completed on January 29, 2026. Chainlink’s decision to sunset oracle feeds on Moonriver forced a gradual reduction of collateral factors. With MIP-R38 passed, all Moonriver markets reached a 0% collateral factor, formally closing the deployment.

As Moonriver operations wind down, the Apollo DAO governed by MFAM will consolidate into the primary Moonwell DAO governed by WELL.

The proposal described the transition as “simplifying governance, aligning incentives, and closing out legacy infrastructure.” MFAM holders will convert their holdings into stkWELL at a 1:1.5 ratio, based on a snapshot taken at proposal submission.

The proposal noted that this conversion brings MFAM holders “direct exposure to Moonwell’s ongoing development on Base and future deployments, while eliminating fragmentation across governance tokens and treasuries.” The MFAM-to-stkWELL conversion will also be claimable for up to 12 months via Sablier.

By addressing both the cbETH incident and the MFAM wind-down together, the proposal aims to close out Moonriver “in a clean, accountable manner.”

The Moonwell DAO will vote separately on treasury allocation, the long-term repayment commitment, and execution authority.

Crypto World

US CLARITY Act To ‘Hopefully’ Pass By April: Bernie Moreno

The US CLARITY Act, a highly anticipated bill aimed at providing greater clarity for the US crypto industry, could make it through Congress in just over a month, according to crypto-friendly US Senator Bernie Moreno.

“Hopefully by April,” Moreno told CNBC during an interview at US President Donald Trump’s Mar-a-Lago property in Florida on Wednesday.

Coinbase CEO Brian Armstrong joined Moreno for the interview, explaining that they were with representatives from the crypto, banking and US Congress at the World Liberty Financial (WLF) crypto forum to reach a solution on market structure.

“A path forward” is in sight, says Moreno

“One of the big issues that did come up in the past was this idea of stablecoins on rewards,” Armstrong said. The banking industry previously raised concerns that offering stablecoin yields could undermine traditional banking and shift deposits and interest away from banks.

While Armstrong had issues with the draft bill and withdrew his support for the CLARITY Act in January, he said there is “now a path forward, where we can get a win-win-win outcome here.”

“A win for the crypto industry, a win for the banks, and a win for the American consumer to get President Trump’s crypto agenda through to the finish line, so we can make America the crypto capital of the world,” Armstrong said.

Armstrong said the crypto exchange previously couldn’t support the bill because it includes provisions that ban interest-bearing stablecoins and position the US Securities and Exchange Commission as the primary regulator of the crypto industry. The White House was reportedly disappointed by Coinbase’s decision to withdraw its support, describing the move as a “unilateral” action that blindsided administration officials.

Moreno admitted that the delay stems from “getting hung up” on the stablecoin rewards, which he said “shouldn’t be part of this equation.”

Crypto prediction platform Polymarket’s odds of the US CLARITY Act passing in 2026 briefly surged to 90% on Wednesday before falling to 72% at the time of publication.

Moreno shuts down idea of a Democrat-led midterm election

Meanwhile, Moreno dismissed the idea that a Democratic takeover of Congress could threaten the bill when asked. “The House isn’t going to go Democrat, and neither is the Senate,” Moreno said.

“The American people are sick and tired of open borders; that is why we got elected. They were sick and tired of high inflation, and they were sick and tired of an out-of-control government,” he added.

Related: ECB targets 2027 digital euro pilot as provider selection begins in Q1 2026

On Dec. 19, White House crypto and AI czar David Sacks voiced strong confidence that the bill would pass early this year.

“We are closer than ever to passing the landmark crypto market structure legislation that President Trump has called for. We look forward to finishing the job in January,” Sacks said at the time.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Crypto World

Ledn raises $188m with first BTC backed bond sale in asset backed market

Ledn, a crypto lending company, has completed the first asset-backed securities (ABS) deal backed by bitcoin collateral, raising $188 million for crypto credit markets.

Asset-backed securities are bonds backed by pools of underlying loans, with investors receiving payments from the cash flows generated by those loans.

Bloomberg reported that the bonds are secured by a pool of more than 5,400 consumer loans issued by the firm, each backed by borrowers’ bitcoin holdings. The loans carry a weighted average interest rate of 11.8%.

The deal includes two tranches, with the investment-grade portion priced at 335 basis points over the benchmark rate. Jefferies served as sole structuring agent and bookrunner, according to Bloomberg.

Bitcoin’s volatility has been in focus, with the largest cryptocurrency by market capitalization falling as much as 50% over the past four months to as low as $60,000.

Crypto firm Ledn sells Bitcoin-backed bonds in ABS market first

>First ever deal of its kind in asset-backed debt

>Secured by pool of 5,400 Bitcoin-collateralized loans that consumers took from Ledn at weighted avg rate of 11.8%

>Investment grade tranche priced at +335bps pic.twitter.com/Rx3944uGys— matthew sigel, recovering CFA (@matthew_sigel) February 18, 2026

The structure employs automated collateral liquidation when thresholds are breached, a feature designed to protect investors during sharp market declines.

Crypto World

Crypto, TradFi Execs Mingle At Trump Crypto Event

Trump family-owned Mar-a-Lago was home to traditional finance giants, US government officials and crypto executives in a crypto forum on Wednesday, hosted by the family’s sprawling crypto company.

Coinbase CEO Brian Armstrong and Binance co-founder Changpeng Zhao, who Donald Trump pardoned last year, were at the exclusive World Liberty Forum event alongside Goldman Sachs CEO David Solomon and the heads of the Nasdaq and New York Stock Exchange.

The event saw traditional finance executives and US regulators embrace crypto, with Solomon, a long-time crypto skeptic, saying on stage that he now owns “a little Bitcoin, very little,” according to one of the attendees.

“The great irony is this whole world has gone full circle,” Bloomberg reported Eric Trump as saying at the event.

“There’s people in this room that were probably on the opposite side of us, that were canceling bank accounts for us, that were kicking us out of their big banks for no reason other than the fact that my father was wearing a hat that said, ‘Make America Great Again.’”

Commodity Futures Trading Commission chair Mike Selig, the head of an agency that is pushing to regulate the crypto industry, was also in attendance, along with Republican senators Ashley Moody and Bernie Moreno.

World Liberty announces tokenization tie-up for Trump hotel

World Liberty announced at the event that it has partnered with tokenization firm Securitize, with plans to tokenize loan revenue interests in an upcoming Trump-branded resort in the Maldives.

The company said it was part of a “broader strategy to design, structure, and distribute [World Liberty]-branded tokenized real-world asset offerings.”

Related: Warren warns crypto bailout would enrich Trump family biz: Report

The Trump Organization said in November that it would tokenize the development of the project, which is being built by real estate developer DarGlobal. The resort is set to be completed in 2030 and feature 100 luxury villas.

World Liberty said that the offering will give investors “both a fixed yield and loan revenue streams” from the resort, giving exposure to “both potential income distributions and the potential for certain profits upon any future sale.”

It added that the offering is only available to eligible accredited investors in the US and would be accessed via “select third-party partners and wallets.”

Big Questions: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Base Chain Ditches OP Stack for Unified base/base Architecture: Here’s What Changes

TLDR:

-

- Base is moving from OP Stack to a unified base/base repository, requiring node operators to migrate to the new Base client.

- The new upgrade schedule targets six hard forks per year, doubling the current rate of three annual protocol upgrades.

- Base retains its Stage 1 Decentralized Rollup status and is adding an independent signer to its Security Council.

- All Base specifications and code remain open-source, with alternative client implementations actively encouraged by the team.

- Base is moving from OP Stack to a unified base/base repository, requiring node operators to migrate to the new Base client.

Base Chain is moving away from its multi-dependency architecture toward a single, consolidated software stack. The transition consolidates all components into one repository, base/base, built on open-sourced tools. Node operators will need to migrate to the new Base client to stay compatible with future hard forks.

A Single Stack Replaces a Web of Dependencies

Base originally launched as an OP Stack chain, relying on partners like Optimism, Flashbots, and Paradigm. Over time, this created a complex web of external dependencies. Managing these relationships added coordination overhead for the engineering team.

The Base Engineering Team stated: “Base was built on the shoulders of giants — we could not have gotten so far so quickly without the world-class technology underpinning the OP Stack.”

The new unified stack consolidates everything into base/base, removing that friction entirely. This approach makes the protocol easier to understand and maintain for individual developers.

Previously, code for Base components was spread across multiple repositories owned by different teams. That structure slowed down shipping and created communication gaps. Bringing it all under one roof changes how releases are managed going forward.

Faster Hard Fork Schedule Targets Six Upgrades Per Year

One of the clearest changes from this transition is a faster upgrade cadence. Base plans to ship six hard forks per year, up from three. Each fork will be smaller and more tightly scoped to reduce risk.

The team described the goal clearly: “We’re targeting six smaller, tightly scoped hard forks per year, doubling the current schedule.”

This replaces the current model of batching many changes into large, infrequent upgrades. Smaller updates are easier to audit and easier to roll back if needed.

The roadmap already outlines several upcoming releases. Base V1 will handle client consolidation and a proof upgrade from optimistic proofs to TEE/ZK proofs.

