Crypto World

AlienWP Relaunches as Alien Wise Play: Expanding Into iGaming News, Casino Reviews, and a New Player Dashboard App

February 2026 — AlienWP.com, a long-established digital platform has officially relaunched as Alien Wise Play, a new independent hub focused on online casino reviews, iGaming news, and player-first safety tools.

The brand’s expansion marks a significant new chapter for the AlienWP domain, bringing its legacy of clarity, transparency, and user-focused guidance into the rapidly growing world of online gaming and digital gambling.

A New Focus on Trust, Transparency, and Smarter Play

Alien Wise Play has been created to help players navigate an increasingly complex online casino landscape, where licensing standards, bonus terms, payout reliability, and player protections can vary significantly between operators.

The platform provides structured casino reviews, clear educational content, and ongoing iGaming news coverage, with a focus on transparency rather than hype.

“At its core, Alien Wise Play is about helping players make smarter decisions online,” said a spokesperson for the project. “The casino space is crowded, and users deserve independent information they can actually trust.”

Introducing the Wise Play Score

A central feature of the new platform is the Wise Play Score, an independent rating system designed to assess casinos based on the factors that matter most to players.

Rather than relying on subjective star ratings or promotional rankings, the Wise Play Score evaluates operators across areas such as licensing, payment reliability, bonus fairness, game quality, and customer support — providing a clear trust-focused score from 0 to 10.

The company emphasised that scores cannot be bought or influenced through commercial partnerships, and that player safety remains the top priority.

Expanding Into iGaming News and Industry Coverage

Alongside casino reviews and rankings, Alien Wise Play is also launching as a growing source of iGaming news, covering major developments across the online gambling industry.

The site will publish updates on licensing changes, operator launches, regulatory trends, and emerging topics such as crypto gaming, responsible gambling tools, and player protection standards.

This broader editorial direction positions Alien Wise Play as more than an affiliate comparison site — aiming instead to become a trusted industry resource for both players and operators.

Future Plans: A Mobile-First Player Dashboard App

Looking ahead, Alien Wise Play confirmed that it is currently developing a new mobile-first web app designed to give players something the industry has long lacked: a personal dashboard to manage online casinos in one place.

The upcoming app will allow users to save favourite casinos, track bonuses, compare platforms using the Wise Play Score, and receive useful alerts.

The platform is being built as a utility layer above casinos, focused on organisation, safety, and informed decision-making.

The app is expected to launch in stages later this year.

About Alien Wise Play

Alien Wise Play is an independent online casino review and iGaming news platform built to promote transparency, player safety, and responsible gambling. The site provides structured casino profiles, trust-based scoring, bonus tracking tools, and educational content to help users play smarter.

Originally launched in 2013 as AlienWP, the platform has evolved into a modern resource focused on the future of online gaming and digital entertainment.

For more information, visit https://alienwp.com

Media Contact

Press & Partnerships

Email: contact@kooc.co.uk

Website: alienwp.com

Crypto World

200M XRP Pulled From Binance

Some analysts note withdrawals can reflect conviction, as traders rarely shift assets off platforms during panic phases suddenly.

XRP holders have moved approximately 200 million tokens off the Binance exchange over the past ten days, according to CryptoQuant contributor Darkfost.

The move comes with the Ripple token trading 27% lower than a month ago, suggesting some investors see current prices as an accumulation opportunity rather than an exit point.

Exchange Outflows Signal Shift in Investor Strategy

Data tracked by Darkfost shows a steady drop in XRP balances held on the world’s largest cryptocurrency exchange by volume. Per the on-chain observer, the XRP supply ratio on the platform fell from 0.027 to 0.025 over ten days, which translates to about 200 million tokens leaving Binance in the period.

Usually, when investors withdraw assets from exchanges, it reduces immediate selling pressure and points to longer-term holding strategies, as tokens moved to private custody are less accessible for quick trades.

“This dynamic therefore suggests that some investors consider current price levels to be attractive from an accumulation standpoint,” Darkfost concluded.

While some movements could reflect internal exchange reallocations, Binance tends to publish its custody addresses, allowing analysts to distinguish between operational adjustments and organic user-driven withdrawals with reasonable accuracy.

The timing of these outflows coincides with a difficult period for XRP holders. The asset has corrected roughly 40% since the start of the year, with the decline pushing it down to a 15-month low near the $1.00 level earlier in the month.

At the time of writing, the Ripple token was trading at around $1.42, down 4.5% in the last 24 hours and 27% over the past month, based on data from CoinGecko. Over a year, XRP has fallen by more than 44% and currently sits 61% below its all-time high of $3.65 reached in July 2025.

You may also like:

Still, the token has risen about 3% in the last week, outperforming the broader crypto market’s 1.4% gain in the same period. Daily trading volume has also climbed about 6% to just over $2.3 billion, a sign of increased activity even with prices slipping.

Market Sentiment Diverges From Price Action

Despite the price pressure, XRP has continued to attract attention from investors and analysts, with Grayscale recently identifying it as the second-most discussed asset in its community after Bitcoin (BTC).

The firm’s head of product and research, Rayhaneh Sharif-Askary, said during Ripple Community Day that clients frequently ask about XRP and related products tied to the Ripple ecosystem.

Additionally, a recent report from CoinShares showed XRP-linked funds drew about $33 million in inflows at a time when crypto investment products associated with heavyweights like Bitcoin and Ethereum (ETH) suffered a fourth straight week of outflows.

Nevertheless, some market observers and traditional financial institutions have tempered expectations about XRP’s performance this year. For instance, banking giant Standard Chartered slashed its year-end XRP price target by 65%, pushing down its forecast from $8.00 to $2.80, citing challenging near-term conditions across digital assets. The firm also lowered forecasts for Bitcoin, Ethereum, and Solana (SOL).

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

eBay Stock Jumps as Company Acquires Depop from Etsy for $1.2 Billion in Cash

TLDR

- eBay is buying Depop from Etsy for $1.2 billion in cash, deal expected to close Q2 2026.

