Business

FirstFT: UK consumer and business confidence fall to lowest levels this year

Also in today’s newsletter, US backs huge lithium mine and CIA and Mossad chiefs to meet

Travel

Choo-Choo-Choose a Greener Travel Gift: Traingift Rolls into Town

Amsterdam, October 2024 – Say goodbye to cramped airplane seats and endless airport lines. Europe’s best cities are just a train ride away, and now, with Traingift, they’re just a gift card away too.

Experiencegift, the company behind the world’s leading travel gifting brands Flightgift, Hotelgift, and Activitygift, is excited to announce the launch of its newest innovation: Traingift. Founded by entrepreneurs Loes Daniels and Jorik Schröder, Experiencegift launches the first gift card for train journeys across Europe.

“As a frequent traveler myself, I understand the growing appeal of train travel over flying or driving. It’s convenient, flexible, eco-friendly, and you can admire the scenery while staying connected to work or family,” said Loes Daniels, co-founder of Experiencegift. “With Traingift, we’re responding to this rising trend and offering the world a way to gift memorable train journeys. I’ve personally enjoyed the ease of traveling by train between cities like Amsterdam, Paris, and London, and I believe our customers will appreciate this experience as well.”

Traingift provides access to Europe’s largest rail networks, covering over 25,000 destinations in 33+ countries, from high-speed Eurostar trains to scenic Eurail and Interrail passes. Traingift recipients can redeem their cards for one-way trips or unlimited travel passes, opening the door to cities like Paris, Munich, Milan, and more. By partnering with leading rail networks such as Deutsche Bahn, Trenitalia, and Eurostar, Traingift ensures a wide range of options, whether for business travelers, vacationers, or eco-conscious explorers.

Available in multiple languages and 15 currencies, Traingift is designed to be as flexible as possible, appealing to customers worldwide. Gift cards are available as a premium physical gift voucher, featuring a custom image and text printed in high-quality photo resolution. Alternatively, for a quicker option, the gift can be sent digitally as a PDF or eGift, perfect for last-minute gifting.

“We believe in experiences over things. That’s why we created Traingift, to make gifting train travel as exciting and accessible as possible,” added Loes. “Train travel is sustainable, scenic, and stress-free, and we’re excited to offer this new gift card for people to experience Europe.”

Jorik believes this new gift card perfectly fits the current shift towards more sustainable, experience-focused travel options. “More people are opting for train travel because it’s greener, and it’s more convenient than flying. I have friends who’ve even given up flying entirely in favor of train travel. With Traingift, we’re offering the ultimate gift for the conscious traveler—something that allows people to create unforgettable experiences while reducing their carbon footprint.”

Loes and Jorik’s entrepreneurial journey hasn’t been without its challenges. Starting with just two people, they have grown Experiencegift to a team of 70 colleagues and offices in New York, London, Amsterdam, and Athens. “Building a company from the ground up is no small feat,” shared Jorik. “We faced numerous hurdles along the way, including the unprecedented challenges to the travel industry posed by the COVID-19 pandemic. Despite these obstacles, we remained committed to innovation and adaptability. During this time, we managed to improve our operations and grow our gift card brands to the successful company we are today.”

The launch of Traingift is a major step forward for Experiencegift, whose other brands have seen rapid global growth. The company is now active in over 50 countries and has earned a reputation for being innovative, with a strong focus on providing a wide range of redemption options and a personalized gift experience.

Traingift is now available for purchase at www.traingift.com.

About Experiencegift

Founded by Loes Daniels and Jorik Schröder, Experiencegift is a global leader in experience gift cards. With brands like Hotelgift, Flightgift, Activitygift, and now Traingift, they empower people to gift meaningful experiences across the world. The company operates in more than 50 countries and has earned multiple awards, including the top prize in the Deloitte Fast 50 and a nomination for EY Entrepreneur of the Year.

In addition to growing Experiencegift, Loes Daniels is passionate about empowering other women to think big and be ambitious. She founded BusinessWomen to inspire and support women in pursuing their professional dreams.

CryptoCurrency

Ripple files Form C, appeals SEC ruling on XRP institutional sales

Ripple challenges SEC’s ruling on institutional XRP sales, claiming the Howey test was misapplied.

CryptoCurrency

Bitcoin analyst: $100K BTC price by February 'completely within reason'

BTC price trajectory appears all but destined for six figures in the mid term — despite nearly eight months of Bitcoin market consolidation.

CryptoCurrency

1 Top Stock to Buy Hand Over Fist Before That Happens

2024 is turning out to be a solid year for the global semiconductor industry, driven by multiple catalysts. These include the booming demand for chips that can manage artificial intelligence (AI) workloads, a turnaround in the smartphone market’s fortunes, and a recovery in the personal computer (PC) market.

These factors explain why the global semiconductor industry’s revenue is expected to jump 16% in 2024 to $611.2 billion, according to World Semiconductor Trade Statistics (WSTS). That points toward a nice turnaround from last year, when the semiconductor industry’s revenue fell 8%. Even better, the semiconductor space is expected to keep growing in 2025 as well, with WSTS projecting a 12.5% increase in the industry’s earnings to $687.4 billion next year.

More specifically, WSTS predicts a whopping 25% increase in the memory market’s revenue in 2025 to $204.3 billion. As it turns out, memory is expected to be the fastest-growing semiconductor segment next year as well, following an estimated jump of almost 77% in this segment’s revenue in 2024.

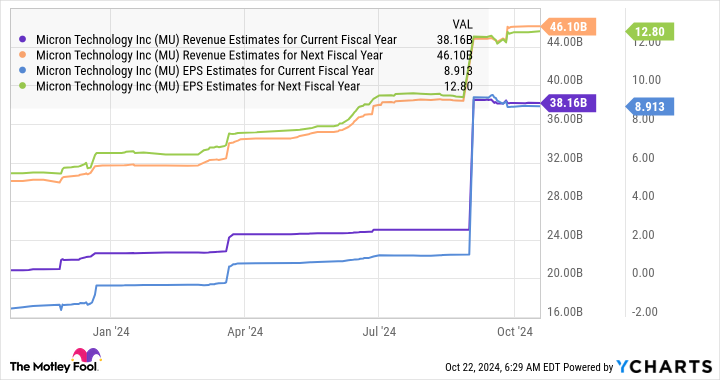

There’s one company that could help investors tap this fast-growing niche of the semiconductor market next year: Micron Technology (NASDAQ: MU). Let’s look at the reasons why buying this semiconductor stock could turn out to be a smart move right now.

WSTS isn’t the only forecaster expecting the memory market to surge higher next year. Market research firm TrendForce estimates that the sales of dynamic random access memory (DRAM) could jump 51% in 2025, while the NAND flash storage market could clock 29% growth. Both these markets are expected to reach record highs next year.

The growth in these memory markets will be driven by a combination of strong demand and improved pricing. TrendForce is forecasting a 35% year-over-year increase in DRAM prices next year, driven by the increasing demand for high-bandwidth memory (HBM) that’s used in AI processors, as well as the growth in DRAM deployed in servers. Meanwhile, the growing demand for enterprise-class solid-state drives (SSDs) and the growth in smartphone storage will be tailwinds for the NAND flash market.

These positive trends explain why Micron is set to begin its new fiscal year on a bright note. The company’s revenue in fiscal 2024 (which ended on Aug. 29) increased 61% year over year to $25.1 billion. The company posted a non-GAAP (generally accepted accounting principles) profit of $1.30 per share, compared to a loss of $4.45 per share in fiscal 2023, driven by a big jump in its operating margin on account of recovering memory prices.

CryptoCurrency

A truly decentralized system would decentralize authority — Cardano exec

Cardano Foundation chief technology officer Giorgio Zinetti told Cointelegraph that centralized authority is good for speed, but decentralized governance would give long-term sustainability.

CryptoCurrency

Intel’s former CEO tried to buy Nvidia almost 2 decades ago

Tech pioneer Intel (INTC) has seemingly missed out on the artificial intelligence boom — and part of it can reportedly be traced back to a decision not to buy the chipmaker at the center of it all almost two decades ago.

Intel’s former chief executive Paul Otellini wanted to buy Nvidia in 2005 when the chipmaker was mostly known for making computer graphics chips, which some executives thought had potential for data centers, The New York Times (NYT) reported, citing unnamed people familiar with the matter. However, Intel’s board did not approve of the $20 billion acquisition — which would’ve been the company’s most expensive yet — and Otellini dropped the effort, according to The New York Times.

Instead, the board was reportedly more interested in an in-house graphics project called Larrabee, which was led by now-chief executive Pat Gelsinger.

Almost two decades later, Nvidia (NVDA) has become the second-most valuable public company in the world and continuously exceeds Wall Street’s high expectations. Intel, on the other hand, has seen its shares fall around 53% so far this year and is now worth less than $100 billion — around 30 times less than Nvidia’s $3.4 trillion market cap.

In August, Intel shares fell 27% after it missed revenue expectations with its second-quarter earnings and announced layoffs. The company missed profit expectations partly due to its decision to “more quickly ramp” its Core Ultra artificial intelligence CPUs, or core processing units, that can handle AI applications, Gelsinger said on the company’s earnings call.

And Nvidia wasn’t the only AI darling Intel missed out on.

Over a decade after passing on Nvidia, Intel made another strategic miss by reportedly deciding not to buy a stake in OpenAI, which had not yet kicked off the current AI hype with the release of ChatGPT in November 2022.

Former Intel chief executive Bob Swan didn’t think OpenAI’s generative AI models would come to market soon enough for the investment to be worth it, Reuters reported, citing unnamed people familiar with the matter. The AI startup had been interested in Intel, sources told Reuters (TRI), so it could depend less on Nvidia and build its own infrastructure.

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Technology4 weeks ago

Technology4 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

MMA3 weeks ago

MMA3 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Technology4 weeks ago

Technology4 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Football3 weeks ago

Football3 weeks agoWhy does Prince William support Aston Villa?

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology4 weeks ago

Technology4 weeks agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Technology3 weeks ago

Technology3 weeks agoGmail gets redesigned summary cards with more data & features

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Sport4 weeks ago

Sport4 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Sport3 weeks ago

Sport3 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

MMA3 weeks ago

MMA3 weeks ago‘I was fighting on automatic pilot’ at UFC 306

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

News3 weeks ago

News3 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

TV3 weeks ago

TV3 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

-

Politics3 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Money3 weeks ago

Money3 weeks agoPub selling Britain’s ‘CHEAPEST’ pints for just £2.60 – but you’ll have to follow super-strict rules to get in

-

Technology3 weeks ago

Technology3 weeks agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

News3 weeks ago

News3 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Technology3 weeks ago

Technology3 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Technology3 weeks ago

Technology3 weeks agoHow to disable Google Assistant on your Pixel Watch 3

-

Business3 weeks ago

Can liberals be trusted with liberalism?

-

Technology3 weeks ago

Technology3 weeks agoA very underrated horror movie sequel is streaming on Max

You must be logged in to post a comment Login