Politics

Labour Together have snuck into the DWP

The sabotage outfit that put Keir Starmer into power, spied on journalists, and whose architect Morgan McSweeney recently resigned in disgrace from his role as the prime minister’s chief of staff, has spun the revolving door at Westminster once again. This time, a former director and senior staff member from the shady pressure group Labour Together have quietly wormed their way into the Department for Work and Pensions (DWP).

So now, its acolytes are in the prime position to shape this Labour Party government’s next callous plans for welfare claimants.

Labour Together grifters: now at the DWP

In December, Labour Together executive director Matthew Upton made like a reverse Ashworth running from constituent scrutiny and landed himself a new role at the DWP. There, he’s now ‘Principal Advisor’ to Alan Milburn’s stitch-up Young People and Work review.

The Canary previously highlighted Upton’s connection to investment (and former insurance) giant Aberdeen Group Plc. Upton was a trustee for its philanthropic research funding arm: arbdn Financial Fairness Trust. The now-defunct organisation financed a 2023 Fabian Society report that proposed a time-limited ‘unemployment insurance’ benefit. In reality though, it’s a trojan horse to do-away with new-style Employment Support Allowance (ESA). So naturally, the new Labour government has been all over the idea.

Upton also appeared next to the overpromoted Blair-era relic in a foreword for a September 2025 Labour Together briefing. Curiously, it was discussing the very same thing.

Hope the (revolving) door hits you on your way out…

Incidentally, that segues quite nicely to the next Labour Together grifter-come-dutiful-benefit-slashing-DWP-disciple. As of January, author of said report and Labour Together chief policy advisor Morgan Wild slid on over to his new position at Westminster. He’s now policy advisor to none other than current DWP benefit-reaper-in-chief himself: Pat McFadden.

Here’s what a New Statesman senior editor had to say about Wild’s appointment:

Spad news: Morgan Wild, Labour Together’s chief policy adviser, has become a policy adviser to Pat McFadden.

He’s a champion of the contributory principle, which will be a key feature of welfare reform. pic.twitter.com/NHk0WRN0QZ

— George Eaton (@georgeeaton) January 13, 2026

The ‘contributory principle’ holds that:

Our society only succeeds when people pay their taxes, care for their families and communities and are recognised for these contributions. Our economy only succeeds when people work, develop skills, take risks, and start businesses.

In other words, anyone who cannot work because of health issues, caring commitments, or any other reason is a workshy layabout who shouldn’t be supported to survive, but punished for existing.

In (not) unrelated news: the government’s recent so-called Fairer Pathway to Settlement consultation rattled off the words ‘contribution’ or ‘contribute’ no fewer than 72 times. Needless to say, the anti-immigration hostile environment is disgustingly alive and thriving at the racist DWP.

Guess who’s back?

And speaking of ex-Labour Together directors, Jonathan Ashworth was at the Centre for Social Justice (CSJ) in Westminster – where it appears the washed-up former DWP sec now works as a senior fellow on “welfare, health, and addiction”.

Ashworth appeared in the Express recently, clamouring to be relevant and spouting trash about welfare ‘reform.’

He’s also claimed that disabled people are “being abandoned to health-related benefits”. He made the stigmatising remarks as part of the announcement for the CSJ’s Welfare 2030 enquiry launch.

Genius interpreter of the public mood and uncontestable political clairvoyant Ashworth is, he told the Express in early January:

I think Labour can turn this around, and I suspect, in a year’s time, if you come back to record me for a follow-up interview, I’ll bet you that Keir Starmer is still the Labour prime minister.

The previously tipped to-be Cabinet member will now be just a short hop and a skip away from Whitehall. Bang, smack in the heart of Westminster, the CSJ’s office is just a five minute walk from parliament.

So not only has Labour Together installed itself in the DWP, but it also has a former director positioned at a Tory-founded think tank that’s influencing the Labour government’s plans to decimate the welfare state.

Labour Together and the party of ‘work’

The intentions behind their appointments are obvious in the buzzword of the moment: ‘contribution’.

For his Welfare 2030 cameo, Ashworth was also crowing on about developing:

a system that values contribution, protects the most vulnerable, and helps thousands more people gain all of the advantages that come with work.

Chuck it alongside vitriol around ‘economic inactivity’ and you have a winning recipe for ripping into the welfare state.

The clear insinuation is that a person’s worth is tied to their productivity inside the capitalist system. What this really means in practice, is that disabled lives are expendable. The fact that ‘cuts kill’ is of little consequence to Labour Together and its devotees.

But as the Canary has previously pointed out, this eugenicist thinking is the corporate fascist wing of the Party’s MO.

Labour Together still shaping the agenda

Suffice to say that despite McSweeney’s departure from Number 10, Labour Together still has its claws in shaping this government’s brutal policy programme.

And Upton and Wild’s appointments wouldn’t be the first instance of the Labour right think tank driving the DWP’s austerity agenda.

As the Canary previously exposed, Labour Together and its donors funded nearly every single one of the ‘Get Britain Working’ group of Labour MPs. In March 2025, it sprung up to back Rachel Reeves and Liz Kendall’s vicious disability benefit cuts.

The clincher that Labour Together has had its grimy mitts all over the DWP benefit cuts all along? As the Canary’s Steve Topple highlighted before, it was Morgan McSweeney who led ‘briefings’ in a bid to:

“win over” MPs for its package of atrocious austerity-driven cuts.

But ultimately, what it all underscores is how the Labour Together right-wing circus is still scattered right throughout this government. For all its smokescreen committees boasting disabled representation, these are the capitalist cronies this government is really listening to.

Because at the end of the day, this rotten ableist ‘party of work’ rhetoric has always been at the Labour right’s very core. Upton and Wild’s new high-profile advisory roles at the DWP show that’s not about to change.

Featured image via author

Politics

The Troubles are over, gangsterism isn’t

“If we go to the police, we would be killed.” Those are the words of a woman featured in a BBC report about paramilitary extortion rackets in the North of Ireland. The investigation spoke to:

…business owners anonymously about being threatened to pay money to proscribed organisations. It includes those running restaurants or shops and those in the construction industry.

The paramilitaries involved would previously have been participants in the sectarian warfare that characterised The Troubles in Ireland.

Since the 1998 Good Friday Agreement, that kind of violence has hugely declined. Paramilitarism remains a feature of the Six Counties, however, particularly in organised crime. The payments which gangsters demand from businesses are typically described as ‘protection money’. The name implies you will receive protection from some unspecified threat, but in reality you are paying to avoid beating or death from those demanding it.

Sometimes the thugs characterise it in other ways. One respondent to the BBC said:

I have never been asked to pay for protection, but they asked me to contribute to the community activities which I did do.

Reverse-Robin Hood paramilitaries rob from those least able to pay

The report refers to “shops, salons and restaurants” as among the businesses targeted. Construction sites are another common source of revenue for paramilitaries. What this essentially amounts to is a regressive tax on people of average income.

The thugs aren’t going to Tesco management, Intel or JP Morgan to demand a cut of their profits. They’re robbing small local businesses often struggling to survive in a climate where large corporations relentlessly lobby government, and where the high street already struggles to survive.

Of course, such gangsters rob everyone on a daily basis, a fact highlighted by the Independent Reporting Commission (IRC) which monitors paramilitary activity. They pointed out that:

If paramilitarism is not brought to an end, it will continue to create

unmanageable strain on public finances through its direct and indirect harms.

This cost to us all comes from the increased policing expenses required to deal with the issue, especially when paramilitaries drive instances of mass rioting and racial pogroms, such as those they stoked in Ballymena in June 2025. The IRC reported with “no doubt” that there was paramilitary involvement in the riots, which took place among loyalist communities in the town. The Belfast Telegraph reported how:

Almost 50 children have been referred to social services by the PSNI after race riots in Northern Ireland over the last two years.

‘Protection’ scam extends to exploiting kids

These are kids who are coerced into participating in criminal racist behaviour. Those with links to far-right loyalist paramilitaries often like to parade as the protectors of women and children. However, as in the case of ‘protection money’, it’s the men in balaclavas who people need protecting from.

The Northern Ireland Human Rights Commission has warned that the Justice Bill before the Northern Ireland Assembly may not provide sufficient protection against criminalising children dragged into crime by paramilitaries. The bill seeks to bring the Six Counties somewhere close to parity with Britain, as the former has previously lacked legislation to deal with organised crime.

Some indicators show a decline in paramilitary activity. The Police Service of Northern Ireland’s (PSNI) Security Situation Statistics give an indication of this. In their latest report, which covers the period from 1 October 2024 to 30 September 2025, there were:

…no security related deaths, compared to one during the previous 12 months.

Shooting incidents also declined from 16 to 11. The chief constable of the PSNI Jon Boutcher has expressed optimism about a downgrading of the security threat rating in coming years. He says it may go from its current ‘substantial’ level to ‘moderate’, meaning “an attack is possible, but not likely.”

Of course, this assessment is based on threats to the state, rather than the general threat posed to the population at large by paramilitary violence, nevermind the other costs.

PSNI must take a share of the blame

The PSNI itself has some role to play in the continued role in daily life of paramilitaries. It has turned a blind eye to displays by violent groups such as the Ulster Volunteer Force (UVF), while arresting peaceful Palestine Action protesters. Like police forces in Britain, it continues to maintain relatively low ratings from the public. According to the Northern Ireland Statistics and Research Agency (NISRA):

60.6% thought police were not visible or not very visible in their local area.

67.5% were satisfied with the job the PSNI do in Northern Ireland.

61.4% were confident in PSNI’s ability to protect and serve.

63.8% thought the PSNI were engaged or very engaged with local communities

While this remains the case, some people will still see paramilitaries as a local replacement for cops, perceived as cracking down on drug dealers and petty crime. This is the legacy of The Troubles — a police force still beholden to appalling British law, and the long tail of paramilitary thuggery given life by an inadequate political settlement.

Featured image via Nazli Tarzi

Politics

Rachel Reeves called ‘genocide supporter’ by heckler

Genocide supporter Rachel Reeves has been called out as – well, a genocide supporter – as she toured a Sainsbury’s supermarket:

All too true. In December 2025, after more than two years of Israel’s genocide in Gaza, she told the racist ‘Labour Friends of Israel’ that she is a “proud” and “unapologetic” Zionist. She added that the idea there’s anything “inherently wrong” in the ethno-supremacist ideology must be “wholeheartedly” rejected.

Getting called out while posing in a supermarket is nowhere near enough – Reeves and her boss belong in jail for collaborating in genocide. But it’s still nice to see.

Featured image via the Canary

Politics

UN calls out Rapid Support Forces over “genocidal intent”

The United Nations (UN) has strengthened its language on Sudan. The international body said the foreign-backed war has a genocidal character. The move is welcome, but too late for the tens of thousands who’ve been murdered.

Genocidal intent

The three-year conflict between the Sudanese government, backed by Egypt and Turkey among other states, and the Rapid Support Forces (RSF), heavily reliant on arms from the UAE, has displaced and killed millions.

The RSF and allied militias are known for acting out their “racist Arab supremacist” ideology against non-Arab populations, murdered and ethnically cleansed from certain areas to maintain an Arab majority.

UN fact-finder Mona Rishmawi said on 18 February:

The body of evidence we collected — including the prolonged siege, starvation and denial of humanitarian assistance, followed by mass killings, rape, torture and enforced disappearance, systematic humiliation and perpetrators’ own declarations — leaves only one reasonable inference.

Rishmawi said:

The RSF acted with intent to destroy, in whole or in part, the Zaghawa and Fur communities in El-Fasher. These are the hallmarks of genocide.

The UN also launched a major humanitarian appeal to support the millions of Sudanese left starving and displaced by the ongoing war. It said that the:

Sudan Regional Refugee Response Plan (2026) aims to deliver lifesaving assistance this year to 5.9 million people across seven neighbouring countries: the Central African Republic, Chad, Egypt, Ethiopia, Libya, South Sudan and Uganda.

The plan will continue to prioritize aid for roughly 470,000 new refugees who are expected to cross into these countries, as well as thousands more who remain in border areas and have received only the most basic assistance.

El Fasher massacre

A report released by the UN on 19 February detailed the El Fasher massacre carried out by RSF in October 2025. The southern city was besieged by RSF for months. When it fell RSF massacred civilians wholesale.

The evidence gathered since:

Establishes that at least three underlying acts of genocide were committed: “killing members of a protected ethnic group; causing serious bodily and mental harm; and deliberately inflicting conditions of life calculated to bring about the group’s physical destruction in whole or in part.”

Mohamed Chande Othman, chair of the mission, said:

The scale, coordination, and public endorsement of the operation by senior RSF leadership demonstrate that the crimes committed in and around El Fasher were not random excesses of war.

They formed part of a planned and organized operation that bears the defining characteristics of genocide.

As the Canary has previously reported, British military equipment has turned up in RSF hands.

The UK is a major supplier to the UAE. In turn, the UAE is supplying the RSF. The UAE is pursuing resources (not least, gold) and control in Sudan as part of its increasingly colonial regional aims. And you can read about Israel’s dangerously under-reported role in the war here.

International bodies have been slow to respond to the crisis in Sudan. They are finally admitting there is an active genocide in Sudan. And, just like in Gaza, the British are playing a role in the slaughter.

Featured image via the Canary

Politics

Bad housing accelerated UK’s mental health decline

The Covid inquiry has highlighted how poor housing conditions led to a structural decline in mental health during the pandemic.

On Monday, 16 February 2026, the first hearing of the final module of the Covid inquiry took place. In total, there have been 10 modules, each focused on a different area of the pandemic response. Module 10 looked at ‘Impact on society’. This included the impact on vulnerable people, such as those experiencing homelessness and housing insecurity.

According to Kate Blackwell, counsel for the inquiry:

People’s housing situations had a profound impact on how they experienced the pandemic.

Of course, this was far worse in more deprived areas. Furthermore, it was:

disproportionately experienced by socio-economically disadvantaged and ethnic minority households.

Both groups were more likely to live in overcrowded or poor-quality housing.

Additionally, the inquiry linked overcrowding, poor housing, and housing insecurity to higher levels of psychological distress. All three are “known risk factors” for poor mental health.

But wasn’t that entirely predictable? From the start of the pandemic, the instructions were to stay at home. Obviously, anyone living in small, overcrowded or shitty conditions would suffer far more than those living in countryside mansions.

Poor management

The inquiry also highlighted how ‘Everyone In’ — a government scheme to get everyone who was sleeping rough off the streets in March 2020 — ended whilst the pandemic was still ongoing. Both the management of the scheme and its ending may have had an “adverse impact” on people experiencing homelessness.

Additionally, people who moved from street homelessness to Covid-secure accommodation had “divergent experiences”. Individuals found the transition from face-to-face to remote contact with support workers especially challenging.

Some groups had overlapping vulnerabilities, such as care leavers, victims of domestic abuse, those with mental health conditions or migrants. For these groups, the inequalities were “particularly pronounced”.

Underinvestment

A report published just before the inquiry also showed that the pandemic exposed the UK’s long-term underinvestment in social housing.

It highlighted how repairs in social housing slowed down or completely stopped during lockdowns, meaning the quality of housing declined significantly.

Issues such as damp and mould became more apparent when people were forced to stay at home. Of course, this further intensified both mental and physical health conditions.

The financial pressure from rising energy bills also made matters worse, especially for people living in poorly insulated homes.

The report also accuses some landlords of using the pandemic as an excuse to delay essential maintenance.

The final hearing of the inquiry is continuing this week, where the panel will hear about the impact of the pandemic response on other vulnerable groups.

Feature image via UK Covid-19 Inquiry

Politics

Die alone or with family

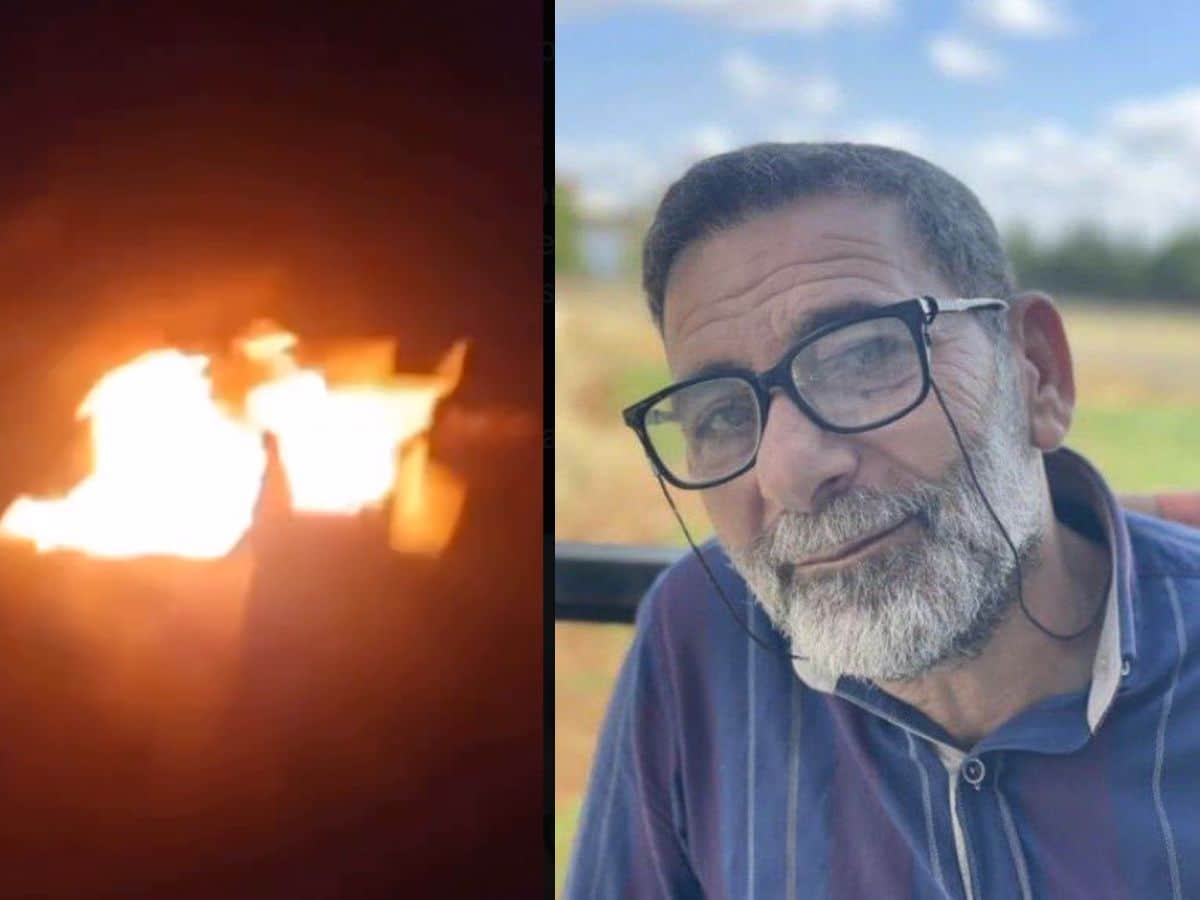

The Israeli military allegedly threatened a man in his home in South Lebanon, as their drones circled overhead. They gave him an ultimatum: die alone or with your family. He left his home. Then they killed him.

Israel drone-bombed Ahmed Turmus in his stationary car. His death was reported on X and by Lebanese citizen news agencies:

JUST IN: 🚨🇱🇧

A message IDF reportedly sent to a 62 year old father in southern Lebanon as he’s visiting relatives:

“It’s the Israeli Army, Ahmed. Do you want to DIE ALONE or with family in the house?”

Ahmed Tirmos’ story is going viral in Lebanon, who asked his family to… pic.twitter.com/lPfMBhoKx6

— Jvnior (@Jvnior) February 19, 2026

South Lebanon media is siloed off from official and corporate media. Grassroots outlet Lebanon Debate reported details of the alleged killing:

On Monday, an Israeli raid targeted a car parked near a residential house in the town of Taloussa – Marjayoun district, killing Ahmed Turmus.

Tallouseh is close to Lebanon’s southern-eastern border with Israel.

Lebanon Debate said a family member has told them Turmus had insisted on staying in the area despite previous Israeli threats.

Ahmed Turmus, 60, was one of the sons of the land who did not leave their village despite all the circumstances. During the war of support, while most of the people of the border strip left their villages, he remained in Taloussa, refusing to leave it.

Turmus was one of the last men standing, it appears.

Israel told residents of Taloussa and 13 other villages to leave in 2024.

Middle East Eye reported:

Israel’s military has told the residents of 14 villages in southern Lebanon to leave their homes ahead of Israeli military operations in the areas.

The villages include Chaqra, Hula, Majdal Selem, Taloussa, Meiss el-Jabal, as-Sawana, Qabrikha, Yahmour, Arnoun, Blida, Muhaibib, Barashit, Fron and Ghandouriya, Israeli army spokesperson Avichay Adraee said.

“For your safety, you must evacuate your homes immediately and move to the north of the Awali River. To ensure your safety, you must evacuate without delay,” Adraee wrote on X.

Killed in his car

Lebanon Direct said Turmus had lost a son in the 2024 war against Israel:

The sources added that “the tragedy was not new to the family, as his son Hassan was martyred during the war of support in January 2024,” noting that “Ahmed Turmus was the one who personally took the initiative to retrieve his son’s body from the Saluki Valley.”

The alleged details of Turmus’ death are harrowing. Lebanon Direct said:

As for the moment of targeting, the sources reported that Ahmed Turmus’s phone received a call minutes before the raid, where the caller identified himself as an Israeli soldier, and he was given two options: either to [die] with those around him, or to [die] alone.

Sources told the outlet:

The martyr did not hesitate for a moment, he chose to be alone. He made his decision to keep the danger away from those who were with him, and asked them to stay indoors. He said goodbye to them quietly, then headed to his car and drove away from the residential house.

After he stopped the car nearby, only a few seconds passed before the drone fired two missiles that hit the vehicle directly, killing Ahmed Turmus, who chose to face his fate alone.

Israeli expansionism in Lebanon

Israel regularly attacks southern Lebanon. Israel sprayed Lebanese territory with a cancer-causing chemical on 6 February. Euro-Med Human Rights Monitor said the “deeply alarming” attack may constitute a war crime:

The deliberate targeting of civilian farmland violates international humanitarian law, particularly the prohibition on attacking or destroying objects indispensable to civilian survival.

They added:

Large-scale destruction of private property without specific military necessity amounts to a war crime and undermines food security and basic livelihoods in the affected areas.

Extremist Zionist settlers — the vanguard of Israeli colonialism — crept over the border to plant trees around the 13th of February.

One said:

We came here today, to plant trees and put down roots in the soil of our country, regardless of the fences. The State of Israel must renew the settlement in Lebanon, this is historically correct, it is right from a security point of view, and it is right from a moral point of view.

Israel is still unswayed by worldwide condemnation for their genocide campaign in Gaza. Through a Zionist lens the entire region is theirs by ancient right. Back on Planet Earth, this is old fashioned settler-colonialism writ large. Israel will take out anybody who stands in its way.

Featured image via the Canary

Politics

Starmer fails to grasp basic economics

Keir Starmer just got community-noted on Twitter again. This time, our vaunted PM managed to display his ignorance of entry-level economics – he seems to think that lower inflation means lower prices.

Now, when writing this kind of piece, I’d normally include a dozen quote tweets dunking on Starmer for such an obvious blunder. Unfortunately, that looks like it’d be rather boring today, given that they’re all some variation on ‘That’s not how inflation works, you utter fucking clown’.

So, instead, let’s take a different tack. Sometimes this job can ingrain a deep cynicism in your soul that challenges your ability to find the common humanity in the politicians we write about. With that in mind, I’m going to try for the most charitable interpretation of Starmer’s tweet I can muster.

Okay Starmer, we’re being nice today

On 18 February, Starmer tweeted:

The choices this Labour government has made means inflation has fallen today to its lowest rate in a year.

Lower food and petrol prices are helping ease the pressure on household budgets.

I know there’s more to do, cutting the cost of living is my number one priority.

Readers almost immediately added context through the site’s community notes function:

Inflation is higher now than when Labour took office and is 1% above target inflation.

Lower inflation does not equal lower prices, as inflation is a measure of rising prices.

Oo, burn.

But, what if the elected leader of the United Kingdom does actually understand what an economy is and how money works? What if the tweet was just phrased a little poorly? What if Starmer is just a tired guy who’s been kept up all week defending his affiliations with his party’s Epstein ties and local election U-turns?

I bet you feel dead mean now, don’t you? The poor bloke could lose his job if people keep being this uncharitable.

Key points

I’ll start with the central assumption that the PM isn’t trying willfully to deceive the voting public. As such, I’m absolutely sure that he meant to say that lower inflation means that the money will have greater worth in real terms.

With that more-kindly interpretation in mind, Starmer is making three key statements here:

- Inflation has fallen to its lowest rate in a year.

- Food and petrol prices are also lower.

- This fall is because of Labour actually doing something right for a change (please clap/ love me – this part is implicit, but important nonetheless).

Let’s examine them in order, and really try to take them at face value. I’ll let go, for the moment, of the biases induced by Starmer’s active support for genocide and the second rise of fascism.

Inflation is down!(?)

So, first up – how’s the inflation level actually doing?

Well, according to the Office of National Statistics, the rate of inflation did drop from 3.4% in the year to December to 3% in January.

Grant Fitzner, chief economist of the ONS, stated that:

Inflation fell markedly in January to its lowest annual rate since March last year, driven partly by a decrease in petrol prices.

Airfares were another downward driver this month with prices dropping back following the increase in December.

But wait – lowest rate since March last year? Given that it’s still currently February, and we’re looking at January’s figures, that means we’re definitely not seeing the “lowest rate in a year”.

Oof, that’s a bad start for the ‘maybe Starmer isn’t a clown’ hypothesis.

Money goes further (??)

Next on the agenda – food prices. The ONS reported that:

Food and non-alcoholic beverages prices rose by 3.6% in the 12 months to January 2026, down from 4.5% in the 12 months to December 2025. On a monthly basis, food and non-alcoholic beverages prices fell by 0.1% in January 2026, compared with a rise of 0.9% a year ago.

Oh dear, it’s not looking good for our ‘Starmer isn’t a dickhead theory’, is it? A monthly fall of 0.1% after a year’s rise of 3.6% makes the ‘lower food prices’ claim technically true, but deeply misleading at best.

Meanwhile, on the subject of petrol, the ONS said:

The largest downward effect came from motor fuels, where the average price of petrol fell by 3.1 pence per litre between December 2025 and January 2026, compared with a rise of 0.8 pence per litre between December 2024 and January 2025. The average price stood at 133.2 pence per litre in January 2026, down from 137.1 pence per litre a year earlier.

A genuine fall in prices! Wonders shall never cease. I’ll give a partial credit to the PM on this point.

‘Thanks to the choices we made’

Like Starmer, chancellor Rachel Reeves was also quick to claim falling inflation as a win for Labour. She stated that:

Thanks to the choices we made at the budget we are bringing inflation down, with £150 off energy bills, a freeze in rail fares for the first time in 30 years and prescription fees frozen again.

Now, whether or not this economic change is down to Labour’s budget wizardry would require a much longer examination. However, if Labour wants to claim this win for its budget, it probably also needs to own its loss. You see, as the BBC reported:

For 16-24s, the unemployment rate now sits at 16.1% – the highest figure in just over a decade. While for 25-34s it’s 4.7%, the highest since 2017.

Average pay also grew by 4.2%, down from a revised 4.4% in the three months to November.

Economists say the latest figures would reinforce expectations that inflation will fall back, making it likely the Bank of England would choose to cut interest rates soon[.]

Inflation is slowing – but also, unemployment is soaring, particularly for young people. Given that a job is usually necessary in order to make the money to buy things like food and petrol, I’m afraid I’m going to have to declare this one another point against Starmer’s claims.

So, there we have it. Even if we take the most charitable tack my jaded soul can manage, our glorious leader still comes out looking like he doesn’t know his ass from his elbow.

Oh, and a corollary point – we definitely don’t need to clap.

Featured image via the Canary

Politics

DWP overhaul from Reform is the same old shit

Robert Jenrick has announced Reform UK’s policies on how it would run the Department for Work and Pensions (DWP):

The benefits bill is a time bomb that will bankrupt the country.

And a moral disaster wasting the potential of millions of people.

Reform will fix it. We’re for workers, not welfare. pic.twitter.com/2YJBgOtXeu

— Robert Jenrick (@RobertJenrick) February 18, 2026

But all of his terrible policies are already happening, or in the process of happening, under Labour.

Most of this already happens:

– You need a diagnosis and evidence to claim PIP

– DWP are returning to in-person assessments (it’s part of their savings forecast bc they know more fail them)

– Luxury cars are already cut from motabilityDog whistle politics at its finest https://t.co/aUxPG1Xcu3

— Rachel Charlton-Dailey (@RachelCDailey_) February 19, 2026

Our politicians seem to be pretty good at coming up with new ways to screw over disabled people, but Jenrick wasn’t even smart enough to think of his own.

Jenrick recycling policies for the DWP

Jenrick is missing the Tories that badly that they’ve given him a bullshit Shadow Chancellor label. Of course, he is not the Shadow Chancellor, as he is not a Tory.

hes not the fucking shadow Chancellor https://t.co/O44fSmPbnq pic.twitter.com/Xy6ccyNbIe

— Iain🌹🇬🇧🇺🇦🇵🇸 (@Iainite_Iain) February 18, 2026

He’s literally recycling shitty policies. It’s the equivalent of Alibaba ripping off a Temu phone case.

Oddly familiar.. https://t.co/NqzAUw3U5c pic.twitter.com/SutWpkpzgb

— (Cllr?) Danny Mosley (@ThatBritishGuyl) February 18, 2026

Was he taking notes at the Tory conference in October?

Stoking division

Jenrick’s policies for how to run the DWP are bullshit – but more importantly, they are already happening.

In-person benefits assessments are still carried out, and you almost always need a formal diagnosis of mental health conditions to use them to claim benefits. Just attacking people on benefits to generate headlines and stir up anger. Fuck Reform and anyone who votes for them. https://t.co/GnvAnb95K2

— allfunandjames (@allfunandjames0) February 18, 2026

During the Autumn Statement back in November, Rachel Reeves announced that the DWP would:

Improve operations by increasing face-to-face assessments, increasing WCA reassessment capability, and PIP award review changes, starting from April 2026.

Then, in December, the DWP issued a press release stating that it would increase face-to-face assessments. It said PIP face-to-face assessments would increase from 6% to 30%, while work capability assessments (WCA) would increase from 13% to 30%.

Do your research, Jenrick

Jenrick is also forgetting that even to claim benefits for a mental health or neurodivergent condition via the DWP, you already need a diagnosis.

I ain’t reading all that. But the 2nd point, that’s literally already the case😭 you need letters with your diagnosis from your doctor to even start your PIP application. Reform shouting at clouds as usual https://t.co/Q6HMRefXy3

— danny (@danxcix) February 18, 2026

“Clinical diagnosis required for those who claim to have mental health disorders”

Isnt this already how it is? 😳😳😳 https://t.co/iWzdUARrYV— Xiao R (@1ostwolf) February 18, 2026

Of course, this follows Wes Streeting’s attempts to prove that conditions such as ADHD don’t exist. For a long time now, Streeting has been trying to push the ‘overdiagnosis‘ narrative, because then he would be able to change the criteria to claim benefits for the condition.

Jenrick has clearly never completed a PIP application form.

And as the Canary has previously reported more times than I can count, the mainstream media routinely exaggerates PIP fraud rates to fit the narrative of the people in power.

The actual fraud rate for PIP is 0.4%. That’s practically non-existent.

HMRC’s own researchers found the PIP fraud rate is just 0.4%. Just say you hate disabled people https://t.co/f9t3zadS3y

— han (@jareaunodi) February 19, 2026

Meanwhile, the government effectively lets rich people off over £180bn in tax every year. I guess the government can’t be arsed to chase people who aren’t disabled.

More lies

Jenrick also mentioned cutting luxury cars from the Motability scheme. Again, already done, pal.

motability is not a luxury bc the people who use it are disabled and still have to foot some of the bill. this shit is ableist as fuck and is a precursor for consent to get rid of the scheme under reform or maybe even labour. https://t.co/iARzxydXNH

— el loves gromit and books (@gromitreads) January 13, 2026

As the Canary previously reported:

Motability currently helps around 860,000 people get around with a greater degree of independence. It’s funded primarily through the Motability Endowment Trust and the exchange of individuals’ mobility allowance payments, as part of the DWP’s Personal Independence Payments (PIP).

The mainstream media and most of our politicians would love for you to believe the DWP is using Motability to just give free cars to people with ADHD. However, the reality is far different. Many disabled people cannot drive cars that are not adapted specifically for their disability.

Additionally, many of these so-called ‘luxury’ cars are in fact just bigger cars, which disabled people need in order to transport equipment such as wheelchairs.

Typical right-wing muppet

Jenrick does not have an ounce of originality in his bones. Or an ounce of compassion. But why are we surprised when, like the majority of our MPs, he went to private school, then Cambridge, and became a Tory MP at 28? He is a typical right-wing muppet, with no real work or life experience.

It feels like the world is falling apart, and the people in power, and those who want to be in power, care more about spending so much time victimising disabled people than holding powerful child rapists to account, or saving the planet, or ending the multiple genocides that are going on right now, or literally any other useful contribution to society.

So, as Ben put it so nicely:

You’re an absolute moron if you vote for these far right cunts https://t.co/NcyQm4Keyd

— Ben 🦏 (@SFCBenW) February 18, 2026

Featured image via HG

Politics

Christian protest at St Paul’s demands an end to Rosebank oil field

The Church of England should speak out and call on the prime minister to stop Rosebank. That’s the demand from Christian Climate Action (CCA). The group held a ‘die-in’ outside St Paul’s Cathedral on 18 February, which was Ash Wednesday, the start of Lent.

Ministers also used symbolic ‘oil’ instead of traditional ash to anoint activists with the sign of the cross as part of the peaceful vigil.

Archbishops urged to campaign against Rosebank

CCA has also written to the archbishops of Canterbury and York calling for their support in urging the government to refuse permission for the Rosebank oil field in the North Sea, stating:

As part of our Stop Crucifying Creation campaign, CCA is urging the Church of England to be a prophetic voice in this existential crisis and speak out against the fossil fuel companies that are driving the Climate Emergency.

Rev James Grote explained:

Climate change is crucifying creation through flood and drought, heat and storms. We must speak up with those who are suffering the loss of everything in our one and only planet.

If we are to continue to live in hope we have to act now, move away from fossil fuels, call out the oil and gas giants and stop Rosebank. The UK government must give us hope.

On Ash Wednesday, they held a ‘die-in’ where protesters shrouded themselves under white sheets, with banner messages that included “Don’t Crucify Creation” and “Stop Rosebank,” at the foot of the steps to the main entrance of St Paul’s Cathedral.

Rev Helen Burnett said:

Ash Wednesday marks the beginning of Lent, which is the season of repentance and reflection. A time when Christians consider their commitment to living within the limits of the gospel which frees us to live in ways that bring justice and peace.

That’s why we have chosen today to urge the Church to speak out against fossil fuel extraction and here in the UK that means stopping the Rosebank oil field from being developed.

The Church of England can ‘Speak Truth to Power’ and be a prophetic voice on climate, calling out oil and gas companies and government inaction on the climate and nature crisis.

Rosebank, the UK’s largest undeveloped oil field, is back on the government’s desk. It received approval in 2023, before Scottish courts ruled it unlawful. Norwegian state oil company Equinor reapplied for drilling permission in September 2025.

Following the completion of the Adura joint venture deal between Equinor and Shell in December, Adura has now assumed majority ownership of the field.

An application to develop Rosebank has been resubmitted, which will now be subject to the government’s new climate test. This requires oil firms to account for the climate impact of burning the oil and gas they plan to extract.

Stop Rosebank campaigner Lauren MacDonald said:

We cannot open new North Sea oil and gas projects if we are to stay within the 1.5ºc threshold set out in the Paris Agreement, to which the UK is a signatory. In fact, Rosebank’s vast CO2 emissions from burning oil and gas, would equate to what more than 700 million people living in the world’s poorest countries produce in a year.

It’s simply not possible to drill at Rosebank and uphold our climate commitments.

Not only this, Rosebank is a very bad deal for the UK. It won’t lower bills and will do almost nothing to boost energy security, given that most of it is oil destined for export. It could also lead to a net loss to the Treasury of hundreds of millions of pounds, thanks to the enormous tax breaks for new drilling in the UK.

It is fantastic to see activists such as Christian Climate Action taking this issue to the highest level. It demonstrates how the Stop Rosebank campaign brings people from all walks of life together in unity and hope to save our planet.

Featured image via Angela Christofilou / Christian Climate Action

Politics

Trump On Former Prince Andrew Arrest

!function(n){if(!window.cnx){window.cnx={},window.cnx.cmd=[];var t=n.createElement(‘iframe’);t.display=’none’,t.onload=function(){var n=t.contentWindow.document,c=n.createElement(‘script’);c.src=”//cd.connatix.com/connatix.player.js”,c.setAttribute(‘async’,’1′),c.setAttribute(‘type’,’text/javascript’),n.body.appendChild(c)},n.head.appendChild(t)}}(document);(new Image()).src=”https://capi.connatix.com/tr/si?token=19654b65-409c-4b38-90db-80cbdea02cf4″;cnx.cmd.push(function(){cnx({“playerId”:”19654b65-409c-4b38-90db-80cbdea02cf4″,”mediaId”:”5141de6f-2224-4fa6-8c8f-a876c07f7f64″}).render(“69978a54e4b012cccb4b72ea”);});

Politics

Argentina strike empties Buenos Aires streets

A national strike by unions in Argentina has left the streets of capital Buenos Aires near-empty. A drone video showing the scene has been posted with the text:

Who moves the world?

Who moves Argentina?

Who moves Buenos Aires?

Workers and Workers.

¿Quién mueve el mundo?

¿Quién mueve Argentina?

¿Quién mueve Buenos Aires?

T R A B A J A D O R E S Y T R A B A J A D O R A Spic.twitter.com/FWwP2iDKCi— Celeste Murillo (@rompe_teclas) February 19, 2026

Argentina’s unions called the general strike in protest at far-right president Javier Milei’s assault on workers’ rights. Milei’s ‘reforms’ — that camouflaging word loved by the right — to abolish overtime pay, cut redundancy payments and ban most strikes, among a host of measures aimed at impoverishing the working class, triggered immediate protests when Argentina’s senate passed them. However, the general strike applies far more concerted pressure ahead of a key vote today on the legislation in Argentina’s ‘lower’ legislative house, the Chamber of Deputies. Public sector workers, bank staff and transport workers are among those staying away or joining protests.

Around 40% of Argentina’s workforce belong to a union. It’s well past time for UK workers to wise up and take similar action against the endless uniparty war on their rights.

Featured image via the Canary

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports22 hours ago

Sports22 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 hours ago

Crypto World5 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show