- Depop hit $1 billion in gross merchandise sales in 2025, with ~60% U.S. growth year-over-year.

- eBay stock rose ~6.7% and Etsy stock surged ~16.9% after the announcement.

- eBay beat Q4 estimates: adjusted EPS of $1.41 vs. $1.35 expected; revenue $2.96B vs. $2.88B forecast.

- Etsy originally paid $1.62 billion for Depop in 2021, taking a loss on the sale.

eBay is acquiring secondhand fashion platform Depop from Etsy for $1.2 billion in cash. Both stocks moved sharply higher Wednesday following the announcement.

eBay shares climbed around 6.7% while Etsy stock surged roughly 16.9% in after-hours trading. Both boards unanimously approved the deal.

Depop is a London-based resale platform where buyers and sellers trade secondhand clothing. Nearly 90% of its 7 million active buyers are under 34, making it one of the more Gen Z-heavy platforms in the space.

The platform generated around $1 billion in gross merchandise sales in 2025, with close to 60% U.S. growth year-over-year. It has over 3 million active sellers and 56.3 million registered users.

Why eBay Wants Depop

For eBay, this is a play for a younger audience. CEO Jamie Iannone said Depop fits into the company’s fast-growing “recommerce” category and gives eBay direct access to Gen Z and Millennial shoppers it hasn’t been able to reach at scale.

Etsy is walking away from an investment it made at a higher price. The company paid $1.62 billion for Depop in 2021 as part of a broader “house of brands” push. That strategy has since been unwound, with Etsy also selling off Elo7 and Reverb in recent years.

CEO Kruti Patel Goyal framed the sale as a way to sharpen Etsy’s focus on its core marketplace, calling it “a great outcome for Etsy’s shareholders.”

eBay Q4 Earnings Beat Estimates

eBay also reported Q4 results Wednesday that topped Wall Street expectations on both lines.

Adjusted EPS came in at $1.41, ahead of the $1.35 estimate. Revenue hit $2.96 billion versus the $2.88 billion forecast — up 15% year-over-year.

Q1 guidance was also strong, with eBay projecting adjusted EPS of $1.53 to $1.59 and revenue of $3 billion to $3.05 billion, both ahead of analyst estimates.

What’s Next for Etsy

Etsy reports Q4 2025 earnings Thursday morning. Analysts are expecting EPS of $0.84, which would mark an 18.4% decline from the same quarter last year.

Wall Street holds a consensus Hold rating on Etsy stock, with an average price target of $61.58 — implying roughly 40% upside from recent levels.

The Depop transaction remains subject to regulatory approval, with both companies targeting a Q2 2026 close.

Crypto World

Polymarket’s Lawsuit Could Decide Who Regulates US Prediction Markets

Key takeaways

-

Polymarket’s federal lawsuit against Massachusetts could determine whether prediction markets are regulated solely by the CFTC or also by states.

-

The dispute centers on whether event contracts qualify as financial derivatives under the Commodity Exchange Act or as gambling under state laws.

-

The lawsuit followed state-level actions against platforms like Kalshi, with Massachusetts and Nevada moving to restrict sports-related prediction contracts.

-

A ruling in favor of Polymarket could establish uniform national oversight and prevent a patchwork of differing state regulations.

Prediction markets are platforms where people trade contracts based on the outcomes of future events. Recently, they have been in the news due to a major legal battle in the US over regulatory authority. Central to the dispute is Polymarket’s federal lawsuit against Massachusetts. The outcome of this case could determine whether these markets are regulated exclusively at the federal level or whether states can also enforce their own rules.

This article explores Polymarket’s federal lawsuit against Massachusetts. It examines the broader legal clash over whether prediction markets fall under the exclusive authority of the US Commodity Futures Trading Commission (CFTC) or under state gambling laws. It also analyzes how the case could reshape regulatory control, market access and the future of US event-based trading platforms.

A federal lawsuit with broad implications

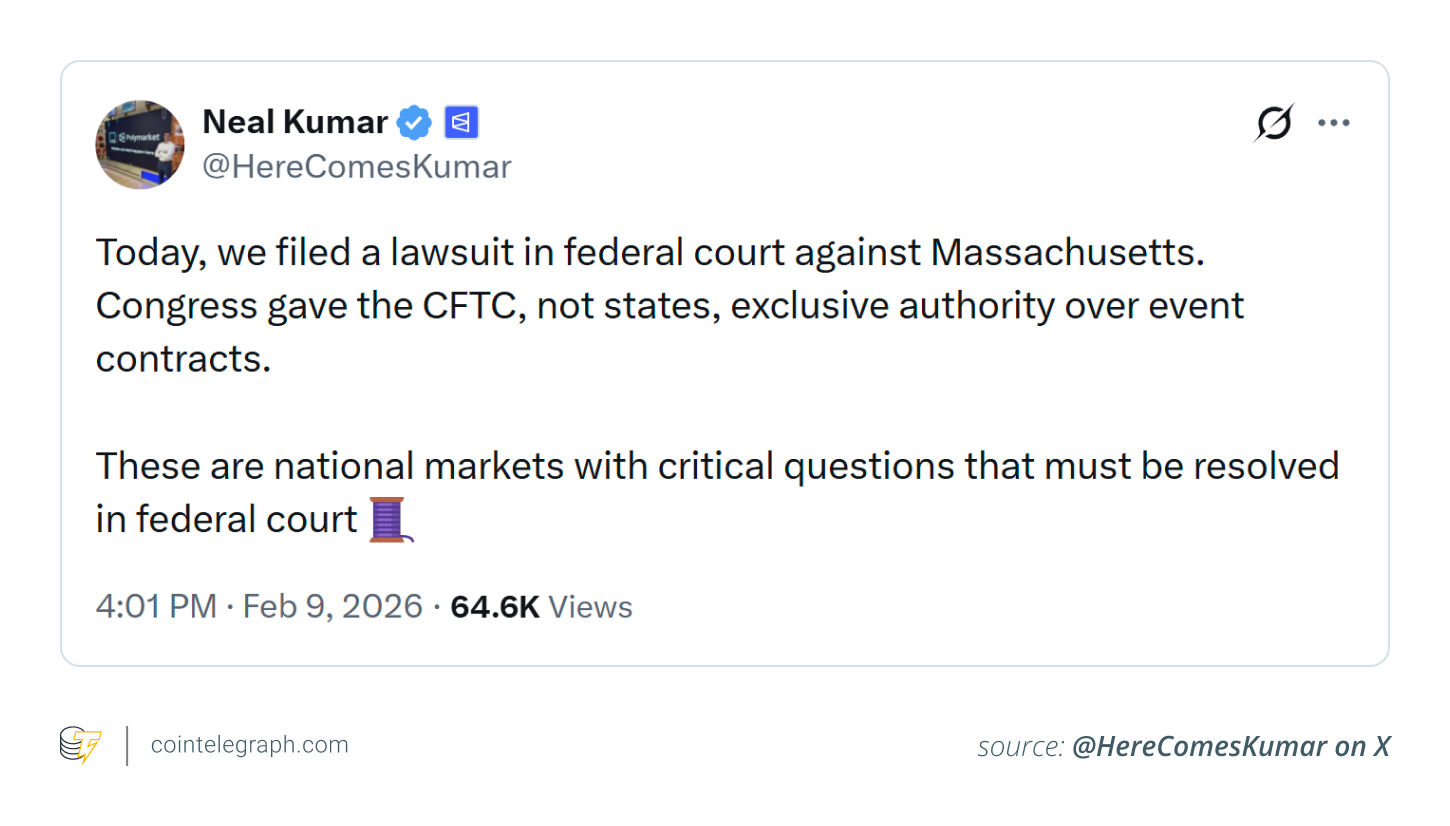

In February 2026, Polymarket filed suit in the US District Court for the District of Massachusetts to preempt enforcement by state regulators that would require it to comply with Massachusetts gambling laws. The company contends that Congress has granted exclusive authority over “event contracts,” the core products of prediction markets, to the CFTC. According to Polymarket, this renders state efforts to stop or limit its operations unlawful.

Polymarket chief legal officer Neal Kumar argues that the dispute involves national markets and that the relevant legal questions should therefore be resolved in federal court. The company opposes piecemeal enforcement by individual states. He said that restricting markets could hinder industry development.

Where it all started: State actions against Kalshi

The lawsuit’s timing was deliberate. It came shortly after Massachusetts courts acted against rival platform Kalshi, blocking sports-related contracts under state gambling laws. A judge upheld a preliminary injunction requiring Kalshi to prevent residents from accessing certain markets without a gaming license. The court directed that these markets be treated as unlicensed sports wagers.

Massachusetts’ approach to prediction markets has received support from similar state-level actions elsewhere. In Nevada, regulators obtained a temporary restraining order against Polymarket’s sports-related offerings, arguing that they violated the state’s sports betting regulatory framework.

Did you know? Corporations have used prediction markets to forecast product launches and internal project deadlines. Some companies quietly rely on employee-based markets because aggregated crowd opinions often outperform traditional executive forecasts.

What is at stake: Federal vs. state authority

The lawsuit centers on a jurisdictional dispute. Polymarket claims its event contracts, whether covering elections, economics or sports, are financial derivatives under the CFTC’s Commodity Exchange Act. In this view, federal law supersedes state gambling statutes, preventing states from independently banning or regulating these markets.

Massachusetts and other states argue that when prediction markets resemble gambling, particularly in the context of sports, they must comply with state gambling frameworks to safeguard consumers and maintain local licensing and age requirements.

If federal courts side with Polymarket, it could strengthen the case for uniform national oversight, preventing a “patchwork” of varying state-level rules or prohibitions. Conversely, upholding state authority would allow states to apply their own gambling laws to platforms operating nationwide.

Did you know? Prediction markets sometimes rival opinion polls in forecasting election outcomes. Universities have studied them for decades as tools for measuring collective intelligence and information efficiency.

Why Polymarket’s lawsuit matters

Prediction markets have experienced growth, with rising trading volumes and visibility. Data tracked by Dune showed that prediction markets recorded about $3.7 billion in trading volume in a single week in January 2026, an all-time high.

As platforms like Polymarket and Kalshi gain mainstream traction, states are pushing to apply protections comparable to those governing traditional gambling. This dynamic has prompted action by multiple states.

The CFTC’s stance has added complexity to the issue. While the federal agency has long regulated derivatives markets, including certain event contracts, it has faced pressure to stay out of specific disputes or to restrict prediction contracts involving war or terrorism.

Did you know? Prediction markets are structured using blockchain smart contracts, automatically settling trades once an outcome is verified. This automation reduces counterparty risk but raises new regulatory and oracle-related challenges.

How jurisdictional disputes are reshaping event contracts

Polymarket’s legal action represents just one element of the broader legal and regulatory disputes surrounding prediction markets across the United States. Courts in jurisdictions such as Massachusetts and Nevada are currently examining the limits of state authority, while federal officials and legislators deliberate over comprehensive guidelines. The outcomes of these proceedings will likely influence how companies structure and offer event contracts.

Whether courts ultimately uphold Polymarket’s federal argument or affirm state authority, the decision will have long-lasting implications for the growth of prediction markets. It will shape user access to these platforms and the balance regulators strike between innovation and consumer protection.

Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

Robinhood Layer-2 Testnet Logs 4 Million Transactions in Crypto First Week

Robinhood loves crypto and really wants to get on-chain as soon as possible.

The company’s new Layer-2 testnet just processed 4 million transactions in 7 days. CEO Vlad Tenev confirmed the milestone, framing the chain as a bridge between traditional finance and on chain markets.

Built on Arbitrum, the network is designed for high throughput financial apps. And the timing is interesting. Even as crypto revenue fell 38% year over year in Q4 2025, Robinhood is doubling down on tokenization and 24/7 trading infrastructure.

They are building for the ‘next cycle’.

Key Takeaways

- Massive Throughput: The testnet logged 4 million transactions in its first week, validating initial network scalability.

- RWA Focus: Built on Arbitrum, the chain is optimizing for tokenized stocks, ETFs, and round-the-clock settlement.

- Infrastructure Pivot: Despite softer crypto revenues, Robinhood is integrating major partners like Alchemy and Chainlink to own the full stack.

Why Is This Surge Significant?

Four million transactions in one week suggests serious developer interest or deliberate stress testing of the network.

Robinhood goal is to build a dedicated lane for institutional grade finance on Ethereum. That means speed, reliability, and compliance ready design from day one.

The timing also fits a bigger pattern. Instead of chasing short term revenue, Robinhood is laying down rails for tokenized assets and round the clock trading.

If tokenization really becomes the freight train Tenev describes, this testnet is the first stretch of track.

Robinhood Built a GOOD Crypto Infrastructure

The network quietly went through six months of private testing before anyone else touched it. Now it is live on testnet. And people are already playing with it.

Developers are building tools focused on tokenized real world assets and onchain finance. Vlad Tenev hinted that the next phase of finance is moving fully onchain.

But here is where it gets interesting.

Users are testing “stock tokens” tied to names like Tesla, Amazon, and Netflix. They get testnet ETH to cover gas and try it out.

Behind the scenes, they brought in serious infrastructure. LayerZero handles interoperability. Chainlink feeds in reliable data. That part matters. Bad oracle or bridge data has wrecked DeFi protocols before. Robinhood clearly wants to avoid that mess.

Traders should expect a mainnet launch later this year, though a specific date remains unannounced. The true test will be whether Robinhood can migrate its massive retail user base onto the chain without friction.

Discover: Here are the crypto likely to explode!

The post Robinhood Layer-2 Testnet Logs 4 Million Transactions in Crypto First Week appeared first on Cryptonews.

Crypto World

Michael Saylor’s Spinal Tap ad says STRC is like a bank account — it isn’t

Michael Saylor used AI to appropriate a famous scene from the mockumentary This Is Spinal Tap to advertise STRC as a competitor to insured savings products like bank accounts and money markets.

STRC is a share of Saylor’s company Strategy (formerly MicroStrategy) that pays non-guaranteed dividends at the sole discretion of the company’s board of directors.

Unlike US bank accounts or money markets that enjoy FDIC, NCUA, or SIPC guarantees against loss, STRC offers no such assurances.

In fact, it’s fluctuated in value over the past 52 weeks from $90.52 to $100.42 — deviating substantially below its $100 par. In the past two weeks, for example, STRC has traded below $94.

In Saylor’s new promotion, a Nigel Tufnel lookalike explains to viewers that earning 0% dividends is “like a normal checking account,” or viewers could “turn it up to 3%” in a money market.

If they want “awesome” dividends, they could turn the dial to 10%, or they could choose STRC at 11%.

Concluding with a call to action and a celebratory chorus, viewers are told they can “stretch your income.”

Saylor has repeated similar comparisons across various broadcast media, even though STRC isn’t any type of insured savings product. Indeed, the brazenness of this new Spinal Tap-themed ad isn’t an anomaly.

Read more: Strategy manager wrong about BTC backing STRC

Months of likening STRC to bank accounts and money markets

“Everybody in the world would love to have a high yield bank account that yielded 10% or more,” Saylor broadcasted on national TV in reference to STRC last September.

“Or they’d love to have a money market that gave them double or triple their normal money market.”

Saylor has repeatedly likened STRC to insured savings products like FDIC-insured bank accounts or SIPC-insured money markets.

His company called STRC “Treasury credit,” even though the common understanding of US Treasury credit is literally risk-free savings bonds — redefining both terms using his ever-expanding dictionary of invented terminology.

The company went on to bury disclaimers about STRC’s “price stability” descriptions on page 90 of its latest earnings presentation where it finely admitted that STRC isn’t a money market fund.

It also admitted that although it plans to continue paying dividends and hopes to encourage traders to keep STRC near its par value, it’s actually “not required to hold any assets to back the STRC Stock.”

Saylor has called STRC his company’s “greatest feat of financial engineering to date.” He once said that Strategy could sell $10 trillion worth of the shares and similar products denominated in foreign currencies.

“They want higher yield than a money market. We designed [STRC] for them,” Saylor said in October. “Who is [STRC] targeted at? There’s $18 trillion of bank accounts.”

Read more: The many weird AI depictions of Michael Saylor

More ‘high-yield savings account’ claims

On the public record, Saylor continued, “You can see the idea of this is a high-yield savings account that just pays twice your normal savings account if you understand and if you believe in bitcoin.”

These quotes are not cherry-picked examples. There are ample, similar examples.

“How many people want a money market that pays them 10% instead of 4%? A lot of people want that. So, we just kind of created something that looks like a money market instrument,” Saylor said at another conference.

In another egregious example, Saylor likened STRC to an FDIC-insured bank account after he calculated the tax-advantaged yield equivalents of STRC’s dividend by state of residence.

“We created a bank account that pays 17-20% by combining digital capital with a digital credit instrument with a digital treasury company that issues securities to pay the dividend,” he declared.

From a stage in Dubai, Saylor said, “When designing STRC, our goal was to create a high-yield bank account-style product.”

He has repeated that claim. “Our goal is to provide you with a bank account that pays you 10% instead of your bank that pays you 4 or 3 or 2 or 0. That’s what STRC is.”

Not a bank account or money market

To be clear, despite Saylor’s promotional statements, STRC is nothing like a bank account or money market.

Indeed, it has no insurance from FDIC, NCUA, SIPC, or otherwise to guarantee its par value.

Strategy isn’t required to hold full assets to back STRC’s par value, isn’t required to maintain any particular pricing or stable value, and isn’t subject to the liquidity requirements of real money market funds.

STRC can and has lost value of its investors’ principal during periods of volatility, trading over 9% below its par value in the past.

Investors don’t have a direct redemption right with Strategy at par value, so they must hope for secondary market traders to bid for shares near par value.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Daily Market Update: Bitcoin Can’t Catch a Break as Middle East Tensions Hit Stocks and Crypto

TLDR

- Bitcoin is on track for its fifth straight weekly loss, last seen in 2022

- BTC is trading below $67,000, down around 3% this week

- Middle East tensions have pushed the U.S. dollar to 97.7 and oil to $65

- U.S. stock futures edged higher Thursday, led by Nasdaq futures up 0.3%

- Walmart reports earnings Thursday as a key read on consumer health

Bitcoin is heading toward its fifth consecutive weekly loss as rising Middle East tensions weigh on crypto markets. U.S. stock futures, meanwhile, are pointing modestly higher ahead of Walmart earnings.

As of Thursday, Bitcoin was changing hands below $67,000, down roughly 3% on the week. A close in the red would mark its longest weekly losing streak since March to May 2022.

Bitcoin peaked near $126,500 in October. It has since fallen more than 50%, with prices dropping as low as $60,000.

The monthly picture is just as bleak. Bitcoin has posted five straight monthly losses since October, making it the second-longest monthly losing streak on record. Only a six-month slide from 2018 to 2019 was longer.

Against gold, Bitcoin has now underperformed for seven consecutive months — its longest stretch on record against the precious metal.

Middle East Tensions Drive Dollar and Oil Higher

Geopolitical pressure is adding to Bitcoin’s woes. Reports say the U.S. has assembled its largest concentration of air power in the Middle East since the 2003 Iraq War.

President Trump has not made a final decision on whether to launch strikes on Iran. Prediction platform Polymarket puts the odds at 27% before the end of February.

The uncertainty has sent the U.S. dollar index to 97.7, its highest point since February 6. WTI crude oil climbed to $65 from a Wednesday low of $62.

A stronger dollar and higher oil prices tend to push risk assets like Bitcoin lower. These macro pressures are compounding an already weak technical setup for the cryptocurrency.

Stock Futures and Fed Minutes in Focus

U.S. stock futures were leaning higher Thursday morning. S&P 500 futures rose 0.2%, Nasdaq 100 futures gained 0.3%, and Dow futures were near flat.

Investors were working through minutes from the Federal Reserve’s January meeting. The minutes showed policymakers are divided, with some raising the possibility of rate hikes due to persistent inflation.

Despite that, market expectations for two rate cuts by the end of 2025 remained largely intact. Traders are also watching weekly jobless claims and pending home sales data due Thursday.

Walmart is reporting before the market opens, with investors using the results to gauge the health of the American consumer. Tariffs are also back in the spotlight after the Trump administration criticized a New York Fed report showing U.S. consumers and businesses are absorbing the cost of tariffs.

Bitcoin’s five-week losing streak, if confirmed at Friday’s close, would be one of its longest sustained downturns since the 2022 bear market.

Crypto World

Cardano (ADA) flashes technical reversal signals following Coinbase integration

- Coinbase has enabled ADA as collateral, boosting liquidity without selling.

- Inverse head-and-shoulders pattern hints at a potential bullish reversal.

- Whale accumulation strengthens confidence in ADA’s near-term outlook.

After the recent surge from around $0.24, Cardano (ADA) has struggled around the $0.27–$0.28 range for several weeks now.

However, recent developments and chart patterns signal a possible breakout.

Coinbase integration boosts ADA utility

One of the main factors driving renewed interest is the announcement that Coinbase now allows ADA to be used as collateral for loans.

This new feature allows users to borrow up to $100,000 in stablecoins without selling their ADA holdings.

Investors who want liquidity but wish to retain their ADA can now do so, thereby avoiding potential taxable events associated with selling.

This feature is especially appealing in volatile markets where traders want flexibility without exposing themselves to full downside risk.

It also underscores ADA’s growing real-world utility. Holding ADA is no longer just a speculative play; it can now serve as a financial instrument.

Large holders, often referred to as whales, may be particularly motivated by this.

Using ADA as collateral encourages them to maintain or even increase their positions.

This kind of activity often reduces supply pressure and stabilises the token in periods of uncertainty.

Moreover, as more users access these loans, the network effect could drive broader adoption across crypto platforms.

It positions ADA as a more functional and versatile asset, strengthening its market presence.

Technical signals suggest a possible reversal

At the same time, ADA’s charts are showing promising signs that a reversal may be in play.

Trading volume has sharply declined over recent months, reaching a multi-month low.

While falling volume often indicates waning interest, in this case, technical indicators suggest something more nuanced.

An inverse head-and-shoulders pattern has started to form, which is typically a bullish signal.

The Relative Strength Index (RSI) also shows divergence, suggesting that the selling pressure is easing and buyers may be stepping in.

If ADA can push above the $0.30 resistance level, it could ignite a rally toward $0.40 or even higher.

Support around $0.27 is now critical; a drop below this level could erode bullish momentum and delay any breakout.

A further slide below $0.22 would indicate that the reversal pattern has failed, potentially opening the door to extended losses.

Even with short-term uncertainty, the combination of technical patterns and Coinbase integration is creating cautious optimism among traders.

Whales are also accumulating the altcoins.

On-chain data from Santiment shows that large holders have been steadily increasing their ADA positions, often a sign that strong hands are preparing for a sustained move higher.

Historically, such accumulation tends to precede upward price momentum once market conditions improve.

The alignment of technical signals, increased utility, and investor confidence could make the coming weeks critical for ADA’s trajectory.

For traders and holders, these developments suggest that Cardano may be on the verge of breaking out from its current consolidation phase.

Crypto World

Morgan Stanley, Top Holders Boost Bitmine Exposure Amid Sell-Off

Bitmine Immersion Technologies (BMNR) (EXCHANGE: BMNR) remains a central node in corporate crypto treasury strategies as its Q4 2025 13F filings show a broad-based uptick in holdings among the top shareholders, even as the crypto market endured a broader crash and the stock underperformed. Morgan Stanley, the largest reported holder, lifted its stake by about 26% to more than 12.1 million shares, valued at roughly $331 million at quarter-end, according to its Form 13F filing with the U.S. Securities and Exchange Commission. ARK Investment Management followed with a roughly 27% increase to over 9.4 million shares, worth around $256 million. The moves underscore a divergent dynamic in which major asset managers deploy capital into a prominent Ethereum treasury specialist even as price action remains challenging for the sector. Ether (ETH) (CRYPTO: ETH) and other treasury-driven strategies are at the forefront of this activity, illustrating how institutional players view long-term relevance amid volatility.

The momentum isn’t isolated to these two institutions. A wider cohort of blue-chip managers also expanded exposure in BMNR during the quarter. BlackRock’s stake surged by 166%, Goldman Sachs’s position jumped 588%, Vanguard increased by 66%, and Bank of America’s exposure soared by a staggering 1,668%, according to the same filings. Collectively, these moves reinforce a narrative of growing institutional curiosity toward corporate treasuries that accumulate and manage Ether holdings as a strategic reserve. The trend aligns with discussions across the market about ESG- and yield-forward treasury management, even as macro liquidity and risk sentiment oscillate.

Further reinforcing the trend, the top 11 shareholders reportedly raised exposure during Q4 2025, including names such as Charles Schwab, Van Eck, the Royal Bank of Canada, Citigroup and Bank of New York Mellon Corporation, based on official filings compiled by observers tracking 13F data. The breadth of buying activity within BMNR’s cap table points to a broad confidence among large institutions that the company’s Ether positions can endure and potentially appreciate over longer horizons, even when near-term prices have pulled back. The aggregate effect is a market where large investors appear to view BMNR as a vehicle for exposure to Ethereum treasury strategies rather than as a proxy for traditional equity beta.

BMNR’s stock, however, has not mirrored this institutional enthusiasm. The shares declined by roughly 48% in the fourth quarter of 2025 and have fallen about 60% over the preceding six months. In premarket trading, BMNR hovered near $19.90, underscoring a disconnect between the capital being deployed by incumbents and the day-to-day price action in the stock market. This divergence has prompted ongoing discussion about the company’s financing flexibility, particularly as it relates to its market net asset value, or mNAV, a metric that contrasts enterprise value with the market value of its crypto holdings. Data tracked by Bitmine monitoring services indicate that the mNAV remained above 1, a sign that the firm retains capacity to raise capital by issuing new shares if needed, supported in part by sustained institutional ownership.

Beyond the equity narrative, BMNR’s treasury strategy remains deeply anchored in Ether purchases and accumulation. In the past week, the company added 45,759 Ether for approximately $260 million, at an average cost basis of around $1,992 per ETH. This ongoing accumulation reinforces BMNR’s status as a leading corporate holder of Ether, a position publicly noted by analysts and tracked by data providers. In aggregate, the company now holds about 4.37 million Ether on its books, worth roughly $8.69 billion at current valuations, according to the StrategicEthReserve dataset. This concentration of Ether on a corporate balance sheet is characteristic of a broader trend where treasuries seek to diversify risk and inflationary pressures by maintaining sizable crypto stacks as strategic assets rather than pure speculative bets.

These developments come as the market navigates a period of heightened volatility and structural shifts in crypto liquidity and custody. While the broader sector has faced drawdowns, the continued accumulation by blue-chip institutions suggests a longer-run thesis in which Ether plays a central role in diversified treasury strategies. Bitmine’s ability to maintain an mNAV above 1—supported by strong institutional ownership—illustrates how the market is increasingly valuing the capacity to deploy capital into Ether holdings without immediate dilution or financing constraints. The data underpinning these conclusions rely on multiple sources, including 13F filings and independent trackers, which collectively provide a window into the evolving dynamics between public market perception and private treasury strategies.

For readers tracking the governance and strategic implications of Bitmine’s approach, the company’s Ether-heavy balance sheet remains a focal point. The combination of rising institutional ownership and persistent buybacks or capital raises could shape how the market evaluates Ether exposure within corporate treasuries over the coming quarters. As the market continues to digest these developments, observers will be watching how BMNR balances liquidity, financing flexibility, and the ability to sustain or adjust its Ether purchases in response to price movements, regulatory signals, and evolving investor expectations.

https://platform.twitter.com/widgets.js

Why it matters

The quarterly inflows from top-tier institutions into BMNR underscore a broader trend: major asset managers are increasingly comfortable aligning with corporate treasury strategies that emphasize Ether as an ongoing hold, not merely a speculative asset. This dynamic supports a narrative where Ether moves beyond a retail-driven hype cycle and becomes a component of risk-managed corporate portfolios. The fact that the mNAV remains above 1 suggests management can pursue additional Ether purchases or liquidity-friendly financings without necessarily triggering dilution worries, a factor that reduces external funding frictions in a volatile market.

From a market structure perspective, the concentration of Ether within a handful of corporate treasuries can influence price discovery and liquidity in the broader Ethereum ecosystem. While stock prices for BMNR have faced a substantial pullback, the ongoing accumulation by entrenched institutions indicates a differentiated view of the asset’s long-term value proposition. For investors and builders in the crypto space, the trend highlights the continued institutionalization of Ether as a treasury asset category, with governance, custody, and risk management practices likely to mature further as more firms participate.

On regulatory and policy grounds, the uptick in 13F disclosures around BMNR is part of a larger disclosure regime that provides visibility into how institutions structure their crypto exposures. This transparency helps investors assess risk, liquidity, and capital allocation strategies in a sector that remains under tight scrutiny in several jurisdictions. While the market environment remains unsettled, the clear signal from these filings is that large financial institutions see strategic merit in backing corporate treasuries that actively manage Ether holdings, even when the broader market is pressured.

What to watch next

- BMNR’s Q1 2026 13F filings to reveal whether institutions maintain or adjust their positions as Ether prices fluctuate.

- Any additional Ether purchases by BMNR and the impact on mNAV and financing options.

- Regulatory developments affecting crypto treasury strategies or corporate disclosures for digital asset holdings.

- Price action in Ether and broader Ethereum-related products that could influence treasury strategies across the sector.

Sources & verification

- Morgan Stanley 13F Q4 2025 filing confirming stake of over 12.1 million BMNR shares (EXCHANGE: BMNR) and a value near $331 million — 13f.info.

- ARK Investment Management 13F Q4 2025 filing showing a stake of about 9.4 million BMNR shares worth roughly $256 million — 13f.info.

- Bank of America 13F filing for Q4 2025, confirming exposure to BMNR — SEC filing: xslForm13F_X02/Q4202513fhr.xml.

- Bitmine tracker data indicating the mNAV remains above 1 and tracking institutional ownership — https://www.bitminetracker.io/.

- StrategicEthReserve data showing BMNR holds 4.37 million Ether (ETH) valued at approximately $8.69 billion — https://www.strategicethreserve.xyz/#.

Rewritten Article Body

Institutional bets sustain Bitmine’s Ether treasury even as price retreats

Bitmine Immersion Technologies (BMNR) (EXCHANGE: BMNR) has drawn renewed attention from the wallet of large-cap fund managers, as its Q4 2025 13F filings reveal a broad-based expansion in ownership among the top shareholders despite a crypto-market downturn and a steep slide in the stock price. Morgan Stanley, the most prominent disclosed holder, raised its stake by roughly 26% to more than 12.1 million shares, a position valued at about $331 million at quarter-end. ARK Investment Management followed with an approximately 27% increase to just over 9.4 million shares, equating to around $256 million in value. These moves, captured in the quarterly forms now on public record, signal a continued institutional tilt toward Bitmine’s Ethereum treasury positioning even as general market sentiment remains cautious. (EXCHANGE: BMNR) (CRYPTO: ETH)

Beyond these two heavyweights, a broader suite of institutions intensified their exposure to BMNR in the quarter. BlackRock’s stake surged by 166%, Goldman Sachs’s by 588%, Vanguard by 66%, and Bank of America by an astonishing 1,668%. The cluster of purchases underscores a deeper institutional conviction that Ether-based treasury strategies can function as a long-horizon component of a diversified balance sheet, particularly for entities seeking to anchor liquidity in a volatile market. The filings also show that the top 11 shareholders, including Charles Schwab, Van Eek, Royal Bank of Canada, Citigroup and Bank of New York Mellon, expanded their positions, suggesting a broad consensus among asset managers about BMNR’s strategic approach to Ether exposure and treasury management.

However, the market performance narrative remains separate from these portfolio moves. BMNR’s stock price declined about 48% in Q4 2025 and roughly 60% over the prior six months, trading near $19.90 in premarket action. The price action contrasts with the resilience implied by the mNAV, a metric that compares enterprise value to crypto holdings and can indicate financing flexibility. Bitmine-tracking services indicate the mNAV stayed above 1, a threshold that can ease the process of raising new capital through equity issuance, thereby supporting continued treasury activity without immediate dilution fears. The juxtaposition of robust institutional inflows with a declining stock price highlights a common theme in crypto corporate finance: markets can discount near-term price volatility while institutions bet on longer-term structural value in the underlying treasury strategy.

Concurrently, Bitmine intensified its Ether accumulation. In the past week alone, the company added 45,759 Ether for roughly $260 million, at an average cost basis of around $1,992 per ETH. This cadence of purchases cements Ether as a cornerstone of Bitmine’s treasury stack, aligning with its broader position as the world’s largest corporate holder of Ether—4.37 million ETH, valued at approximately $8.69 billion, according to StrategicEthReserve data. That scale places Bitmine at the vanguard of corporate custody, illustrating how large holders approach risk and revenue potential in a market that continues to rehearse inflationary and macroeconomic concerns.

The trajectory of these holdings, alongside the mosaic of 13F disclosures, points to a market where public equity dynamics and crypto treasury strategies can diverge meaningfully. Institutional confidence in BMNR’s approach appears to rest not on day-to-day price swings but on the ability to sustain a disciplined, growth-focused Ether program that could weather downside scenarios while remaining positioned for upside in a longer horizon. Observers will monitor whether this institutional appetite translates into greater liquidity, more favorable financing terms, or additional capacity to accumulate Ether in the quarters ahead, particularly as macro conditions evolve and Ethereum-specific catalysts emerge.

Crypto World

Why Humans May Not Be the Real Users of Crypto

Haseeb Qureshi, managing partner at Dragonfly, argues that crypto’s persistent friction stems from a deeper mismatch: its architecture appears better aligned with artificial intelligence (AI) agents.

In his view, many of crypto’s perceived failure modes are not design flaws but signals that humans were never the ideal primary users.

Sponsored

The Human-Crypto Disconnect

In a detailed post on X, Qureshi argued that a fundamental divide exists between human decision-making and blockchain’s deterministic architecture. He said the early vision of the industry imagined a world where smart contracts would substitute legal agreements and courts, with property rights enforced directly on-chain.

That shift, however, has not materialized. Even crypto-native firms such as Dragonfly still rely on conventional legal contracts.

“When we sign a deal to invest into a startup, we don’t sign a smart contract. We sign a legal contract. The startup does the same. Neither of us are comfortable doing the deal without a legal agreement…In fact, even in the cases where we have an on-chain vesting contract, there’s usually also a legal contract in place,” he said.

According to Qureshi, the issue is not technical failure but social misalignment. Blockchain systems function as designed, yet they are not structured around human behavior and error. He also contrasted this with traditional banking, which has evolved over centuries to account for mistakes and misuse.

“The bank, terrible as it is, was designed for humans,” he added. “The banking system was specifically architected with human foibles and failure modes in mind, refined over hundreds of years. Banking is adapted to humans. Crypto is not.”

He added that long cryptographic addresses, blind signing, immutable transactions, and automated enforcement do not align with human intuition about money.

Sponsored

“That’s why in 2026, it’s still terrifying to blind sign a transaction, to have stale approvals, or to accidentally open up a drainer. We know we should verify the contract, double-check the domain, and scan for address spoofing. We know we should do all of it, every time. But we don’t. We’re human. And that’s the tell. It’s why crypto always felt slightly misshapen for us,” the executive remarked.

AI Agents: Crypto’s True Natives?

Qureshi suggested that AI agents may be more naturally suited to crypto’s design. He explained that AI agents do not fatigue or skip verification steps.

They can analyze contract logic, simulate edge cases, and execute transactions without emotional hesitation. While humans may prefer the legal systems, AI agents may favor the determinism of code. According to him,

“In that sense, crypto is self-contained, fully legible, and completely deterministic as system of property rights around money. It’s everything an AI agent could want from a financial system. What we as humans see as rigid footguns, AI agents see as a well-written spec…Even legally, our traditional monetary system was designed for human institutions, not AIs.”

Sponsored

Qureshi forecasted that the crypto interface of the future will be a “self-driving wallet,” entirely mediated by AI. In this model, AI agents manage financial activities on behalf of users.

He also suggested that autonomous agents could transact directly with each other, positioning crypto’s always-on, permissionless infrastructure as a natural foundation for a machine-to-machine economy.

“I think it’s this: crypto’s failure modes, which always made it feel broken for humans, in retrospect were never bugs. They were simply signs that we humans were the wrong users. In 10 years, we will look back at amazement that we ever subjected humans to wrestle with crypto directly,” Qureshi stressed.

Still, he cautioned that such a shift would not occur overnight. Technological systems often require complementary breakthroughs before reaching mainstream relevance.

“GPS had to wait for the smartphone. TCP/IP had to wait for the browser,” Qureshi noted. “For crypto, we might just have found it in AI agents.”

Sponsored

Recently, Bankless founder Ryan Adams also argued that crypto adoption has stalled due to poor user experience. However, he suggested that what appears to be “bad UX” for humans may actually be optimal UX for AI agents.

Adams predicted that billions of AI agents could eventually drive crypto markets beyond $10 trillion.

“In a year or two there’ll be billions of agents, many with wallets (then a year later they’ll be trillions). The “AiFi narrative” is underground like defi was in 2019. The dry tinder is quietly collecting but at some point it will ignite. No one is paying attention to crypto now because price is down…but i believe AI agents will scale to trillions of crypto wallets. AiFi is the next frontier of DeFi,” the post read.

The machine-native crypto thesis is powerful, but real constraints remain. AI agents may transact autonomously, yet liability still ultimately rests with humans or institutions, keeping legal systems relevant.

Deterministic smart contracts reduce ambiguity but do not eliminate exploits, governance failures, or systemic risk. Lastly, an argument could also be made that if AI becomes the primary interface, crypto may fade into backend infrastructure rather than function as a parallel financial order.

Crypto World

World Liberty Financial Partners With Securitize and DarGlobal to Tokenize Trump Maldives Resort

TLDR:

- WLFI partners with Securitize and DarGlobal to tokenize Trump International Hotel & Resort, Maldives.

- The tokenized offering gives everyday investors exposure to income distributions and asset value changes.

- The initial offering will be issued on public blockchains with access via select third-party wallets.

- Eligible users can collateralize holdings and borrow through WLFI Markets where permitted by law.

World Liberty Financial (WLFI) has announced plans to tokenize Trump International Hotel & Resort, Maldives. The initiative is a three-way partnership with Securitize, Inc. and DarGlobal PLC (LSE: DAR).

This move marks the start of WLFI’s broader strategy to structure and distribute tokenized real-world asset offerings.

The resort, a luxury hospitality development scheduled for completion in 2030, will feature roughly 100 ultra-luxury beach and overwater villas.

WLFI Opens Real Estate Investment to a Broader Audience

The tokenized offering aims to give investors direct exposure to a prime Maldivian hospitality asset. Investors stand to gain from both potential income distributions and changes in asset value. The offering is structured within a regulated securities framework, adding a layer of investor protection.

WLFI co-founder Eric Trump spoke on the vision behind the announcement. He noted that the platform was built to open decentralized finance to a wider audience.

Trump said, “We built World Liberty Financial to open up decentralized finance to the world. With tokenized real estate, we’re now extending that access to what we do best.”

He further stressed the importance of retail participation in high-value assets. “For the first time, everyday investors can gain access to an iconic property like Trump International Hotel & Resort, Maldives and can be part of its success,” Trump added. He also confirmed that future tokenized offerings are in the pipeline as the platform scales.

The resort was developed by DarGlobal in collaboration with The Trump Organization. DarGlobal is listed on the London Stock Exchange and operates as an international luxury real estate developer. The Maldives property serves as the flagship asset in this initial round of tokenization.

Securitize and DarGlobal Outline the Structure of the Deal

Securitize, a leading platform for tokenizing real-world assets, is handling the compliance and governance side of the deal.

CEO Carlos Domingo acknowledged the longstanding challenge of bringing real estate on-chain. He stated, “Real estate has been one of the hardest asset classes to tokenize effectively.”

Domingo further explained the rationale behind the partnership’s design. “We believe the first scalable on-chain real estate products will be globally sought-after properties issued with compliance, governance, and market structure in mind,” he said. He confirmed that this partnership with WLFI is structured precisely to meet that standard.

DarGlobal CEO Ziad El Chaar described the collaboration as a turning point for real estate investment. He said, “Together, we are rethinking how global investors can access, trade, and ultimately gain liquidity in high-quality real estate as it is being developed.” El Chaar also pointed to WLFI’s investor network as a major advantage for expanding market participation.

The initial offering is expected to be issued on supported public blockchains. Access will be enabled through select third-party partners and wallets, subject to applicable requirements.

Additionally, the parties plan to support on-chain utilities, including the ability for eligible users to collateralize holdings and borrow through WLFI Markets, where permitted by law.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment23 hours ago

Entertainment23 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports9 hours ago

Sports9 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment15 hours ago

Entertainment15 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World18 hours ago

Crypto World18 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

Funding: $5.77 Billion

Funding: $5.77 Billion