CryptoCurrency

Complete Guide to AI-Powered Crypto Token Launchpad Development on XRP Ledger

Demand is rarely the problem in token launches. Success belongs to teams that prepare infrastructure capable of scaling when attention peaks. As investors become more selective, launchpads are expected to deliver fairness, transparency, and predictable execution, not just speed or hype. Static allocation models, manual controls, and congested networks introduce risks that serious capital no longer accepts.

This is why AI-powered crypto launchpads are quickly becoming the standard. Intelligence now sits at the core of allocation, participation quality, and launch performance. At the same time, teams are rethinking their infrastructure choices, favoring networks that offer consistent execution and cost stability. XRP Ledger is emerging as a strong foundation for this shift. Its reliable performance, low fees, and growing institutional adoption make it increasingly relevant for launchpads built to scale beyond early cycles. If you are designing a launchpad meant to attract serious capital and deliver repeatable outcomes, this guide shows what that architecture looks like and why it matters now.

Why XRP Ledger Is Becoming a Strategic Choice for Crypto Launchpads

For founders and investors assessing long-term infrastructure bets, XRP Ledger increasingly stands out as a network optimized for execution certainty rather than speculation. Token launches succeed or fail on reliability under pressure, and XRPL’s ability to finalize transactions in roughly 3 to 5 seconds, with consistently low fees near $0.0002, directly protects capital flow during high-demand events.

From an investment perspective, this predictability matters. Launchpads built on volatile fee environments expose projects to failed transactions, uneven allocations, and investor drop-off. XRPL removes that friction, allowing capital to move smoothly even when thousands of participants enter simultaneously. With native throughput around 1,500 transactions per second and proven stress-test performance far beyond that, the network supports growth without infrastructure bottlenecks.

Institutional adoption further strengthens the investment case. In 2025, partnerships involving DBS, Franklin Templeton, and Ripple brought tokenized money market funds and enterprise-grade stablecoins onto XRPL. Monthly stablecoin volumes exceeding $1 billion and daily transactions above 2 million signal sustained economic activity, not short-term hype. The XRP Ledger offers an AI-powered crypto token launchpad that enables the reduction of execution risk while supporting compliant, high-volume capital flows as launch activity increases. That combination lowers execution risk, improves investor confidence, and makes XRPL a practical foundation for launchpads built to attract long-term investment rather than speculative volume.

See what an AI-powered launchpad should look like at scale

Role of AI in Modern Crypto Launchpads

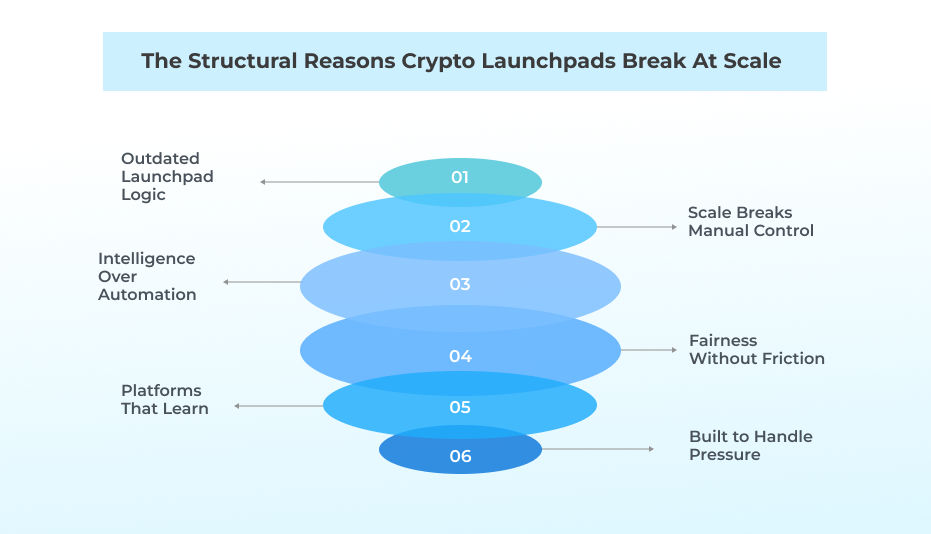

As token launches grow larger and more complex, the limitations of traditional launchpad models become impossible to ignore.

Most crypto launchpads were built for a time when demand was smaller, and participation was easier to manage. Static tiers, first-come, first-served mechanics, and simple whitelists struggle once launches attract global attention and heavy traffic in a short window. These models were never designed to protect fairness or stability when thousands of participants arrive simultaneously.

- Scale Breaks Manual Control

Modern token sales involve thousands of wallets interacting at the same time. Contribution timing, behavior patterns, and risk signals shift constantly. Manual oversight cannot keep up with this pace, which leads to unfair allocations, manipulation, and operational breakdowns during peak demand. This is a challenge every serious crypto development company encounters when building launch infrastructure at scale.

- Intelligence Over Automation

This is where Ai Launchpad development reshapes how launchpads function. Instead of executing fixed rules, the system continuously evaluates live data and adapts decisions as conditions evolve throughout the launch, making the platform resilient under pressure rather than reactive.

- Fairness Without Friction

Machine learning models assess wallet behavior, transaction history, and participation consistency to separate genuine users from automated or low-quality activity. This improves allocation fairness while preserving a smooth experience for legitimate participants, which is essential for long-term trust.

AI-driven launchpads improve with every launch. Each event generates new insights that refine allocation logic, demand modeling, and risk controls. Over time, the platform becomes harder to exploit and more predictable in its outcomes.

Manual systems tend to collapse when demand peaks. Intelligent systems are designed to absorb complexity, maintain stability, and protect launch outcomes when it matters most, which is why AI is now central to modern cryptocurrency development services.

Core System Architecture of an AI-Powered Launchpad on XRP Ledger

An AI-powered launchpad functions as a connected decision system rather than a set of isolated modules. Each layer feeds the next, enabling real-time adaptability and long-term improvement across multiple launches, which is now a baseline expectation in advanced cryptocurrency development services.

- Token Execution: Token creation, supply control, vesting logic, and distribution rules are anchored to XRP Ledger’s fast settlement and predictable execution. This foundation ensures reliability even when launch activity peaks, a requirement for any product built with long-term development goals in mind.

- Fundraising Flow: All contribution activity moves through a unified engine that manages caps, allocations, refunds, and settlements. Instead of enforcing fixed rules, this layer responds dynamically to live demand and participation behavior, enabling smoother execution during high-traffic token launches.

- Intelligence Layer: This is where AI token development reshapes how launchpads operate. Wallet activity, transaction timing, and participation patterns are continuously evaluated to guide allocation adjustments, participant prioritization, and bot resistance during the active launch period.

- Risk Controls: Jurisdiction checks, identity signals, and behavioral risk indicators operate alongside intelligence systems. This approach enables platforms to meet evolving compliance expectations without compromising the user experience, which is increasingly demanded by enterprises working with a seasoned launchpad development firm.

- Analytics & Insight: Post-launch data is translated into clear dashboards showing allocation outcomes, demand behavior, and performance trends. This transparency strengthens trust and supports long-term ecosystem planning for an AI-powered crypto token launchpad.

- Learning Loop: Each launch feeds new data back into the system. Over time, the platform becomes more accurate, resilient, and predictable, reinforcing the strategic advantage of investing in an AI launchpad when building scalable launch infrastructure.

Planning a launchpad? Validate your architecture before you build.

Use Cases That Directly Improve Launch Performance

AI-powered architecture proves its value only when it improves outcomes that founders and platforms actually care about, which is why modern AI-powered crypto token launchpads focus on a small number of high-impact use cases.

- Smarter Participant Quality Control

What changes:

AI evaluates wallet behavior, transaction history, and participation patterns to distinguish genuine contributors from bots and low-quality activity. This happens dynamically during the launch rather than through rigid pre-launch filters.

Why it matters:

Instead of blocking users with strict rules, the system quietly prioritizes higher-quality participants. This leads to healthier investor composition, reduced noise during the sale, and stronger post-launch engagement.

Business impact:

For teams investing in AI Launchpad development services, this approach delivers cleaner launches, lower manipulation risk, and a smoother experience for genuine participants.

- Adaptive Allocation Under Real Demand

What changes:

Allocaton logic adjusts in real time based on live demand signals and participant scoring, rather than relying on static tiers or fixed contribution formulas.

Why it matters:

When demand spikes, static systems encourage aggressive early extraction. Adaptive allocation spreads access more fairly and keeps launch dynamics stable even under pressure.

Business impact:

An AI-Powered crypto token launchpad built around adaptive allocation delivers more predictable outcomes, lower volatility, and greater confidence for both founders and investors.

Together, these two use cases form the backbone of effective AI-driven launch infrastructure. Rather than relying on assumptions or hype cycles, platforms built with intelligent decision layers operate on continuous insight and controlled execution. For founders building scalable platforms or enterprises launching multiple projects, this approach significantly reduces risk and improves consistency across every launch.

Conclusion

Building an AI-powered crypto token launchpad today is no longer about speed to market or surface-level features. It is a long-term infrastructure decision that directly impacts capital confidence, launch performance, and platform scalability. As investor expectations rise and regulatory and technical complexity increase, platforms built on predictable execution layers and intelligent systems gain a clear edge.

Choosing the right foundation, combined with AI-driven decision logic, reduces execution risk, improves allocation fairness, and supports consistent outcomes across multiple launches. For teams serious about scalable cryptocurrency development services and future-ready launchpad architecture, partnering with an experienced builder that understands both technology and market dynamics becomes the final differentiator. That is where execution, strategy, and long-term vision come together with Antier.

Frequently Asked Questions

01. Why do token launches fail if not due to weak demand?

Token launches often fail because the infrastructure cannot handle demand effectively, leading to risks associated with static allocation models, manual controls, and congested networks.

02. What advantages does the XRP Ledger offer for crypto launchpads?

The XRP Ledger provides reliable performance, low fees, and the ability to finalize transactions quickly, which helps protect capital flow during high-demand events and supports growth without infrastructure bottlenecks.

03. How does AI enhance the performance of crypto token launchpads?

AI enhances crypto token launchpads by improving allocation, participation quality, and launch performance, making them more reliable and appealing to serious investors.