Crypto World

Is BTC About to Drop Below $60K?

Analysts are expecting a volatile near-term future for BTC, with some questioning whether new lows are on their way.

Bitcoin went through some intense trading sessions at the end of January and the beginning of February, plunging from over $90,000 to a 15-month low at $60,000 in under ten days. However, it has been rather sluggish since then, mostly trading below $70,000, with little sign of a breakout.

Founder and CIO of MN Fund, Michaël van de Poppe, outlined the recent stagnation, indicating that BTC’s volatility is “the lowest it has been since the crash.” Consequently, he determined that “there’s a big move on the horizon” and outlined his plan for buying or selling.

Sub-$60K or Above $80K?

The volatility on #Bitcoin is the lowest it has been since the crash.

That means; there’s a big move on the horizon.

If we dip, I’ll be a big buyer, for sure.

If we go back upwards, I’ll start taking some profits on a test at $80-85K to be trading the trend.

Volatility is… pic.twitter.com/7Irp4iTzT9

— Michaël van de Poppe (@CryptoMichNL) February 18, 2026

The popular analyst said he would be a “big buyer for sure” if bitcoin dips again. In contrast, he would “start taking some profits” if the cryptocurrency tests the $80,000-$85,000 range.

Merlijn The Trader also weighed in on BTC’s recent performance, highlighting the significance of the current $67,000 level. If lost, the analyst believes $60,000 will come into focus again. His worst-case scenario envisions a massive drop below $50,000 if the February 6 bottom gives in.

BITCOIN IS AT THE CRUX: $67K.

Reclaim $73K the trend repair begins.

Lose $60K liquidity vacuum opens below.Next real demand zone:

$48K–$49K (0.618 retrace)This isn’t volatility.

It’s the market choosing a direction. pic.twitter.com/FQfrBNYrTe— Merlijn The Trader (@MerlijnTrader) February 18, 2026

Glassnode was slightly less bearish, predicting that bitcoin could drop to as low as $55,000 if the landscape worsens again soon.

You may also like:

Year of the Metals

Doctor Profit, who has been among the few analysts to predict BTC’s crash below $100,000 at the end of 2025, said the cryptocurrency now trades around 50% lower than its October all-time high. He noted that “it’s bad to lose money, but it’s even worse to lose it in terms of USD.”

The analyst predicted that 2026 will be the year of precious metals, such as gold and silver. Both assets experienced intense volatility in 2026 as well. Gold, for example, skyrocketed to a new all-time high of $5,600/oz in late January before it crumbled to $4,400 days later. It has managed to rebound to $5,000 as of press time.

Silver, on the other hand, exploded to over $120, dumped to $64, and now sits close to $80. Both metals are slightly in the green on a year-to-date scale, while BTC is deep in the red.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Crypto steadies after selloff while derivatives flash caution signals

Bitcoin and ether (ETH) both rose around 0.9% overnight while the broader altcoin market lagged on Thursday.

BTC was recently trading at $67,000 following a brief touch of $66,000 on Wednesday. Ether, at $1,970 after bouncing off $1,924, is struggling to break through the psychological $2,000 price level.

Volatility has waned since the selloff on Feb. 5. Two subsequent weeks of consolidation have left investors wondering whether this is the calm before another stormy move to the downside, or whether the market is establishing a macro low before rising back toward 2025 levels.

World Liberty Financial’s Mar-a-Lago forum on Wednesday failed to provide a bullish catalyst despite being attended by CFTC Chairman Michael Selig and executives from companies including Goldman Sachs.

From a macro perspective, bitcoin remains in a downtrend since hitting a record high of $126,600 in early October. It has notched a series of lower highs and lower lows with periods of choppy consolidation in between each major move.

Derivatives positioning

- Market dynamics have stabilized with open interest holding at $15.38 billion.

- That marks a transition from a leverage cleanup to a steady floor.

- Retail sentiment shows a subtle rebound with funding rates flipping flat to positive (Binance back at 4%), while institutional conviction remains anchored with the three-month annualized basis persisting at 3%.

- The BTC options market has reached a 50/50 volume equilibrium between calls and puts. While the one-week 25-delta skew has edged up to 12%, the implied volatility (IV) term structure remains in short-term backwardation.

- The front-end spike in the IV curve confirms that traders are still paying a “panic premium” for immediate protection, even as longer-dated tenors stabilize near 49%.

- Coinglass data shows $218 million in 24-hour liquidations, with a 77-23 split between longs and shorts. BTC ($75 million), ETH ($53 million) and others ($22 million) were the leaders in terms of notional liquidations.

- The Binance liquidation heatmap indicates $67,400 as a core liquidation level to monitor in case of a price rise.

Token talk

- The altcoin market is starting to suffer in the low-liquidity trading environment.

- Shares of lost more than 10% of their value after selling off during Wednesday’s event in a classic “sell the news” move.

- Axie Infinity (AXS) is retesting its Feb. 6 lows after falling 5.9% since midnight UTC.

- Lending platform Morpho’s native MORPHO token has now given back all of Wednesday’s gains, trading at $1.39 after shedding 4.2% of its value overnight.

- A whopping 97 of the top 100 cryptocurrencies, not including stablecoins or tokenized gold tokens, are in the red over the past 24 hours as the market remains in “extreme fear” territory.

- The fear and greed index is currently at 11/100, up from February’s low of 6/100.

Crypto World

Why BlackRock is Merging TradFi and Crypto

Before we dig into the corpses of the past, let’s clear the air on what we’re actually talking about. RWA (Real World Assets) is exactly what it says on the tin: taking physical or traditional financial assets (think real estate, gold, treasury bills, or corporate shares) and “tokenizing” them. In plain English, it’s turning a deed to a house or a share of a company into a digital token on a blockchain.

The goal? To make the “un-movable” parts of the real world as liquid and tradable as Bitcoin.

The Market Context: From “Play Money” to Infrastructure

For years, the market review of RWA was a graveyard of questionable pilots and over-hyped whitepapers.

In 2018-2019, Maecenas were the darlings of the “democratized art” movement, making headlines on CNN for tokenizing a multimillion-dollar Andy Warhol painting. The pitch was seductive: own a piece of a masterpiece for a few satoshis. Fast forward to today, and Maecenas is a digital ghost town. Its ART token has effectively flatlined to zero, and the “revolution” stalled because a flashy story couldn’t compensate for a lack of secondary market liquidity and institutional-grade legal custody.

Then there was the Freeway case of late 2022, for instance. It was the ultimate “RWA-lite” cautionary tale. The platform promised eye-watering 43% yields, claiming they were fueled by the “magic” of traditional forex markets and real-world asset management. It had all the buzzwords but zero transparency. When the $160 million ecosystem inevitably froze and its token cratered by 75% in hours, it confirmed everyone’s darkest fears: in the “Wild West” era of RWA, “real-world” was often just a marketing sticker slapped onto a black box.

To be fair, the underlying idea was never stupid. Putting real assets on-chain, making them liquid, borderless, 24/7 tradable, that’s genuinely interesting. The execution, however, was… let’s call it enthusiastic. The barrier to entry for launching an RWA project was essentially “do you have a wallet and a story?” Both requirements were consistently met by people who probably shouldn’t have been trusted with either.

The financial establishment has spent the last decade treating “tokenization” like a petulant child: loud, disruptive, and ultimately ignorable. But as we move deeper into 2026, the numbers have stopped being funny for the skeptics. According to recent projections, the asset tokenization market is hurtling toward $9.43 trillion by 2030 and reach a CAGR of 72.8% from 2025-2030.

The Great Migration: From Volatility to Utility

The irony of 2026 is that the crypto native’s greatest dream is no longer a 100x memecoin, it’s a boring 5% yield on a T-bill that actually belongs to them.

The market is currently in a state of profound exhaustion. We are over-scammed, over-sold, and frankly, bored of “magic internet money” that only trades against other “magic internet money.” There is a desperate hunger for the stability of the S&P 500, but the traditional gatekeepers haven’t made it easy.

Buying “stonks” through a legacy broker in 2026 still feels like using a fax machine. You’re trapped by:

- Geographical Redlining: Your access to the best markets depends on where you were born.

- The 9-to-5 Mirage: Markets that shut down on weekends while the world keeps turning.

- Brokerage Silos: Try moving your Apple shares from one platform to another in real-time. You can’t. They don’t exist as “assets” in your hand; they are just entries in someone else’s database.

This is the “aha!” moment for RWA. True tokenization isn’t just a new way to buy assets; it’s a technological prison break for TradFi. It’s taking the reliability of a stock and giving it the freedom of a stablecoin: self-custody, 24/7 trading, and zero borders.

Look at Tether. They didn’t print USDT, they pivoted into a massive RWA powerhouse, aggressively buying up stakes in everything from plantations 70% stake in Adecoagro, 148 tonnes of gold, and major offline corporations. They are realizing that the ultimate power move isn’t just holding dollars but owning the physical world through a digital lens.

The skepticism of the first RWA project era was justified because they were selling dreams. Today, the industry is selling infrastructure. And as it turns out, the “boring” stuff is where the next $9 trillion is hidden.

The Institutional Land Grab: Why the Giants Woke Up

If Tether is the example of a “crypto-native” moving toward the physical world, the titans of TradFi are moving even faster to colonize the digital one. The conversation has shifted from “if” to “how fast,” driven by three heavyweight examples that prove the plumbing of global finance is being rebuilt:

- BlackRock & BUIDL: With the launch of their first tokenized fund on Ethereum, the world’s largest asset manager signaled that the “petulant child” of tokenization is now the guest of honor. For BlackRock, RWA isn’t a trend; it’s a way to unlock trillions in “dead” capital by moving from slow, 48-hour settlement (T+2) cycles to near-instant, on-chain finality.

- Franklin Templeton: A century-old investment giant that moved its U.S. Government Money Market Fund (FOBXX) onto public blockchain Solana. And they are using it to offer a Treasury-backed asset that can be used as 24/7 collateral, something a traditional bank account could never dream of.

- J.P. Morgan & Kinexys Digital Assets: Through their Kinexys platform, the biggest bank in the U.S. is already processing billions in “tokenized collateral” for repo trades. They realized that by digitizing assets, they could fire the army of middlemen and automate the complex legal dance of shifting ownership with smart contracts.

This leads us to the final realization of 2026: The Infrastructure Flip.

And the big three are moving because:

- Atomic Settlement: The “T+2” delay is a relic of the era of paper certificates. In RWA, the trade is the settlement.

- Programmable Yield: You can’t program a physical plantation or a bond to automatically distribute dividends to 10,000 global investors every hour. A smart contract can.

- Efficiency over Hype: They are eliminating the “intermediary tax” and the fees paid to banks and clearers just to verify that an asset exists.

The skepticism of the Maecenas era was about the assets, because no one knew if Warhol actually existed in a vault. Today, the revolution is about access. The big players aren’t here for the 5% yield; they are here because they’ve realized that the blockchain is a better, faster, and cheaper way to run the world’s financial operating system.

The Risks: The Fine Print of the Future

Before we get too comfortable with this “upgraded” reality, we have to acknowledge that RWA brings a whole new set of failure points. We’ve traded the risk of a “rug pull” for the risk of Regulatory Seizure.

- The Oracle Problem: If a smart contract says you own the gold, but the physical vault is empty, the blockchain is just a sophisticated lie.

- Centralization Risk: If a government decides to freeze a specific RWA contract, your “self-custody” share of an Apple stock is as dead as a frozen bank account.

- Smart Contract Legal Friction: We still don’t have a global court that can “undo” an exploit on a tokenized real estate deed. When the code fails, the legal system is still too slow to catch up.

The Control Paradox: TradFi’s Trojan Horse

Crypto originally dreamed of a world without intermediaries. We wanted a peer-to-peer utopia where the code was the law and the middleman was a relic of the past.

But as the institutions move in, they’ve brought a different message: “The intermediaries are staying. We’re just upgrading our tools.”

If RWA becomes the dominant financial layer, we aren’t heading toward a decentralized nirvana. Instead, we are looking at a Hybrid Reality. Tokenization won’t destroy TradFi; it will simply re-code it. We are moving toward a system defined by:

- On-chain assets backed by off-chain legal enforcement.

- Compliance by default: Less confidentiality and more transparency when real-world monikers are involved.

- Permissioned liquidity pools: High-yield RWA vaults that only let you in once you’ve scanned your passport.

The real question isn’t whether the market will hit $10 trillion. It will. The question is: Who will own the pipes?

My bet? It won’t be the idealists who built Bitcoin in 2009. The winners will be whoever controls three things: the legal wrapper (BlackRock has armies of lawyers), the liquidity (J.P. Morgan moves $10 trillion daily), and the regulatory blessing (Franklin Templeton didn’t ask permission; they co-wrote the rules).

We called RWA a pipe dream because we thought “real world” and “blockchain” were incompatible. Turns out, they’re not. They’re just being merged by people we didn’t expect, in ways we didn’t predict, with outcomes we’re still figuring out. The revolution is here. It’s just wearing a suit.

Crypto World

$27.8B in Unrealized Losses Hit Bitcoin Self-Custody Holders as ETFs Shed $8.5B

ETF capital flight mirrors private wallet stress, suggesting institutions and individuals are reacting to the same pressure worldwide now.

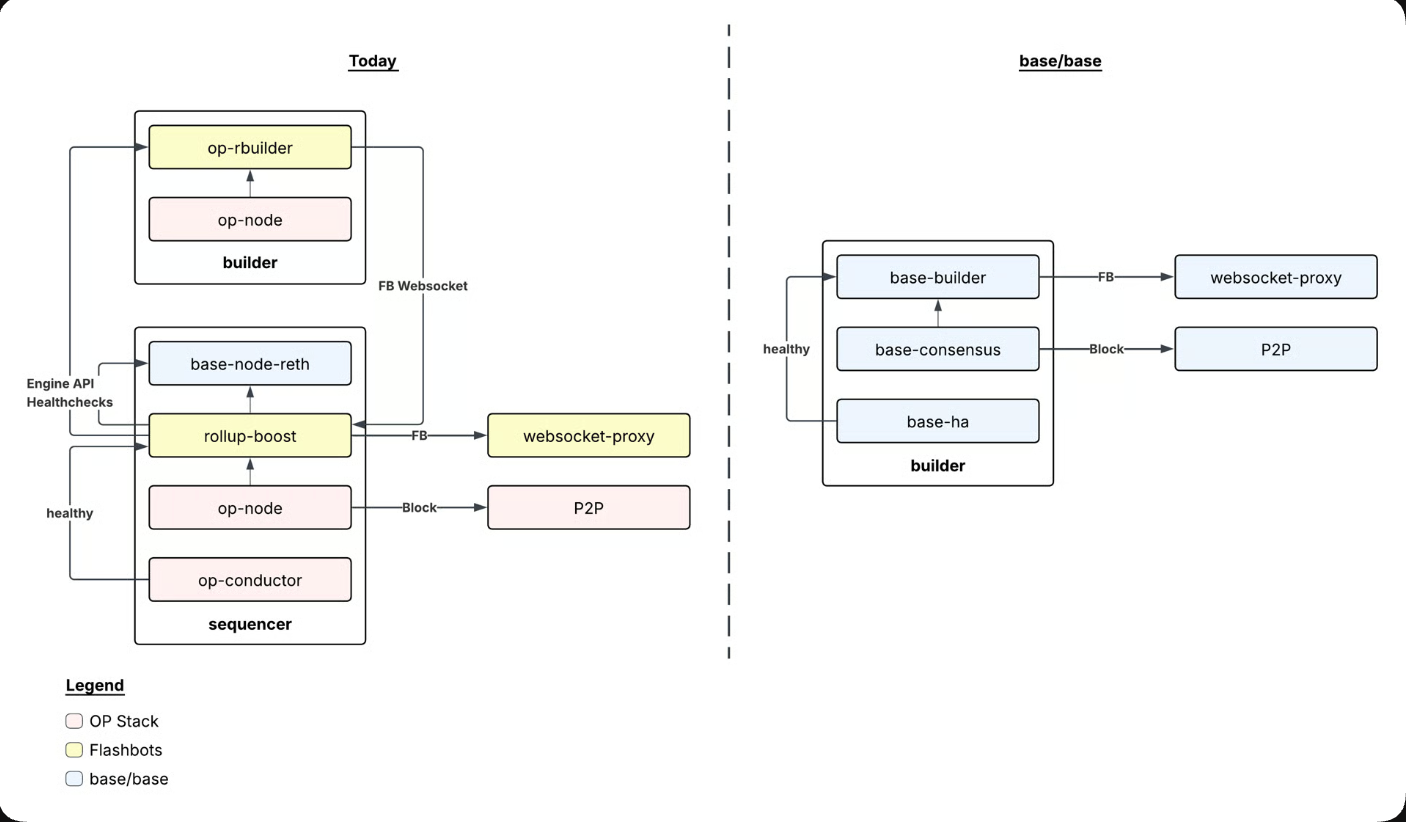

A specific cohort of Bitcoin (BTC) holders practicing strict self-custody is now sitting on a collective unrealized loss of $27.89 billion, a figure that mirrors the financial bleeding seen in the U.S. institutional market, which has seen ETF exposure plummet by two-thirds since late 2024.

The data shows that the sell-side pressure crushing Bitcoin is not just a Wall Street phenomenon but a systemic event equally impacting long-term believers using cold storage.

ETFs and On-Chain Hodlers Share the Same Red

According to a detailed on-chain analysis by GugaOnChain, addresses that self-custody between 10 and 10,000 BTC with a UTXO age of 1 to 3 months are suffering a drawdown of -23.39%, translating to nearly $28 billion in paper losses.

This group, which rejects centralized exchange deposits in favor of hard wallets, has found itself in the same position as the institutional giants trading via CME futures and ETFs. Data shows those U.S. institutional products have shed $8.5 billion since October, with exposure contracting by two-thirds from the 2024 peak. GugaOnChain believes this confluence of stress validates the thesis that the market is “hostage to the same bloodbath,” whether on a trading floor or in a private vault.

Unfortunately, the macro environment suggests relief is not imminent. While three pillars of support, namely accumulators (demand of 371,900 BTC), retail (adding 6,384 BTC monthly), and miners (with an MPI of -1.11), have managed to keep the number one cryptocurrency from an immediate collapse, the analyst views these as mere delays.

Meanwhile, Bitcoin’s price data shows mixed performance across different timeframes, with the asset trading just below $67,000 at the time of writing, down about 1% in 24 hours but slightly positive for the week. The broader trend remains negative, with the asset down about 27% over 30 days and roughly 42% across six months per CoinGlass.

“The recovery? It depends on price reaction at the levels above,” stated GugaOnChain.

Whale Accumulation Meets Retail Hesitation

Despite the pervasive losses, the market is witnessing a stark divergence in behavior that adds complexity to the outlook. While short-term retail demand has cooled significantly, with Alphractal data showing the 90-day net position change for short-term holders dropping rapidly, whales are treating the dip as a fire sale.

You may also like:

Per CryptoQuant, whale holdings have gone up by approximately 200,000 BTC over the past month, climbing from 2.9 million to over 3.1 million BTC. Furthermore, the analytics firm noted that this scale of accumulation was last seen during the April 2025 correction, right before Bitcoin’s rally from $76,000 to past $126,000. This suggests that while “dumb money” may be experiencing panic, “smart money” is preparing for the long term.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Senator Elizabeth Warren Urges Fed and Treasury Not to Bail Out ‘Crypto Billionaires’

U.S. Senator Elizabeth Warren has sent a stark warning to the Federal Reserve and Treasury Department, urging them not to use taxpayer funds to bail out cryptocurrency investors as digital asset markets face renewed volatility.

Summary

- Elizabeth Warren urged the Federal Reserve and Treasury Department not to use taxpayer funds to stabilize cryptocurrency markets, warning it would amount to a bailout for “crypto billionaires.”

- Warren said any intervention could indirectly benefit a crypto venture tied to former President Donald Trump, raising potential ethical and political concerns.

- The senator pressed officials to clarify whether the government has authority to backstop crypto assets, amid heightened market volatility and political scrutiny.

Elizabeth Warren warns against federal crypto bailout

In a letter to Treasury Secretary Scott Bessent and Fed Chair Jerome Powell, Warren argued that any government intervention to stabilize the cryptocurrency market would be “deeply unpopular” and could amount to a transfer of wealth from everyday Americans to “crypto billionaires.””

Warren’s letter, sent amidst a significant downturn in Bitcoin prices, which have fallen roughly 50 % from their October highs, pushes back against pressure for federal agencies to step in to support the embattled sector.

She warned that federal intervention, such as direct asset purchases, guarantees or liquidity support, could disproportionately benefit a small group of wealthy crypto holders, and might even benefit President Donald Trump’s family-linked cryptocurrency venture, World Liberty Financial.

The letter follows questioning by lawmakers during a February 4 hearing, where Congressman Brad Sherman asked Bessent whether the Treasury had authority to bail out Bitcoin or crypto assets.

Bessent responded that the government is “retaining seized Bitcoin” referring to crypto forfeited through law enforcement actions but did not rule out broader intervention. Warren called this response a “deflection” and demanded clear assurances that taxpayer funds would not be used to support crypto markets.

Warren’s stance highlights growing political scrutiny of crypto, particularly in the context of World Liberty Financial, which has been the focus of bipartisan concern. Just days earlier, Warren and Senator Andy Kim urged the Treasury to investigate a reported $500 million investment by the United Arab Emirates in the Trump-linked company, citing potential national security implications.

The pushback against potential bailouts echoes broader debates over how government should respond to crypto market stress and bolsters calls for regulatory clarity and stronger investor protections as digital assets continue to attract mainstream attention — and political controversy.

Crypto World

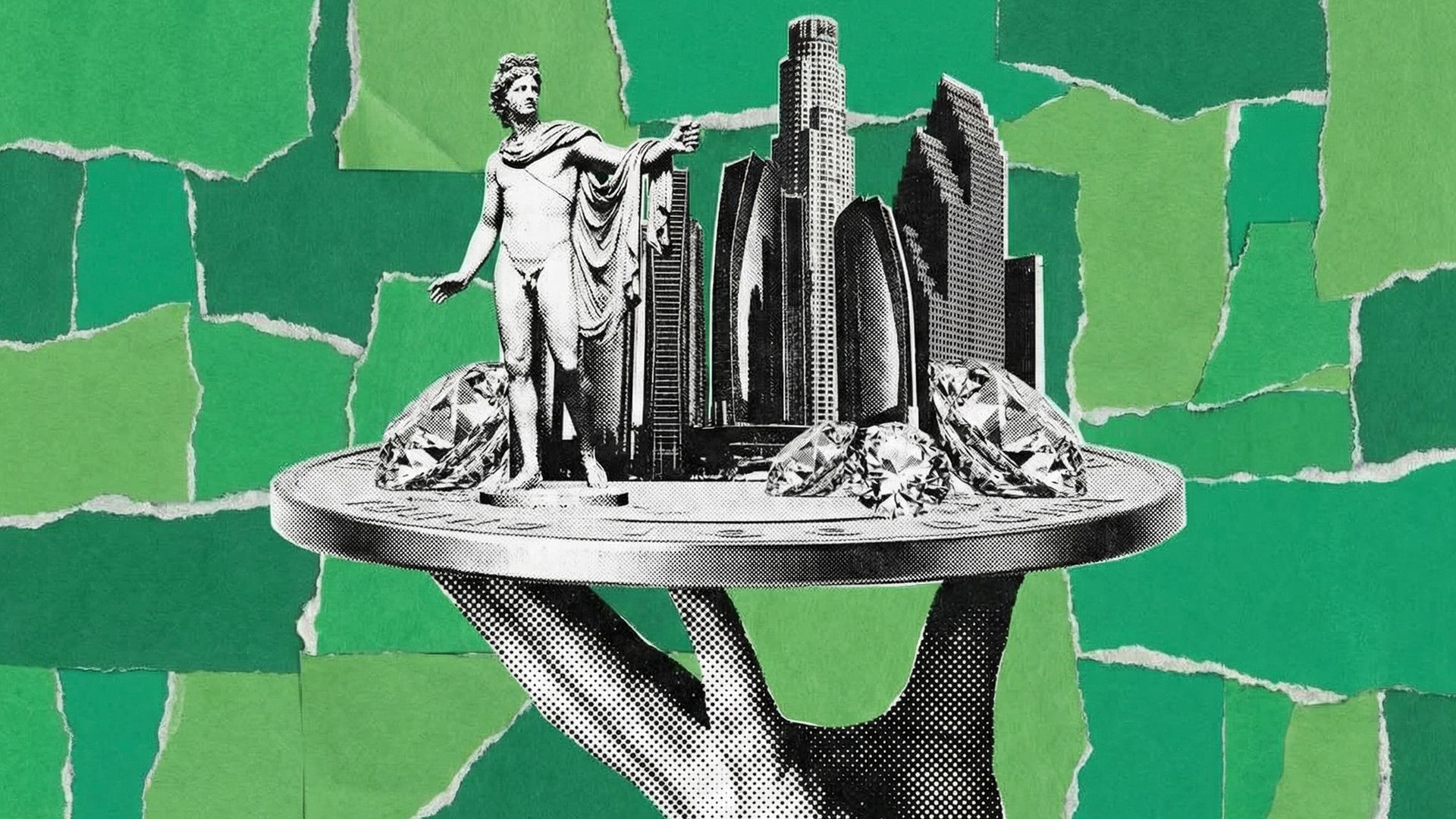

Base To Shift From Optimism Tech Stack to a ‘Unified’ Architecture

Base, the decentralized Ethereum layer-2 scaling network, said Wednesday that it is transitioning from running on Optimism’s L2 tech stack to its own unified software architecture.

Launched in 2023 as an Optimism chain, Base is shifting to its own tech stack to reduce dependence on external service providers and shorten the time to ship new upgrades, according to an announcement from Base. The team said:

“Consolidating into Base changes how Base packages and releases software for the network. We will ship one official distribution for each upgrade: a single Base binary for operating nodes on the network.”

The transition is also expected to simplify the Base network’s sequencer, which helps network validators to order transactions, the Base engineering team said.

The rollout will take place in four phases, according to the project’s roadmap, with node runners required to switch to the new Base client over the next several months for official upgrades.

Related: Base says configuration change caused transaction delays, fixes issue

Ethereum co-founder changes tune on layer-2 scaling networks

Earlier this month, Vitalik Buterin, the co-founder of the Ethereum L1 blockchain network, reversed course on scaling Ethereum through L2s.

L2s are taking longer than initially thought to transition to fully decentralized models, Buterin said, adding that the Ethereum L1 is already scaling on its own and features record-low network fees.

“The original vision of L2s and their role in Ethereum no longer makes sense, and we need a new path,” Buterin said in February.

Buterin’s comments drew mixed reactions from L2 teams, with some agreeing that scaling networks must pivot beyond being a cheaper execution layer for Ethereum.

“It’s great to see Ethereum scaling L1 — this is a win for the entire ecosystem. Going forward, L2s can’t just be ‘Ethereum but cheaper,’” Base founder Jesse Pollak said in response.

Other L2 founders contend that scaling layers are already in alignment with the network’s long-term goals.

There are more than 128 different Ethereum L2 scaling networks at the time of publication, according to L2Beat.

Magazine: Coinbase and Base: Is crypto just becoming traditional finance 2.0?

Crypto World

Retail Investors Hit Record $48 Billion Stock Buying Spree as Institutional Investors Head for the Exit

TLDR:

- Retail investors recorded the largest-ever three-week stock buying spree, surpassing GameStop and 2021 crypto mania levels.

- Household equity allocations reached 45–49%, exceeding the dot-com bubble’s 40% peak by as many as nine percentage points.

- The money market-to-market cap ratio sits at 0.19, matching the 2021 peak and far below the 0.35 threshold for a real market bottom.

- Institutions sold $31 billion in April while Warren Buffett held a record $325 billion cash position, signaling elite-level caution.

Retail investors have funneled $48 billion into equities over just three weeks, marking the largest retail buying spree ever recorded.

This surge surpasses even the GameStop frenzy and the 2021 crypto market euphoria. It also exceeds the retail activity recorded before the 2022 market downturn.

Meanwhile, household equity allocations have reached 45–49%, well above the dot-com bubble’s 40% peak. Several market indicators are now flashing levels not seen since prior major corrections.

Household Allocations and Cash Levels Raise Red Flags

Retail investors are currently allocating a historic share of household wealth to equities. That figure sits between 45 and 49%, surpassing the dot-com bubble’s peak of 40%. The dot-com collapse that followed wiped out trillions in market value across two years.

Crypto analyst Leshka.eth posted on X, noting that the money market-to-market cap ratio stands at 0.19. That matches the exact reading from the 2021 market peak. Analysts typically look for a ratio of 0.35 or higher before calling a real market bottom.

By that measure, the market would need roughly 84% more cash on the sidelines to reach normal levels. The common argument that sidelined cash will rescue equity markets does not hold up against this data. The numbers tell a different story from the bullish narrative.

This pattern mirrors conditions seen before the 2000 and 2008 crashes. In both cases, retail confidence peaked just before institutions began quietly reducing exposure. History shows this sequence has repeated without exception.

Margin Debt and Institutional Behavior Signal Caution

Margin debt has climbed to over $800 billion, approaching record territory. The last two times margin debt peaked at similar levels were March 2000 and October 2007. Both periods preceded market drawdowns exceeding 50%.

The put/call ratio has also dropped to extreme lows. Retail investors are currently buying three times more call options than put options. That level of directional confidence has historically appeared just before sharp market reversals.

Institutional behavior is moving in the opposite direction. According to the same post by Leshka.eth, institutions sold $31 billion worth of equities in April alone, while retail continued to buy. Warren Buffett’s cash position has also reached a record $325 billion.

Past cycles reinforce this concern. In 2022, retail bought $33 billion before a crash and sold $10 billion at the bottom. In 2007, retail equity funds saw $72 billion in inflows, followed by $234 billion in outflows during the crisis. The 2000 peak followed the same script, with record retail flows into tech funds right at the top.

Crypto World

SOL Traders Lose Reasons To Hold As Solana Activity Slumps

Key takeaways:

-

SOL is struggling to hold $80 as a 75% drop in futures’ open interest shows that traders are heading for the exits rather than opening new bets.

-

Solana remains heavily dependent on retail and memecoin activity, while Ethereum maintains its lead in high-value decentralized finance.

Solana’s native token, SOL (SOL), has hit a wall, repeatedly failing to break back above $89 over the last two weeks. This sluggish price action follows a rejection at $145 in mid-January and a sharp drop to $67.60 during the Feb. 6 crash. Demand for bullish leverage has essentially evaporated as traders brace for more pain.

Those betting against SOL are currently paying an annual rate of 20% just to keep their short positions open, a rare and aggressive move. When funding rates remain negative for over a week, it shows bears have strong conviction. In contrast, ETH’s annualized funding rate sat at 1% on Wednesday. While that’s below the usual 6% neutral mark, it’s nowhere near the lopsided levels seen in SOL.

Frustration is mounting as SOL underperformed the rest of the crypto market by 11% over the past 30 days.

Even though SOL remains among the top seven cryptocurrencies by market cap, the 67% slide from its $253 peak in September 2025 has left a mark on both onchain activity and derivatives. In fact, SOL futures open interest has dropped 75% from its $13.5 billion high seen only five months ago.

Solana “death spiral” feared

This price slump is also hurting the decentralized applications (DApps) built on Solana. Revenues are down across the board, from staking and decentralized exchanges to launchpads and lending platforms. Investors are starting to worry about a “death spiral,” in which falling prices reduce incentives, making it harder for people to justify holding SOL for the long haul.

Weekly DApp revenue on Solana dropped to $22.8 million, the lowest since October 2024. Notably, the memecoin launchpad Pump generated $9.1 million in revenue over those seven days, accounting for 40% of the network’s total revenue. In comparison, weekly DApps revenue on Ethereum totaled $16 million, up 2% from the previous month.

Related: Pump.fun rolls out trader cashbacks in tweak to memecoin model

Unlike Solana, the top revenue-generating DApps on Ethereum are Sky, Flashbots, and Aave — key infrastructure players for decentralized finance. Essentially, Solana is heavily dependent on retail onboarding and the memecoin sector, while Ethereum has secured its lead in total value locked (TVL) and use cases that require higher decentralization.

This weak institutional demand is visible in SOL exchange-traded funds (ETFs). Solana’s high transaction volume and second-place TVL haven’t been enough to convince traditional investors to buy into SOL ETFs offered by Bitwise, Fidelity, Grayscale, 21Shares, CoinShares and REX-Osprey.

While relevant, Solana’s $2.1 billion in ETF assets under management is still 86% behind Ethereum’s $15.8 billion. Many investors have lost confidence that demand for Solana DApps will spike anytime soon, likely a side effect of the heavy hype around memecoins and launchpads.

For SOL to regain its bullish momentum, it will likely need a push from sectors like artificial intelligence infrastructure and prediction markets. These areas show promise, but the competition is fierce.

Presently, weak SOL derivatives and Solana onchain metrics are a warning sign. Any further disappointment may trigger another price drop, putting the already shaky $78 support level at serious risk.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Bitcoin ETFs Extend Losses as Solana Funds Keep Ground

US-listed spot Bitcoin exchange-traded funds (ETFs) continued to bleed on Wednesday as market sentiment remained negative and BTC briefly dipped below $66,000.

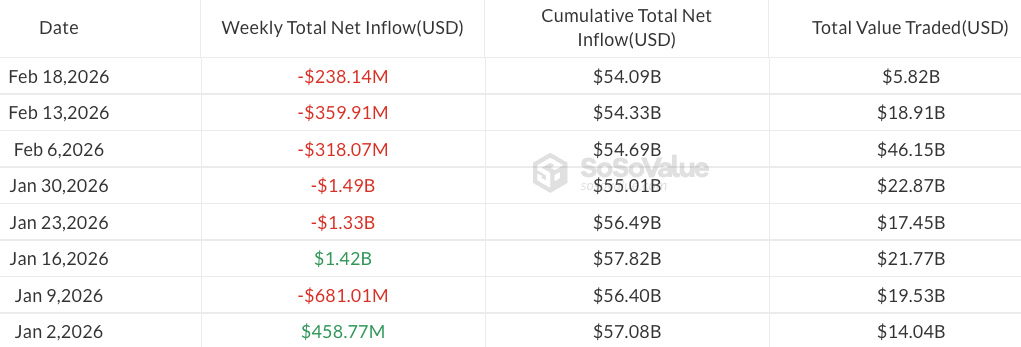

Spot Bitcoin ETFs recorded $133.3 million in net outflows on Wednesday, bringing weekly losses to $238 million, according to SoSoValue data. BlackRock’s iShares Bitcoin Trust (IBIT) led outflows, with over $84 million exiting.

Trading volumes remained subdued at less than $3 billion, highlighting a persistent lack of activity even as analysts had previously noted potential inflection points amid the slowdown in outflows.

If the ETFs fail to recover in Thursday and Friday sessions, this week will mark the first five-week outflow streak for Bitcoin (BTC) ETFs since last March.

Year-to-date, Bitcoin ETFs have seen about $2.5 billion in outflows, leaving assets under management at $83.6 billion.

Solana ETFs keep bucking the trend after launch in late 2025

While Ether (ETH) and XRP (XRP) ETFs posted modest daily outflows of $41.8 million and $2.2 million, respectively, Solana (SOL) funds continued to buck the trend.

Solana ETFs have recorded a six-day streak of inflows, with year-to-date gains totaling around $113 million. Trading activity, however, remains subdued compared with past months, as February inflows of $9 million so far are well below $105 million in January and December 2025’s $148 million.

Since their October 2025 launch, US spot Solana ETFs have accumulated almost $700 million in assets under management, trailing XRP funds, which have amassed $1 billion since their November debut.

Crypto market remains in extreme fear, BTC down 24% year-to-date

The ongoing sell-off in Bitcoin ETFs comes as the Crypto Fear & Greed Index continues to signal persistent negative sentiment.

Even though Bitcoin has slightly recovered from multi-month lows near $60,000 logged in early February, the index has remained mostly in “Extreme Fear” territory.

At the time of writing, Bitcoin traded at $67,058 on Coinbase, down about 24% year-to-date. Analysts at major financial institutions, including Standard Chartered, have predicted that BTC could fall as low as $50,000 before potentially recovering to $100,000 later in 2026.

Related: Bitwise, GraniteShares join race for prediction market-style ETFs

According to the crypto analytics platform CryptoQuant, Bitcoin’s short-term Sharpe ratio has reached levels historically associated with “generational buying zones.”

“The arrows in the chart illustrate this clearly: each prior extreme negative reading was followed by violent recoveries to new highs,” CryptoQuant analyst Ignacio Moreno De Vicente said.

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express

Crypto World

Ledn’s $188M Bitcoin-Backed ABS Deal Enters US Bond Market

Bitcoin-backed loan platform Ledn sold about $188 million of bonds tied to Bitcoin‑collateralized consumer loans into the mainstream asset‑backed securities (ABS) market, Bloomberg reported on Wednesday, citing people familiar with the matter.

In a first-of-its-kind deal, one of the two tranches — the investment‑grade portion — was reportedly priced at a spread of about 335 basis points over a benchmark rate, implying that investors are demanding 3.35 percentage points in extra yield to hold crypto‑linked credit risk rather than conventional consumer ABS.

The deal is structured through Ledn Issuer Trust 2026‑1, which securitizes a pool of 5,441 short‑term, fixed‑rate balloon loans extended to 2,914 US borrowers, backed by 4,078.87 Bitcoin (BTC) held as collateral, according to S&P Global Ratings’ preliminary documentation on Feb. 9.

How the structure and ratings stack up

Balloon loans are structured with relatively small periodic payments and a large lump‑sum “balloon” payment at maturity, which keeps near‑term payments low but leaves a sizeable principal balance due at the end.

S&P assigned preliminary BBB‑ (sf) and B‑ (sf) ratings to the $160 million senior Class A notes and $28 million subordinated Class B notes, respectively.

Related: $25B crypto lending market now led by ‘transparent’ players: Galaxy

A BBB- rating is the lowest tier of investment-grade debt, reflecting an adequate capacity to meet financial commitments but higher vulnerability to adverse conditions than higher‑rated bonds, while B‑ sits in deep non‑investment‑grade “junk” territory, where default risk is materially higher.

Jefferies Financial Group acted as the sole structuring agent and bookrunner, as a major Wall Street dealer intermediated between institutional fixed‑income investors and this new form of crypto‑linked exposure.

BTC increasingly seen as legitimate collateral

Bitwise head of research Europe, Andre Dragosch, told Cointelegraph that the fact that Ledn was able to package these loans into a traditional ABS implied that BTC is “increasingly seen as safe and legit collateral by traditional financial institutions.”

He highlighted major banks like JPMorgan offering BTC-backed loans to customers as a further indication of this. “Bitcoin is increasingly being integrated into traditional finance as the new pristine collateral,” he said.

Jinsol Bok, research lead at Four Pillars global crypto research company, told Cointelegraph that this means liquidity no longer needs to remain locked up and “can instead be expanded into new lending,” adding that the size of the BTC collateralized lending market could “grow far beyond its current level in the future.”

Related: Anchorage–Mezo partnership opens institutional access to BTC-backed loans

He said that unlike real estate mortgages, BTC collateralized loans could be transparently tracked onchain and liquidated in a programmable manner. “For this reason, I believe that the risks associated with ABS in this context do not need to be excessively overstated.”

What investors are buying

Asset‑backed securities are bonds funded by pools of loans, so investors in Ledn’s notes do not own Bitcoin (BTC) directly.

Instead, they take on credit and structural risk to a pool of BTC‑secured loans whose performance depends on borrower repayments and the lender’s ability to liquidate collateral during market stress.

“These loans generally have a low default rate because they tend to have low LTV [loan-to-value] ratios and are well capitalized with BTC,” Dragosch said.

Founded in 2018, Ledn says it has funded over $9.5 billion in loans so far in over 100 countries. The company received a strategic investment from Tether, the issuer of the USDt (USDT) stablecoin, in November 2025.

Cointelegraph reached out to Ledn for comment but had not received a response by publication time.

Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

DOGE price eyes $0.20 if X, CLARITY Act spark breakout above $0.18

DOGE price slips ~1% in 24h, holding $0.09–$0.10 as traders eye X, CLARITY Act.

Summary

- DOGE price is trading around $0.098–$0.099, holding $0.09–$0.10 support but stuck below major MAs and a structural daily downtrend.

- Resistance sits near $0.104–$0.116, with $0.116 flagged as pivotal level aligning with upper Bollinger Band and 50% Fib of January’s drop.

- Base case is range‑bound; break above $0.116 could target $0.15–$0.20, while a clean loss of $0.09 risks a retest of yearly lows.

Dogecoin (DOGE) price is clinging to support just under the $0.10 mark, trading around $0.0988 as meme‑coin bulls try to turn a shaky bounce into a sustained reversal. Analysts describe the move as a “fragile recovery” after DOGE defended key support but failed to break out of its broader downtrend.

Market backdrop and key levels

Dogecoin is changing hands near $0.098–$0.099 today, marginally lower over the past 24 hours as liquidity concentrates around a tight support zone. A recent weekly analysis notes that DOGE “is currently trading at $0.099, staging a recovery attempt after successfully defending a critical support zone,” but stresses that “the daily chart confirms that Dogecoin remains in a structural downtrend.” Technicians flag resistance around $0.104–$0.116, with one wave analysis pointing to $0.1160 as “pivotal resistance,” aligning with the upper Bollinger Band and a 50% Fibonacci retracement of January’s selloff.

Crypto.news warns that the token “dropped to the important support level at $0.100, much lower than this month’s high of $0.1176,” and now trades below all major moving averages, with momentum gauges stuck in bearish territory. In parallel, bitcoin is trading near $66,879, down about 1.2% on the day, while ether changes hands around $2,466, up just under 1% over the same period, underscoring a cautious, range‑bound majors environment.

Catalysts and near‑term outlook

Sentiment hinges on two overlapping narratives: regulatory clarity and big‑tech integration. A recent outlook argues DOGE “could reach $0.20 in February 2026” if market growth, meme‑coin rotation and risk appetite align, but stresses that breaking “significant technical resistance levels” around $0.18–$0.20 with high volume is essential. Separate coverage highlights that DOGE’s recent spikes have tracked rumors around X’s crypto‑trading features and potential payment support, with one desk noting the coin “jumped 15.25% to $0.1113” following X’s trading announcement as volume surged to $1.76 billion on strong whale activity.

For now, the base case is range‑bound: DOGE holding the $0.09–$0.10 floor while facing overhead supply into the low‑$0.11s. A decisive close above $0.116 with expanding volume would open room toward $0.15, while a loss of $0.09 support risks a retest of the yearly lows. Traders watching this compressing range are effectively betting on whether the next major impulse comes from Washington’s CLARITY Act headlines or the next product move out of X.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment22 hours ago

Entertainment22 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports7 hours ago

Sports7 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment13 hours ago

Entertainment13 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World16 hours ago

Crypto World16 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit