Politics

Andrew arrested on birthday with sympathy in short supply

If former royal, and mate of serial child-rapist Jeffrey Epstein, Andrew Mountbatten-Windsor was hoping for any public sympathy after his arrest this morning – on his birthday – he’s going to be sorely disappointed.

The family of Virginia Giuffre, Andrew’s most well-known victim, welcomed the arrest as a sign that no one is above the law:

At last, today, our broken hearts have been lifted at the news that no one is above the law, not even royalty,” Giuffre’s family said in the statement given to CBS News.

However, Windsor was arrested on suspicion of ‘misconduct in a public office’. Knowing the British state, this was more likely linked to his leaking of secrets to Epstein than his abuse of trafficked and potentially under-age girls. But the offence carries a potential life sentence, so there’s that.

Andrew gets birthday wishes

If sympathy is in short supply, mockery isn’t – and many were wishing Andy a delighted “happy birthday” – while also pointing out the vileness of him being arrested for passing info to the rapist instead of for his crimes against the victims:

Happy 66th birthday, Andrew.

Trafficking and sexual abuse allegations against Andrew — no arrest.

Alleged misconduct in public office? Arrest.

No wonder women don’t trust the police. pic.twitter.com/rUFSRLAmie

— Dr Charlotte Proudman (@DrProudman) February 19, 2026

Happy Birthday Andrew Mountbatten-Windsor pic.twitter.com/9R1Ixm0kIb

— Manxy (@Manxy) February 19, 2026

Happy Birthday Andrew you crock of shit! 🤣

— Mark Hopkins (@Hopperz1980) February 19, 2026

Just to wish Andrew a Happy 66th Birthday………. 👀 pic.twitter.com/BFLIaueIp1

— Peter Hulbert (@Peterhulbert195) February 19, 2026

Happy 66th birthday Andrew! May you rot in prison for what you did to those kids! Evil bastard! pic.twitter.com/cli4SSFhSc

— 👑LMJ👑 (@Jonsey_8) February 19, 2026

Andrew Mountbatten-Windsor has been arrested after a complaint about sharing confidential material with Epstein.

Here. We. Go.

If Britain can arrest a Royal, the US should get it together and arrest Trump and every other person involved with Epstein’s child trafficking ring pic.twitter.com/e7XCiSvF2c

— Kelly (@broadwaybabyto) February 19, 2026

And of course, it didn’t take long before AI was eagerly used to imagine the scene:

Happy birthday ex Prince Andrew 🥳🎈🥳 pic.twitter.com/hwldcaN8jI

— Jackson2244 (@PatriotWoman22) February 19, 2026

Happy Birthday to the jailed prince $Andrew #PrinceAndrew #EpsteinFiles @realDonaldTrump @elonmusk

ASDvJ3koPUMqx8e4mdYi7r5mhBPZbJe4GEtfNaRVpump pic.twitter.com/BKWxoxAqJM— george hacker (@GHacker98613) February 19, 2026

Sources say the Police sang Happy Birthday to Andrew once they booted the door in 😂 pic.twitter.com/99cIyzDMp0

— *LittleChic ❤️❤️❤️ (@_Littlechic_) February 19, 2026

Happy 66th Birthday to Andrew Mountbatten-Windsor! 🎉

Gift from the police: Arrested for misconduct in public office over Epstein secrets.

Cake, candles, and cuffs what a royal party. 🥳👮♂️

Sweating yet?#PrinceAndrew #Epstein pic.twitter.com/5tdqlo5NFY

— Sarah White (@advancesarah) February 19, 2026

No accountability

More seriously, others pointed out how little accountability there has been so far for anyone implicated in Epstein’s crimes:

🚨 BREAKING: Prince Andrew taken into custody

We will post the full arrest counter and all verified updates shortly.#PrinceAndrew #Breaking pic.twitter.com/XzMW63ku1R

— Index Stats (@indexstatshq) February 19, 2026

And if Windsor was hoping the fam might be a bit more supportive, those hopes were quickly dashed. Brother Chuck fell over himself in his haste to distance himself – but still no word for the victims:

King Charles issued the following statement regarding the arrest of his brother Andrew.

Extraordinary and unprecedented! pic.twitter.com/VHHZWrag9N

— Lori Spencer (@RealLoriSpencer) February 19, 2026

Maybe Charles is hoping his ‘hot potato’ act will make us forget he funded his brother’s out-of-court payment to Giuffre. But the British state and its corporate media enablers will certainly do their best – and no doubt focus on ‘Randy’s secret-leaking as a handy distraction from the establishment’s involvement in the rape, murder, and trafficking of children and young women.

For more on the the Epstein Files, please read the Canary’s article on way that the media circus around Epstein is erasing the experiences of victims and survivors.

Featured image via the Canary

Politics

Greens Say They’re 73 Votes Behind Reform In By-Election Run-Up

The Green Party believes it is only 73 votes behind Reform in run-up to the Gorton and Denton by-election, HuffPost UK understands.

The party came to that conclusion after more than 13,000 doorstep conversations, according to an internal Green Party WhatsApp group seen by HuffPost UK.

Campaigners in the constituency believe the Greens are now just 0.2% behind Reform, equating to just 73 votes.

The activists described the vote as being on a “literal knife edge”.

Voters in the Greater Manchester seat will head to the ballot box next Thursday for the crunch contest.

The seat has traditionally been Labour so it will be a significant test of Keir Starmer’s authority and approval among the electorate.

The Greens and Reform UK have both soared in popularity over the last 18 months and are hoping to boost their seat numbers in the Commons.

The outsider parties have also insisted they are now locked in a race with each other, while Labour has told HuffPost UK that it is only between their party and Reform.

Meanwhile, the UK Polling Report’s website is currently predicting Labour will hold the seat.

It claimed Labour candidate Angeliki Stogia will win with 35.47% of the vote, while Reform’s Matt Goodwin will come in second place with 29.17%.

The Greens’ Hannah Spencer is expected to come in third with 20.83%, according to the data.

Reform UK and Labour have been contacted for comment.

Green activists also used their WhatsApp group to warn they are “seriously short of campaigners for the final stretch of the campaign”.

The party believes that they need 300 people every weekday to campaign across the remaining week, with more 1,000 activists on the trail this weekend and 2,000 people on polling day.

In a message to campaigners, warns that the party is “not even close” to reaching that number right now.

When approached for comment on a potential shortage of campaigners, a party source told HuffPost UK: “That’s campaigns, campaigning. We have hundreds of volunteers out every day and we are expecting Saturday to be the largest action day the party has ever had.

“Our data shows we’re neck and neck with Reform and every extra volunteer out on the streets from now till next Thursday could make the difference to stop Reform.”

Politics

How Do Olympians Cope With Performance Anxiety

I don’t know about you but suddenly all of my friends are experts on skiing, figure skating and snowboarding – and it’s all thanks to the 2026 Winter Olympics completely captivating them all.

I mean, who can blame them?

The drama, the skill, the absolutely terrifying risks they take as athletes — these sports are not for the faint-hearted and for us, the audience, they make for an incredible viewing experience, even for those who don’t usually care about sports.

All of this got me thinking, though, how do they cope with performance anxiety?! I struggle to keep it together for a Zoom presentation to 12 people. Can you imagine knowing the world has its eyes on you and the country you represent is depending on you to win?

What Olympians can teach us about performance anxiety

Writing about the mental health impacts of being an Olympian back in 2021, Dr David M. Lyreskog, of the Department of Psychiatry at the University of Oxford, said: “In elite sports teams, the prevalence of depression and anxiety is sometimes as high as 45%, and in adolescent elite sports the prevalence of eating disorders is approximately 14%. The pursuit of performance – of excellence – does not appear to be a healthy one.”

Among the wider population, mixed anxiety and depression is Britain’s most common mental disorder, with 7.8% of people meeting the criteria for diagnosis, according to the Mental Health Foundation.

So, how do almost half of Olympians cope with anxiety when they’re supposed to be at the top of their game? And what can we learn from them?

Writing for the official Olympics website, four-time swimming Olympian-turned-sports psychologist Markus Rogan shared how he had been an anxious athlete and had learned four key lessons to get him through bouts of anxiety.

1. ‘Growing through anxiety’ and connecting with loved ones you trust

“It’s easy to surround yourself with people when you’re amazing, but maybe you can explore relationships with those who are there with you when you’re down,” he said.

2. Facing tough questions

When your brain is racing with ‘what if’ questions, ask yourself why you’re worried about this. Is the worry founded or are you just having anxious thoughts?

3. Asking people for their opinions

Sometimes, our anxiety simply comes from the unknown. Ask your loved ones to help. Ask them what you’re afraid to hear and trust them to protect you as they do so.

4. Not ignoring your thoughts

Sometimes bad thoughts are just bad thoughts, but once you label them, you can work on them. “Don’t forget that even the most profound thought is still just a thought,” he assured.

Speaking to Psychology Today, Dr Cindra Kamphoff, who has worked with professional and Olympic athletes for two decades, shared how she supports them following Olympic performances.

She said: “After the Olympics, we debrief. We evaluate what worked, what didn’t, and how to grow from the experience. Then we reset goals and begin preparing for the next competition.

“Confidence and mental performance are ongoing processes, not event-specific interventions.”

Politics

Andrew’s arrest was met with relief from Virginia Giuffre’s family

Disgraced Andrew Mountbatten-Windsor, the former prince, has finally been arrested in connection with revelations from the Epstein files.

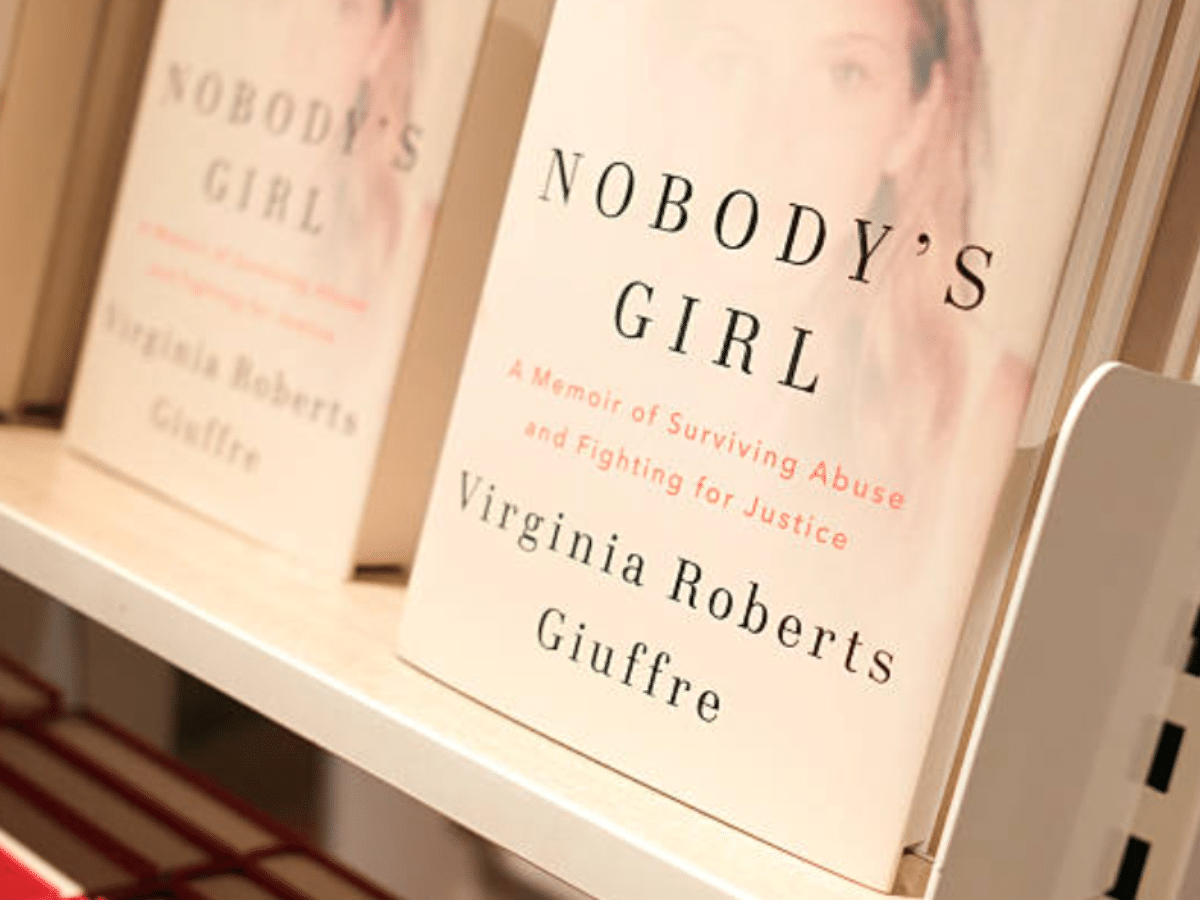

Among those who have responded are the family of Virginia Giuffre. Giuffre accused Windsor of sexual abuse:

Statement from the family of Virginia Giuffre:

“At last.

Today, our broken hearts have been lifted at the news that no one is above the law, not even royalty.

On behalf of our sister, Virginia Roberts Giuffre, we extend our gratitude to the UK’s Thames Valley Police for their… pic.twitter.com/bgtHZtb2qO

— MeidasTouch (@MeidasTouch) February 19, 2026

Nevertheless, it hasn’t escaped attention that the arrest is regarding misconduct in public office and apparently not in connection with Giuffre’s allegations.

Andrew arrest: ‘at last’

On 19 February 2026, Thames Valley Police arrested Andrew on suspicion of misconduct in public office. This came after they reviewed documents from the Epstein files which suggest he shared information from his time as a UK trade envoy with the late convicted paedophile.

Mountbatten-Windsor is currently in police custody amid searches of multiple properties as part of the criminal inquiry. The Epstein files have raised serious concerns about the scale of this sinister web of elitist men. This has prompted widespread demands for full transparency and accountability for sexual abuse against women and girls.

However, this pattern underscores how far more precedence is given to economic interests and institutional power over justice for victims and accountability for abusive men.

The statement from Giuffre’s family reads in full:

At last.

Today, our broken hearts have been lifted at the news that no one is above the law, not even royalty.

On behalf of our sister, Virginia Roberts Giuffre, we extend our gratitude to the UK’s Thames Valley Police for their investigation and arrest of Andrew Mountbatten-Windsor.

He was never a prince.

For survivors everywhere, Virginia did this for you.

Virginia Giuffre

Virginia Giuffre accused Andrew of sexually abusing her when she was just 17 years old. She became a prominent advocate fighting against sex trafficking, in light of her own experience being sexually exploited by Epstein and Ghislaine Maxwell. She died by suicide in April 2025 leaving her loved ones and survivors across the world devastated and heartbroken. Giuffre’s push for accountability has been continued by advocacy groups across the West. Many have joined the call in demanding powerful men face consequences for the abuse they have evidently inflicted.

We wrote about Andrew’s arrest shortly after it happened:

If former royal, and mate of serial child-rapist Jeffrey Epstein, Andrew Mountbatten-Windsor was hoping for any public sympathy after his arrest this morning – on his birthday – he’s going to be sorely disappointed.

The family of Virginia Giuffre, Andrew’s most well-known victim, welcomed the arrest as a sign that no one is above the law:

“At last, today, our broken hearts have been lifted at the news that no one is above the law, not even royalty,” Giuffre’s family said in the statement given to CBS News.”

However, Windsor was arrested on suspicion of ‘misconduct in a public office’. Knowing the British state, this was more likely linked to his leaking of secrets to Epstein than his abuse of trafficked and potentially under-age girls. But the offence carries a potential life sentence, so there’s that.

Giuffre had long pursued seeing the suspected paedo-prince face accountability for his abuse against her. Obviously, Andrew has always denied these claims, which is no surprise as it’s damn rare to find a man actually hold his hands up in disgust at the abuse he has inflicted.

Because of this, she was denied the justice she deserved over the allegations against Windsor, after Epstein and Maxwell allegedly trafficked her to him. Giuffre also shared in her memoir even more sinister allegations against former Israeli PM Ehud Barak.

We wrote in October:

Virginia Giuffre, one of the most prominent survivors (but now a victim) of serial child rapist and trafficker – and almost certain Israel intelligence asset – Jeffrey Epstein, was repeatedly left battered and bloodied after being beaten and raped by a man she describes, in a new memoir published after her death earlier this year, as a “well-known prime minister”.

Adding:

Giuffre said that she called the man ‘the Prime Minister’ and did not name him, because she was afraid he would come after her and cause her harm if she did. Before Epstein’s death, however, she named former Israeli PM Ehud Barak – also a close friend of Epstein’s ardent fan Peter Mandelson – as one of the many men to rape her, an accusation he has denied.

Virginia Giuffre wrote in horrific detail about the violence inflicted on her by the ‘PM’, whom she met when she was just eighteen:

“He repeatedly choked me until I lost consciousness and took pleasure in seeing me in fear for my life. Horrifically, the Prime Minister laughed when he hurt me and got more aroused when I begged him to stop. I emerged from the cabana bleeding from my mouth, vagina, and anus. For days, it hurt to breathe and to swallow… [He] raped me more savagely than anyone had before.”

King’s ‘concern’

The King chose his words carefully – and choice matters here, because men can choose to amplify victims’ voices and examine allegations critically. Rather than doing so, he voiced his “deepest concern” about his brother’s arrest and stated that “the law must take its course,” adding:

What now follows is the full, fair and proper process by which this issue is investigated in the appropriate manner and by the appropriate authorities.

This statement is reported to have the full support of Will and Kate, the Prince and Princess of Wales. Queenie Camilla had nothing to offer but a wave when asked for her feelings on the arrest. We can’t help but feel the Royal family’s concern here lies solely with Andrew, the man-child sex-pest, rather than the countless victims across the world who fell victim to powerful, privileged men and their sick fancies.

How the mighty have fallen, thus proving that powerful men can be brought to task if the political will is there:

‘Do you know who I was?’ #Andrew #AndrewWindsor pic.twitter.com/Gp6Eu5NuD9

— The Rev. Anton Mittens 🌹👮🎓 (@MittensOff) February 19, 2026

Accountability NOW

Don’t get us wrong, it is bloody wonderful to see the disgraced prince brought to task and finally facing a criminal investigation. A potential life sentence is equally refreshing to see. Nonetheless, many wish to see this go further. Despite the long relationship with Epstein, there has never been a thorough investigation into his involvement in the apparent trafficking ring instrumentalized by Epstein and co.

Enough must be enough. Andrew is now in a police station with more than enough evidence to legitimise a full investigation into allegations of sexual abuse. Yet powerful men have shown us that the protection of young girls will never be as important as protecting power.

Shame on them. Down with the monarchy.

For more on the Epstein Files, please read:

Featured image via the Canary

Politics

Huntsman convicted for illegal hare-hunting

Hunt Saboteurs Association (HSA) is celebrating the legal victory, with another huntsman brought to justice. Northampton magistrate’s court has found Philip Saunders guilty of illegal hunting on Wednesday 18 February. Saunders is one of the arsehole huntsman for criminal gang, the Pipewell Foot Beagles.

Another one?

The conviction is the second time these bloodthirsty arseholes have been caught out illegally hare-hunting.

And it beautifully landed just before the 21st anniversary of the Hunting Act.

The court heard how Saunders led his pack to kill a hare at the Boughton Estates on Kettering. Richard Scott is the current Duke of Buccleuch and one of the largest land owners in Scotland. It’s no shock that he would allow an illegal hunt to take place on ‘home turf.’

Courageous wildlife photographer Emma Reed was on the scene and captured the entire incident.

Reed’s video clearly shows Saunders encouraging the hounds to kill. The huntsman was heard growling “Get onto it!” at the dogs. This is a specific hunting term which incites animal cruelty and it proves the hunt intended to pursue the hare.

As per usual, the HSA provided names to the police at the time, but they failed to act on the evidence. Again.

Losing the horn

The magistrate fined Saunders £1,000 for his role in the illegal hunt. He also has to pay £3,600 in costs and a £400 victim surcharge.

In the landmark move, the court also ordered the destruction of Saunders’ hunting horn. Saunders must surrender it to the police by 5pm Thursday 19 Feb.

Destroying the horn is beautifully symbolic as this is the primary tool a huntsman uses to control the hounds. The HSA believe this should be common practice in all cases as it effectively strips the bloodthirsty wankers of the ability to lead.

Reed expressed her satisfaction with the guilty verdict stating:

“I am pleased with the guilty verdict as justice has been served. The judge was strong in his summing up of sending a message to the hunting community that these illegal actions will not be tolerated and are totally unacceptable.”

Justice for wildlife

The Judge was strong in his summing up of the case, making it clear that illegal hunting of hares is totally unacceptable and it sends a clear warning to the hunting community.

Simon Russell, chair of the HSA spoke to the Canary about this landmark victory:

Hare Hunts always pack up and go home when sabs find them, this is what they are really doing when they’re not under observation, killing our public wild Hares. A good hunting horn is hard to come by, the really decent ones rack in at £300 plus and we would suggest that future convictions have the horns donated to the Hunt Saboteurs Association. We would put them to good use saving wildlife.

Images via Emma Reed

Politics

Heat rises for Iran as Trump ramps up military pressure

An American attack on Iran appears imminent. US president Donald Trump has deployed massive military force to the Persian Gulf while negotiations between the two counties seem to have stalled. Media reports the attack could start as soon as Saturday 21 February.

Iran’s leadership has said that the principles of the negotiations — centring on Iran’s nuclear plans (or lack thereof) — were understood but that no agreement had been reached. The US has said military options are very much ‘on the table’ while Iran now says it’s open to international nuclear inspections.

Iran closed large areas of its airspace on 19 February. It’s aviation authority said it was:

to allow a planned missile launch exercise tomorrow. It specified danger zones where flying will be completely banned due to military activity.

Anonymous Iranian security officials said it was a show of force, and the US aviation authority has followed suit:

warning that uncoordinated missile launches could pose catastrophic risks, including endangering civilian flight paths.

The closure was enough to active alarm bells for some countries. Poland urged its citizens to leave Iran. Prime minister Donald Tusk said:

In a few, a dozen, or several dozen hours, evacuation may no longer be possible.

Behind the scenes, US military aircraft have been moving into the region for days.

Tankers inbound

Sky News reported that American refuelling planes have passed through the UK as part of the build-up. Starmer’s Britain, it appears, is happy to serve as checkpoints for Trump’s march to war.

Military expert professor Michael Clarke was on Sky on 18 February. Using open source air traffic mapping, he showed how on 16 February six US tankers passed through the UK on their way to Greece. On 18 February, a further ten tankers passed through the UK on their way towards the Mediterranean:

You can hear his analysis from around 1.55 in this report:

And Drop Site News journalists Jeremy Scahill and Murtaza Huzzain reported:

the largest buildup of firepower in the Middle East since President Donald Trump authorized a 12-day bombing campaign against Iran last June that killed more than 1,000 people.

One anonymous former Trump insider told the investigative outlet that:

based on his discussions with current officials, he assesses an 80-90% likelihood of U.S. strikes within weeks.

And retired Lt. Col. Daniel Davis said the level of build-up:

harkens back to what I saw ahead of the 2003 Iraq war.

Davis warned:

You don’t assemble this kind of power to send a message. In my view, this is what you do when you’re preparing to use it. What I see on the diplomatic front is just to try to keep things rolling until it’s time to actually launch the military operation. I think that everybody on both sides knows where this is heading.

And a key US command and control aircraft is now in the region…

Critical command and control aircraft

Former US Marine and State Department whistleblower Matthew Hoh said the presence of the E-3 command and control aircraft was an indicator Trump intended to pull the trigger:

The E3 is an incredibly important aircraft. For those unfamiliar, it is the large airplane that looks like an airliner, but with a revolving radar disc on top.

The airplane is loaded with an air crew whose job is to observe, manage and control the airspace in its area. It is especially important for directing fighters and ground/sea based missile interceptors against Iranian missiles and drones.

This is the strongest indication to me of the seriousness of the US threat to Iran. The US has deployed more than 2/3 of its available E3 command/control aircraft to Europe and the Middle East.

The E3 is an incredibly important aircraft. For those unfamiliar, it is the large…

— Matthew Hoh (@MatthewPHoh) February 19, 2026

Renowned international relations scholar John Mearsheimer reminded us that barring UAE – which has close ties with the settler-colonial pariah state – the only country absolutely determined to have a war with Iran was Israel:

Drop Site broke down the scale of the build-up:

Two carrier strike groups—each built around one aircraft carrier, several guided‑missile destroyers armed with Tomahawk missiles, and at least one submarine—are also being stationed nearby, along with several additional U.S. destroyers and submarines in regional waters near Iran to defend against ballistic missile attacks, as well as more than 30,000 U.S. military personnel and numerous Patriot and THAAD anti-missile batteries spread across regional military bases.

The USS Gerald R. Ford is on its way to the Gulf from the Caribbean. The ship took part in Trump’s last ‘spectacular’ – the Caracas raid which snatched Venezuelan president Nicolas Maduro on 3 January. The Ford is the biggest and most advanced carrier in the world.

Former Pentagon official Jasmine El-Gamal told Drop Site.

This is not a dress rehearsal. This is it. This is not the negotiations of last year or the year before or the year before that. They’re backed into a corner. There’s no off ramp.

El-Gamal said:

The fact that that carrier is there tells me that this isn’t just a routine kind of, ‘Hey, let’s flex some muscle.’ He didn’t need that. He didn’t need to send that second carrier to flex muscle.

But what would a US-Iran war actually look like?

Short intense war?

With negotiations deadlocked, one expert said that Iran and US might favour a short intense war followed by a return to talks.

Swedish-Iranian scholar Trita Parsi told Democracy Now:

We have a very dangerous situation, because both sides actually believe that a short, intense war may improve their negotiating position.

The US believes its overwhelming military capability will:

be able to take out Iran militarily rather quickly and then force it to capitulate.

Parsi said the Iranians have other plans:

They believe that they have the ability to inflict significant damage on the United States in the short term, including on civilian oil installations in the region, closing down the Strait of Hormuz, that would shoot up oil prices…

The Iranians were calculating that:

the initial cost of this to the United States would be so immense, and the United States would recognize that it would have to go for a longer war, which it cannot afford, and as a result, it would get the United States to back off.

Yes another Middle east war is looming. It would be a war which is not at all separate to the current genocide in Gaza and the legacies of the Iraq war. In fact, it would compound both. The best case scenario is that it doesn’t happen at all. Next best? The sort of ‘limited’ bombing we’ve seen in the past.

The third, most terrifying and not at all unlikely outcome is that the war escalates into something altogether more existential with profound impacts for the region and the world, and which sends violent shocks through the global economy. A number of experts and insiders are saying we’ll find out sooner rather than later.

Featured image via the Canary

Politics

Mandelson’s Lobbying Firm Goes Into Administration

City AM reports that Global Counsel, the embattled lobbying firm founded by Peter Mandelson, will go into administration as soon as tomorrow. Its CEO Ben Wegg-Prosser – close friend of Mandelson – stood down two weeks ago. Global Cancelled…

Politics

PETA again calls out uni over ‘cruel and pointless’ mice experiments

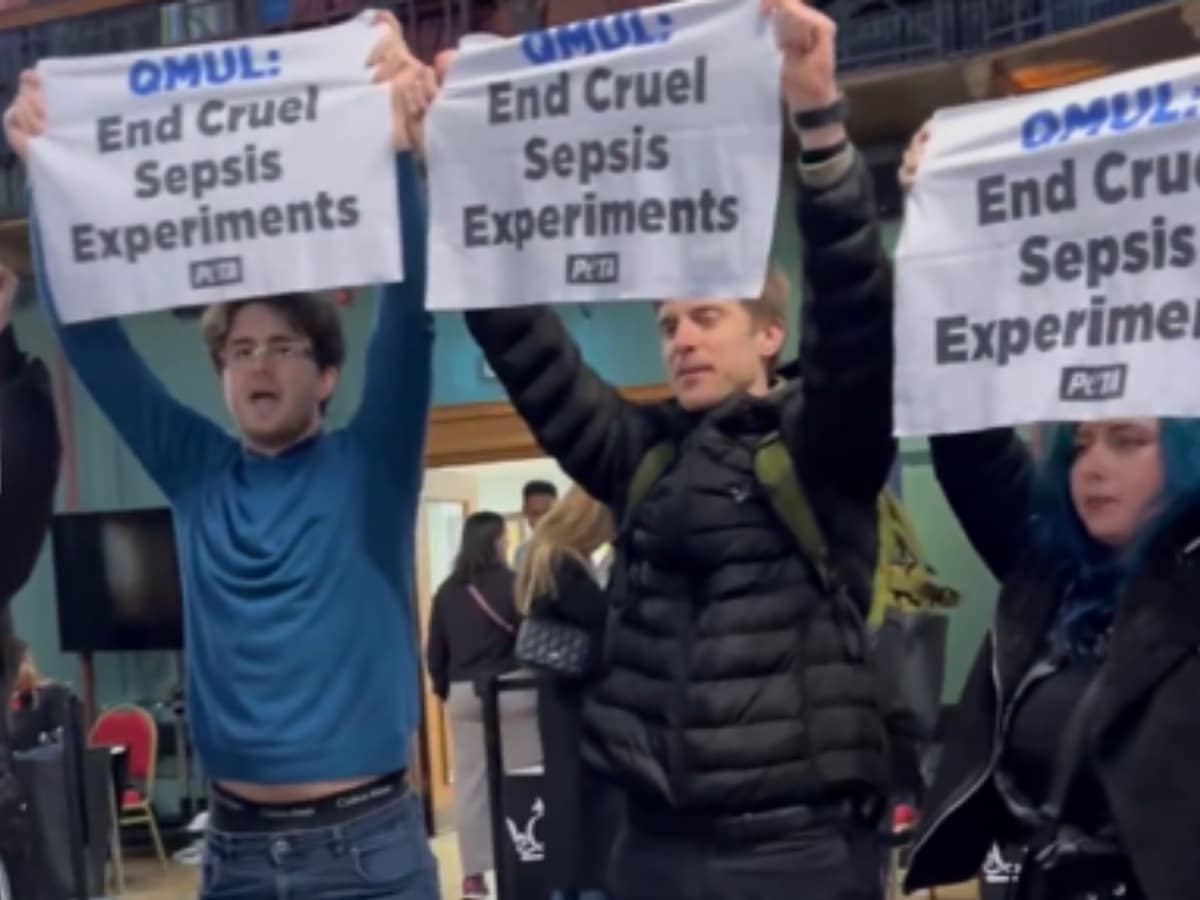

Attendees at the Queen Mary University of London (QMUL) Postgraduate Open Day Event had a more memorable experience than expected on 18 February. A group of PETA supporters stormed the famous Octagon inside the Queens’ Building bearing signs that read, “QMUL: End Cruel Sepsis Experiments,” and chanting, “Sepsis experiments should be cruelty free.”

Cruel experiments

The action is part of PETA’s ongoing campaign calling on the university to stop tormenting mice in cruel and useless sepsis experiments, which consistently fail to lead to effective treatments for humans. Activists previously crashed a meeting of the QMUL Senate to draw the attention of university leadership.

PETA senior campaigns manager Kate Werner said:

Prospective QMUL students should know that the university is using their tuition fees to torture and kill terrified mice in cruel and pointless experiments that have done nothing to advance human health.

PETA urges QMUL to stop wasting animals’ lives on these cruel experiments and switch to cutting-edge, animal-free research that actually helps humans.

More than 150 drugs have successfully treated sepsis in mice, yet none have been effective in treating humans. Despite the well-documented failure in using mice to model human sepsis, QMUL experiments are cutting open terrified mice and puncturing their intestines to leak faecal matter into their bodies.

Experimenters noted that some mice experienced severe sepsis, which can include major organ failure and abject suffering. Data from some of these experiments has been published in papers that were later retracted by the publisher because data and conclusions were deemed ‘unreliable’.

Mice are intelligent, complex, and social individuals who experience a wide range of emotions. They become attached to each other, love their families, and easily bond with their human guardians – returning as much affection as they receive.

PETA encourages everyone to urge Queen Mary to heed the scientific evidence and join other institutions, including the University of Kent, that have committed to non-animal methods in sepsis research.

PETA – whose motto reads, in part, that “animals are not ours to experiment on” – points out that Every Animal Is Someone and offers free Empathy Kits. For more information, visit PETA.org.uk or follow PETA on X, Facebook, or Instagram.

Featured image via PETA

Politics

Four Years In, Trump Remains On Putin’s Side In His Stagnated Invasion Of Ukraine

WASHINGTON – Four years after launching an invasion to seize neighboring Ukraine in a matter of days, Russian dictator Vladimir Putin can no longer replenish the tens of thousands of soldiers he is losing per month, has watched his ground offensive grind to a halt and has escalated a war-crime campaign to instead kill civilians. None of it has convinced President Donald Trump to drop his tacit approval of the invasion.

Rather than resume defensive weapons shipments to Ukraine that had existed under predecessor Joe Biden or further pressure Putin economically to end the biggest and deadliest conflict in Europe since World War II, Trump is instead still leaning on Ukrainian President Volodymyr Zelenskyy to give up the territory that Putin wants.

“Ukraine better come to the table fast, is all I’m telling you,” Trump told reporters Monday night on the flight back from his South Florida country club, Mar-a-Lago. It was a repeat of the warning he gave Zelenskyy on Friday as he left for his three-day golf weekend: “Well, Zelenskyy is going to have to get moving. Russia wants to make a deal, and Zelenskyy is going to have to get moving, otherwise he’s going to miss a great opportunity. He has to move.”

In reality, Zelenskyy has repeatedly accepted US calls for a ceasefire while negotiators work out a final peace agreement, while Putin has rejected that concept as he continues to kill and maim Ukrainian civilians with missiles and drones.

Those attacks and deaths have surged dramatically in the year since Trump took office last January. In Biden’s final year in the White House, there were 13,897 missiles and drones launched at Ukraine by Russia, or 38 on an average day, according to figures compiled by the Institute for the Study of War. In Trump’s first year back in office, there were 57,333 missiles and drones, or 157 per day – a 300% increase. The escalation coincided with the cutoff of new US military aid to Ukraine under Trump.

To experts and analysts, Trump’s choice to pressure Zelenskyy rather than Putin is simple: He sees Ukraine as weaker and therefore easier to coerce.

“Trump wants any kind of deal he can get that results in a ceasefire, hoping this will be evidence for his Nobel Peace Prize campaign,” said John Bolton, one of Trump’s national security advisers during his first term and now a target of Trump’s Justice Department. “He doesn’t care about the substance of an agreement, just getting one.”

Jim Townsend, who has worked at both the Pentagon and Nato and is now an analyst with the Center for a New American Security, said Putin knows Trump will never truly pressure him.

“Putin will keep stalling until he gets his way, either by Trump forcing Zelenskyy to the table or by some battlefield victory, which doesn’t look likely either,” Townsend said. “So he will always demand his maximalist position, knowing Zelenskyy will never agree and that irritates Trump, who squeezes Zelenskyy even more.”

To Russia With Love

Trump White House aides did not respond to HuffPost queries. At a news briefing on Tuesday, White House press secretary Karoline Leavitt, asked about Zelenskyy’s comment that it was unfair to demand concessions of Ukraine but not Russia, repeated Trump’s frequent lie that the US was bankrolling Ukraine’s defense under Biden.

“The president views this entire situation as very unfair, not just for Russians and Ukrainians who have lost their lives, but also for the American people and the American taxpayer who were footing the bill for this war effort before President Trump put a stop to it,” she said.

In fact, America’s allies in Western Europe have provided more in both military and financial assistance to Ukraine since the invasion started four years ago.

Trump’s statement on Monday night was in keeping with numerous other remarks Trump has made since returning to office. During the infamous visit by Zelenskyy to the Oval Office a year ago, Trump essentially blamed Ukraine for getting invaded and chided Zelenskyy for starting a war against a larger and more powerful neighbor.

Last June, in response to a Ukrainian attack on a Russian airfield, Trump again sided with Russia.

“They gave Putin a reason to go in and bomb the hell out of them last night,” he told reporters.

Trump, who at the time of the invasion called Putin a “genius” and “savvy” and later claimed while campaigning for office that his great relationship with Putin would let him end the fighting on his first day back in the White House, has instead failed to convince the dictator to make any concessions.

Heading into an August meeting with Putin in Alaska, Trump claimed there would be “consequences” for Putin if he did not agree to a ceasefire. Trump literally rolled out a red carpet for Putin and honored him with a flyover of military jets. Putin did not agree to a ceasefire and suffered no consequences.

And last month, Trump boasted that Putin had agreed to his request not to attack Ukrainian cities and towns for a week because of the extreme cold weather. Putin continued the attacks throughout the entire period, after which Trump claimed Putin had honored his pledge.

Trump, nevertheless, continues to boast of his “relationship” with the murderous dictator whose actions in 2023 led to war crime charges by the International Criminal Court. In late August, he showed off a photo of himself and Putin that Putin had sent him. More recently, he has hung a large photo of the two of them in the West Wing.

“Trump looks more and more impotent,” said Fiona Hill, a Russia expert who served on the White House National Security Council in Trump’s first term. “Which is more why he wants Zelenskyy to give it up, to capitulate.”

The de facto tilt away from Ukraine and toward Russia was tacitly acknowledged by Secretary of State Marco Rubio’s visit to the Munich Security Conference last weekend, where he skipped a meeting to discuss Ukraine with traditional U.S. allies. His visit there was highlighted by a speech in which he emphasized a “blood and soil” Christian nationalist message regarding the bonds between the United States and Europe, rather than the one of shared values of individualism and freedom that sprang from the European Enlightenment that American leaders have historically praised.

That new approach was then punctuated by visits to Hungary and Slovakia, which are currently led by the most pro-Russia leaders in Europe. Rubio, who seven years ago warned about Hungarian leader Viktor Orban’s turn toward autocracy, on Monday gave him the endorsement of the U.S. government in his coming election.

His remarks and his itinerary worried Europeans and their leaders, who see Russia’s invasion of Ukraine not as a faraway problem, but a potential preview of what might happen to their own countries.

In response to a query, State Department spokesman Tommy Pigott insulted HuffPost but did not address why Rubio had visited only pro-Russia leaders after his Munich visit and why he had endorsed Orban.

“S.V. Date is a low IQ, anti-Trump clown masquerading as a blogger,” Pigott wrote in a statement. “The secretary met with dozens of leaders from all across the world last weekend in Munich, including Volodymyr Zelenskyy. To claim they were all pro-Russian is an idiotic and bizarre claim. In addition to his historic speech at the Munich Security Conference, Secretary Rubio visited European allies in the region.”

It was not immediately clear what made Rubio’s speech “historic.”

Putin’s Four-Year-Old Quagmire

Ironically, Trump’s continued insistence that Ukraine give away its territory to get a ceasefire comes as its army has increased the lethality of its strikes against Russian troops in Ukraine. According to both Zelenskyy and outside analysts, Ukraine’s military is now killing and injuring more invading soldiers each month than the 35,000 or so that Putin is able to conscript to replace them.

“Increased losses on the battlefield and declining, expensive recruitment likely contributed to the loss rate finally exceeding recruitment rate,” said Kateryna Stepanenko, a research fellow at the Institute for the Study of War.

In a report last month, the Center for Strategic and International Studies estimated that Russia, since the invasion began in 2022, has suffered 1.2 million military casualties, including as many as 325,000 deaths. In contrast, the United States lost 47,434 service members over a decade in Vietnam and 6,897 over two decades in Afghanistan and Iraq.

As a result, Putin has implemented an involuntary draft in some areas of Russia as well as increased his reliance on mercenaries from Central Asia, Cambodia, Pakistan and Africa, among other places.

“There are all kinds of people who are getting press-ganged into going to the front,” Hill said.

Leaders of several African nations, in fact, have publicly called for Putin to stop recruiting young men — who are frequently getting killed quickly after deployment — from their countries.

Last week, Kenya’s Foreign Minister Musalia Mudavadi, who called the recruitment of Kenyan nationals “unacceptable and clandestine,” announced a trip to Moscow to discuss the matter.

Experts also doubt that Putin’s decision to increase his attacks on civilians in their homes and workplaces will have the intended effect of wearing down their will.

“This is like the blitz bombing campaign… he wants to punish them and pummel them,” Hill said. “What it does do is make the people under bombardment more willing to resist.”

“His offensives don’t take much ground and the price is high for what he does take,” Townsend said of Putin. “So hitting Ukrainian civilians and the energy grid is his weapon to hit Zelenskyy domestically, hoping to get the people riled up and moving against Zelenskyy. That tactic didn’t work for Hitler against the Brits and I don’t think it will work with Ukraine either.”

Trump’s affinity for Putin, now manifesting itself in his war of conquest, is decades old. Trump publicly tried to befriend the dictator in 2013 and spent years, including the period when he ran for president in 2016, trying to build a Trump Tower in Moscow.

In that election, Trump willingly accepted and used Russian assistance as he campaigned against Democrat Hillary Clinton, even though he knew it was coming from Russia. He later stood beside Putin at a news conference in Helsinki and said he believed Putin’s denials of interfering in the election over his own intelligence agencies’ analysis.

To this day, Trump continues to call the investigation into that election interference a “hoax” that has also unfairly impugned Putin’s good name.

Politics

Why the Greens are so scared of saying the word ‘Islamist’

It was the look of terror in Hannah Spencer’s eyes that was most telling. There she was, the gurning Green candidate in the Gorton and Denton by-election in Greater Manchester, being asked the simplest of questions. What was the cause of the Manchester Arena bombing of 2017? Her face froze into a rictus of fear. She stuttered but the words clogged in her throat. She couldn’t believe it – she was being pressed on live TV to say a word that her morally supine kind have sworn never to utter in public. Islamism.

It gets worse. Her gentle interrogator was Matt Goodwin, the Reform UK candidate in Gorton and Denton. After Ms Spencer spouted the usual kumbaya bullshit about how Manchester ‘came together’ after the arena atrocity, he quizzed her again. Okay, fine, but ‘why are [these] things happening?’, he asked. Then came what will surely rank as the dumbest reply of 2026, a remark that should make Spencer cringe in ignominy every time the memory of it invades her mind. It’s ‘because people like you are dividing people’, she told Goodwin.

He was startled. So was everyone else whose brains haven’t yet been fried by that moral spinelessness that gets dolled up as ‘progressivism’. ‘So I’m responsible for the Manchester Arena bombing?!’, he said. ‘That’s not what I’ve just said’, Spencer protested. But it is what you said. You were asked why Britain has been rocked by such sadistic acts of misanthropy as the slaughter of teens at an Ariana Grande concert, and instead of giving the correct answer – which is that our nation is ailed by the pox of Islamist militancy – you said it’s because people like Goodwin have hot takes on immigration, etc.

This is a serious matter. That a candidate in a Manchester by-election cannot tell the truth about the murderous ideology that caused such suffering and sorrow in that great city is profoundly troubling. Twenty-two people were butchered that night, 22 May 2017. Ten were under the age of 20. The youngest was an eight-year-old girl. Their crime? Enjoying pop, being free, being British. That was why Salman Abedi – say it, Hannah: an Islamist terrorist – laid waste to their lives. This was an act of Islamist savagery against the city that Orwell called ‘the belly and guts of the nation’.

To refuse to name the homicidal creed that motored that massacre of innocents is a betrayal of the dead and the survivors. Ask yourself: if it had been a neo-Nazi bloodbath, do you think Ms Spencer would have held back from saying the word ‘Nazi’? If the killer had been a devotee of the knackered old National Front, do you think Spencer would have squirmed in her seat when asked why that atrocity happened? Of course not. She’d have shouted from the rooftops the names of those poisonous ideologies. But when it comes to Islamism, there’s a conspiracy of silence. ‘Islamism’ is the equivalent of ‘Voldemort’ to our chickenshit chattering classes – a taboo word never to be uttered lest it turn thick oiks into an ‘Islamophobic’ mob.

That’s the thing: Spencer’s physical inability to form and say the word ‘Islamist’ is not unique to her. The entire cultural establishment has excised that word from its vocabulary. In the immediate aftermath of the arena atrocity, the mayor of Manchester, Andy Burnham, would only call the killer an ‘extremist’. As Morrissey quipped, ‘An extreme what? An extreme rabbit?’ When then UKIP leader Paul Nuttall described it as an Islamist attack, the then leader of the Green Party, Caroline Lucas, branded his words ‘completely outrageous’. So the Greens have form when it comes to snivelling self-censorship in the face of the Islamist mass murder of working-class children.

At points, the establishment has even sought to institutionalise its craven dread of the i-word. In 2020, three years after the barbarism in Manchester, counter-terrorism police openly discussed dropping the term Islamist ‘when describing terror attacks’. And instead of saying ‘jihadist’, perhaps we should say ‘terrorists abusing religions motivations’, the cops mused. Rolls off the tongue. In the end they scrapped their demented Orwellian plans to erase the word Islamist in the service of the state’s sainted ideology of ‘diversity’. They probably clocked that such brutish speechpolicing was unnecessary. After all, the elite is stacked with fainthearted finger-waggers who are more than happy to bark ‘Bigot!’ at any mortal who dares to name the ideology that has slain a hundred souls in Britain these past 20 years.

A nauseating mix of classism and paternalism motors the elites’ memory-holing of Islamism. They fear that the ‘gammon’ – the working classes – will be whipped into a Muslim-baiting frenzy if any derivation of the word ‘Islam’ is used in relation to terror attacks. And they have a deep patrician impulse to protect Muslims from offence. Quite why our Muslim citizens would feel offended by a frank discussion of the scourge of Islamism is anyone’s guess. From their distant sanctums of lazy correct-think, these people cannot see that the white working classes and the Muslim working classes have a shared interest in driving the poison of Islamist dogma from their communities.

The Green Party has a particular problem. It is now the chief candle-carrier for that most suicidal strain in British politics – the Islamo-left. Its ranks are stuffed with bigots who celebrated the fascistic slaughter of 7 October 2023 and who call rabbis ‘animals’. The Greens are currently flirting with the idea of branding Zionism a form of racism, which would further isolate Britain’s already beleaguered Jews, a large majority of whom identify as Zionists. And Hannah Spencer has given an interview to 5Pillars, the vile, pro-Taliban website that frequently platforms neo-fascist lowlifes like Nick Griffin. Imagine calling Matt Goodwin ‘divisive’ when you rub shoulders with such despicable people. Next year is the 10th anniversary of the Islamist slaughter of Manchester kids. If you’re still refusing to speak the truth about that anti-British abomination, then you should be nowhere near Manchester’s levers of power.

Politics

Wings Over Scotland | When the law breaks the law

There is a not particularly funny joke that is sometimes told in legal circles about why a law student failed to finish his coursework – because he had no conviction. With rare exceptions lawyers aren’t renowned for their sense of humour but I can’t help thinking someone, at the highest levels of our justice system, is having a right laugh at my expense and those who have loyally supported me over the past six years.

I’m talking about the Lord Advocate, Dorothy Bain KC – a sitting member of the Scottish Government’s cabinet who was nominated by Nicola Sturgeon to that post in 2021, five months after I was acquitted.

For those unfamiliar with my case, I offer this brief summary. In March 2020 I made a short video on my mobile phone that was two minutes and thirty eight seconds in length. I hadn’t planned to make the video when I went out for a walk in a field near my home. But I was annoyed and wanted to articulate that annoyance, although at the time I recorded it I wasn’t intending for it to go much further.

Later that night, just before turning in, I uploaded it to my YouTube channel on a closed, unlisted link and then posted that link to my Twitter account that, at the time, had a modest 1000 or so followers. I then forgot about it.

Little did I know that short mobile phone video would result in me facing initially a criminal trial, then a five year legal battle in the highest civil court in Scotland and now, most likely, an appeal to the European Court of Human Rights in Strasbourg.

In that very short video, I expressed my disdain for the complainers and conspirators, male and female, who were still trying to destroy the reputation of Alex Salmond, despite the fact he had been fully acquitted at the High Court just a few days before I made that video.

So what did I say? What possible criminal offence could I have uttered in less than three minutes that would result in the Crown Office and Procurator Fiscal Service, then led by Ms Bain’s predecessor James Wolffe, despatching five Edinburgh detectives to raid my home, confiscate all of my tech and then bring me to trial where I potentially faced a year’s imprisonment if found guilty.

The video simply highlighted my opinion that if the complainers continued with their efforts against the former First Minister, ignoring the judgement of the High Court that had acquitted Alex, and they persisted in this campaign behind a veil of anonymity, then eventually, one way or another their identities would become widely known.

In evidence produced at the High Court the complainers themselves made plain that they could undertake this politically motivated campaign by exploiting the legal protections that rightly exist to protect actual victims of sexual assault. Their cynical and stated exploitation of this important protection not only continued to damage Alex’s reputation but also undermined wider confidence in those actual victims of such assault whose identities to deserve to be protected from the wider public.

That aspect is one of the more egregious and nefarious undertaken by the complainers and those who coordinated them in what has become the Alex Salmond saga.

As Sheriff Patterson concluded at Jedburgh Sheriff Court, “I do not accept [the comments made in the video] would cause a reasonable person fear and alarm. The video contained an opinion, nothing more.” He accepted my defence team’s motion of “no case to answer” and the prosecution case was dismissed and I was fully acquitted.

But such is the lunacy of Scotland’s once-revered independent legal system that my only hope of a subsequent remedy for this wrongful prosecution would have come if I had been jailed in January 2021. Only then would I have a legal route to seek compensation.

As Fergus Ewing MSP, former Scottish Government Cabinet Secretary and Minister noted in Holyrood just last week (see from 17.08), that situation is plainly “absurd”.

After my acquittal I instructed Solicitor Advocate Gordon Dangerfield – easily the most tenacious and dogged lawyer I have ever come across – and Andrew Smith KC to act on my behalf and in May 2025 we finally secured two full days of legal debate with the aim, on our side, of moving to the “proof stage”. That would potentially have enabled “certain facts”, as Alex Salmond put it following his acquittal, to see the light of day.

After these hearings we waited for Lord Lake’s considered written judgement, which was finally published on 5th February 2026. It is 31 pages in length and narrates, for the most part, all the legal issues around my case in some considerable detail before coming to a conclusion on whether I could proceed to the proof stage and what would have been the “juicy parts”.

Myself and my legal team were confident we could prove that there was clear malicious intent behind the decision to prosecute me in 2021. However, as Lord Lake makes plain in his conclusions, my case cannot proceed because of legislation passed by the UK Parliament.

The Criminal Procedure (Scotland) Act 1995, section 170 provides that prosecutors are immune from liability for malicious prosecution in summary proceedings like mine, where the person suing was not imprisoned.

In his written submissions to the court, my solicitor advocate posed these questions about that provision: “On what rational basis is a prosecutor liable for malicious prosecution only if imprisonment has been imposed on the person suing? … Is it compatible with Article 6 for there to be no remedy for a person seeking to sue and caught by the terms of section 170?”

Our answers to those questions had already been given almost four years earlier in our letter before action to the Lord Advocate, lodged as a production with the court. Section 170 was, we said, “incompatible with Article 6 of the European Convention in that it fails to provide a remedy when a wrong is committed”.

Lord Lake has now agreed. In a formal declaration in his judgment he has found section 170 to be “inconsistent with the European Convention on Human Rights and Fundamental Freedoms, Article 6 (right to a fair hearing), as it is an unjustifiable restriction on a pursuer’s right to have a determination of the merits of his claim that he was the subject of a malicious prosecution”.

That is an incredible statement in its own right, but Lord Lake continued: “Nothing has been brought to my attention to indicate why, notwithstanding the submission of no case to answer being upheld, it could be said that there was a case fit to try. It therefore appears that in the circumstances, the decision of the sheriff to sustain a submission of no case to answer indicates that there was no objective reasonable and probable cause [for bringing a prosecution].”

He then conducted his own analysis of the evidence and concluded: “Whether on the basis of the view taken by the sheriff at the trial or an examination of the evidence available in relation to the requirements of section 38 [the statutory breach of the peace provision under which I was prosecuted], viewed objectively there was no reasonable and probable cause to commence the prosecution – no case fit to be put before a court.”

In other words, Lord Lake is saying that if it was not malice that lay behind the decision to prosecute me, then what was it? In effect, he is laying out the basis of my claim and that it has clear merit. Indeed, he concludes in terms that “the requirements for a case of malicious prosecution against the Lord Advocate … are admitted, established, or the subject of relevant averments” in my pleadings before the court, and that I should be able to go to proof on them.

However, my claim cannot continue because the law stands at present is inconsistent with ECHR and my rights to a fair trial.

Now you might think that conclusion would have been a welcome one for our Lord Advocate because it effectively brings an end to my legal claim against her.

But on Monday 16th February 2026 the Lord Advocate took the decision to appeal Lord Lake’s decision to the Inner House of the Court of Session, the highest civil law court in Scotland. It is a fair assumption that the Lord Advocate is not best pleased by the ruling, not least because it leaves the door wide open for us to proceed with an application to the European Court of Human Rights.

Given Lord Lake’s very strong judgement substantively in my favour, albeit having been forced to dismiss my claim, we are confident of getting a very sympathetic hearing in Europe.

However, one consequence (intended or otherwise is hard to say) of this decision is that we now face unexpected additional court costs.

From the start, it has been clear that the Crown Office, led by the Lord Advocate, has sought to grind us down and price me out of this important legal case. Through the sheer generosity of my supporters in both my initial criminal trial and later in this civil case, we have kept up the fight.

Some have argued that it might have been easier for me to have simply walked away after my acquittal in 2021. They have misjudged me.

For simply offering an opinion in a 158-second video that initially hardly anyone viewed, I had my home raided, my mobile and laptop taken and all of my digital fingerprint forensically scrutinised in what was evidently a fishing expedition. Even after this, so weak was their case they had to amend my initial charge and hope they could jail me under a catch-all breach of the peace.

The publicity, generated by the complainers who didn’t even wait for the initial police report to be actioned, was relentless and highly critical of me personally, causing huge reputational damage that ultimately saw me lose contracts amounting to tens of thousands of pounds. As so often in modern Scotland the process was the punishment, but if they had succeeded I would also have been in prison for a year, for uttering a short opinion on legal proceedings that had been concluded and were of huge public interest.

Senior Counsel for the Lord Advocate during his pleadings at last May’s Court Of Session hearings before Lord Lake made no effort to hide the real agenda; to send a chilling effect across all those who had criticised the complainers.

This is not how actual justice systems are meant to function or how a state prosecutor should be conducting public affairs. Their actions are, as many within the criminal justice system have already noted, brought the entire system into disrepute, but still they continue.

This week I have reluctantly relaunched my financial appeal to get us over this next hurdle. We are genuinely optimistic about our chances but we cannot do that without support.

It has already become a landmark and historic case but we need one big final push. Hopefully then, the joke and the last laugh will be on Scotland’s malicious state prosecutor.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports13 hours ago

Sports13 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment20 hours ago

Entertainment20 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World23 hours ago

Crypto World23 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show