Entertainment

Jelly Roll Breaks Silence On Digesting His Wife’s Memoir

For Jelly Roll, the truth is not an easy pill to swallow.

The country singer shared some insights he got from reading his wife’s new piping hot memoir and how her brave stories reminded him of their journey together, which has not been a completely smooth ride.

Jelly Roll and Bunnie XO got hitched in 2016, after a year of dating, and have worked their way through several storms so far, including an infidelity episode two years into their marriage.

Article continues below advertisement

Jelly Roll Remains Proud Of His Wife For Telling Her Truth

The 41-year-old caught up with PEOPLE on Tuesday, February 17, where he admitted that it was quite a rollercoaster to go through the pages of “Stripped Down: Unfiltered and Unapologetic,” hismemoir.

Jelly Roll stated that the stories in the book reminded him of such a pivotal period in their lives as a married duo. In the country singer’s words:

“It was rough at times just for me to read it. You know what I mean? We went through a lot of pain and had to go through it together, but reading the whole book and seeing where it ended at is really touching.”

Article continues below advertisement

The singer then showered his partner with tons of praise for making vulnerability so intriguing to read. He stated that Bunnie XO has carved a niche for herself when it comes to talking about everything so fearlessly, be it domestic assault, sexual assault, and other sensitive topics.

Article continues below advertisement

Bunnie XO Was Never In Doubt About Documenting Her Journey

The memoir captured Bunnie XO’s grass-to-grace stories while reflecting on the heartbreaks, healing, triumphs, and trauma in her life’s journey. On the book’s cover, the singer’s wife stayed right on theme by appearing topless while a pair of light-washed denim stayed on her lower part, letting her tattoos take center stage.

The media personality justified her reason for taking such a deep plunge into her story, stating that she is an open book and that telling all her business came as a second nature this time around.

She added that it was very seamless for her to pour her heart into the chapters and write about her life, her perspective, and the grit that continues to carry her through life.

Article continues below advertisement

Bunnie XO tagged her memoir as existing in her truest, rawest form with no desire to coat the truth from her readers, further helping them to see how she lives her life “raw, unfiltered and in my naked truth.”

Article continues below advertisement

Jelly Roll’s Wife Deep Dived Into Their Interesting Ideologies About Marriage

As shared by PEOPLE, the author addressed an important part of her marriage to the Grammy winner, which took form when she discovered that he was having an affair two years after they got married.

Bunnie XO confessed that they often invited other women into bed with them, and it did not pose a problem in the marriage, as she felt it was the best way to prevent cheating on Jelly Roll’s part.

She clarified that they had both shunned the idea of monogamy before they got married, and while they are not in an open marriage, they would not turn away a willing third wheeler in the bedroom.

Bunnie XO continued that her husband also gave her the freedom to sleep with other men, and so she initially took it as proof that Jelly Roll never loved her.

“We both live by the motto that we aren’t each other’s possessions and consider our relationship to be free, not open,” Bunnie XO explained, noting that it meant openness in the sexual conduct with each other, too.

Article continues below advertisement

How Did The Author Handle Her Husband’s Infidelity?

In the memoir, The Blast shared that Bunnie XO revealed that she began growing suspicions about Jelly cheating two years into their marriage, although he would always deny it.

The podcaster added that Jelly even moved out of their Nashville home after an argument and also became very upset when she showed up at one of their concerts uninvited.

It was upon her arrival that she discovered he had a former fling waiting for him in a hotel down the street. A close family friend also confirmed the situation to be true, leading Bunnie XO into a dangerous spiral where she considered ending it all.

She revealed that, from grabbing a bottle of pills in a bid to end it all before having a rethink about the situation, discovering Jelly’s infidelity hurt her in ways she did not expect. The author ultimately moved out of their home to Las Vegas until Jelly decided to make a move toward reconciliation.

Article continues below advertisement

Jelly Roll’s Controversial Grammy Speech Unearthed An Old Viral Video

When the singer stepped on the Grammy stage to proclaim his faith and belief, he sparked a discourse on social media, analyzing just how much of a Christian he has proven to be in the past. Jelly’s old video, where he lashed out at a teen and threatened to beat him for not attending to him instantly, made its way back online.

The singer appeared very displeased in the 2022 video where he noted that he had taken his aged mom to a shoe store and a young store attendant refused to help the 71-year-old out, even after the store manager’s instruction.

He recalled watching the interaction with rage building up inside him at the attendant’s lack of consideration for his mother despite the manager’s efforts. Jelly continued that he, however, did not let it slide, and he addressed the young man immediately after he led the mother out of the store.

He noted that he was mad at the staff in the establishment alongside the manager, who tried to de-escalate the situation, because he felt that if they had properly trained their staff on etiquette, they would not be so rude to his mother.

Entertainment

Ray J applied 'fake blood' to his eyes and heart monitor before alarming live show, photographer alleges

:max_bytes(150000):strip_icc():format(jpeg)/ray-j-021826-c132f4f53d62481f89fc799329366592.jpg)

The R&B singer previously claimed that he has less than a year to live.

Entertainment

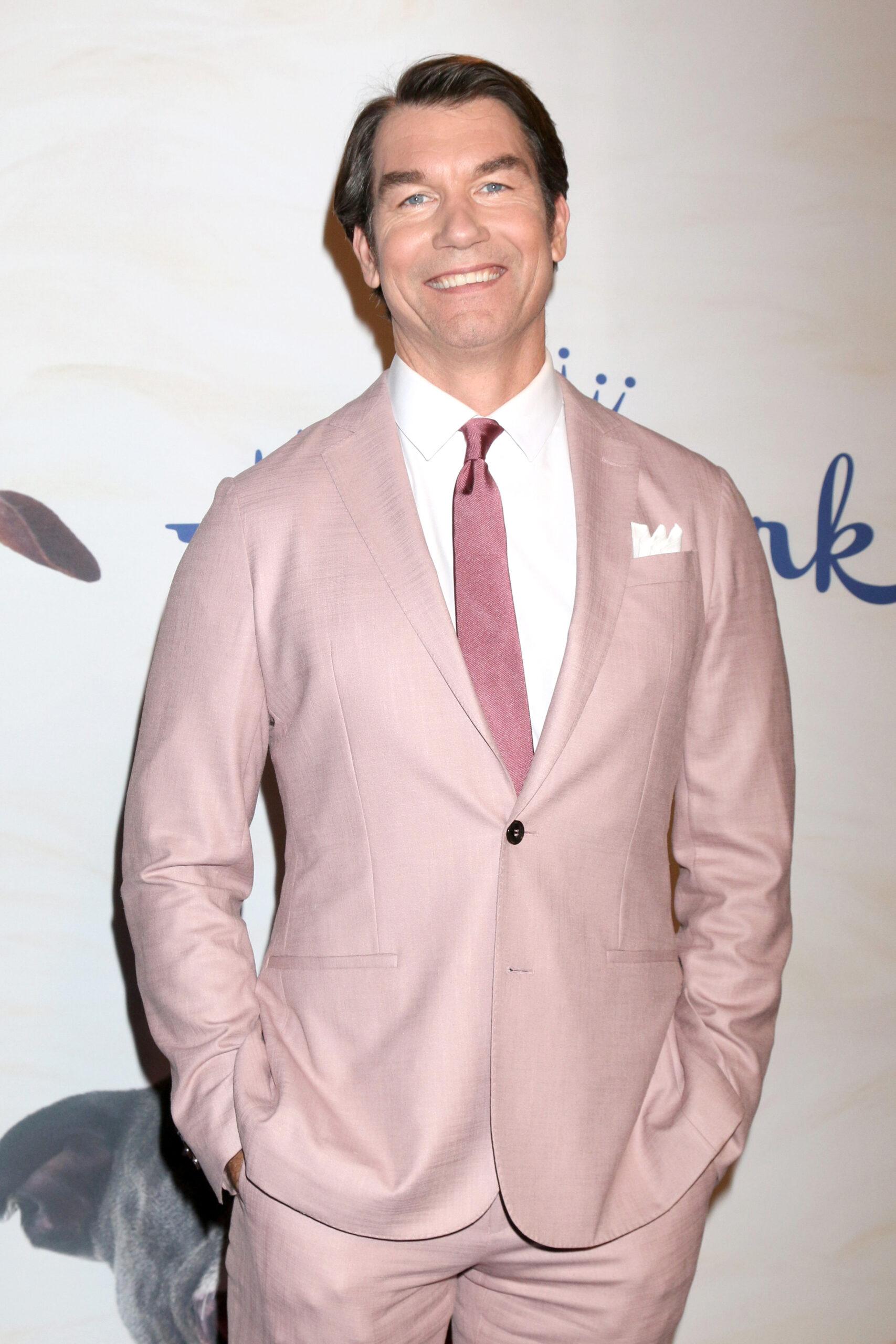

Jerry O’Connell Reveals How His Wife Helped Him Quit Smoking

Jerry O’Connell recently reflected on two major turning points in his life: quitting smoking after decades and nearly walking away from Hollywood.

During a podcast appearance, he revealed that hypnosis helped him stop smoking 14 years ago, crediting his wife, Rebecca Romijn, for pushing him to change.

Jerry O’Connell also shared that during a career lull in 2009, he enrolled at Southwestern Law School before ultimately returning to acting.

Article continues below advertisement

Jerry O’Connell Reveals How Wife Rebecca Romijn Pushed Him To Finally Quit Smoking After Decades

The 51-year-old actor discussed his longtime struggle with nicotine during the February 13 episode of the “Work In Progress” podcast with Sophia Bush,

O’Connell revealed that he had battled the habit for decades and ultimately had to turn to hypnosis. Now, thanks to the hypnosis, he hasn’t “had a ciggy in, like, 14 years.”

He credited his wife, Rebecca Romijn, with giving him the push he needed to make the lifestyle change.

“My wife said she would not touch me if I smoked, and that lasted about two months,” he recalled, per People Magazine. “I thought it was a joke. Then, after, like, two weeks, there was no physical contact. After about three and a half weeks, I was like, I gotta do something.”

Article continues below advertisement

Though he initially tried to quit on his own, the “Sliders” actor struggled until he reached out to a friend who had successfully stopped smoking thanks to a hypnotist.

Article continues below advertisement

Jerry O’Connell Initially Doubted Hypnosis Would Help Him Quit Smoking

O’Connell’s friend referred him to a hypnotist, and he brought a photo of his wife and children to the session.

Recalling the session, the actor shared: “I sat down on her… recliner, and she put her headphones on me, and there was, like, spa music. And she was like, ‘Count to nine, eight…’ and I fell asleep.”

He admitted that he was skeptical at first, thinking it “was baloney.”

“What a joke,” he recalled thinking. “I can’t believe I just gave some old lady $800. What a waste of money.”

However, the results shocked him. “I walked to my car. I got in it. I had a pack [cigarettes], put the ciggy in my mouth, brought the lighter up… I couldn’t light it… I swear to you. I swear to you. I’ve never been hypnotized for anything else.”

Article continues below advertisement

O’Connell and Romijn have been married since July 2007 and share 16-year-old twin daughters, Charlie Tamara Tulip and Dolly Rebecca Rose, born in December 2008.

Article continues below advertisement

Jerry O’Connell Says He Enrolled In Law School After Fearing His Acting Career Was Over

In the same podcast appearance, O’Connell revealed that he once considered leaving entertainment altogether after fearing his acting career had stalled.

He explained that in 2009, during a slowdown in roles, he enrolled at Southwestern Law School in Los Angeles. At the time, Romijn was working steadily, and their twin daughters were about one year old.

O’Connell said he had long thought about graduate school and decided to take the LSAT and apply to two night law programs.

He was accepted into one and attended classes at night for about a year before eventually returning his focus to acting.

The Actor Made A Hollywood Return After Landing A Role As A Lawyer

Looking back, O’Connell described that period when he struggled to land acting roles as a crossroads in his career.

After a television series he was part of ended suddenly, he assumed it signaled the end of his opportunities in entertainment.

For nearly a year, he believed his career might be over. But things shifted, as he began auditioning again and eventually landed a new CBS series.

Fittingly, O’Connell portrayed a defense attorney, marking an unexpected return to the screen.

Article continues below advertisement

Rebecca Romijn And Jerry O’Connell Reveal How They Manage Money And Marriage After 18 Years Together

O’Connell and Romijn previously shared insight into how they manage their marriage and finances during a chat with Andy Cohen on his SiriusXM show.

Over their 18 years of marriage, Romijn revealed that they keep their money separate but maintain a “community pot” for family expenses, which they contribute to quarterly.

The actress explained that contributions are adjusted “depending on who’s working more. The one who’s not working gets a little bit of a break, and the one who is working puts in a little more.”

She added. “And we really tag-team with work.”

After the birth of their twins, the couple also decided that one of them would always stay home to raise the children themselves. “No one else is ever going to raise them besides us,” she said.

O’Connell and Romijn married two years after her divorce from John Stamos, to whom she was married from 1998 to 2005.

Entertainment

New Clip Shows Sophie Turner Gag After Kissing Kit Harington

Six months later, a new clip of the pair executing the intimate scene appears to confirm that Turner did not make up the story.

The awkwardness may not come as a surprise to longtime fans, who would have watched the two actors portraying siblings in “Game of Thrones” for nearly a decade.

Ironically, Turner also serves as a producer on “The Dreadful” and played a direct role in the addition of Harington to the film’s cast lineup.

Article continues below advertisement

Sophie Turner Said She Was ‘Grossed Out’ Kissing Kit Harington On Set

During an appearance on “Late Night with Seth Meyers” in August 2025, Turner opened up about what it was like filming intimate scenes with Harington for their horror film “The Dreadful.”

The actress told the audience that both she and Harington had to mentally prepare themselves before shooting got underway.

“We put it out our minds, and then we get on set,” Turner recalled. “And it’s the first kissing scene, and we are both retching. Like, really, it is vile. It was the worst.”

Turner went on to joke that the experience was somehow worse than dealing with cockroaches on the set of “Trust,” the thriller film she was promoting on “Late Night.”

Article continues below advertisement

A Clip Depicting The Moment Has Surfaced Online

Just days before “The Dreadful” premieres in select theaters, Entertainment Tonight shared footage of Turner and Harington filming one of their kissing scenes.

The Jon Snow actor had previously described the experience as “bizarre,” and claimed that his character in “Game of Thrones” was “probably the least up for incest.”

The irony was not lost on viewers, many of whom referenced the complicated reputation of his character’s family in the HBO fantasy series.

“It looks like Jon Snow is finally accepting his Targaryen roots,” one user quipped on X.

Another wrote, “The real horror in ‘The Dreadful’ isn’t the plague… It’s Kit & Sophie having to film that scene after 8 seasons of sibling energy.”

Article continues below advertisement

Inside The Film Reuniting Sophie Turner And Kit Harington

Turner and Harington reunite in the period horror film “The Dreadful,” which is set against the backdrop of a plague-ravaged landscape.

The story follows a young woman living in isolation with her mother-in-law as she waits for her husband to return from war.

The arrival of an injured man from the battlefield himself appears to set off a curse and threatens to reopen wounds from the past.

First-look photos of Turner and Harington in character were published by Entertainment Weekly in January.

Director Natasha Kermani reflected on reuniting the former “GoT” stars for the project.

“To see Kit and Sophie back together onscreen was a special thrill,” she told EW. “Their friendship and chemistry is impossible to miss.”

Article continues below advertisement

Turner Recommended Her ‘GoT’ Co-Star For The Film

Although she ended up gagging while shooting a kissing scene with Harington in “The Dreadful,” Turner was in fact the one who first recommended him for the role.

In an interview with E! News, Harington explained how he came to join the project, revealing Turner had sent him the script.

“She was the one that sent that movie to me and somehow didn’t see what I saw in it,” he said. “I was like, ‘These guys, these are lovers, right?’ I felt very odd about that.”

Turner also confirmed this version of events during her feature on “Late Night with Seth Meyers.”

Article continues below advertisement

Production Rolls On For Sophie Turner’s ‘Tomb Raider’ Reboot

With “The Dreadful” almost in theaters and the “awkward” experience with Harington behind her, Turner can channel most of her energy toward her upcoming “Tomb Raider” reboot series.

The Emmy-nominated actress is set to bring iconic video game character Lara Croft back to life in a new live-action adaptation.

The character was famously portrayed by Angelina Jolie in the film installments of the early 2000s.

The upcoming series is developed by “Fleabag” creator Phoebe Waller-Bridge and will stream on Amazon Prime Video.

While no official release date has been announced yet, production is ongoing.

Entertainment

17 Flattering Boat-Neck Tops to Nail East Coast Preppy Style

Us Weekly has affiliate partnerships. We receive compensation when you click on a link and make a purchase. Learn more!

Want to dress like a Nantucket socialite? So do we, and it’s never been easier. East Coast rich moms are wearing boat-neck tops on repeat; not only is the style trendy, but also mega flattering. We found 17 blouses that nail the aesthetic, and they start at just $9!

With their buttery-soft fabrics, intricate stitching and nautical elements, these blouses look straight out of a Cape Cod boutique. Better yet, the neckline subtly highlights your collarbone, creating a sophisticated, balanced silhouette and making you appear instantly polished. Read on to see the cutest boat-neck tops from Old Navy, Nordstrom, Free People and more!

17 Trendy, Flattering Boat-Neck Tops — From $9

1. Sweater Top: Cashmere-blend material, billowy short sleeves and a rich green hue are just a few luxurious features. This piece is ideal for the transitional season!

2. Everyday Outfit: At just $13, you’ll want a few of these three-quarter-sleeve blouses that are enhanced with elegant smocked cuffs.

3. Extra Cozy: Calling comfort connoisseurs! This ribbed sweater carries you from winter days to summer nights.

4. Nautical Flair: Stripes and a Henley style give this top a yacht wife appeal. You’ll adore the relaxed fit that feels like an easy Sunday morning at the dock.

5. Parisian Rich Mom: This classy sweater top could totally be designer, thanks to the delicate knit fabric and bold color-block print.

6. Mood Boost: Love the colorful things in life? This dressy blouse looks eerily similar to Lilly Pulitzer.

7. Wardrobe Staple: Comfy and refined, this loose sweater transitions from in-office days to date nights, so don’t be surprised if you wear it nonstop.

8. Elevated Tee: T-shirts aren’t usually sleek, but this expensive-looking version is a different story. It screams ‘rich rich’ even with jeans and sneakers.

9. Flattering Find: Cinch your waist without even trying in this office-friendly bow-tie blouse that hangs in all the right places.

10. Super Casual: Channel cool mom energy from errands to school pick-ups in this drapey short-sleeve tee. It’s boho, chic and oh-so comfy.

11. Bestseller Alert: Old Navy is totally back, and this fitted top proves why. The cotton-and-spandex blend makes it breathable, while the snug fit shapes without squeezing.

12. $10 Stunner: People will think you spent hundreds on this lightweight sweater, and you will, too, since the fabric feels like high-end activewear.

13. Total Trendsetter: Imagine a hybrid between a boat-neck top and a cowl-neck blouse. That’s this one-of-a-kind wonder.

14. Pilates Princess: Active gals rave about this athleisure top that’s loose, stretchy and breathable. It’s ideal for Pilates, yoga, hot mom walks and beyond.

15. Preppy Pick: Ruffles, frills, knit, oh my! This long-sleeve top channels country-club vibes, especially with its posh black-and-white contrast design.

16. Cute Crochet: Both coastal and modern, this crochet sweater is the definition of versatile. It gives jeans, trousers and skirts a stylish upgrade.

17. Spread the Love: The heart print is optional, but not if you want to channel your inner romantic. This loose top is a no-brainer in our book!

Entertainment

‘Starfleet Academy’ Actor Explains How Darem’s Story Honors 60 Years of ‘Star Trek’ History [Exclusive]

EDITOR’S NOTE: This article contains spoilers for Star Trek: Starfleet Academy, Season 1, Episode 7, “Ko’Zeine.”

The latest episode of Starfleet Academy gives audiences a glimpse into a new species in a grand tradition that echoes through the last 60 years of Star Trek history, with interplanetary lore and themes of identity and duty at its core. As the cadets arrive at their first school holiday, the episode sees George Hawkins‘ Darem Reymi ceremonially kidnapped back to Khionia for an arranged marriage to his royal childhood sweetheart. When Jay-Den (Karim Diané) boldly follows him through the portal, Darem is forced to re-evaluate whether the destiny that was chosen for him at birth is something he’s ready for or if his real future lies among the stars.

I recently sat down with Hawkins to dive deep on this episode and break down Darem’s Khionian culture, duty, and sacrifice. During our conversation, he spoke about what it’s like to walk in the footsteps of Star Trek legends like Leonard Nimoy and Michael Dorn as he introduces a new species to the franchise. We also spoke about the deliberate choices he makes as an actor to portray the layers Darem and the duality of the two worlds he’s torn between. This episode also further explores the burgeoning relationship between Darem and Jay-Den, and Hawkins revealed how he and Diané have been able to craft such compelling and magnetic chemistry between their characters. Hawkins gave major props to the costume department for the stunning new outfits Darem wears in this episode and revealed how they also worked to inform his character choices. Finally, he shared some forward-looking moments to keep an eye out for in the Season 1 finale and the soon-to-be-wrapped Season 2. You can read our full conversation below.

George Hawkins Did His Homework Before Joining Star Trek

“You’ve really got to understand Star Trek to understand the value of that moment.”

COLLIDER: I’m so excited to talk to you about this episode. It was such a good one for your character. Star Trek is such a massive franchise that’s been around for so long. What was your relationship with the franchise before you got the part?

HAWKINS: Wow. It was very little. I had very little experience with Star Trek. I was not a Trekkie. I was not part of that part of this world. But I was aware of it. I was very aware of it. And it’s quite hard not to be aware of it. Which gives it testament, right? It has its own Emoji. It’s crazy. So I had a lot of work to do when I came onto this project. And the most important thing was to know the value of things. Something happens in this season, at the end of this season, where you’ve really got to understand Star Trek to understand the value of that moment, to be like, wow, that’s really impressive. That’s really important. So I think that was my homework, to know the significance of things, to know, “Oh, that’s really important. That person’s really important. Their relationship is really important, or that’s not important.” So yeah, I had a lot of homework to do.

You and a few of your co-stars on Starfleet Academy are introducing entire races of aliens to the franchise for the first time. In this episode, we get a little glimpse into Darem’s species and community. What’s it like to sort of walk in the footsteps of Leonard Nimoy and Michael Dorn, to be introducing an entire race of aliens to Star Trek, and that, hopefully, they’ll refer back to you in another sixty years when the franchise is still going?

HAWKINS: Oh, wow, wow. No one’s ever made that sort of reference before. I would — yeah. That’s incredible. It’s amazing. It’s such a privilege. It’s such a privilege to introduce a species not just to Star Trek, but just as a performer. Right? Just general. Even outside of Star Trek, it’s actually a freeing thing. It’s very freeing. I can imagine it was very difficult for some of our cast members or past cast of previous shows to pay homage to already existing species that you’re not actually a part of. So you’ve got to really invest in it. I think it was very freeing. It’s a very freeing experience to know that what I do sort of paves the way for that species. You’ve got to just let go. I think just let go, be truthful to the character, be truthful to the circumstance that the scene finds you in, and enjoy it. I think when you watch on screen, you want to watch someone enjoying themselves, and you want to watch a performer really commit to the world that our showrunners have so wonderfully made. So it’s a testament to our showrunners, to be honest, and our writers’ room, who have done an amazing job on this character.

Absolutely. I think this show is absolutely firing on all cylinders at all times. And I love that.

HAKWINS: Thank you so much, Samantha, thank you.

Playing Darem Pushed Hawkins Out of His Comfort Zone Early on in ‘Starfleet Academy’

“If someone walks into the room, their energy doesn’t have as much of an effect on Darem as it does on me.

We get a lot of Khionian in the lore in this episode with the kidnapping ritual and the matrimonial moon. What’s something that we don’t necessarily see on screen, but you maybe did in your character work for Darem, that fuels your performance?

HAWKINS: Oh, yes! Actors love to talk about their own process. I really had to work on slowing down, I think, which is really funny because I feel like I talk quite quickly, and I’ve got quite an intensity to myself. Darem is a lot slower; he turns to see something a lot slower than I do. Or if someone walks into the room, their energy doesn’t have as much of an effect on Darem as it does on me. So I did a lot of physical work on the king caricature, where they are slower in temperament, and they move, they cut through the air. Something I really loved about playing with Darem is when he moves, it’s almost like he cuts through the air. So I just wanted to slow down. I think I wanted to slow down and allow status to rise and to inflate in someone’s ego. And what does that feel like, to be full of confidence in a moment? You see Darem in a few moments in this season, like when he becomes the captain, and he’s being paraded around on the chair. That for me was really hard. That was really difficult for me to do. Having loads of people just staring at you, and you have to, like, flaunt yourself like that. I had to really, really build some adrenaline up for that. It was just about taking up space. How do you take up space and feel confident in that, and like, really breathe into that? Yeah. Not the easiest thing to do for sure.

I love the insight that we get into Darem in this episode. As a queer person and also a people pleaser myself, I found him very relatable. For you as an actor, when you’re diving into these two sides of who he is, how did you go about reconciling this sort of double life he’s been living?

HAWKINS: I think, firstly, there’s nothing to reconcile. I think there’s something that we all see in ourselves where we live in a certain sense, like a double life, where we believe this thing and we say this thing. I want to say this, but I do this. And we have these two minds, and I think that’s where anxiety comes from, is these two places, like a conflicted mind. I think it’s about being kind and compassionate towards Darem. I think that’s sort of why I was cast as Darem, is that I didn’t really want to approach him as just this surface level, sort of cocky guy that’s just going to have sex with everything that moves and sort of just wants to be worshiped by everyone, but actually to understand that where that deep ambition comes from is a longing and a running away from something. So in every moment where I saw Darem show these huge moments of confidence and bravado, I wanted to fill that with some sense of humanity. And to know that no matter how confident someone comes off and no matter how assured and comfortable someone comes off in a scenario, there’s an equal sense of anxiety, and fear, and running that they’re doing at the same time.

You do such a good job of that duality because both parts of his personality are true. You’ve woven it in very beautifully through the season.

HAWKINS: I appreciate that.

Another thing that I really loved about that storyline was that even though marrying Kyra isn’t what’s right for him anymore, you can see why he would feel such a strong sense of duty to her and to his people. Because there’s so much love there. How do you think abdicating will affect his relationship with his parents and his people moving forward?

HAWKINS: I think you see it. You see it in the moment where Kyra gives Darem permission to live the life that he wants to live, or live the life that feels truer to him. Because I can imagine for Darem, there’s a sort of purpose, and there’s fulfillment in actually being the king and actually living the life with Kyra and leading that life out. But it’s just that moment where you see everyone turn around, where Kyra expresses to everyone and sort of lets everyone know what’s happened. And you see his parents turn, and that’s the moment. That’s what I was envisioning when in Episode 3, where we talk about the moment where he’s playing the Belaklavion, and he misses a note, and then his parents leave. That sort of judgment that he gets from his parents, where his value was found in what he could do and what he could achieve and uphold and be, instead of living, for being alive, for being who he was. This episode is really special. It’s really, really special. And it’s really important for Darem’s story, to see what he’s running away from. And what he’s trying to define himself as.

How Hawkins and Diané Crafted Darem and Jay-Den’s Will-They-Won’t-They Chemistry

“He’s an answer to a lot of empty space for Darem.”

I also really love the burgeoning relationship between Darem and Jay-Den. The tension between those two is really good, and it feels like there’s a little thread of jealousy between Darem and Kyle.

HAWKINS: [Laughs] Just a little bit.

I would love to hear about how you and Karim went about crafting that dynamic.

HAWKINS: Karim is such a beautiful human being, and we get on really, really well. We come from such different backgrounds, and it’s such a lovely thing to see two completely different people come together and sort of create chemistry. Karim was the first person I had chemistry reads with to do this project, to play this character. And he was the first person I met in my auditions who was playing another character. So he is sort of the person I held onto, and he’s like a staple in this job for me. Karim is a sweetheart. Karim is such a sweetheart. So it’s quite hard not to, he’s just a great person. My family loves him. My friends love him. He’s a sweetheart. And he’s an incredible actor. He’s incredible to work off of. And actually watching Karim create Jay-Den, and then seeing the end result…Jay-Den is so powerful because of his stillness. It’s like he’s rooted to the ground, I think, and that’s just an admirable thing. I think that’s a really admirable thing for Darem to witness, is someone standing still, confidently saying what they love, saying what they want, and saying what they believe. Because that’s just such an absence of what Darem has had in his life. He’s like an answer. He’s an answer to a lot of empty space for Darem.

I love that so much. We have to take a minute to talk about the incredible costumes that you guys got to wear in this episode. What was it like to finally get out of the cadet uniforms and into such stunning looks?

HAWKINS: You know what — the costumes, big up to Avery [Plewes], our costume designer. She’s incredible. And the robe that I get to wear in this episode was incredible. The way it pins your shoulders back, your head up, your neck up, so you can’t help but hold some sort of regality to it. And that’s what the cadet uniforms do as well. They do half the job for you, because they pin you in this position, and you can’t really pull your arms up, but you feel the authority, you feel the status. You feel what you’re trying to uphold. And there wasn’t much difference in the Khionian wedding costumes because they were heavy. Like, oh, my gosh, this thing has alligator skin on it. It’s deep, deep fabrics, thick fabrics. It was incredible. So you’ve just got to let it do its work. You’ve got to allow the costumes to play a part in the story themselves. They’re a character in their own right. It was beautiful. It was a beautiful experience.

I think it was a bit of a surprise, both for Jay-Den and the audience, when we got to Khionia’s moon, and it’s a very dry climate. I know they have the explanation that it dried up, but I am curious if, at some point, we will get to see Khionia in its aquatic glory or if we’ll see Darem’s fish form again in Season 2, perhaps?

HAWKINS: You know what, I can’t say anything about Season 2, because I’ll get sniped. Man, Khionia is such a beautiful place. And it’s such a perfect opportunity to show a different culture. So, I hope so. I really, really hope so. I really hope we get to dive deeper into the Khionian culture, because it’s a beautiful thing to be a part of. And it’s a beautiful thing to play. I really hope so.

I know you can’t share spoilers, but you guys were gearing up to film the finale when I spoke with you guys last, at the beginning of January. Have you wrapped yet?

HAWKINS: We wrap on Saturday. […] We’re almost there.

Working With Holly Hunter on ‘Starfleet Academy’ Was a Tremendous Honor for Hawkins

“For me to collaborate with Holly is a really big thing.”

Also in this episode, just a little thing that I caught onto potentially coming back in the future, we learned that Darem can be sort of knocked unconscious with a little boop to the forehead. Is that going to come back at any point? That seems a little dangerous for him!

HAWKINS: I know! They’ve given him a secret, it’s like Kryptonite. I would like to believe that that’s only a Khionian warrior sort of thing that can happen that they can do to people. It’s not necessarily something you can just happen to Darem, but it’s something that Khionians can do. So I actually want to see Daram use it. I want to see Darem use against other people.

Like the Vulcan nerve pinch!

HAWKINS: Exactly. That would be good.

Star Trek is such a wide-ranging thing in terms of tone and genre. You can be doing hard sci-fi and drama one week and be doing camp and comedy the next. What’s something in Starfleet Academy that pushed you as an actor and allowed you to grow and your craft further?

HAWKINS: Wow. Wow, wow, wow. I can’t speak for all actors, but I think something that’s really powerful and really fulfilling is being a part of a story that means so much to people and has something to say. And there’s a lesson. I think what’s helping, and what I’ve learned and what I’m learning, is a lot of doing this show is how to hold a message. It’s almost like Shakespeare, really. As an actor, you want the text to sort of do its job for you. Or to do its job for you, but to do its job. And there are deep lessons, psychological lessons, and moral lessons in our show. So it’s about giving yourself over to a story. That’s what I’ve loved doing, is knowing that there’s something so much bigger going on than me, and I’m a part of a franchise that really cares about its audience and really cares about the message that it’s giving. So yeah, just being subservient to a story and being subservient to a message has been a really, really lovely lesson. How to give myself over.

Lastly, is there a particular moment, either in this episode or in the season in general, that you are especially proud of? Maybe it was challenging to get there, or just something that, when you got there, it just unlocked something for you.

HAWKINS: Oh my gosh. Yeah. Something that comes to mind is that there is a moment in Episode 10. It’s not really it’s not really a scripted moment, but there’s a moment between my character, Darem, and Nahla. It’s just a lovely moment of connection. It wasn’t really in the script, but it made so much sense. And Holly Hunter is who she is, right? She holds the authority that she has every right to hold. And for me, who does not have the same authority, for me to collaborate with Holly is a really big thing. That’s a huge thing for me. And I had an idea for one of our scenes, and she was so receptive to it. It was risky, because she could have very easily been like, “Who are you talking to? Who do you think you are?” But she was so, so receptive, and it was such a beautiful lesson of sharing ideas, sharing personal beliefs.

In that moment, in that scene, it shows a moment of courage and unity, and we get to see Nahla Ake being who she is, and why she’s such a good captain is because she comes down to the cadets’ level and really — she, like, kneels. It’s almost like when you meet someone who’s really great with kids, they get down to the child level, and they become an equal with that child. In a, in a sense, sort of like a holistic, symbolic way, I think that that interaction with Nahla in that scene really feels like she’s like a humble leader, I guess. […] I really hope they keep it in. I haven’t seen Episodes 9 and 10, so I really, really hope. Because I was at dinner with Holly the other night, and we were speaking about it. I really, really hope it’s in the show, because it’s a beautiful moment.

Episode 7 of Starfleet Academy is now streaming on Paramount+. Stay tuned at Collider for more.

- Release Date

-

January 15, 2026

- Network

-

Paramount+

- Showrunner

-

Alex Kurtzman, Noga Landau

- Directors

-

Douglas Aarniokoski

- Writers

-

Alex Taub, Tawny Newsome, Kirsten Beyer, Jane Maggs, Kiley Rossetter

Entertainment

9 Years Later, a Sci-Fi Icon’s Ahead-of-Its-Time Computer Thriller Is Rewriting History on Streaming

No other show has captured the 1980s tech scene better than the 2014 AMC drama series Halt and Catch Fire. It remains the epitome of character-centric stories, set in a time when much of the technology we use today was in its infancy and cost many people a great deal to develop. Halt and Catch Fire was neither loud nor abrasive, yet it captures the tension of a monumental breakthrough with incredible precision. The show ended in 2017, but recent streaming data from FlixPatrol shows renewed interest in it.

Halt and Catch Fire is one of several AMC shows receiving fresh attention on Apple TV’s VOD service. The series is the third most popular show on the service in the US at the time of writing. Other AMC shows on the chart currently include Fear the Walking Dead and Into the Badlands. Halt and Catch Fire was created by Christopher Cantwell and Christopher C. Rogers and was anchored by strong performances from sci-fi icon Lee Pace, as well as Mackenzie Davis, Scoot McNairy, and Kelly Bishé.

With near-perfect critic and audience scores on Rotten Tomatoes, Halt and Catch Fire remains a masterpiece that stayed true to its identity to the very end. While reviewing the finale for Collider, Emma Fraser praised the show for remaining people-centric even as the tech leaned heavily toward commercialization. “Thankfully, Halt and Catch Fire evolved into something that went beyond a Mad Men retread, and became something that stood on its own, with this final season proving to be leaps and bounds from where it began. It is an achingly beautiful portrayal of four people striving to make something that matters, all the while screwing up relationships and finding a way back to each other. Rebooting, but not erasing, each season improved on the one that came before it,” she wrote in her review.

What Is the Cast of ‘Halt and Catch Fire’ Up to Currently?

Being some of the most talented actors, the cast of Halt and Catch Fire has achieved significant success in the years following the show’s conclusion. Davis led the critically acclaimed HBO series Station Eleven and starred in the beloved holiday comedy Happiest Season. Pace stars in the Apple TV sci-fi epic Foundation, while Bishé has delivered memorable performances on shows like Super Pumped and Penny Dreadful: City of Angels. McNairy has had a successful transition to films with movies like Lyle, Lyle Crocodile, A Complete Unknown, and Nightbitch. McNairy and Davis recently reunited for the horror film Speak No Evil.

Halt and Catch Fire is available to stream on AMC+ in the US or for purchase on Apple TV.

- Release Date

-

2014 – 2017-00-00

- Network

-

AMC

- Directors

-

Juan José Campanella, Daisy von Scherler Mayer, Karyn Kusama, Michael Morris, Phil Abraham, Kimberly Peirce, Larysa Kondracki, Terry McDonough, Meera Menon, Reed Morano, Tricia Brock, Andrew McCarthy, So Yong Kim, Craig Zisk, Jon Amiel, Johan Renck, Jake Paltrow, Ed Bianchi

Entertainment

Steven Soderbergh admits frustration over scrapped Ben Solo “Star Wars” movie with Adam Driver: 'It's insane'

:max_bytes(150000):strip_icc():format(jpeg)/steven-soderbergh-adam-driver-star-wars-021826-b06bfa2c2ac94af9aea18334293485b6.jpg)

“The Hunt for Ben Solo” would have followed Driver’s Kylo Ren after the events of “The Rise of Skywalker.”

Entertainment

Mormon Wives’ Demi Wants Marciano’s Defamation Lawsuit Against Her Dismissed

The Secret Lives of Mormon Wives star Demi Engemann has requested that Marciano Brunette’s defamation lawsuit against her be dismissed.

According to court documents obtained by Us Weekly on Tuesday, February 17, Engemann, 31, asked the judge to throw out Marciano’s lawsuit, claiming that Brunette, 33, was punishing her “for exercising her First Amendment right to speak out concerning [Brunette’s] misconduct.”

Engemann, who called the lawsuit a “sham,” alleged that Brunette previously bragged about how his workplaces made a “special policy prohibiting him from sleeping with other employees” because he allegedly “slept with an ‘extraordinary’ number of employees.”

Engemann also requested Brunette’s to pay her attorneys’ fees and costs.

TMZ was first to report.

Us Weekly has reached out to Engemann and Brunette for comment.

Engemann and Brunette first connected in 2024 when the Mormon Wives cast traveled to Italy to appear on season 2 of Vanderpump Villa. Brunette claimed that he shared a consensual kiss with Demi, who is married to husband Bret Engemann. Demi, for her part, accused Brunette of crossing the line in May 2025.

“I did come out with a pretty bold and true statement against Marciano [recently] because at that point it was like, ‘You’re lying about me. Actually, you were the predator.’ So I’m not going to stay quiet — and I stand by that statement,” she exclusively told Us Weekly in May 2025. “There’s more happening behind the scenes that will come to light. I’m sure at this point it’s become a legal matter. There’s not much more I can say on it as of now because I want to preserve the fact that it’s a serious situation. But I stand behind those statements.”

Later that year, Demi claimed during a Secret Lives of Mormon Wives’ season 3 confessional that any physicality between her and Brunette was “unwanted.”

“Everyone is going to handle these kinds of situations different. You never deserve unwanted touch,” Demi said in the November 2025 episode. “No matter what it looks like, no matter what your relationship was like before or after, unwanted touch is unwanted touch.”

Following the episode, Brunette denied Demi’s accusations.

“It is unfortunate to see everything that is going on now, because everything that happened [on Vanderpump Villa] was consensual,” Brunette claimed on a November 2025 episode of the “Juicy Scoop” podcast. “I will just flat-out say that the accusations she’s making against me are 100 percent false.”

The following month, Brunette sued Demi for defamation. According to documents obtained by Us at the time, Brunette alleged that Demi falsely described him as a “sexual predator.”

“The truth is straightforward. Engemann and Marciano met while filming in Italy. They flirted. They spoke privately. They shared a consensual kiss. They separated,” Marciano’s legal team said per the docs. “After filming, Engemann stayed in contact with Marciano for months through calls, FaceTime, texts, invitations, and even location sharing. That behavior confirms a continued relationship, not a person reacting to sexual assault.”

Brunette claimed that Demi’s allegations caused “severe” damage to his reputation.

“They accuse Marciano of criminal sexual conduct he did not commit. They were published broadly, republished repeatedly, and framed to harden into ‘truth’ in the minds of viewers,” the docs read. “The damage has been immediate and severe, including lost professional opportunities, harassment by strangers, and lasting harm to Marciano’s reputation.”

After filing the lawsuit, Brunette took to social media to open up about how challenging life had been for him in the past year.

“This past year has been one of the hardest of my life — honestly maybe the hardest ever,” he said in a December 2025 Instagram video. “I know if you have seen me, on TV or on the internet, you know I like to joke around and have fun and always keep the energy high. But behind the scenes, I’ve been dealing with a lot mentally — it’s really f***** me up.”

Entertainment

2026 Oscar winner predictions: Who will win Best Picture, Best Actor, and more among top Academy Awards contenders?

:max_bytes(150000):strip_icc():format(jpeg)/awardist-oscar-predictions-236c93362233445abd7e1c501d1eb5ed.jpg)

“One Battle After Another,” “Sinners,” Timothée Chalamet, and more enter a crowded Oscars race. EW shares predictions for who will win at the 2026 Oscars.

Entertainment

Rapper Lil Poppa dies at 25

:max_bytes(150000):strip_icc():format(jpeg)/Lil-Poppa-Last-Lap-Tour-2024-021826-1996901cfd9b44e093b1557fd9dcdf08.jpg)

The Georgia musician released his most recent song, “Out of Town Bae,” on Feb. 13.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment21 hours ago

Entertainment21 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports7 hours ago

Sports7 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment13 hours ago

Entertainment13 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World16 hours ago

Crypto World16 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit