Business

Not doomsday, AI will ring in modernisation: C S Venkatakrishnan, Barclays

In a matter of days, the world seems to have changed dramatically because of Anthropic’s recent AI update. How disruptive could this become?

The global AI ecosystem outside China is being driven by large US tech firms. Hyperscalers such as Amazon, Microsoft and Google provide cloud and computing capacity, supported by chipmakers like Nvidia and major data centre infrastructure. But the real transformation will come only when companies rebuild their processes end-to-end to integrate these tools. AI will make interactions more natural, reduce the need for coding expertise, and eventually reshape core functions such as customer service, fraud detection and wealth advisory. For this to work, companies must overhaul decades-old systems – a difficult and slow process.

What about the doomsday forecast?

No. We are far from that. Much of the work in large, traditional companies still depends on existing systems, and they continue to own customer relationships and products. The employment challenge is more relevant in certain functions, but AI can free up capacity which means existing people can do other things better. Companies are operating on technology infrastructure that is 30-40 years old, and there is a lot to fix. So I don’t see a doomsday scenario.

Apart from AI, we have geopolitical tensions and supply-chain realignments…

The world today resembles the 1970s-80s. The era of hyper-globalisation from 1990 to 2020 is over. Covid broke supply-chain trust, forcing large countries to secure medical supplies, drugs and other essentials domestically, while smaller countries aligned with bigger nations for vaccine access. We now see greater trade friction and a shift from global agreements to bilateral ones, including India’s deal with the European Union. Major economies, including India, are securing their own supply chains, especially for critical inputs like rare earths.

Will the dollar’s supremacy change?

The dollar will retain its supremacy as the world’s reserve currency for a long time. The US remains the hub of global trade and is a large manufacturing, services and digital economy. Key global commodities – oil, gold – are priced in dollars, giving it enormous standing. About 80% of all foreign-exchange trades have the dollar on one side. Reserve-currency status requires economic strength and trust, and replacing the dollar will be very hard.

Where does India fit into the scheme of things for Barclays?

We are headquartered in the UK but have a substantial presence in the US. India is our second-largest employee base with 30,000 people out of 90,000, so it’s very clear where we’re making our bets. India is a very important part of our global strategy and serves as the hub from which we run our Asian operations, including Hong Kong, Singapore and Japan. That reflects our long-term view on India. It was true before an Indian CEO, and I hope it remains true after, because it’s driven by economic logic, not anything else.

What will change after India’s trade deals with the EU and US?

Indian companies will continue expanding in the UK, US and Europe, and we help them do that – whether financing acquisitions, finding partners or identifying targets. After the India-US trade deal, we expect more FDI from US companies, and we support them in entering the Indian market. We do not intend to enter retail banking in India, but we have a private banking business and remain a strong partner to Indian firms expanding into the Middle East and Southeast Asia.

What are the strengths of the Indian market?

Barclays has a significant presence in only a few emerging markets, and India is one of them. A long period of political stability and strong economic growth has made India a very different prospect in 2026 versus 2010, compared to traditional emerging markets. There have been ups and downs in Argentina, and some of the bigger emerging markets. But India has held out. India is different from China. That’s why it’s a category of its own.

India may be a growth story, but do you think it’s not easy to do business here?

India’s operating environment has improved with world-class digital infrastructure – digital ID, seamless payments and modern commerce – and steady liberalisation of the financial and economic system. GST and tax rationalisation have strengthened efficiency. But India still needs a deeper domestic capital market that matches its scale, with more corporate credit flowing into insurance, securitisation and fixed-income markets. Improving ease of doing business – labour laws, PF rules, approvals – helps our clients and therefore us. The market which has done well in spite of the problems is real estate. It has done well because of scarcity of land, not because of transparency. Not because of the cleanness of title and ability to, correct rents or evict and so on. Those things are still weak. And if those were freed up, it would do even better.

From your vantage point, is there something you worry about?

Two things. First, the credit cycle: it has been long, and borrowing costs were low. A shock could unsettle it. Second, the implications of AI: how to use this technology to transform our business and deliver better products faster. We don’t want to be surprised again the way big banks were by fintechs. We run a risk-managed company with clear visibility of exposures and limits. I hope we are equipped to absorb a severe fall in asset prices, but when shocks happen, they come in ways you cannot predict – and they test you.

How will the era of higher interest rates affect global markets?

Two major forces kept inflation low over the last 30 years: global supply-chain shifts, especially manufacturing moving to China, and generally low interest rates that allowed companies to borrow and grow without triggering inflation. Now the impact will show up in credit. Borrowers who relied on cheap funding could face rising default risks. If I had to worry about something, it would be that changes in interest rates and weaker economic growth will pressure companies, weaken corporate balance sheets, and create risks in financial markets.

Is the private-equity model under strain?

The core PE model of buy, fix and sell still works, but firms are struggling to sell companies at expected valuations. IPO markets have slowed, and strategic or PE-to-PE sales have become harder. The rise of continuation funds signals pressure in the model. Large players remain resilient, but prolonged stress will make raising new capital more difficult.

How do you view the continued strength of China despite sanctions?

China’s 35-year growth story is nothing short of a miracle. Its trade surplus remains strong partly because global tariff adjustments take time, and partly because domestic demand is weakening, pushing more exports. These challenges do not take away from China’s broader economic achievements.

Business

(VIDEO) Former Prince Andrew Arrested on Suspicion of Misconduct in Public Office

Andrew Mountbatten-Windsor, formerly known as Prince Andrew, was arrested Thursday on suspicion of misconduct in public office, Thames Valley Police confirmed, in connection with allegations that he shared confidential trade documents with convicted sex offender Jeffrey Epstein while serving as Britain’s special trade envoy more than a decade ago.

The 66-year-old, who resides at Wood Farm on the Sandringham estate in Norfolk, was taken into custody early Thursday morning — coinciding with his birthday — following a police operation involving searches at addresses in Berkshire and Norfolk. Officers executed warrants at the properties as part of an ongoing investigation, Thames Valley Police said in a statement released shortly after 8 a.m. local time.

“We have today (19/2) arrested a man in his sixties from Norfolk on suspicion of misconduct in public office and are carrying out searches at addresses in Berkshire and Norfolk,” the force stated, without naming the suspect as per national guidance on arrests. Mountbatten-Windsor remains in custody while inquiries continue, police added.

The arrest stems from a complaint lodged by the anti-monarchy group Republic, which alleged that Mountbatten-Windsor forwarded sensitive trade reports to Epstein around 2010 during his tenure as the United Kingdom’s special representative for international trade and investment. The role, held from 2001 to 2011, involved promoting British business interests abroad.

Thames Valley Police opened a formal investigation in mid-February after assessing the allegations, which surfaced amid renewed scrutiny following recent revelations in unsealed Epstein-related court documents. Those files, released in batches through late 2025 and early 2026, included references to Mountbatten-Windsor’s interactions with Epstein, though no new criminal charges related to sexual misconduct have been filed in this probe.

Mountbatten-Windsor, the younger brother of King Charles III, was stripped of his royal titles and military affiliations in 2022 amid fallout from his association with Epstein and a settled civil lawsuit brought by Virginia Giuffre, who accused him of sexual abuse — claims he has always denied. He has not held public royal duties since.

The misconduct in public office charge carries a maximum sentence of life imprisonment under British law, though such cases often involve abuse of position for personal gain or improper disclosure of information. Prosecutors would need to prove he knowingly breached official duties in a way that harmed public trust.

Buckingham Palace has not commented on the arrest. A spokesperson for King Charles III declined to address the matter, citing it as a police investigation. The development is likely to intensify scrutiny on the royal family at a time when King Charles continues recovery from cancer treatment announced in 2024.

Public reaction has been swift and polarized, with social media flooded by commentary ranging from calls for accountability to expressions of sympathy. Anti-monarchy campaigners hailed the move as a step toward ending royal impunity, while supporters questioned the timing and evidence.

Thames Valley Police emphasized the investigation remains active and urged anyone with information to come forward. No charges have been filed, and Mountbatten-Windsor has not been formally interviewed beyond the initial arrest process.

The case marks an unprecedented legal action against a former senior royal, highlighting ongoing fallout from the Epstein scandal more than a decade after the financier’s 2019 death in custody. Epstein’s network included high-profile figures across politics, business and entertainment, with Mountbatten-Windsor one of the most prominent British connections.

As the investigation proceeds, authorities are expected to review documents, communications and witness statements related to the alleged disclosures. The outcome could have significant implications for Mountbatten-Windsor’s legal and personal standing.

Business

Bill Gates pulls out of India's AI summit over Epstein files controversy

The Gates Foundation said the decision was made to “ensure the focus remains on the summit’s key priorities”.

Business

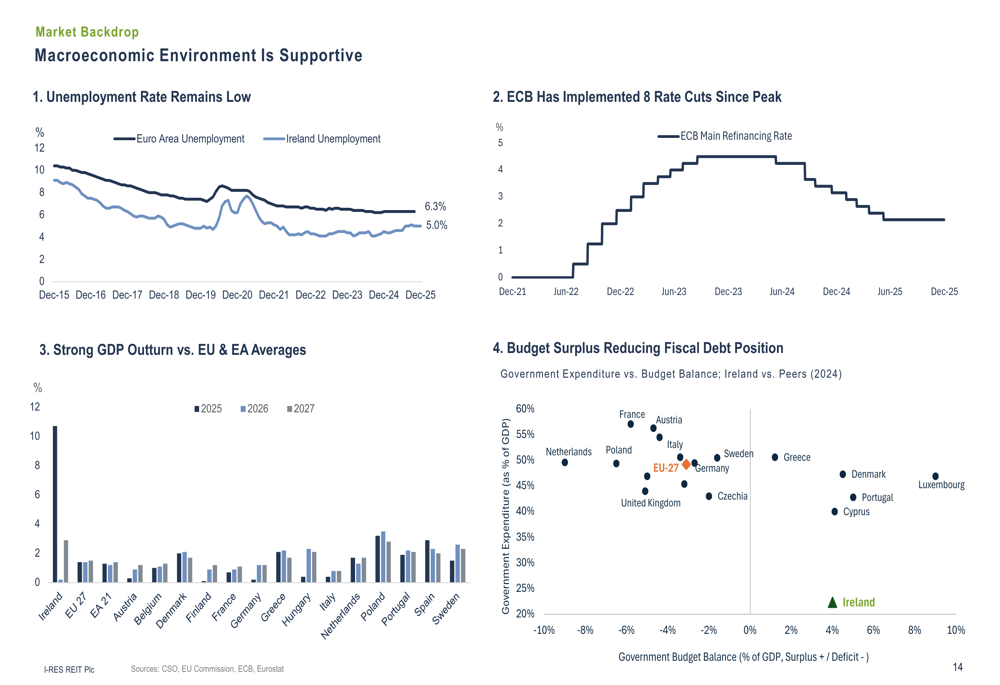

I-RES 2025 Preliminary Results presentation: Earnings growth and regulatory clarity boost outlook

I-RES 2025 Preliminary Results presentation: Earnings growth and regulatory clarity boost outlook

Business

Recommendations System Glitch Blamed for Massive Disruption

YouTube experienced a widespread global outage on Tuesday evening, Feb. 17, 2026, that left millions of users unable to load videos, access the homepage or use related services like YouTube Music and YouTube Kids, with the company attributing the issue to a problem in its recommendations algorithm.

The disruption began around 7:45-8:00 p.m. ET (00:45-01:00 GMT on Feb. 18), with outage tracker Downdetector recording a peak of more than 320,000 user reports in the United States alone and tens of thousands more internationally, including spikes in the United Kingdom, India and other regions. Complaints centered on blank homepages, failure to play videos, app freezes, login issues and error messages like “Something went wrong.”

YouTube’s official TeamYouTube account on X (formerly Twitter) acknowledged the problem shortly after reports surged, stating engineers were investigating. By approximately 9:00 p.m. ET, the company provided more detail on its support page and social channels: “An issue with our recommendations system prevented videos from appearing across surfaces on YouTube (including the homepage, the YouTube app, YouTube Music and YouTube Kids). The homepage is back, but we’re still working on a full fix.”

The recommendations engine — the AI-driven system that suggests personalized videos based on viewing history, search behavior and engagement — malfunctioned, causing cascading failures across the platform’s front-end interfaces. This prevented content from loading on key surfaces, rendering the service effectively unusable for many despite backend servers remaining operational.

The outage lasted roughly 90-120 minutes in most regions, with partial restoration (homepage functionality returning) by around 9:30-10:00 p.m. ET. YouTube issued a final update around 10:15 p.m. ET: “The issue with our recommendations system has been resolved and all of our platforms (YouTube.com, the YouTube app, YouTube Music, Kids, and TV) are back to normal! We really appreciate you bearing with us while we sorted this out.”

No widespread reports of the issue persisted into Wednesday, Feb. 18, or Thursday morning, though isolated lingering complaints appeared in some time zones. YouTube did not disclose whether the glitch stemmed from a configuration error, software update deployment failure or other technical root cause, but sources familiar with Google’s operations suggested an incorrect configuration may have been applied too broadly across server clusters in multiple regions, amplifying the impact.

The incident affected YouTube TV subscribers as well, with thousands reporting streaming interruptions and channel access problems. No data loss, security breaches or permanent damage to user accounts were reported.

This marks one of the more significant YouTube outages in recent years, following smaller disruptions in 2025 tied to similar algorithmic tweaks or regional network issues. Google’s vast infrastructure typically provides redundancy, but front-end recommendation dependencies created a single point of failure in this case.

Users in high-traffic areas like the U.S. West Coast (San Francisco, Los Angeles) and India reported the heaviest impacts, consistent with time-zone peaks in evening viewing. Social media erupted with memes and frustration, with many turning to alternatives like TikTok or Twitch during the downtime.

YouTube, owned by Google (Alphabet Inc.), serves more than 2.5 billion monthly logged-in users and remains the dominant video platform globally. The company emphasized rapid resolution and thanked users for patience, but the event renewed discussions about over-reliance on complex AI recommendation systems and the need for better failover mechanisms.

No compensation or official apologies were announced, though YouTube’s history includes goodwill gestures like ad credits for prolonged creator outages. As services stabilized, normal viewing resumed without apparent long-term effects.

Business

Nine in 10 high-risk pension funds fail to beat FTSE 100 over five years

Nearly nine in 10 higher-risk pension funds have failed to match the performance of the FTSE 100 over the past five years, according to new analysis that raises fresh concerns about retirement outcomes for millions of savers.

Research by Investing Insiders examined almost 13,000 personal and workplace pension funds holding more than £1tn in assets between December 31, 2020 and December 31, 2025. Funds in the medium-high and high-risk categories were benchmarked against the FTSE 100 over the same period.

The FTSE 100 delivered cumulative returns of 84.67 per cent over five years, turning £20,000 into £36,934 and £50,000 into £92,335.

By contrast, 89 per cent of pension funds in the higher-risk categories underperformed that benchmark. Of 7,370 funds analysed at these risk levels, 6,540 failed to keep pace with the index.

The worst-performing fund in the study, Zurich Assurance’s Zurich JPM Emerging Europe Equity Pn ZP GTR in GB, lost 98.59 per cent of its value over five years. A £50,000 investment in that fund would now be worth just £705 — more than £91,000 less than if the same sum had tracked the FTSE 100.

Other underperformers included funds linked to the collapsed Woodford Equity Income strategy and several UK property-focused vehicles, many of which suffered heavy losses during periods of market stress.

All of the 10 worst-performing funds were categorised as high risk, and 87.6 per cent of the 1,418 funds in that bracket failed to beat the benchmark.

In contrast, the best-performing fund in the study — Aviva Life & Pensions UK’s Aviva Pen Ninety One Global Gold Pn S6 GTR in GB — delivered returns of 180.28 per cent over five years, growing £50,000 to £140,140.

Investing Insiders estimates that the gap between the best and worst performers could equate to a difference of £139,000 on a £50,000 contribution over the same period.

Antonia Medlicott, founder of Investing Insiders, described the findings as alarming. “Some funds in the same risk category are almost tripling investments, while others are wiping out value,” she said. “Savers often assume their pensions are steadily progressing, but performance can vary dramatically.”

She argued that greater transparency is needed from providers, particularly when funds underperform benchmarks for sustained periods. She also urged individuals to take a more active role in reviewing their pension allocations.

While the FTSE 100 is a widely recognised benchmark, pension portfolios are typically diversified across global equities, bonds and alternative assets. As such, some fund managers argue that direct comparison with a single UK index may not fully reflect investment strategy.

Nevertheless, the scale of underperformance highlighted in the report underscores the impact of asset allocation, fund selection and risk profile on long-term retirement savings.

With retirement outcomes increasingly dependent on defined-contribution schemes, the findings add weight to calls for better default fund design and clearer communication to help savers avoid significant shortfalls in later life.

Business

Earnings call transcript: Eramet SA’s H2 2025 results show revenue decline

Earnings call transcript: Eramet SA’s H2 2025 results show revenue decline

Business

Is MCX stock too expensive after doubling money in just 1 year? A CME case study explains it

In 2025, silver soared 170%, while gold climbed over 60%. The momentum spilled into 2026, with silver rising more than 70% in the first two months before correcting sharply, tumbling 42% from its January 29 record high of Rs 4.20 lakh. Gold, too, has cooled off, slipping 20% from its peak of Rs 1.93 lakh.

The sharp reversal triggered higher margin requirements aimed at curbing volatility. After nearly a month of turbulence and wide price swings, MCX and NSE withdrew the additional 7% and 3% margins on silver and gold contracts, respectively, starting February 19. The easing provided relief to sentiment, pushing MCX shares up as much as x% on the BSE today.

But after a 113% run-up, the key question is: has the stock run ahead of fundamentals?

During FY21, when crude oil prices turned negative amid the Covid shock, MCX sharply increased margin requirements on crude futures. The immediate impact was visible in volumes. Average daily turnover (ADTV) in crude futures plunged from Rs 17,200 crore in February 2020 to Rs 3,300 crore in April 2020.

Crude options premium ADTV rose as volatility surged. Premium turnover as a share of notional turnover increased from 2.2% in February 2020 to 3.9% in March 2020 and further to 8.3% in April 2020. Over the next few years, participation structurally shifted towards options. Crude options premium ADTV expanded from around Rs 5.5 crore in FY21 to Rs 2,120 crore in FY25 and about Rs 2,400 crore in FY26-to-date.

Since early February 2026, gold prices have declined roughly 10%, while silver is down about 33%. In response, average margin requirements for silver futures jumped from 15% earlier to 72% in February 2026. For gold futures, margins increased from 10% to 30%. The result has been a sharp contraction in futures activity. Gold futures ADTV fell 41% month-on-month to Rs 33,600 crore in February 2026-to-date, while silver futures ADTV declined 58% to Rs 22,700 crore over the same period.Yet, mirroring the crude episode of 2020, options activity has picked up. Premium turnover as a share of overall turnover in gold and silver options increased in late January and February 2026, indicating a shift in trader preference rather than an outright drop in participation.

Is the multiple really stretched?

The CME (Chicago Mercantile Exchange) is the world’s largest commodity derivatives exchange by open interest. Between 2004 and 2007, CME witnessed exponential growth in volumes, according to ICICI Securities. Options contracts traded rose from 48 million in CY04 to 107 million in CY07. Futures contracts doubled from 211 million to 432 million over the same period.

The surge in activity was accompanied by a sharp re-rating. CME’s trailing P/E multiple expanded from 24.62x in January 2004 to a peak of 49.31x in November 2006. Notably, the stock traded above 40x trailing earnings for 24 months between September 2005 and August 2008.

Outlook

The domestic brokerage has an Add rating and a target price of Rs 2,780 per share. That implies an upside potential of 19% from current levels. MCX’s futures average daily traded volume (ADTV) stood at Rs 55,800 crore for 9MFY26 and Rs 1,09,700 crore for January FY26-to-date. Based on the current trend, futures ADTV is projected at Rs 66,500 crore in FY26E, rising to Rs 80,000 crore in FY27E and Rs 90,000 crore in FY28E. These estimates imply a run-rate of Rs 98,700 crore in the remaining three months of FY26.

In the options segment, at the prevailing run rate, options premium ADTV is estimated at Rs 6,200 crore in FY26, Rs 8,100 crore in FY27 and Rs 9,500 crore in FY28, implying Rs 9,200 crore in the final quarter of FY26.

Also read | As AI panic grips IT stocks, where are market opportunities for big and small investors?

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Business

Victory Income Fund Q4 2025 Commentary

Victory Income Fund Q4 2025 Commentary

Business

How Asia’s Growing Mineral Nationalism is Reshaping Global Supply Chains

A fundamental transformation is underway across Asia in how nations control and leverage their mineral wealth, with profound implications for global technology supply chains, renewable energy transitions, and geopolitical power dynamics.

Key takeaways

- China’s mineral dominance is a geopolitical weapon: Beijing controls the vast majority of global rare earth processing capacity and has repeatedly demonstrated willingness to restrict exports as leverage, with October 2025 controls on 12 rare earth elements prompting emergency U.S.-China negotiations.

- Indonesia leads Southeast Asia’s rejection of raw material exports: Jakarta’s ban on unprocessed nickel ore exports since 2014 has forced billions in foreign investment into domestic smelting facilities, transforming the country from a colonial-style resource exporter into an emerging battery manufacturing hub.

- Resource nationalism is now institutionalized across Asia: From China’s strategic stockpiles to India’s push for mineral self-reliance, Asian governments are permanently consolidating state authority over mining and refining, reshaping global supply chains while complicating Western diversification efforts.

What was once viewed primarily as a technical matter of extraction and trade has evolved into a central pillar of national security strategy, as governments from Beijing to Jakarta assert unprecedented control over critical minerals essential to electric vehicles, semiconductors, defense systems, and clean energy technologies.

China Demonstrates Mineral Power in High-Stakes Standoff

The most dramatic recent illustration came last October, when China’s Ministry of Commerce expanded export controls to cover 12 of 17 rare earth elements, materials indispensable to everything from fighter jets to wind turbines. The restrictions went beyond raw ores to include processing equipment, refined materials, and even products manufactured overseas using Chinese-origin rare earths.

The move sent immediate shockwaves through global markets, prompting an emergency diplomatic intervention. By late October, Presidents Donald Trump and Xi Jinping negotiated a one-year suspension of the new controls during a meeting in Busan, South Korea, in exchange for U.S. tariff reductions.

Yet experts caution that the “settlement” is more a tactical pause than a genuine resolution. Earlier restrictions imposed in April 2025 remain fully operational, and China’s licensing regime continues to bind companies exporting controlled materials. “Critical minerals are not merely economic assets; they are also instruments of state power,” the analysis notes.

China’s dominance stems from decades of strategic policy interventions beginning in the 1980s. Today, Beijing controls the vast majority of global processing capacity for rare earths and several other critical minerals, having consolidated state-owned enterprises, built strategic stockpiles, and invested heavily in mining operations across Africa, Latin America, and Southeast Asia.

The country has repeatedly demonstrated willingness to weaponize this advantage, restricting rare earth shipments to Japan during 2010 tensions, and again imposing embargoes on Tokyo in early 2026, targeting dual-use technologies required for defense production.

Indonesia Rejects “Colonial” Export Model

Indonesia has emerged as one of Asia’s most assertive practitioners of resource nationalism, particularly regarding nickel, the world’s largest reserves of which lie within its borders. The country has pursued an aggressive strategy to transform itself from raw material exporter into a manufacturing hub for electric vehicle batteries.

Beginning in 2014, Jakarta implemented a ban on unprocessed nickel ore exports, forcing foreign companies to invest in domestic smelting and refining facilities. Major Chinese firms, supported by Belt and Road Initiative funding and Indonesian incentives, poured billions into smelters and industrial parks.

Former President Joko Widodo framed the policy in explicitly anti-colonial terms, arguing that exporting raw minerals perpetuates an extractive relationship that must be replaced with industrialization. The government expanded requirements for foreign investors to partner with local firms, transfer technology, and contribute to domestic industrial ecosystems.

The strategy has successfully reshaped global nickel markets and demonstrated how developing nations can leverage resource control to force industrial upgrading.

Regional Powers Chart Independent Courses

Malaysia has pursued a more moderate path, balancing strategic concerns with environmental governance. Home to one of the few rare earth processing facilities outside China, the Lynas Advanced Materials Plant, Malaysia has faced periodic public pressure to tighten regulations, particularly regarding radioactive waste management.

The country also imposed a temporary moratorium on bauxite mining in the mid-2010s after exports to China caused severe environmental degradation, later lifting the ban with stricter licensing requirements.

Thailand’s mineral nationalism operates primarily through regulatory sovereignty rather than export restrictions. Strong community opposition to mining, including the 2016 closure of the Chatree gold mine following environmental contamination allegations, has pushed the government toward strengthened oversight and social accountability mechanisms.

Last October, protesters gathered outside the U.S. embassy in Bangkok opposing a rare earth minerals agreement with Washington, concerned about sovereignty risks and potential environmental damage from deals made without public consultation.

Myanmar, though politically unstable, remains one of Asia’s most significant sources of heavy rare earths. Much production occurs in northern border regions controlled by ethnic armed groups, with substantial Chinese company involvement operating through informal channels. Materials typically cross into China for processing, a strategic lifeline for Beijing, especially after it imposed stricter domestic environmental controls.

India has intensified focus on critical mineral security driven by concerns over supply-chain vulnerabilities and technological sovereignty. New Delhi has launched initiatives to map resources, expand domestic mining, and reduce dependence on Chinese imports. Recent reforms opening previously restricted minerals to private mining reflect India’s pursuit of strategic autonomy in a fragmenting global order.

Outlook: Nationalism Becomes Institutionalized

Analysts project Asian resource nationalism will intensify rather than diminish, with governments continuing to strengthen control over mineral resources while deepening industrial policies that push extraction industries up the value chain.

“China’s dominance in rare earth processing, Indonesia’s nickel industrialization and India’s push for critical mineral self-reliance suggest a long-term consolidation of state authority over mining, refining and export mechanisms,” according to the assessment.

The effect is region-wide reinforcement of mineral nationalism that remains compatible with global supply chains even as it complicates diversification efforts by Western and East Asian manufacturers. States are expected to maintain export restrictions on unprocessed ores while crafting supply agreements that simultaneously attract foreign investment and preserve sovereign leverage.

A less likely but plausible scenario involves coordinated regional strategies, where Southeast Asian states leverage mineral resources collectively through harmonized export policies, shared industrial hubs, or informal alignment around processing standards, potentially positioning themselves between U.S. and Chinese technological competition.

What appears virtually impossible is any significant rollback. The momentum behind national industrial policy, strategic resource planning, and rising domestic expectations for value creation suggests Asia’s mineral nationalism represents a fundamental and enduring shift in how these nations engage with the global economy.

Other People are Reading

Continue Reading

Business

Consumer Staples Are on a Tear. These Still Look Like Bargains.

Consumer Staples Are on a Tear. These Still Look Like Bargains.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment21 hours ago

Entertainment21 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports7 hours ago

Sports7 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment13 hours ago

Entertainment13 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World16 hours ago

Crypto World16 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit