Crypto World

How the Scam Works and How to Protect Your Wallet

Address poisoning is reshaping risk in crypto wallets by shifting focus from private keys to how users interact with interfaces. Rather than breaking encryption, attackers exploit human habits and design flaws to misdirect funds. In 2025, a victim lost about $50 million in Tether’s USDt after copying a poisoned address. In February 2026, a phishing campaign tied to Phantom Chat drained roughly 3.5 Wrapped Bitcoin (wBTC) worth more than $264,000. These episodes underscore how small UI cues—copy buttons, visible transaction histories, and dust transfers—can seduce users into repeating trusted patterns and handing over assets they believe they are sending to legitimate contacts.

Key takeaways

- Address poisoning operates on user behavior and UI cues, not on private key theft or code flaws.

- Two high-profile losses illustrate the scale: a $50 million hit in 2025 and a February 2026 incident involving about 3.5 Wrapped Bitcoin ($WBTC) worth over $264,000.

- Copy buttons, visible transaction histories, and unfiltered dust transfers can make poisoned addresses look legitimate within wallet UIs.

- Because blockchains are permissionless, attackers can send tokens to any address, and many wallets display all incoming activity, including spam, which can seed trust in fake entries.

- Mitigations hinge on better UX and guardrails: explicit address verification, dust-filtering, proactive warnings, and recipient-address checks during sending flows.

Tickers mentioned: $USDT, $WBTC

Sentiment: Neutral

Market context: The cases underscore ongoing UX-driven security challenges in a market where on-chain activity is highly transparent and attackers increasingly target everyday user workflows. As stablecoins and tokenized assets gain prominence, wallet design and on-chain visibility will be central to risk management, alongside traditional education and phishing countermeasures.

Why it matters

The essence of address poisoning lies in the reproducible, human-centered mistakes that occur when users manage crypto transfers. Private keys remain secure in these scenarios; the vulnerability emerges when recipients or senders rely on partial address fragments or familiar transaction patterns. The attack chain typically unfolds with attackers locating valuable wallets, crafting near-identical recipient addresses, and initiating a tiny or zero-value transfer to insert their spoofed address into the victim’s recent-history view. The attacker then waits for the user to copy the address from that history and accidentally paste it into a new transfer, thereby sending funds to the wrong destination. The absence of a cryptographic breach highlights a fundamental truth: the security model of public blockchains hinges on user judgment as much as cryptography.

UX design decisions amplify the risk. Many wallets provide one-click copy buttons adjacent to recent transactions, a convenience that can backfire when spam or dusting entries appear in the same list. Investigators have long noted that victims often “trust” their own transaction history, presuming it signals legitimacy. In cases like the 2025 loss of USDt and the 2026 wBTC incident, the cost of this cognitive shortcut becomes starkly clear. The broader lesson is that user interfaces—the way addresses are displayed, verified, and confirmed—play a pivotal role in security outcomes, sometimes more so than key management alone.

Industry voices have urged wallets to adopt stronger safeguards. Tech leaders, including Changpeng “CZ” Zhao, have publicly called for enhanced protections to curb address poisoning, signaling a potential shift in wallet governance toward more rigorous recipient verification and anti-poisoning features. The tension is real: developers must balance smooth UX with robust safety checks, ensuring users can transact efficiently without becoming victims of lookalike addresses or suspicious dust transfers. In the meantime, the onus remains on users to verify destinations beyond quick-glance cues and to adopt disciplined sending practices.

At the core, the risk is not about breaking cryptography but about breaking user habits in high-friction moments—entering long addresses, approving approvals, and acting on incomplete information. The public and permissionless nature of blockchains makes every address accessible, and the legibility of transactions often lags behind the complexity of strings that represent keys and addresses. The result is a security rhythm in which attackers rely on social and UX dynamics, not on bypassing cryptographic barriers.

What address poisoning really involves

Address poisoning scams hinge on manipulating a victim’s transaction history to misdirect funds, rather than compromising keys or exploiting software vulnerabilities. The typical playbook unfolds as follows:

- Attackers first identify high-value wallets using publicly visible on-chain data.

- They generate a lookalike address that closely resembles a recipient the victim uses regularly, matching several leading and trailing characters to maximize recognizability at a glance.

- They initiate a small or zero-value transfer from the fake address to seed legitimacy and appear in the recipient’s recent activity.

- The attacker then relies on the victim copying the address from the recent transfers list when preparing a legitimate payment to someone else.

- The final step is when the victim pastes the attacker’s address and authorizes the transfer, unwittingly sending funds to the malicious destination.

The victim’s wallet and private keys remain untouched—the crypto-cryptographic layer is intact. The scam thrives on human error, habitual behavior, and trust built from familiar patterns. In some instances, the exploit is reinforced by dusting operations, where tiny transfers flood a user’s activity feed, nudging them toward interacting with suspicious entries without suspicion.

Did you know? Address poisoning scams have gained visibility in parallel with the expansion of Ethereum layer-2 networks, where reduced fees enable mass small transfers that populate users’ histories with fodder for identity-based deception.

How attackers craft deceptive addresses

Crypto addresses are long hexadecimal strings, often 42 characters on Ethereum-compatible chains. Wallets typically truncate the display to a short fragment, such as “0x85c…4b7,” which attackers exploit by constructing lookalikes with identical prefixes and suffixes while altering the middle portion. A legitimate example might read 0x742d35Cc6634C0532925a3b844Bc454e4438f44e, while an almost identical poisoned variant could appear as 0x742d35Cc6634C0532925a3b844Bc454e4438f4Ae. The strategy hinges on human visual heuristics: people rarely verify the entire string and often rely on the start and end characters to judge authenticity.

Some attackers even use vanity-address generation tools to produce thousands of near-identical strings. The social engineering angle is reinforced by dusting, where small funds accompany the malicious address to create a sense of legitimacy in a user’s transaction history. In practice, this is less about AI or cryptography and more about UX trust and careful scrutiny during each sending action.

Security researchers emphasize a key distinction: the breach lies in behavior and interface design, not in the encryption or signing process. Private keys are still the powerhouse that authorizes transactions, but they cannot verify whether the destination address is correct. The result is a paradox: the strongest security on the planet (cryptography) is undermined not by a technical flaw but by a failure to verify addresses thoroughly at the moment of sending.

Practical ways to stay safer

Because address poisoning exploits human tendencies rather than technical vulnerabilities, small but deliberate changes in how you interact with crypto wallets can markedly reduce risk. Here are practical steps for users and developers alike.

For users

- Build and maintain a verified address book or whitelist for frequent recipients, then reference it instead of retyping or copying from history.

- Always verify the full address before sending. If possible, use a character-by-character comparison or an address-checking tool.

- Avoid copying addresses from recent transaction history. If you need to, double-check the source in the list, or re-enter addresses from trusted bookmarks.

- Be wary of unsolicited small transfers that appear in your history; treat them as potential poisoning attempts and isolate them from normal activity.

For wallet developers

Design choices can dramatically reduce risk by making it harder for poisoned addresses to slip through in everyday flows. Suggested safeguards include:

- Filtering or dimming or automatically isolating very low-value (dust) transactions from typical recipient lists.

- Implementing recipient-address similarity checks that flag near-identical addresses during sending.

- Providing pre-signing simulations and risk warnings when the destination looks suspicious or matches a poisoned-pattern entry.

- Integrating on-chain checks or shared blacklists to identify and block known poisoned addresses before a user confirms a transfer.

Sources & verification

- Phantom Chat address poisoning and related bitcoin phishing details: https://cointelegraph.com/news/phantom-chat-address-poisoning-bitcoin-phishing

- General phishing attack overview in crypto: https://cointelegraph.com/learn/articles/what-is-a-phishing-attack-in-crypto-and-how-to-prevent-it

- Tether price index reference: https://cointelegraph.com/tether-price-index

- Critical observations from ZachXBT on poisoning cases: https://x.com/zachxbt/status/2021022756460966139

- Industry commentary on wallet safeguards and address poisoning: https://www.binance.com/en/square/post/34142027296314

Crypto World

Bitcoin miner tumbles 17% on debt raise and stock sale

Bitdeer Technologies (BTDR) shares plunged on Thursday on plans to raise $300 million through a private sale of convertible senior notes, alongside a separate registered direct offering of Class A shares.

The notes, due in 2032, can convert into cash, shares or a mix of both at Bitdeer’s election. The underwriter greenshoe option is for another $45 million in notes.

The Singapore-based company also intends to sell an unspecified number of Class A shares directly to certain holders of its 5.25% convertible notes due 2029. It plans to use proceeds from both offerings to fund capped call transactions designed to limit share dilution if the new notes convert, and to repurchase a portion of the 2029 notes in private deals.

Any remaining funds will go toward expanding data centers, growing its high-performance computing and AI cloud businesses and developing ASIC-based mining rigs.

Convertible debt often puts pressure on shares because investors factor in the risk of future dilution. In simple terms, if the company’s stock rises, noteholders may convert their debt into equity, increasing the share count. Bitdeer’s use of capped calls aims to offset some of that effect, though such hedging can add volatility around pricing.

The registered direct offering depends on completion of the notes sale and related repurchases, while the notes offering can proceed on its own.

Bitdeer’s shares fell 17% in the early morning trading below $8 for the first time since April.

Crypto World

UAE sits on $344 million in BTC mining profits, Arkham says

The United Arab Emirates is sitting on roughly $344 million in unrealized profit from its bitcoin mining operations, according to onchain data from Arkham, making it one of the world’s most significant sovereign crypto plays.

Wallets tied to the UAE Royal Group currently hold roughly 6,782 BTC valued about $450 million. Excluding energy costs, Arkham estimates the position is deep in the green, reflecting the lower-than-average cost from years of industrial-scale mining compared with open-market buying.

Over the past seven days, the operation has produced some 4.2 BTC a day, suggesting the country’s mining infrastructure remains active despite bitcoin’s recent slide from late-2025 highs and broader volatility across risk assets.

The UAE’s mining push dates back to 2022, when Citadel Mining, linked to Abu Dhabi’s royal family through International Holding Company, built large facilities on Al Reem Island.

In 2023, Marathon Digital (MARA), now renamed as MARA Holdings, partnered with Abu Dhabi-based Zero Two to develop 250 megawatts of immersion-cooled mining capacity, one of the largest disclosed deployments in the region.

In August, when bitcoin traded at higher levels, Arkham estimated the UAE’s mined holdings at closer to $700 million. The latest figures reflect updated wallet tracking and lower market prices rather than major sales, with the most recent notable outflows occurring roughly four months ago.

Unlike the U.S. or U.K., whose bitcoin holdings largely stem from asset seizures, the UAE’s stash is the product of sustained mining. By holding most of what it produces, the Gulf nation is effectively converting energy and infrastructure into a strategic digital reserve that compounds over time.

In a market where many miners have been forced to sell into weakness to fund their operations, the UAE appears to be doing the opposite, steadily accumulating duing the drawdown.

Crypto World

McGlone shifts bitcoin forecast to $28,000 after critics blast $10,000 call as ‘nonsense’

Bloomberg Intelligence’s Mike McGlone appeared to walk back his $10,000 forecast for bitcoin, instead highlighting $28,000 after being challenged on social media and accused of being an alarmist whose “nonsensical” forecasts put real capital at risk.

Earlier this week, McGlone warned that collapsing crypto prices could signal broader financial stress and that bitcoin could revert toward $10,000 if U.S. equities peak and recession follows. He framed the token as a high-beta risk asset vulnerable to a breakdown in the post-2008 “buy the dip” regime.

But in a subsequent post on X, McGlone pointed to $28,000 as a more probable level based on historical price distribution, a notable shift from his earlier base case. He also said his analysis “suggests why not to buy bitcoin or most risk assets.”

His correction upward also followed being challenged to a debate by market analyst and AdLunam co-founder, Jason Fernandes on X and LinkedIn posts.

Fernandes, whose LinkedIn challenge was liked but not accepted by McGlone, told CoinDesk his broader critique still stands, even after the Bloomberg analyst revised his target. “$28K is obviously more realistic than $10K,” Fernandes said. “Proportionately fewer things need to go wrong for $28K than $10K.”

Mati Greenspan, a market analyst and the Quantum Economics founder, said $28,000 was still unlikely, “but in markets we never want to rule anything out.”

Greenspan had also called McGlone out in a post on X following his lower forecast, saying, “Mr. @mikemcglone11 would have you believe that an asset with trillions of dollars in monthly volumes could crash to a market cap of 200 billion.” He said the forecast was “literally nonsense.”

Fernandes previously estimated a more likely reset in the $40,000 to $50,000 range absent a systemic liquidity shock. He noted that $28,000 now sits closer to his lower bound than to McGlone’s original call. “It bears mentioning that he has adjusted his near-term outlook closer to my low end than his previous prediction,” Fernandes said.

At stake in the debate is more than price targets. Fernandes said that deterministic, alarmist framing can materially influence positioning and put “real capital at risk,” particularly in reflexive markets like crypto.

Crypto World

Trump-linked crypto venture WLFI taps Securitize for Maldives resort tokenization

World Liberty Financial is tapping real-world asset specialist Securitize to help tokenize loan interests tied to the Trump International Hotel and Resort in the Maldives.

Rather than direct equity in the properties, investors will be able to buy tokens tied to loan revenue, according to a Wednesday announcement timed for the privately held company’s Mar-A-Lago crypto conference.

World Liberty Financial is turning to one of the largest companies in digital securities. Securitize has worked with major asset managers such as BlackRock, Hamilton Lane and Apollo Global Markets to issue tokenized funds and private credit on public blockchains. BlackRock and Cathie Wood’s Ark Invest are also investors in the firm, which plans to go public by merging with a Cantor Fitzgerald-sponsored special-purpose acquisition company (CEPT).

“We built World Liberty Financial to open up decentralized finance to the world,” said Eric Trump, a co-founder of the company. “With today’s announcement, we are now extending that access to tokenized real estate.”

Eligible accredited investors will receive a fixed yield and payments linked to the loan’s performance. The sale will take place under U.S. private placement rules, with restrictions on resale.

Plans to tokenize the Maldives resort were unveiled in November. The resort, developed by DarGlobal in collaboration with the Trump Organization, is expected to include about 100 beach and overwater villas and reach completion in 2030. In October, Eric Trump said on CoinDesk TV that WLFI planned to tokenize a new real estate project.

The latest announcement focuses on who will handle the mechanics. Securitize will oversee issuance and compliance for tokens representing interests in a development loan connected to the project.

While tokenization of traditional assets like stocks and funds has gained the attention of Wall Street firms, real estate represents a smaller slice of the $25 billion tokenized asset market. Proponents argue that blockchain rails can streamline property ownership records and settlement, but uneven regulation and thin secondary trading pose a risk, an EY report noted last year.

The company’s WLFI token has dropped 6.6% in the past 24 hours to 11.63 cents.

Crypto World

Here’s why being listed on CoinMarketCap is more than just visibility

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

This week, several new projects were listed on CoinMarketCap, including Monstro DeFi, Espresso, and BitGW. The BitGW team states that this development is not simply about brand exposure. It represents integration into the global reference layer of the crypto market, a framework through which exchanges are continuously evaluated, compared, and monitored.

BitGW is spot on with this observation. CoinMarketCap is far more than a directory. For millions of users, institutional analysts, compliance professionals, and infrastructure providers, CMC data functions as a default reference point. As a result, a listing signals that an organization’s trading activity and platform metrics are now visible within a standardized, globally recognized data structure.

Transparency as a competitive edge

As the digital asset sector matures, transparency has become one of the most decisive competitive differentiators.

For example, in BitGW’s case, being listed on CoinMarketCap means operating within a framework that requires structured, continuously updated information. This level of openness allows market participants to independently observe platform performance over time.

Rather than relying solely on marketing narratives, BitGW’s metrics can now be evaluated directly within a neutral, third-party environment, an increasingly important factor in building long-term credibility.

Institutional visibility and market positioning

A CoinMarketCap listing also reshapes how a platform is perceived beyond retail audiences.

Institutional observers, liquidity providers, and compliance teams frequently consult CMC as part of their research and benchmarking processes. BitGW’s presence within this ecosystem strengthens its visibility across regions while positioning the exchange within a globally recognized data standard.

In a market driven by measurable performance and trust, this transition, from simply being available to being systematically trackable, carries significant weight.

Entering the market’s long-term memory

In crypto, hype is fleeting. Data is permanent.

By being listed on CoinMarketCap, companies like BitGW enter what could be described as the market’s long-term memory. Its trading metrics, consistency, and growth trajectory will now be observed and compared against peers over extended periods.

While this level of transparency introduces sustained scrutiny, it also creates opportunity. Platforms that demonstrate operational stability and disciplined growth over time are more likely to earn lasting market confidence.

Looking ahead

As the industry continues to prioritize transparency, data integrity, and institutional standards, exchanges that embrace this level of openness position themselves for long-term credibility.

Therefore, being listed on CoinMarketCap means more than just visibility. It represents commitment and signals an organization’s intention to compete where the standards are highest, and the scrutiny is constant.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

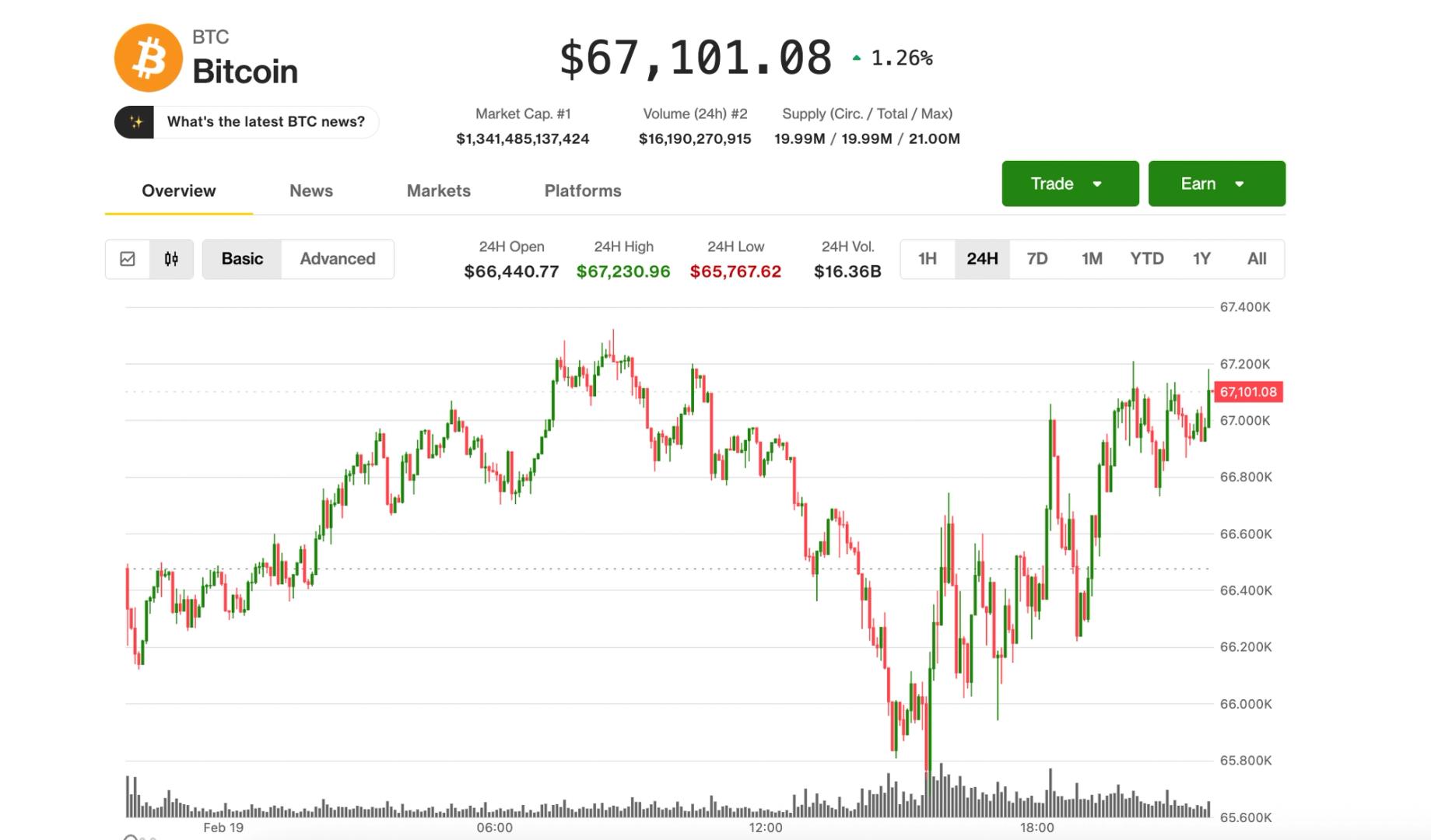

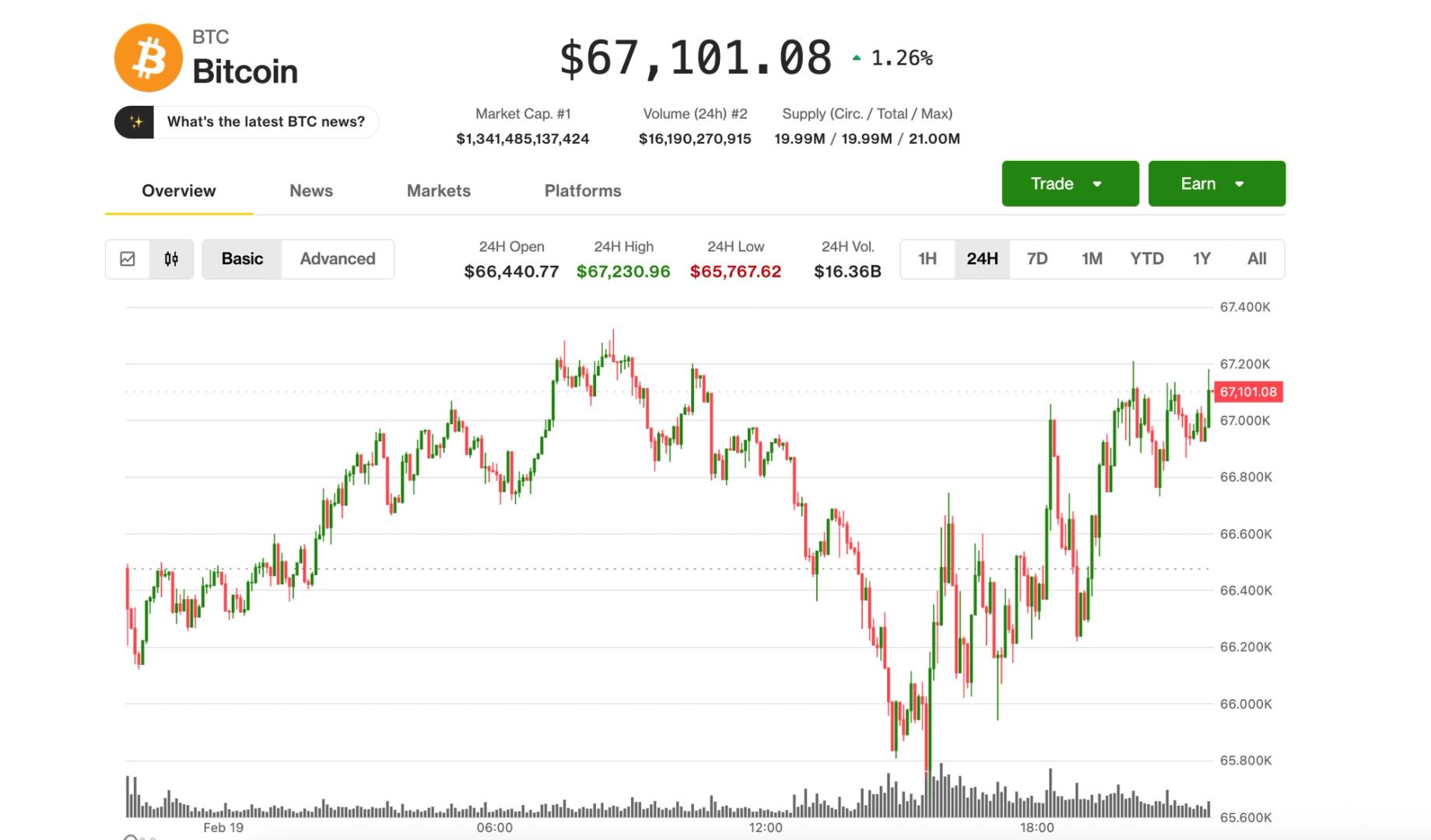

BTC steadies at $67,000 as traders pay for crash protection

Bitcoin found its footing on Thursday, stabilizing above a key technical level after briefly slipping below $66,000 in early U.S. trading. The largest cryptocurrency recently changed hands at around $67,000, up roughly 1% over the past 24 hours.

The CoinDesk 20 Index lagged, with ether (ETH), XRP, BNB, and solana (SOL) flat to slightly lower during the same period, perhaps a signal of continued caution in altcoins amid shaky crypto markets.

Crypto-related stocks climbed modestly higher across the board, with bitcoin miners CleanSpark (CLSK) and MARA (MARA) standing out with 6% gains. Meanwhile, the S&P 500 and the tech-heavy Nasdaq 100 were 0.3% and 0.6% lower, respectively.

On the policy front, there were tentative signs of progress on the digital asset market structure bill. As CoinDesk’s Jesse Hamilton reported, White House-hosted talks between crypto industry representatives and bankers yielded incremental movement, though no compromise has yet emerged.

At the same time, cracks from the recent crypto downturn are still surfacing. Chicago-based crypto lender Blockfills, as CoinDesk reported, is exploring a sale after enduring a $75 million lending loss during the recent price crash and having temporarily suspended client deposits and withdrawals last week. With crypto prices tumbling sharply in recent months, investors have been bracing for potential blowups like those of Celsius and FTX in 2022. So far, however, the fallout appears contained — on the one hand, tempering worst-case fears, but on the other, avoiding the kind of complete washout that set the stage for the bottom of that brutal bear market and the beginning of the 2023-25 bull run.

Still, risks outside the crypto sphere continue to loom that leave investors hesitant to take risks.

Worries about mounting stress in credit markets flared up after private-equity company Blue Owl (OWL) permanently curbed redemptions in its $1.7 billion retail-focused private credit fund. OWL fell 6% on Thursday, while the shares of other major private credit managers, including Apollo Global (APO), Ares Capital (ARES) and Blackstone (BX) slid more than 5%.

Geopolitical tensions remain another overhang, with the prospect of U.S. military action against Iran still in play amid an ongoing regional buildup. Crude oil rallied another 2.8% over $66 per barrel, hitting its highest price since August.

Traders play defense

That caution is reflected in crypto derivatives markets, Jake Ostrovskis, head of OTC at trading firm Wintermute, pointed out. Many traders are buying downside protection while limiting upside participation, he noted, which means they are effectively paying for insurance against another drop while capping potential gains in a breakout to the upside.

The average U.S. bitcoin ETF cost basis now sits near $84,000, leaving a large share of ETF investors underwater — nursing a 20% paper loss on average — and potentially vulnerable to “capitulation selling” if prices slide further.

Still, total ETF holdings remain within about 5% of their peak in bitcoin terms, suggesting institutions are trimming exposure rather than rushing for the exits.

Crypto World

Intesa Sanpaolo Reveals $96M Bitcoin ETF Bet and Strategy Hedge

Italy’s largest lender, Intesa Sanpaolo (BIT: ISP), has significantly expanded its exposure to digital assets through exchange-traded funds, crypto-linked equities, and derivatives strategies tied to the sector’s most influential players. Regulatory filings covering positions as of Dec. 31, 2025 reveal nearly $100 million allocated to spot Bitcoin ETFs, alongside targeted bets designed to hedge valuation imbalances in publicly traded crypto companies. The disclosures come as institutional participation in cryptocurrency markets continues evolving through regulated investment vehicles, reflecting how traditional banks are cautiously integrating digital assets into broader portfolio strategies.

Key takeaways

- Intesa Sanpaolo disclosed more than $96 million in spot Bitcoin ETF holdings across multiple issuers in a U.S. regulatory filing.

- The bank combined long Bitcoin exposure with a sizable put option tied to Strategy shares, signaling a potential valuation hedge.

- A $4.3 million allocation to a Solana staking ETF highlights growing institutional interest beyond Bitcoin.

- Additional equity stakes include Circle, Robinhood, Coinbase, BitMine Immersion Technologies, and ETHZilla.

- The investments were filed under a shared-decision structure involving affiliated asset managers.

Tickers mentioned: $BTC, $SOL, $MSTR, $IBIT, $ARKB, $HOOD, $COIN

Sentiment: Neutral

Price impact: Neutral. The filing reflects portfolio positioning rather than a new market catalyst or capital inflow announcement.

Market context: Institutional investors increasingly prefer regulated crypto exposure through ETFs and structured derivatives as liquidity conditions and regulatory clarity evolve across global markets.

Why it matters

Large European banks moving deeper into crypto-related investments signal a gradual normalization of digital assets within traditional finance. Rather than direct token custody, institutions are increasingly using ETFs and derivatives to manage exposure while limiting operational risk.

The combination of long Bitcoin exposure and downside protection tied to crypto-equity valuations illustrates a more sophisticated approach to digital asset investing. This suggests institutions are no longer treating crypto purely as a speculative allocation but as part of broader relative-value strategies.

For builders and market participants, the development underscores how institutional adoption may increasingly flow through regulated capital markets rather than direct blockchain participation, shaping liquidity patterns and product innovation.

What to watch next

- Future quarterly regulatory filings showing whether Bitcoin ETF exposure expands or contracts.

- Potential updates or disclosures regarding the performance or adjustments of the Strategy derivatives position.

- Institutional adoption trends in staking-focused ETFs tied to alternative cryptocurrencies.

- Any public commentary from Intesa Sanpaolo regarding its proprietary crypto trading desk strategy.

Sources & verification

- SEC Form 13F filings covering positions held as of Dec. 31, 2025.

- Public disclosures from ETF issuers referenced in the filing.

- Corporate filings and treasury disclosures regarding Strategy’s Bitcoin holdings.

- Official statements and reporting regarding Intesa Sanpaolo’s crypto trading desk operations.

European banking giant expands crypto strategy through ETFs and derivatives

Intesa Sanpaolo has revealed a diversified set of cryptocurrency-related investments, combining exchange-traded funds, equity exposure, and options strategies as part of a broader institutional approach to digital assets. The positions were disclosed in a U.S. regulatory filing covering holdings at the end of December 2025, offering a detailed snapshot of how a major European bank is navigating crypto markets through regulated financial instruments.

The filing shows that the lender allocated slightly more than $96 million to spot Bitcoin exchange-traded funds tracking Bitcoin (CRYPTO: BTC). The largest allocation, valued at approximately $72.6 million, was invested in the ARK 21Shares Bitcoin ETF (BATS: ARKB). A further $23.4 million was directed toward the iShares Bitcoin Trust (NASDAQ: IBIT), reflecting a preference for large, liquid ETF products designed to mirror the cryptocurrency’s price performance.

These holdings place the bank among a growing group of traditional financial institutions using ETFs to gain exposure without directly holding digital assets. Spot Bitcoin ETFs allow investors to participate in price movements through familiar market infrastructure, simplifying compliance and custody considerations compared with direct token ownership.

The filing also included a smaller but notable position tied to alternative cryptocurrencies. Intesa Sanpaolo reported a $4.3 million investment in a staking-focused exchange-traded fund tracking Solana (CRYPTO: SOL). Unlike standard price-tracking funds, staking ETFs aim to capture blockchain rewards generated through network validation activities, potentially offering yield alongside market exposure.

The addition suggests institutional curiosity is gradually expanding beyond Bitcoin toward networks associated with decentralized applications and staking economics, though allocations remain comparatively modest.

Alongside directional crypto exposure, the bank disclosed a derivatives position tied to Strategy (NASDAQ: MSTR), widely recognized as the largest corporate holder of Bitcoin. The lender holds a sizable put option referencing shares whose underlying securities were valued at roughly $184.6 million at the time of filing.

A put option grants the holder the right, but not the obligation, to sell shares at a predetermined price before expiration. Such a position can generate gains if the stock declines, making it a common hedging tool.

When viewed alongside the bank’s long exposure to Bitcoin ETFs, the derivatives strategy may represent a relative-value trade. Strategy’s share price has historically traded at a premium compared with the value of the Bitcoin held on its balance sheet, often measured using a multiple of net asset value, or mNAV.

According to publicly available company metrics, Strategy shares previously traded near 2.9 times the value of their underlying Bitcoin holdings before narrowing to roughly 1.21 mNAV. A continued compression of that premium could benefit investors positioned for downside movement in the stock while maintaining broader bullish exposure to Bitcoin itself.

Beyond ETFs and derivatives, Intesa Sanpaolo also reported equity stakes in several companies closely tied to the digital asset ecosystem. The largest disclosed position was a roughly $4.4 million holding in Circle Internet Group, a company associated with stablecoin infrastructure.

Additional allocations included approximately $3.6 million invested in Robinhood Markets (NASDAQ: HOOD), $347,400 in Coinbase Global (NASDAQ: COIN), and smaller positions in BitMine Immersion Technologies and ETHZilla Corp. These investments collectively represent exposure to trading platforms, infrastructure providers, and emerging crypto-related ventures.

Compared with the ETF allocations, these equity stakes remain relatively small, suggesting they function as supplementary exposure rather than core portfolio drivers.

The filing categorized the investments under a “DFND,” or shared-defined, structure. This designation typically indicates that investment decisions were made collaboratively between the parent institution and affiliated asset managers. Such arrangements are common when a central strategy is overseen at the group level while execution occurs across subsidiaries or client mandates.

Whether the positions were driven primarily by proprietary trading activity or institutional client portfolios has not been clarified publicly. Requests for comment regarding the strategy were not answered at the time of disclosure.

A separate filing submitted by the bank’s U.S.-based wealth management division reported no direct digital asset exposure, highlighting how crypto positioning may remain concentrated within specific operational units rather than broadly distributed across the organization.

The disclosures align with a gradual expansion of the lender’s crypto capabilities over recent years. In 2023, Intesa Sanpaolo established a proprietary trading desk within its corporate and investment banking division focused on digital assets. The following year, the bank executed its first direct Bitcoin purchase, acquiring roughly €1 million worth of the cryptocurrency.

At the end of December, when the filing snapshot was taken, Bitcoin traded near $88,000. Market conditions have since shifted significantly, with prices declining toward the $68,000 range during early 2026 trading sessions in London. That volatility underscores why institutions increasingly rely on diversified instruments such as ETFs and derivatives rather than maintaining concentrated spot exposure.

More broadly, the strategy illustrates how traditional banks are approaching digital assets through familiar financial frameworks. By combining regulated investment vehicles, hedging mechanisms, and selective equity stakes, institutions can participate in the sector while maintaining risk controls consistent with existing portfolio management practices.

As crypto markets mature, filings such as this provide insight into how legacy financial players are adapting. Instead of treating digital assets as isolated speculative bets, major institutions appear increasingly focused on relative pricing opportunities, diversified exposure, and capital efficiency within a rapidly evolving asset class.

Crypto World

85% Rally Possible Despite Criticism

The ASTER price has fallen nearly 70% from its post-launch highs, reflecting fading hype and rising criticism. User activity and trading volume seem to have collapsed even faster, raising doubts about its recovery.

Yet beneath this weakness, technical patterns and whale accumulation show a different picture. These signals suggest Aster may still attempt a major breakout despite the sharp decline in participation.

Aster User Activity and Trading Volume Collapse After Post-Launch Frenzy

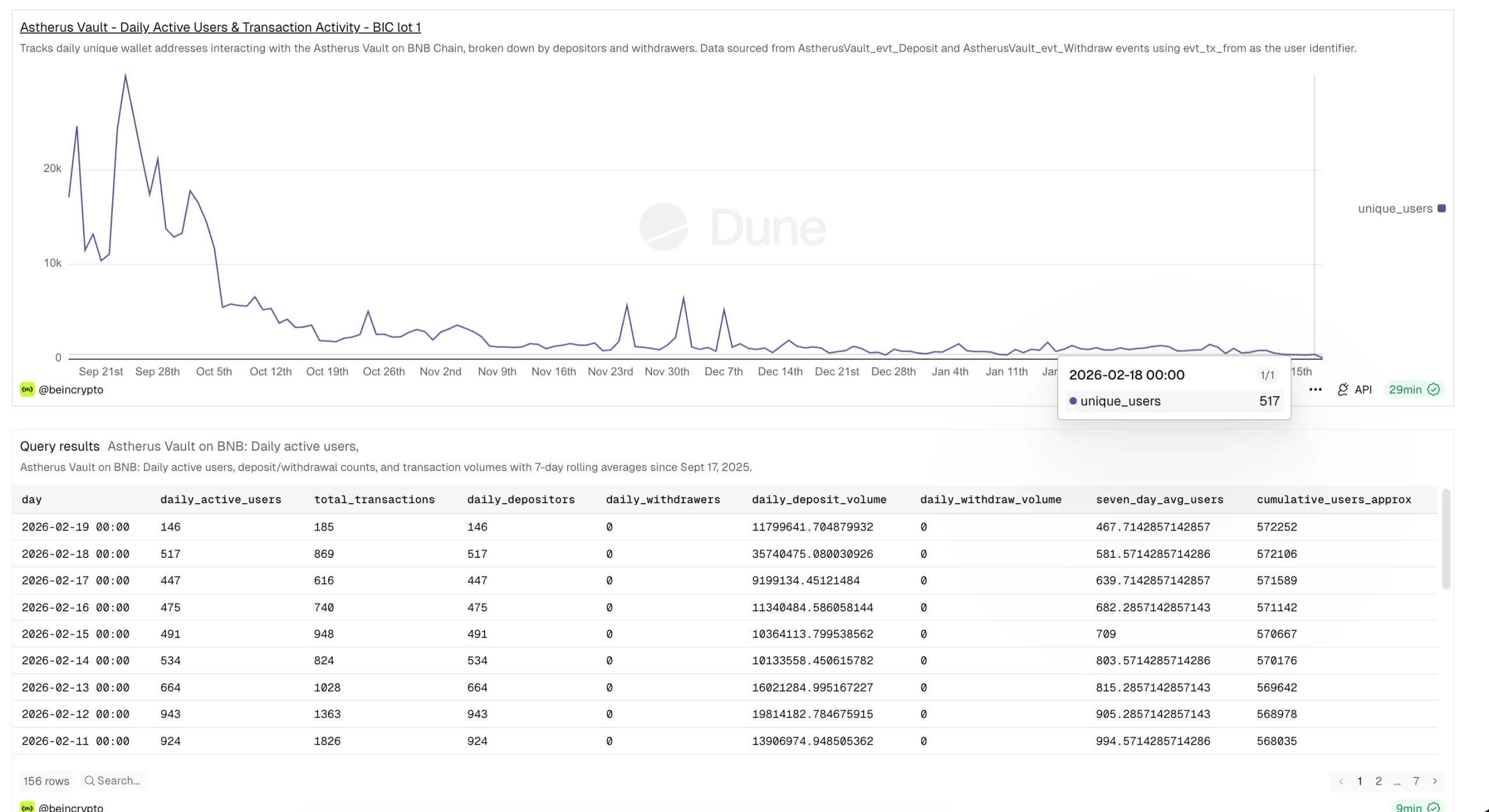

ASTER (formerly Astherus) has seen a dramatic collapse in user participation since its September 2025 token launch.

Daily active addresses interacting with the Astherus Vault on BNB Chain peaked at 29,062 on September 24. As of February 19, that number has fallen to just 146. This represents a 99.5% drop in daily active users.

Disclaimer: These figures reflect Astherus Vault deposit and withdrawal activity on BNB Chain specifically. Aster operates across BNB Chain, Ethereum, Solana, and Arbitrum, and total platform-wide trader activity — including perpetual and spot trading — is likely significantly higher than vault-only metrics suggest.

Trading activity has followed the same trend. Daily decentralized exchange volume on BNB Chain, per data pulled via Dune, has declined from a peak of $327.75 million to just $17.31 million.

This marks a 94.7% drop in trading volume. On-chain trading volume reflects real buying and selling happening on the blockchain. When it falls sharply, it shows reduced participation and weaker demand.

This collapse aligns with Aster’s price decline. The token is down about 70% from its $2.41 high reached shortly after launch. The drop reflects the end of a possible hype-driven phase.

However, the full picture is more complex. Cumulative unique addresses interacting with the protocol have continued rising, reaching 572,252. This shows new users are still entering the ecosystem, even as daily activity declines.

More importantly, the remaining users are committing large capital. On February 19, total deposits reached $11.8 million from just 146 wallets. This equals an average of about $80,000 per wallet. This shows that while retail participation has dropped, high-value investors remain active.

Additionally, daily withdrawals from the vault have remained at zero consistently since the TGE, indicating that while fewer users are depositing new capital, existing capital is not exiting the system.

Bullish Divergence and EMA Setup Show Early Reversal Signs

Despite the fundamental weakness, technical indicators show early signs of recovery. On the 12-hour chart, ASTER has formed a bullish divergence between December 7 and February 14. During this period, the price made a lower low. But the Relative Strength Index, or RSI, made a higher low.

RSI measures buying and selling strength on a scale from 0 to 100. When the price falls while the RSI rises, it indicates that selling pressure is weakening. This pattern often appears before a price recovery begins. Aster has not yet fully responded to this signal. This suggests the bullish pressure may still be building.

At the same time, the 20-period exponential moving average, or EMA, is approaching a bullish crossover above the 100-period EMA. EMA tracks the average price over time, giving more weight to recent prices. When shorter EMAs cross above longer ones, it signals strengthening momentum and a possible trend reversal.

The price is also forming an inverse head-and-shoulders pattern.

This is a bullish reversal structure showing buyers slowly gaining control. The neckline of this pattern sits near $0.79. A breakout above this level would confirm the recovery.

Whale Accumulation and Sentiment Collapse Create Opposing Forces

Large investors continue accumulating ASTER despite weak public sentiment. Wallets holding between 100 million and 1 billion ASTER have increased their holdings from 2.75 billion to 2.96 billion ASTER since early February. This steady increase shows strong confidence from the largest holders.

Mid-sized whales holding between 1 million and 10 million ASTER have also increased their holdings from 262.48 million to 278.96 million ASTER.

However, some of these smaller whales have recently started reducing positions slightly. This decline appears to be linked to the recent collapse in positive sentiment.

Market sentiment has dropped sharply. Positive sentiment scores fell from 10.39 on February 12 to near zero recently.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This reflects rising criticism and negative perception around Aster’s declining activity, which, based on available data, appears somewhat exaggerated but not entirely unfounded.

This creates a conflict in the market. Large whales continue accumulating, showing long-term confidence. But smaller investors are becoming more cautious as sentiment weakens. This divergence between whale behavior and public sentiment often appears near major turning points.

ASTER Price Levels That Could Trigger an 85% Breakout

The ASTER price now sits near a critical technical level. The neckline of the inverse head-and-shoulders pattern is located at $0.79. A breakout above this level would confirm the bullish reversal. If this breakout happens, the next resistance levels appear at $0.92, $1.06, and $1.29. The full breakout target sits near $1.46. This would represent an 85% rally from current levels.

However, downside risks still exist. If Aster falls below $0.68, the bullish setup would weaken. A deeper drop below $0.39 would invalidate the pattern completely and confirm continued bearish pressure.

For now, Aster remains at a turning point. User activity and sentiment have collapsed sharply. But whale accumulation, bullish divergence, and reversal patterns suggest recovery remains possible. The next move above $0.79 or below $0.39 will likely decide Aster’s long-term direction.

Crypto World

Anchorage Digital Builds Federal Rails for Stablecoin Payments

TLDR:

- Anchorage Digital Stablecoin Solutions enables international banks to settle USD transfers using regulated stablecoin infrastructure.

- Federal oversight through the OCC places stablecoin custody and issuance under a single national banking framework.

- The platform replaces correspondent banking with programmable balances that reduce settlement time and trapped liquidity.

- Support for multiple USD stablecoins creates a unified rail for minting, custody, and cross-border dollar movement.

Anchorage Digital has launched a new banking platform designed to move U.S. dollars across borders using stablecoin infrastructure. The product targets licensed international banks seeking regulated access to blockchain-based settlement.

The rollout aligns with recent U.S. legislative efforts to formalize stablecoin oversight. The initiative positions stablecoins as an institutional payment rail rather than a retail crypto product.

Anchorage Digital Stablecoin Solutions targets regulated global settlement

The new service allows foreign banks to onboard directly with Anchorage Digital and access both fiat and stablecoin wallets. Institutions can conduct outbound and inbound U.S. dollar transfers using supported blockchain networks.

According to statements shared at ETHDenver and on social media, the platform consolidates minting, redemption, custody, and treasury management into a single system.

This replaces correspondent banking flows that often rely on pre-funded nostro and vostro accounts.

By shifting settlement to programmable stablecoin balances, banks can reduce idle capital and shorten transfer timelines. Settlement windows compress from several days to minutes while maintaining regulated custody standards.

Company co-founder Kevin Wysocki described the product as consistent with federal goals under the GENIUS Act. His comments framed stablecoins as an extension of dollar dominance through compliant digital infrastructure.

Federal oversight anchors stablecoin issuance and custody model

Anchorage Digital operates as a federally chartered trust bank supervised by the Office of the Comptroller of the Currency. This structure removes the need for state-by-state licensing and places client assets under a single regulatory framework.

Funds remain segregated and bankruptcy remote, according to product documentation released with the launch. Digital assets are stored in vaults using institutional policy controls designed for compliance and risk management.

The platform supports multiple dollar-backed stablecoins across major chains. These include USA₮ from Tether, USDtb from Ethena Labs, USDGO from OSL, and future issuances such as Western Union’s USDPT.

Anchorage Digital stated that it will provide primary mint and redeem access for federally issued stablecoins once the GENIUS Act reaches final implementation. The system remains stablecoin-agnostic, allowing banks to custody and transfer other approved tokens through the same interface.

Nathan McCauley, the company’s chief executive, said the service aims to modernize settlement while preserving compliance controls. He emphasized that blockchain rails can operate behind the scenes without altering bank-facing workflows.

The launch follows growing onchain settlement volumes tied to dollar-pegged tokens. Industry data shows stablecoins now process trillions of dollars annually, driven by demand for faster and cheaper cross-border transfers.

By combining regulated issuance, qualified custody, and blockchain-native settlement, the product connects banks into a shared network of compliant counterparties. This approach positions stablecoins as financial infrastructure rather than speculative assets.

Crypto World

Aptos Pivots Tokenomics Towards Performance-Driven Deflation

The Layer 1 network proposes token buybacks, raising gas fees by 10x, and reducing the staking rewards rate.

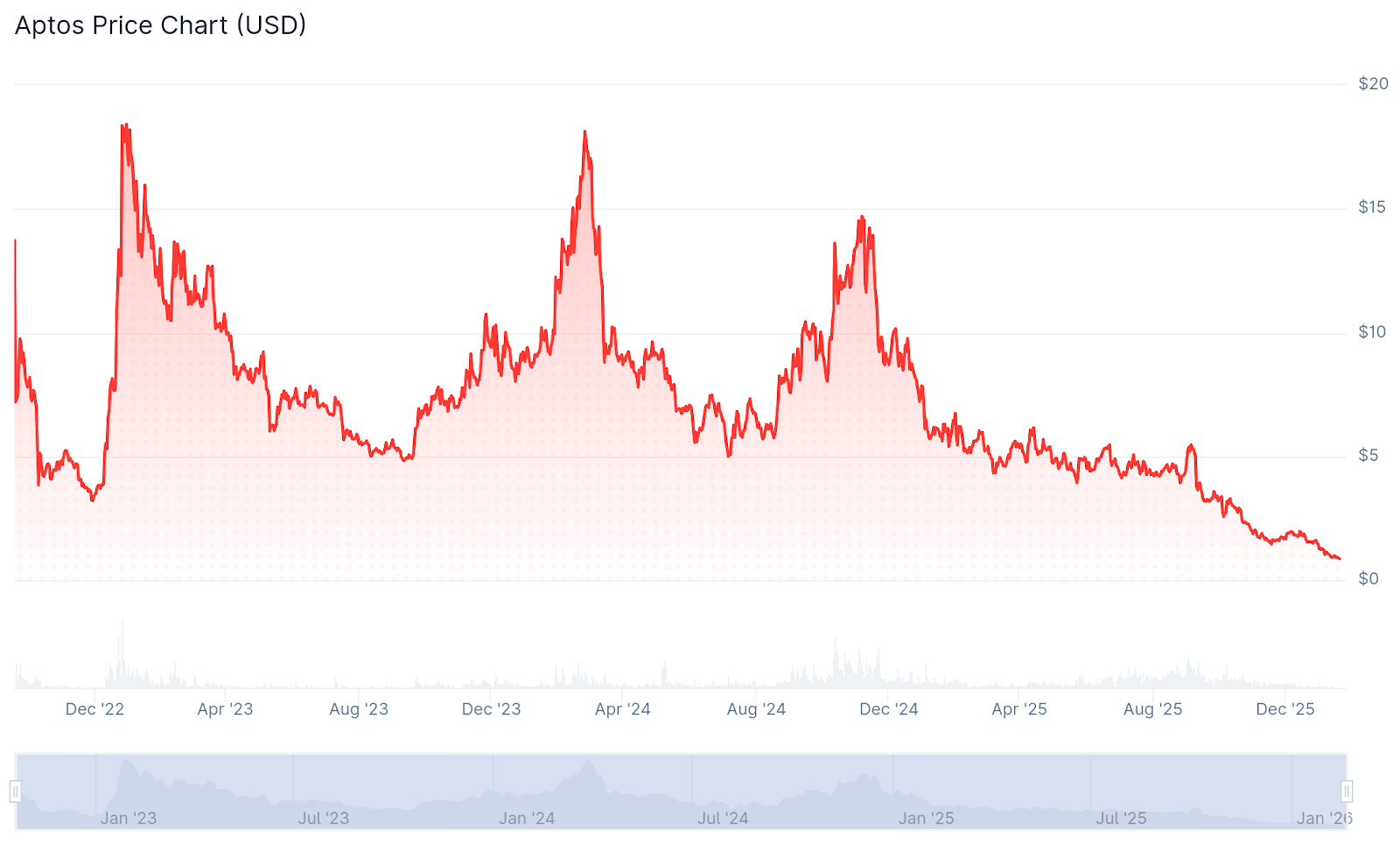

Layer 1 blockchain Aptos is proposing a major shift in its tokenomics, intended to reward long-term stakers and use transaction fees to fund token buybacks, as the APT token continues to hit new lows.

The team posted the update on X today, stating that “The Aptos network is transitioning to performance-driven tokenomics designed to align supply mechanics with network utilization.”

Through this update, Aptos aims to transition from its high-inflation, subsidy-based model to a deflationary, revenue-driven supply. The update proposes a hard cap of 2.1 billion APT, and the Aptos Foundation will permanently lock 210 million APT, worth $180 million, and use staking rewards to support network operations rather than token sales.

The update also calls for a tenfold increase in gas fees, claiming that even after this increase, network fees would “still be the lowest in the world at around $0.00014.” The increased fees are expected to boost the amount of APT purchased and burned through the programmatic buyback program.

Aptos also proposes to drop the staking reward rate by 50% from 5.19% to 2.6%. This decrease is expected to be paired with a future governance proposal that would offer higher reward rates to users who commit to longer staking terms, whereas short-term stakers would be subject to the 2.6% rate.

APT has had a rough year, falling 87% from 6.31 to $0.86 since February 2025, and 95% from its all-time high of $19.92 in 2023.

Despite the token’s poor performance, Aptos is DeFi’s tenth-largest blockchain by stablecoin market capitalization, with $1.4 billion in total value, and is ranked eleventh by stablecoin transaction volume, with $587 billion, according to Artemis Terminal.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports17 hours ago

Sports17 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment24 hours ago

Entertainment24 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

-

Crypto World6 days ago

Crypto World6 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

![CPI is OUT! The Market Reaction Explained [Bitcoin & Stocks]](https://wordupnews.com/wp-content/uploads/2026/02/1771536648_hqdefault-80x80.jpg)