- Elementor announced Site Planner, a new AI-powered tool

- It allows users to create sitemaps, wireframes, and more

- It is currently free to use

Elementor, one of the best website builders, just announced a new Artificial Intelligence-powered (AI) tool that will help users plan new websites faster than ever before. It is called Site Planner, and it is currently free for everyone to use.

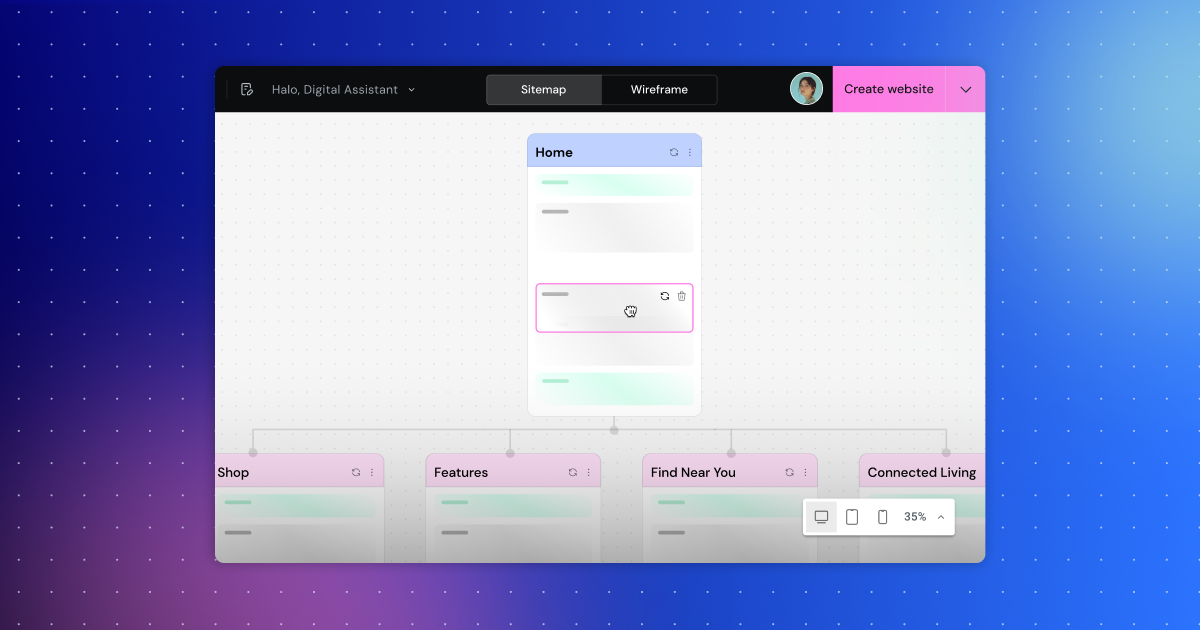

In a brief shared with TechRadar Pro, Elementor explained that Site Planner leverages AI technology to generate the site brief, sitemap, and wireframe – three key pillars to every website’s design process.

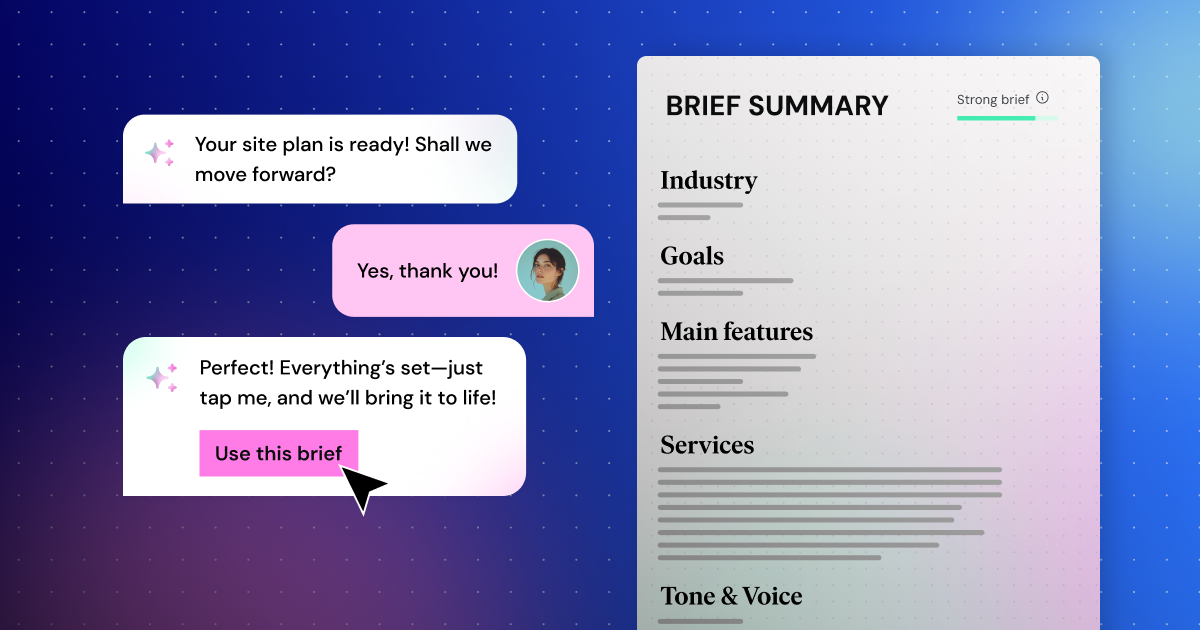

The brief also outlines the shared project goals, key messages, and desired outcomes, Elementor explained. “With Site Planner, you can upload your own brief or generate it in several ways with AI helping to guide you toward a strong, professional brief that sets the foundation for building successful websites.”

Google Meet integrations

A sitemap is a hierarchical representation of all the pages within a website, outlining their relationships and structure. It is an essential part since both users, and search engines, use the sitemap to understand and navigate the site effectively. Ultimately, a wireframe is a basic skeletal framework of a website page, showing the placement of key elements like headers, navigation, content areas, and calls to action without visual design elements.

As is standard practice with AI-powered website generators these days, designers can simply talk to the tool to get going. However, Elementor goes a step further, integrating the tool with Google Meet, and allowing AI to capture key details of client discussions in real-real time, and transform them into actionable briefs.

“The notes serve as input to Site Planner for creating a professional brief,” the company explained.

Websites built this way can be hosted either with Elementor, or with a third-party website hosting provider. Elementor notes that the tool is “currently free”, suggesting that this may become a premium product once the initial promotional stage ends.

Owain Williams

Owain covers everything website builder related at TechRadar. He has experience in building sitemaps on a range of large website projects.

AI is the name of the game in the website building space, with practically all of the best website building platforms racing to integrate artificial intelligence into tools and features.

This latest announcement by Elementor is certainly an exciting one, at least for some users. Businesses and individuals creating single sites will likely fail to see any real benefit from using this tools – although it could certainly inject a little fun into an otherwise dull part of the website creation process.

On the other hand, businesses that create multiple websites stand to make the biggest gain from this update, with the new tool helping to drastically reduce the time investment required to complete the website planning stage. This could help Elementor better position itself as one of the best website builders for agencies and freelancers.

Wix recently launched a similar tool, but Elementor’s ability to connect with Google Meet makes this a stand-out feature in the website building space.

You must be logged in to post a comment Login