Business

Manchester United and Chelsea owners aim for late winner in Lord’s Hundred auction | Money News

Part-owners of Chelsea and Manchester United football clubs are among a quartet of finalists vying to buy a big stake in London Spirit, the most prestigious franchise in English cricket’s Hundred competition.

Sky News has learnt that a vehicle controlled by Todd Boehly, a shareholder in Chelsea, and members of the Manchester United-owning Glazer family have been shortlisted to acquire 49% of the Lord’s-based team from the England and Wales Cricket Board (ECB).

The other two shortlisted bidders are a consortium of technology company owners and financiers which includes the bosses of Google and Microsoft; and RPSG Group, the owner of the Indian Premier League team Lucknow Super Giants.

Money latest: TV chef points finger over hospitality troubles

People close to the process said on Thursday that the four bidders would be asked to submit sealed bids for the ECB stake next week, with the highest bidder expected to be chosen by the ECB.

The London Spirit franchise is expected to be valued at about £140m, meaning the proceeds to be received and distributed by the ECB would be approximately £70m, the insiders added.

The identities of the shortlisted parties means that India’s Ambani family, owner of the Mumbai Indians IPL team, is not in the running to buy the Lord’s-based outfit.

Instead, the Mumbai Indians’ owners are pursuing bids for the Oval Invincibles and Manchester Originals teams, according to insiders.

Shortlists for some of the eight Hundred franchises are said to number fewer than four bidders, although the process has been complicated by the presence of some parties in several processes.

The Lucknow Super Giants owners, for example, are said to have been in pursuit of four of the eight teams.

In total, the ECB has indicated that it could receive in the region of £350m for its 49% stakes in the eight teams.

The host counties are also allowed to sell their 51% shareholdings, although some have said they do not intend to do so.

The MCC, which controls the London Spirit franchise, does not intend to offload any of its stake at this point, according to cricket insiders.

Sky News revealed earlier this month that the consortium of tech company chiefs was also bidding for the Oval Invincibles, with them also expected to be shortlisted in that process.

CVC Capital Partners, the buyout firm which has made a swathe of sports investments, has also tabled an offer for the Oval-based team.

Investors will only be allowed to own a stake in one of the eight teams, which also include Welsh Fire, Southern Brave and the Northern Superchargers.

A bigger-than-expected windfall from the process could offer a financial lifeline to a number of cash-strapped counties, with part of the proceeds likely to be used to pay down debt.

Concerns have been raised, however, that windfalls from the Hundred auction will not deliver a meaningful improvement in counties’ long-term financial sustainability.

The outcome of the Hundred auction is also likely to intensify other searching questions about the future of cricket, as the Test format of the game struggles for international commercial relevance against shorter-length competition.

The Hundred auction is being handled by bankers at Raine Group, the same firm which oversaw the sale of large stakes in both Manchester United and Chelsea in recent years.

An MCC spokesman declined to comment, while none of the bidders contacted by Sky News would comment.

CryptoCurrency

Trump Issues Crypto Executive Order to Pave U.S. Digital Assets Path: Reports

U.S. President Donald Trump has come through with an eagerly awaited executive order on crypto that directs his administration to establish friendly policies to put the industry on solid U.S. footing and work toward establishing a “digital asset stockpile.”

After years of courtroom combat with federal authorities, Trump’s order could allow the digital assets sector to move forward in the U.S. with a more welcoming framework set by the White House. Such orders are more of a beginning than an end in federal policy, but the pro-crypto president has taken that first step, Bloomberg reported Thursday.

When Trump had failed to issue it among his opening flurry of executive orders, crypto insiders grew increasingly tense about the new relationship he’s promised. But behind the scenes, leaders at the U.S. markets regulators — the Securities and Exchange Commission and Commodity Futures Trading Commission — were already prepping this week to move digital assets businesses out of the multi-year penalty box the previous agency officials kept them in.

CryptoCurrency

Top Cryptocurrency To Buy Right Now (Hint: It’s Not Bitcoin)

Bitcoin and large-cap crypto assets are caught in a state of uncertainty, as investors closely monitor both Donald Trump’s actions and the broader macroeconomic landscape.

While Bitcoin’s sustained trading above $100,000 is seen as a sign of strength, altcoins — particularly Ethereum — remain lackadaisical.

However, low-cap meme coins are showing little correlation with the broader market outlook and continue to create generational wealth. The Trump family coins — $TRUMP and $MELANIA — have driven the hype and FOMO to reach a fever pitch.

