Crypto World

what happens beyond the yield

In today’s newsletter, Nassim Alexandre from RockawayX takes us through crypto vaults, what they are, how they work and risk evaluation.

Then Lucas Kozinski, from Renzo Protocol, answers questions about decentralized finance in Ask an Expert.

Understanding vaults: what happens beyond the yield

Capital flowing into crypto vaults surged past $6 billion last year, with projections indicating it could double by the end of 2026.

With that growth, a sharp split has emerged between vaults with robust engineering and controls and vaults that are essentially yield packaging.

A crypto vault is a managed fund structure deployed on-chain. An investor deposits capital, receives a token representing their share, and a curator allocates that capital in accordance with a defined mandate. The structure can be custodial or non-custodial, redemption terms depend on the liquidity of the underlying assets and portfolio rules are often encoded directly into smart contracts.

The central question around vaults is exposure: what am I exposed to, and can it be more than I am being told? If you can explain where the yield comes from, who holds the assets, who can change the parameters and what happens in a stress event, you understand the product. If you cannot, the headline return is irrelevant.

There are three risk layers worth understanding.

The first is smart contract risk: the risk that the underlying code fails. When was the last audit? Has the code changed since? Allocation controls sit here as well. Adding new collateral to a well-designed vault should require a timelock that allows depositors to see the change and exit before it takes effect. Strategy changes should require multi-signature approval.

The second is underlying asset risk: the credit quality, structure and liquidity of whatever the vault is actually holding.

The third underappreciated risk is redemption: under what conditions can you get your capital back, and how quickly? Understand who handles liquidations in a downturn, what discretion they have and whether the manager commits capital to backstop them. That distinction matters most in the exact moments you would want to leave.

The quality of a vault is largely dependent on the quality of its curation. A curator selects which assets are eligible, sets parameters around them and continuously monitors the portfolio.

For example, most real-world asset strategies on-chain today are single-issuer, single-rate products. A curated vault, by contrast, combines multiple, vetted issuers under active management, giving diversified exposure without managing single-name credit risk yourself.

Then there is ongoing monitoring. Default rates shift, regulations change and counterparty events happen. A curator who treats risk assessment as a one-time exercise is not managing risk.

What makes crypto vaults different from a traditional fund is transparency; investors don’t have to take the curator’s word for it. Every allocation, position and parameter change happens on-chain and is verifiable in real time. For advisors familiar with private credit, the underlying collateral may be recognisable. What requires attention is the on-chain structuring around it: whether you have genuine recourse, in which jurisdiction and against whom. That is where curator expertise matters. A curator is the risk manager behind a vault. They decide what assets are eligible, set the rules capital operates within, and actively manage the portfolio.

Curated vault strategies typically target 9-15% annually, depending on mandate and assets. That range reflects risk-adjusted return generation within defined constraints.

Vaults also allow a more efficient way to access assets you already allocate to, with capabilities that traditional structures do not offer. For family offices managing liquidity across multiple positions, this is a practical operational improvement.

The key one is composability. On-chain, a vault can allow you to borrow against a collateral position directly, without the documentation overhead of a traditional loan facility. For family offices managing liquidity across multiple positions, this is a practical operational improvement.

Permissioned vault structures are also noteworthy, as they allow multiple family offices or trustees to deposit funds into a single managed mandate without commingling, each retaining separate legal ownership while sharing the same risk-management infrastructure.

The vaults that survive this scrutiny will be the ones where the engineering, mandate, and curator’s judgment are built to hold under pressure.

– Nassim Alexandre, vaults partner, RockawayX

Ask an Expert

Q: With “yield-stacking” and many layers of decentralized finance (DeFi) protocols, what is needed to mitigate risk in vaults?

The first thing is minimizing complexity. Every additional protocol in the stack is another attack surface. So if you don’t need it, cut it. We won’t deposit into protocols that have discretionary control over funds — meaning they can move capital wherever they want without user consent. We want transparency about what other protocols are doing with our capital, but privacy around our strategies so others can’t see anything proprietary.

Beyond that, it comes down to transparency and time. Users should always be able to see exactly where their funds are and what they’re doing. And any parameter changes — fees, strategies, risk limits — should go through a timelock so people have a window to review and react before anything goes live. Smart contract audits matter too, but audits are a baseline, not a safety net. The architecture has to be sound before the auditor even shows up.

Q: At what point does institutional capital inflow compress DeFi yields to the level of traditional risk-free rates, and where will the next “alpha” be found?

It’ll happen eventually in the most liquid, simple strategies. But here’s what traditional finance (TradFi) can’t replicate: composability. The underlying instruments might be identical — take the USCC carry trade as an example — but in DeFi you can plug that same position into a lending market, use it as collateral, provide liquidity to a DEX pool and do all of that simultaneously. That’s not possible in TradFi without significant infrastructure cost.

The alpha won’t disappear. It’ll just move to whoever builds the most efficient capital pathways between strategies. The people who figure out how to stack yields across composable layers while managing risk properly will consistently outperform. And that gap between DeFi and TradFi infrastructure costs alone keeps the spread wide for a long time.

Q: How will the integration of Real World Assets (RWAs) into automated vaults change the correlation between crypto yields and global macro interest rate cycles?

Yes, crypto yields will become more correlated with macro as RWAs come in. That’s just the nature of bringing rate-sensitive assets on-chain. But I think people underweight the other side of that tradeoff.

Before RWAs, crypto holders had a binary choice: keep stables on-chain and earn crypto-native yields, or pull everything out and deposit into a brokerage. Now you can hold stables on-chain and access the same strategies you’d find in TradFi, without leaving the ecosystem. And crucially, you can layer on top of them — borrow against your RWA position, deploy that capital into a lending market, LP against pools that use these assets as collateral. The capital efficiency you get from that kind of setup is just not available in traditional finance. So yeah, more macro correlation — but also more optionality for where to deploy capital, which should push rates up over time as liquidity deepens.

– Lucas Kozinski, co-founder, Renzo Protocol

Keep Reading

Crypto World

Anchorage Digital offers non-U.S. banks a stablecoin stand-in for correspondent banking

Anchorage Digital, the first crypto firm to get a U.S. banking charter, wants international banks to swap out correspondent banking relationships with a new service that offers U.S.-regulated stablecoin rails for non-U.S. institutions.

The bank is launching what it calls “Stablecoin Solutions” to permit easy, cross-border movement of dollar-tied assets, combining “minting and redemption, custody, fiat treasury management, and settlement” into one service, it said in a Thursday statement.

“Stablecoins are becoming core financial infrastructure,” said Nathan McCauley, co-founder and CEO of Anchorage Digital, in a statement. “Stablecoin Solutions gives banks a federally regulated way to move dollars globally using blockchain rails, without compromising custody, compliance, or operational control.”

Now that the U.S. has a new law governing stablecoin issuers under last year’s Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, Anchorage Digital — already regulated under a federal charter by the Office of the Comptroller of the Currency — is moving to offer the stablecoin services. While it’s ready to handle any brand of stablecoin, a field currently dominated by Tether’s $USDT and Circle $USDC, the company said institutions can natively mint and redeem tokens “issued by Anchorage Digital Bank, including Tether’s USA₮, Ethena Labs’ USDtb, OSL’s USDGO and upcoming issuances such as Western Union’s USDPT.”

Correspondent banking allows foreign banks to tap another institution to handle their cross-border activities, such as wire transfers, currency exchange, taking foreign deposits and otherwise acting as a third-party proxy. But it can be expensive and time-consuming. Anchorage Digital is suggesting it can use stablecoin rails to cut settlement delays and simplify the complexity of the existing system.

The GENIUS Act that will govern this business isn’t yet implemented by the federal agencies involved in regulation and oversight, such as the OCC and other banking watchdogs. Those agencies have begun proposing some of the future regulations.

Some provisions on stablecoin yield are now being reopened in the ongoing Senate negotiation over the Digital Asset Market Clarity Act.

Read More: Tether invests $100 million in U.S. crypto bank Anchorage, valued at $4.2 billion

Crypto World

Latest White House talks on stablecoin yield make ‘progress’ with banks, no deal yet

More progress was made but no compromise deal has yet emerged after a meeting hosted by the White House on Thursday to bring crypto insiders and bankers to the table again on U.S. digital assets legislation, according to crypto insiders who attended.

“Today’s constructive meeting at the White House reflects the importance of focused working engagement,” said Ji Kim, the CEO of the Crypto Council for Innovation, who has been a regular participant in the talks. “The conversation built upon previous meetings to establish a framework that serves American consumers while reinforcing U.S. competitiveness,” he said, adding that there will be “more to come” to continue the progress.

“The dialogue was constructive and the tone cooperative,” Paul Grewal, the chief legal officer at Coinbase, wrote in a post on social media site X, saying the sides made “more progress.”

This was the third in a series of meetings meant to pierce the impasse that’s locked up the crypto market structure bill on a point that has nothing to do with market structure. The U.S. banking industry put its foot down about the way the previous legislative effort that’s now law — the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act — allowed crypto firms to offer rewards on stablecoins. Bankers argue that such rewards threaten the deposits business at the core of their industry, and they’ve demanded the Digital Asset Market Clarity Act rehash that point in the GENIUS Act.

After the most recent meeting in which the bankers arrived with a principles document that shut out talk of compromise, Thursday’s gathering extended well beyond the two-hour schedule, said people briefed on the talks. White House officials applied pressure on the participants to stay until they’d found common ground, including collecting their phones, the people said.

The question of whether stablecoins should be able to offer yield, such as in the products offered to customers on platforms like Coinbase, is among the major remaining sticking points of the legislation that would govern the U.S. crypto markets. An earlier compromise effort sought to give up rewards on static stablecoin holdings and only retain them on certain activities and transactions made with the assets. But banks had held the line on a demand that all rewards be banned.

If the industries come to terms on this point, it still doesn’t lock in a congressional victory. The Senate Banking Committee needs to hold a hearing to consider advancing the legislation, just as the Senate Agriculture Committee did when it voted along partisan lines to approve its own version. But to get a bill that can pass the Senate, the process will need many Democrats on board, and that hasn’t yet happened.

Democratic negotiators have insisted on a few major points, such as prohibiting senior government officials from significant business interests in crypto — a concern directed squarely at President Donald Trump. They’ve also called for the White House to fill the commissions at the Commodity Futures Trading Commission and the Securities and Exchange Commission, including nominating to fill the Democratic vacancies. Also, the members have demanded tighter controls on illicit finance risks, especially in decentralized finance (DeFi).

None of their requests have yet been met with offers from the Republicans and White House that have so far satisfied Democrats.

The Clarity Act is the top policy priority for the crypto industry. Once U.S. regulations are permanently set, the sector expects to see a surge in activity and investment as it becomes an indelible part of the U.S. financial system.

Read More: Banking trade groups responsible for impasse on market structure bill, Brian Armstrong says

UPDATE (February 19, 2026, 19:17 UTC): Adds comment from CCI’s Ji Kim.

Crypto World

Hack VC-Backed Nillion to Shut Down Its Chain on Cosmos, Shift Focus to Ethereum

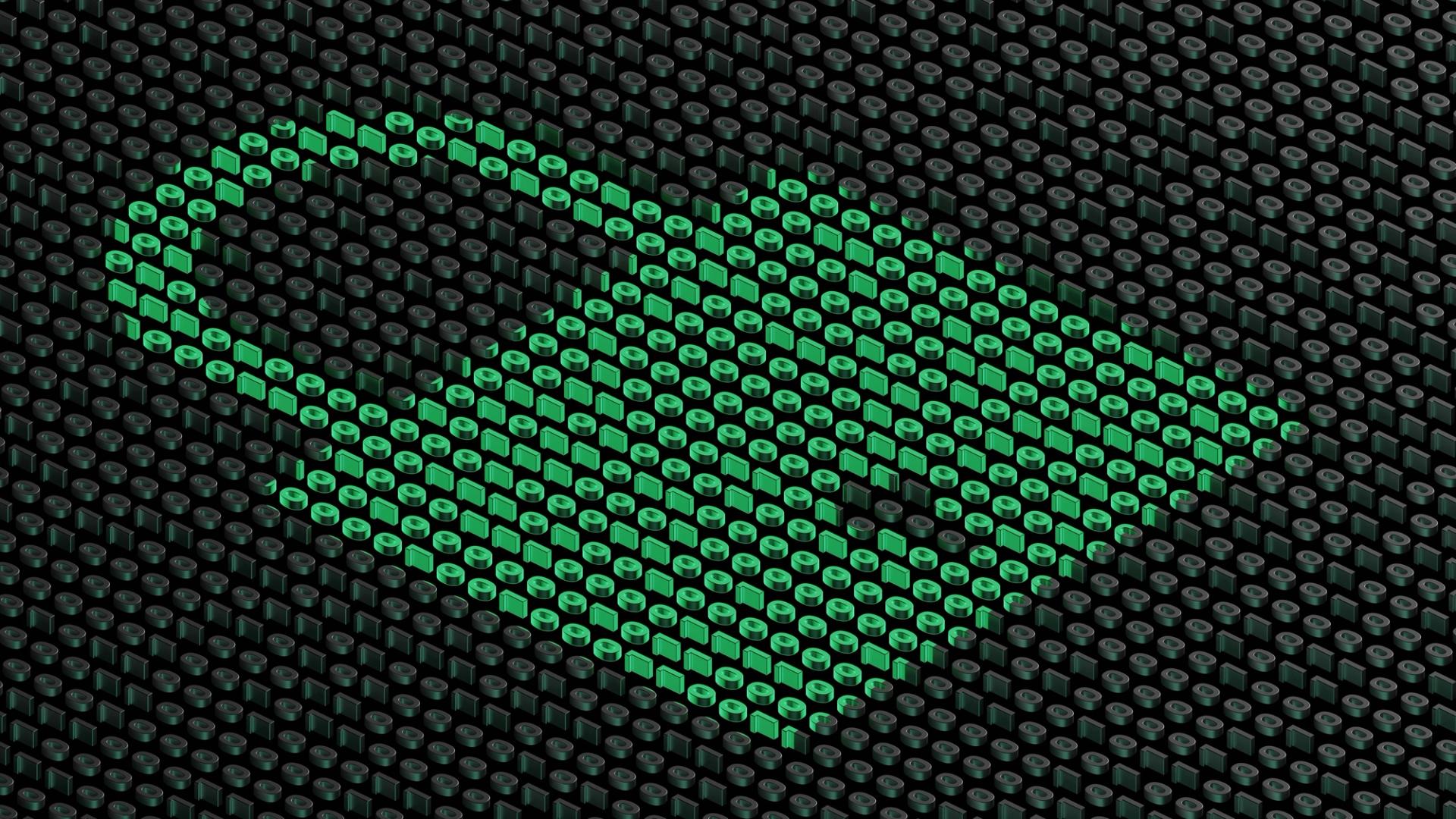

The migration comes just months after Cosmos announced it’s stepping back from efforts to turn the Cosmos Hub into a smart contract platform as TVL declines.

NilChain, a privacy-focused blockchain built with the Cosmos SDK by Nillion, is winding down operations on Cosmos as part of broader shifts across the interoperability-focused ecosystem.

In an X announcement on Feb. 17, the team said the network will halt operations on March 23, urging holders of the NIL token to migrate their assets to Ethereum before the shutdown.

NilChain was designed as a network for secure computation. But the chain has seemingly not been able to reach broad usage inside the Cosmos ecosystem.

Leaving Cosmos, however, doesn’t mark an end to Nillion itself, as the company plans to continue operating on Ethereum. Amid the news, nilChain’s native token NIL briefly jumped over 10% on the day to $0.06 and is currently trading around $0.053, per data from CoinGecko.

It remains unclear why the team decided to migrate away from Cosmos. The Nillion team declined The Defiant’s request to comment on the move for this story.

NilChain may not be widely known compared with larger Layer 1 or Layer 2 networks, but Nillion has raised sizable funding. In December 2022, the company closed a roughly $20 million seed round led by Distributed Global, with participation from GSR Markets and HashKey.

It raised another $25 million in October 2024 in a round led by Hack VC, with backing from the Arbitrum Foundation, Worldcoin, Sei, HashKey Capital, and Animoca Brands.

Exodus from Cosmos

The move comes as Cosmos itself reassesses its direction. In July 2025, the Cosmos Hub scrapped plans to add native smart contract support, citing high costs and weak developer demand. Teams that had planned to deploy applications on the Hub were encouraged to build on other Cosmos-based chains instead.

That shift forced a reset for many teams and coincided with a wave of departures. Since mid-2025, several projects have announced exits or wind-downs across the Cosmos ecosystem.

The stablecoin-focused project Noble said earlier in January of this year it would leave Cosmos to launch its own EVM-compatible L1, saying the team wants to “meet users and developers where they already are.” Others have taken different paths with chains like Pryzm and Quasar announcing shutdowns or significant changes.

Some have publicly said they are leaving Cosmos after years of struggling with liquidity, user distribution, and developer traction following the collapse of Terra in 2022. Others, including infrastructure providers, argue the ecosystem still makes sense for teams focused on interoperability rather than consumer DeFi.

The Cosmos Hub itself has also seen declining activity. Data from DefiLlama shows total value locked on the network falling from about $2.65 million to roughly $131,000 earlier this month, the lowest level on record.

Network fees have also dropped sharply. By January, fees reached an all-time low of around $218,000, with only four of the 11 protocols deployed on the Cosmos Hub generating any revenue.

ATOM, the native token of Cosmos Hub, is down about 4% over the past 24 hours, though it rallied over 18% in the past week, per CoinGecko.

Crypto World

Brian Armstrong Slams Wall Street’s Misunderstanding of Coinbase’s Value

Brian Armstrong, CEO of Coinbase, has voiced concerns about the traditional financial industry’s perception of his company. In a recent Q&A session, Armstrong argued that Coinbase is undervalued and misunderstood by Wall Street. He attributes this to an ongoing resistance against cryptocurrency disruption, suggesting that the broader financial world has yet to fully recognize the true potential of Coinbase. The CEO highlights this misunderstanding as part of a larger trend where innovations are initially dismissed but later accepted as they prove their value.

“Why is Coinbase always misunderstood or under-appreciated by Wall Street?” – I got asked this today in our AMA with analysts, and it’s an interesting question. Sharing my answer here.

I do think Coinbase is a bit of a misunderstood company. It’s a classic innovator’s dilemma.…

— Brian Armstrong (@brian_armstrong) February 17, 2026

Armstrong Highlights the Innovator’s Dilemma in Finance

Armstrong attributes Wall Street’s reluctance to embrace Coinbase to what he calls the innovator’s dilemma. He compares the current skepticism toward cryptocurrency to the resistance faced by e-hailing services like Uber when they disrupted the traditional taxi industry.

Armstrong believes that, like the taxi companies of the past, Wall Street views cryptocurrency as a threat rather than a valuable innovation. According to him, traditional financial institutions fail to see that the future of finance is rapidly changing.

Despite these challenges, Armstrong remains confident about Coinbase’s future. He argues that while the financial industry resists the shift toward crypto, progressive institutions are starting to collaborate with Coinbase. Armstrong pointed out that five of the Global Systemically Important Banks (GSIB) have already engaged with Coinbase and begun exploring collaborations. He believes this is a crucial step in the mainstream acceptance of cryptocurrency as a legitimate financial tool.

Coinbase’s Growth Metrics Challenge Traditional Valuation

Armstrong underscores Coinbase’s impressive growth in an attempt to shift Wall Street’s perception. He highlights significant increases in key metrics, such as a 156% year-on-year rise in trading volume. Additionally, Coinbase’s market share has doubled, and its asset growth has tripled over the past three years. Armstrong stresses that these metrics should challenge Wall Street’s view of Coinbase as an undervalued asset.

The CEO also noted that Coinbase is no longer just a trading platform but a comprehensive financial infrastructure company. With 12 products currently generating over $100 million annually, Armstrong believes this diversification underscores Coinbase’s potential for long-term growth. He urges investors and financial institutions to recognize these achievements rather than relying on outdated perceptions of the company as merely a crypto exchange.

A Shift in Global Financial Systems with Crypto at the Core

According to Armstrong, the future of global finance is increasingly centered around cryptocurrency. He insists that Coinbase is not simply a digital asset exchange but an integral player in the evolving financial infrastructure.

Armstrong believes that banks and financial institutions must adapt to this new reality to stay competitive. He argues that those who embrace cryptocurrency infrastructure will benefit greatly, while those who resist will struggle to remain relevant in the future financial landscape.

Coinbase’s role in this transformation is becoming clearer with its partnerships with leading global financial institutions. As blockchain technology continues to disrupt traditional financial systems, Armstrong predicts that the companies most willing to embrace crypto will be the ones that thrive in the future. He encourages Wall Street to move beyond its initial skepticism and adopt a more forward-thinking approach, recognizing Coinbase as a key player in reshaping the financial world.

Crypto World

Important Coinbase Announcement Concerning XRP, ADA, and Other Altcoin Investors

“Borrowing up to $100K in USDC against your tokens, instantly, without selling,” the announcement reads.

The US-based exchange Coinbase expanded its crypto-backed loan offerings to include additional tokens, such as Ripple’s XRP and Cardano’s ADA.

For the moment, the new service is available across the USA, except for residents of New York State.

Further Support for These Assets

The company rolled out its lending product, called Coinbase Borrow, in 2021. Two years later, it discontinued the service, only to bring it back at the start of 2025.

Coinbase Borrow lets users take a loan using their cryptocurrency possessions as collateral instead of selling them. Until recently, clients were able to borrow up to $5 million in USDC against their Bitcoin (BTC) holdings and as much as $1 million in the stablecoin against Ethereum (ETH). The exchange, though, decided to expand the service by adding Ripple (XRP), Cardano (ADA), Dogecoin (DOGE), and Litecoin (LTC).

“Now you can unlock the value of your portfolio without giving up your position. Borrowing up to $100K in USDC against your tokens, instantly, without selling. Available now in the US (ex. NY),” the official announcement reads.

Backing from a major exchange like Coinbase can positively influence the prices of the involved cryptocurrencies by boosting their reputation and accessibility. In this case, however, XRP, ADA, DOGE, and LTC continued trading lower, reflecting the broader market’s bearish conditions.

It is important to note that the strongest price pumps typically occur right after Coinbase lists a token or reveals its intentions to do so. Last summer, for instance, the company added SPX6900 (SPX), AWE Network (AWE), Dolomite (DOLO), Flock (FLOCK), and Solayer (LAYER) to its roadmap. Some of the involved assets headed north by double digits following the disclosure.

It’s a completely different story when Coinbase terminates services with certain coins. Towards the end of last year, Muse Dao (MUSE), League of Kingdoms Arena (LOKA), and Wrapped Centrifuge (WCFG) tumbled substantially after they were removed from the trading venue.

You may also like:

What Else is New on Coinbase?

The exchange has been quite active lately, enabling additional trading options for its clients. Earlier this month, it announced that users can buy, sell, convert, send, receive, or store RaveDAO (RAVE), Walrus (WAL), AZTEC (AZTEC), and Espresso (ESP). All assets are live on Coinbase’s official website and application.

WAL, AZTEC, and ESP experienced an initial price upswing after the news but then headed south. RAVE, on the other hand, has kept pumping and currently trades around $0.44 (per CoinGecko), representing a 25% weekly increase.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

LayerZero CEO Clarifies ZRO Will Capture All Zero Network Fees

TLDR:

- ZRO becomes the only gas, staking, and fee asset across Zero, LayerZero, and Stargate infrastructure layers.

- Protocol revenue from priority fees, MEV tips, markets, and payments will all route directly into ZRO.

- Institutional buyouts removed 19.77 percent of total ZRO supply from future unlock circulation schedules.

- Public dashboards currently overstate ZRO unlock pressure by nearly twofold due to outdated supply data.

LayerZero has clarified how its ZRO token will function inside the upcoming Zero network after days of market speculation.

The update outlines a single-asset economic design that ties protocol activity directly to ZRO. It also revises assumptions about future supply pressure from token unlocks. The disclosure arrives ahead of Zero’s planned mainnet launch later this year.

ZRO Tokenomics Anchors Zero Network Fee Structure

Bryan Pellegrino published the clarification in a post on X, addressing questions around Zero’s economic design. He stated that the project will not issue a new token for the network. ZRO will serve as the only asset across all Zero functions.

ZRO will act as both the staking and gas token inside Zero. Every transaction and message will rely on the same asset for settlement. This approach removes the need for parallel fee tokens across zones.

According to the statement, all excess fees generated from priority fees linked to state contention will route to ZRO. Tips and MEV-related revenue will also accrue to the token. The design connects congestion and execution demand directly to token value flows.

Trading fees from the markets zone and payment fees from the payments zone will follow the same model.

Once LayerZero activates its fee switch, every protocol message will include a ZRO-denominated charge. This makes ZRO the financial endpoint for Zero, LayerZero, and Stargate activity.

Institutional Buybacks Cut ZRO Unlock Pressure in Half

Pellegrino also disclosed updated figures on institutional participation and internal buybacks.

He said institutional purchases and early investor buyouts now represent 19.77 percent of the total ZRO supply. Most of this came from absorbing future unlock allocations.

The update challenges assumptions shown on public token dashboards. Pellegrino noted that many trackers still treat those tokens as pending unlocks. That misclassification, he said, nearly doubles the projected supply pressure.

Community members amplified the data point after the post circulated. X user Zuuu highlighted the reduction in effective unlock risk as a key takeaway. The comment gained traction as traders reassessed ZRO’s circulating supply outlook.

LayerZero confirmed that the buyouts focused mainly on early investors and upcoming vesting schedules. The move shifts a portion of expected emissions into long-term holdings. It also reshapes how market participants model future dilution.

Zero aims to launch with permissionless infrastructure for payments, markets, and messaging. By assigning all economic flows to ZRO, the protocol links network usage with a single asset. The team said mainnet remains scheduled for this fall.

Crypto World

Ripple CEO Confirms White House Meeting between Crypto, Banking Reps

Update (Feb. 19 at 7:21 pm UTC): This article has been updated to include a statement from the Crypto Council for Innovation.

The White House has held another meeting between representatives from the cryptocurrency and banking industries on a market structure bill under consideration in the US Senate, seeking to iron-out differences on stablecoin yield provisions, among other issues.

In a Thursday Fox News interview, Ripple CEO Brad Garlinghouse said that the company’s chief legal officer, Stuart Alderoty, attended the meeting with White House officials earlier in the day. The CEO’s comments came after unconfirmed reports that the Trump administration would follow its Feb. 10 meeting on the CLARITY Act, a bill to establish digital asset market structure. That meeting did not result in a deal on stablecoins.

Passed by the US House of Representatives in July, the CLARITY Act has seen several delays while moving through the Senate and its relevant committees. These included two government shutdowns — the longest one in the country’s history spanned 43 days in 2025 — concerns from Democratic lawmakers on conflicts of interest, and groups pushing for provisions on decentralized finance, tokenized equities and stablecoin yield.

The meeting occurred a day after policymakers, including CFTC Chair Michael Selig and two US senators, and representatives from the crypto industry met at US President Donald Trump’s private Mar-a-Lago club to attend a forum hosted by World Liberty Financial, the company founded by the president’s sons and others. Ohio Senator Bernie Moreno said at the event that he expected the CLARITY Act to make it through Congress and be ready to be signed into law “by April.”

Related: US CLARITY Act to pass ‘hopefully by April’: Senator Bernie Moreno

Cointelegraph reached out to Ripple for comment on Alderoty’s presence at the meeting, but had not received a response at the time of publication. White House crypto advisers Patrick Witt and David Sacks had not publicly commented on the event at the time of publication.

In a statement shared with Cointelegraph, Crypto Council for Innovation CEO Ji Hun Kim said the Thursday discussion “built upon previous meetings to establish a framework that serves American consumers while reinforcing US competitiveness,” describing it as “constructive.”

Market structure bill awaits markup by Senate Banking panel

Although the Senate Agriculture Committee voted to advance its version of a digital asset market structure bill in January, another committee crucial to the legislation’s passage has stalled following stated opposition from Coinbase CEO Brian Armstrong.

Armstrong has objected to provisions that would restrict rewards paid on stablecoin holdings and warned the bill could weaken the CFTC’s role in favor of broader SEC authority.

The Senate Banking Committee had been scheduled to mark up its market structure bill in January, but delayed the event indefinitely after Armstrong said the exchange could not support the legislation as written, citing concerns about tokenized equities. As of Thursday, the committee had not rescheduled the markup.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Ripple CEO Confirms White House Meeting With Crypto and Banking Reps

Washington’s ongoing push to align crypto policy with traditional finance took another step as White House officials hosted a second meeting with industry representatives and banking executives to refine a proposed market-structure bill in the U.S. Senate. The talks, aimed at narrowing gaps on stablecoin yields and other guardrails, arrive amid broader efforts to reconcile consumer protections with U.S. competitiveness in crypto innovation. In a Thursday Fox News appearance, Ripple (the company) CEO Brad Garlinghouse said his company’s chief legal officer, Stuart Alderoty, joined White House officials at the discussions earlier in the day. The remarks followed unconfirmed reports that the administration would push ahead with the CLARITY Act, a framework designed to establish a market structure for digital assets, though no deal was announced at the time of reporting. The evolving dialogue underscores the delicate balance lawmakers seek between enabling financial innovation and safeguarding taxpayers and markets.

Key takeaways

- White House discussions with crypto and banking representatives continue as lawmakers weigh stablecoin yield provisions and market-structure safeguards.

- Ripple’s leadership participated in the talks, signaling high-level interest from the sector in shaping policy deliberations.

- The CLARITY Act remains a focal point in Congress, having passed the House earlier in the year but facing delays in the Senate and ongoing committee scrutiny.

- Coinbase (EXCHANGE: COIN) CEO Brian Armstrong has publicly challenged certain provisions, arguing they could curb the regulatory role of the CFTC in favor of the SEC and raise concerns about tokenized equities.

- Crypto policy advocates described the White House meeting as constructive and aimed at a framework that preserves American competitiveness while protecting consumers.

Tickers mentioned: $COIN

Sentiment: Neutral

Market context: The discussions sit within a broader regulatory backdrop as lawmakers and agencies navigate the overlap between traditional securities rules and crypto tokens, with market participants watching for signals on how a potential framework may affect liquidity and risk appetite.

Why it matters

The conversations in Washington reflect a policy environment where the United States is attempting to define a national standard for digital assets without stifling innovation. While lawmakers have advanced parts of their market-structure agenda in some committees, others have pressed pause or demanded clarifications. A central tension is how to treat stablecoins and yield mechanisms—areas that could influence capital flows and the attractiveness of the U.S. as a hub for crypto and blockchain experimentation. The involvement of high-profile industry voices, including Ripple’s Alderoty and Coinbase’s Armstrong, signals that the stakeholder community is intent on shaping the legislative design rather than merely reacting to it.

The CLARITY Act has been a cornerstone in this debate. Passed by the House but hampered by delays in the Senate and internal concerns about conflicts of interest and the scope of regulation, the bill’s path forward hinges on finding consensus around DeFi rules, tokenized equities, and stablecoin governance. The ongoing discourse also highlights the role of regulators—specifically the CFTC and the SEC—in delineating authority over different asset classes. As policy debates intensify, market participants are weighing how any forthcoming framework could alter trading venues, custody standards, and the treatment of tokenized assets within investor portfolios.

From a market perspective, the immediate impact of policy discussions tends to be less about dramatic price shifts and more about positioning and expectations. Traders monitor committee schedules, public statements by key figures, and any formal markup dates that could signal a near-term stance or a shift in trajectory. The meetings also underscore a broader operational reality: policy clarity is often valued more than policy speed, as clearer rules can reduce regulatory risk and encourage longer-horizon project development in the crypto economy.

What to watch next

- Rescheduling and outcome of the Senate Banking Committee markup on digital asset market structure legislation.

- Public commentary from White House crypto advisers and other senior policymakers on the CLARITY Act and related regulations.

- Further statements from the private sector, including the participation of major exchanges and industry groups, on provisions affecting stablecoins and tokenized equities.

- Any new revelations from meetings hosted at high-profile venues (e.g., discussions linked to industry events or forums) about governance and enforcement expectations.

- New official documents or filings that detail how the proposed rules might interact with existing CFTC and SEC authorities.

Sources & verification

- Congress.gov — Text of the CLARITY Act and details on its legislative timeline.

- YouTube — Brad Garlinghouse Fox News interview referencing Alderoty’s attendance at the White House meeting.

- Crypto Council for Innovation — Public statements describing the discussions and their constructive tone.

- Cointelegraph coverage — Reporting on the Mar-a-Lago forum and related policy discussions, including sentiment from lawmakers.

Market reaction and key details

The White House’s latest round of talks with cryptocurrency and banking representatives illustrates a persistent drive to harmonize digital-asset policy with traditional financial oversight. The aim is to craft a framework that resists regulatory fragmentation while ensuring robust protections for consumers and market integrity. In a Thursday appearance on Fox News, Ripple (the company) CEO Brad Garlinghouse reiterated that Alderoty attended the White House discussions earlier in the day, signaling the depth of the policy engagement from the industry side. The remarks followed media speculation about how the administration would approach the CLARITY Act—the House-approved package designed to regulate digital assets and present a coherent market structure—now navigating Senate committees and potential amendments.

The CLARITY Act’s journey through Congress has been irregular. After passing the House in July, the bill faced a series of delays in the Senate, with lawmakers weighing provisions that would influence conflicts of interest and extend governance for decentralized finance, tokenized equities, and stablecoins. The evolving legislative signal is that the administration seeks to balance innovation with safeguards rather than rushing to a verdict. In this context, the meeting with White House officials, as described by Crypto Council for Innovation chief Ji Hun Kim, was noted as constructive and aimed at building a framework that preserves American consumer welfare while maintaining competitive edge in global crypto markets.

Meanwhile, the broader legislative calendar remains complex. The Senate Agriculture Committee earlier advanced its own version of a digital-asset market-structure bill in January, a development that underscores the multi-committee path such legislation often travels before markup and potential floor votes. Yet opposition from some industry players has complicated the process. Coinbase (EXCHANGE: COIN) CEO Brian Armstrong publicly challenged certain provisions that would cap rewards on stablecoin holdings and warned that the bill risks weakening the CFTC’s role in favor of the SEC. These concerns illustrate a familiar tension in U.S. policy debates: how to allocate regulatory authority without constraining innovation or market functionality.

As policymakers navigate these issues, the policy discourse has also touched on high-profile gatherings. A private forum at Mar-a-Lago, attended by policymakers and industry representatives, added another layer to the conversation around the CLARITY Act’s prospects. Senator Bernie Moreno, present at the event, suggested that the act could reach a point where it could be signed into law by spring, though the legislative reality remains uncertain given the ongoing committee reviews and potential revisions. The episodic nature of such appearances reflects the evolving, often negotiation-heavy, path that digital-asset policy typically follows in Washington.

Overall, the latest round of meetings and public statements suggests a cautious but forward-looking stance from both policymakers and industry participants. The objective appears to be a framework that discourages harmful practices, clarifies regulatory jurisdiction, and supports responsible innovation in crypto markets—without stifling the capital flows that underpin a growing ecosystem. For investors and builders, the near-term takeaway is to monitor committee calendars, regulatory updates, and official statements from the White House and key agencies for hints about the direction of risk management, disclosure requirements, and the scope of oversight that a forthcoming bill could impose.

Interim guidance and verbatim quotes from executive statements will likely continue to influence sentiment, particularly as the Senate Banking Committee and other panels recalibrate their approach to market structure, stablecoins, and tokenized assets. In the interim, the market context remains one of guarded optimism, with careful attention paid to regulatory clarity as much as to any immediate policy actions. The interplay between public policy, industry feedback, and the practical realities of operating in a highly dynamic crypto landscape will continue to shape liquidity conditions and risk sentiment in the months ahead.

Notes from the coverage and the primary sources referenced above should be verified for any updates to committee schedules, official statements, or new voting outcomes as the legislative process evolves.

Crypto World

Ethereum price holds 0.618 fibonacci support as bullish volume signals reversal

Ethereum price is testing a critical confluence support zone around the 0.618 Fibonacci level, where improving bullish volume suggests a potential reversal may be developing.

Summary

- 0.618 Fibonacci and value area low form key support zone

- Bullish volume emerging, signaling possible accumulation

- $2,286 resistance becomes upside target, if reversal confirms

Ethereum (ETH) price action has entered a decisive technical region after an extended corrective phase pushed the asset toward high-timeframe support. Following sustained selling pressure, ETH is now trading within a major confluence zone that historically attracts demand and often acts as a pivot for market reversals.

Rather than showing continued acceleration lower, recent behavior indicates stabilization near support. This shift is drawing attention from traders watching for early signs of accumulation. When price approaches major Fibonacci retracement levels alongside strong structural support, the probability of a rotational move higher begins to increase, provided buyers continue to defend the area.

Ethereum price key technical points

- 0.618 Fibonacci retracement aligns with major support, creating reversal potential

- Value area low and $1,826 high-timeframe support converge, strengthening demand zone

- Bullish volume response emerging, suggesting early accumulation behavior

Ethereum is currently trading near $1,826, a level reinforced by multiple technical factors. The 0.618 Fibonacci retracement, often referred to as the “golden ratio” in technical analysis, sits directly within this region. Historically, this level frequently acts as a turning point during corrective moves within broader trends.

The significance of this area is amplified by its overlap with the value area low, which represents the lower boundary of fair value within the previous trading range. When price revisits such zones, markets often attempt to rebalance as buyers and sellers reassess value.

This confluence transforms the region into a high-probability reaction zone rather than an arbitrary support level.

Liquidity sweep could trigger reversal

An important dynamic unfolding around this support is the presence of resting liquidity below recent lows. Markets commonly sweep liquidity beneath key support before reversing direction. Such moves allow larger participants to accumulate positions while forcing weaker hands out of the market.

If Ethereum briefly trades below support and quickly reclaims it, the move could resemble a swing failure pattern (SFP), a classic reversal setup. This type of price action often signals that selling pressure has been absorbed and that demand is beginning to outweigh supply.

The emergence of bullish volume during these tests is particularly important, as it indicates buyers actively stepping into the market rather than passive stabilization.

Bullish volume suggests accumulation

One of the more constructive developments is the gradual increase in bullish volume near support. Rising buy-side participation at key technical levels often precedes rotational moves higher.

Volume behavior frequently acts as confirmation of intent. When buyers appear at high-timeframe support while momentum indicators begin stabilizing, markets transition from distribution into accumulation phases. Ethereum’s current setup reflects early signs of this transition.

However, confirmation remains essential. Sustained buying interest must continue to defend the support region to validate the reversal thesis.

Upside rotation targets higher resistance

If Ethereum successfully holds the $1,826 support cluster, attention shifts toward higher resistance zones. The first major objective lies near the value area high, where price previously faced rejection.

Beyond that, high-timeframe resistance around $2,286 becomes the next technical target. A rotational move toward these levels would represent a recovery within the broader trading structure rather than an immediate trend reversal.

Such moves often unfold gradually, beginning with stabilization, followed by higher lows and expanding bullish momentum.

Market structure at a turning point

From a market structure perspective, Ethereum remains at an inflection point. The broader correction has not yet invalidated long-term structure, but continued defense of support is necessary to prevent deeper downside continuation.

The combination of Fibonacci confluence, liquidity dynamics, and improving volume creates conditions favorable for a reversal attempt. Still, failure to hold this region would reopen risks toward lower support levels.

What to expect in the coming price action

From a technical, price action, and market structure standpoint, Ethereum is positioned at a potential turning point. Holding above the 0.618 Fibonacci support near $1,826 significantly increases the probability of a rotational move higher.

In the immediate short term, traders should monitor volume expansion and price acceptance above support. A confirmed swing failure or strong bullish reaction could initiate a move toward higher resistance zones, beginning with the value area high and extending toward $2,286.

Until proven otherwise, Ethereum appears to be transitioning from corrective weakness toward stabilization. If demand continues to build at current levels, the market may be preparing for a relief rally following its recent decline.

Crypto World

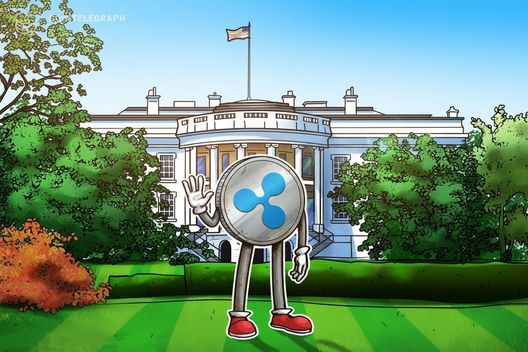

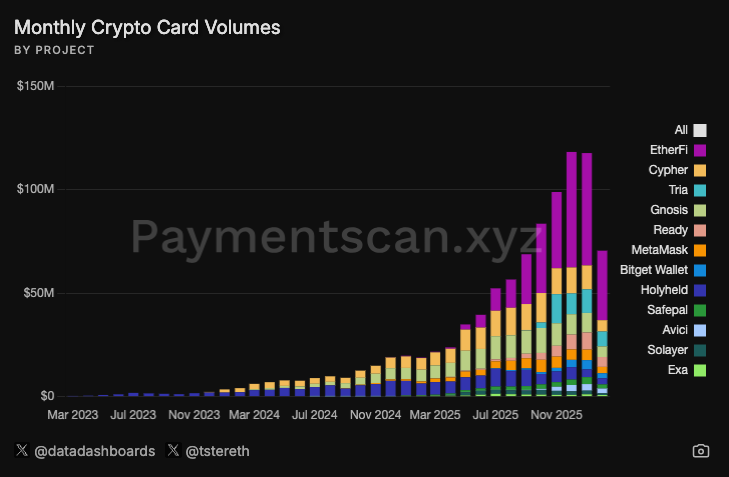

Ether.fi Moves Crypto Card Product to OP Mainnet From Scroll

Ether.fi is migrating its payments rail, Ether.fi Cash, to OP Mainnet, moving roughly 70,000 active cards and 300,000 accounts away from the Scroll Layer 2 network, according to a recent blog post.

The transition, announced Wednesday, involves shifting millions in Total Value Locked (TVL) over the coming months to integrate with Optimism’s broader Superchain ecosystem.

This strategic pivot underscores the fierce competition among Layer 2 solutions for high-volume consumer applications, with Ether.fi citing access to a larger DeFi ecosystem as a primary driver.

Key Takeaways

- Mass Migration: Approximately 70,000 active cards and 300,000 accounts are moving to Optimism.

- Volume Impact: Ether.fi Cash processes roughly $2 million in daily spend volume.

- Incentives: Gas fees for card transactions will be fully absorbed by Ether.fi during and after the transition.

Why Is Network Choice Critical?

Ether.fi initially built its reputation on asset restaking but successfully pivoted to consumer payments with Ether.fi Cash in 2024.

The product allows users to spend stablecoins or borrow against staked assets like eETH to fund real-world Visa purchases.

According to Paymentscan, these cards now facilitate nearly half of all crypto-native card transactions.

The choice of underlying network defines transaction speed and liquidity depth.

Operational stability is paramount for consumer products; just look at what happened to what happened to Moonwell this week.

Payment providers must mitigate infrastructure risks by selecting mature execution layers. Ether.fi’s move signals that liquidity depth on OP Mainnet currently outweighs the ZK-rollup advantages offered by Scroll for this specific use case.

Discover: The best crypto presales right now

Breaking Down the Migration

The migration utilizes an OP Enterprise partnership, providing Ether.fi with dedicated support and shared codebase tooling.

Transaction costs for card usage will be absorbed by the protocol, ensuring users experience no friction during the switch. This is critical as Ether.fi Cash currently processes roughly 2,000 internal swaps and 28,000 spend transactions daily, metrics that have reportedly doubled every two months.

Capital efficiency is the core technical driver here. Much like how new frameworks are introducing unified liquidity and staking solutions, Ether.fi expects deeper liquidity for swaps on OP Mainnet compared to its previous deployment.

Optimized liquidity pools mean lower slippage for users converting crypto to fiat at the point of sale.

The OP Stack itself processed a staggering 3.6 billion transactions in the second half of 2025, representing 13% of all crypto transactions in that period.

What Does This Mean for the L2 Landscape?

For Scroll, this represents a notable loss of volume. The ZK-powered chain had relied on Ether.fi as a significant driver of daily activity.

Conversely, Optimism reinforces its position as a dominant hub, securing a high-retention consumer product just as internal ecosystem dynamics shift, notably with Base signaling moves toward a bespoke chain platform.

This consolidation reflects a maturing Ethereum ecosystem where projects prioritize battle-tested liquidity over novel tech stacks.

It aligns with broader institutional positioning, similar to how funds like Founders Fund have adjusted their ETH-related exposure to align with prevailing market realities.

For the end user, the backend plumbing changes, but the card in their digital wallet simply becomes more efficient.

Discover: Diversify your crypto portfolio with these top picks

The post Ether.fi Moves Crypto Card Product to OP Mainnet From Scroll appeared first on Cryptonews.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports16 hours ago

Sports16 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment22 hours ago

Entertainment22 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

-

Crypto World6 days ago

Crypto World6 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery