Crypto World

XRP shorts dominate as funding drops 80% and OI falls

XRP slips below support as funding drops ~80% today on bearish leverage.

Summary

- XRP funding rate dropped nearly 80% on Thursday, signaling aggressive short bias and sustained downside positioning in derivatives markets.

- Open interest declined alongside negative funding, showing leveraged traders are de-risking as spot price trades below its short-term moving average and key Fibonacci support.

- XRP trends lower with RSI nearing oversold while crypto Fear & Greed prints “Extreme Fear” and BTC dominance climbs, pointing to rotation away from altcoins.

Daily XRP (XRP) funding rates declined nearly 80% on Thursday, February 19, according to derivatives market data, indicating continued pressure on the cryptocurrency.

Negative funding rates indicate that traders holding short positions are paying those maintaining long positions, a sign that bearish bets currently outweigh bullish exposure, according to market mechanics. The decline was accompanied by a drop in open interest, according to real-time data.

Negative funding rates suggest the market is positioned for further downside, as the metric reflects the balance between long and short traders.

Deeply negative funding can signal overcrowded positioning, according to market analysts. Historical data shows extreme short bias has sometimes preceded sharp reversals, particularly when price action stabilizes and short sellers are forced to cover positions. A prolonged negative funding environment marked a cyclical bottom for XRP in 2022 during the FTX collapse, according to historical market data.

XRP’s spot price showed a decline on the daily chart, falling below its short-term moving average and a key Fibonacci retracement level, which represents a loss of near-term support. The Relative Strength Index has fallen and is approaching oversold territory, according to technical indicators.

Market sentiment remains weak, reflected in an “Extreme Fear” reading on the Crypto Fear & Greed Index. Bitcoin dominance data suggests capital is consolidating into larger-cap assets rather than flowing into altcoins such as XRP, according to market metrics.

Technical analysts note that a recovery above the recent short-term resistance zone would signal price stabilization. Current short-term momentum favors bearish positions, as evidenced by the state of funding rates, according to derivatives market data.

Crypto World

Nexo’s Cumulative Credit Withdrawals Hit $863M All-Time High as Bitcoin Stabilizes

TLDR:

- Nexo’s cumulative credit withdrawals hit an all-time high of $863 million between 2025 and 2026.

- Weekly retail withdrawals on Nexo surged 107%, climbing from $6.73M to $13.92M in just one month.

- CryptoQuant’s Estimated Leverage Ratio reset to healthier levels, pointing to reduced systemic risk across crypto markets.

- Bitcoin’s stabilization near $67,000 is lowering collateral risks, making crypto-backed borrowing more practical for users.

Nexo’s cumulative credit withdrawals have reached an all-time high of $863 million between 2025 and 2026. This record arrives as Bitcoin stabilizes near $67,000 following a -48% correction between October and February.

The broader crypto market is now shifting from sharp repricing toward steady consolidation. Weekly retail borrowing on Nexo nearly doubled from December 2025 to January 2026. This renewed activity points to growing confidence among crypto-backed liquidity users.

Retail Credit Withdrawals Signal a Market Shift

Nexo’s retail credit withdrawals declined through most of 2025, reflecting a broad risk-off trend. Many clients moved to tighten their balance sheets as crypto prices fell sharply.

However, the pace slowed considerably in late 2025 and early 2026. This leveling off suggests that retail participants have mostly completed their balance sheet tightening.

Weekly retail withdrawals grew from $6.73 million to $13.92 million between December 2025 and January 2026. That jump represents approximately 107% growth in just one month.

The data shows borrowing demand returned quickly once market conditions began steadying. Clients are clearly more willing to access crypto-backed credit in the current environment.

CryptoQuant’s Estimated Leverage Ratio has also been resetting to healthier levels during this period. Declining leverage across the market often creates a foundation for more sustainable borrowing activity.

As excess leverage clears, participants tend to re-engage credit markets with renewed conviction. This broader trend aligns with the withdrawal data now emerging from Nexo.

Bitcoin’s stabilization near $67,000 plays a direct role in this borrowing recovery. A steadier price environment lowers the risk of rapid collateral liquidation for active borrowers.

When the leading cryptocurrency consolidates, crypto-backed lending becomes a more practical financial tool. Nexo users appear to be responding directly to this change in market conditions.

Cumulative Withdrawals and the Path to Renewed Confidence

Nexo’s $863 million in cumulative credit withdrawals reflects consistent demand across multiple market cycles. This figure covers borrowing activity through both bullish and bearish price periods.

It confirms that appetite for crypto-backed liquidity holds up even during extended corrections. The milestone speaks to the resilience of Nexo’s lending model over time.

Open interest across the broader crypto market has declined from prior highs. Funding rates are also normalizing, and liquidation volumes have been subsiding in recent weeks.

These conditions are typical of a market absorbing the final stages of a correction cycle. They create a more stable ground for platforms offering crypto-backed credit solutions.

Selling pressure around Bitcoin has also weakened noticeably in recent weeks. Reduced sell-side activity supports a more stable price for collateral-backed borrowers.

Borrowers on platforms like Nexo benefit directly when Bitcoin holds within a tighter price range. Credit activity tends to pick up naturally as volatility subsides.

Recent data from Nexo suggests the market may now be entering a new borrowing phase. Weekly withdrawal growth and cumulative figures together tell a coherent recovery story.

Borrowing demand is returning as the correction cycle winds down. The broader crypto credit market appears to be stabilizing after months of contraction.

Crypto World

Bitcoin Faces 5th Consecutive Red Month: Where Is The Bottom?

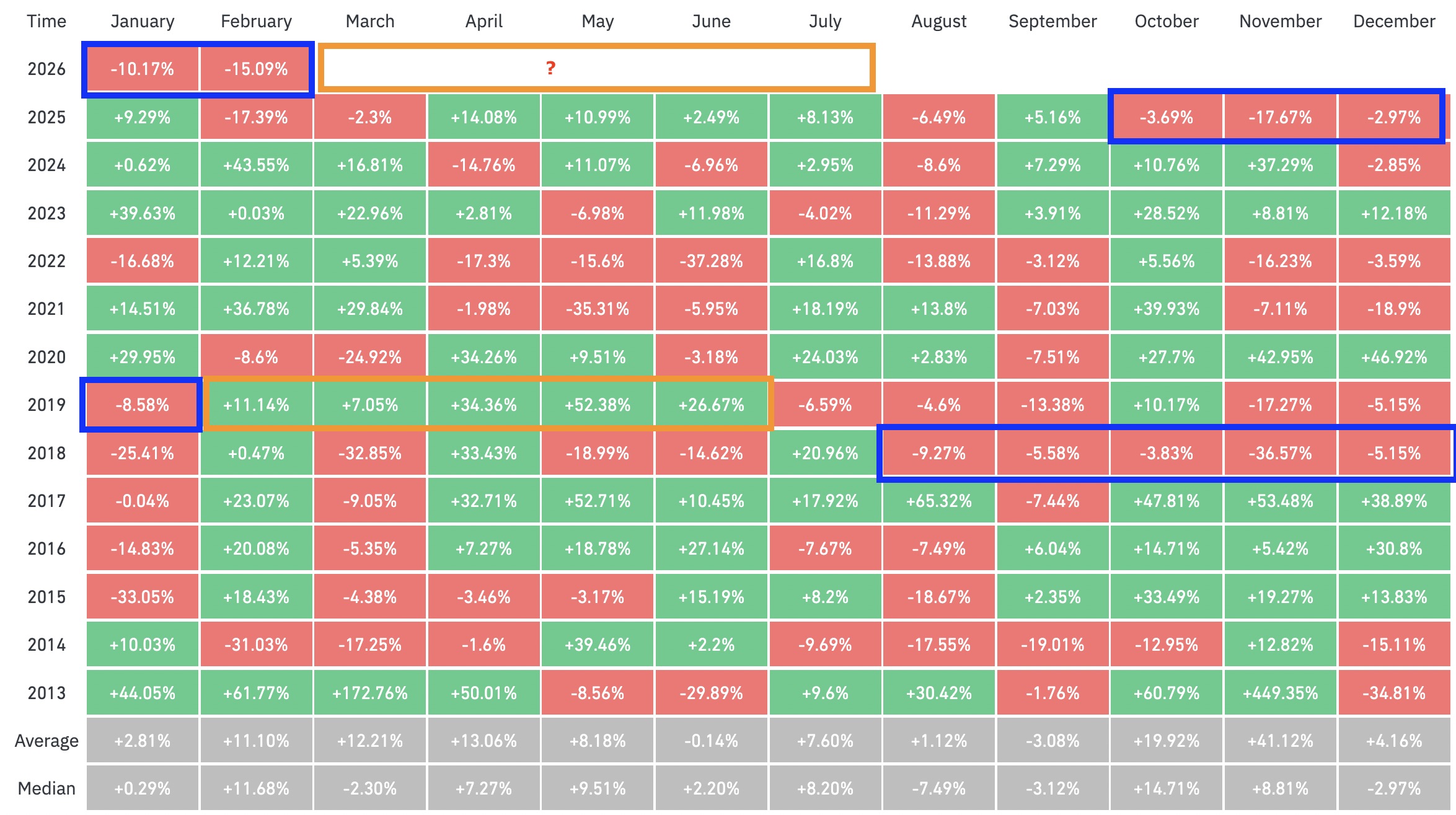

Bitcoin (BTC) is forming what may prove to be a fifth consecutive red monthly candle, which would be the longest losing streak since 2018. The silver lining is that data suggests that March may prove to be a profitable month for BTC.

Previous multimonth downtrends were followed by 300% price gains

Historical price data from CoinGlass confirms Bitcoin is now facing its fifth consecutive red month, down 15% this month after closing the previous four months in the red.

The last time this happened was in 2018, when it entered a bear market after reaching record highs in 2017.

“Last time this happened was in 2018/19 when we saw 6 red months,” analysts at macro investor outlet Milk Road said in an X post on Thursday.

This led to a reversal with over 316% returns over the following five months, the analysts said, adding:

“If history repeats, the reversal will begin on April 1st.”

Analyzing Bitcoin’s quarterly performance during the 2022 bear market provides a more cautious interpretation of BTC price history. The data shows Bitcoin recorded four consecutive red quarters during that year.

Losses stacked across the four quarters, bringing the total losses to 64% as the BTC/USD pair closed the year at $16,500 from an opening price of $46,230. This marked one of the harshest drawdowns in Bitcoin’s history.

As Cointelegraph reported, many analysts expect 2026 to be a bear market year, and a similar stretch of four losing quarters could extend the weakness below the 15-month low of $60,000.

Analyst Solana Sensei shared a chart that focused on Bitcoin’s weekly performance, with the price printing the fifth candlestick in a row.

This is the longest streak since 2022, making it the second-longest losing streak on record.

In 2022, BTC price saw nine red weeks, dropping to $20,500 from $46,800.

Therefore, while past monthly performance suggests an impending rebound, quarterly and weekly data from 2022 demonstrate that BTC price declines could last longer than expected.

Related: Bitcoin’s consolidation nears ‘turning point’ as $70K comes in focus: Analyst

The current market is “fundamentally different”

Veteran analyst Sykodelic argues that Bitcoin’s current bear phase is “fundamentally different” for several reasons, including the monthly relative strength index (RSI) having already reached the 2015 and 2018 bear market lows.

Sykodelic said that due to the lack of a true overbought expansion in the monthly RSI during the bull phase, market participants will be misguided to expect a symmetric contraction.

“This is yet again another situation in which we look a lot more like 2020 than any other period in time,” the analyst said in a post on X, adding:

“I am not seeing anything that tells me we are in the same style bear market as we have had previously, and everyone should be aware of these differences.”

This suggests the current bear cycle is not following historical patterns, and Bitcoin’s bottom and subsequent recovery could catch many traders off guard.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Trader Leaves Crypto Forever After Losing $10,000 in LIBRA

One year has passed since Argentine President Javier Milei backed a project that drove hundreds of thousands of people worldwide to invest in Libra, a meme coin that turned out to be a rug pull.

Alfonso Gamboa Silvestre, a 25-year-old from Chile, was among the many traders who suffered steep losses. The token’s launch and swift demise cost him $10,000. Since that moment, he has left the crypto industry for good.

A Presidential Endorsement That Drove a Buying Frenzy

On Valentine’s Day last year, Gamboa Silvestre was trading on his computer. The day seemed normal until a notification popped up on his phone from one of the many crypto groups he had on Telegram.

He opened the message, which read something along the lines of “Argentina’s president just launched a crypto token.” Gamboa Silvestre ran to X (formerly Twitter) to see whether it was true.

At first, he thought Milei’s account had been hacked. But after carefully reading the president’s verified tweet and the “Viva La Libertad Project” website he included, Gamboa Silvestre ruled out the possibility.

So he bought the token. In total, he invested $5,000.

“I made two purchases. First, a smaller one. When I was totally sure it was [Milei’s] tweet, I made a bigger one,” Gamboa Silvestre told BeInCrypto in an interview in Spanish.

After that, Gamboa Silvestre left the house to go out to dinner with his family, but he couldn’t keep his eyes off his phone. Libra’s price kept dropping, and he didn’t know what to do.

Choosing what looked best on the menu and averting his family’s worried gaze was hard enough, so he locked himself in the restaurant’s bathroom.

“At first I thought the token was going to go down, and then it was going to go back up to infinity,” Gamboa Silvestre said. “But that didn’t happen. I saw that it was going down and down, and my February 14th ended up being a nightmare.”

As investors began withdrawing their money en masse, so did Gamboa Silvestre. He ended up doubling his original investment in losses.

The event also marked his permanent exit from the crypto ecosystem.

From Active Trader To Complete Exit

Gamboa Silvestre first ventured into crypto in 2016, mostly out of curiosity. However, he began to take it seriously in 2022 and became an active trader.

The meme coin sector had treated him well at first.

Gamboa Silvestre was among the first investors in TRUMP and MELANIA, the two tokens launched by US President Donald Trump and First Lady Melania Trump less than 48 hours before Trump assumed the presidency.

He fared well for himself, and he believed that the story would be similar with Libra.

“I thought that, since Milei had been having different meetings with Donald Trump and Elon Musk, I said, well, this is going down the same path, they’re going to do things right, and I’m going to be able to make money with that,” Gamboa Silvestre recalled.

But things didn’t turn out that way. Besides the money he lost, Gamboa Silvestre surrendered something that was even more important to him: his love for crypto.

“After what happened with Libra, I completely stepped away from that world. I stopped doing something that I really liked that had generated me a lot of profitability during that period,” he said. “In the future, I saw myself only living from that. But I lost all confidence.”

Today, the only ties that Gamboa Silvestre has left to the industry are his participation in a class action brought against Milei.

Data Disputes Milei’s Claims

Gamboa Silvestre is one of 212 investors seeking reparation for their losses in a lawsuit pending in Argentina.

Even though Milei has repeatedly dialled down the impact that LIBRA had on investors, the facts tell a different story.

According to data from Ripio, just one centralized exchange operating in the country, 1,329 citizens lost money. These numbers directly contradicted Milei’s previous claims that only a handful of Argentine investors had been affected.

Argentines weren’t the only ones who had lost money. The impact was international, affecting investors anywhere from Bosnia to Lebanon to Australia.

In the United States, a separate class action lawsuit is moving forward against Hayden Davis, the American investor and CEO of Kelsier Ventures, who has been accused of being the mastermind behind the project.

Trust Erodes As Investigation Continues

Despite it being a year since Libra launched, Milei has yet to provide a coherent explanation of his level of involvement in the token project.

According to Agustín Rombolá, one of the lawyers representing the complainants in the class action, Milei’s answers have varied greatly over the past year.

“He first told us it was a casino, that you don’t cry in the casino. Then he told us that he had the right to sell his opinions. And then he told us that he was not working as the president at the moment of the tweet. [After that], he told us he was scammed,” Rombolá told BeInCrypto.

According to Congressman Maximiliano Ferraro, one of the most outspoken critics in the Libra scandal, Milei has yet to address a key issue regarding his role in the case.

“There are still many questions unanswered. Who approached the President, and how did they give him that [smart contract address] that had more than 40 characters and did not have a public status?” Ferraro said in an interview in Spanish.

As the investigation into what happened continues, the financial damage is still being tallied, as is the loss of trust.

For Gamboa Silvestre and thousands of others, Libra was not just a failed investment but a turning point that reshaped their relationship with crypto altogether.

Crypto World

BTC Lightning Network Tops $1B in Monthly Transaction Volume: River

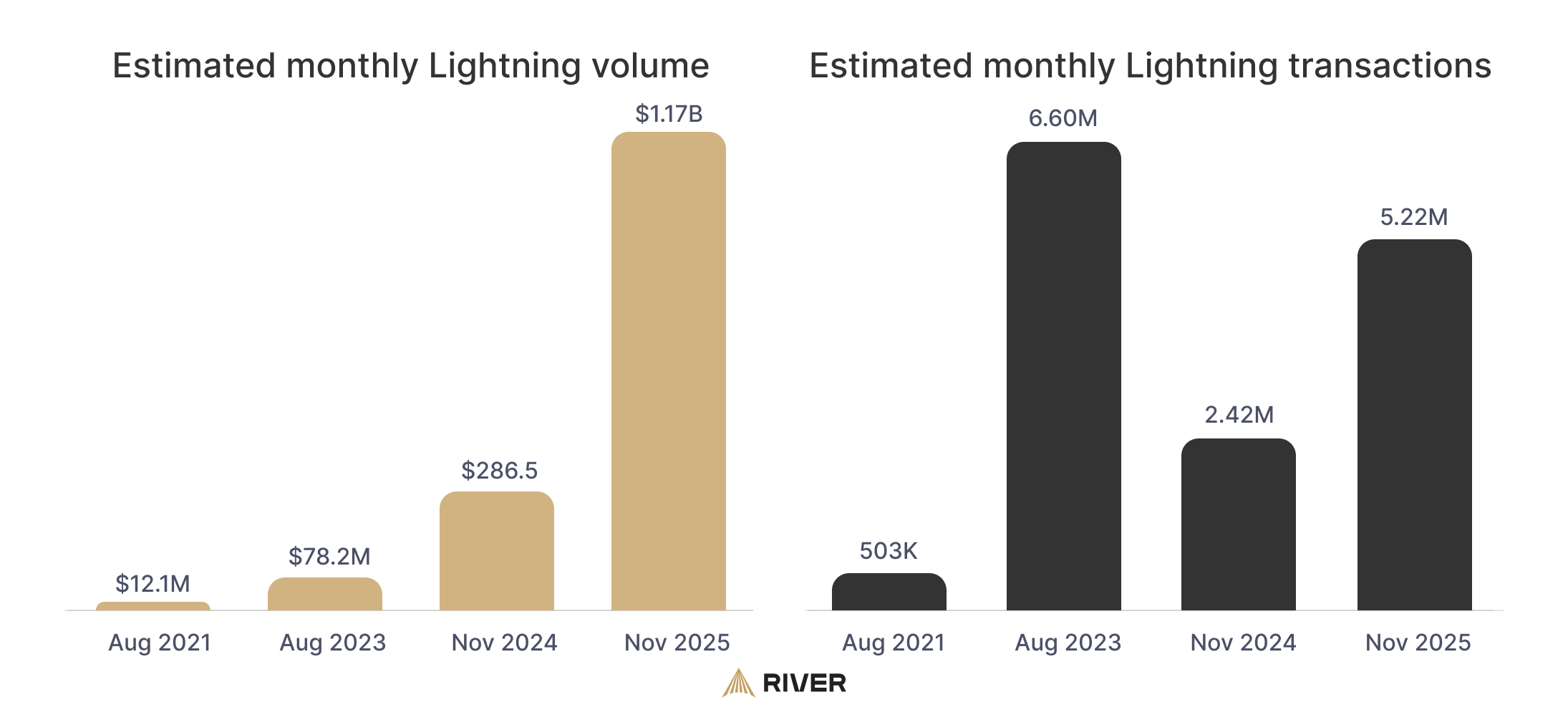

Monthly transaction volume on the Bitcoin (BTC) Lightning Network, a secondary layer for BTC that enables payment use cases, surpassed the $1 billion milestone in November 2025, according to a report from Bitcoin financial services company River.

Transaction volume on the Lightning Network hit an estimated $1.1 billion in November, across 5.2 million transactions, according to a report shared by Sam Wouters, River’s director of marketing. The report said:

“Lightning adoption happened despite the price declining all of November and generally not doing much in 2025. The adoption was largely driven by exchanges, as well as a growing number of businesses accepting bitcoin payments.”

However, the total transaction count in 2025 is lower compared with 2023, when monthly Lightning transactions peaked at 6.6 million in August of that year, which River attributed to experiments with micropayments in gaming and messaging apps.

The report forecast a similar surge in Lightning transactions as individuals and businesses experiment with AI payments.

The Bitcoin Lightning Network helps scale the Bitcoin network, enabling Bitcoin payments between parties that settle in seconds instead of minutes, encouraging Bitcoin’s use as a medium of exchange, instead of just a risk asset or store of value.

Related: Voltage rolls out USD-settled Bitcoin Lightning credit line for businesses

Exchanges and institutional clients adopt Lightning Network

The Lightning Network reduces transaction costs and settlement times by opening up a payment channel between two or more parties to handle transactions offchain, posting only the net balance of the channel to the Bitcoin ledger once it is closed.

Typically, Bitcoin blocks take 10 minutes on average to be added to the ledger, severely limiting BTC payments, particularly for smaller purchases at physical businesses.

In December 2025, the Lightning Network’s capacity, the total number of coins locked on the network for liquidity, reached 5,606 BTC, as more companies and institutions began using it.

Secure Digital Markets, an Institutional trading and lending company, sent crypto exchange Kraken $1 million in a Lightning transaction in February.

The transaction showed that large, seven-figure amounts can be transferred between institutional parties using Bitcoin’s layer-2 scaling network.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Crypto World

Ethereum Foundation Sets 2026 Protocol Priorities

The EF announced its 2026 Protocol priorities, emphasizing scalability, user experience, and security, as the network prepares for the Glamsterdam upgrade.

The Ethereum Foundation (EF) has outlined its Protocol priorities for 2026, focusing on scalability, improved user experience, and enhanced network security.

Over the coming year the EF looks to push its gas limit “toward and beyond” 100 million, lean into account abstraction and interoperability, and continue to “harden the L1” focusing on security, censorship resistance, and network resilience.

Today’s initiative release comes shortly after co-executive director Tomasz Stańczak announced his intent to step down at the end of the month. Stańczak indicated he will continue to spend his professional time in the Ethereum ecosystem, working closely with developers and founders. Bastian Aue is assuming interim co-executive director duties for the time being.

The Foundation established Protocol in June 2025 as an improved and more responsive path towards network development. This initiative potentially laid the groundwork towards Ethereum co-founder Vitalik Buterin’s new outlook on the Layer 2 ecosystem, and lays the foundation for future network upgrades like Glamsterdam and Hegota.

Glamsterdam, which is expected to ship in the first half of 2026, is comprised of up to 22 different Ethereum Improvement Proposals (EIPs) and focuses on Layer 1 scalability.

This article was generated with the assistance of AI workflows.

Crypto World

Russia eyes fines for gray-market crypto as fraud cases surge

Russia plans liability for gray-market crypto after fraud-linked bank freezes.

Summary

- Central bank wants liability for crypto deals outside regulated segment, citing rising fraud complaints.

- Over 1,800 Russians sought help after bank account freezes tied to suspicious crypto inflows.

- Officials push legalization for cross-border crypto payments while preparing broader licensing regime.

Russia’s central bank has proposed new penalties for cryptocurrency operations conducted outside the country’s regulatory framework, according to statements reported by Russian state media on Wednesday.

Central Bank of Russia

Central Bank of Russia Governor Elvira Nabiullina said during a financial cybersecurity forum that prosecution of unregulated cryptocurrency transactions is necessary to address fraud concerns.

“Fraudsters are taking advantage of the gray market,” Nabiullina stated, according to the official TASS news agency. “A systemic solution is, of course, regulating cryptocurrency with the introduction of liability for transactions outside the regulated segment.”

The central bank chief added that the institution has submitted proposals to the government and is currently in discussions regarding the changes.

Nabiullina noted that Russians who sell cryptocurrency frequently face banking restrictions, with their accounts suspended when received funds are linked to fraudulent activities. More than 1,800 individuals contacted Russian law enforcement agencies in the past three months seeking restoration of banking services after being added to a state database for suspicious transactions, according to government newspaper Rossiyskaya Gazeta on Thursday.

During the same conference in Yekaterinburg, VTB Bank CEO Andrey Kostin called for accelerated legalization of cryptocurrency transactions, particularly for payment purposes. The executive of Russia’s second-largest bank said a significant number of clients, including major exporters, are requesting cryptocurrency payment options, according to news portal Gazeta.ru.

VTB, which is majority state-owned and subject to Western sanctions, announced plans last year to launch cryptocurrency trading through brokerage accounts once regulations are established.

Russia’s push toward cryptocurrency legalization has been driven primarily by the need for international settlement options. In October, the Ministry of Finance and the Central Bank agreed to legalize cryptocurrency payments in foreign trade, enabling Russian firms to circumvent financial restrictions imposed by Western nations over the conflict in Ukraine.

Moscow authorities aim to replace an experimental legal regime for such transactions with comprehensive legislation covering cryptocurrency activities, including investment and trading. The framework will be based on a regulatory concept proposed by the central bank in late December that would recognize cryptocurrencies and stablecoins as “monetary assets.”

Parliamentary Financial Markets Committee Chairman Anatoly Aksakov urged swift action on crypto market regulation at the Yekaterinburg forum, stating that the unregulated sector has resulted in significant financial losses.

Russian authorities have indicated plans to approve the legislation by summer, according to reports.

Industry analysts interviewed by business news outlet RBC this week suggested that Russian regulators may restrict access to foreign cryptocurrency exchanges such as Bybit and OKX once domestic regulations are implemented. Nikita Zuborev, senior analyst at crypto exchange aggregator Bestchange.ru, predicted such restrictions could occur after Russia begins licensing domestic cryptocurrency service providers, potentially by year-end.

Crypto World

Pi Network’s PI Dominates the Altcoin Market, Yet Bears See Storm Ahead

Painful decline or a bull run to $1: what is next for PI?

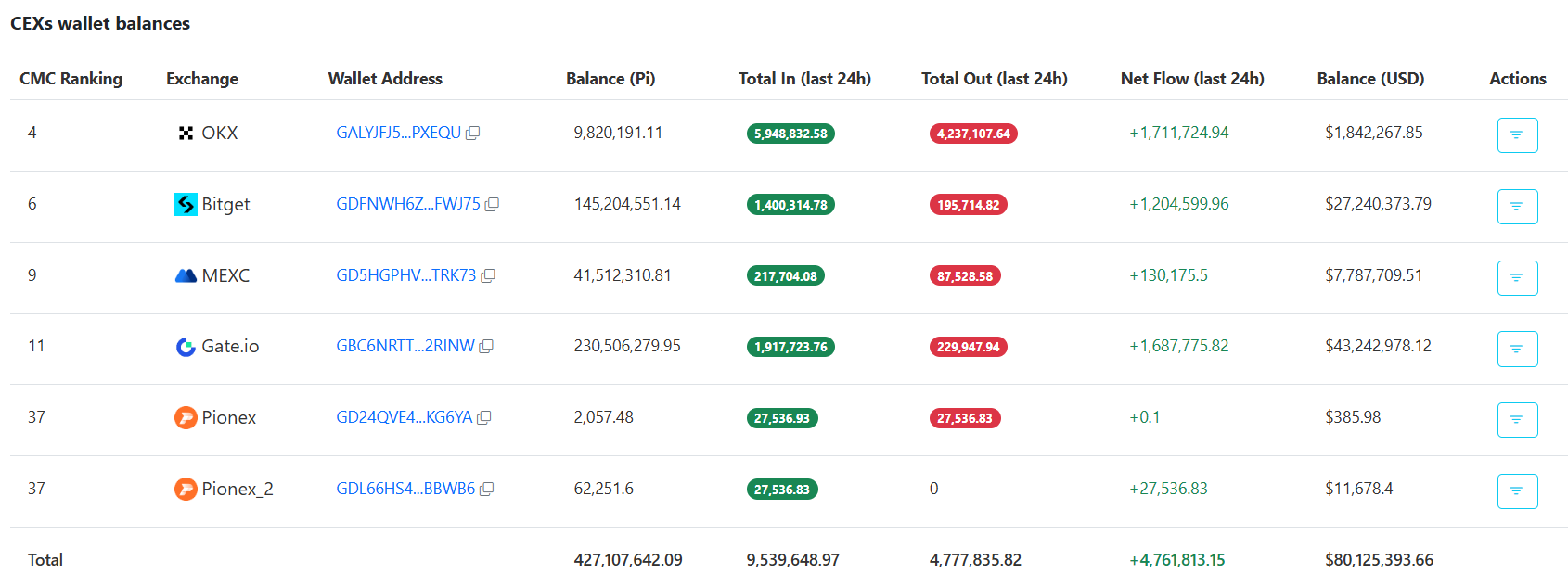

Pi Network’s PI has been the best-performing top 100 cryptocurrency over the past week, with its valuation rising by almost 40%.

Although some market observers foresee additional short-term gains, one factor could dampen their enthusiasm by hinting at a renewed decline.

The Bears Are Coming Back?

PI has finally managed to reverse its massive downtrend over the last several months, posting an upswing to as high as $0.20 just days ago. Currently, it trades at around $0.18 (per CoinGecko’s data), placing it well in green territory on a seven-day and two-week timeframe.

With its market capitalization soaring to roughly $1.7 billion, the asset now ranks as the 47th-largest cryptocurrency. The evident recovery has put PI back in focus, making it one of the most-trending tokens on CoinGecko lately.

The good days, though, may be coming to an end because the amount of coins stored on crypto exchanges has risen sharply. Almost 5 million PI have been transferred to such platforms in the last 24 hours alone, bringing the total to approximately 427.1 million. More than half of that is held on Gate.io, while Bitget ranks second with approximately 145.2 million tokens.

While the shift from self-custody to centralized exchanges doesn’t guarantee a price correction, it is often viewed as a bearish signal, as it could be interpreted as a pre-sale step.

The aggressive token unlocks scheduled for the coming days should also serve as a warning to investors. Data indicates that daily figures will approach 15 million on several occasions before the end of February. After that, though, the process is set to slow down.

You may also like:

New Push From the Bulls?

Contrary to the aforementioned factors, some community members believe PI is on the verge of a more serious surge in the short term. X user Pi Network Academy argued that the asset “is warming up for another big pump,” predicting an explosion to $1.

For their part, Pi Global claimed that “momentum is building, utility is expanding, and community is stronger than ever.” That said, they wondered if the coin’s valuation could hit $0.50 before Pi Day. The date (March 14) is symbolic to Pi Network because it resembles the mathematical constant π (3.14).

Earlier this month, X user Captain Faibik also chipped in. The renowned crypto analyst revealed they had added some PI for the midterm, expecting a 500% rally.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Does XRP Really Have Any Utility in 2026 and Who Uses It?

Few cryptocurrencies are as polarizing as XRP. Critics across the crypto and DeFi ecosystem often claim XRP has no real utility. They argue it exists mainly as a speculative asset with limited real-world use.

At the same time, XRP maintains one of the largest and most vocal communities in crypto – The XRP Army. They believe the altcoin will eventually power global financial infrastructure.

The truth sits somewhere between those two extremes. XRP does have real utility, but its usage is more specific and narrower than many assume.

XRP is More Unique Than Any Other Cryptocurrency

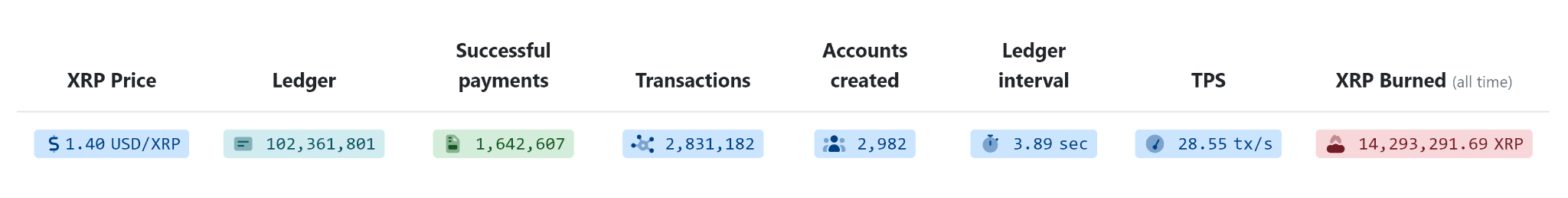

XRP is the native token of the XRP Ledger, launched in 2012 with a clear purpose: enabling fast and efficient cross-border payments.

Unlike Bitcoin, which focuses on decentralized value storage, or Ethereum, which focuses on programmable smart contracts, XRP was designed primarily to move money between financial systems quickly and cheaply.

Transactions on the XRP Ledger settle in about three to five seconds and cost a fraction of a cent. This makes XRP particularly efficient as a bridge currency, allowing instant conversion between two different fiat currencies without requiring banks or payment providers to hold large reserves in foreign accounts.

Millions Hold XRP — But Most Usage Comes From Traders and Infrastructure

Retail investors make up the largest group of XRP users today. As of early 2025, the XRP Ledger had roughly 6 to 7 million funded accounts, which represent wallets holding XRP.

After adjusting for exchange custody and users holding multiple wallets, analysts estimate around 2 to 3 million individuals globally actually hold XRP.

Crypto exchanges are another major user. Platforms such as Binance, Bitstamp, Kraken, and Uphold use XRP for liquidity management and transfers.

XRP’s speed and low cost make it an efficient tool for moving funds between exchanges and managing trading liquidity.

Payment providers also represent a key real-world use case. Companies like SBI Remit in Japan and Tranglo in Southeast Asia use XRP through Ripple’s On-Demand Liquidity system to facilitate international remittances.

In these cases, XRP acts as a temporary bridge asset, allowing money to move across borders instantly without pre-funded foreign accounts.

Banks Use Ripple Technology, But Only Select Partners Actually Use XRP

Banks, however, present a more nuanced picture. Major financial institutions including Santander, Standard Chartered, and Bank of America have used Ripple’s payment infrastructure.

But most of them use Ripple’s messaging and settlement software without directly using XRP itself. Only select payment providers, rather than global banks broadly, use XRP directly for liquidity.

Beyond financial transfers, XRP also plays an essential technical role within its own network. Every XRP Ledger account must hold XRP, and all transactions require XRP to pay network fees.

XRP supports decentralized trading, token issuance, and asset transfers on the ledger.

So, XRP is neither useless nor universally adopted. Its utility exists in specific financial infrastructure roles, particularly in liquidity provisioning and payment settlement.

Understanding who actually uses XRP reveals a clearer picture—one grounded in real-world function rather than speculation.

Crypto World

Kraken Acquires Magna for Early Token Support

The acquisition closed on Friday and should enable Kraken to work closely with token teams early in development.

U.S.-based centralized exchange (CEX) Kraken announced its acquisition of token management platform Magna yesterday.

The deal closed on Friday and marks the CEX’s latest strategic move as it prepares for an initial public offering (IPO).

The move was reported by Fortune, which said Kraken declined to disclose the deal terms, but Kraken’s co-CEO Arjun Sethi told the news outlet that the acquisition will allow Kraken to support token issuer teams “early on in their life cycle,” indicating that it may provide Kraken a strategic leg up in terms of token listings.

While it is unlikely there is any connection, Kraken also moved to list and promote a memecoin from 2016, PEPECOIN, yesterday, which trades at just a $15 million market capitalization, and should not be confused with PEPE, which launched in 2023 and trades at a $1.7 billion market capitalization.

PEPECOIN is only up 7.6% since the announcement, indicative of the market’s risk-off environment.

Despite the market’s lack of enthusiasm for the listing, the Magna acquisition and the listing of a micro-cap token on the same day may indicate continued aggression from Kraken in expanding asset diversity on the exchange.

Crypto World

Crypto markets feel the chill, Base, ether.fi reorganize layer-2 landscape: Crypto Daybook Americas

By Jacob Joseph (All times ET unless indicated otherwise)

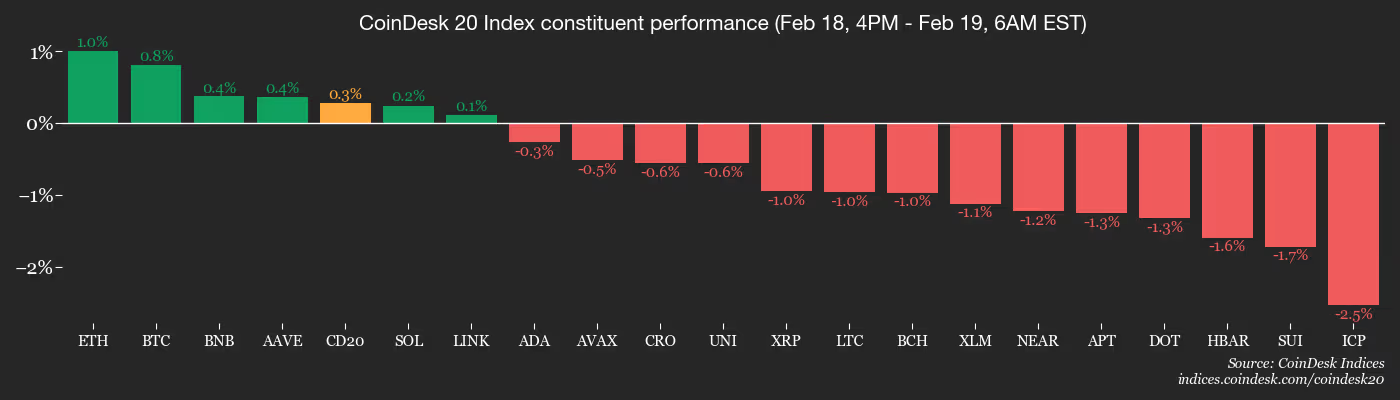

Even with the CoinDesk 20 index (CD20) little changed since midnight UTC, crypto markets remain under pressure. All but one member has dropped, and the outlier, bitcoin , is less than 0.1% in the green.

The index has lost 2% in 24 hours, and spot bitcoin exchange-traded fund flows were negative for a second consecutive session, with $133 million in net outflows on Wednesday. Spot ether (ETH) ETFs also posted net outflows. The second-largest cryptocurrency has lost another 0.2% since midnight.

The key development overnight was Coinbase’s (COIN) announcement that its layer-2 network, Base, will move away from the OP Stack, the open-source, modular rollup framework developed by Optimism that currently powers it. The OP Stack enables chains such as Base and Unichain to operate as low-cost, Ethereum-secured layer 2s, fully compatible with the Ethereum Virtual Machine (EVM) and aligned with Optimism’s broader Superchain vision.

Rather than relying on multiple external contributors for core upgrades and protocol changes, Base intends to consolidate development into a self-managed codebase, giving the team greater control over infrastructure, roadmap, and technical evolution.

The move carries meaningful implications for Optimism. Base has historically accounted for the vast majority of Superchain-generated revenue — often exceeding 90% — which accrues to the Optimism Collective. The announcement represents a significant potential headwind to Optimism’s revenue outlook, with the OP token declining 24% since Wednesday following the news.

In a more positive development, ether.fi said it will migrate its Cash product to Optimism’s OP Mainnet. The move will bring some 70,000 active cards, 300,000 accounts and millions of dollars in total value locked. The non-custodial payment card allows users to spend ETH, BTC and stablecoins at over 100 million Visa merchants, offers 3% crypto cashback and processes about $2 million in daily transaction volume.

In another notable layer-2 development, Robinhood’s testnet recorded 4 million transactions in its first week, according to CEO Vlad Tenev. The Arbitrum-based Robinhood Chain is designed to support tokenized real-world assets and a broader suite of onchain financial services, signaling the firm’s continued push into blockchain-based infrastructure.

While these ecosystem developments remain constructive, broader markets continue to trade within a wider downtrend. The latest Federal Reserve meeting minutes, released yesterday, highlight a growing divergence among policymakers on the path of interest rates.

Several officials indicated that further rate cuts should be paused for now, with the possibility of resuming easing later in the year only if inflation continues to fall. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 19, 8 a.m.: Zama to host a live presentation of its 2026 roadmap.

- Macro

- Feb. 19: U.S. Fed’s Raphael Bostic, Michelle Bowman and Neel Kashkari make speeches throughout the day.

- Feb. 19, 8:30 a.m.: U.S. initial jobless claims for Feb. 14 est. 225K (Prev. 227K)

- Earnings (Estimates based on FactSet data)

- Feb. 19: Riot Platforms (RIOT), post-market, -$0.32

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- ENS DAO is voting to register the on.eth name and establish it as an onchain registry for blockchain metadata. Voting ends Feb. 19.

- Unlocks

- Token Launches

- Feb. 19: Resolv to complete rollout of updated USR/RLP yield distribution parameters

- Feb. 19: Injective to start INJ Community Buyback Round #226

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 0.87% from 4 p.m. ET Wednesday at $66,896.68 (24hrs: -1.31%)

- ETH is up 1.29% at $1,966.13 (24hrs: -1.49%)

- CoinDesk 20 is up 0.39% at 1,932.97 (24hrs: -2.57%)

- Ether CESR Composite Staking Rate is unchanged at 2.81%

- BTC funding rate is at 0.0056% (6.1747% annualized) on Binance

- DXY is unchanged at 97.67

- Gold futures are unchanged at $5,009.90

- Silver futures are up 1.13% at $78.47

- Nikkei 225 closed up 0.57% at 57,467.83

- Hang Seng closed up 0.52% at 26,705.94

- FTSE is down 0.63% at 10,618.95

- Euro Stoxx 50 is down 0.81% at 6,054.02

- DJIA closed on Wednesday up 0.26% at 49,662.66

- S&P 500 closed up 0.56% at 6,881.31

- Nasdaq Composite closed up 0.78% at 22,753.63

- S&P/TSX Composite closed up 1.5% at 33,389.73

- S&P 40 Latin America closed up 0.37% at 3,707.85

- U.S. 10-Year Treasury rate is up 1.3 bps at 4.094%

- E-mini S&P 500 futures are down 0.3% at 6,873.25

- E-mini Nasdaq-100 futures are down 0.39% at 24,857.50

- E-mini Dow Jones Industrial Average Index futures are down 0.35% at 49,549.00

Bitcoin Stats

- BTC Dominance: 58.74% (0.26%)

- Ether-bitcoin ratio: 0.0294 (-0.09%)

- Hashrate (seven-day moving average): 1,057 EH/s

- Hashprice (spot): $33.63

- Total fees: 2.31 BTC / $155,155

- CME Futures Open Interest: 118,610 BTC

- BTC priced in gold: 13.4 oz.

- BTC vs gold market cap: 4.47%

Technical Analysis

- The ratio of altcoins (excluding the top 10) to the bitcoin price continues to rise from key weekly support and is now testing the 50-week exponential moving average.

- A break above that level would imply continued resilience of altcoins relative to bitcoin, which is most likely a result of their being extremely oversold.

Crypto Equities

- Coinbase Global (COIN): closed on Monday at $164.05 (-1.19%), +0.24% at $164.45 in pre-market

- Circle Internet (CRCL): closed at $63.15 (+2.48%), +0.19% at $63.27

- Galaxy Digital (GLXY): closed at $21.73 (+2.02%), +0.74% at $21.89

- Bullish (BLSH): closed at $31.85 (-0.47%), unchanged in pre-market

- MARA Holdings (MARA): closed at $7.50 (-0.13%), +0.40% at $7.53

- Riot Platforms (RIOT): closed at $15.49 (+5.73%), +0.19% at $15.52

- Core Scientific (CORZ): closed at $17.27 (+0.23%)

- CleanSpark (CLSK): closed at $9.27 (-0.11%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.04 (+0.10%)

- Exodus Movement (EXOD): closed at $9.88 (-2.08%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $125.20 (-2.70%), unchanged in pre-market

- Strive (ASST): closed at $8.05 (-1.59%)

- SharpLink Gaming (SBET): closed at $6.60 (-0.90%)

- Upexi (UPXI): closed at $0.69 (-4.17%)

- Lite Strategy (LITS): closed at $1.10 (+0.00%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$133.3 million

- Cumulative net flows: $54.07 billion

- Total BTC holdings ~1.26 million

Spot ETH ETFs

- Daily net flows: -$41.8 million

- Cumulative net flows: $11.68 billion

- Total ETH holdings ~5.74 million

Source: Farside Investors

While You Were Sleeping

- Bitcoin shakes off U.S. session losses as Trump says trade deficit cut by 78% (CoinDesk): Bitcoin trading remained volatile on Thursday, rising to around $67,000 after briefly dipping near $65,900, as traders digested President Trump’s claims the U.S. trade deficit was cut by 78%.

- Bitcoin, ether, xrp ETFs bleed while Solana bucks outflow trend (CoinDesk): U.S.-listed spot crypto ETFs are flashing red across the board, with one exception. SOL ETFs recorded $2.4 million in net inflows, pushing cumulative inflows to nearly $880 million.

- Gold recaptures $5,000 with focus on the Fed’s rate path (Bloomberg): Gold advanced back to around $5,000 an ounce after jumping 2% on Wednesday, with traders focused on the Fed’s next move on interest rates. Bullion climbed as much as 0.9% on Thursday, silver 3%.

- European shares dip as Airbus, Rio Tinto plunge; Nestle gains (Reuters): European shares slipped on Thursday, as investors sifted through a mixed bag of earnings from the likes of Airbus, Rio Tinto and Nestle.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports21 hours ago

Sports21 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 hours ago

Crypto World3 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show