CryptoCurrency

CME website hints at XRP, SOL futures debut in February

According to the CME, 29.4 million crypto futures contracts were traded in 2024, valued at over $1.7 trillion in notional figures.

CryptoCurrency

ANIME gets Binance airdrop ahead of new listing

The Azuki-backed ANIME token will be airdropped to Binance users prior to its official listing and debut on Jan. 23, 2025 at 14:00 UTC.

The Animecoin community token ANIME will be making its debut on Jan. 23 in a number of major exchanges, including Binance. The token named after the Japanese pop culture phenomenon will be airdropped to BNB (BNB) holders subscribed to the BNB Simple Earn products from Jan. 17 until Jan. 20.

ANIME will be officially listed on Binance starting from Jan. 23 at 14:00 UTC. Trading pair support will available for ANIME alongside USDT, USDC, BNB, FDUSD, and TRY. However, due to its status as a freshly launched token, Binance will be adding the seed tag to ANIME.

For the HODLer Airdrop, Binance will be giving away 500 million ANIME tokens, which is around 5% of the maximum token supply. Animecoin will launch on Ethereum (ETH) and Arbitrum (ARB) with 50.5% of tokens being allocated to the community and more than 20% going to the team, advisors and company.

Aside from Binance, Animecoin is also set to list simultaneously on Bybit and OKX on Jan. 23.

What is ANIME on crypto?

ANIME or Animecoin is the native token of the Animecoin Foundation, the community backed by the Arbitrum Foundation and popular NFT brand Azuki. Dubbed the “culture coin of the anime industry,” the Animecoin ecosystem seeks to combine original IP works, mainstream distribution, and on-chain infrastructure that will grant the anime fandom power to further expand itself.

“The Animecoin ecosystem will provide a collaborative environment to democratize content creation. The Azuki IP will be the first of many native anime IPs providing the cultural energy that drives engagement across the blockchain-powered anime network,” wrote the community in a recent X post.

Additionally, Anime.com is set to be the first platform available on the Animecoin ecosystem.

The ANIME token will be used as a gas and governance token for Animechain, its anime-based web3 network set to go live in the first quarter of 2025. The project will bring in various anime-related content from original and third-party IPs, including games, merchandise, and NFTs.

The Animecoin foundation has prepared a total token supply of 10 billion ANIME tokens and an initial circulating supply of 7.69 billion ANIME.

CryptoCurrency

Why Did Worldcoin (WLD) Price Pump on Wednesday?

Those gains leveled out some by mid-afternoon US Central Time. Worldcoin’s WLD tokens were the tallest green candle for the day on Wednesday, with a 12% daily surge.

Hyperliquid’s HYPE (8.6% gains) and Raydium’s RAY (8% gains) were the second and third most bullish tokens for the day. A few places down on the leaderboard was Fartcoin. Traders probably don’t want their Hyperliquid anywhere near that.

So why was the Worldcoin price pumping on Wednesday?

Why Did Worldcoin Price Pump on Wednesday?

President Donald Trump announced in a press conference on Tuesday that he wants the government to make a $500 billion grant in an AI project led by OpenAI.

Of course, OpenAI is doing more than large language models with ChatGPT. In fact, its Worldcoin project may be more ambitious. OpenAI founder Sam Altman plans to dominate biometrics with cryptographically secured iris scans. The project pays participants in WLD tokens.

On Tuesday, Trump announced he wants the government to invest $500 billion in a new OpenAI project called Stargate, so the artificial intelligence sector can go on a hiring spree.

That statement probably had something to do with this cryptocurrency’s big moves on Tuesday and Wednesday. But investors should be wary about a thing or two related to this trade.

DOGE-Loving Musk Opposes Gov Grant

To begin with, Stargate and Worldcoin are not exactly the same thing, and they are only loosely related through OpenAI. So, an investment in Worldcoin at this time may be more based on the recent news cycle than long-term market leverage.

Moreover, Elon Musk, the key influence in the new White House other than the president himself, opposes the newly announced plans to invest $500 billion in a project led by OpenAI. So, these plans may not come to fruition.

“They don’t actually have the money,” Musk wrote in a post on X. “SoftBank has well under $10B secured. I have that on good authority.” A grant from the White House of that size to a single private company would certainly be questionable on the grounds of government efficiency.

Worldcoin isn’t the only splash the White House has made in cryptocurrency this week. Dogecoin’s price erupted 15% within minutes Tuesday after the website for the Department of Government Efficiency went live. Meanwhile, analysts are rife with bullish Dogecoin predictions.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Bitcoin Capital Inflows See Notable Slowdown, But Is This A Worry?

On-chain data shows the capital inflows into Bitcoin have slowed down since last year’s high. Here’s what this could mean for BTC’s price.

Bitcoin Realized Cap Continues To Grow, Albeit At A Slower Rate

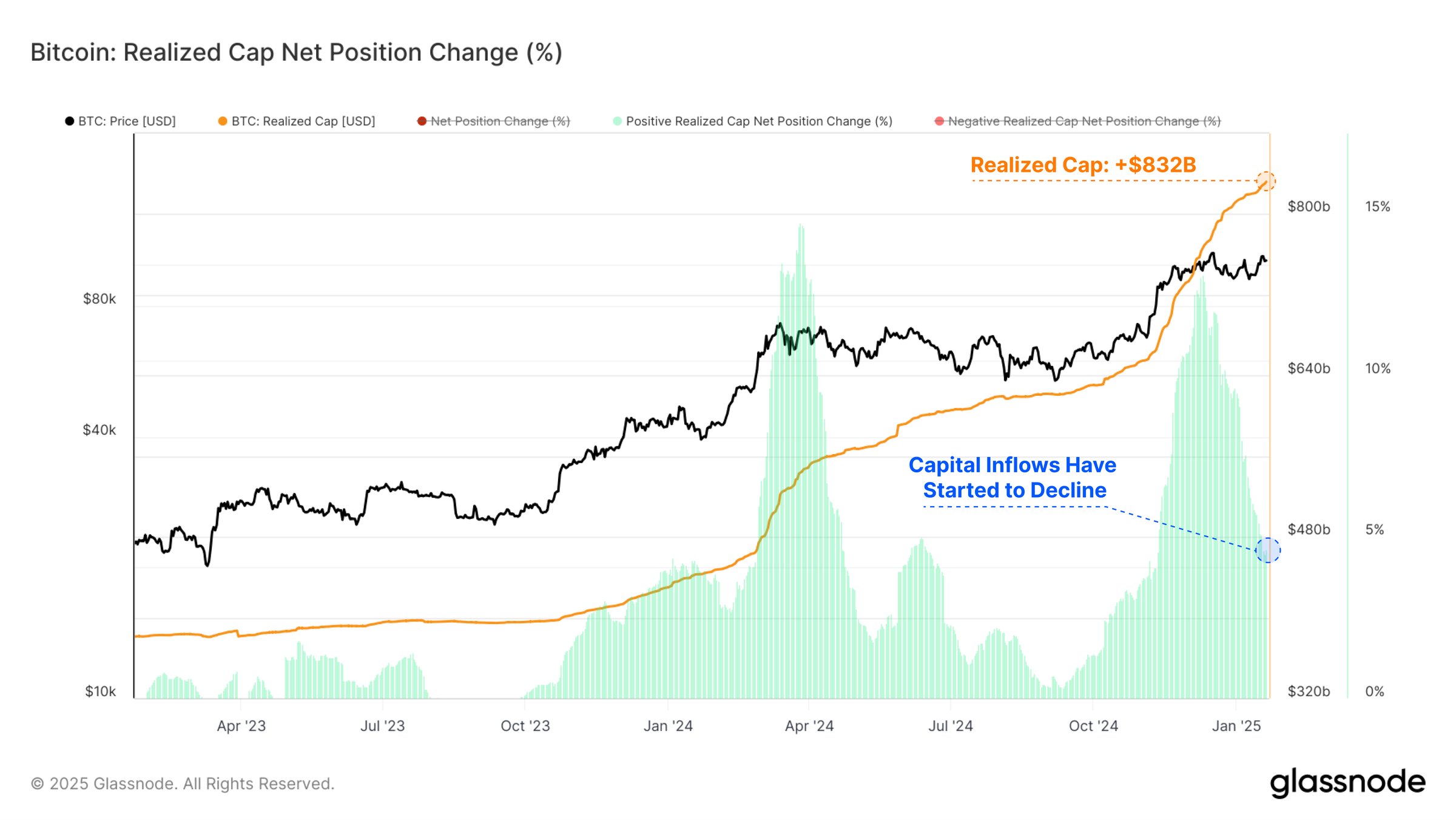

According to data from the on-chain analytics firm Glassnode, capital inflows into BTC have been on the decline recently. The indicator of relevance here is the “Realized Cap,” which is a capitalization model for Bitcoin that calculates its total valuation by assuming that the ‘real’ value of any token in circulation is equal to the price at which it was last transacted on the blockchain.

The last transaction for any token can be considered to be the last point at which it changed hands, so the price at its time would denote its current cost basis. As such, the Realized Cap takes the total sum of the cost basis of the entire BTC supply in circulation.

This value is nothing, but the total amount of capital that the investors as a whole have used to purchase the cryptocurrency. Changes in the indicator, therefore, reflect the capital flowing into or out of the asset.

Below is the chart for the Realized Cap shared by the analytics firm, which shows the trend in its daily value, as well as its 30-day percentage change, over the last couple of years.

As displayed in the graph, the Bitcoin Realized Cap observed some sharp growth during the last couple of months of 2024, implying capital was flowing at a rapid rate into the cryptocurrency.

This is more easily visible through the monthly percentage change, which shot up to a very high positive level. These inflows appear to have provided the fuel for BTC’s rally above $100,000.

From the chart, it’s apparent that after hitting a peak, the 30-day change in the Realized Cap reversed its direction and started going down in a sharp manner instead. This decline in the metric has continued into 2025.

Despite the drawdown, though, its value is still quite positive, suggesting the Realized Cap continues to grow at a notable rate. A similar trend was also witnessed back in the first few months of 2024, where a high in capital inflows was followed by a cooldown, which led into a lengthy consolidation period for Bitcoin.

So far, capital is still flowing into BTC at a rate of $38.6 billion per month, which is significantly higher than the lows observed during last year’s sideways phase. It now remains to be seen whether the inflows will continue to decline in the coming days, or if a reversal would happen, potentially acting as a bullish signal for the asset.

Following the latest streak of inflows, the Bitcoin Realized Cap has reached the $832 billion mark, which is a new all-time high.

BTC Price

Bitcoin has been struggling to pick a direction during the last few days as its price is still trading around the $104,000 level.

CryptoCurrency

Crypto Lender Nexo Introduces $5,000 Minimum to Focus on Wealthy Clients

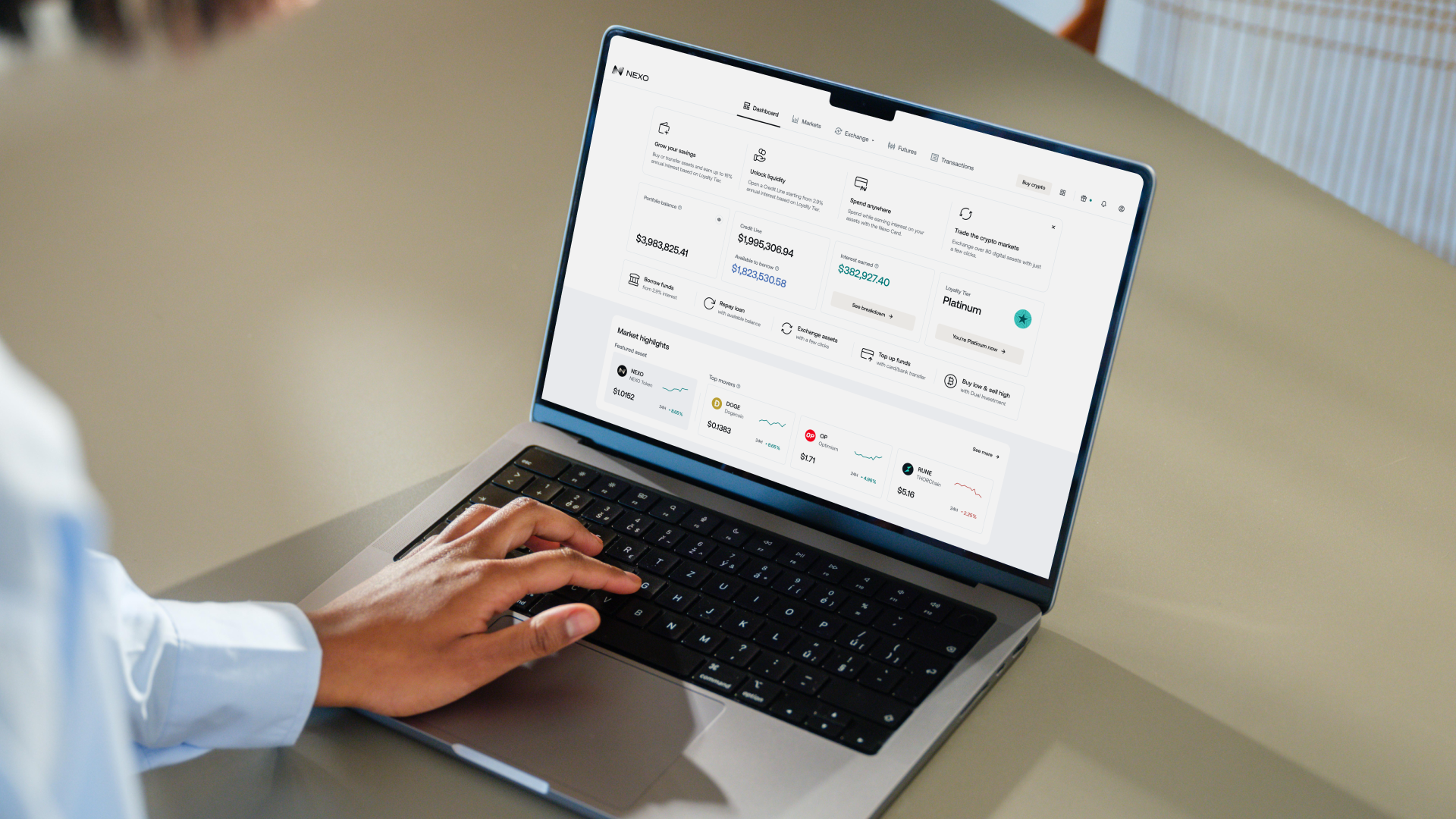

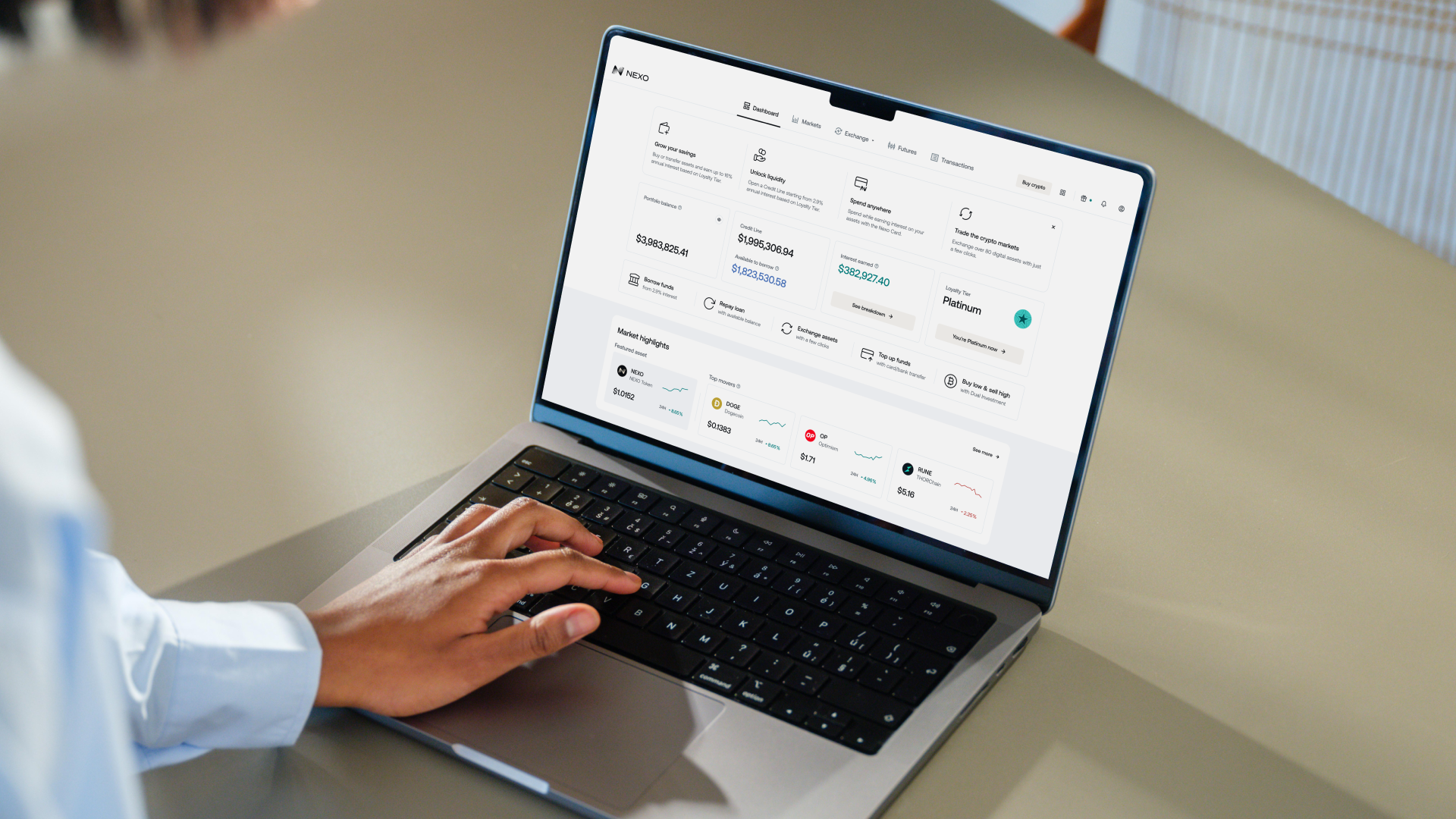

Crypto trading and lending platform Nexo is set to introduce a $5,000 minimum limit to use its services as the firm evolves into a digital assets wealth manager targeting the mass affluent market.

The move, which comes into effect in February, is part of the firm’s 2025 growth strategy and recent rebranding, according to a press release on Tuesday.

“Guided by principles rooted in traditional finance and the personalized excellence of private white-glove services, we are committed to delivering sustainable wealth solutions for generations to come,” Nexo co-founder Kosta Kantchev said in a statement.

Nexo is one of the few crypto borrow and lend platforms to have survived the bear market of 2022-23, and collapse of many centralized crypto finance firms at that time. Looking ahead, Nexo won an initial approval to operate as a licensed entity in Dubai in March of last year.

Nexo has over $11 billion in assets under management, has issued $8 billion in crypto credit, and paid out over $1 billion in interest, the company said.

[Update: date in story changed to February]

CryptoCurrency

Which Is The Best ICO To Invest In 2025? Remtitix, Rexas Finance, Litechain AI Or WEPE?

In the search for the best Initial Coin Offering to invest in for 2025, many investors are pondering the potential of a promising ICO known as Remittix (RTX) alongside other ICOs like Rexas Finance, Litechain AI, and WEPE. Undoubtedly, Rexas Finance, Litechain AI, and WEPE all have their benefits and uniqueness, which have attracted a great deal of inflows to their respective presales.

However, experts still think Remittix stands out among them as it promises up to 100x gains during its presale and to tackle the complex problems often experienced in the online payment landscape. Learn about these ICOs and so find out why Remiitix is considered a more promising options

Analyzing Rexas Finance’s Success: What’s Driving Investor Interest?

Rexas Finance, is one of the new ICOs that is currently in the headlines. The token has risen to $42 million in its presale, with Stage 11 selling out quickly. The token, RXS, is now in Stage 12 at $0.20, up from $0.03 in Stage 1, reflecting strong investor confidence. The planned listing price is $0.25, with a launch on June 19, 2025.

One reason investors think Rexas Finance is viewed as one of the best cryptocurrency investments is due to its potential to transform the crypto landscape by linking real-world assets, like real estate and gold, to blockchain. With fractional ownership of these assets, investors can own shares of properties worldwide and earn passive income.

$12 Million Raised: Light Chain AI’s Presale a Massive Success

Like other new ICOs, Light Chain AI has captured the attention of crypto enthusiasts seeking significant gains. A key feature is its Artificial Intelligence Virtual Machine (AIVM), which enables efficient AI task execution on the blockchain. Unlike traditional systems, the AIVM evolves and develops through the collaboration of global developers.

Currently, you can buy LCAI tokens for $0.005625 each before the price increases to $0.006. So far, the project has raised over $12 million. You can purchase LCAI using Ethereum or USDT, and the platform allows you to connect your wallet to participate in the token presale.

WEPE Raises $54 Million: Is This the Next Meme Coin Sensation?

Inspired by the popular Pepe meme, Wall Street Pepe is a new cryptocurrency aimed at helping regular investors with trading tools and resources. While in its token presale, WEPE raised an impressive $54 million, indicating strong interest from its growing community.

As of now, 1 WEPE is priced at $0.0003665, with 25 days left until the presale concludes. While WEPE has made a promising start, its long-term success will depend on delivering on its commitments and maintaining community engagement.

Remittix (RTX) Dominates 2025 ICOs: $4.6 Million Raised, 100x Potential

As we assess the landscape of emerging ICOs for 2025, Remittix (RTX) stands strong alongside promising projects like WEPE, Litechain AI, and Rexas Finance. So, what’s drawing people to Remittix? Its innovative approach to converting cryptocurrencies into fiat effectively addresses the frustrations many users face with existing financial systems.

The project has garnered attention for its potential to simplify the remittance process, providing a much-needed service that can make financial transactions easier and more accessible. As we look toward the crypto landscape of 2025, it’s becoming increasingly clear that tokens with real, practical applications will hold significant value.

Moreover, the design and structure of Remittix further bolster investor confidence. The project features a locked liquidity pool, which helps maintain stability and minimizes the risk of sudden market dips. Transparent auditing practices also improve the project’s credibility, assuring backers that Remittix is not just another passing trend.

The ongoing Remittix token presale presents an exciting opportunity for early investors. With 72.93% of tokens for the current round already sold, the presale has raised an impressive $4.6 million, with 240 million tokens sold so far. Currently, the price of 1 $RTX is $0.0239, but it is being predicted to skyrocket possibly by 100x, just after it lists on exchanges.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Coinbase asks appeals court to rule crypto trades aren’t securities

Coinbase asked the Second Circuit Appeals Court to say that crypto trades on its exchange aren’t securities in a bid to end a 2023 lawsuit from the SEC.

CryptoCurrency

CME could launch SOL and XRP futures on Feb. 10

The CME’s staging website indicated that investors could soon access futures contracts for Solana and Ripple’s XRP.

Solana (SOL) and Ripple (XRP) futures trading is set to debut on the Chicago Mercantile Exchange platform on Feb. 10, according to a supposed CME subdomain.

Bloomberg exchange-traded fund analyst, Eric Balchunas, noted that the update appeared on the “beta.cmegroup” website, which stated that the two products were pending regulatory approval.

Fellow ETF expert James Seyffart also emphasized that the news wasn’t shared via official channels, advising caution until the exchange posts confirmation. “Honestly, if this is fake, it’s a pretty good fakeout. I’m waiting for CME to officially confirm this via press release or their actual website though,” Seyffart wrote on X.

Several financial juggernauts, including JPMorgan and Standard Chartered, believe that more ETFs will go live in 2025. Analysts have predicted up to $14 billion in new cash flow into SOL and XRP products if regulators give the green light.

Issuers have filed documents with the Securities and Exchange Commission to bring these products to market, although roadblocks emerged last year. Industry sentiment suggests that regulatory clarity over SOL’s security status will be a deciding factor. However, optimism remains due to a new pro-crypto administration expected under President Donald Trump.

CryptoCurrency

Is a Surge Around The Corner?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

CryptoCurrency

Regulation and Compliance Are Key to Building Crypto Derivatives

For crypto to mature fully, regulated derivatives are non-negotiable.

Derivatives already comprise 70-75% of crypto transaction volumes, with institutional players leading the charge. While there is a growing number of regulated offerings, the majority of the volume – about 95% – happens in “offshore” venues, meaning in unregulated or lightly regulated jurisdictions. This exposes investors to risks like market manipulation and fraud, and leaves consumers with a lack of protections.

Luckily, there are a growing number of pathways, particularly in Europe, for crypto exchanges to meet the demands of risk-averse institutional investors whose primary concern is compliance, security and regulation.

What We Can Learn From Market History

Historically, spot markets have served as foundational liquidity sources and initial price discovery venues. As markets mature, derivatives markets often take the lead by incorporating broader information and future expectations. This transition has already been observed in commodities and equities markets globally, signaling a shift towards more advanced trading strategies — a key indicator of a maturing market.

Similarly, in the crypto space, for a mature and balanced crypto market, it is imperative to have access to both spot and derivatives trading. Futures and options will play — and have always played — an essential role in managing risk, hedging and enhancing capital efficiency. They are crucial for attracting sustained institutional participation, allowing capital efficiency and affording a wide array of trading strategies.

However, only regulated exchanges will be able to provide the security and compliance essential for large financial clients. For crypto exchanges to offer E.U.-regulated crypto derivatives like perpetual swaps, getting a MiFID license is a must. There’s no doubt about the growing demand for derivatives — about $3 trillion. MiFID brings the clarity and protections that crypto markets desperately need, giving us oversight that aligns with traditional financial services. This boosts market integrity and helps curb fraud.

Regulated exchanges can attract a wider range of institutional clients with demand for crypto derivatives. And they can become sources of innovation. The growing appetite for sophisticated products like perpetual swaps reflects the maturation of trading strategies, provided they come with oversight. Effectively leveraging these tools is critical to promoting market integrity and creating sustainable yield opportunities.

Managing the Real Institutional Risks

As we have seen in 2024, hedge funds and family offices are diversifying beyond Bitcoin and Ether, increasingly focusing on stablecoins, derivatives and emerging products. These players know that all markets have volatility, and trading comes with inherent risks – and crypto is no different. Rapid market shifts can quickly transform profitable positions into losses. Derivatives, in general, carry more inherent risk than spot markets due to factors like leverage and complexity, as their value is derived from underlying assets.

Access alone is insufficient. While regulated exchanges offer compliant crypto derivative products, they cannot shield traders from potential losses. They can only provide defenses against risky practices, abuses and bad actors.

Compliance is the next essential piece of the decentralized, cross-border landscape of crypto, where regulatory gaps can amplify risks. Regulatory bodies in reputable jurisdictions are implementing stricter standards for platforms offering crypto derivatives, requiring exchanges to register, maintain sufficient capital, and adopt robust anti-money laundering (AML) and know-your-customer (KYC) practices.

Custody has matured the most since the last bull run in terms of compliance.

Institutions need custodians that combine technical expertise in securely holding crypto assets with rigorous compliance akin to traditional asset management. Leading custodians bridge this gap through secure storage, operational transparency, and robust safeguards, thereby reducing risks associated with hacks or technical failures.

The result has been institutions are gaining confidence in the crypto market now that regulated custodians can align with their operational standards.

The industry must learn from past mistakes. Focusing solely on venues for liquidity that lack adequate licensing in reputable jurisdictions, developed compliance practices and other trust factors can lead to disastrous consequences. Web pages about “Proof of Reserves” mean nothing without other safeguards in place. Global financial audits (preferably from a Big 4 accounting firm), ISO and SOC2 designations are exceedingly important for both institutional and retail users to consider and prioritize when they choose a crypto platform or partner.

Today’s institutional players seek a marketplace that effectively balances spot liquidity with derivatives for risk management and capital efficiency. The complementary roles of spot and derivatives markets can create a stable and growing crypto ecosystem where transparency, security, and compliance facilitate broader participation.

Therefore, exchanges must prioritize regulated products and secure custody if they want to offer comprehensive trading options for institutional investors moving into 2025.

CryptoCurrency

Baden Bower Helps Crypto Firms Adapt to EU MiCA Regulation with Ease

The European Union is introducing new rules for cryptocurrency with the Markets in Crypto-Assets (MiCA) law. These regulations became fully effective in December 2024, establishing a unified system for overseeing crypto-asset service providers (CASPs) and issuers. Baden Bower, a global PR cryptocurrency agency, works with businesses to help them adjust to these changes smoothly and effectively.

MiCA: A Unified System for Crypto Regulation

The MiCA regulation, introduced in June 2023, replaces the varied national rules in the EU with a single set of guidelines. This system protects consumers, promotes fairness, and improves financial security. It applies to many crypto-related activities, including token issuance, exchanges, wallet services, and trading platforms.

Stablecoin issuers and CASPs must now follow the rules about financial reserves, governance, and operational processes. Token issuers, even those focused on promoting a meme coin, must also meet new standards for transparency, providing investors with detailed and accurate information. These measures aim to create a safer and more reliable environment for the cryptocurrency industry.

The EU is rolling out MiCA in phases. While some parts are already active, the complete set of rules took effect in December 2024, which allowed businesses time to prepare and align their operations.

Getting Ready for MiCA Compliance

Meeting MiCA’s requirements can feel overwhelming for businesses. Many are still beginning their preparations, and few have fully adjusted to the changes. Companies need to take steps now to avoid falling behind.

“MiCA regulation brings both difficulties and opportunities. We help businesses comply and build trust with their customers,” says AJ Ignacio, CEO of Baden Bower.

Companies must obtain authorization to operate in the EU, which involves meeting strict operational and governance requirements. They must also strengthen systems to prevent money laundering, monitor activity more thoroughly, and meet detailed reporting rules. These steps require careful planning, resources, and support.

Businesses that comply with MiCA will gain advantages like increased customer trust, smoother operations, and interest from larger investors. The unified licensing system also makes expanding businesses across EU countries easier.

Baden Bower’s Support for Businesses

Clear communication is essential for companies adapting to MiCA. Baden Bower helps its clients explain how they meet the new standards while strengthening their image in the industry. It provides tailored solutions for firms seeking guidance on how to promote a crypto project while staying compliant.

“Transparent messaging is critical right now,” says Ignacio. “Baden Bower guides our clients through this process and helps them build lasting trust.”

It develops strategies focused on clear messaging, creating trust, and helping businesses stand out as leaders in their field. It also prepares clients to handle potential obstacles with well-planned solutions.

In addition to providing expert guidance, Baden Bower helps its clients secure high-profile media placements that showcase their compliance and thought leadership, increasing their chances of getting featured in influential media outlets.

With a presence on five continents and clients in areas like the US, Canada, Australia, the UK, and France, it offers a broad perspective. This helps businesses effectively manage EU regulations and global requirements.

Opportunities for Growth Through MiCA

As MiCA is fully in place, businesses must align with the regulations to stay ahead. Those who adapt successfully will meet the regulations and strengthen their standing by showing their readiness and reliability.

Baden Bower’s work supports companies through this transition and helps them improve their reputation as trustworthy organizations. With its strong knowledge of the industry and broad reach, Baden Bower assists businesses in making meaningful progress toward meeting these requirements.

Under the new rules, clear and honest communication about compliance efforts will remain crucial for success. With the right guidance, businesses can use this time to grow and strengthen their customer relationships.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login