A new meme coin, Meme Index (MEMEX), has quickly established itself as a top cryptocurrency to buy right now. The project is building the first decentralized meme coin index fund, allowing investors to gain broader market exposure with just one coin.

Meme Index — The Smart Way To Invest In Meme Coins

The market has been eagerly anticipating the launch of an index fund-like investment model for meme coins.

There are simply too many high-upside meme tokens to invest in, particularly for retail investors. Due to the broader market bearishness, interested buyers can find promising assets like Moo Deng, Peanut The Squirrel and NEIRO in highly undervalued territory.

Meanwhile, new meme coins continue to launch. Inspired by Offical Trump’s success, the CEO of Vine Rus Yusopov launched his own meme coin, which has a $224 million market capitalization in just a day. Vine is one of TikTok’s biggest competitors and is rumoured to integrate with X.

However, it is highly improbable that small-scale investors can even find an asset like $VINE in time. Moreover, they either go all-in on one asset or are spread too thin across many, owing to the budget constraint.

Now, Meme Index’s meme coin baskets allow MEMEX holders to gain broader market exposure while spreading the risk. The project will soon launch 4 baskets, each with varying risk-reward ratios.

For instance, the Meme Titan Index is designed for safe players and features large-cap coins like Pepe and Dogecoin. On the contrary, the Meme Frenzy Index is designed for the degens and will include low-cap meme coins that could offer anywhere between 10x to 100x returns.

Meme Moonshot and Meme Midcap are the two other attractive options. Check out the project whitepaper for more of its salient features.

Noticeably, only MEMEX holders will be able to invest in the baskets. More importantly, they will get to vote on which tokens to be included in each basket. This would ensure every entry has strong community support and isn’t a scam.

Moreover, small-scale investors will finally benefit from projects like VINE, MOBY and UFD before they explode.

Considering its high upside potential, it is no surprise the Meme Index presale has raised nearly $3 million in short order, with many viewing it as one of the top cryptos to buy now

The Top Crypto To Buy Right Now?

Donald and Melania Trump’s meme coin launches have paved the way for major players to join the space. Just today, Barstool President Dave Portnoy released a video mulling about launching his own meme coin.

I’ve been going back and forth about if I want to launch my own meme coin #DDTG pic.twitter.com/KdEdXgdvJT

— Dave Portnoy (@stoolpresidente) January 23, 2025

Against such a backdrop, Meme Index’s investment model could prove to be a game-changer for whales and small-scale retailers alike.

Smart money investors are already impressed with the project’s uniqueness, innovation and community governance model, with many calling it the next 100x crypto.

Despite its ambitious goals, MEMEX is highly undervalued and is still in the early stages of its presale. Interested buyers can invest in the meme coin today with just a few clicks and take a major step towards diversifying their portfolio.

Check out Meme Index’s X and Telegram accounts for the latest updates.

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Business

Race to build more AI infrastructure dominates tech—and the U.S. presidential transition

A planned $500 billion data center building spree under Trump is just the biggest in a long list of AI-related infrastructure projects. Read More

Technology

Bill Gates’ nuclear energy startup inks new data center deal

TerraPower, a nuclear energy startup founded by Bill Gates, struck a deal this week with one of the largest data center developers in the US to deploy advanced nuclear reactors. TerraPower and Sabey Data Centers (SDC) are working together on a plan to run existing and future facilities on nuclear energy from small reactors.

Tech companies are scrambling to determine where to get all the electricity they’ll need for energy-hungry AI data centers that are putting growing pressure on power grids. They’re increasingly turning to nuclear energy, including next-generation reactors that startups like TerraPower are developing.

“The energy sector is transforming at an unprecedented pace.”

“The energy sector is transforming at an unprecedented pace after decades of business as usual, and meaningful progress will require strategic collaboration across industries,” TerraPower President and CEO Chris Levesque said in a press release.

A memorandum of understanding signed by the two companies establishes a “strategic collaboration” that’ll initially look into the potential for new nuclear power plants in Texas and the Rocky Mountain region that would power SDC’s data centers.

There’s still a long road ahead before that can become a reality. The technology TerraPower and similar nuclear energy startups are developing still have to make it through regulatory hurdles and prove that they can be commercially viable.

Compared to older, larger nuclear power plants, the next generation of reactors are supposed to be smaller and easier to site. Nuclear energy is seen as an alternative to fossil fuels that are causing climate change. But it still faces opposition from some advocates concerned about the impact of uranium mining and storing radioactive waste near communities.

“I’m a big believer that nuclear energy can help us solve the climate problem, which is very, very important. There are designs that, in terms of their safety or fuel use or how they handle waste, I think, minimize those problems,” Gates told The Verge last year.

TerraPower’s reactor design for this collaboration, Natrium, is the only advanced technology of its kind with a construction permit application for a commercial reactor pending with the U.S. Nuclear Regulatory Commission, according to the company. The company just broke ground on a demonstration project in Wyoming last year, and expects it to come online in 2030.

CryptoCurrency

BlackRock CEO wants SEC to ‘rapidly approve’ tokenization of bonds, stocks: What it means for crypto

BlackRock CEO Larry Fink said he’s “a huge believer in crypto” and urged the SEC to “rapidly approve” asset tokenization. Is this a net positive for the crypto sector?

Business

Airlines flex pricing power, signaling higher fares in 2025

Travelers walk through O’Hare International Airport in Chicago, Illinois, on December 20, 2024 ahead of the upcoming Christmas holiday.

Kamil Krzaczynski | AFP | Getty Images

Higher airfare is in store this year as strong demand, even during the dead of winter, and limited capacity growth prompt airlines to flex their pricing power.

Fare-tracking platform Hopper this month said domestic “good deal” U.S. airfare in January is at $304, up 12% over last year, with more domestic flights going for more than they did last year through at least June.

Late deliveries of new aircraft from Boeing and Airbus, air traffic constraints and financial pressures have limited airlines’ ability to expand flights, which has pushed fares higher. Spirit Airlines, which filed for Chapter 11 bankruptcy protection in November, was the most dramatic case and has slashed its flights to cut costs.

American Airlines on Thursday forecast a jump in revenue of as much as 5% in the first quarter over the same three months of 2024, while capacity will be flat or even down as much as 2%.

“We do expect airfare to come up,” American CFO Devon May said in an interview. The airline forecast a wider-than-expected-loss for the first quarter, however, disappointing investors as it expects an increase in costs, like higher wages from new labor contracts signed last year.

Startup carrier Breeze Airways on Thursday reported its first quarterly operating profit, for the fourth quarter, and founder David Neeleman, the founder of JetBlue Airways, said conservative industry growth is boding well for future results.

“The tide is lifting a lot of boats,” he said in an interview. “We’re exceeding our targets in revenue. Momentum we saw in the fourth quarter is continuing into the first.”

Alaska Airlines late Wednesday said it expects revenue growth for the first quarter to rise by “high single digit” percentage points with capacity up no more than 3.5%.

United Airlines, which had a first-quarter earnings forecast that far surpassed analysts’ expectations, shared a similar sentiment, particularly for domestic trips.

“The domestic pricing environment is improving as underperforming airlines remove unprofitable capacity at an increasing rate and business traffic growth accelerates,” United’s chief commercial officer, Andrew Nocella, said on the company’s earnings call on Wednesday. “Industry fare sales are less prevalent with lower discount rates as airlines are prioritizing profitability.”

Delta Air Lines, which kicked off airline earnings season earlier this month, forecast revenue growth of 7% to 9% for the first quarter, with unit sales growing across its globe-spanning network.

Off-season travel, particularly to Europe, has been a big bright spot for large U.S. carriers. Delta’s president, Glen Hauenstein, for example, said on the Jan. 10 earnings call that trans-Atlantic unit revenue should be up mid-single digits with demand “benefiting from strong U.S. point of sale and an extension of the season with unprecedented off-peak results.”

Carriers are also seeing more customers buy up for roomier — and pricier — seats.

JetBlue Airways and Southwest Airlines are scheduled to report fourth-quarter results and provide their 2025 outlooks next week. Both carriers are trying to ramp up revenue with more new premium seating and by debuting other amenities.

Technology

Threads rolls out a post scheduler, ‘markup’ feature, and more

While Meta lures TikTok creators to Instagram and Facebook with cash bonuses, its X competitor Instagram Threads is now making things easier for creators, brands, and others who need more professional tools to manage their presence on the app. On Thursday, Instagram head Adam Mosseri announced a small handful of new features coming to Threads, including a way to schedule posts and view more metrics within Insights.

In a post on the social network, Mosseri shared that users would now be able to schedule posts on Threads and view the metrics for individual posts within the Insights dashboard which offers a way for Threads users to track trends including their views, number of followers and geographic demographics, number and type of interactions, and more, for a given time period.

In addition, he said that Threads is adding a new feature that allows users to “markup” a post they’re resharing so they include their own creative take. While Mosseri didn’t elaborate on what that means or share an example, earlier findings from tech enthusiast Chris Messina indicate that Threads will add a new icon next to the buttons for adding photos, GIFs, voice, hashtags, and more that provide access to this feature.

The squiggle icon, when clicked, takes users to a screen where they can choose between tools like a highlighter pen or arrow tool, that would allow them to draw directly on a Thread post. This feature was also spotted last week by Lindsey Gamble, who posted on Threads to show the feature in action.

It’s an odd sort of addition for Threads, given that users are more often sharing something clipped from the web, like a news article, where they’ve added a highlight or underline in a screenshot. There hasn’t been much consumer demand for a tool to mark up Threads’ posts directly.

However, the feature does offer Threads users something unique, when compared with social networking rivals like X, Bluesky, and Mastodon — and that could be the point.

CryptoCurrency

Here’s why Bitcoin and most altcoins are falling

Bitcoin and most altcoins have fallen this week even after Donald Trump’s inauguration to become the most crypto-friendly president in the US.

Bitcoin (BTC) price dropped to $101,000 on January 23rd, while popular meme coins like ai16z, Fartcoin, and Official Trump fell by over 20%. Other top laggards were coins like Lido DAO, Jupiter, Virtuals Protocol, and Hyperliquid.

There are four possible reasons for the ongoing crypto retreat. First, economists expect the Bank of Japan to hike interest rates by 0.25% on Friday. This would bring the official cash rate to 0.50%, the highest level since 2008.

The last BoJ rate hike occurred in August last year, leading to a sharp decline in cryptocurrencies and other assets. This was due to the unwinding of the Japanese yen carry trade. As such, another BoJ rate hike may trigger another drop, albeit at a smaller size.

Second, in line with this, Bitcoin and altcoins fell as traders waited for next week’s Federal Reserve interest rate decision. A hawkish tone may also lead to more weakness in the crypto industry since it would push government bond yields higher.

Third, they have dropped because Donald Trump has not mentioned crypto since his inauguration. He has also not signed any executive order on cryptocurrency. This explains why the odds of him creating a strategic Bitcoin reserve have dropped to 40% on Polymarket.

The coins also dropped because of the popular practice of buying an asset ahead of a major event and then selling it when it occurs.

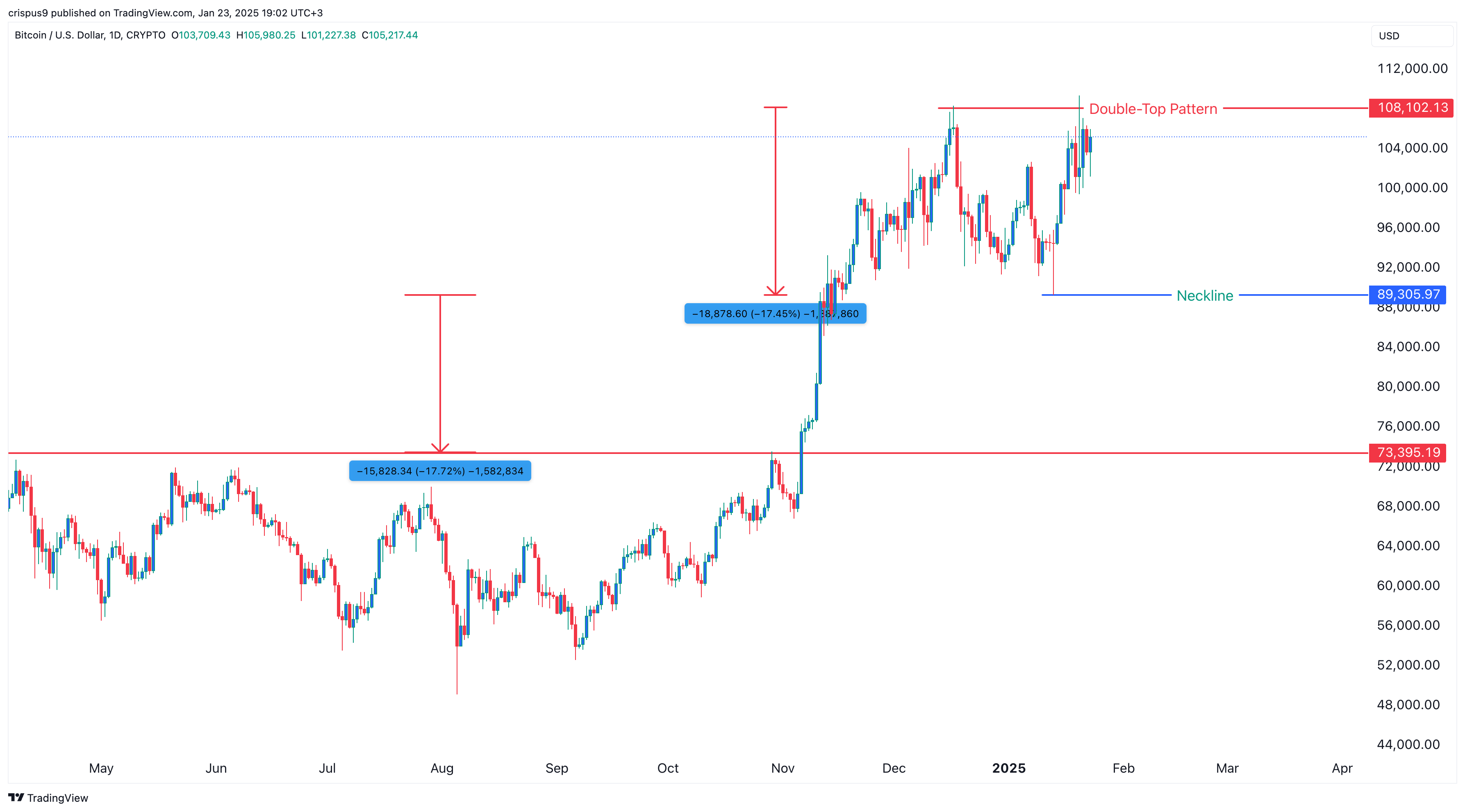

Risks of a Bitcoin price double top

Bitcoin has also formed the risky double-top chart pattern at $108,100.This pattern is made up of two peaks and a neckline and is usually a bearish reversal sign. The neckline in this case is at $89,305. By measuring the distance between the double-top and the neckline, the potential target for the coin is about $74,000.

Therefore, Bitcoin will remain on edge as long as it is below that double-top pattern. This will, in turn, affect other altcoins that often move in the same direction as Bitcoin.

Moving above the double-top point at $108,100 will invalidate the bearish view and point to more gains, potentially to the psychological level at $110,000.

CryptoCurrency

Boba Network Integrates Nucleus to Expand Cross-Chain Functionality and Ecosystem Accessibility

[PRESS RELEASE – San Francisco, United States, January 22nd, 2025]

Boba Network has announced the integration of Nucleus, a protocol designed for blockchain networks. This collaboration enables users bridging ETH, Liquidity Staking Tokens (LSTs), or Liquidity Reward Tokens (LRTs) to the Boba Network to engage with Ethereum mainnet functionalities while accessing various DeFi protocols, gaming platforms, and NFT marketplaces

The partnership aligns with Boba Network’s focus on scalability and user-focused development. The integration of Nucleus expands Boba Network’s ecosystem offerings, highlighting advancements in cross-chain functionality and composable infrastructure.

Enhancing Results Through Cohesion

- ETH, LSTs, or LRTs bridged to Boba Network are integrated into the network’s system, facilitating seamless interaction with decentralized applications. This approach aims to optimize user engagement without additional complexity.

- This version removes promotional language and references to financial benefits, focusing solely on functionality.

- Frictionless Cross-Chain Operations

- Secure interchain messaging protocols connect Ethereum Mainnet and Boba Network, enabling efficient yield aggregation. The flow of assets and rewards benefits from streamlined coordination between chains.

- Composable Infrastructure

- Smart contracts empower cross-chain deposits, withdrawals, and liquidity management. This allows developers to build robust decentralized applications that incorporate Nucleus’s functionality without added complexity.

Boba Network as a Foundation for Innovation

Boba Network’s advanced capabilities support Nucleus’s goal of integrating core functionalities into blockchain ecosystems.

- HybridCompute™

- Off-chain data computation at scale lowers costs and boosts performance for yield-bearing protocols.

- Account Abstraction

- Simplified user interactions reduce onboarding barriers and enhance overall accessibility.

- Low Transaction Costs

- Lower fees support high-volume user participation and provide a cost-effective environment for dApp developers.

This synergy bolsters ecosystem capabilities, drives the adoption of decentralized technology, and sets the stage for new market opportunities.

Aligning with Nucleus’s Mission

By deploying on Boba Network, Nucleus aims to integrate core functionality across multiple crypto networks. This approach supports ecosystem participation by leveraging Boba Network’s features, including speed, cost-efficiency, and access to a range of decentralized applications.

What the Integration Brings

- For Users: Convenient access to a variety of applications within the Boba Network ecosystem.

- For Developers: Tools and resources for integrating advanced features into decentralized applications to support innovative product development.

- For Ecosystems: Increased network activity supported by integrated functionalities, contributing to the ongoing development of blockchain technology.

Setting a New Standard for Blockchain Networks

The collaboration between Nucleus and Boba Network aims to integrate advanced network functionalities as a core feature rather than an additional option. This integration seeks to enhance the accessibility and utility of blockchain technology, supporting broader adoption and facilitating advancements in decentralized finance and related fields.

Users can learn more about Nucleus on Boba Network and experience how this integration is redefining blockchain networks.

About Nucleus

Nucleus is a protocol designed to integrate core functionalities at the foundational layer of blockchain ecosystems. By streamlining cross-chain operations and providing developers with tools for integrating advanced features, Nucleus aims to enhance how users interact with Web3 technologies.

About Boba Network

Boba Network is a multichain Layer 2 solution designed for scalability, low transaction costs, and enhanced developer capabilities. Through innovations such as HybridCompute™ and account abstraction, Boba Network supports diverse dApps spanning DeFi, gaming, and NFTs, aiming to bring the next wave of users into the blockchain space.

Website: https://boba.network

Twitter: @bobanetwork

LinkedIn: https://www.linkedin.com/company/bobanetwork/

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Here’s Why $96,000-$111,000 Is Most Important

Although Bitcoin price action is still holding above the $100,000 price level, the past 24 hours have been highlighted by a 2.5% decline. According to liquidation data from Coinglass, this decline has seen $65.47 million worth of positions liquidated, with the majority ($54.10 million) being long positions.

Crypto analyst Kevin (Kev_Capital_TA) noted a significant range between $96,000 and $111,000, calling it the most pivotal zone on Bitcoin’s liquidation heatmap. This zone could determine the market’s next trajectory after months of back and forth movement trading between this range.

Bitcoin’s Liquidity Heatmap Highlights Key Levels

According to Kevin’s analysis, which he posted on social media platform X, large liquidity blocks dominate the range between $96,000 and $111,000, which has created an important zone for Bitcoin traders to keep an eye on.

Related Reading

Liquidity heatmaps visualize areas where buy and sell orders accumulate, often serving as potential reversal or breakout points. The presence of significant liquidity in this range suggests that the market could experience heightened volatility once Bitcoin approaches these levels, and inexperienced investors could be caught up in the price action.

The liquidity blocks within this range are highlighted in green in the Bitcoin price chart below. These green zones are high-activity zones that act as a magnet for price action. Notably, the largest liquidity cluster lies near $109,700, slightly above Bitcoin’s current all-time high of $108,786, achieved just three days ago. This proximity to this all-time high means that Bitcoin could undergo another strong price action once it reaches this level. There are many market participants with buy and sell orders here around $109,700.

Bitcoin Needs To Break Above its Prolonged Sideways Trading

Kevin also pointed out Bitcoin’s extended period of sideways trading, which has tested the patience of many investors. He noted that Bitcoin traded sideways for eight months at the end of 2024, followed by a brief surge in price, only to return to another three-month period of low volatility.

Related Reading

Since then, however, the strong bullish momentum has yet to repeat itself. Although long-term holders may still be in profit, short-term traders are feeling the most strain from the lack of any substantial upward price action.

The first step in repeating bullish momentum would be to break above the upper end of the liquidation zone at $110,000.

If Bitcoin breaches this range, it could trigger a significant rally or sell-off depending on the prevailing sentiment and trading activity within the zone.

However, the lack of liquidity beyond these levels also poses risks, especially below the lower end of the zone. The thinner orders means there isn’t enough hold up liquidity to reject a price breakdown.

At the time of writing, Bitcoin is trading at $102,200, down by 2.8% in the past 24 hours.

Featured image from Unsplash, chart from Tradingview.com

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login