Base V2 and V3 will introduce new transaction types, block access lists, and alignment with Ethereum’s Glamsterdam upgrade.

Security Council and Decentralization Standards Are Preserved

Base confirmed it remains a Stage 1 Decentralized Rollup through this transition. The team made clear that no tradeoffs were made on security or technical decentralization. An additional independent signer is being added to the Base Security Council to replace Optimism’s previous role.

The engineering team noted: “The protocol spec and codebase should be understandable by a single developer.” The accelerated roadmap also includes faster withdrawals through a more robust multi-proof system. Base-specific governance structures are being developed alongside enhanced neutrality standards.

Base will continue working with Optimism as a client of OP Enterprise for mission-critical support. Bug fixes will still be upstreamed, and security disclosures will be coordinated to protect the broader Superchain ecosystem. The separation is technical, not adversarial.

Open-Source Commitments Remain Central to Base’s Direction

Despite moving away from the OP Stack, Base reaffirmed its commitment to building in public. All specifications and code will remain open-source and available for forking. Alternative client implementations are actively encouraged to strengthen network resilience.

The team was direct on this point: “Base specifications and code will always be public, open for contribution, and available for others to fork.”

Base also confirmed continued contributions to ecosystem tooling like Foundry and Wagmi. The team views this work as maintaining Base’s role as a public good within the ecosystem.

Node operators currently face no immediate action. However, over the next few months, migration to the Base client will be required to stay compatible with future hard forks.

All existing RPCs, including those in the Optimism namespace, will continue to be fully supported during the transition.

.

Crypto World

Bitcoin Range-Bound Under Pressure as Analysts Eye $55,000

The longer Bitcoin remains rangebound, the more likely it is to fall further as the bear market deepens.

Bitcoin is “range-bound under pressure,” having broken below the “True Market Mean,” slipping into a “defensive range toward the Realized Price,” of around $55,000, reported Glassnode on Wednesday. The on-chain analytics provider remained bearish, noting that demand across spot and derivative markets was weak.

“Spot flows and ETF demand remain weak, accumulation is fragile, and options positioning shows panic hedging fading, but not renewed bullish conviction.”

Glassnode noted that historically, deeper bear market phases have found their lower structural boundary around the Realized Price. This is a measure of the average acquisition cost of all circulating coins, which now stands near $54,900.

This level is almost 18% lower than current prices and would put the fall from peak to 56.4%, which is much shallower than the last two bear markets.

Market in Controlled Consolidation

The analysts also noted that the Accumulation Trend Score sits near 0.43, well short of the 1.0 level that would signal serious large-entity buying.

Spot Cumulative Volume Delta (CVD), which tracks the difference between market buy orders and market sell orders over time, has turned firmly negative across major exchanges such as Binance and Coinbase, meaning sellers are in control.

Glassnode concluded that the market is “transitioning from reactive liquidation to controlled consolidation.”

“For a durable recovery to emerge, renewed spot demand, sustained accumulation, and improving liquidity conditions will be required.”

Range-Bound Under Pressure

Bitcoin has broken below the True Market Mean, slipping into a defensive range toward the Realized Price (~$54.9k). Spot and ETF demand remain weak, and panic hedging has eased.

Read the full Week On-Chain👇 https://t.co/XAp8OQr65i pic.twitter.com/iLuDT8o50v

— glassnode (@glassnode) February 18, 2026

You may also like:

Bitcoin network activity has also collapsed, according to Santiment, which reported on Wednesday that there have been large declines in new and unique addresses as Bitcoin’s utility declined in 2025.

“A justification for crypto beginning to see a true long-term relief rally will be when metrics like active addresses and network growth begin to rise.”

“BTC is still strengthening its bear trend,” observed analyst Willy Woo, who said that volatility is a key metric to detect trends. Bitcoin entered its bear market when volatility spiked upwards quickly, he said, before adding:

“Volatility then continues to climb, meaning the bear trend is strengthening. Then volatility finds a peak in the mid to late phase bear market… that’s when the bear trend starts to weaken.”

BTC Price Outlook

Bitcoin continues to weaken, dropping below $66,000 briefly in late trading on Wednesday. It came just shy of $67,000 during the Thursday morning Asian trading session, but had not reclaimed it at the time of writing.

The asset has been trading sideways for the past two weeks, and the path of least resistance appears to be downwards.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment19 hours ago

Entertainment19 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech24 hours ago

Tech24 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports4 hours ago

Sports4 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment11 hours ago

Entertainment11 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World14 hours ago

Crypto World14 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit