Crypto World

Daily Market Update: Bitcoin Can’t Catch a Break as Middle East Tensions Hit Stocks and Crypto

TLDR

- Bitcoin is on track for its fifth straight weekly loss, last seen in 2022

- BTC is trading below $67,000, down around 3% this week

- Middle East tensions have pushed the U.S. dollar to 97.7 and oil to $65

- U.S. stock futures edged higher Thursday, led by Nasdaq futures up 0.3%

- Walmart reports earnings Thursday as a key read on consumer health

Bitcoin is heading toward its fifth consecutive weekly loss as rising Middle East tensions weigh on crypto markets. U.S. stock futures, meanwhile, are pointing modestly higher ahead of Walmart earnings.

As of Thursday, Bitcoin was changing hands below $67,000, down roughly 3% on the week. A close in the red would mark its longest weekly losing streak since March to May 2022.

Bitcoin peaked near $126,500 in October. It has since fallen more than 50%, with prices dropping as low as $60,000.

The monthly picture is just as bleak. Bitcoin has posted five straight monthly losses since October, making it the second-longest monthly losing streak on record. Only a six-month slide from 2018 to 2019 was longer.

Against gold, Bitcoin has now underperformed for seven consecutive months — its longest stretch on record against the precious metal.

Middle East Tensions Drive Dollar and Oil Higher

Geopolitical pressure is adding to Bitcoin’s woes. Reports say the U.S. has assembled its largest concentration of air power in the Middle East since the 2003 Iraq War.

President Trump has not made a final decision on whether to launch strikes on Iran. Prediction platform Polymarket puts the odds at 27% before the end of February.

The uncertainty has sent the U.S. dollar index to 97.7, its highest point since February 6. WTI crude oil climbed to $65 from a Wednesday low of $62.

A stronger dollar and higher oil prices tend to push risk assets like Bitcoin lower. These macro pressures are compounding an already weak technical setup for the cryptocurrency.

Stock Futures and Fed Minutes in Focus

U.S. stock futures were leaning higher Thursday morning. S&P 500 futures rose 0.2%, Nasdaq 100 futures gained 0.3%, and Dow futures were near flat.

Investors were working through minutes from the Federal Reserve’s January meeting. The minutes showed policymakers are divided, with some raising the possibility of rate hikes due to persistent inflation.

Despite that, market expectations for two rate cuts by the end of 2025 remained largely intact. Traders are also watching weekly jobless claims and pending home sales data due Thursday.

Walmart is reporting before the market opens, with investors using the results to gauge the health of the American consumer. Tariffs are also back in the spotlight after the Trump administration criticized a New York Fed report showing U.S. consumers and businesses are absorbing the cost of tariffs.

Bitcoin’s five-week losing streak, if confirmed at Friday’s close, would be one of its longest sustained downturns since the 2022 bear market.

Crypto World

UNI price falls further despite Uniswap Protocol fee expansion proposal

- Uniswap (UNI) price drops despite plans to expand protocol fees and burn tokens.

- If approved, the fees will be activated across all v3 pools and eight additional chains.

- Currently, the key support sits at $3.38 while the immediate resistance is at $4.24.

Uniswap’s native token, UNI, has seen its price dip despite the ongoing governance push to expand protocol fees across more chains and all v3 pools.

While the protocol fee expansion promises to increase token burns and revenue for the protocol, short-term price action has remained under pressure.

The dip comes amid a broader downturn in the cryptocurrency market, with traders closely watching key support and resistance levels.

Uniswap protocol fee expansion proposal

The Uniswap community is currently voting on a proposal to activate protocol fees across all remaining v3 pools on Ethereum mainnet.

In addition, the plan includes extending fees to eight other networks, including Arbitrum, Base, Celo, Optimism Mainnet, Soneium, X Layer, Worldchain, and Zora.

This proposal is notable because it is the first to use the updated governance process known as UNIfication.

This system allows fee parameter changes to bypass the traditional proposal stage, speeding up voting while retaining on-chain security.

If approved, fees collected on these chains would flow to chain-specific TokenJar contracts before being bridged back to the Ethereum mainnet.

From there, UNI tokens would be burned, effectively reducing supply and increasing scarcity over time.

The proposal also introduces a new tier-based system for v3 pools, known as v3OpenFeeAdapter.

Instead of setting fees pool by pool, the system applies fees based on liquidity provider fee tiers.

This simplifies governance oversight and ensures every pool automatically contributes to protocol fee revenue.

Market response

Despite these ambitious plans, UNI’s market performance has struggled.

The token opened today at $3.56 but quickly fell, losing 4.8% from its opening price.

UNI briefly rallied to $3.59 but faced resistance and could not sustain momentum.

This highlights that market sentiment is cautious, even as governance improvements promise long-term benefits.

Currently, UNI is trading around $3.40, down roughly 4.7% in the last 24 hours.

Its market cap sits at just over $2.15 billion, while total value locked in Uniswap remains above $3 billion.

Uniswap price forecast

While the protocol fee expansion may boost long-term value and increase token burns, market reaction shows that short-term price action is likely to remain volatile.

The support at $3.38 is critical, according to market analysis.

If the token holds above this level, it may attempt to move toward the first major resistance at $4.24.

If the token breaches $4.24, it could open the path to $4.76, with a third resistance at $5.41.

However, failure to maintain above the support at $3.38 could see UNI struggle in the short term, limiting the impact of positive governance developments.

Crypto World

Top 6 Metaverse Blockchain Games Driving Engagement in 2026

Metaverse blockchain games are no longer experimental concepts reserved for crypto enthusiasts. They are evolving into persistent digital economies where users socialize, transact, build assets, and invest time and money. For enterprises, this shift signals more than a gaming trend. It signals a new model of digital engagement, ownership, and monetization. Unlike traditional games, metaverse blockchain games combine:

- Persistent virtual worlds

- Digital asset ownership

- Token-driven economies

- User-generated ecosystems

- Decentralized governance

- Interoperable digital identities

These components help turn games into platforms and communities into economies. For enterprises exploring metaverse game development or blockchain game development, studying current leaders provides valuable strategic insights. The most successful projects reveal what actually works and what enterprises must prioritize.

Below are six metaverse blockchain games shaping the space, followed by the practical lessons they have on offer for enterprises.

1) The Sandbox

The Sandbox is one of the most recognized metaverse platforms where players and brands build experiences on virtual land parcels represented as NFTs. Major brands, artists, and entertainment companies have entered The Sandbox to host events, create branded worlds, and sell digital assets.

Why It Matters

The Sandbox demonstrates that metaverse value grows when users are creators, not just consumers. It transforms players into ecosystem contributors.

Enterprise Takeaway

Enterprises entering metaverse game development should not design closed worlds. They should provide creation tools, SDKs, and monetization channels for users. A platform where users build experiences scales faster than one where only developers create content. This, in turn, reduces content burden and increases engagement longevity.

2) Decentraland

Decentraland is a decentralized virtual world where users own land, assets, and governance rights. Decisions are often driven by community votes. Virtual real estate, digital commerce, and virtual events form the backbone of its ecosystem.

Why It Matters

Decentraland shows that digital ownership changes user behavior. When users truly own assets, they invest more time and value into the platform.

Enterprise Takeaway

Ownership is not a feature, it is a retention mechanism. Enterprises leveraging blockchain game development must design ownership structures that give users real control and tradable value. This creates long-term loyalty and repeat engagement.

3) Illuvium

Illuvium pushes the boundary of production quality in Web3 gaming. With high-end graphics and deep gameplay, it challenges the stereotype that blockchain games lack polish.

Why It Matters

Illuvium proves that Web3 players expect AAA-level quality. Blockchain alone does not attract users; gameplay and visual quality still drive adoption.

Enterprise Takeaway

Enterprises should not treat blockchain as the product. The game must stand on its own merit. Strong art direction, smooth mechanics, and immersive design remain essential for user acquisition and retention. For faster launch, enterprises can certainly make use of the Illuvium clone script.

4) Axie Infinity

Axie Infinity introduced millions to play-to-earn mechanics. At its peak, it became a livelihood source in some regions.

Why It Matters

Axie Infinity revealed both the potential and the risks of token-driven economies.

Enterprise Takeaway

Tokenomics must be designed for sustainability, not short-term hype. Enterprises must plan emission schedules, sinks, and reward balancing carefully. Poorly structured economies inflate quickly and collapse user trust. In this regard, enterprises can also try the Axie Infinity clone to build a similar game within a short span of time with help from professional service providers.

5) Star Atlas

Star Atlas combines metaverse scale, space exploration, and political governance systems.

Why It Matters

It highlights the growing ambition of metaverse blockchain games to become persistent virtual universes.

Enterprise Takeaway

Large-scale visions require scalable backend architecture and long-term roadmaps. Enterprises must treat metaverse game development as platform development, not a one-off release.

6) Otherside (Yuga Labs)

Otherside connects major NFT communities into a shared metaverse experience.

Why It Matters

It leverages brand power and community loyalty as a growth engine.

Enterprise Lesson

Community is a growth multiplier. Enterprises should integrate social systems, creator incentives, and shared experiences.

Do You Wish to Make a Mark in Metaverse Blockchain Gaming?

Cross-Game Insights for Enterprises

Analyzing these metaverse blockchain gaming projects reveals some common success factors:

1) Digital Ownership Drives Engagement

Users engage more when they own assets that carry value beyond the game. Ownership creates emotional and financial investment.

2) Community-Led Growth Scales Faster

Platforms that empower communities tend to grow organically. Social engagement drives retention and virality.

3) Sustainable Economies Matter

Token models must balance rewards and sinks. Inflation destroys ecosystems.

4) Quality Cannot Be Ignored

Gameplay, UX, and visuals still determine success, hence cannot be ignored at any cost.

5) Scalability Is Non-Negotiable

Infrastructure must support growth without bringing in any kind of performance issues.

The Hidden Complexity Behind Metaverse Blockchain Games

Many enterprises underestimate what goes into building these ecosystems. Real blockchain game development requires:

- Blockchain architecture

- Smart contract design

- NFT systems

- Multiplayer infrastructure

- Scalable servers

- Security-first design

- Wallet integration

- Marketplace mechanics

- Tokenomics modeling

Thus, enterprises should always keep in mind that it is not typical game development. It is platform engineering.

Why Enterprises Partner with a Specialized Game Development Company

Very few in-house teams combine gaming, blockchain, and economic design expertise. On the other hand, a specialized game development company provide:

- Proven frameworks

- Faster deployment

- Reduced risk

- Cross-domain knowledge

- Long-term support

This, in turn, allows enterprises to focus on strategy while execution is handled by experts.

Final Thoughts

Metaverse blockchain games are early blueprints for future digital economies. Enterprises that enter the field thoughtfully can build platforms where users spend time, creativity, and money. The leaders of tomorrow will not be those who chase hype, but those who build sustainable ecosystems today.

Antier, a leading game development company, works with enterprises to build metaverse blockchain ecosystems designed for scalability and longevity. The experienced team’s capabilities include:

- End-to-end metaverse blockchain game development

- Blockchain and NFT integration

- Tokenomics planning

- Scalable backend architecture

- Security-first engineering

The goal is not just launching a game but building a digital economy that lasts. Let’s collaborate to build your next hit title.

Frequently Asked Questions

01. What are metaverse blockchain games?

Metaverse blockchain games are evolving digital economies where users can socialize, transact, build assets, and invest time and money, combining elements like persistent virtual worlds, digital asset ownership, and token-driven economies.

02. How do metaverse blockchain games differ from traditional games?

Unlike traditional games, metaverse blockchain games offer persistent virtual worlds, user-generated ecosystems, decentralized governance, and digital asset ownership, transforming players into contributors rather than just consumers.

03. What should enterprises consider when developing metaverse games?

Enterprises should focus on creating open platforms that provide users with creation tools, monetization channels, and real ownership structures, as these elements enhance user engagement and retention.

Crypto World

CME Goes 24/7: Here’s When Crypto Futures and Options Trading Starts

TLDR:

- CME will offer 24/7 crypto futures and options starting May 29, pending approval.

- Year-to-date 2026 ADV hits 407,200 contracts, up 46% from last year.

- Futures ADV rises 47% YoY, signaling strong institutional interest in crypto derivatives.

- CME implements brief weekly maintenance; all holiday trades settle the next business day.

CME Group will begin round-the-clock trading for cryptocurrency futures and options starting May 29. The move awaits regulatory approval. Trading will run continuously on CME Globex, with a brief weekly maintenance window.

The update comes amid record demand for digital asset risk management, according to Walter Bloomberg. In 2025, CME reported $3 trillion in crypto notional volume. Year-to-date 2026 volumes are up 46%, highlighting growing institutional participation.

The announcement was confirmed via a press release from CME Group. It emphasizes access to regulated, transparent crypto products at all times for market participants.

Continuous Trading and Market Access

Starting Friday, May 29 at 4:00 p.m. CT, CME cryptocurrency products will trade 24/7. A

two-hour weekly maintenance period will occur over weekends. Trade dates for holiday or weekend activity will follow the next business day. Clearing, settlement, and regulatory reporting will also be processed on the next business day.

Tim McCourt, Global Head of Equities, FX, and Alternative Products at CME Group, said client demand for digital asset risk management is at an all-time high. Providing 24/7 access aims to let clients manage exposure anytime. Consequently, traders can react to market changes without delay.

This continuous trading structure includes both futures and options. CME Globex will host all transactions. As a result, the exchange meets rising institutional interest in high-frequency crypto risk management.

Record Volumes and Market Impact

Crypto trading at CME continues to reach record levels in 2026. Average daily volume stands at 407,200 contracts, up 46% year-over-year. Futures ADV alone is 403,900 contracts, marking a 47% increase. Open interest has risen 7% to 335,400 contracts.

CME operates across multiple asset classes, including interest rates, equity indexes, and commodities. Its derivatives platform allows clients to manage risk efficiently and capture opportunities.

By offering 24/7 crypto trading, CME provides a regulated alternative to unregulated markets.

The update also aligns with CME’s goal to enhance market transparency. Clients can trade with confidence, knowing all activity occurs under regulated oversight. This development strengthens the exchange’s position as a leading crypto derivatives marketplace.

Crypto World

Cambodia has deported 48K foreigners since scam center crackdown began

Cambodia’s Deputy Prime Minister Sar Sokha has announced that 48,000 foreign nationals have been deported since the launch of a widespread scam center crackdown in 2023. However, he’s cautioned that despite this apparent success, the country’s police force is stretched worryingly thin.

Sokha reportedly shared the statistic as part of a “Safer Internet Day” campaign, launched last Tuesday.

However, he also warned that the nation’s police force is “stretched thin” with roughly one officer for every 3,100 citizens. In an effort to mitigate the shortfall, he outlined plans for a new initiative that would pay residents for any tips that lead authorities to scam center compounds.

He said, “We cannot do this alone. We need local residents to be our ‘eyes and ears’ to help sweep these operations out of our country.”

Sokha also said the government will introduce exit restrictions at airports to stop victims from being trafficked.

Women between the ages of 18 and 35 without clear documentation, verified sponsors, and little in the way of funds will be checked, as well as tourist travellers with very little money.

Read more: China executes four more in pig butchering scam crackdown

Additionally, there will be an effort to educate Cambodia’s population about the risks of AI and the ability it has to make scams more difficult to recognise.

Scam center compounds have been disrupted

In January, Sokha also promised to increase the minimum number of local police officers available to deal with drug trafficking and youth crime.

That month saw several scam center compounds significantly disrupted after the arrest of Chen Zhi, the alleged kingpin behind the billion-dollar operation. Since then, thousands have been deported after being inked to similar operations in casinos and other shady businesses.

The majority of these deported nationals are victims of trafficking who are forced to carry out crypto scams known as “pig-butchering.” Chinese victims often make up the bulk of these nationals but many come from other countries across Asia, and in rare cases, America.

Cambodia juggles scam center crackdown with Thailand war

On top of the 48,000 deported, Sokha said that around 210,000 foreign nationals have also voluntarily left the country. While the scam center epidemic has contributed to this exodus, the country’s ongoing armed conflict with Thailand may also be a factor.

Border clashes between the two countries began in May 2025 and have escalated to include exchanges of artillery fire, frequent gunfights, and Thai air bombardment directed towards Cambodia.

Hundreds of thousands of citizens have reportedly been displaced, while at least 149 have been killed. A peace agreement was first brokered in late July before fighting began again in December.

Cambodia’s Prime Minister Hun Manet claimed yesterday that Thai forces are still occupying its territory despite a peace deal brokered by US President Donald Trump in late December.

Read more: Thailand cuts power to Myanmar crypto scam center regions

Cambodia accused Thailand of killing one of its soldiers in May, leading to Thai ambassadors being pulled out of Cambodia. More clashes followed in July, with both sides disputing who fired first.

Many citizens are waiting to return to their homes, while Thailand’s newly elected nationalist Prime Minister, Anutin Charnvirakul, is pushing for a wall to be built along the border.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

XRP price breaks local bearish structure as rising volume targets $1.70

XRP price breaks local bearish market structure, shifting momentum, with price now testing a key volume support zone that could establish a higher low for higher prices.

Summary

- Local bearish structure invalidated, signaling momentum shift

- Key volume support zone being defended, favoring higher-low formation

- $1.76 resistance becomes upside target, if bullish volume confirms continuation

XRP (XRP) Price action has begun to show early signs of recovery after breaking its local bearish market structure. Following a period of sustained downside pressure, the market has transitioned back into a technically significant support region where buyers are attempting to regain control. This development suggests that the corrective phase may be nearing completion, provided key support levels continue to hold.

Markets often transition through phases of imbalance before stabilizing around high-liquidity zones. The current move back into a major volume support cluster highlights a potential shift away from bearish continuation toward rotational price behavior. Whether this develops into sustained upside momentum will depend heavily on how price reacts within this support region.

XRP price key technical points

- Local bearish market structure has been broken, signaling momentum shift

- Major volume support cluster is being tested, including POC and Fibonacci confluence

- $1.76 high-timeframe resistance becomes the upside target, if higher low confirms

XRP price has rotated back into an important technical region defined by strong volume participation. This zone includes the point of control (POC), the value area high, and the 0.618 Fibonacci retracement, creating a powerful confluence of support levels.

When multiple technical indicators align in one region, it often increases the probability of price stabilization. Such areas typically attract liquidity and institutional interest, making them ideal locations for higher lows to form during trend transitions.

The return to this volume area indicates that sellers are losing immediate dominance, while buyers are beginning to defend price more aggressively.

Establishing a higher low is critical

The most important technical requirement moving forward is the confirmation of a higher low. A higher low represents a shift in market structure from bearish to constructive and often marks the early stages of trend continuation to the upside.

For this scenario to remain valid, the value area low must continue acting as support. Acceptance below this level would weaken the bullish thesis and reopen downside risks. However, sustained holding above value strengthens the probability that accumulation is taking place.

Once a higher low is confirmed, XRP gains structural support for continuation within the newly developing trend.

Market structure transition underway

The recent break of local bearish structure is a meaningful technical event. Previously, price action was characterized by lower highs and continued weakness. That pattern has now been disrupted, indicating a transition from distribution toward potential accumulation.

Market structure shifts rarely occur instantly. Instead, they typically unfold through rotations between support and resistance levels. The current consolidation within the volume support region may represent the early phase of this transition.

As buyers defend support and absorb supply, momentum can gradually build for a larger expansion move.

Resistance at $1.76 comes into focus

If the higher low successfully forms, attention shifts toward high-timeframe resistance near $1.76. This level represents the next major technical objective and aligns with prior rejection zones within the broader trading range.

A rotational move toward resistance would confirm that the market has transitioned out of its corrective phase and into a recovery structure. However, reaching this target will require strong bullish participation.

Bullish volume is the deciding factor

While structural signals are improving, confirmation ultimately depends on bullish volume expansion. Breakouts or rotations without volume often fail, leading to renewed consolidation or reversals.

Increasing buy-side volume would validate demand returning to the market and strengthen the probability of continuation toward resistance. Without this confirmation, price may remain range-bound despite structural improvement.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, the market is attempting to transition from bearish control into a more constructive environment. The break of the local bearish structure, combined with strong volume support, suggests that a higher low may be forming.

In the near term, consolidation around the volume support zone is likely as the market searches for equilibrium. As long as the value area low holds, the probability favors a rotational move for XRP toward the $1.76 resistance level.

A decisive increase in bullish volume would confirm continuation, while failure to hold support would delay the recovery. For now, the technical landscape favors stabilization and potential upside rotation as the market attempts to establish a new structural trend.

Crypto World

The Market Priced in Cuts, the Fed Mentioned Hikes. What It Means For Bitcoin Price?

Minutes from the January meeting show rate hikes are not off the table. If inflation stalls, policymakers are ready to tighten again. That is a direct warning to risk markets.

For Bitcoin price, this flips the script. The market was leaning toward cuts. More liquidity. Easier conditions. Now the Fed is signaling the opposite.

Higher rates. Tighter liquidity. And that changes everything for crypto.

Key Takeaways

- The Signal: Fed officials discussed “upward adjustments” to rates if inflation stays above target levels.

- The Split: The vote was 10-2 to hold rates, but a significant “hawkish” contingent is pushing back against cuts.

- The Risk: Higher-for-longer rates typically drain liquidity, creating headwinds for Bitcoin and ETF inflows.

Why Does This Matter for Crypto and Bitcoin Price?

Markets were relaxed. Cuts in 2026 felt almost guaranteed. Now that confidence got shaken again.

The Fed held rates at 3.5% to 3.75%, hitting pause after three straight cuts in late 2025. But the tone was not soft. Inside the discussion, a hawkish group made it clear they are not ready to promise more easing.

Some officials even floated “upward adjustments” if inflation sticks around. That is a big shift. The market had assumed a smooth path lower. The minutes analysis say otherwise.

The Fed wants clear proof that disinflation is real before cutting again. That puts serious weight on the February CPI print. If inflation runs hot, rate hikes move from theory back to reality.

What Happens Next?

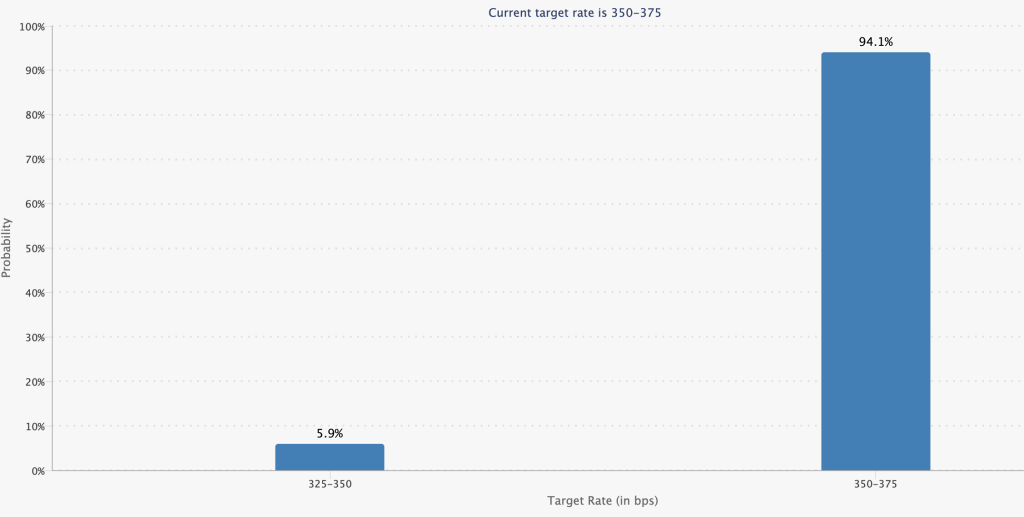

Pricing is getting messy. CME futures still show a 94% chance of a pause in March. But the hike risk is no longer zero.

Now it all comes down to inflation data. If the next print runs hot, the Fed fears get validated. If not, this scare might fade just as fast as it appeared.

Discover: Here are the crypto likely to explode!

The post The Market Priced in Cuts, the Fed Mentioned Hikes. What It Means For Bitcoin Price? appeared first on Cryptonews.

Crypto World

Banks Can’t Seem To Service Crypto, Even as It Goes Mainstream

Across the globe, it remains common for crypto users to have their bank accounts frozen and transfers blocked, even as institutional adoption rises.

Panos Mekras, co-founder and CEO of blockchain fintech Anodos Labs, began dealing with crypto in Greece in the late 2010s. Most Greek banks didn’t allow transfers to crypto exchanges back then. Mekras experienced blocked card payments until one bank finally permitted his transfers, but first, he was questioned to ensure he understood he was interacting with a “risky” counterparty.

Mekras told Cointelegraph that those early rejections are symptomatic of how banks treat digital assets as inherently high risk. That label often led to account closures or sudden freezes without explanation, ultimately pushing his business to rely solely on onchain tools and payment rails.

Public perception of crypto has since evolved. Now, crypto is undergoing an image refresh, from a speculative asset class to an infrastructure layer for future financial products. However, Mekras said he still experiences the same banking barriers, as recently as a “few months ago”:

“I tried to send money from an exchange to Revolut, and they froze my account for three weeks. I had no access to my [funds] during that time.”

The long shadow of crypto debanking

Mekras isn’t the lone crypto holder with such complaints despite banks announcing expansions into custody and blockchain initiatives.

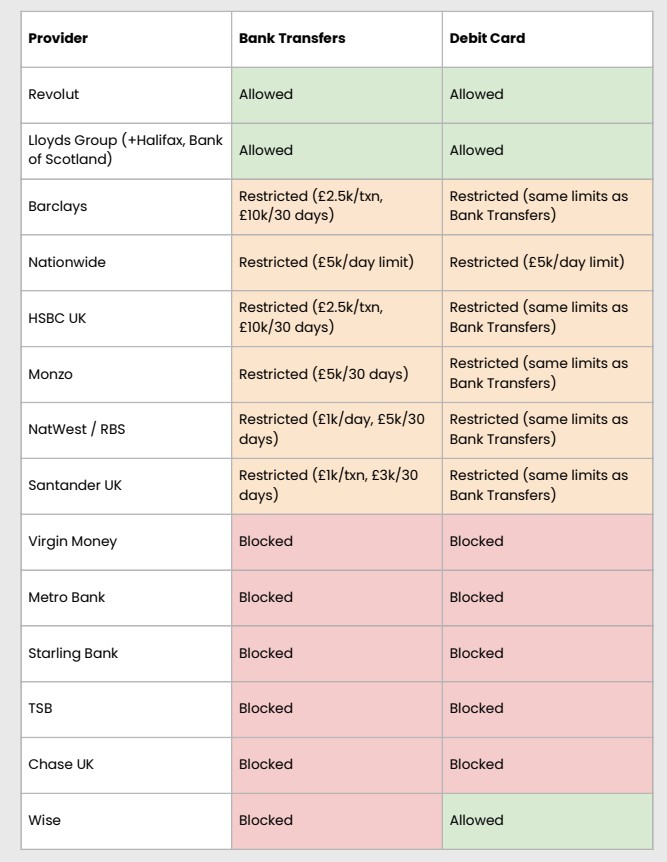

A January report from the UK Cryptoasset Business Council found that bank transfers to exchanges were being blocked or delayed, with roughly 40% of payments encountering restrictions and 80% of exchanges reporting increased friction over the past year.

The council warned that blanket bans and transaction limits are often applied without regard to the legal status of the exchange.

Revolut is one of two banks that permit both bank transfers and debit cards in the UK council’s study, and it is also the platform where Mekras claims to have experienced his recent account freeze. It operates as an authorized UK bank “with restrictions,” meaning it is currently building up its banking processes before full launch. It also holds a European Union banking license through Lithuania and offers crypto trading services in its app.

A Revolut spokesperson told Cointelegraph it treats account freezes as a “last-resort” customer protection measure in compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

“A temporary freeze may occur if our systems detect irregular activity. This could be a combination of a few factors, such as if a customer interacts with a platform frequently exploited by fraudsters, or we believe that the funds in question may be the proceeds of crime or sanctions circumvention,” the spokesperson said.

The representative added that since Oct. 1, just 0.7% of Revolut accounts where customers deposited crypto funds were restricted or frozen after investigation.

Related: How Europe’s blockchain sandbox finds innovation in regulation

When banks close doors, users move onchain

In some regions, crypto is blocked and leaves users to more extreme restrictions. Crypto on- and off-ramps are not legally possible in regions like China, so users resort to peer-to-peer (P2P) platforms or black markets to trade crypto.

While China sits on the extreme end of the spectrum, other jurisdictions have eased official and unofficial restrictions. Nigeria once banned crypto and even blocked P2P platforms. However, it formally recognized digital assets as securities in 2025.

Related: Crypto takeaways from Davos: Politics and money collide

Similar banking friction patterns also emerged in the US. Lawmakers and the industry have invoked the term “Operation Chokepoint 2.0” to describe the federal regulators’ informal guidance that discouraged banks from maintaining relationships with crypto companies.

The original “Operation Choke Point” was an initiative in which enforcement agencies were accused of pressuring banks to cut ties with politically contentious industries such as payday lenders and firearms sellers.

In January 2025, Donald Trump took office as the president of the US and has been pushing for crypto-friendly policies to position the world’s largest economy as the “crypto capital” of the world.

Crypto debanking issues have since been officially recognized. In December, the US Office of the Comptroller of the Currency (OCC) released its findings on debanking practices by nine of the country’s largest banks. The OCC also published an interpretive letter to confirm that banks may facilitate crypto transactions in a broker-like capacity.

Regardless of the positive momentum, users still complain that the banking sector won’t service accounts exposed to cryptocurrencies.

“This is still the case [and] there are still anti-crypto positions. Some have even said publicly that they are not willing to support crypto activity or engage with the industry,” said Mekras.

Mekras argued that users can consider fully detaching from the traditional banking system and moving finances onchain. It sounds viable in theory, but in reality, most businesses and users still cannot operate purely within crypto without reliable access to fiat rails.

Banking’s turn toward blockchain infrastructure

In recent years, there has been a global shift in how traditional financial institutions engage with crypto.

Major banks and financial infrastructures are increasingly building products and services tied to Web3. In the US, 60% of the top 25 banks are reportedly offering or planning Bitcoin-related services, including custody, trading and advisory solutions.

Across Europe, regulated services such as crypto custody and settlement are being introduced by legacy exchanges and financial groups under the Markets in Crypto-Assets Regulations (MiCA). In the UK, HSBC’s blockchain platform was selected to support pilot issuances of tokenized government bonds.

In that backdrop of institutional adoption, some companies working to bridge banks and blockchain claim that the challenges that lead to account freezes are linked to tooling gaps and risk frameworks inside banks.

“The problem is that there’s a huge amount of friction because traditional banks don’t really have the internal infrastructure to interpret blockchain data in a way that fits inside their existing risk and compliance frameworks,” Eyal Daskal, CEO of Crymbo — a blockchain infrastructure platform for institutions — told Cointelegraph.

He described the situation as one where banks often default to precautionary measures because they lack the ability to link onchain activity with the identity and compliance signals they rely on:

“If crypto is involved, they block the account and treat it as out of scope. It’s the simplest option for them because they don’t have the tools to assess it properly.”

Crypto is entering the financial mainstream, but for many users, access to basic banking still depends on whether a bank’s risk engine can understand what happens onchain. Until that gap closes, the industry’s institutional embrace and retail friction may continue to coexist.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

Franklin Templeton, Binance Roll Out Off-Exchange Collateral

Editor’s note: In this era of digital finance, institutional collaboration between traditional asset managers and crypto exchanges is reshaping markets. The collaboration between Franklin Templeton and Binance demonstrates a practical path to bridge regulated money market products with 24/7 digital markets, using tokenized assets as collateral while preserving custody and risk controls. This editorial snapshot previews how off-exchange collateral programs can improve capital efficiency for institutions without moving assets onto exchanges.

Key points

- Off-exchange collateral using Benji tokenized money market fund shares now live on Binance.

- Custody by Ceffu minimizes counterparty risk for institutions.

- Enables yield-bearing assets to be used for trading without on-exchange parking.

- Expands Franklin Templeton and Binance’s networks of off-exchange program partners.

Why this matters

This collaboration signals growing institutional adoption of tokenized real-world assets, improving capital efficiency and risk controls in crypto markets. By tokenizing money market funds and maintaining custody off-exchange, institutions can participate in 24/7 trading with regulated protections, potentially broadening the set of assets available for collateral and fueling more stable liquidity in digital markets.

What to watch next

- Broader rollout to additional institutional clients.

- Addition of more tokenized Benji funds.

- Deeper custody and settlement integrations with Ceffu.

- Ongoing collaboration expansion across networks since the 2025 announcement.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Franklin Templeton and Binance Advance Strategic Collaboration with Institutional Off-Exchange Collateral Program

Institutions can now use Benji-issued tokenized money market funds as off-exchange collateral to trade on Binance using Ceffu’s custody layer.

SAN MATEO, CA, and ABU DHABI, UAE, February 19, 2026 — Franklin Templeton, a global investment leader, and Binance, the world’s leading cryptocurrency exchange by trading volume and users, today announced a new institutional off-exchange collateral program, making digital markets more secure and capital-efficient. Now live, eligible clients can use tokenized money market fund shares issued through Franklin Templeton’s Benji Technology Platform as off-exchange collateral when trading on Binance.

The program alleviates a long-standing pain point for institutional traders by allowing them to use traditional regulated, yield-bearing money market fund assets in digital markets without parking those assets on an exchange. Instead, the value of Benji-issued fund shares is mirrored within Binance’s trading environment, while the tokenized assets themselves remain securely held off-exchange in regulated custody. This reduces counterparty risk, letting institutional participants earn yield and support their trading activity without hedging on custody, liquidity, or regulatory protections.

“Since partnering in 2025, our work with Binance has focused on making digital finance actually work for institutions,” said Roger Bayston, Head of Digital Assets at Franklin Templeton. “Our off-exchange collateral program is just that: letting clients easily put their assets to work in regulated custody while safely earning yield in new ways. That’s the future Benji was designed for, and working with partners like Binance allows us to deliver it at scale.”

“Partnering with Franklin Templeton to offer tokenized real-world assets for off-exchange collateral settlement is a natural next step in our mission to bring digital assets and traditional finance closer together,” said Catherine Chen, Head of VIP & Institutional at Binance. “Innovating ways to use traditional financial instruments on-chain opens up new opportunities for investors and shows just how blockchain technology can make markets more efficient.”

Assets participating in the program remain held off-exchange in a regulated custody environment, with tokenized money market fund shares pledged as collateral for trading on Binance. Custody and settlement infrastructure is supported by Ceffu, Binance’s institutional crypto-native custody partner.

“Institutions increasingly require trading models that prioritize risk management without sacrificing capital efficiency,” said Ian Loh, CEO of Ceffu. “This program demonstrates how off-exchange collateral can support institutional participation in digital markets while maintaining strong custody and control.”

Launching the institutional off-exchange collateral program expands on both Franklin Templeton’s and Binance’s growing networks of off-exchange program partners and represents another effort since announcing Franklin Templeton and Binance’s strategic collaboration in September 2025.

By using Benji to bridge tokenized money market funds, Franklin Templeton is taking trusted investment products and making them work in modern markets—allowing institutions to trade, manage risk, and move capital more efficiently as digital finance becomes an everyday part of the financial system.

Offering more tokenized real-world assets on Binance meets the increasing institutional demand for stable, yield-bearing collateral that can settle 24/7. This gives investors greater choice and enhances their trading experience on the world’s largest regulated digital asset exchange.

Franklin Templeton is a pioneer in digital asset investing and blockchain innovation, combining tokenomics research, data science, and technical expertise to deliver cutting-edge solutions since 2018. Learn more at http://franklintempleton.com/investments/asset-class/digital-assets.

About Binance

Binance is a leading global blockchain ecosystem behind the world’s largest cryptocurrency exchange by trading volume and registered users. Binance is trusted by more than 300 million people in 100+ countries for its industry-leading security, transparency, trading engine speed, protections for investors, and unmatched portfolio of digital asset products and offerings from trading and finance to education, research, social good, payments, institutional services, and Web3 features. Binance is devoted to building an inclusive crypto ecosystem to increase the freedom of money and financial access for people around the world with crypto as the fundamental means.

For more information, visit https://www.binance.com.

About Ceffu

Ceffu is a compliant, institutional-grade custody platform offering custody and liquidity solutions that are ISO 27001 & 27701 certified and SOC2 Type 2 attested. Our multi-party computation (MPC) technology, combined with a customizable multi-approval scheme, provides bespoke solutions allowing institutional clients to safely store and manage their virtual assets.

For the purposes of this program, custody services for Benji-issued tokenized money market fund shares are provided by Ceffu Custody FZE, a virtual asset custodian licensed and supervised in Dubai.

About Franklin Templeton

Franklin Templeton is a trusted investment partner, delivering tailored solutions that align with clients’ strategic goals. With deep portfolio management expertise across public and private markets, we combine investment excellence with cutting-edge technology. Since our founding in 1947, we have empowered clients through strategic partnerships, forward-looking insights, and continuous innovations – providing the tools and resources to navigate change and capture opportunity.

With more than $1.7 trillion in assets under management as of January 31, 2026, Franklin Templeton operates globally in more than 35 countries.

To learn more, visit franklintempleton.com and follow us on LinkedIn.

Franklin Resources, Inc. [NYSE: BEN]

All investments, including money funds, involve risk, including loss of principal. There are risks associated with the issuance, redemption, transfer, custody, and record keeping of shares maintained and recorded primarily on a blockchain. For example, shares that are issued using blockchain technology would be subject to risks, including the following: blockchain is a rapidly-evolving regulatory landscape, which might result in security, privacy or other regulatory concerns that could require changes to the way transactions in the shares are recorded.

This is a general announcement. Products and services referred to here may not be available in your region. Terms and conditions apply.

Copyright © 2026. Franklin Templeton. All rights reserved.

Crypto World

What Is the Most Probable Next Move for BTC as Momentum Stays Weak?

Bitcoin is trading under sustained pressure after losing key higher-timeframe support levels, with the price structure showing a clear transition from distribution to a developing downtrend. Momentum remains weak, and recent rebounds appear corrective rather than impulsive, keeping downside risk elevated in the near term.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, the asset continues to respect a descending channel while trading below major moving averages, confirming bearish market structure. The rejection from the mid-range resistance zone and subsequent sharp sell-off toward the low-$60K region reinforces that sellers still control trend direction.

Momentum indicators remain subdued, with RSI holding far below neutral and failing to produce strong bullish divergence. Unless the price can reclaim the $75K–$80K resistance cluster and close above the channel midpoint, the broader bias stays tilted toward continuation lower or prolonged consolidation near the $60K support level.

BTC/USDT 4-Hour Chart

The 4-hour chart shows a steep impulsive drop followed by choppy sideways movement, typical of a bear-flag or accumulation attempt after liquidation. Lower highs continue to form beneath descending dynamic resistance, signaling that buyers have not yet regained short-term control.

Key support sits around the recent wick low near the $60K area, while immediate resistance is clustered between roughly $73K and $76K. A breakout above this range would be the first technical signal of a momentum shift, whereas a breakdown below the mentioned support zone could accelerate another leg downward and lead to another round of massive liquidations.

Sentiment Analysis

Funding rate data shows sentiment cooling significantly compared to earlier overheated conditions, with the recent deeply negative prints suggesting reduced long-side leverage. This type of reset is constructive over the medium term but does not, by itself, confirm an immediate bullish reversal.

Overall market psychology appears cautious rather than euphoric, which often precedes range formation before the next major move. For sentiment to flip decisively bullish, price strength must return alongside rising but controlled funding and improving momentum across timeframes.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Finish the job on digital asset market structure

In Washington, the safest vote is often no vote at all, and the most convenient timeline is “next session.” But when it comes to the future of banking, financial markets and financial services, inaction is unacceptable. The United States needs crypto regulatory clarity to compete and succeed in the digitally networked financial system of the 21st Century.

The Senate is today at a crossroads on market structure legislation—policy designed to bring order to digital asset innovation, an increasingly important component of global finance. Failing to codify the “rules of the road” doesn’t just stall crypto; it invites regulatory chaos that harms banks and consumers alike, saps economic dynamism and forces innovation to drift offshore. Congress must choose whether America leads the next generation of finance or watches from the sidelines.

The current stalemate centers on a perceived conflict between banks and crypto platforms regarding interest yield and rewards on stablecoins—an issue already addressed by the GENIUS Act, signed into law by President Trump last year. The law permits crypto companies to offer rewards and incentives to customers for holding and using stablecoins made available by separate providers. Banks counter that such reward structures closely resemble traditional bank savings and checking products and, if left unchecked, could shift customer balances away from insured deposits without the same prudential requirements.

Framed this way, the disagreement carries more weight than it should. Yield and rewards are questions of design within a payments framework, not questions of systemic safety or financial stability. Treating them as existential risks has delayed an otherwise straightforward resolution, stalling progress on crucial market structure issues.

If one looks past talking points, a workable compromise is already available. Congress can explicitly enable federally regulated banks—including community banks—to offer yield on payment stablecoins. Banks gain a clear, federally sanctioned revenue and customer-acquisition opportunity in the stablecoin market. They obtain a straightforward way to secure customers and funds, especially important for community banks seeking to remain competitive in a world of mega-banks and scaled payment platforms. Crypto platforms, meanwhile, retain the incentive structures their customers expect and that are available under existing law. Congress gets to move market structure legislation forward and create a bill that can pass. And, most importantly, the American consumer benefits from increased competition and the ability to share in the yield potential of their own money.

Framing crypto as an existential threat to the community bank is a rhetorical tactic, not an economic reality. A recent empirical analysis finds no statistically meaningful relationship between stablecoin adoption and deposit outflows, suggesting stablecoins function primarily as transactional instruments rather than savings substitutes. In fact, properly regulated stablecoins may provide local and community banks with a pathway to modernize their payment offerings and reach new customers.

The rewards-yield question is a design issue that can be addressed without upending progress already made. A workable compromise exists that addresses banks’ economic interests, protects crypto innovation and respects the settled law of the GENIUS Act. Advancing on that basis keeps the broader market structure package intact and provides the legal clarity that the American economy deserves.

The Senate has the tools to resolve this impasse and to follow the strong leadership displayed by the White House. Failing to do so would be a choice, not an inevitability.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports11 hours ago

Sports11 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment17 hours ago

Entertainment17 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World20 hours ago

Crypto World20 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

(@Binansmartkid)

(@Binansmartkid)