Crypto World

Here’s why being listed on CoinMarketCap is more than just visibility

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

This week, several new projects were listed on CoinMarketCap, including Monstro DeFi, Espresso, and BitGW. The BitGW team states that this development is not simply about brand exposure. It represents integration into the global reference layer of the crypto market, a framework through which exchanges are continuously evaluated, compared, and monitored.

BitGW is spot on with this observation. CoinMarketCap is far more than a directory. For millions of users, institutional analysts, compliance professionals, and infrastructure providers, CMC data functions as a default reference point. As a result, a listing signals that an organization’s trading activity and platform metrics are now visible within a standardized, globally recognized data structure.

Transparency as a competitive edge

As the digital asset sector matures, transparency has become one of the most decisive competitive differentiators.

For example, in BitGW’s case, being listed on CoinMarketCap means operating within a framework that requires structured, continuously updated information. This level of openness allows market participants to independently observe platform performance over time.

Rather than relying solely on marketing narratives, BitGW’s metrics can now be evaluated directly within a neutral, third-party environment, an increasingly important factor in building long-term credibility.

Institutional visibility and market positioning

A CoinMarketCap listing also reshapes how a platform is perceived beyond retail audiences.

Institutional observers, liquidity providers, and compliance teams frequently consult CMC as part of their research and benchmarking processes. BitGW’s presence within this ecosystem strengthens its visibility across regions while positioning the exchange within a globally recognized data standard.

In a market driven by measurable performance and trust, this transition, from simply being available to being systematically trackable, carries significant weight.

Entering the market’s long-term memory

In crypto, hype is fleeting. Data is permanent.

By being listed on CoinMarketCap, companies like BitGW enter what could be described as the market’s long-term memory. Its trading metrics, consistency, and growth trajectory will now be observed and compared against peers over extended periods.

While this level of transparency introduces sustained scrutiny, it also creates opportunity. Platforms that demonstrate operational stability and disciplined growth over time are more likely to earn lasting market confidence.

Looking ahead

As the industry continues to prioritize transparency, data integrity, and institutional standards, exchanges that embrace this level of openness position themselves for long-term credibility.

Therefore, being listed on CoinMarketCap means more than just visibility. It represents commitment and signals an organization’s intention to compete where the standards are highest, and the scrutiny is constant.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Crypto markets feel the chill, Base, ether.fi reorganize layer-2 landscape: Crypto Daybook Americas

By Jacob Joseph (All times ET unless indicated otherwise)

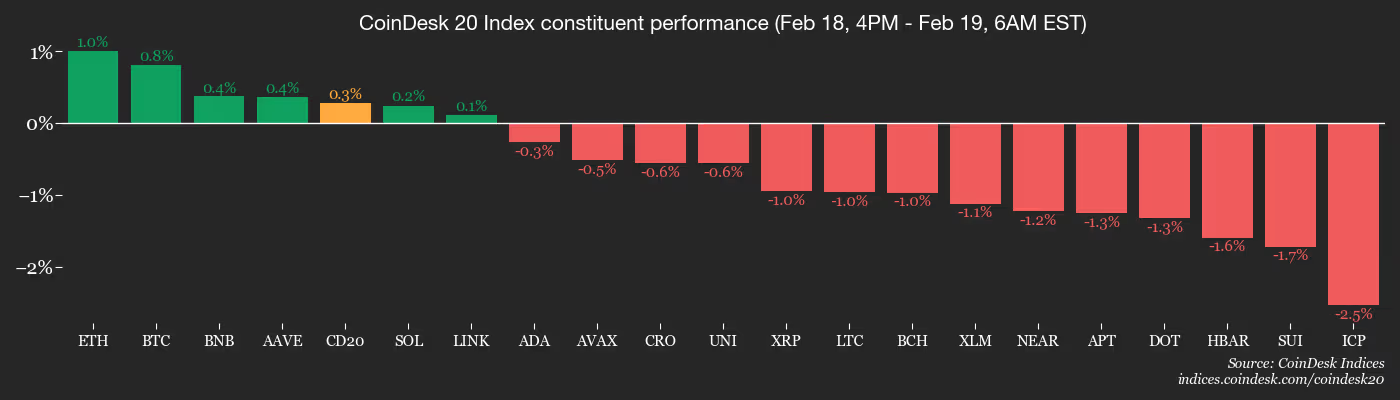

Even with the CoinDesk 20 index (CD20) little changed since midnight UTC, crypto markets remain under pressure. All but one member has dropped, and the outlier, bitcoin , is less than 0.1% in the green.

The index has lost 2% in 24 hours, and spot bitcoin exchange-traded fund flows were negative for a second consecutive session, with $133 million in net outflows on Wednesday. Spot ether (ETH) ETFs also posted net outflows. The second-largest cryptocurrency has lost another 0.2% since midnight.

The key development overnight was Coinbase’s (COIN) announcement that its layer-2 network, Base, will move away from the OP Stack, the open-source, modular rollup framework developed by Optimism that currently powers it. The OP Stack enables chains such as Base and Unichain to operate as low-cost, Ethereum-secured layer 2s, fully compatible with the Ethereum Virtual Machine (EVM) and aligned with Optimism’s broader Superchain vision.

Rather than relying on multiple external contributors for core upgrades and protocol changes, Base intends to consolidate development into a self-managed codebase, giving the team greater control over infrastructure, roadmap, and technical evolution.

The move carries meaningful implications for Optimism. Base has historically accounted for the vast majority of Superchain-generated revenue — often exceeding 90% — which accrues to the Optimism Collective. The announcement represents a significant potential headwind to Optimism’s revenue outlook, with the OP token declining 24% since Wednesday following the news.

In a more positive development, ether.fi said it will migrate its Cash product to Optimism’s OP Mainnet. The move will bring some 70,000 active cards, 300,000 accounts and millions of dollars in total value locked. The non-custodial payment card allows users to spend ETH, BTC and stablecoins at over 100 million Visa merchants, offers 3% crypto cashback and processes about $2 million in daily transaction volume.

In another notable layer-2 development, Robinhood’s testnet recorded 4 million transactions in its first week, according to CEO Vlad Tenev. The Arbitrum-based Robinhood Chain is designed to support tokenized real-world assets and a broader suite of onchain financial services, signaling the firm’s continued push into blockchain-based infrastructure.

While these ecosystem developments remain constructive, broader markets continue to trade within a wider downtrend. The latest Federal Reserve meeting minutes, released yesterday, highlight a growing divergence among policymakers on the path of interest rates.

Several officials indicated that further rate cuts should be paused for now, with the possibility of resuming easing later in the year only if inflation continues to fall. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 19, 8 a.m.: Zama to host a live presentation of its 2026 roadmap.

- Macro

- Feb. 19: U.S. Fed’s Raphael Bostic, Michelle Bowman and Neel Kashkari make speeches throughout the day.

- Feb. 19, 8:30 a.m.: U.S. initial jobless claims for Feb. 14 est. 225K (Prev. 227K)

- Earnings (Estimates based on FactSet data)

- Feb. 19: Riot Platforms (RIOT), post-market, -$0.32

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- ENS DAO is voting to register the on.eth name and establish it as an onchain registry for blockchain metadata. Voting ends Feb. 19.

- Unlocks

- Token Launches

- Feb. 19: Resolv to complete rollout of updated USR/RLP yield distribution parameters

- Feb. 19: Injective to start INJ Community Buyback Round #226

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 0.87% from 4 p.m. ET Wednesday at $66,896.68 (24hrs: -1.31%)

- ETH is up 1.29% at $1,966.13 (24hrs: -1.49%)

- CoinDesk 20 is up 0.39% at 1,932.97 (24hrs: -2.57%)

- Ether CESR Composite Staking Rate is unchanged at 2.81%

- BTC funding rate is at 0.0056% (6.1747% annualized) on Binance

- DXY is unchanged at 97.67

- Gold futures are unchanged at $5,009.90

- Silver futures are up 1.13% at $78.47

- Nikkei 225 closed up 0.57% at 57,467.83

- Hang Seng closed up 0.52% at 26,705.94

- FTSE is down 0.63% at 10,618.95

- Euro Stoxx 50 is down 0.81% at 6,054.02

- DJIA closed on Wednesday up 0.26% at 49,662.66

- S&P 500 closed up 0.56% at 6,881.31

- Nasdaq Composite closed up 0.78% at 22,753.63

- S&P/TSX Composite closed up 1.5% at 33,389.73

- S&P 40 Latin America closed up 0.37% at 3,707.85

- U.S. 10-Year Treasury rate is up 1.3 bps at 4.094%

- E-mini S&P 500 futures are down 0.3% at 6,873.25

- E-mini Nasdaq-100 futures are down 0.39% at 24,857.50

- E-mini Dow Jones Industrial Average Index futures are down 0.35% at 49,549.00

Bitcoin Stats

- BTC Dominance: 58.74% (0.26%)

- Ether-bitcoin ratio: 0.0294 (-0.09%)

- Hashrate (seven-day moving average): 1,057 EH/s

- Hashprice (spot): $33.63

- Total fees: 2.31 BTC / $155,155

- CME Futures Open Interest: 118,610 BTC

- BTC priced in gold: 13.4 oz.

- BTC vs gold market cap: 4.47%

Technical Analysis

- The ratio of altcoins (excluding the top 10) to the bitcoin price continues to rise from key weekly support and is now testing the 50-week exponential moving average.

- A break above that level would imply continued resilience of altcoins relative to bitcoin, which is most likely a result of their being extremely oversold.

Crypto Equities

- Coinbase Global (COIN): closed on Monday at $164.05 (-1.19%), +0.24% at $164.45 in pre-market

- Circle Internet (CRCL): closed at $63.15 (+2.48%), +0.19% at $63.27

- Galaxy Digital (GLXY): closed at $21.73 (+2.02%), +0.74% at $21.89

- Bullish (BLSH): closed at $31.85 (-0.47%), unchanged in pre-market

- MARA Holdings (MARA): closed at $7.50 (-0.13%), +0.40% at $7.53

- Riot Platforms (RIOT): closed at $15.49 (+5.73%), +0.19% at $15.52

- Core Scientific (CORZ): closed at $17.27 (+0.23%)

- CleanSpark (CLSK): closed at $9.27 (-0.11%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.04 (+0.10%)

- Exodus Movement (EXOD): closed at $9.88 (-2.08%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $125.20 (-2.70%), unchanged in pre-market

- Strive (ASST): closed at $8.05 (-1.59%)

- SharpLink Gaming (SBET): closed at $6.60 (-0.90%)

- Upexi (UPXI): closed at $0.69 (-4.17%)

- Lite Strategy (LITS): closed at $1.10 (+0.00%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$133.3 million

- Cumulative net flows: $54.07 billion

- Total BTC holdings ~1.26 million

Spot ETH ETFs

- Daily net flows: -$41.8 million

- Cumulative net flows: $11.68 billion

- Total ETH holdings ~5.74 million

Source: Farside Investors

While You Were Sleeping

- Bitcoin shakes off U.S. session losses as Trump says trade deficit cut by 78% (CoinDesk): Bitcoin trading remained volatile on Thursday, rising to around $67,000 after briefly dipping near $65,900, as traders digested President Trump’s claims the U.S. trade deficit was cut by 78%.

- Bitcoin, ether, xrp ETFs bleed while Solana bucks outflow trend (CoinDesk): U.S.-listed spot crypto ETFs are flashing red across the board, with one exception. SOL ETFs recorded $2.4 million in net inflows, pushing cumulative inflows to nearly $880 million.

- Gold recaptures $5,000 with focus on the Fed’s rate path (Bloomberg): Gold advanced back to around $5,000 an ounce after jumping 2% on Wednesday, with traders focused on the Fed’s next move on interest rates. Bullion climbed as much as 0.9% on Thursday, silver 3%.

- European shares dip as Airbus, Rio Tinto plunge; Nestle gains (Reuters): European shares slipped on Thursday, as investors sifted through a mixed bag of earnings from the likes of Airbus, Rio Tinto and Nestle.

Crypto World

Bitcoin Options Market Signals $60K Retest in February

Bitcoin (CRYPTO: BTC) faced renewed selling pressure after failing to clear the $71,000 threshold, slipping toward the $66,000 zone that had provided support in the prior days. The move comes as options markets reveal growing caution among professional traders who are paying a premium for downside protection while hedging risk in a mixed macro backdrop. Despite strength in equities and gold, institutional risk appetite appears to have cooled, with market participants scrutinizing potential catalysts for a deeper pullback. Data during the week showed traders defending the $66k line, but buyers did not mount a decisive comeback, leaving the door open to a retest of lower levels. The dynamic underscores a broader tension between bullish sentiment that sparked a recent rally and a risk-off mood that has crept into crypto trading.

Key takeaways

- Professional traders are paying a 13% premium for downside protection as Bitcoin struggles to maintain support above $66,000.

- While stocks and gold remain resilient, $910 million in Bitcoin ETF outflows since Feb. 11 signal rising institutional caution amid macro uncertainty.

- Put options dominated Deribit activity, with bear diagonal spreads, short straddles and short risk reversals among the most traded strategies in the last 48 hours.

- The delta skew between put and call options remained unconventionally bearish, suggesting traders are hedging against downside moves rather than betting on immediate upside.

- Stablecoin dynamics point to modest outflows, with a 0.2% discount to parity relative to USD/CNY, improving from a prior 1.4% discount.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. A break below key support and persistent hedging pressure hint at further near-term softness for Bitcoin.

Trading idea (Not Financial Advice): Hold. The market backdrop remains tethered to macro cues and evolving ETF flows, so a cautious stance is warranted until clearer catalysts emerge.

Market context: The narrative surrounding Bitcoin is increasingly entwined with broader liquidity concerns, risk sentiment shifts, and ETF flow dynamics that continue to influence institutional exposure amid a volatile macro environment.

Why it matters

For market participants, the current configuration—soft price ceilings around $71,000 giving way to a test of the lower band near $66,000, alongside a persistent premium on downside hedges—highlights a fragile balance between optimism and risk management. The 13% delta skew in put versus call options signals that professional traders are prioritizing protection over speculative bets, which can compress upside opportunities if selling accelerates. This is not merely a Bitcoin story; it reflects how institutions are sizing risk in a backdrop of mixed signals from equities, precious metals, and cross-asset liquidity conditions.

The ETF backdrop compounds the narrative. With US-listed Bitcoin ETFs recording about $910 million in net outflows since Feb. 11, traders are re-evaluating the appetite of large funds to hold or add exposure through traditional wrappers. While broad U.S. equities and gold have shown resilience, crypto-specific demand appears tempered, underscoring the pace at which macro concerns can seep into digital-asset markets. The dislocation between crypto price action and broader risk assets underscores a broader market mood: crypto remains highly sensitive to capital allocation shifts, even as some macro indicators remain supportive for risk-taking in other sectors.

In this environment, traders are not simply playing for a bounce; they are positioning for a potential downside scenario without incurring significant upfront costs. The behavior of the Deribit order book—where bear diagonals, short straddles, and short risk reversals dominated activity in the last 48 hours—illustrates a risk-off posture that seeks to profit from limited price movement in Bitcoin while capping potential losses if liquidation accelerates. The strategy mix effectively lowers the upfront cost of a bearish bet while exposing traders to the risk of a sharp decline, a combination that speaks to growing caution rather than outright pessimism about a rapid collapse.

Beyond price action, the stablecoin channel offers another lens into market sentiment. A 0.2% discount relative to USD/CNY—versus a neutral 0.5% to 1% premium expected under normal conditions—points to moderate outflows or a cautious stance on offshore capital flows. This dynamic can reflect tighter risk appetite in the near term, even as on-chain activity and other on-ramp/off-ramp metrics present a more nuanced picture. The comparison to a prior 1.4% discount earlier in the week signals a partial stabilization, yet it remains a reminder that stablecoin markets often act as a liquid proxy for risk tolerance amid turbulent conditions.

The ETF dynamic remains central to the narrative. While the broader macro environment has not collapsed, crypto-specific inflows have cooled, suggesting that institutional demand for Bitcoin via exchange-traded vehicles is not currently robust enough to sustain a bullish tilt. In parallel, reference to industry coverage suggests that Bitcoin ETFs still sit on substantial net inflows overall—though not enough to offset the near-term outflows and price softness—highlighting a tension between longer-term demand signals and short-term sentiment shifts.

As the market digests these signals, a key question remains: will Bitcoin defend the $66,000 floor, or will sellers reassert control and push the price toward the next set of targets? The answer may hinge on a confluence of factors, including upcoming options activity, regulatory developments, and macro catalysts that can alter the risk calculus for institutions. In the near term, the balance of evidence points to a cautious posture among traders, with hedges and selective exposure dominating the narrative rather than broad-based buying appetite.

Overall, the current environment underscores the complexity of pricing risk in a market where crypto-specific headlines can swing quickly, while cross-asset indicators offer a more tempered read. The juxtaposition of a resilient stock market and a fragile crypto setup creates a dynamic in which investors may rotate away from high-beta crypto exposure until a clearer catalyst emerges. In this sense, Bitcoin’s fate in the weeks ahead will likely depend as much on external liquidity and macro cues as on internal crypto-specific developments, with options markets acting as a barometer for the evolving risk appetite among sophisticated participants.

What to watch next

- Watch Deribit option flows and delta skew in the coming days for signs of renewed hedging or a shift toward riskier bets.

- Monitor Bitcoin ETF net flows over the next two weeks to gauge institutional appetite and potential catalysts for price moves.

- Track stablecoin market dynamics (premium/discount to USD) as a proxy for offshore risk sentiment and liquidity conditions.

- Assess macro catalysts (regulatory developments, inflation data, or Fed commentary) that could reframe risk appetite for crypto assets.

SOURCES & verification

- Deribit option activity and delta skew data cited in Laevitas data (bear diagonal spreads, short straddle, short risk reversal as top strategies over the past 48 hours).

- Stablecoin premium/discount relative to USD/CNY data (OKX) as an indicator of on-chain/FX-related risk flows.

- $910 million in total outflows from US-listed Bitcoin ETFs since Feb. 11; reference to recent ETF flow coverage.

- Bitcoin ETF inflow/outflow context and comparisons to gold and the S&P 500 performance as macro backdrop.

- Bloomberg report noting that Bitcoin ETFs still sit on $53B in net inflows despite recent outflows (as a broader ETF context).

Bitcoin options reflect risk-off mood as ETF outflows weigh on price

Bitcoin (CRYPTO: BTC) is moving in a cautious mode as buyers struggle to push through the $71,000 barrier, with the asset testing the lower support near $66,000. The latest data indicates that professional traders are prioritizing downside hedges, evident in the premium paid for put options and the selective use of bearish strategies on Deribit. In a market where equities and bullion have shown resilience, crypto traders appear to be prioritizing risk management over speculative bets, a stance reinforced by notable ETF outflows and a cautious stance toward new positions.

The premium structure in the option market—specifically a 13% put premium relative to calls on a recent trading day—suggests a market not confident in a rapid revival of momentum. This condition aligns with the broader narrative of risk-off sentiment, where hedges are favored as a way to mitigate the potential for a sharper drawdown should volatility spike or macro catalysts disappoint. The existence of bearish formations such as bear diagonals, short straddles, and short risk reversals among the most active trades over the last two days further underscores a cautious posture among institutional participants who are navigating a delicate balance between preserving capital and seeking incremental exposure.

The ETF story adds another layer of nuance. With $910 million in net outflows since Feb. 11, the flow data reflects a degree of institutional hesitation that cannot be fully explained by price alone. While gold and the broader stock market have been robust, crypto-specific demand appears to be cooling, at least in the near term. The divergence between crypto price action and the appetite of large funds to deploy capital in standard wrappers is a telling indicator of how investors are reassessing risk in a landscape where cross-asset liquidity can tighten quickly, especially in times of macro uncertainty.

On stablecoins, a modest 0.2% discount to parity relative to USD/CNY signals a transitional phase in which cross-border liquidity and currency controls influence how capital moves in and out of crypto markets. That said, the improvement from a prior 1.4% discount suggests some stabilization, but it remains to be seen whether this will translate into stronger on-chain demand or simply reflect a temporary reprieve in selling pressure.

For the broader market, the “risk-off but not outright bearish” stance in Bitcoin contrasts with the relative strength seen elsewhere. A comparison of market conditions suggests that the crypto sector remains more reactive to liquidity flows and sentiment shifts than to standalone fundamental catalysts. This dynamic can produce outsized volatility within short windows, even as longer-term macro considerations remain in flux. Investors and traders alike should stay vigilant for any shifts in ETF flows, option activity, or regulatory signals that could reconfigure the risk premium embedded in BTC and related instruments.

Crypto World

China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and PEPE By the End of 2026

Running a well-crafted prompt through Alibaba AI model KIMI can surface some eye-opening 2026 price scenarios for XRP, Shiba Inu, and Pepe.

According to Alibaba’s outlook, all three digital assets could generate substantial returns by New Year, perhaps much sooner than investors expect.

Below is a closer look at the projections and the logic behind them.

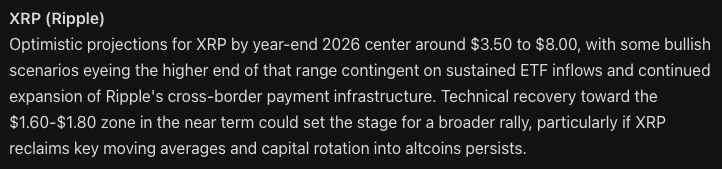

XRP ($XRP): Will Ripple’s Payments Solution Hit $8?

In a recent statement, Ripple once again emphasized that XRP ($XRP) sits at the heart of its strategy to position the XRP Ledger as a globally scalable, enterprise-grade payments infrastructure.

Thanks to near-instant transaction settlement and ultra-low fees, XRPL has also gained traction as a preferred blockchain for two of crypto’s fastest-expanding sectors: stablecoins and tokenized real-world assets.

With XRP currently changing hands around $1.41, Alibaba forecasts that the token could reach as high as $8 by the end of 2026, a sixfold increase from today’s levels.

Technical indicators appear to support this scenario. XRP’s recent support and resistance lines for a bullish flag, which could be a precursor to a major rally.

Potential tailwinds include accelerating institutional demand following the approval of U.S.-listed XRP exchange-traded funds, Ripple’s growing roster of enterprise partners, and the possible advancement of the U.S. CLARITY bill later this year.

Shiba Inu (SHIB): Alibaba Think SHIB Will Grow 850% by Christmas

Shiba Inu ($SHIB), launched in 2020 as a lighthearted alternative to Dogecoin, has since matured into a sizable crypto ecosystem with a market cap of $3.6 billion.

Currently trading around $0.000006187, Alibaba’s analysis suggests that a decisive breakout above resistance in the $0.000025 to $0.00003 range could trigger a strong upside move, potentially lifting SHIB to $0.000059 by year-end.

Such a rally would equate to approximately 850% gains from current prices and place SHIB just below its October 2021 ATH of $0.00008616.

Additionally, Shiba Inu has expanded well beyond meme status. Its Layer-2 network, Shibarium, delivers faster transactions, lower fees, added privacy features, and improved developer tools.

Pepe ($PEPE): Alibaba Examines a 2,200% Bull Case

Pepe ($PEPE), which debuted in April 2023, has grown into the largest meme coin outside the doge category, boasting a market capitalization of roughly $1.8 billion.

Drawing inspiration from Matt Furie’s “Boy’s Club” comics, PEPE’s instantly recognizable branding and cultural relevance have kept it highly visible across social media platforms.

Despite fierce competition in the meme coin arena, PEPE’s dedicated community, and the countless imitators it has spawned, have helped it remain a consistent leader within the sector.

Occasional cryptic posts from Elon Musk on X have further fueled speculation that PEPE could sit alongside DOGE and BTC among his personal holdings.

At present, PEPE trades near $0.0000042, roughly 85% below its December 2024 ATH of $0.00002803.

Under Alibaba’s most bullish assumptions, PEPE could surge by as much as 2,233%, climbing to approximately $0.000098 and decisively breaking its previous record.

Maxi Doge: A New Meme Coin Contender Steps Into the Spotlight

Limited by their size, PEPE and SHIB’s potential gains might be substantial, but they’re just short of explosive.

However, Maxi Doge ($MAXI) hasn’t even launched yet and it’s already one of the most talked-about meme coins of 2026, raising $4.6 million in its ongoing presale.

The project revolves around Maxi Doge, a brash, gym-obsessed, unapologetically degen character portrayed as a distant cousin and would-be rival to Dogecoin’s crown, capturing the raw, DGAF energy that defined the 2021 meme coin boom.

MAXI is an ERC-20 token on Ethereum’s proof-of-stake network, giving it a significantly smaller environmental footprint than Dogecoin’s proof-of-work design.

Early presale participants can currently stake MAXI tokens for yields of up to 68% APY, with rewards tapering as more users join the staking pool.

The token is $0.0002804 in the current presale stage, with automatic price increases programmed at each funding milestone. Purchases are supported via MetaMask and Best Wallet.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Maxi Doge Website Here

The post China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and PEPE By the End of 2026 appeared first on Cryptonews.

Crypto World

Base’s Shift Away From Optimism Raises Questions About Superchain’s Future

Analysts told The Defiant that the move tests whether Optimism’s shared revenue model is sustainable in the long term.

Base’s decision to move away from the OP Stack to a unified software stack is raising questions about the long-term economics behind Optimism’s Superchain model.

The OP Mainnet, which is powered by the OP Stack, is currently the third-largest Ethereum Layer-2 by total value locked (TVL) at $1.84 billion, per L2beat.

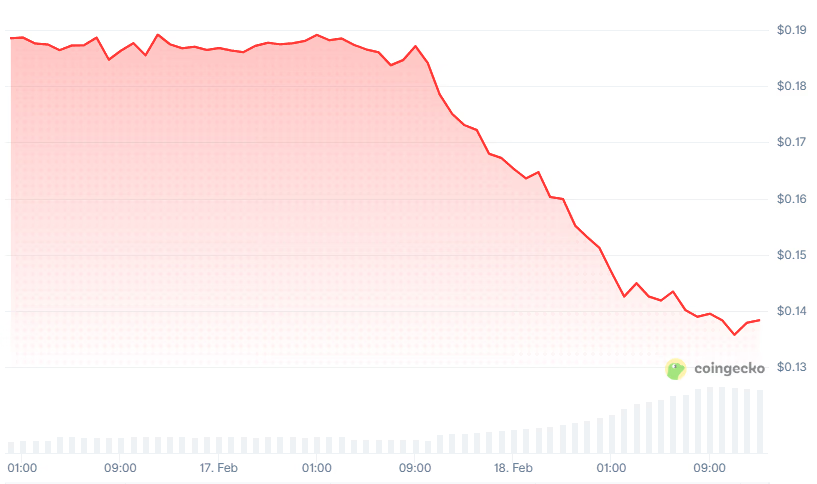

OP, Optimism’s native token, is currently trading at around $0.14, down 26% over the past 24 hours, according to CoinGecko data. The sell-off followed a Wednesday, Feb. 18, blog post from Base – the Ethereum Layer-2 blockchain launched by Coinbase with a TVL of $3.8 billion – outlining plans to move away from Optimism’s software over the coming months.

Experts told The Defiant this move matters because Base is the biggest network using Optimism’s technology. If Base steps away, it raises doubts about whether the Superchain can keep growing its shared revenue over time.

Optimism’s Superchain Model

Under Optimism’s Superchain model, chains that join agree to share a small portion of their fees with the Optimism Collective, according to an official Optimism blog post from 2024. Specifically, each chain sends back either 2.5% of its chain revenue or 15% of its on-chain profits (after costs and gas fees), whichever is higher.

Because Base has been one of the busiest rollups, it was widely seen as one of the biggest contributors to this shared pool.

“Base moving away from the OP Superchain isn’t that surprising when you look at the incentives,” said Shresth Agrawal, CEO of Pod Network. “Base was reportedly contributing around 97% of the revenue, so at some point the ‘Superchain tax’ becomes hard to justify.”

Nicolai Sondergaard, a research analyst at Nansen, told The Defiant that Base was processing roughly four times more transactions than Optimism, generating about 144 times more decentralized exchange (DEX) volume, and producing 80 times more gas fees.

“The ~26% crash in OP (now around $0.14) is the market repricing the whole Superchain thesis,” Sondergaard added. “If Coinbase’s Base, the flagship OP Stack chain, is leaving to build their own stack, why would anyone else stay and share revenue?”

However, Agrawal said that the broader issue, in his opinion, is licensing. “The OP Stack became the default L2 framework partly because it embraced open-source norms,” Agrawal explained. “But fully permissive licenses make monetization difficult—large, well-distributed players can fork or internalize the stack without long-term revenue sharing.”

He pointed to alternatives such as business-style licenses (similar to Arbitrum’s early approach), which he said may be harder to adopt at first but could prove more commercially sustainable.

“Main Revenue Driver”

Meanwhile, Oxytocin, head of ecosystem at Umia and a former Optimism governance delegate, explained to the Defiant that rollup partnerships like Base are integral to Optimism’s long-term revenue narrative.

“While this revenue would go directly to the Foundation as opposed to a token-controlled treasury, the value accrued through these kinds of deals with rollups was one of the main proposed revenue drivers,” Oxytocin said. “The timing of this announcement will also impact the effectiveness of the recently proposed OP buyback scheme.”

In January, the Optimism Foundation proposed a buyback program that would use 50% of incoming Superchain revenue to purchase OP tokens starting sometime in February. The plan is meant to better align the token’s value with the growth of the Superchain ecosystem.

Moving Forward

The Defiant reached out to Optimism for comment and was redirected to an X post by Jing Wang, the CEO of OP Labs and Co-founder of Optimism. “This is a hit to near-term on-chain revenues,” Wang wrote on Feb.18. “But as cryptotwitter has been saying for ages, we needed to evolve our biz model.”

Wang added that the OP Stack remains the “most performant” and has “endured the most traffic in production,” regardless of Base’s fork. Data from DeFiLlama shows that the TVL in Optimism Bridge is $498 million, down sharply from its peak of around $5 billion in 2024.

In an official statement, Optimism said it was “grateful” for its three-year partnership with Base and that it will continue working with Base as an OP Enterprise customer “while they build out their independent infrastructure.”

The development also comes as Optimism is attracting new partners. On Wednesday, decentralized finance (DeFi) firm EtherFi said it plans to move its Cash accounts and card program from Scroll to Optimism’s OP Mainnet.

The move is expected to bring $160 million in TVL and more than 70,000 active cards to the network, The Defiant previously reported. Both companies described the move as a long-term partnership.

“While the recent news is a significant shakeup for many, I remain confident that OP Labs will be able to iterate on their value mission and continue attracting new members to the OP Stack, like the recent announcement from EtherFi,” Oxytocin concluded. “Optimism’s ethos has always been one of strong reflection and iteration, and they have proven many times in the past that they are able to re-align their roadmap as needed.”

Crypto World

Bitcoin’s record monthly losses; history says a brewing turnaround

Bitcoin is sculpting what could become a five-month red stretch, a pattern that would mark the longest losing run for the largest crypto asset since the 2018 bear market. With BTC down about 15% this month after four consecutive negative closes, traders are weighing whether March might bring a contrarian turn. Data from CoinGlass underscores the current malaise, while some analysts point to historical precedents suggesting a relief rally could follow a protracted drawdown. Yet others caution that the narrative this time could be structurally different, complicating parity between history and the present price action.

Key takeaways

- Bitcoin is on its fifth straight red monthly candle, placing it on the longest losing streak since 2018 if the pattern persists into March.

- Historical analogs show that multi-month declines have sometimes been followed by substantial rallies, with Milk Road suggesting as much as a 316% gain over the next five months if history repeats.

- A potential reversal could begin as early as April 1, according to an analyst-led interpretation of prior cycles.

- In 2022, BTC endured four consecutive red quarters, culminating in a 64% annual drawdown and a year-end close near $16,500 after opening near $46,230.

- Some market voices argue the current bear market is fundamentally different, pointing to RSI behavior and other indicators that diverge from prior cycles, complicating traditional bottoming expectations.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Neutral. While patterns hint at a possible rebound, no definitive price move is confirmed yet.

Market context: The Bitcoin narrative sits amid a broader backdrop of historic drawdowns, with weekly and quarterly signals suggesting a mixed path ahead. Analysts note that the current bear period may not mirror past cycles, even as the same asset class contends with macro and liquidity dynamics that shape risk appetite across crypto markets.

Why it matters

The persistence of downbeat monthly candles keeps a number of questions at the forefront for investors and builders alike. If Bitcoin’s streak ends in the near term, it could validate a patience-driven approach in a market where volatility remains a defining feature. The potential for a sizable rebound — should the cycle mirror past recoveries — would have implications for institutional engagement, risk management, and the development of on-chain infrastructure that often aligns with price cycles.

From a risk-management perspective, the divergence between monthly patterns and weekly or quarterly signals matters. While a five-month red run would align with the memory of 2018’s late-stage bear, the more nuanced pattern observed in 2022 — four red quarters culminating in a brutal annual drawdown — suggests that the bottoming process can be uneven and drawn out. This nuance is essential for traders who rely on calendar-based expectations, as opposed to a purely price-driven narrative. The discussion around whether the bear is structurally different adds another layer to how market participants interpret leverage, liquidity provisioning, and hedging strategies within the crypto ecosystem.

Analysts emphasize that a bottom is not a singular event but a process that unfolds across multiple timeframes. The contrast between longer, slower-moving monthly candles and shorter, more volatile weekly candles can produce whipsaws or false signals, challenging even seasoned traders. The current discourse also highlights how historical reference points can both illuminate potential paths and mislead when the fundamentals have shifted — for example, the RSI, a widely watched momentum indicator, is said to be at levels that resemble prior bear-market lows, which some observers interpret as either a cap on upside or a prelude to a reversal depending on the broader setup.

In practical terms, this means market participants should remain vigilant for changes in liquidity conditions, risk sentiment, and macro drivers that influence appetite for risk across crypto assets. The evolving narrative around whether this bear is “different” matters not just for price trajectories but for how developers, investors, and miners approach long-horizon planning, supply dynamics, and the deployment of new financial products tied to BTC exposure.

What to watch next

- Monitor April 1 as a potential pivot point if the historical pattern repeats, with attention to whether the fifth red month translates into a sustained rebound.

- Track weekly candle formations and RSI behavior for signs of a bottom or renewed downside pressure.

- Follow commentary around the notion that the current bear cycle is fundamentally different, to assess whether this changes risk management and capital allocation approaches.

- Observe any shifts in macro sentiment and liquidity that could influence BTC’s risk-on/risk-off dynamics in the near term.

Sources & verification

- CoinGlass data on Bitcoin’s fifth consecutive red month and the 15% monthly decline.

- Milk Road analysis and X post citing the potential 316% upside over the next five months if history repeats, with an April 1 timeframe mentioned.

- Historical quarterly performance in 2022 showing four red quarters and a 64% annual drawdown, as contextualized by on-chain and price-history analysis.

- Analyst commentary noting a potentially different bear market structure in 2026 relative to prior cycles, as discussed by market observers.

- Solana Sensei’s chart discussion focusing on Bitcoin’s weekly performance and the persistence of a five-candle streak.

Bitcoin’s latest drawdown and what it changes

Bitcoin (CRYPTO: BTC) finds itself at a crossroads as a fifth consecutive monthly red candle looms, a scenario that would mark the longest such streak since the 2018 downturn. CoinGlass’s data frames the cue: BTC has declined around 15% this month after finishing the four preceding months in the red. The most notable parallel in recent history is the 2018 bear, a period that preceded a protracted decline before a multi-times rally years later. This context frames the current debate: are we approaching a traditional bear-market bottom, or is this cycle signaling a new regime with different dynamics?

Within this debate sits a striking counterpoint from Milk Road, which highlighted that prior episodes of extended debits often culminated in powerful rallies. The analysis notes a potential 316% gain in the subsequent five months if the pattern repeats, with an initial pivot anticipated around early April. While such projections draw on historical analogs, they do not guarantee future outcomes, and market participants remain mindful of the speed and scale of moves that can occur in crypto markets. The possibility of a rapid reversal exists, but it is contingent on a confluence of favorable conditions that historically have proven elusive to time with precision.

The 2022 bear period adds another layer of caution. That year, BTC endured four consecutive red quarters, culminating in a total drawdown of roughly 64% as the price collapsed from a starting point near $46,230 to around $16,500 by year-end. The stark difference between that season and the present has led some to question whether history offers a reliable playbook for all cycles. In a broader sense, the bear narrative for 2026 has permeated analysis, with voices warning that a similar stretch could push prices toward new lows if macro and liquidity conditions deteriorate further. One linked discussion even imagines a scenario where the decline might extend below the 15-month support band near $60,000, underscoring the potential for further downside if selling pressure intensifies.

Within the microstructure, weekly performance has drawn the attention of traders as well. A well-known analyst in the space highlighted that Bitcoin printed its fifth consecutive weekly down candle, marking the longest such streak since 2022 and positioning it as the second-longest losing run on record. The 2022 period saw nine red weeks and a descent to around $20,500, illustrating how abrupt and protracted declines can be, even after substantial drawdowns. The interplay of monthly, weekly, and quarterly signals underscores the challenge of diagnosing a bottom with a single timeframe in mind and highlights the risk of misreading the onset of a durable recovery.

Beyond the numbers, a divergence in narrative is shaping market sentiment. Veteran analyst Sykodelic argues that the current bear phase is fundamentally different from earlier cycles, pointing to the monthly RSI having already touched levels associated with prior bear-market lows in 2015 and 2018. The assertion is that the absence of a classic overbought expansion in the bull phase can complicate expectations of symmetric contractions. In other words, traders may be dealing with a regime where the typical playbook fails to capture the full complexity of price action, making caution and disciplined risk management all the more important as the market tests key psychological and technical thresholds.

All of this occurs as broader market narratives evolve around risk tolerance and the appetite for crypto exposure. The tension between potential upside and the risk of renewed downside remains a core feature of the current price environment. For market participants, the central question is whether the repeated red candles are signaling a deeper pattern or simply a fraught interim phase that could resolve in a relatively swift re-pricing if buyers step back in with confidence. The answer will likely hinge on a mix of on-chain signals, liquidity conditions, and macro developments that influence whether BTC can sustain any rally beyond a few weeks or months.

What to watch next

- April 1 as a potential inflection point if the historical pattern repeats, with close attention to price action in the days that follow.

- Confirmation signals from weekly candles and RSI stabilization, which could indicate a bottoming process even amid ongoing volatility.

- Shifts in risk sentiment and liquidity that may tilt BTC toward a risk-on or risk-off regime in the near term.

Crypto World

Bitcoin $60K Retest Odds Rise As Bearish Options, ETF Outflows Show Fear

Key takeaways:

-

Professional traders are paying a 13% premium for downside protection as Bitcoin struggles to maintain support above $66,000.

-

While stocks and gold remain strong, $910 million in Bitcoin ETF outflows suggest that institutional investor caution is rising.

Bitcoin (BTC) price entered a downward spiral after rejecting near $71,000 on Sunday. Despite successfully defending the $66,000 level throughout the week, options markets reflect growing fear as professional traders avoid downside price exposure.

Even with relative strength in the stock market and gold prices, traders seem to be effectively betting on a $60,000 retest rather than overreacting to Bitcoin price dips.

Bitcoin put (sell) options traded at a 13% premium relative to call (buy) instruments on Thursday. Under neutral conditions, the delta skew metric typically ranges between -6% and +6%, indicating balanced demand for upside and downside strategies. The fact that these levels have been sustained over the past four weeks shows that professional sentiment is leaning heavily toward caution.

This bearish bias is clear in the neutral-to-bearish positioning seen in Bitcoin options. According to Laevitas data, the bear diagonal spread, short straddle and short risk reversal were the most traded strategies on the Deribit exchange over the past 48 hours.

The first lowers the cost of the bearish bet because the short-term option loses value faster, while the second maximizes profit if Bitcoin price barely moves. The short risk reversal, on the other hand, generates profit from a downward move with little to no upfront cost, but it carries unlimited risk if the price spikes.

Weak institutional demand for Bitcoin ETFs fuels discontent

To better gauge the risk appetite of traders, analysts often look at stablecoin demand in China. When investors rush to exit the cryptocurrency market, this indicator usually drops below parity.

Under neutral conditions, stablecoins should trade at a 0.5% to 1% premium relative to the US dollar/Yuan exchange rate. This premium compensates for the high costs of traditional FX conversion, remittance fees and the regulatory friction caused by China’s capital controls. The current 0.2% discount suggests moderate outflows, though this is an improvement from the 1.4% discount seen on Monday.

Part of the current discontent among traders can be explained by the lackluster flows in Bitcoin exchange-traded funds (ETFs), which serve as a proxy for institutional demand.

Related: Bitcoin ETFs still sit on $53B in net inflows despite recent outflows–Bloomberg

US-listed Bitcoin ETFs have seen $910 million in total outflows since Feb. 11, which likely caught bulls off balance, especially as Bitcoin traded 47% below its all-time high while gold prices hovered near $5,000, up 15% in just two months. Similarly, the S&P 500 index sat only 2% below its own all-time high, indicating that this risk-aversion is largely restricted to the cryptocurrency sector.

While Bitcoin options signal a fear of further downside, traders are likely staying extremely cautious until a clear rationale for the crash to $60,200 on Feb. 6 finally emerges.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Ethereum Foundation Flags Post-Quantum Security as Core Priority in 2026 Protocol Roadmap

Ethereum developers plan major protocol changes in 2026, combining scaling, security hardening, and UX improvements following last year’s network upgrades.

The Ethereum Foundation said it will prioritize post-quantum security and further increases to the gas limit as part of its protocol roadmap for 2026.

The organization is also restructuring its development efforts into three core tracks covering scaling, user experience, and Layer 1 security.

Three-Track Protocol Overhaul

On Wednesday, the Foundation said Ethereum’s next phase will focus on expanding network capacity while ensuring long-term security and resilience. Gas limit increases also remain a central objective, following a rise from 30 million to 60 million over the past year. Developers are now targeting a move toward and beyond 100 million gas per block.

Post-quantum readiness was identified as a crucial consideration across multiple areas of protocol development, amidst growing attention to cryptographic security as quantum computing capabilities advance. The Foundation said its protocol work in 2026 will be organized into three tracks – Scale, Improve UX, and Harden the L1.

The “Scale” track combines work previously split between Layer 1 execution scaling and blob data availability. This track will oversee continued gas limit increases supported by client benchmarking and block-level access lists, further blob parameter increases following recent upgrades, and delivery of scaling components planned for the Glamsterdam network upgrade. It will also advance state scaling efforts, including near-term repricing and history expiry, and longer-term plans for statelessness and new data structures.

The “Improve UX” track will focus on protocol-level changes that aim to simplify how users interact with Ethereum. Focus will also be on native account abstraction and interoperability. Building on EIP-7702, which allows externally owned accounts to temporarily execute smart contract code, developers are working toward making smart contract wallets the default without relying on additional infrastructure or incurring extra gas overhead.

The Foundation said this work also intersects with post-quantum readiness, as native account abstraction provides a pathway for transitioning away from ECDSA-based authentication. Efforts to improve interoperability will continue through the Open Intents Framework, in addition to progress on faster Layer 1 confirmations and shorter Layer 2 settlement times.

You may also like:

The “Harden the L1” track introduces a dedicated focus on preserving Ethereum’s core properties as the network scales. This includes security initiatives such as post-quantum readiness and execution-layer safeguards, research into censorship resistance for transactions and blob data, and expanded testing infrastructure to support a faster upgrade cadence. The Foundation said work on devnets, testnets, and client interoperability will remain critical as protocol changes are deployed more frequently.

Looking Ahead

Meanwhile, Glamsterdam is targeted for the first half of 2026, according to the update shared by the Ethereum Foundation. Additionally, the Hegotá upgrade is planned for later in the year.

These upgrades are expected to include higher gas limits, continued blob scaling, enshrined proposer-builder separation, and further progress on native account abstraction, censorship resistance, and post-quantum security.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Active Supply Plateaus as Price Volatility Fades

Quiet networks and idle supply point to social demotivation, which often appears before sentiment and price narratives flip.

Bitcoin has been trading around the mid-$60,000s after losing significant ground from its late-2025 highs. It has failed to reclaim the psychologically crucial $70,000 threshold despite several attempts.

On-chain activity of the world’s largest cryptocurrency and blockchain is showing signs of stagnation, according to data shared by Alphractal.

Bearish Divergence Builds

The firm reported that Bitcoin’s active supply has stopped growing, which indicates that fewer BTC are moving across the network, and overall activity has slowed. The latest decline goes beyond market structure and reflects ” global human behavior,” as weaker prices and rising uncertainty have made participants less willing to act.

Alphractal explained that holders are increasingly keeping coins idle, which has resulted in a quieter network. This phase is being described as “social demotivation” on-chain, amid emotional fatigue, reduced engagement, and a lack of conviction. Such changes in behaviour often surface before broader market narratives change.

Santiment’s data also reported a sharp deterioration in Bitcoin’s network activity compared with 2021 levels, with 42% fewer unique BTC addresses making transactions and 47% fewer new addresses being created. These trends do not mean crypto is “dead” or that a multi-year bear market is inevitable. However, the analytics platform did highlight a clear bearish divergence developed throughout 2025, as total market capitalizations continued to reach new highs even as BTC’s on-chain utility declined.

Whale Accumulation Accelerates

Even as on-chain participation has slowed, accumulation by large BTC holders has accelerated. Bitcoin whale accumulation has increased by more than 200,000 BTC in recent weeks. While whale inflows to exchanges have picked up, a trend often linked to short-term selling, overall whale holdings have continued to rise.

To assess behavior over a longer timeframe, CryptoQuant tracks whale-held supply using monthly averages rather than short-term flows. This metric dropped sharply to nearly minus 7% on December 15 but has since reversed, as whale holdings increased by 3.4% over the past month.

You may also like:

During this period, the amount of Bitcoin held by whales grew from around 2.9 million BTC to more than 3.1 million BTC. CryptoQuant observed that a similar scale of accumulation last occurred during the April 2025 market correction, when whale buying helped absorb selling pressure and boosted the BTC rally from $76,000 to $126,000. With Bitcoin being 46% below its peak, the current level could be encouraging some large holders to accumulate.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

SEC Chair Paul Atkins Says Regulators Should Not Panic Over Falling Crypto Prices

Rather than reacting to market drops, Paul Atkins signaled regulators are prioritizing crypto frameworks over price stabilization efforts.

U.S. Securities and Exchange Commission (SEC) Chair Paul Atkins has said that regulators should not panic over falling crypto prices, pushing back against calls for emergency intervention as Bitcoin (BTC) slipped toward $66,000.

The remarks signal the SEC’s intent to focus on structural rulemaking rather than market volatility, offering a roadmap for tokenized securities while dismissing short-term price action as irrelevant to the agency’s mission.

Regulators Address Market Downturn With Policy Agenda

Speaking at ETHDenver on February 18 with Commissioner Hester Peirce, Atkins acknowledged the market’s recent slide but rejected the idea that the SEC should respond to price swings.

“It is not the regulator’s job to worry about the daily swings of the markets,” Atkins said. “People whose only focus is on the number always going up are likely to be disappointed.”

The comments come as crypto markets face sustained pressure, with Bitcoin trading near $66,000 at the time of writing, and analysts watching the $60,000 support level as a potential next test. Meanwhile, Ripple’s XRP dropped nearly 5% to $1.40, and Ethereum (ETH) fell back below $2,000. Some market watchers have warned of further downside, with Bloomberg Intelligence strategist Mike McGlone reiterating a bearish $10,000 Bitcoin forecast just days before Atkins’s speech.

But rather than address price action, the SEC Chair used the appearance to outline a series of regulatory initiatives under “Project Crypto,” a joint effort with the Commodity Futures Trading Commission (CFTC).

The agenda includes developing frameworks for crypto asset classification, crafting rules for tokenized securities trading on automated market makers, and issuing guidance on custody for non-security assets like stablecoins.

Building a Framework Beyond Market Cycles

The SEC’s approach reflects a deliberate shift away from the enforcement-heavy tactics of previous years. Atkins noted that the agency has already dropped numerous crypto cases, ended what critics called “regulation by enforcement,” and issued staff guidance on mining, staking, and meme coins.

You may also like:

On her part, Commissioner Peirce framed the current downturn as an opportunity for builders. “Numbers go down is the mantra of the moment,” she said, noting that some critics are engaging in “Schadenfreude” over crypto’s struggles.

But she argued that regulatory clarity alone does not create value.

“You have to build stuff that people want and need,” Peirce said. “That is the best way to garner support on both sides of the aisle in Washington.”

Atkins emphasized that the SEC’s rulebook should not be a barrier to innovation, encouraging developers to “come in and talk to us” and announcing plans for an “innovation exemption” to allow limited trading of tokenized securities on decentralized platforms.

The exemption would be temporary and include volume limits, designed to let market participants experiment while the agency develops permanent rules.

“Put your nose to the grindstone and work to build things that matter,” Atkins told the audience. “That is how you transform Schadenfreude to Freudenfreude—the sense of happiness we feel when others succeed.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

SocGen taps XRP-linked firm for expanding euro stablecoin

Societe Generale’s digital assets arm SG-FORGE has deployed its euro stablecoin, EUR CoinVertible, on the XRP Ledger, expanding beyond its existing integrations on Ethereum and Solana as competition heats up in Europe’s regulated stablecoin race.

EUR CoinVertible is issued under French digital asset rules and is backed 1 to 1 by cash deposits or high-quality securities. It has a circulating supply of roughly 65.8 million euros, per CoinGecko, making it one of the larger euro stablecoins in the market behind Circle’s EURC.

SG-FORGE said it chose the XRP Ledger for its low transaction costs and fast settlement, while Ripple’s custody infrastructure will be used to support the rollout. The stablecoin could eventually be explored as collateral for trading or integrated into Ripple’s payment-related products.

For XRPL, the listing is another institutional credibility win as the network positions itself as a compliant venue for tokenized finance. The launch lands just as XRPL validators have been voting on new upgrades such as Permissioned DEX, a feature meant to allow controlled trading environments where only approved participants can interact, a requirement for many regulated firms.

The stablecoin push also comes as blockchains compete to host tokenized deposits, bonds and settlement assets. For XRP itself, the news is more structural than price-driving, but it adds to the narrative that XRPL is trying to be more than a payments chain.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports20 hours ago

Sports20 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

-

Crypto World2 hours ago

Crypto World2 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market