Crypto World

UNI price falls further despite Uniswap Protocol fee expansion proposal

- Uniswap (UNI) price drops despite plans to expand protocol fees and burn tokens.

- If approved, the fees will be activated across all v3 pools and eight additional chains.

- Currently, the key support sits at $3.38 while the immediate resistance is at $4.24.

Uniswap’s native token, UNI, has seen its price dip despite the ongoing governance push to expand protocol fees across more chains and all v3 pools.

While the protocol fee expansion promises to increase token burns and revenue for the protocol, short-term price action has remained under pressure.

The dip comes amid a broader downturn in the cryptocurrency market, with traders closely watching key support and resistance levels.

Uniswap protocol fee expansion proposal

The Uniswap community is currently voting on a proposal to activate protocol fees across all remaining v3 pools on Ethereum mainnet.

In addition, the plan includes extending fees to eight other networks, including Arbitrum, Base, Celo, Optimism Mainnet, Soneium, X Layer, Worldchain, and Zora.

This proposal is notable because it is the first to use the updated governance process known as UNIfication.

This system allows fee parameter changes to bypass the traditional proposal stage, speeding up voting while retaining on-chain security.

If approved, fees collected on these chains would flow to chain-specific TokenJar contracts before being bridged back to the Ethereum mainnet.

From there, UNI tokens would be burned, effectively reducing supply and increasing scarcity over time.

The proposal also introduces a new tier-based system for v3 pools, known as v3OpenFeeAdapter.

Instead of setting fees pool by pool, the system applies fees based on liquidity provider fee tiers.

This simplifies governance oversight and ensures every pool automatically contributes to protocol fee revenue.

Market response

Despite these ambitious plans, UNI’s market performance has struggled.

The token opened today at $3.56 but quickly fell, losing 4.8% from its opening price.

UNI briefly rallied to $3.59 but faced resistance and could not sustain momentum.

This highlights that market sentiment is cautious, even as governance improvements promise long-term benefits.

Currently, UNI is trading around $3.40, down roughly 4.7% in the last 24 hours.

Its market cap sits at just over $2.15 billion, while total value locked in Uniswap remains above $3 billion.

Uniswap price forecast

While the protocol fee expansion may boost long-term value and increase token burns, market reaction shows that short-term price action is likely to remain volatile.

The support at $3.38 is critical, according to market analysis.

If the token holds above this level, it may attempt to move toward the first major resistance at $4.24.

If the token breaches $4.24, it could open the path to $4.76, with a third resistance at $5.41.

However, failure to maintain above the support at $3.38 could see UNI struggle in the short term, limiting the impact of positive governance developments.

Crypto World

Beeple turns ETHDenver into a post-apocalyptic wasteland

The latest ETHDenver conference, which got underway earlier this week, has been depicted as a post-apocalyptic wasteland of crumbling booths and discarded conference swag in a new painting by renowned NFT artist Beeple.

Ethereum has declined 29% over the past 12 months, costing investors over $90 billion in market capitalization.

In an effort to convey the sheer scale of the collapse, Beeple, who’s one of the highest-earning NFT creators in history, has created a nightmarish scene that imagines a decrepit venue stacked with trash, pigeons, stray dogs, and destitute attendees.

Tattered signs hang from the ceiling and trash boxes are filled with worthless merchandise from prior campaigns like DeFi Summer, NFTs, and memecoins.

The image immediately resonated on Crypto Twitter and spurred users to post their own wasteland jokes. One likened ETHDenver to Skid Row, a famous homeless area of downtown Los Angeles.

Read more: Beeple NFT tops almost every ‘Old World Masters’ ever auctioned

ETHDenver stats crater

Attendance at the flagship Ethereum conference, which once rivaled the largest Bitcoin conference from 2023-2024, has collapsed this year. Indeed, ticket sales have dipped below 10,000 from a previous 25,000 high.

The number of side events planned a month in advance, such as mixers, afterparties, and workshops, also fell 85% from last year’s 668.

“I have to say that this was the internal monologue of most of the attendees at ETHDenver,” agreed one attendee.

“The show was about 1/10th the size of last year’s. Probably a lot more reminiscent of ETHDenver 2019 and not what we would have expected for ETHDenver 2026.”

“Hilarious Trump even said no ETHDenver and threw a crypto event at Mar a Lago,” noted another observer.

The Trump family’s crypto forum in Palm Beach, Florida and a White House stablecoin meeting directly conflicted with the dates of ETHDenver 2026.

Others disagreed entirely. Indeed, Jesse Pollack posted a stream of positive updates, as did other Ethereum permabulls like David Hoffman.

Several users posted photos and videos from the conference floor under Beeple’s art to contest his characterization.

Ethereum founder Vitalik Buterin ignored the social drama entirely, quietly posting technical updates. The Ethereum Foundation posted its 2026 roadmap to minimal media attention.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

How the Scam Works and How to Protect Your Wallet

Address poisoning is reshaping risk in crypto wallets by shifting focus from private keys to how users interact with interfaces. Rather than breaking encryption, attackers exploit human habits and design flaws to misdirect funds. In 2025, a victim lost about $50 million in Tether’s USDt after copying a poisoned address. In February 2026, a phishing campaign tied to Phantom Chat drained roughly 3.5 Wrapped Bitcoin (wBTC) worth more than $264,000. These episodes underscore how small UI cues—copy buttons, visible transaction histories, and dust transfers—can seduce users into repeating trusted patterns and handing over assets they believe they are sending to legitimate contacts.

Key takeaways

- Address poisoning operates on user behavior and UI cues, not on private key theft or code flaws.

- Two high-profile losses illustrate the scale: a $50 million hit in 2025 and a February 2026 incident involving about 3.5 Wrapped Bitcoin ($WBTC) worth over $264,000.

- Copy buttons, visible transaction histories, and unfiltered dust transfers can make poisoned addresses look legitimate within wallet UIs.

- Because blockchains are permissionless, attackers can send tokens to any address, and many wallets display all incoming activity, including spam, which can seed trust in fake entries.

- Mitigations hinge on better UX and guardrails: explicit address verification, dust-filtering, proactive warnings, and recipient-address checks during sending flows.

Tickers mentioned: $USDT, $WBTC

Sentiment: Neutral

Market context: The cases underscore ongoing UX-driven security challenges in a market where on-chain activity is highly transparent and attackers increasingly target everyday user workflows. As stablecoins and tokenized assets gain prominence, wallet design and on-chain visibility will be central to risk management, alongside traditional education and phishing countermeasures.

Why it matters

The essence of address poisoning lies in the reproducible, human-centered mistakes that occur when users manage crypto transfers. Private keys remain secure in these scenarios; the vulnerability emerges when recipients or senders rely on partial address fragments or familiar transaction patterns. The attack chain typically unfolds with attackers locating valuable wallets, crafting near-identical recipient addresses, and initiating a tiny or zero-value transfer to insert their spoofed address into the victim’s recent-history view. The attacker then waits for the user to copy the address from that history and accidentally paste it into a new transfer, thereby sending funds to the wrong destination. The absence of a cryptographic breach highlights a fundamental truth: the security model of public blockchains hinges on user judgment as much as cryptography.

UX design decisions amplify the risk. Many wallets provide one-click copy buttons adjacent to recent transactions, a convenience that can backfire when spam or dusting entries appear in the same list. Investigators have long noted that victims often “trust” their own transaction history, presuming it signals legitimacy. In cases like the 2025 loss of USDt and the 2026 wBTC incident, the cost of this cognitive shortcut becomes starkly clear. The broader lesson is that user interfaces—the way addresses are displayed, verified, and confirmed—play a pivotal role in security outcomes, sometimes more so than key management alone.

Industry voices have urged wallets to adopt stronger safeguards. Tech leaders, including Changpeng “CZ” Zhao, have publicly called for enhanced protections to curb address poisoning, signaling a potential shift in wallet governance toward more rigorous recipient verification and anti-poisoning features. The tension is real: developers must balance smooth UX with robust safety checks, ensuring users can transact efficiently without becoming victims of lookalike addresses or suspicious dust transfers. In the meantime, the onus remains on users to verify destinations beyond quick-glance cues and to adopt disciplined sending practices.

At the core, the risk is not about breaking cryptography but about breaking user habits in high-friction moments—entering long addresses, approving approvals, and acting on incomplete information. The public and permissionless nature of blockchains makes every address accessible, and the legibility of transactions often lags behind the complexity of strings that represent keys and addresses. The result is a security rhythm in which attackers rely on social and UX dynamics, not on bypassing cryptographic barriers.

What address poisoning really involves

Address poisoning scams hinge on manipulating a victim’s transaction history to misdirect funds, rather than compromising keys or exploiting software vulnerabilities. The typical playbook unfolds as follows:

- Attackers first identify high-value wallets using publicly visible on-chain data.

- They generate a lookalike address that closely resembles a recipient the victim uses regularly, matching several leading and trailing characters to maximize recognizability at a glance.

- They initiate a small or zero-value transfer from the fake address to seed legitimacy and appear in the recipient’s recent activity.

- The attacker then relies on the victim copying the address from the recent transfers list when preparing a legitimate payment to someone else.

- The final step is when the victim pastes the attacker’s address and authorizes the transfer, unwittingly sending funds to the malicious destination.

The victim’s wallet and private keys remain untouched—the crypto-cryptographic layer is intact. The scam thrives on human error, habitual behavior, and trust built from familiar patterns. In some instances, the exploit is reinforced by dusting operations, where tiny transfers flood a user’s activity feed, nudging them toward interacting with suspicious entries without suspicion.

Did you know? Address poisoning scams have gained visibility in parallel with the expansion of Ethereum layer-2 networks, where reduced fees enable mass small transfers that populate users’ histories with fodder for identity-based deception.

How attackers craft deceptive addresses

Crypto addresses are long hexadecimal strings, often 42 characters on Ethereum-compatible chains. Wallets typically truncate the display to a short fragment, such as “0x85c…4b7,” which attackers exploit by constructing lookalikes with identical prefixes and suffixes while altering the middle portion. A legitimate example might read 0x742d35Cc6634C0532925a3b844Bc454e4438f44e, while an almost identical poisoned variant could appear as 0x742d35Cc6634C0532925a3b844Bc454e4438f4Ae. The strategy hinges on human visual heuristics: people rarely verify the entire string and often rely on the start and end characters to judge authenticity.

Some attackers even use vanity-address generation tools to produce thousands of near-identical strings. The social engineering angle is reinforced by dusting, where small funds accompany the malicious address to create a sense of legitimacy in a user’s transaction history. In practice, this is less about AI or cryptography and more about UX trust and careful scrutiny during each sending action.

Security researchers emphasize a key distinction: the breach lies in behavior and interface design, not in the encryption or signing process. Private keys are still the powerhouse that authorizes transactions, but they cannot verify whether the destination address is correct. The result is a paradox: the strongest security on the planet (cryptography) is undermined not by a technical flaw but by a failure to verify addresses thoroughly at the moment of sending.

Practical ways to stay safer

Because address poisoning exploits human tendencies rather than technical vulnerabilities, small but deliberate changes in how you interact with crypto wallets can markedly reduce risk. Here are practical steps for users and developers alike.

For users

- Build and maintain a verified address book or whitelist for frequent recipients, then reference it instead of retyping or copying from history.

- Always verify the full address before sending. If possible, use a character-by-character comparison or an address-checking tool.

- Avoid copying addresses from recent transaction history. If you need to, double-check the source in the list, or re-enter addresses from trusted bookmarks.

- Be wary of unsolicited small transfers that appear in your history; treat them as potential poisoning attempts and isolate them from normal activity.

For wallet developers

Design choices can dramatically reduce risk by making it harder for poisoned addresses to slip through in everyday flows. Suggested safeguards include:

- Filtering or dimming or automatically isolating very low-value (dust) transactions from typical recipient lists.

- Implementing recipient-address similarity checks that flag near-identical addresses during sending.

- Providing pre-signing simulations and risk warnings when the destination looks suspicious or matches a poisoned-pattern entry.

- Integrating on-chain checks or shared blacklists to identify and block known poisoned addresses before a user confirms a transfer.

Sources & verification

- Phantom Chat address poisoning and related bitcoin phishing details: https://cointelegraph.com/news/phantom-chat-address-poisoning-bitcoin-phishing

- General phishing attack overview in crypto: https://cointelegraph.com/learn/articles/what-is-a-phishing-attack-in-crypto-and-how-to-prevent-it

- Tether price index reference: https://cointelegraph.com/tether-price-index

- Critical observations from ZachXBT on poisoning cases: https://x.com/zachxbt/status/2021022756460966139

- Industry commentary on wallet safeguards and address poisoning: https://www.binance.com/en/square/post/34142027296314

Crypto World

Susquehanna-backed Blockfills seek sale after millions in lending losses

Blockfills, the crypto lender backed by trading giant Susquehanna, has incurred losses of around $75 million during the recent market downturn, according to two people with knowledge of the matter.

Blockfills is now looking for a buyer, one of the people said, who spoke on condition of anonymity because the matter is private.

Asked about the losses, Blockfills declined to comment.

Chicago-based Blockfills suspended deposits and withdrawals last week. The firm’s management said in a press release on Feb. 11 that it was working with investors and clients to achieve a swift resolution and restore liquidity to the platform.

“Clients have been able to continue trading with BlockFills for the purpose of opening and closing positions in spot and derivatives trading and select other circumstances,” the firm said.

The company said it transacted over $60 billion in trading volumes in 2025, a 28% increase from 2024 and is one of the most active institutional lending and borrowing desks in the crypto industry. The liquidity provider services around 2,000 institutional clients, including hedge funds, asset managers and mining companies.

Bear market woes

Blockfill’s sudden halting of withdrawals recalls memories of 2022’s crypto winter, when a cascade of firms such as Celsius, BlockFi and Genesis halted customer withdrawals as markets unraveled.

The crypto market has struggled to regain momentum in early 2026, with flagship assets trading well below recent peaks amid cautious investor sentiment. Bitcoin has languished under $70,000 following a sharp selloff from late-2025 highs, while ether (ETH) sits below $2,000 amid broader weakness across digital assets.

Broader market indicators, including slumping crypto-focused funds and declines in related equities, underscore lingering volatility and risk aversion, even as periodic rallies and profit-taking drive short-term price swings

Blockfills closed a $37 million Series A round in January 2022, led by institutional investors including Susquehanna Private Equity Investments, CME Ventures, Simplex Ventures, C6E and Nexo Inc. The raise marked the company’s second multimillion-dollar funding round since its 2018 founding, bringing total capital raised to $44 million.

Read more: Institutional crypto platform BlockFills said to halt withdrawals, restrict trading

Crypto World

Bitcoin Going to Zero? Google Searches Spike to Highest Since 2022

As fear and macro uncertainty weigh on markets, researchers report a spike in Google searches for “Bitcoin going to zero,” marking the highest level since the FTX era panic in late 2022. Bitcoin has retreated from its Oct. 6, 2025 all-time high near $126,000 to roughly $66,500 at the time of writing, according to data tracked by Coingecko. The retreat comes as the Bitcoin Fear and Greed Index plunged into extreme fear, a mood reminiscent of past crises, while macro indicators register heightened anxiety that could influence risk appetite across asset classes. In this environment, institutional participants have continued to accumulate BTC even as retail chatter centers on worst-case scenarios, complicating the narrative around downside risk.

Key takeaways

- Google Trends shows searches for “Bitcoin going to zero” reach levels last seen during the November 2022 FTX crisis, signaling amplified fear rather than a narrowing probability of success.

- Bitcoin’s price dropped from its Oct. 6, 2025 all-time high near $126,000 to about $66,500, marking roughly a 50% retracement from the peak.

- The Bitcoin Fear and Greed Index sank into extreme fear, with readings around 9, echoing the Terra collapse and the FTX fallout era.

- Macro uncertainty, as captured by global indices like the World Uncertainty Index (WUIGLOBALSMPAVG), sits near record levels, suggesting a cautious backdrop for risk assets.

- Even as headlines skew bearish, institutional buyers — including sovereign wealth funds and large corporates — are quietly increasing BTC exposures, often via ETFs and treasury strategies.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. The asset traded down from its peak, signaling a retreat rather than a renewed uptrend.

Trading idea (Not Financial Advice): Hold. In a setting where macro headwinds and sentiment fluctuate, patience may be prudent given ongoing institutional demand and mixed narrative signals.

Market context: The current mix of macro uncertainty, risk-off sentiment, and evolving ETF flows continues to shape crypto liquidity and price action.

Why it matters

The contradiction at the heart of the current moment is stark: sentiment data — the Google Trends spike for catastrophic outcomes — points to heightened fear, while on the ground, large buyers appear to be amassing BTC. A crypto intelligence study analyzing 650+ crypto media sources found that the fear cycle in 2022 was driven largely by internally cascading failures in centralized lenders and a high-profile exchange crisis, whereas today’s fear is framed more by macro concerns and is amplified by a single bearish voice. The result is a narrative split between public perception and professional activity, a dynamic that can create abrupt shifts in risk appetite.

Bloomberg’s Mike McGlone has emerged as a dominant figure in the current bearish framing, repeatedly warning that Bitcoin could go to zero or near-zero. His stance has been described as a relentless, media-saturated forecast that crypto outlets have repeatedly echoed. The effect is a tightened feedback loop: more coverage feeds more searches, which in turn can influence retail behavior even as professional buyers continue to accumulate. The tension between fear-driven narratives and evidence of continued institutional interest is a key feature of the present market environment.

Nikolic notes that this time around the fear narrative benefits from macro dread, rather than the idiosyncratic shock seen in 2022. “This is not a single event; it’s a composite of price volatility, macro doom, and a prominent bearish voice all converging in a single window,” he said. The discussion around Bitcoin’s prospects is increasingly nuanced: while some voices warn of existential risk, others emphasize resilience and long-term demand, underscoring a market that can remain volatile even as core holders accumulate.

On the price front, Bitcoin’s swing from its October peak to the mid-$60,000s signals a significant retracement rather than a capitulation phase. The price action occurs in a broader risk-off backcloth, where macro indicators such as the World Uncertainty Index show elevated references to global risk and policy uncertainty. While fear in search trends runs hot, official data from on-chain analytics and ETF activity suggest a more complex dynamic than a straight-line decline. The tension between fear-based narratives and steady accumulation by institutions is likely to dominate the near-term discourse as traders weigh tactical entries against longer-horizon exposure.

The narrative around quantum risk has also hung over the market in fits and starts. While the topic has persisted as a backdrop since late 2025, searches for “Bitcoin quantum” surged earlier in the year but have since moderated. In Nikolic’s framing, quantum risk is an amplifier rather than a primary driver of price; it tends to intensify existing bearish sentiment when price action is weak, but it is not by itself a sufficient trigger for a sustained move lower. In this sense, the current spike in “Bitcoin going to zero” queries appears to be a confluence of price backdrop, macro anxiety, and the echo chamber effect of bearish voices in financial media.

Amid the fear narrative, there are tangible signs of demand on the other side of the ledger. Reports tracing ETF flows and corporate treasury strategies show ongoing BTC accumulation by both sovereign wealth funds and major corporations, even as retail chatter fixates on doom scenarios. This dichotomy reinforces the view that the crypto market remains a battleground of narratives, with price action often lagging behind shifts in sentiment and on-chain behavior. The interplay between media cycles, macro risk indicators, and institutional positioning will likely set the tone for the next phase of this cycle.

The broader macro backdrop remains a critical factor. The fear spike around “Bitcoin going to zero” is nested within a climate of record-level uncertainty, underscored by research indicating that spikes in global uncertainty can precede weaker growth and delayed investment. As the market absorbs both the fear-driven headlines and the evidence of ongoing demand, participants should remain attentive to policy signals, ETF development, and any fresh macro data that could recalibrate risk appetite. The rise and fall of emotion in crypto markets continues to be closely tied to global economic cues and the narratives built around them.

For readers seeking anchor points, several sources referenced in this narrative offer context: Google Trends provides the search data illustrating consumer fear; CoinGecko tracks Bitcoin’s price trajectory from its peak to the current level; and macro indicators such as the World Uncertainty Index contextualize the mood against a backdrop of global risk. The discourse around Bitcoin’s future is evolving, and while fear remains a potent force in the short term, it coexists with a persistent undercurrent of institutional support that could help stabilize the market over the longer horizon.

What to watch next

- Price action around the current mid-$60k range and any decisive move toward or away from the $70k level that could alter near-term momentum.

- Updates to the World Uncertainty Index and other macro indicators that might influence risk sentiment and capital allocation in crypto.

- ETF and institutional flow data, including potential shifts in sovereign wealth fund positioning and corporate treasury strategies.

- Regulatory developments or macro-policy signals that could sway the risk environment for digital assets.

Sources & verification

- Google Trends: the query “Bitcoin going to zero” worldwide over the last five years.

- CoinGecko data for Bitcoin price movements, including the Oct. 6, 2025 high and current levels around 66,500.

- Bitcoin Fear and Greed Index and related social discussions.

- World Uncertainty Index (WUIGLOBALSMPAVG) as a macro-risk gauge.

- IMF research on uncertainty spikes and growth implications (Bloom.pdf).

Crypto World

Dash Evolution Chain Integrates Zcash Orchard Privacy Pool

Dash, a layer-1 blockchain protocol with privacy-preserving features, announced on Thursday the integration of Zcash’s “Orchard” shielded pool into the Dash Evolution chain, a secondary layer on the L1 network that supports smart contract functionality. The rollout will proceed after cybersecurity audits are completed and is expected to launch in March, according to the project’s announcement. In the initial phase, Evolution will facilitate basic transfers of Zcash (ZEC) from one party to another, with subsequent upgrades planned to bring Orchard’s privacy features to tokenized real-world assets (RWAs) on the platform. The news adds a new privacy-centric rails dimension to Evolution and signals a broader push to blend shielded transactions with smart-contract enabled networks.

Key takeaways

- Dash (DASH) will integrate Zcash (ZEC)’s Orchard shielded pool into the Evolution layer, enabling private transfers on a smart-contract-capable L1.

- The launch is slated for March, pending cybersecurity audits, with initial support limited to basic ZEC transfers before privacy features for tokenized RWAs are rolled out.

- Privacy-focused tokens and on-chain privacy tooling gained renewed momentum in 2025–2026, as practitioners argue privacy is essential for practical crypto payments and for protecting sensitive business information.

- Dubai’s DFSA moved to ban privacy tokens like ZEC and XMR in January 2026, highlighting tensions between regulatory regimes and privacy tech development.

- Dash’s price action has reflected renewed interest in privacy narratives, with January 2026 seeing a surge of more than 125% and a local high near $96 on Binance before pulling back.

Tickers mentioned: $DASH, $ZEC, $XMR, $BTC

Market context: The integration arrives as the crypto market weighs the balance between privacy protections and regulatory compliance. Privacy-preserving tools are increasingly viewed as necessary for large-scale institutional use cases and for safeguarding payrolls, supplier payments, and partner disclosures from exposure, even as policy makers scrutinize anonymity features for potential misuse.

Why it matters

The Dash–Zcash collaboration underscores a broader industry push to weave shielded, privacy-forward capabilities into programmable networks. By incorporating Zcash’s Orchard shielded pool into Evolution’s smart-contract framework, Dash aims to deliver private on-chain transactions alongside the ability to deploy decentralized applications and tokenized assets. That combination could address one of the long-standing friction points in crypto payments: the need to protect transaction data while still enabling verifiable, auditable activity on a public chain. The approach also raises questions about how privacy protections interact with anti-money-laundering (AML) and know-your-customer (KYC) requirements, particularly as institutions contemplate using private rails for payroll, vendor payments, and cross-border settlements.

From a technical perspective, the Orchard integration pivots on a layered model: the base Dash network remains the settlement layer, while Evolution acts as a second layer capable of complex logic and asset tokenization. The plan to enable ZEC transfers first, followed by privacy enhancements for RWAs, suggests a measured rollout designed to test privacy-preserving mechanics in a controlled environment. For users and developers, this could open doors to more private asset issuance and private, auditable cash flows, while still leveraging the existing interoperability of Dash with other blockchains and services.

Regulatory debates frame the pace and scope of such privacy tools. Dubai’s DFSA ban on privacy tokens illustrates a regulatory hard line: while individuals may continue to hold privacy tokens, exchanges operating under its jurisdiction cannot offer them to new customers. The policy reflects a broader tension between enabling private financial activity and maintaining a measurable, compliant financial system. Advocates, including privacy researchers and industry practitioners, argue that real-world privacy needs to be addressed through a blend of regulation, culture, and code — not by siloing privacy features entirely. Critics contend that on-chain privacy can complicate enforcement and compliance, fueling a broader debate about how best to balance privacy and lawfulness in crypto ecosystems.

Amid these discussions, the narrative around privacy remains dynamic. The discourse includes prominent voices who argue that privacy is a fundamental requirement for practical adoption, especially in the context of enterprise use cases, where sensitive data such as compensation and strategic partnerships could be exposed if not shielded. Critics, meanwhile, push back on the idea that anonymity should be absolute on public networks, warning of misuse and illicit activity. The ongoing exchange of viewpoints—ranging from industry leaders to academics—continues to shape how privacy features are implemented and regulated across networks and jurisdictions.

Historical threads also color the conversation. The broader privacy discourse includes debates about anonymity, traceability, and the potential for forensic analysis to identify ownership of privacy tokens, even when on-chain data is shielded. These discussions inform the way privacy technologies are designed, tested, and deployed, as researchers seek to strike a balance between protecting user privacy and enabling legitimate oversight where needed. In parallel, researchers and practitioners increasingly emphasize that true financial privacy requires more than mere cryptographic obfuscation; it demands thoughtful regulation and governance, aligned with technical safeguards and practical use cases.

In a related vein, the debate around privacy in payments remains a central theme. Industry observers note that the lack of privacy may hinder crypto payments adoption, a concern echoed by industry leaders who argue that privacy-preserving tools are essential to shield sensitive details in business-to-business and enterprise transactions. The integration of Orchard into Evolution can be seen as part of a broader movement to embed privacy options into mainstream blockchains, rather than to keep them confined to niche use cases.

What to watch next

- March 2026: Audits complete and the initial ZEC transfers on Evolution become publicly available.

- Rollout of Orchard’s privacy features for tokenized RWAs, including governance and upgrade milestones for Evolution.

- Regulatory developments in other jurisdictions regarding privacy tokens and on-chain privacy tooling.

- Market reaction to the integration, including any shifts in Dash liquidity and trading activity on major exchanges.

Sources & verification

- Official announcements from Dash and Zcash regarding the Orchard integration and Evolution roadmap.

- Regulatory actions and statements from Dubai’s Financial Services Authority (DFSA) on privacy tokens, including ZEC and XMR.

- Historical price data for Dash (DASH) around January 2026 and associated market commentary on privacy narratives.

- Industry commentary on the role of privacy coins and the debate surrounding privacy versus regulatory compliance.

Key figures and next steps

Dash, positioned at the intersection of privacy and programmable money, is advancing a multi-phase plan to bring Orchard’s shielded capabilities to Evolution. The initial focus on basic ZEC transfers on Evolution lays the groundwork for more sophisticated privacy features tied to RWAs, potentially enabling confidential settlement and private asset issuance. If the March timeline holds post-audits, developers and users could begin testing privacy-first workflows within a familiar Dash ecosystem, while regulators and market participants watch how such integrations comport with compliance regimes around the world. The path forward will likely involve ongoing audits, governance voting on feature upgrades, and a careful articulation of privacy controls within a broader regulatory framework.

Why it matters — concluding thoughts

Privacy continues to be a critical axis for the crypto market’s maturation. The Dash–Zcash integration exemplifies how teams are attempting to reconcile the demand for private, verifiable transactions with the realities of regulatory scrutiny. For builders, it signals a roadmap for embedding privacy-by-design into smart-contract-capable networks, potentially broadening the range of use cases from payment rails to regulated asset tokenization. For users, the development could translate into more flexible privacy options without sacrificing access to a broad ecosystem of DeFi, wallets, and cross-chain services. As the regulatory landscape evolves, the ability to demonstrate privacy safeguards that align with compliance frameworks will be a decisive factor in determining how widely such technologies gain traction. In the near term, investors will be watching not just the march launch, but how the privacy feature set evolves and how this blend of shielded transactions with programmable rails resonates with real-world adoption.

What to watch next

- Audits concluding and March rollout of ZEC transfers on Evolution.

- Public validation of Orchard privacy features for tokenized RWAs on Dash.

- Regulatory updates in other jurisdictions regarding on-chain privacy tools.

Crypto World

Kresus raises $13M from Hanwha to expand wallet and RWA infrastructure

- Hanwha invests KRW 18B ($13M) in Kresus to expand digital asset infrastructure.

- Funding supports enterprise wallets, RWA tokenization, and on-chain workflows.

- Deal follows MoU signed at Abu Dhabi Finance Week in December 2025.

Kresus Labs, a US-based digital wallet and blockchain infrastructure company, has raised about KRW 18 billion(roughly) in a strategic investment from Hanwha Investment & Securities.

The deal highlights how traditional finance is increasingly looking beyond crypto trading and toward the “plumbing” behind digital assets: secure wallets, enterprise systems, and tokenized products that can fit into existing financial services.

Strategic capital targets the infrastructure layer of digital assets

Kresus said the investment will support product development, enterprise deployments, and global partnerships, areas that typically require long implementation timelines and rigorous security standards.

The company builds digital asset tools for both consumers and institutions, and it operates enterprise-grade platforms for digital wallets and real-world asset (RWA) tokenization, along with on-chain financial workflows.

The investment follows a memorandum of understanding signed by Kresus and Hanwha Investment & Securities at Abu Dhabi Finance Week in December 2025, according to the companies.

That sequencing matters: MoUs are often used to formalize intent, outline collaboration areas, and set up technical and commercial work before funding or deeper integration plans are finalized.

Kresus also emphasized its security approach. It offers seedless wallet recovery technology, designed to reduce reliance on a single recovery phrase that can be lost or stolen.

It also uses MPC-based security systems which broadly refers to splitting sensitive signing or authorization steps across multiple components so there is less dependence on one device or one key.

In practice, these designs aim to make wallets harder to compromise and easier to recover, two pain points that have limited mainstream adoption.

“This investment validates both our technology and the direction Kresus has taken as a company,” Trevor Traina, founder of Kresus, said in a statement.

He added that Kresus has focused on infrastructure that works in real-world conditions, from consumer applications “used at scale” to enterprise solutions built for institutional requirements.

RWA tokenization becomes a practical focus for financial firms

For Hanwha Investment & Securities, the partnership is framed as a way to strengthen client-facing digital asset services and to pursue tokenization initiatives linked to existing financial products.

RWA tokenization generally means creating blockchain-based representations of real-world financial claims or instruments, with the goal of improving how assets are issued, tracked, or transferred inside digital systems.

“Kresus’s unique wallet security technology and RWA infrastructure will play a core role in advancing Hanwha Investment & Securities’ digital asset capabilities,” said Son Jong-min, chief strategy officer at Hanwha Investment & Securities.

He said the firm will continue collaborating with global technology companies as it seeks to evolve into a specialized digital asset securities firm.

The announcement fits a broader industry pattern: established financial institutions are showing more interest in controlled, enterprise-ready blockchain use cases than in retail speculation.

Wallet technology and tokenization platforms are increasingly treated as building blocks, tools that can be integrated into existing product lines, rather than standalone consumer brands.

Crypto World

Binance adds news features to Binance Junior to increase family crypto savings and learning

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Binance Junior introduces festive Red Packet gifting, Merchant Pay, and educational tools to foster financial literacy for kids and teens under parental supervision.

Summary

- Binance expands Binance Junior with gifting, payments, and in-app learning to boost family crypto literacy and savings habits.

- New Binance Junior updates let parents supervise crypto gifts, payments, and education for children aged 6–17 in a controlled setting.

- Interactive tools and parental controls position Binance Junior as a family-focused gateway to early digital asset education and use.

Binance has introduced new features to its Binance Junior platform, launched in December 2025. The news features focus on making saving and learning about crypto more accessible for families.

Binance Junior is a program designed for kids and teens aged 6 to 17 that offers a parent-controlled platform that encourages savings habits and financial literacy from an early age.

The newly added features include Red Packet gifting, Merchant Pay options, and seamless integration of the educational “ABCs of Crypto” eBook directly inside the Binance Junior app. These updates aim to create an interactive experience for families to delve into the digital assets world.

Parents can use the Binance Junior platform to guide their children through the world of digital assets while maintaining full control and the ability to enable or disable selected features. Parents can also monitor account activity through the platform’s interactive interface.

With parental approval, children now have permission to receive crypto gifts, make payments, and access education content that present crypto concepts in a fun and interesting way.

Parents can also now enable non-parental transfers from adult Binance accounts to Junior accounts, such as Red Packet gifting and regular peer-to-peer (P2P) transfers, allowing relatives and family friends to send crypto gifts to their children’s Binance Junior accounts.

Commenting on the matter, Yi He, Binance co-CEO, said that Binance Junior is designed to help children manage their allowance with savings and payment features. According to He, the company’s goal is to empower families build a solid foundation for their financial future by helping children develop good money management habits whilst they are still young.

Binance sees Binance Junior as a platform for users to grow in line with its broader goal of nurturing a new generation well-prepared for a financially digital future.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Eric Trump reitrates claim bitcoin (BTC) is just getting started on its road to $1 million

Eric Trump doubled down on his $1 million price prediction for bitcoin and said he has never been more bullish during the World Financial Forum that took place in Mar-a-Lago.

President Donald Trump’s younger son doubled down on his long-term optimism for bitcoin, calling it “one of the greatest performing asset classes” of the last decade in an interview with CNBC on Wednesday.

“I’m a huge proponent because I do think it hits $1 million dollars,” Trump said. “Go back two years. Bitcoin was at $16,000. Where is it at right now, $70,000?”

In August of 2025, Eric Trump, who described himself as a “bitcoin maxi, said bitcoin would reach $175,000 before the end of the year and, eventually climb to $1 million.

BTC closed 2025 at about $88,750, having fallen sharply from an all-time high of more than $126,000 in early October, according to CoinDesk data.

Trump also said that over the past 10 years, bitcoin has climbed roughly 70% annually on average, challenging viewers to “name an asset class that has performed better than Bitcoin.”

While acknowledging the asset’s volatility, Trump framed it as a trade-off for upside potential. “You’re going to have volatility with something that has tremendous upside,” he said. “But I’ve never been more bullish on bitcoin in my life. I’ve never been more bullish on cryptocurrency in my life.”

The post comes as bitcoin trades just below $67,000, after failing to reclaim the $70,000, a level it has not visited since Feb. 15.

The World Liberty Financial forum, held Wednesday at Mar-a-Lago, is tied to World Liberty Financial, a crypto-focused venture backed by the Trump family.

Crypto World

Four Sub-$60,000 BTC Price Levels Form Bitcoin Bottom ‘Roadmap’

Bitcoin (BTC) has four new key support levels to watch as a fresh wave of bearish BTC price action aims to push the market price below $50,000.

Key points:

-

Bitcoin’s realized prices remain important milestones as the market forms a long-term floor.

-

Binance users’ deposit cost basis is next up as a safety net, says analysis.

-

Realized losses reach levels unseen since the end of the 2022 bear market.

BTC price analysis puts focus on Binance traders

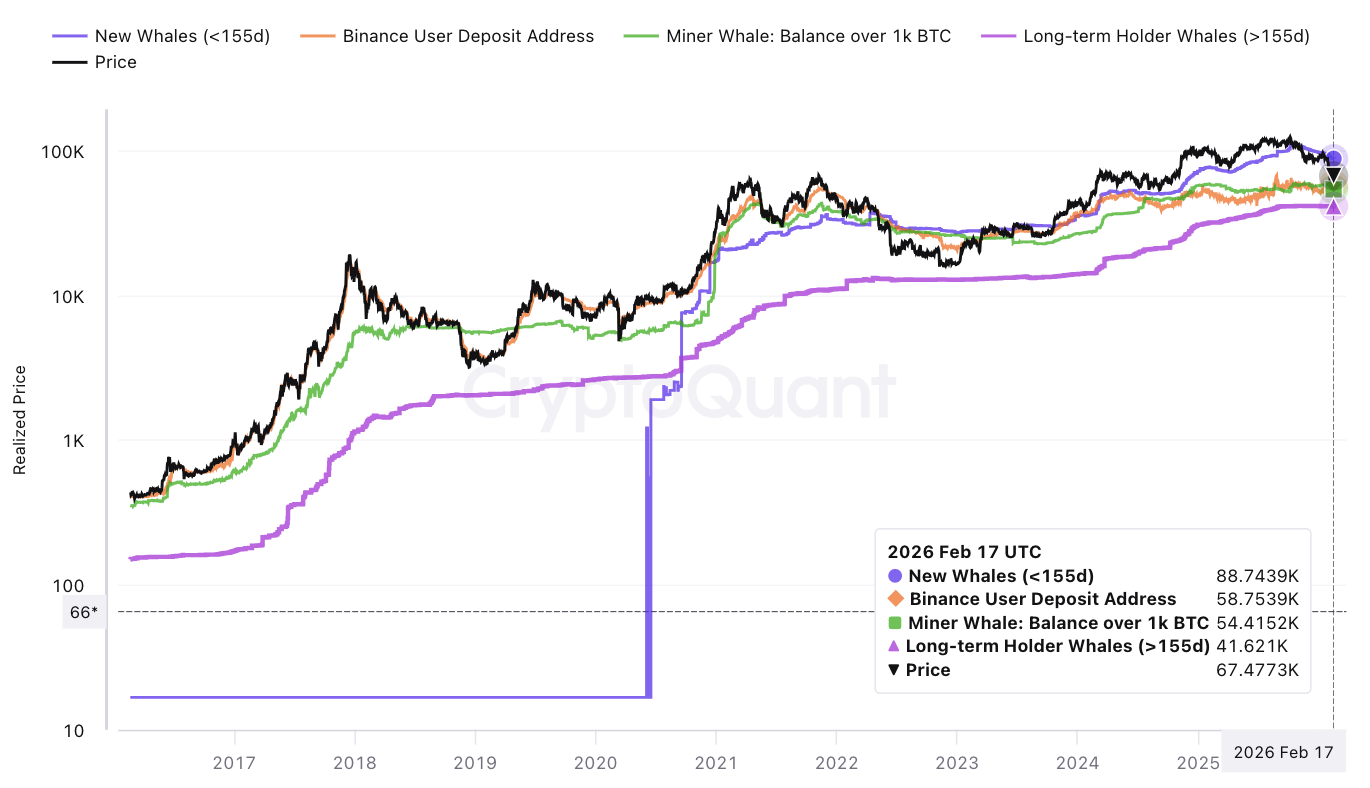

New analysis from Burak Kesmeci, a contributor to onchain analytics platform CryptoQuant, sees $58,700 as Bitcoin bulls’ next line in the sand.

“Which 4 levels am I watching in Bitcoin? 4 key realized price levels — essential for tracking the long-term trend in my view,” he wrote in one of CryptoQuant’s Quicktake blog posts on Wednesday, titled “Bitcoin’s Roadmap to the Bottom.”

Realized price refers to the aggregate cost basis of the BTC supply or a subset of it. When BTC moves onchain, its realized price becomes that at which it was last involved in a transaction.

Realized prices that involve larger groups of coins can often function as market support or resistance zones.

“Bitcoin has been dropping ever since it lost the New Whales’ cost basis — a classic bear cycle signal,” Kesmeci noted.

Newer Bitcoin whales’ aggregate buy-in price stands at $88,700, but with the price now far below, three others are on the radar. Older whales’ realized price is the lowest of the selection at $41,600, while Bitcoin’s overall cost basis now sits at $54,700.

Between the current spot price and those two levels, however, lies the realized price for deposit addresses (UDA RP) on major global crypto exchange Binance.

“From here, the 2 key supports I’ll be watching in order are Binance UDA RP and Bitcoin RP (58.7K and 54.7K),” Kesmeci added.

“The reason: once Bitcoin falls below New Whales’ cost basis, it historically tends to at least test the Realized Price. And the only support standing between here and there is 58.7K.”

Bitcoin losses echo 2022 bear market bottom

While panic selling from exchange users has cooled since BTC/USD rebounded from 15-month lows near $59,000 at the start of February, CryptoQuant data underscores the risk of further capitulation.

Related: Bitcoin 2024 buyers steady BTC price as trader sees $52K ‘next week or so’

The proportion of the BTC supply currently held at an unrealized loss has reached 46%, its highest reading since the end of Bitcoin’s 2022 bear market.

“It is worth noting that the correction has been so severe that the increase in supply held at a loss has occurred very rapidly,” CryptoQuant contributor Darkfost commented on X during the $60,000 swing lows.

Last week, meanwhile, Darkfost reported similarly conspicuous levels of realized losses from Bitcoin investors — coins moving at a lower price than in their previous transaction.

“At its peak, on February 5, realized losses exceeded 30,000 BTC,” he confirmed.

“This remains well below the extreme levels observed during the last bear market, when realized losses reached 92000 BTC and 80000 BTC on separate occasions. Nevertheless, it is still a clear sign that a capitulation phase has taken place.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

$58.7K Hint, Binance Cost Basis Critical

Bitcoin has moved into a phase where on-chain metrics and the behavior of larger holders are shaping short- to medium-term risk levels. A freshly published CryptoQuant analysis identifies four key realized-price levels that market participants watch for evidence of a long-term floor or renewed downside pressure, with the nearest line in the sand sitting around $58,700 and another around $54,700. The narrative suggests a fragile balance between momentum and capitulation risk as BTC hovers near critical support zones and as exchange-driven selling cooled after a recent dip near $59,000. In this context, market participants are closely watching how the realized price framework interacts with exchange-derived cost bases, especially on Binance, and how these factors could influence the next leg of the cycle.

Key takeaways

- Four key realized-price levels are identified as essential for tracking Bitcoin’s long-term trend, with liquidity pressure and potential support near the 58.7K and 54.7K marks.

- Realized price represents the aggregate cost basis of BTC that has moved on-chain, serving as a potential support or resistance zone depending on the direction of price action.

- Binance deposit cost basis (UDA RP) sits between the current price and other critical levels, functioning as a near-term safety net in the event of renewed selling pressure.

- The share of BTC supply held at an unrealized loss has climbed to the high 40s percentage range, approaching levels not seen since the end of the 2022 bear market, signaling a potential capitulation risk if prices weaken further.

- Older and newer whale cost bases provide a spectrum of pressure points: newer whales around $88,700 and older whales near $41,600, with the overall cost basis around $54,700.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. The analysis points to risk of further downside as realized-price barriers are tested and unrealized losses rise among holders.

Trading idea (Not Financial Advice): Hold

Market context: The market remains sensitive to on-chain signals and macro liquidity trends, with a cautious tone prevailing as investors evaluate long-term cost-basis milestones against current spot prices.

Why it matters

At the core of the discussion is the concept of realized price—the average price at which BTC moved on-chain for a given cohort. This metric can act as a magnet for price actions, especially when the market experiences cascading moves. CryptoQuant’s analyst Burak Kesmeci emphasizes that four realized-price levels are essential for mapping Bitcoin’s trajectory over a prolonged downturn or potential bottom formation. The proximity of these levels to current prices matters not only for immediate liquidity but for the psychology of holders who evaluate whether this cycle is generating a fresh undercurrent of selling pressure or laying the groundwork for a durable base.

Indeed, the analysis points to the Binance UDA RP (the realized-price marker for deposit addresses on the exchange) as a near-term anchor that sits between prevailing prices and the deeper levels identified by longer-term holders. The logic is simple but consequential: once the price dips below a major realized-price threshold, there is historical tendency for price action to retest that marker, potentially triggering further selling that could push BTC toward the lower bound around 58.7K. The quote from the analyst underscores this dynamic: the only substantial support between the current level and the next test of realized price rests near 58.7K, creating a palpable risk of a test of the realized-price framework if price pressure intensifies.

Beyond the price action itself, the data reflect broader supply dynamics. The proportion of BTC supply currently at an unrealized loss has surged to levels not seen since the end of the 2022 bear market. Analysts have highlighted the speed with which this metric has climbed during the latest drawdown, pointing to rapid changes in holders’ on-chain costs as a key indicator of potential capitulation risk. Observers note that, while the extreme losses observed during the last bear cycle dwarfed today’s figures (with historic peaks well above 90,000 BTC in realized losses), the current level is still a meaningful signal that a phase of distribution may have intensified. The combination of elevated unrealized losses and a price break below key realized-price thresholds could increase the probability of a test of major anchors in the days ahead.

The story is nuanced by the behavior of different cohorts on-chain. Newer Bitcoin whales have a buy-in around $88,700, while older, longer-held addresses show a realized price near $41,600. The broad market’s cost basis sits around $54,700, providing a spectrum of pressure points that market participants monitor as price moves unfold. Between the current price and these thresholds lies the Binance UDA RP, creating a near-term focal point for traders who watch whether the market will hold above that line or slide toward the next substantial marker. A line from CryptoQuant summarizes the practical implication: once Bitcoin falls below the New Whales’ cost basis, it has historically tended to test the realized price, and the 58.7K level remains the pivotal buffer between here and that eventual test.

To illustrate the sense of risk, recent exchange-driven momentum has cooled after Bitcoin’s dip from multi-month highs near the $60,000+ zone. Yet the combination of rising unrealized losses and a price structure that now brackets several critical cost bases means the market remains vulnerable to renewed drawdown if buyers fail to reassert demand at or above these anchor points. The on-chain narrative, therefore, remains a crucial prism through which traders assess whether the market is carving out a sustainable floor or merely pausing before another leg lower.

The analysis is not isolated to one metric or one exchange narrative. It sits at the intersection of realized prices, exchange-specific cost bases, and the evolving behavior of large addresses that have shown significant exposure to price swings in recent months. As investors parse the implications of these data points, the broader market context—ranging from liquidity conditions to risk sentiment and macro developments—continues to shape which side of the range the market tests next. In short, the realized-price framework provides a structured lens for understanding where support might emerge and how far the market could fall before buyers re-enter with conviction.

What to watch next

- Bitcoin’s price reaction around 58.7K and 54.7K, and whether the market tests those thresholds again in the near term.

- Movement in Binance UDA RP: any shifts that indicate a critical mass of deposit-address cost-basis pressure is bearish or bullish for the next leg.

- Changes in the composition of unrealized losses across the BTC supply, especially in relation to newly active whales versus older holders.

- Updates to CryptoQuant’s Quicktake analyses or similar on-chain signals that might recalibrate the four-key-level framework.

- Macro or regulatory developments that could influence risk appetite and liquidity in the broader crypto space.

Sources & verification

- CryptoQuant Quicktake by Burak Kesmeci: Bitcoin’s Roadmap to the Bottom — 4 Levels to Watch (link to cryptoquant quicktake).

- Cointelegraph discussion on realized price and aggregate cost basis as a market metric (link to aggregate cost basis article).

- Cointelegraph coverage of New Whales’ cost basis and related on-chain signals (link to New Whales cost basis article).

- Cointelegraph reporting on Bitcoin price action during the February swing lows and peaks near $60,000 (link to Bitcoin rally and derivatives metrics article).

- Cointelegraph piece on early 2024 BTC buyers steadying price and the $52K level projection (link to 2024 buyers article).

Market reaction and key details

Bitcoin’s current setup centers on a four-fold realized-price framework that coinside with near-term support considerations, particularly the 58.7K and 54.7K markers. The Binance UDA RP line and the broader realized price for deposit addresses play a decisive role in shaping how the market traverses this zone. Realized losses have climbed, signaling that, even if price action stabilizes, the path toward a durable bottom may require a balance of renewed demand and patience from long-term holders. The pattern aligns with past cycles where downside pressure thins after a bear-market rally, but it also warns that a decisive break below the major anchors could accelerate a testing sequence toward lower support bands. As always, the on-chain narrative remains a critical counterpart to conventional price analysis, contributing to a more nuanced view of where Bitcoin could go next and what investors should monitor as events unfold. (CRYPTO: BTC)

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports15 hours ago

Sports15 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment21 hours ago

Entertainment21 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World24 hours ago

Crypto World24 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

-

Crypto World6 days ago

Crypto World6 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery