Politics

Katie Price’s Rep Sets The Record Straight On Pregnancy Headlines

Katie Price’s team has clarified reports that she and her new husband are expecting a baby.

Last month, the former glamour model and reality star made headlines when she announced that she’d married entrepreneur Lee Andrews in Dubai just one week after meeting him in real life.

On Wednesday, in a pointed Instagram post aimed at her new husband’s ex, Katie claimed she is “having his child”.

Lee then shared a picture of himself and Katie on his own account, alongside a message claiming they were the “perfect couple soon to be triple”, adding a pregnant emoji, leading several outlets to run headlines claiming that the Celebrity Big Brother winner is pregnant.

However, her spokesperson has now set the record straight, confirming to Yahoo that this is not the case.

HuffPost UK has contacted Katie’s team for additional comment.

Katie is currently a mum to five children.

She welcomed her eldest son Harvey, whose father is the retired footballer Dwight York, in May 2002, followed by a son and daughter, Junior and Princess, during her marriage to her first husband, the pop singer Peter Andre.

After marrying and divorcing the ex-cage fighter Alex Reid, she had two more children, a son and daughter named Jett and Bunny, with her third husband, the builder and former stripper Kieran Hayler.

In recent years, Katie has also been engaged to the reality stars Kris Boyson, Carl Woods and JJ Slater, with whom she was reported to have split just a few weeks before marrying her fourth husband, Lee.

Lee recently shot down speculation that his and Katie’s marriage wasn’t legally binding, insisting to his Instagram followers: “We’ve had the most wonderful wedding. We are married. It’s official, and I’m the happiest man in the world. Lots of love to everyone.

“That might clear up a lot of the 99 percent of the junk that’s in my requests.”

Politics

Is Winter Going To Be Very Wet From Now On? Experts Comment

If we have anything to say when we look back on this past winter, it will likely be that the weather was really, really, wet.

It’s been relentless, even by Britain’s standards.

In fact, according to the Met Office, this soggy weather has been record-breaking in some areas. The weather experts said: “North Wyke in Devon logged 40 consecutive wet days from 31 December 2025 to 8 February 2026.

“Cardinham (Bodmin) in Cornwall also reached 40 consecutive wet days over the same period, while Astwood Bank in Hereford and Worcester matched that 40‑day run from 31 December 2025 to 8 February 2026.”

And according to data from the University of Reading Atmospheric Observatory, January 2026 was the fourth-wettest in almost 120 years with total rainfall levels well above those expected at this time of year.

Will all winters be wetter from now on?

Of course, we’re all aware that climate change is something we now live alongside and that, over time, it is fundamentally impacting the weather.

While terms like ‘global warming’ might have you thinking everything will get steadily warmer, it’s a little more complex than that when it comes to the UK’s winters.

The Met Office has predicted that by 2070, winters in the UK will be up to 30% wetter than they were in 1990 and that rainfall will be up to 25% more intense.

Our summers are expected to get drier overall with more heatwaves and droughts – but when it rains, it will be 20% more intense than it was in 1990.

The meteorological experts add: “In the future, we project the intensity of rain will increase. When we talk about intensity, we mean how heavy rainfall is when it occurs. In the summer, this could increase by up to 20%. In winter, it could increase by up to 25%.”

They also warn that a greater risk of flooding will have large impacts, both on the environment and in our daily lives.

Politics

Politics Home Article | Antonia Romeo Appointed As Head Of Civil Service

Romeo replaces Wormald in the role (Alamy)

3 min read

Keir Starmer has confirmed Dame Antonia Romeo’s appointment as the new Cabinet Secretary, making her the first ever woman to hold the role.

Romeo replaces Sir Chris Wormald, who stood down as head of the civil service last week.

The changes come amid a wider reshuffle at the top of government. In recent weeks, Morgan McSweeney has resigned as Starmer’s chief of staff, and Tim Allan quit as the Prime Minister’s communications director, following outrage over the decision to appoint Peter Mandelson as US ambassador despite being aware of links to paedophile Jeffrey Epstein.

Romeo, who was formerly permanent secretary at the Home Office, was widely expected to be Starmer’s pick after Wormald’s departure.

However, her ascension to the most senior role in the civil service has triggered an extraordinary briefing row.

Previous allegations of Romeo’s use of expenses and bullying of staff when she was the UK’s consul general in New York resurfaced, despite investigations at the time concluding there was “no case to answer”.

In an interview with Channel 4 last week, former senior civil servant Simon McDonald said that the government should carry out “more due diligence” before appointing Romeo.

Former colleagues have come to her defence, however. Ex-cabinet minister Robert Buckland told The House magazine that Romeo is an “extremely impressive person”.

Meanwhile, one high-ranking civil servant, an ally of Romeo, described McDonald’s behaviour as outrageous.

“At all levels of the civil service, there is a feeling of sheer outrage that a retired civil servant could launch an attack on an existing one, knowing she can’t defend herself against it. It is a drive-by on her, and deeply damaging to the institution.”

Starmer said on Thursday morning: “I am delighted to appoint Dame Antonia Romeo as the new cabinet secretary. She is an outstanding public servant, with a 25‑year record of delivering for the British people.

“Since becoming prime minister, I’ve been impressed by her professionalism and determination to get things done. Families across the country are still feeling the squeeze, and this government is focused on easing the cost of living, strengthening public services and restoring pride in our communities. It is essential we have a cabinet secretary who can support the government to make this happen.

“Antonia has shown she is the right person to drive the government to reform, and I look forward to working with her to deliver this period of national renewal.”

Responding to her appointment, Romeo said: “It is a huge privilege to be asked to serve as cabinet secretary and head of the civil service.

“The civil service is a great and remarkable institution, which I love. We should be known for delivery, efficiency and innovation, working to implement the government’s agenda and meet the challenges the country faces.

“I look forward to working with all colleagues across the civil service to do this, in support of the prime minister and the government.”

Politics

Pro-Israel group wades into Democratic House primaries

A pro-Israel group is wading into nearly a dozen contentious House primaries as it tries to shape the Democratic Party’s approach to the controversial issue.

The Democratic Majority for Israel PAC, which backs pro-Israel Democrats, is endorsing 11 House candidates, including several in expensive and crowded primaries the party must win in order to retake the House. The group’s initial endorsement list was shared first with POLITICO.

DMFI, first launched in 2019, is one of several groups across the political spectrum looking to influence the party’s views on Israel, even as its military operations in Gaza have divided the Democratic Party and become an early litmus test for both 2026 congressional candidates and 2028 presidential hopefuls.

The endorsements include candidates in six battleground races and five more in safe-blue, but crowded, Democratic primaries. They are backing moderate state Rep. Shannon Bird over progressive state Rep. Manny Rutinel for the right to face Rep. Gabe Evans (R-Colo.) in a swingy Colorado district.

In New York, the group is backing Cait Conley, who has entered a crowded primary to take on Rep. Mike Lawler (R-N.Y.) in a district which Kamala Harris won by a one-point margin in 2024. In Texas, DMFI has endorsed police officer Johnny Garcia in a wide-open primary for the newly drawn, red-leaning seat.

DMFI is backing a pair of candidates in two of the four most competitive seats in Pennsylvania — Scranton Mayor Paige Cognetti, who will face off against Rep. Rob Bresnahan (R-Pa.), and former TV anchor Janelle Stelson, who is also on track to run against Rep. Scott Perry (R-Pa.). And in Virginia, former Rep. Elaine Luria picked up the group’s support as she vies to take on her former opponent, Rep. Jen Kiggans (R-Va.).

The other candidates who are receiving DMFI’s endorsement are all running in crowded primaries in safe blue seats: Maryland state Del. Adrian Boafo, who is running to replace retiring Rep. Steny Hoyer (D-Md.); Michigan state Sen. Jeremy Moss, who is running to replace Rep. Haley Stevens (D-Mich.), who is running for Senate; and former Obama administration official Maura Sullivan, who is running to replace Rep. Chris Pappas (D-N.H.), who is running for the Senate.

“The vast majority of Americans support the right of Israel to exist as a Jewish state and understand the importance of the U.S.-Israel relationship,” said former Rep. Kathy Manning, who serves on the DMFI PAC board. “If you’re running in a competitive district, you need Democrats, you need independents, you need Republicans.”

Several groups, including DMFI and the American Israel Public Affairs Committee, known as AIPAC, are boosting pro-Israel candidates with significant outside spending. The two groups have often overlapped in their endorsements, but AIPAC supports Democrats and Republicans — and has drawn the ire of progressives. DMFI, for its part, is focused on regaining a Democratic congressional majority.

AIPAC’s super PAC, United Democracy Project, dropped more than $38 million on independent expenditures in 2024, while DMFI spent about $4.3 million. DMFI President Brian Romick said the group expects to be spending “comfortably” in the “seven-figures again” in 2026 but declined to elaborate further on the plans.

In Illinois, among the first primaries next month, DMFI and AIPAC appear aligned in their preferred candidates. DMFI announced it is backing former Rep. Melissa Bean, who is running to replace Rep. Raja Krishnamoorthi (D-Ill.), who is running for the Senate, and Cook County Commissioner Donna Miller, who is vying to replace Rep. Robin Kelly (D-Ill.), another Senate candidate.

Bean and Miller have also attracted attention for their connections to AIPAC. Their primary opponents in both races have accused them of benefiting from AIPAC’s spending, concealed by shell super PACs that are boosting them with hundreds of thousands of dollars in positive TV spending. But DMFI has not yet endorsed in Illinois’ 9th District, another contentious primary to replace retiring Rep. Jan Schakowsky that AIPAC appears to have waded into.

Earlier this month, AIPAC triggered a wave of criticism and frustration, even from its own allies, for spending $2 million to sink former Rep. Tom Malinowski in a congressional special election in New Jersey. The group’s spending backfired, eliminating Malinowski, but failing to lift up its preferred candidate. Analilia Mejia, a progressive organizer who has said Israel committed genocide in Gaza, ultimately won.

Romick and Manning declined to comment on AIPAC’s strategy, with the former congresswoman noting DMFI is “a distinctly different and separate organization.”

In 2024, DMFI and AIPAC targeted former Reps. Cori Bush (D-Mo.) and Jamaal Bowman (D-N.Y.) in 2024, both of whom lost their primaries to pro-Israel candidates. Romick demurred on whether DMFI planned to target any Democratic incumbents in 2026, adding that it is going “to take these primaries as they come and see if things develop.”

Jessica Piper contributed reporting.

Politics

Gorton and Denton: A three cornered fight in a seat of two halves

Ahead of the Gorton and Denton by-election on Thursday 26 February, Rob Ford analyses the prospects for Labour, Reform and the Green Party.

Next week voters in the South Manchester seat of Gorton and Denton will choose a new MP in the second by-election of Keir Starmer’s administration. Last May Labour lost the formerly safe seat of Runcorn and Helsby and with the government unpopular and unstable, Labour could again struggle in this once rock-solid constituency, and the loss of a second safe seat in less than a year could see the questions around Keir Starmer’s leadership get louder once again.

Gorton and Denton is a Frankenstein’s monster constituency, created in 2024 when the Boundary Commission stitched together pieces of three earlier Manchester seats. The seat is shaped like a battle axe, with the handle running Southwest through diverse and gentrifying wards in Manchester city council, while the head of the axe in the Northeast covers the three Tameside wards of Denton.

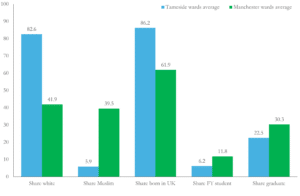

Demographic differences: Tameside and Manchester wards of Gorton and Denton

Source: Census 2021

Though both parts of the seat have long voted Labour, they are poles apart demographically. The four Manchester wards are on average nearly 60% non-white and 40% Muslim, and 42% of the residents are either students or graduates. These wards resemble places Labour has struggled in the last couple of years with challenges on the left. The three Tameside wards of Denton are on average 83% white, 86% UK born, and with a high share of residents doing working class jobs. Reform UK made hay in wards like this in last May’s local elections. But the two chunks of the seat are not equally matched – about two thirds of the population live in the more diverse, graduate and student heavy Manchester wards.

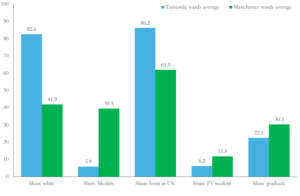

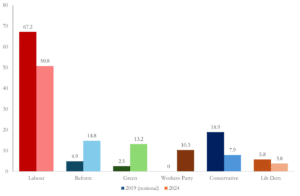

Gorton and Denton has long been deep red. Labour won 50.8% here in 2024, making the seat one of just 70 where Labour won an absolute majority, but this share was down sharply on an estimated 67.2% in 2019. The seat was one of four in central/south Manchester where Labour support dropped by double digits, all with large Muslim communities and many students and young graduates. Both the Greens and the Worker’s Party made major gains at Labour’s expense in 2024, winning nearly a quarter of the vote between them. While the Greens start in third place on 13.2%, the Worker’s Party are not standing in the by-election and have all but endorsed the Greens, saying “Labour and Reform must lose.” Reform are now the largest right wing party locally, having won nearly 15% in 2024, while the Conservatives, already marginal have now become irrelevant, having fallen to fifth place with less than 8% of the vote

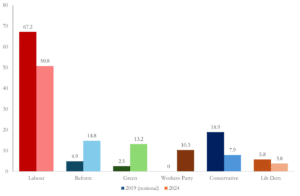

2019 and 2024 election results in Gorton and Denton

Dark bars on left – 2019 notional results (Rallings and Thrasher); light bars on right – 2024 results

Three routes to victory

On paper, Gorton and Denton should not be a hard seat for Labour to hold. They have won every general election in this seat and its predecessors for generations, and almost every local election in every ward here since 2011. This is a Labour leaning seat in a Labour leaning city in a Labour leaning region. Alas things are not so simple for a governing party polling below 20%, led by the most unpopular Prime Minister in polling history, a Prime Minister who has particularly struggled with the young progressives and Muslim voters who congregate in the seat’s Manchester wards.

Labour’s national troubles provide a local opening for the Greens, who are campaigning both as the vehicle for discontent with the Starmer government among young progressives and Muslims and as the strongest local opponent to Reform. The Greens are hoping they can to do to Labour in Gorton and Denton what Plaid Cymru did to Labour in Caerphilly – convince disaffected Labour voters that they can indeed have their cake and eat it – voting for a party who are both more progressive than Labour nationally and better able to stop Reform locally.

But the Greens face greater obstacles in Gorton and Denton that Plaid Cymru did in Caerphilly. Plaid had an exceptionally high profile candidate, and benefitted from national polling showing them well ahead of Welsh Labour. The Greens have little organisation and no presence in local government in Gorton and Denton’s wards, and their candidate is little known in the area. With national polling ambiguous and no reliable seat polling, Labour and the Greens have been waging an intense leaflet war over who is the strongest “stop Reform” option.

The risk to both, and the opportunity to Reform, is that neither side wins that argument and the left vote splits evenly. A split left is likely a necessary condition for Reform success, but not a sufficient one, in an area which has never been receptive to right wing politicians of any stripe. The combined Conservative and Reform vote in 2024 was just 22.4% – whereas in Runcorn and Helsby, where Reform defeated Labour by just six votes last May, it was 34.1% (18.1% Reform, 16.0% Tory). Reform will need everything to go their way if they are to take this seat. They will need to dominate the vote in the more Reform friendly Denton wards, an even split between Labour and the Greens in the Manchester wards, and low turnout in less Reform friendly areas to reduce the inherent advantages to their opponents. There is a route to Reform victory here but it is a narrow one.

This fragmented and uncertain contest will go to the wire, but one thing is already certain: defeat for Labour would be a disaster for the Starmer government, regardless of who inflicts it. This would be the second time in less than a year that Labour loses one of the 70 seats where it started with an absolute majority. Results like that are not “typical mid-term blues” but signs of an existential crisis. The political fallout could be severe, as the drumbeat of defeat in once rock-solid areas, set to get louder still in May’s local and devolved elections, will lead ever more Labour legislators to worry not only about their own electoral prospects, but about the future viability of their party.

By Professor Rob Ford, Senior Fellow, UK in a Changing Europe and Professor of Politics, University of Manchester.

A longer version of this article was previously published at “The Swingometer”

Politics

Trump fixates on sewage, a favored talking point, in fight with Wes Moore

President Donald Trump didn’t just take his feud with Maryland governor and possible 2028 Democratic presidential hopeful Wes Moore into the gutter this week. He turned to the toilet.

In a series of social media posts Monday and Tuesday, Trump blasted Moore for what he deemed an inept response to a sewage spill that sent hundreds of millions of gallons of raw waste into the Potomac River beginning four weeks ago.

“There is a massive Ecological Disaster unfolding in the Potomac River as a result of the Gross Mismanagement of Local Democrat Leaders, particularly, Governor Wes Moore, of Maryland,” Trump wrote Tuesday on Truth Social, saying that it’s time for the federal government to step in. “I cannot allow incompetent Local ‘Leadership’ to turn the River in the Heart of Washington into a Disaster Zone.”

On Wednesday, White House press secretary Karoline Leavitt said the president is worried that the Potomac River will carry the stench of excrement during the July 4 celebration of the country’s semiquincentennial that Trump has been planning since returning to office.

“He is worried about that. Which is why the federal government wants to fix it, and we hope that the local authorities will cooperate with us in doing so,” Leavitt said in response to a reporter’s question during the White House press briefing.

It’s not the first time Trump has turned poop into a political weapon. In fact, the president who complains regularly about low-flow toilet standards has a long list of scatological gripes that have become one of the few areas where his administration is seeking additional environmental protections as it aggressively rolls back dozens of climate, air and water pollution rules.

It was on the sewage-fouled beaches of San Diego that EPA Administrator Lee Zeldin marked his first Earth Day as the nation’s top environmental regulator. The administration has put concerted effort into pressuring Mexico to do more to stem the tide of raw sewage pollution flowing across the border from Tijuana, which for years has dirtied beaches and sickened residents and Navy SEALs who train nearby.

And during Trump’s first term, it was San Francisco’s long-running sewer overflow problem that EPA targeted for enforcement after the president groused about the city’s large homeless population — a move that California leaders saw as politically charged.

Now as Trump feuds with Moore, the nation’s only Black governor, less than two weeks after excluding him from a White House dinner for the National Governor’s Association, the image of millions of gallons of raw sewage flowing into the nation’s capital offered another level of political punch altogether. The situation comes as Moore is pushing to redraw Maryland’s congressional lines to counter Trump’s red-state redistricting.

“It’s a great political issue. Nobody wants sewage in the water — that is true of Democrats and Republicans,” said Mae Stevens, a water infrastructure lobbyist who previously served as an environment staffer for Democratic former Maryland Sen. Ben Cardin.

Asked about the president’s longstanding interest in sewage pollution, White House spokesperson Taylor Rogers said the administration would not allow “the failures of local and state Democrats to diminish the quality of life for millions of Americans.”

The source of the spill is the Potomac Interceptor sewer line, which partially collapsed Jan. 19 near Cabin John, Maryland, amid frigid winter temperatures, releasing nearly 200 million gallons of untreated wastewater in the first five days. Operating since constructed in 1964, the 54-mile line carries wastewater from D.C. suburbs as far away as Dulles Airport to a treatment plant in southern Washington.

DC Water, the utility that operates the line, has been making emergency repairs to the broken interceptor, but the effort will take four to six more weeks. After that, crews will need to get to work on an already-planned rehabilitation project, which could take a further nine or 10 months, DC Water spokesperson Sherri Lewis said.

Though the spill captured the nation’s attention only this week, local environmentalists have been sounding the alarm from the beginning.

“It’s certainly a big ecological problem and an incredible threat to public health to have raw sewage splashing around and on shorelines,” said Hedrick Belin, president of the Potomac Conservancy, a conservation group. “We don’t need partisan politics getting in the way. This crisis is just too serious.”

Officials in Maryland, which is technically responsible for the Potomac River, responded “within hours” of the initial spill, said Ammar Moussa, a spokesperson for Moore. But the interceptor falls under EPA’s regulatory purview, according to the governor’s office, accusing the agency that’s lost thousands of staff under Trump of failing to take action.

“For the last four weeks, the Trump Administration has failed to act, shirking its responsibility and putting people’s health at risk,” Moussa said in a statement. “Notably, the president’s own EPA explicitly refused to participate in the major legislative hearing about the cleanup last Friday.”

Zeldin shot back at that accusation on Tuesday afternoon.

“At no point in the lead up to today had DC Water or the state of Maryland requested EPA to take over their responsibilities, and EPA has continued to offer its full support to state and local leaders from the onset,” Zeldin said in a post on X.

Funding woes and ‘really poor infrastructure’

Water experts say the sewage spill is a symptom of a larger problem: Aging sewer pipes and water lines nationwide are in desperate need of repairs, but cash-strapped local governments are struggling to pay for them.

The Trump administration has repeatedly pushed to slash federal funding for water projects. Last year, the White House proposed a 90 percent cut to EPA’s State Revolving Funds, the water sector’s largest source of federal dollars. The Senate ultimately rejected the cut in a spending bill that Trump signed into law last month.

But extra water funding from the 2021 bipartisan infrastructure law is set to run out this fall, and experts warn of a coming funding cliff at the same time as extreme weather and AI data centers put more pressure on existing pipes, sewers and treatment plants.

“We’ve got really poor infrastructure. A lot of these pipes, especially on the East Coast, were built decades ago,” said Jon Mueller, a visiting associate law professor at the University of Maryland. “I think it’s unfortunate that it takes a disaster like this to get people to focus on the problem.”

It’s not yet clear how much the Potomac spill will cost, but the broader rehabilitation project for the interceptor sewer system’s “most vulnerable sections” is $625 million, said DC Water spokesperson Sherri Lewis. The utility has been coordinating with EPA, she added.

“Just last week, we hosted the Assistant Administrator for Water for a tour of the site and briefing on the project and the progress made to date,” Lewis said in a statement.

Although officials say the worst of the spill has been contained and that it has not impacted drinking water supplies, 243.5 million gallons of sewage overflows have been reported thus far.

Environmental advocates are worried about long-term implications for the river, which feeds into the Chesapeake Bay, the nation’s largest estuary and the subject of decades of cleanup efforts.

Earlier this month, University of Maryland researchers recorded extremely high concentrations of bacteria, including a strain that resists antibiotics, tied to the spill. By springtime, that could render parts of the water unsafe for boating, canoeing and fishing.

Dean Naujoks, who leads the environmental group Potomac Riverkeeper, said he hopes Trump’s involvement could improve what he described as a “botched” cleanup process by DC Water. But he cast blame as well on EPA, describing the agency as essentially missing in action.

“We can’t get a hold of [EPA]. I have no idea what they’re doing,” Naujoks said. “The squabble between Trump and Gov. Moore has focused more of the attention on accountability, which I think is a good thing.”

Politics

Andrew Windsor arrested for ‘public misconduct’

Andrew Mountbatten-Windsor, the Epstein buddy formerly known as ‘prince’, has been arrested this morning at the Sandringham estate in Norfolk.

Police arrived early this morning in unmarked cars. The exact reason for the arrest is still unannounced, though it is under the umbrella term of misconduct in public office. BBC correspondent Laura Manning speculated that:

My understanding is that there’s been a very significant development in the investigation into the Epstein files. Andrew Mountbatten-Windsor has been arrested this morning on suspicion of misconduct in public office.

That goes back to documents from when he was a trade envoy, that are alleged to have been passed to Epstein.

Knowing the priorities of the British state, it is more likely to be linked to his leaking of secrets to serial chiild-rapist Jeffrey Epstein than his alleged trafficking of women.

For more on the the Epstein Files, please read the Canary’s article on way that the media circus around Epstein is erasing the experiences of victims and survivors.

Featured image via the Canary

Politics

Royal British Legion celebrates universally condemned Iraq war

The Royal British Legion (RBL) have announced an Iraq War ’15 years on’ memorial event. The veterans charity, which is backed by major global arms firms, said the event would be held in Staffordshire in May 2025 at the National Arboretum.

The Arboretum is a national site for military remembrance, and is known for partnering with military-linked firms.

The Legion’s press release says:

We will remember the lives lost and those affected and pay tribute to the professionalism and dedication of the men and women who served, from the initial invasion to the crucial rebuilding of Iraqi institutions and infrastructure.

That last little bit is particularly deceptive. It makes Iraq sound like a humanitarian mission, rather than a war crime-riddled heist.

Iraq denials don’t hold water

In fact, one Iraq veteran told the Canary that the RBL’s claim was flat wrong:

When I was on Telic one [the Iraq invasion] there was a planned campaign of arresting anyone that had membership of the Ba’ath party (this was after the government had fell). In effect teachers, dentists, doctors, or anyone with a skilled job, had to be members of the party under the old regime, or they wouldn’t have been allowed to work.

In effect, anyone that knew how to do something in society was removed, and when we questioned this on the ground, we were told that this policy had come from the very top (Downing Street)

So it wasn’t just the military campaign it was also the removal of all people that ran Iraqi society. At the same time the army was pretty much made redundant.

The institutions and infrastructure wouldn’t have needed building up or repairing without this.

When we asked the RBL about their links to corporate sponsors, they told us:

The RBL Iraq 15 event will not have any corporate sponsors.

Which certainly doesn’t clear up the issue of their corporate sponsors as an organisation. And, when we asked the Iraq veteran about the Legion’s links to arms firms, he told us:

Yes the RBL are basically partnering with the arms business, which surely must be against the principles of when the organisation started.

The truth is that the Iraq War was illegal and killed and maimed hundreds of thousands of people. The war destabilised the entire Middle East region, leaving a lasting impact on those who carried it out. By all measures, it was an unmitigated disaster. Yet, bizarrely, figures like Trump’s secretary of state Marco Rubio are clamouring to revive colonialism. Regime change in Iraq clearly taught them that war is profitable for the West.

In the pockets of Big Death

Since the ousting of the pre-2003 government, Iraq has become a lucrative cash cow for certain players, including global arms firms — what I prefer to call Big Death. Welcome to the military charity-industrial complex.

What makes the Iraq event and comments from the Royal British Legion striking is that both the legion and the National Arboretum proudly state their connections to the global killing business.

BAE Systems is a major partner of the RBL — to the tune of £400,000. The Arboretum’s website names Amey, Key Systems, Briggs Equipment and Jaguar Land Rover among its partners and supporters. All of these firms make profit from war and global instability.

The press and RBL did not even attempt to reflect these galling truths in their coverage of the event.

Flattening Iraq: literally and ideologically

Instead, the Mirror led with stories about veterans horribly wounded in the war — yep veterans, not the countless Iraqis killed as a result of the war.

Certainly, these are awful and harrowing tales involving terrible injuries. But the point, my friends, is that the choice to focus on individual stories is deeply political.

In 2018 Professor Paul Dixon wrote a report called Warrior Nation: War, militarisation and British democracy. Dixon recently published a much-expanded book on the same issue.

In his original report, Dixon identified many different tactics used by pro-war groups and individuals to de-politicise and flatten discussions about war. One of these is ‘personalisation”.

As Dixon has it:

The personalisation of war refers to the focus on human stories and the plight of the troops. This may serve militarists well in ‘depoliticising’ the war (which is, ironically, to conceal the highly political motivations of those behind the war) diverting attention from wider questions as to why it was necessary to fight these wars.

He adds:

Personalisation can be combined with deflection in which opposition to the war is presented

as opposition to military personnel, militaristic ideals and the nation. War becomes ‘a fight to

save our own soldiers… rather than as a struggle for policy goals external to the military.’

These military elites, Dixon argues:

[often] claim to be non-political, [but] their history suggests a close relationship with the political right, sympathy for monarchy and imperialism, and hostility to liberalism, socialism, feminism and democracy.

The British military produces far-right ideologues? Quelle surprise.

Britain’s war machine

It might seem odd that major arms firms and the powerful UK military charities are so closely linked. But, this is what it has always been.

You could read about the historical links between the Legion and the military establishment in my second book Veteranhood. Except you can’t. Why? Because an Israeli AI bro bought the publishing house and now myself and load of my fellow authors are boycotting our own work and giving any future royalties to Palestinian causes.

And if you want to understand militarism in the UK and globally — and how it’s enmeshed with global capitalism — one of the best places to start is by scrutinising military charities (which are themselves big firms) in bed with the war trade.

Because underneath the rhetoric about remembrance, sacrifice, and courage you’ll find that what arms firms and these big charities really do is re-write, obscure, and mythologise as noble what is, in fact, the UK’s violent, counter-productive, imperialist foreign policy. Lipstick on the pig, if you like? They limit the space to critique those policies, to make them harder to challenge and to conflate criticism with disrespect for ‘the troops’.

The real face of that war is much less marketable, as another Iraq veteran told us:

I’m 38 now. I had only just turned 20 when i deployed, I redeploy most nights. Waking my partner up – kicking & screaming. You come home, but bits of it stay with you — and your family carries it too.

He pointed out the lack of accountability too:

Chilcot told us what went wrong, but nothing really changed at the top. Blair is still a free man. If remembrance means anything, it should mean telling the truth, rather than white washing the nations war crimes.

But the truth is, when you see and hear about the dead and wounded in wars like Iraq, the real disrespect lies in failing to criticise, probe, and challenge the ugly consequences of war.

Featured image via Peter Kennard and Cat Picton-Phillipps

Politics

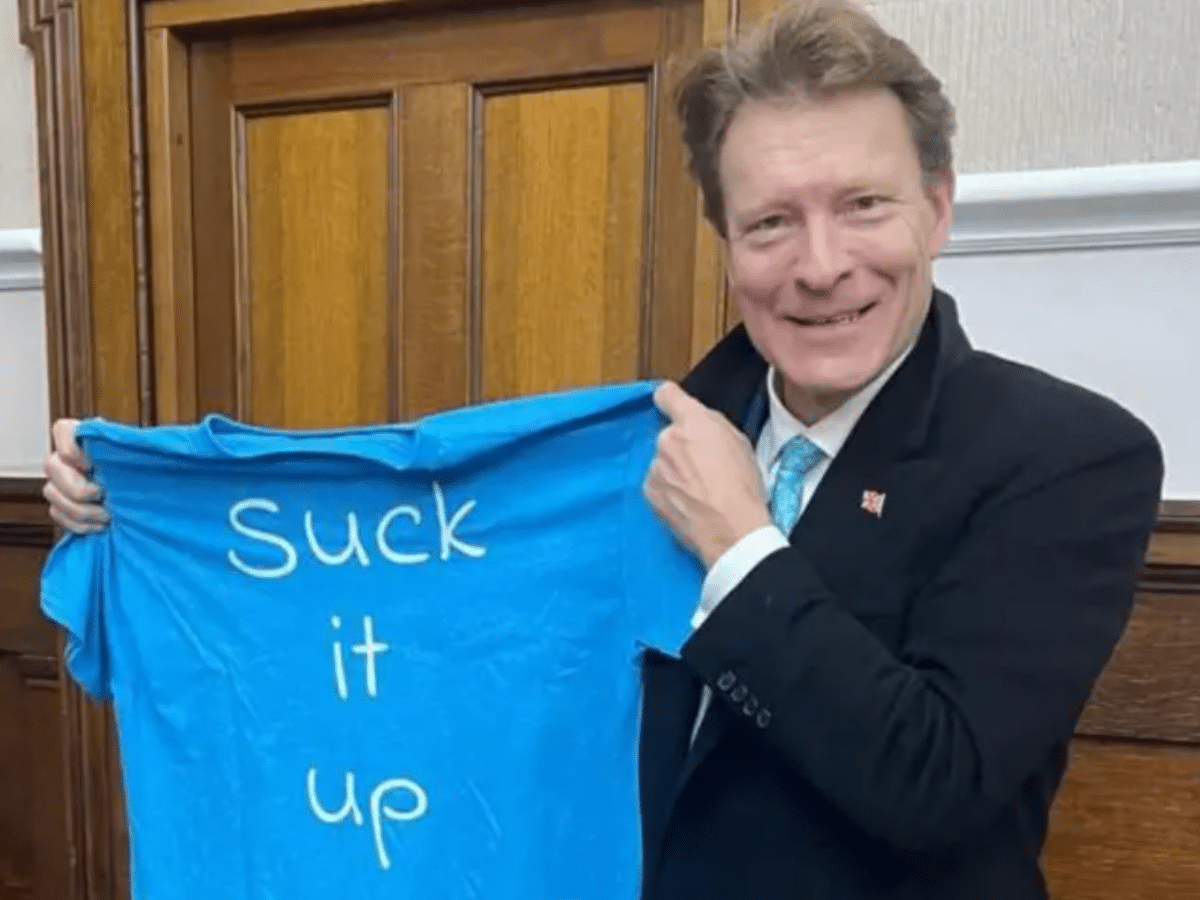

Millionaire-backed Reform considers slashing minimum wage

The Trades Union Congress (TUC) is exposing on X the dangerous impact Reform MP Richard Tice would have if he makes it to office.

Live on LBC, Tice stated that Reform would:

Will consider cutting the minimum wage for younger workers.

This demonstrates how disastrously out of touch Tice is with the very voters he’s trying to win over.

The post below from the TUC underscores the contrast between billionaire-funded Reform UK, and the real challenges facing ordinary people — just trying to make ends meet.

Young people: We can’t afford our rent.

Multi-millionaire Reform MP Richard Tice: We’re going to cut your pay. https://t.co/i9SoVTcAPb

— Trades Union Congress (@The_TUC) February 17, 2026

Richard Tice: “100% of nothing is nothing”

The original LBC interview went as follows:

Ben Kentish: If you were in government, would reform cut the minimum wage for young people to get more of them into work? Is that on the table?

Richard Tice: Well, we’ll be talking about that over the coming weeks. We’ve got to re-look at it because the evidence is immediately there within a matter of six to nine months. But this has had a catastrophic impact as well, of course, of the impact of national insurance contribution rises, employment rights, fears from the dreadful employment rights bill. All of these things have a cumulative impact, which means that employers are saying, why should I take the risk?

Kentish: A potential pay cut for millions of young workers on the minimum wage is something you are considering?

Tice: If you’re unemployed, I mean, 100% of nothing is nothing.

Kentish: But we’re talking specifically about the minimum wage here and whether it needs to be cut for young people.

Tice: But the wage is irrelevant if you’re not employed. If businesses are not employing you, so it’s much better to say, actually, we look at…

Kentish: But the young people who are employed on the minimum wage obviously would also be affected by a cut in the minimum wage.

Tice: And that’s why I’m not going to make policy on the hoof. That’s why you’ve got to look at the implications of this.

Kentish: But you’re looking at it.

Tice: We’ve got to look at all of this because they’ve got themselves in a terrible pickle and sometimes it’s then quite hard to unwind these things.

Kentish: And to young people who say, well, I’m in work, I’m earning the minimum wage, why on earth would I vote Reform if they think I should potentially earn even less than I’m getting?

Tice: That’s…

Kentish: What would you say?

Tice: Well, that’s not what I’m saying. What I’m saying is other young people are not being employed who could be and should be because of this extra cost. And it’s a significant disadvantage. But it’s now… it’s a complicated issue.

Unfortunately, Kentish misses another reality: giving bosses ‘recruitment discounts’ through low pay requirements doesn’t lift people out of poverty.

Many will still need benefits to survive, with taxpayers footing the bill for what rich employers refuse to pay. After all, workers can’t get their PAYE sent to offshore tax havens — they’re captured by the tax system from the get-go.

Once again, the majority are forced to bear the burden the super-rich continue to shrug-off.

As if it wasn’t completely clear already, if you vote #Reform, what you are voting for is taking money out of the pockets of the working class and giving it to millionaires and billionaires. It really is that simple. They are a bunch of absolute grifters who prey on stupidity https://t.co/dAHbz1C1TV pic.twitter.com/QzNQQBlGvm

— Jim Kavanagh (@Jimbokav1971) February 17, 2026

Says the immigrant from Dubai. Has he learned Arabic yet?

Reform couldn’t give a damn about the working class. They’re a private members’ club for billionaire tax-dodging wankers and offshore-trust boys who lecture 16 year old shelf-stackers to “tighten their belts for… https://t.co/kuCOsOtU1Z

— Atlanta Rey ❤️🔥🐦🔥 (@areyoflight) February 17, 2026

Reform stand with bosses, not workers

This interview exposes how a billionaire-backed party puts profit before people. In the past five years, “greedflation” has driven record returns for executives and shareholders, while ordinary households have faced tightening budgets and rising hardship.

The Canary’s own James Wright wrote yesterday:

The neoliberal system leaves 40 percent of Britons with less than £25 at the end of each week, a survey by the Cost of Living Action (COLA) group has found. This is a pittance and unlikely to stretch far under the cost of living crisis, where even employed people are finding themselves out of pocket.

He added:

Privatised essentials like energy and extractive supermarket chains are driving the cost of living crisis. British Energy companies alone have accrued £125bn since 2020, according to the End Fuel Poverty Coalition.

Meanwhile, profits for the German-owned supermarket, Lidl, rose by 297% since 2021. As for Aldi, its operating profit has risen by 50% and 72% since 2020.

While costs have increased due to climate change and other factors, supermarkets are using these pressures not to break even but to fatten profit margins – otherwise known as ‘greedflation’.

In other words, the fuel feeding the cost-of-living fire is the ‘privatisation tax’ on common essentials – not a natural disaster but a manmade problem.

Claiming the unemployed must accept lower pay might soothe some. But the rich’s growing wealth proves they could pay fairly — they just won’t.

It’s far more appealing for them to watch their bank balances swell than to invest in fairly paid staff — especially if it means sacrificing one of their many extravagances.

Therefore, Kentish rightly highlights that reductions to the minimum wage won’t only affect unemployed workers taking new jobs – they will ripple far wider. This makes clear, a Reform government will affect all workers at a time when people are feeling absolutely done in trying to keep going on shoestring budgets and rocketing private rents. As the TUC aptly pointed out in their subsequent post.

One X account posted a stark rebuke to those voting for Reform:

These Boomer Cunts thinking of voting Reform will have to look their Grandchildren in the eyes and say ‘Yes, I voted for your abject misery’.

Under Reform, workers pay will be slashed

As if we didn’t need another reason to see that these bellends have zero intention of tackling the issues impacting ordinary people countrywide.

In fact, this party is a gathering of the very people whose greed and influence created Britain’s economic hellscape in the first place.

We will not stop exposing the deep rot that runs through this deplorable party.

Featured image via Kent Online

Politics

Thank you, Henry | Conservative Home

I am writing today not just to let you know – as he himself has done in his final Tory diary – that Henry Hill is moving on from ConservativeHome after more than a decade with the site but to properly thank him.

Henry first joined ConHome in 2013 as an Assistant Editor, rising through News Editor to become Deputy Editor at the start of 2022. Across all of those roles, and all of those years, his output was prolific and wide-ranging.

Regular readers will know Henry for his writing on two subjects in particular. The first is constitutional and Union questions. His Red, White, and Blue column became a fixture for anyone trying to make sense of devolution, the integrity of the United Kingdom, and the often-tortuous politics of Scotland, Wales, and Northern Ireland. He wrote about these subjects with a seriousness that was not always fashionable and a clarity that made complex constitutional arguments genuinely accessible.

The second is housing – an area where Henry argued consistently and forcefully that the Conservative Party needed to grapple with the scale of the problem rather than look the other way. Whether or not readers agreed with every position he took, he helped ensure the debate had a home on these pages.

Beyond the daily output, Henry built a considerable profile outside ConservativeHome – writing for the Daily Telegraph, The Spectator, The Times, the New Statesman, CapX, UnHerd, The Critic, and others; as well as regularly appearing on programmes such as Newsnight, Sky Papers and Politics Live. Henry was also a familiar fixture in ConservativeHome’s Party Conference programme, where his chairing was sharp, well-briefed, and good-humoured (as long as your question wasn’t more of a comment!).

Henry leaves with our gratitude and our very best wishes for the future.

Thank you, Henry.

Politics

Newslinks for Thursday 19th February 2026

Trump ‘prepares for Iran strikes’ and warns Starmer not to give away Chagos Islands

“Donald Trump has demanded Sir Keir Starmer “not give away” Diego Garcia in a fresh attack on his Chagos Islands deal. The US president warned the Prime Minister that he was making a “big mistake” by entering into a 100-year lease with Mauritius. It is the latest in a series of about-turns from the president on the deal, which he previously called an act of “great stupidity” before giving it approval earlier this month. Mr Trump said Diego Garcia, the shared US base, was crucial for possible air strikes on Iran, which experts predict could take place within days, despite peace talks.” – Daily Telegraph

- Trump pulls support for Chagos Islands deal – The Times

- Trump renews attack on Starmer’s plan to cede UK ownership of Chagos Islands – FT

- Brits evicted from sovereign territory 6,000 miles from home – The Sun

- Trump ‘identifies timeline for strike on Iran’ – Daily Mail

- President sends fighter jet squadron to ‘kick the door down’ in Iran – Daily Telegraph

- Trump’s Chagos rant means he’s preparing to bomb Iran – Daily Telegraph

- And Trump prepares to unleash ‘weeks-long blitz on Iran within days’ – The Sun

- British couple jailed by Iran for 10 years, family says – BBC News

- Obama thought Trump was a joke – Daily Telegraph

Comment

Starmer ‘not being honest’ on defence spending, say ex-military chiefs

“Sir Keir Starmer is not being honest with the British public over defence spending, former military chiefs have claimed. In a damning open letter, retired heads of the Army and Navy and an ex-MI6 boss warned the Prime Minister that the Armed Forces had been “hollowed out by years of chronic underfunding”. They said that instead of receiving more money because of Labour’s planned increase in defence spending, funding pressures such as pay rises for servicemen and high inflation meant the Ministry of Defence (MoD) was being forced to make cuts. Rachel Reeves, the Chancellor of the Exchequer, is locked in talks with the MoD, which is demanding more money to cover the estimated £28bn shortfall in its budget.” – Daily Telegraph

- Double defence spending or face war, Starmer warned – The Times

- Reeves just gaslit millions of Brits – and made voting Tory an option again – Daily Express

- Reeves to do ‘as little as possible’ in Spring Statement despite pressure to spend – Daily Telegraph

- Retail chiefs warn of fresh job losses as Labour prices people out of work – Daily Telegraph

Comment

Tech firms must remove ‘revenge porn’ in 48 hours, warns PM

“Deepfake nudes and “revenge porn” must be removed from the internet within 48 hours or technology firms risk being blocked in the UK, Keir Starmer has said, calling it a “national emergency” that the government must confront. Companies could be fined millions or even blocked altogether if they allow the images to spread or be reposted after victims give notice. Amendments will be made to the crime and policing bill to also regulate AI chatbots such as X’s Grok, which generated nonconsensual images of women in bikinis or in compromising positions until the government threatened action against Elon Musk’s company.” – Guardian

- Zuckerberg insists Meta does not target children in landmark trial – Daily Telegraph

Attacks on Romeo ‘driven by misogynistic jealousy’

“A vicious briefing war has broken out over the imminent appointment of Dame Antonia Romeo as cabinet secretary after her allies accused Foreign Office mandarins of “misogynistic” briefings against her. Romeo’s supporters accused Foreign Office officials of orchestrating a briefing campaign against her in an attempt to derail Sir Keir Starmer’s plan to appoint her as the first female head of the civil service. Her appointment is expected as early as next week but has triggered a backlash from current and former senior civil servants. Foreign Office sources hit back at her allies, dismissing accusations that the department’s officials were behind the briefing campaign against Romeo as “nonsense”. – The Times

- Mandelson ‘fuelled whisper campaign’ against Sunday Times – The Times

Starmer blames councils for scrapping elections

“Sir Keir Starmer has blamed councils for the cancellation of local elections. The Government had justified the delays by claiming that a looming reorganisation of 30 local authorities would have made elections expensive, complicated and unnecessary. However, Labour was accused of disenfranchising voters to avoid a wipeout by Reform UK and the Greens on May 7. The policy was reversed following The Telegraph’s Campaign for Democracy, which called for the delayed elections to go ahead. Asked about the reversal on Wednesday, Sir Keir said: “I think it’s important to remind ourselves that the decision to cancel was a locally-led decision in the sense that each authority could decide.” – Daily Telegraph

Comment

- If Starmer is ousted, Labour could still win the next election. Here’s how that would work – Larry Elliott, Guardian

>Today:

>Yesterday:

BBC argues Trump failed to prove defamation

“Donald Trump failed to show the BBC defamed him in its edit of his Jan 6 speech, the broadcaster said in its argument for his lawsuit to be thrown out. Mr Trump sued the BBC in December seeking $5bn (£4bn) in damages for defamation after The Telegraph revealed a Panorama documentary had edited the speech he gave to his supporters before they stormed the US Capitol building in Washington, DC on Jan 6, 2021. In his legal complaint filed in Miami’s court for the Southern District of Florida, the president described the programme as a “brazen attempt” to influence the outcome of the presidential election between Mr Trump and Kamala Harris, the Democratic candidate.” – Daily Telegraph

Other political news

- Children face review of right to special needs support at 11 – The Times

- Reform UK would bring back two-child benefit cap, says Jenrick – FT

- ‘Tories walking different streets to me,’ says Jenrick – Daily Mail

- Child poverty figures in the UK expected to be revised down – BBC News

- UCL students win £21mn over Covid disruption in watershed UK settlement – FT

- Pubs to stay open til 2am for all World Cup knockout rounds – The Sun

News in Brief

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment22 hours ago

Entertainment22 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports7 hours ago

Sports7 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment13 hours ago

Entertainment13 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World16 hours ago

Crypto World16 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit