NewsBeat

Judi Dench says she can no longer leave home alone due to deteriorating eyesight | Ents & Arts News

Dame Judi Dench has revealed she can no longer leave her house alone due to her deteriorating eyesight.

The 90-year-old actress has macular degeneration, a condition which leads to a gradual loss of vision.

In a new interview on Trinny Woodall’s Fearless podcast, Dame Judi says “somebody will always be with me” when she leaves the house.

“I have to [have someone] now because I can’t see,” she continues. “And I will walk into something or fall over.”

Reflecting on how she used to feel about attending events alone, Dame Judi said she was “no good at that at all”.

“And fortunately, I don’t have to be [alone] now because I pretend now to have no eyesight,” she laughs.

In July 2023, Dame Judi said she was determined to work “as much as I can” despite her health issues.

“I mean, I can’t see on a film set anymore,” she told The Mirror’s Notebook magazine. “And I can’t see to read. So I can’t see much. But, you know, you just deal with it. Get on.”

Dame Judi’s acting career began in the 1950s when she made her stage debut in a production of Hamlet at London’s Old Vic theatre.

In the decades since, she’s conquered the worlds of TV and film, winning an Oscar for her role in the 1998 movie Shakespeare In Love and, more recently, playing the head of MI6, M, alongside Daniel Craig’s James Bond.

More entertainment news:

Sting cancels shows on doctor’s advice

The Brutalist director defends using AI

Dame Judi has also cemented herself as one of the UK’s best stage actresses, winning a string of Olivier awards for starring roles in plays including The Winter’s Tale and Macbeth.

Her most recent screen credit was in 2022, for a small role in Christmas film Spirited. She has continued to make public appearances and last October, she was a speaker at the Cheltenham Literary Festival.

NewsBeat

Bloc may consider UK joining pan-Europe customs area

The new European Union trade chief responsible for post-Brexit negotiations has told the BBC that a “pan-European [customs] area is something we could consider” as part of “reset” discussions between the UK and EU.

Maros Sefcovic was referring to the idea, backed by some UK business groups, of Britain joining the Pan-Euro-Mediterranean Convention (PEM).

The PEM allows manufacturers to use parts or ingredients from dozens of countries, from Iceland to Turkey, in tariff-free trade.

The previous Conservative government chose not to pursue PEM as part of its post-Brexit trade deal, but some businesses say it will help Britain rejoin complex supply chains that have been hit by customs barriers.

Speaking at the World Economic Forum in Davos, Mr Sefcovic said the idea has not been “precisely formulated” by London yet and the “ball is in the UK’s court”.

The BBC understands that the UK government has begun consultations with business over the benefits of the PEM plan that could help cut red tape and improve trade. No final decision has been made yet.

Mr Sefcovic also said that a full-scale veterinary agreement that helped reduce frictions on farm and food trade would also require review.

The EU-UK fisheries deal is also due to expire next year. “A solution for fisheries is very important for the EU, again, we communicated this on multiple occasions”.

Single market treatment for UK food and farm exports would mean “we would have to have the same rules and we have to upgrade them at the same time, we call it dynamic alignment”.

Mr Sefcovic also said he was surprised that the European Commission’s offer on youth exchanges had been “spun”. “It’s not freedom of movement. It’s a bridge-building proposal.

“We do not want to look like the demanders here, because we believe this is good for the UK,” he said

The trade commissioner said UK-EU relations were “definitely” in a better place and his British counterpart Nick Thomas-Symonds was “on speed dial”.

Prime Minister Sir Keir Starmer will attend a defence and security focused EU summit next month.

As well as relations with the UK, Mr Sefcovic acknowledged that the EU needed to be “extremely cautious and responsible” in addressing trade with the Trump administration in Washington but said he was willing to negotiate.

He added that while the EU did have a surplus in goods such as cars, the US had a surplus in services

NewsBeat

A lost song from Tina Turner’s Private Dancer has been rediscovered

Music Correspondent

EPA

EPAA song recorded for Tina Turner’s blockbuster album Private Dancer, that was presumed lost, has been rediscovered and will receive its first play on BBC Radio 2 later.

Hot For You, Baby, was cut at Capitol Studios in Hollywood and originally intended to be an album track.

But it was ultimately jettisoned in favour of era-defining pop hits such What’s Love Got To Do With It, Better Be Good To Me and the album’s title track.

Presumed missing, the master tape was recently rediscovered as her record label compiled a 40th anniversary re-release of Private Dancer.

An up-tempo rocker, full of showboating guitar chords and an extremely 1980s cowbell, Hot For You, Baby is a prime example of Turner’s raspy, physical style of soul.

The track will receive its first play on the Radio 2 Breakfast Show on Thursday, between 08:30 and 09:00 GMT.

Produced by John Grant, the record executive who masterminded her mid-career comeback, it was written by Australian musicians George Young and Harry Vanda.

It had already been recorded once by Scottish-Australian singer John Paul Young, the voice behind disco classic Love Is In The Air.

However, his version largely flew under the radar when it was released in 1979.

PA Media

PA MediaPrivate Dancer, released in May 1984, launched an unprecedented second act in Tina Turner’s career.

She had escaped an abusive marriage to musician Ike Turner at the end of the 1970s, but the divorce left her penniless, living off food stamps and playing ill-conceived cabaret shows to pay her debts.

The music industry had largely written her off – but in England, where pop was in thrall to American R&B, she still had some heavyweight fans.

In 1981, Rod Stewart invited Turner to play with him on Saturday Night Live; and the Rolling Stones asked her to be part of their US tour. More importantly, perhaps, David Bowie told Capitol Records that Turner was his favourite singer.

A landmark album

But the turning point came when she hooked up with British producers Martyn Ware and Ian Craig Marsh, of the band Heaven 17, to record a synth-pop version of the Temptations’ 1970 hit Ball of Confusion.

A huge hit in Europe, its success persuaded Capitol to let her record an album, but they hardly threw their weight behind it.

The budget only paid for two weeks in the studio, and many of the songs Turner recorded were other artists’ cast-offs (both Cliff Richard and Bucks Fizz had turned down What’s Love Got To Do With It).

But she used her time wisely – recording all but one of Private Dancer’s songs in the UK with five different British production teams.

With the country in the grips of new wave and the new romantics, Turner was steered away from raw, fiery soul that first made her famous. But somehow, her electrifying vocals were a perfect fit for the chilly, programmed grooves she was given.

“Turner seems to completely understand the touch that each of these songs needed,” wrote Debby Miller, in a contemporaneous review of Private Dancer for Rolling Stone magazine.

In the New York Times, Stephen Holden described the record as “a landmark, not only in the career of the 45-year-old singer, who has been recording since the late 1950s, but in the evolution of pop-soul music itself”.

The album went on to sell more than 10 million copies, and earned three Grammys, including record of the year for What’s Love Got To Do With It.

Turner also performed the song on the live TV broadcast, wowing audiences with her vocals despite fighting a bad case of the flu.

A support slot on Lionel Richie’s US tour in 1984 reminded audiences of her ability to tear the roof off any venue she set foot in.

By 1985, Turner was one of the world’s biggest acts in an era of stadium superstars like Michael Jackson, Madonna and Prince.

Getty Images

Getty ImagesThe decision to withhold Hot For You, Baby from the original tracklist of Private Dancer makes sense. It sounds a little cheesy next to the sultry, sophisticated material that eventually populated the record.

But fans will welcome the chance to hear Turner let rip, back in her prime, with a promise to “love you all night long”.

Mark Goodier, who is currently covering the Radio 2 breakfast show, said: “To have something new to hear from Tina Turner is a treat for fans of all generations and a reminder of her unique talent.

“I’m lucky enough to have both interviewed Tina and seen her perform live. She was an outrageously good performer and at the same time a remarkable graceful lady, whose every note was shaped by her incredible life.”

As well as being released as a single, the track will feature on a new five-disc deluxe edition of Private Dancer, which is due for release in March.

The collection will also feature B-sides, remixes and live tracks, as well as a film of Turner playing Birmingham’s NEC Arena in March 1985, featuring guest appearances by David Bowie and Bryan Adams.

Turner died in 2023 at the age of 83. No cause of death was given, but she was known to be struggling with a kidney disease, intestinal cancer and other illnesses.

NewsBeat

Search for suspect after ‘serious assault’ in Plymouth

Police in Plymouth say they are searching for a suspect following a “serious assault” in the West Hoe area of the city.

Devon and Cornwall Police said its officers were called at 20:55 GMT on Wednesday evening after a person was found seriously injured on West Hoe Road. They were treated by paramedics at the scene before being taken to Derriford Hospital.

The victim and their assailant are believed to know each other, the force added.

Detectives are appealing for anyone with information to contact them.

Det Ch Insp Dave Pebworth said there is a large police presence in the area and enquiries are continuing with officers carrying out a search for the suspect.

“We believe this is an isolated incident and there is no immediate threat to the wider public,” Mr Pebworth said in a statement.

“We would ask members of the public to please stay away from the West Hoe area of the city while we continue our investigation,” he added.

NewsBeat

Ukrainian comedians cope with war through humour

BBC Monitoring Russia editor

Anton Tymoshenko/Underground Standup

Anton Tymoshenko/Underground StandupOn 14 October 2023, an unusual event was held in Ukraine’s most prestigious venue, Palace Ukraine in Kyiv.

Anton Tymoshenko became the first Ukrainian stand-up comedian to give a solo performance there.

“I grew up in a village with fewer people than Palace Ukraine can hold,” he said after the concert. “So many people had told me: It’s not going to happen… stand-up comedy has not reached that level.”

It has now, to a large extent because of the full-scale invasion launched by Russia.

The invasion turned many Ukrainians away from the previously popular and lavishly promoted Russian acts and triggered a renewed interest in Ukrainian culture.

Key Ukrainian comedians say they are now making jokes to help the public deal with the grim reality of war and also help the army by raising funds.

“Stand-up comedy is a budget version of psychotherapy,” Anton Tymoshenko tells the BBC.

“I like to relieve social tension with my jokes. When that happens, that’s the best thing.”

Another popular performer, Nastya Zukhvala, says Russia’s full-scale invasion in February gave stand-up comedy in Ukraine “a boost,” albeit for darker reasons.

“The demand for comedy looks totally natural to me now because comedy supports and unites.

“It can also make reality look less catastrophic. It is a tool which can help us process this stream of depressing information,” she tells me.

“To stay optimistic or even sane, we’ve got no other choice.”

Anhelina Hlukhova

Anhelina HlukhovaSo what are the jokes that are making Ukrainians laugh?

This kind of humour is grim, says comedian Hanna Kochehura, but making fun of the danger makes it easier to cope with.

“It looks even darker from abroad, and it’s clear why. Anyone who’s in Ukraine knows that there are no safe places here,” she says.

“You never know if this air raid is going to be your last. You don’t know if a Shahed drone is going to target your house or your family’s house.

“Naturally, all our themes are related to the war. Because it’s our life now. Stand-up comedy is a frank genre where comedians speak about their own experiences or thoughts,” Ms Kochehura says.

Here’s an example – a joke from Anton Tymoshenko’s performance at Palace Ukraine:

“I never worried about a nuclear attack because I know it would mean death for rich residents of Kyiv. I live on the outskirts – but the nukes will hit central parts. Before fallout reaches me, it will have to make two changes on the metro.

“More realistically, I’ll get killed by Iranian Shahed drones. The sad thing is – did you hear the noise they make? They sound very demotivating, like the cheapest kind of death.”

“People can laugh at the news,” Anton tells me.

“If we’re not allowed to use [Western] missiles against targets in Russia — yes, that is funny because it is absurd. I build upon this absurd fact, and it becomes funny.

“Of course, Ukrainians find it funny.”

Western allies were initially reluctant to allow Ukraine to use their missiles against targets in Russia for fear of escalation. But the permission was granted after months of pleading by Kyiv: first shorter-range weapons in May 2024, then long-range missiles in November.

Underground Standup

Underground StandupJoking about the war is fraught with pitfalls.

Anton Tymoshenko says he is trying not to “trigger” his audiences or add to the trauma from which they may already be suffering.

“Stand-up comedy in wartime is the most difficult type. Making jokes without offending anyone is possible to do, but that would be like joking in a vacuum,” he says.

But, it is usually possible to see where the line lies according to Nastya Zukhvala:

“I feel what other Ukrainians feel. If I find something sad or tragic, I don’t see any need to turn it into stand-up comedy.”

There’s also a very practical side to stand-up comedy in Ukraine – helping its army.

“Almost all of the comedians I know have been helping the armed forces. All of us are involved in raising funds [for the Ukrainian army]. We hold charity shows and many perform in front of the military,” says Hanna Kochehura.

Some, like Nastya Zukhvala’s husband Serhiy Lipko, a comedian himself, are in the army.

“Culture, humour or psychology – that’s all fine and well, but everything must be of practical use to the military. When so many missiles are on the way to hit you, you’re not as interested in talking about art alone,” says Mr Tymoshenko.

“My main task is holding concerts so I can raise funds for them.”

He says he has donated more than 30m hryvnyas (£580,000; $710,000) since the start of the full-scale invasion in February 2022.

Politics

ABC The View ‘hypocrisy’ row explodes as panel defends Biden pardons while Trump’s branded ‘spineless’

The hosts of ABC’s The View have sparked outrage and claims of “hypocrisy” as they discussed the recent pardons issued by President Donald Trump and former President Joe Biden.

Tuesday’s episode of the US talk show was hosted by comedian Joy Behar, 82, lawyer Sunny Hostin, 56, journalist Sara Haines, 47, political strategist Alyssa Farah Griffin, 35 and TV personality Ana Navarro, 53.

The segment was prompted by President Trump’s move to pardon some 1,500 January 6 rioters as part of a flurry of executive orders signed immediately as he retook office.

Trump gave a “full pardon” to those jailed following the violent disorder in the last days of his first presidency, who he described as “hostages” of the previous administration.

As he signed the order, the president raised a complaint about former President Biden’s choice to issue blanket pre-emptive pardons for his family and members of the January 6 committee, including Dr Anthony Fauci and General Mark Milley, who had been investigating Trump.

“I was surprised that President Biden would go and pardon his whole family because that makes him look very guilty… and how about this J6 committee, why is he pardoning them? They were guilty as hell, they rigged it. It was a rigged deal,” he said to journalists.

Trump pardoned 1500 January 6 rioters amid a flurry of executive orders

Getty

“So, in Trump’s world the lawmakers trying to save democracy are ‘thugs’ and the lawbreakers are ‘hostages,” Behar said incredulously as she opened the floor to debate.

Also picking up on Trump’s use of the term hostages, Haines called the move “the biggest middle finger he could give the entire country out of all of his options.”

Alyssa Farah Griffin, who had worked as a communications director in Trump’s previous administration, slammed his pardons as “dangerous and reckless.”

While she praised Biden’s pardoning of Fauci and Milley, Griffin attempted to provide balance as she criticised Biden’s decision to extend the immunity to his family, saying his choices “floored her”.

Behar and her panel pulled no punches in criticising Trump

ABC

She explained it set a “dangerous precedent” for futurepresidents to abuse, adding: “I think it was disgraceful, and it’ll harm his legacy.”

The comment set the studio alight, with a volcanic Navarro furiously hitting back and defending the Democrat by arguing: “I think comparing Biden’s pardons to Trump’s is like comparing apples to Volkswagens.”

The audience clapped and cheered as she blasted Republicans who were not objecting to Trump’s pardons as having “absolutely no spine.”

“Nobody who stood up and condemned that and is today silent after those pardons should be able to look at themselves in the mirror because you have no morals,” she slammed.

Defending Biden, she added: “Joe Biden’s family and the people he pardoned have not actually committed any crimes. He is trying to prevent them spending the rest of their lives fighting the government.”

While not part of the most recent moves, the former president did issue an unconditional pardon to his son Hunter, who had pleaded guilty to tax charges in September 2023 – despite previously pledging not to.

Nevertheless, Hostin agreed, stating that she “was not offended by Biden pardoning his family.”

“We’ve already had a Trump presidency, we know this administration will be a vengeful one, we know this is a vengeful man.

“If I could protect me and mine, I would do that. SoI think we need to Joe Biden some grace,” she declared.

On Trump’s pardons, she said furiously: “He ran on this, ‘I’m going to be a law-and-order president,’ which a lot of the Republican Party runs on, so I think it’s really disgraceful that he would do that.”

LATEST DEVELOPMENTS:

The View panel were slammed as ‘”hypocrites” online for their comments

ABC

The debate sparked a huge response online, with some branding The View panel as “hypocrites” and “disgusting” after the majority defended Biden’s pardons while dismantling Trump’s.

“And here we have it: these women praise Biden for pardoning his family… and in return, condemn Trump for doing the same f*****g thing by pardoning the January 6th rioters. These women are f*****g insane. #TheView,” one slammed.

Another raged: “The same day Biden pardoned his entire family and the j6 committee. Something he said he wouldn’t do. Actually STFU,”

“This show is a boatload full of angry, disgruntled, downright mean women who hate love,” a third wrote disparagingly.

“This is absolutely DISGUSTING!!!” a fourth wrote in response to the clip while another simply raged: “Such hypocrisy.” (sic)

NewsBeat

Sneaky Britain? How our moral compasses are changing

Could the popularity of The Traitors link to something wider going on among Britons – and our shifting attitudes towards dishonesty?

Politics

Watch as Patrick Christys launches blistering attack on Keir Starmer’s ‘appalling’ press conference

GB News presenter Patrick Christys has launched a scathing attack on Prime Minister Sir Keir Starmer’s handling of the Southport atrocity.

Speaking on GB News, Patrick called Starmer’s recent press conference “appalling” over his initial response to the incident.

He highlighted that Starmer knew about Axel Rudakubana’s jihadi terror manual and biological weapon whilst suggesting far-right involvement.

The PM defended withholding this information, stating “it would not have been right to disclose those details.”

Christys dismissed this explanation, questioning why police could reveal the same details in October without prejudicing the trial.

When asked by GB News Political Editor Christopher Hope about blaming the far-right, Starmer responded: “Responsibility for the violence lies with them that perpetrated it.”

The PM referenced thanking frontline emergency services in Southport instead of addressing the question directly.

Christys expressed concern that public trust in Starmer has been damaged by this incident.

“How can we ever trust that when confronted with the choice between telling us the truth or trying to hide things, to not inflame racial tensions, that he would actually choose the truth?” he said.

WATCH THE CLIP ABOVE FOR MORE

NewsBeat

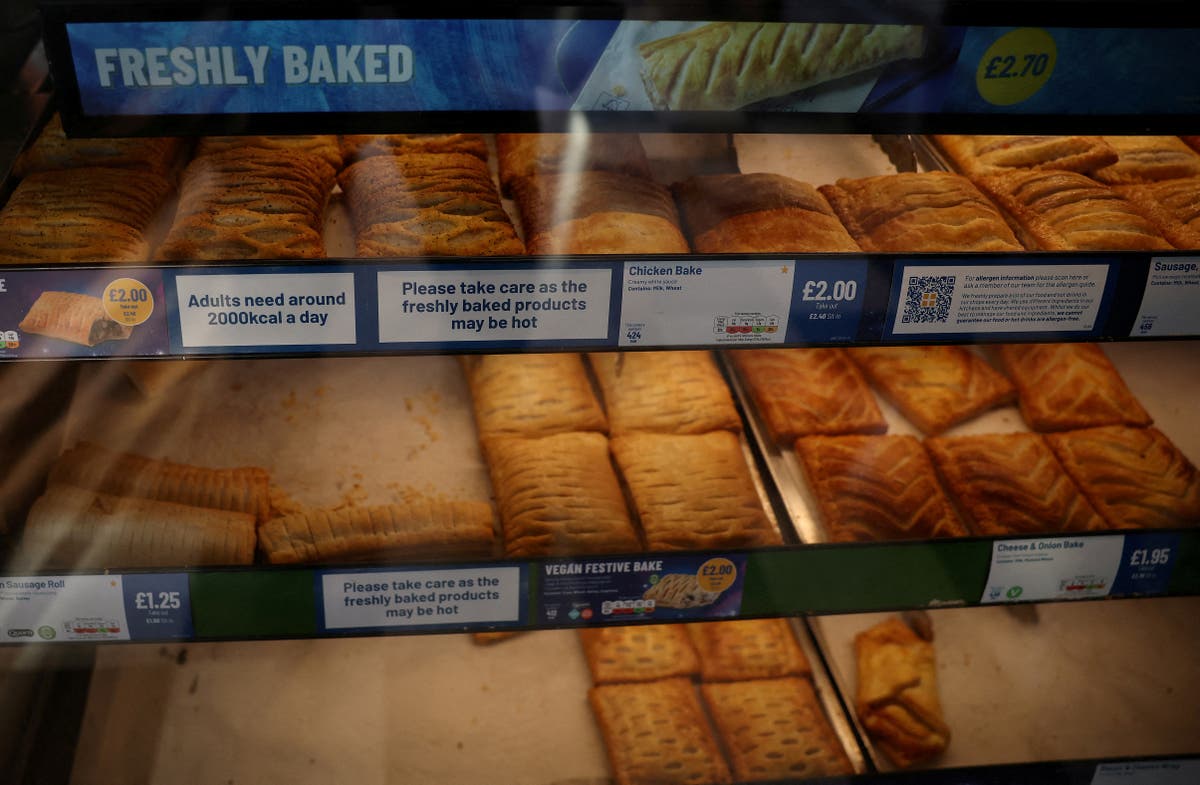

Greggs issues recall of supermarket steak bakes due to possible health risk

Greggs have recalled one of its most popular items from shelves after a packaging error.

The popular high street bakery chain has warned that some of its packs of steak bakes contain sausage, bean and cheese melts, which were incorrectly labelled as Steak Bakes. This means that some sulphites are not declared on the label.

The UK’s Food Standards Agency (FSA) said: “the product is a possible health risk for anyone with a sensitivity to sulphur dioxide and/or sulphites”

This recall specifically applies to packs of two frozen steak bakes which are sold exclusively at the supermarket chain Iceland, with the best before date of 15 May 2025. No other products, date codes or batches are believed to have been affected.

Customers who have recently bought the product have been advised not to consume it, but return it to their nearest Iceland store for a full refund instead.

Sulphites can be naturally found in some foods, but are also used in the production of some foods to make them last longer and preserve their colour and flavour. They can trigger stomach issues or problems with airways for people with sensitivities.

Sulphites work as food preservatives by releasing sulphur dioxide. This is an irritant gas which can cause the airway to become irritated and constricted for those who are sensitive to sulphites.

The gas is released when sulphite containing foods interact with stomach acid, which can trigger stomach issues, but the gas can back up into the airway which causes symptoms.

The incidence of sulphite sensitivity in the general population is thought to affect less than two per cent, but this rises between five and 13 per cent in those who suffer from asthma, according to Allergy UK.

Those who have asthma may have mild reactions to sulphites, although there are a small number of reports of serious allergic reactions to sulphites, such as anaphylaxis.

NewsBeat

Starmer vows to curb ‘NIMBY’ legal blocks on infrastructure

Politics reporter

Political reporter

Getty Images

Getty ImagesMajor infrastructure projects like nuclear plants, train lines and wind farms will be built faster under new planning rules, the government has pledged.

Prime Minster Sir Keir Starmer said Nimby (Not in My Back Yard) “blockers” of major infrastructure projects will have fewer chances “to frustrate growth” through repeated legal challenges.

Currently, infrastructure schemes can be challenged in the courts up to three times – ministers intend to reduce that to once in most cases.

Tory shadow levelling up secretary Kevin Hollinrake accused Labour of “taking forward Conservative initiatives” but warned their efforts would fail unless they stopped “blocking our attempts to cut EU legacy red tape”.

Existing rules open up projects approved by elected officials to years of delays and hundreds of millions of pounds of additional costs, the government said.

Opponents of schemes currently have three opportunities to secure permission for a judicial review of a major infrastructure projects in England and Wales: writing to the High Court, attending an oral hearing and appealing to the Court of Appeal.

Under the government’s proposals, the written stage would be scrapped – meaning campaigners will have to convince a judge in person.

Additionally, any challenges deemed “totally without merit” by a High Court judge would be unable to go over their heads to the Court of Appeal.

Scotland has its own legal and Judicial Review system.

Ministers said overhauling the rules, via the upcoming Planning and Infrastructure Bill, would send a strong signal to global firms looking to do business – that the UK is a “great place to invest”.

Sir Keir said it was time to fix “a broken system that has slowed down our progress as a nation”.

“For too long, blockers have had the upper hand in legal challenges – using our court processes to frustrate growth,” he said.

“We’re putting an end to this challenge culture by taking on the Nimbys and a broken system that has slowed down our progress as a nation.”

Labour has placed planning reforms at the heart of its mission to drive economic growth, also promising to deliver 1.5 million new homes in five years.

During the election Sir Keir’s election pledged to back “builders, not blockers” and promised Labour would prioritise infrastructure to boost growth and expand green energy.

The government has promised to make 150 major infrastructure project decisions by the next election.

The latest announcement follows a review by planning lawyer Lord Charles Banner, who recommended streamlining the judicial review process so claimants had “fewer bites of the cherry” when seeking permission to bring a case.

The review found that around a third of applications for judicial review of major projects were refused permission to proceed entirely, although it was not clear how many had been deemed “totally without merit”.

Welcoming the changes Lord Banner said “reducing the number of permission attempts to one for truly hopeless cases should weed out the worst offenders”.

“I look forward to seeing these changes help to deliver a step change in the pace of infrastructure delivery in the months and years ahead.”

According to the government, more than half of decisions on nationally significant infrastructure projects are taken to court – causing an average delay of 18 months and adding millions to costs.

Officials pointed to cases including the approval of Sizewell C in Suffolk, where campaigners spent 16 months seeking permission for a judicial review despite their case being described as “unarguable” at every stage.

However, only some of the grounds in the Sizewell C case were deemed “totally without merit”, meaning the remaining grounds could still have been reconsidered by the Court of Appeal.

In response to the government’s proposals Hollinrake said: “While we welcome the government taking forward Conservative initiatives to streamline the planning system, Labour’s blocking of our efforts to cut EU legacy red tape, such as nutrient neutrality, so they can align more closely with the European Union will hold Britain back.”

NewsBeat

‘I got a credit card after losing the winter fuel payment’

Cost of living correspondent & producer

BBC

BBCSandra said she used to depend on her winter fuel payment, but when it became means tested her pension pushed her £20 a week over the threshold so she lost it.

“I’ve had to take out a credit card, overdraft and a credit account to be able to pay for things this winter,” she told the BBC.

Sandra is one of the 11 million pensioners who lost the payments, worth up to £300, just as temperatures dropped.

The government said it was committed to supporting pensioners but charity Age UK said it had seen a 60% increase in calls to its advice line during the worst of the cold snap.

“I have £4 in my [bank] account currently,” said Sandra, 66, who lives alone in County Durham. “I’m paying off my credit [card] account month by month, something that is a direct result of losing the winter fuel allowance.

“Psychologically, it makes you feel a bit of a failure.

“We’re still in the middle of winter, so I’m just hoping and praying we don’t get another cold snap because I don’t have anywhere to go if I can’t pay my bills.”

The winter fuel payment is a lump sum of £200 a year for pensioners under 80, increasing to £300 for over 80s. It is paid in November or December and used go to all pensioners regardless of their income.

Last year the government announced it would be restricted to those who qualify for pension credit and other means-tested benefits.

Age UK said the number of calls to its Advice Line increased by 50% in the first full week of January, rising to 60% the week after.

A spokesperson said: “The cold weather is one of the biggest topics callers are worried about at the moment.

“Even though the date to claim pension credit by, to be awarded the winter fuel payment this year has now passed, we are still seeing enquiries for benefit checks due to the increased worry of meeting the cost of living.”

‘A lot of money to lose’

Earlier this month, temperatures dropped so low in the small village of Sedbergh in Cumbria that cold weather payments were triggered.

The one-off £25 sum is paid to those on benefits during prolonged cold weather.

Next door neighbours Rosemary, 93, and Marjorie, 92, have known each other since primary school. Neither of them qualified for winter fuel allowance or cold weather payments this year.

“It’s a lot of money to lose,” Rosemary said. “It makes a big difference. You shouldn’t rely on it but you did rely on it, I though ‘oh well I can get a bit of extra food I can get another bag of coal in’.”

Marjorie’s home is old and poorly insulated. “I find it difficult to heat my home because I’ve got all outside walls and they’re stone,” she said.

Data from the Department for Levelling Up shows that the area to the north of Sedberg is the worst in England for energy efficient homes.

17.7% of homes in and around Penrith have the lowest EPC ratings – F or G.

‘They’re not turning the heating on’

At the Grange Community Centre in Blackpool, Rachel Denby advises pensioners on how to make their homes more energy efficient and keep their bills down.

“An elderly person might pay all the bills, stay on top of payments and not be in any debt so from the outside it doesn’t look like there’s an issue, but in reality they’re not eating or they’re not turning the heating on,” she told the BBC.

The government said it did not want to see anyone suffer this winter and was committed to supporting pensioners with millions set to see their state pension rise in April.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login