Entertainment

Raunchy 70s Sci-Fi Horror From Master Director Is A Deadly Experiment

By Robert Scucci

| Published

A fast-spreading parasitic infection that turns the entire world into one beautiful, mindless orgy may sound like a great idea on paper, but not if David Cronenberg has anything to say about it. His third feature, 1975’s Shivers, viscerally demonstrates exactly what could go wrong in this context, and how, if such a parasite were to run amok among the general population, nobody is going to have a good time. In fact, everybody is going to have a terrible time, because the friction involved alone will leave you feeling worse for wear.

Just watching Shivers in the comfort of your own home is an upsetting experience, which is par for the course with David Cronenberg. Since that’s the exact aesthetic he’s pursued his entire career, I can’t really fault the movie for doing what it sets out to do. I can only give it credit for being a raw, more extreme version of themes he’d later explore in films like The Brood, Scanners, Videodrome, The Fly, and beyond.

An Unflinching Exercise In Unwholesomeness

Shivers kicks off with a murder-suicide in which Dr. Emil Hobbes (Fred Doederlein) cuts open a young woman named Annabelle and pours acid into her stomach before turning the blade on himself, for reasons that are revealed much later in the film. The bodies are discovered by Dr. Roger St. Luc (Paul Hampton), who learns from Hobbes’ colleague, Rollo Linsky (Joe Silver), that they had been working on a controversial study involving parasites engineered to act like replacement organs. The idea was that these organisms would dissolve damaged tissue and assume its function, but the results were far more volatile than advertised.

The B story in Shivers centers on Nick Tudor (Allan Kolman), who lives in the same building as the slain Annabelle, sees the crime scene before authorities arrive, and simply goes about his life as if he witnessed nothing. While his coldness seems callous at first, it’s soon revealed that Nick is suffering from convulsions caused by a parasite living inside him, potentially influencing his behavior. His wife, Janine (Susan Petrie), tries to care for him, but he downplays how sick he actually is until he can no longer hide it, resulting in him ralphing up the parasite, which looks like a writhing blood clot that slithers around like a slug.

Can’t Put The Cat Back In The Bag

Once Nick’s parasite is let loose in Shivers, all bets are off. Roger begins to suspect that Dr. Hobbes’ research is directly tied to the outbreak, a suspicion that’s confirmed when Linsky alludes to work involving the creation of a sexually transmitted organism designed to spread rapidly. The infected are transformed into libido-driven maniacs who feel compelled to feed the parasite and pass it along, ensuring the cycle continues to its most extreme end.

Escalating with each passing scene, the world that Shivers constructs becomes exactly what Dr. Emil Hobbes intended. Parasites are furiously transmitted, and those who are infected grow increasingly aggressive in their efforts to convert as many residents as possible before anyone can contain the spread.

If you’re a fan of Cronenberg’s later classics but haven’t yet familiarized yourself with Shivers, think of it as a low-budget, stripped-down preview of what his career would continue to refine once he had the clout and studio backing to fully realize his body horror ambitions.

With a reported production budget of $179,000 CAD, compared to The Fly’s $15 million, Shivers is distinctly a Cronenberg vehicle operating with limited resources. If anything, Shivers proves that all you really need is a twisted imagination, patience, and instinct to make an early effort stick. The film was warmly received by critics and currently boasts an 85 percent approval rating on Rotten Tomatoes.

Shivers is raw, uncomfortable, upsettingly violent, and exactly what you should expect from a young and ambitious David Cronenberg before he became a household name. If you want to see one of the earliest examples of his ability to thoroughly get under your skin, you can stream Shivers on Tubi for free as of this writing.

Entertainment

Eric Dane Dead at 53

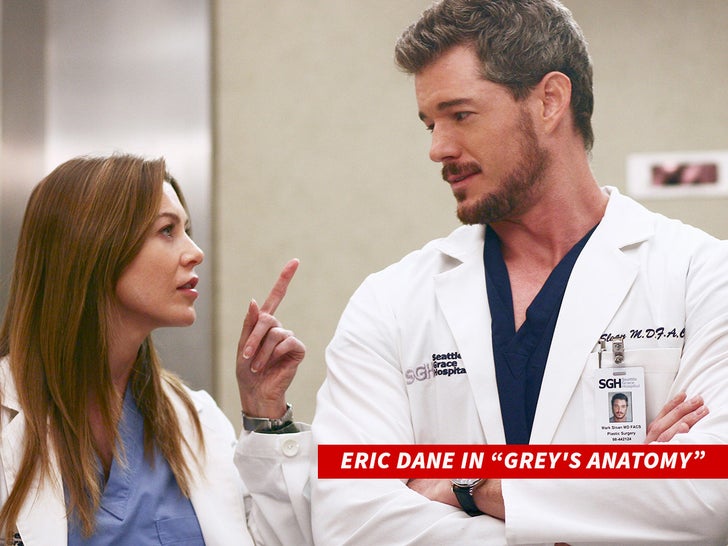

Eric Dane

Dead at 53 After ALS Battle

Published

Eric Dane has died at the age of 53, following a battle with ALS, TMZ has learned.

The family says in a statement to TMZ … “With heavy hearts, we share that Eric Dane passed on Thursday afternoon following a courageous battle with ALS. He spent his final days surrounded by dear friends, his devoted wife, and his two beautiful daughters, Billie and Georgia, who were the center of his world. Throughout his journey with ALS, Eric became a passionate advocate for awareness and research, determined to make a difference for others facing the same fight. He will be deeply missed and lovingly remembered always. Eric adored his fans and is forever grateful for the outpouring of love and support he’s received. The family has asked for privacy as they navigate this impossible time.”

The “Grey’s Anatomy” star announced he was diagnosed with amyotrophic lateral sclerosis, commonly referred to as ALS, back in April 2025.

He explained it had been an exhausting road just to get accurate answers. He bounced from one specialist to another, test after test … until a neurologist finally dropped the bomb: ALS.

Over the months, he chronicled his battle with the progressive neurodegenerative disease … revealing how he was down to just one functioning arm and was running out of body strength.

Commonly known as Lou Gehrig’s disease, ALS is a nervous system disease that affects nerve cells in the spinal cord and brain … it gets worse over time and causes loss of muscle control, according to the Mayo Clinic. There is no known cure for ALS.

Eric persevered with work … even filming the third season of the HBO series, “Euphoria.”

TMZ.com

11/9/22

Last time we saw Eric was on his 50th birthday in 2022, where we talked about birthday cake.

He was 53.

RIP.

Entertainment

Tina Win Turns Up The Heat At New York Fashion Week!

New York Fashion Week always delivers drama, but this season, Tina Win made sure all eyes were locked on her.

The 27-year-old Romanian American singer-songwriter stepped out in head-turning looks that felt less like outfit changes and more like a statement of intent. Glittering silhouettes, sharp tailoring, bold textures. It was high glamour with a pop star pulse. And if her style was loud, her message was even louder. A new era is coming.

Article continues below advertisement

A Pop Star On The Rise

Fresh off the buzz surrounding her debut single “Try Anything,” Tina is gearing up to release her second track, “How To Be Cool.” And from what we are hearing, it is not subtle.

The upcoming dance-pop anthem blends emotional intensity with club-ready production. Think pounding beats layered with lyrics that hit where it hurts. It is confident, polished, and built for repeat plays. If “Try Anything” introduced her, “How To Be Cool” looks ready to define her.

While plenty of artists flirt with the dance floor, Tina is diving in headfirst. The track leans into glossy pop while still holding onto the raw edges that set her apart.

Article continues below advertisement

Inspired By Icons, But Playing Her Own Game

Tina has cited powerhouses like Lady Gaga and Stevie Nicks as inspirations, and you can feel that influence in her aesthetic. There is drama. There is mystique. There is a refusal to shrink.

But she is not copying anyone’s blueprint. Her sound weaves alt-rock textures into mainstream pop hooks, creating something that feels both emotional and explosive. Vulnerability meets volume.

And she is not just building songs. She is building a structure.

Article continues below advertisement

After launching Tina Win Music LLC, the singer made it clear she wants control over her creative future. This is not a quick viral moment. It is a long game. She has plans to eventually use her platform to support other artists, especially women navigating complicated industry deals. That kind of foresight feels rare in a space that often prioritizes speed over strategy.

Article continues below advertisement

Fashion Week Was Just The Tease

Her presence at New York Fashion Week was more than a red carpet cameo. It was a preview.

Behind the scenes, Tina is collaborating with producer Joey Auch on a full-length debut album set for 2026. At the same time, she is quietly mapping out ventures in fashion, beauty, and fragrance. The vision is clear. Pop star today, mogul tomorrow.

The NYFW looks were not random. They felt intentional. Polished but daring. Glamorous but strong. Exactly how she describes her evolving sound.

Article continues below advertisement

From Personal Pain To Pop Power

The glitz might grab attention, but Tina’s story runs deeper.

Adopted from Romania and shaped by early experiences of loss and adversity, she channels that history into her music. She has described songwriting as both therapy and mission. Beneath the synths and high-energy beats, there is vulnerability. Beneath the confidence, there is reflection.

That emotional core is what separates her from the crowd. The spectacle may pull you in, but the honesty keeps you there.

With “How To Be Cool” on the horizon, Tina Win is not chasing whatever trend is hot this week. She is building her own universe where fashion, sound, and self-determination collide.

And if New York Fashion Week was any indication, she is just getting started.

Entertainment

This Liquid Electrolyte Delivers a Crash-Free Energy Boost

Us Weekly has affiliate partnerships. We receive compensation when you click on a link and make a purchase. Learn more!

Waking up in the morning and feeling like you didn’t get a wink of sleep is never a good feeling. Instead of drinking multiple cups of coffee or chugging energy drinks for a pick-me-up, we found a sugar-free alternative that offers an energy boost without the jitters. Thanks to the Buoy Energy Drops, you’ll feel rejuvenated without an afternoon crash.

Say goodbye to non-stop fatigue! This energy booster is enriched with B vitamins, caffeine from green tea and pre-dissolved electrolytes that promote mental clarity, enhanced physical performance and hydration. According to the brand, this science-backed find is clinically proven to hydrate 64% more than water alone.

Get the Energy Drops Ocean Electrolytes & Minerals for just $45 at Buoy!

It doesn’t take long for this energy booster to deliver game-changing results. It has a bioavailable formula that absorbs faster than powders or tablets, offering a pick-me-up in a hurry. Even better? It’s sugar-free, with no sweeteners or added flavors, so you can add it to your favorite daily beverage without altering the taste.

Real-life shoppers compare this energy booster to other alternatives. “These [have] given me a booster I haven’t had since I gave up energy drinks and coffee,” one fan shared. “I appreciate knowing I’m building up healthy electrolytes and minerals and getting the boost!”

Another reviewer noted how helpful this booster is during lengthy work shifts: “I work in a factory, so it’s hot, dirty, dingy & soul draining,” they began. “I don’t like energy drinks or pills, but this really gives me a push to get through the night.”

Tired of always feeling . . . tired? This sugar-free liquid electrolyte is formulated to hydrate and recharge, so you’ll get an energy boost without a post-caffeine crash.

Get the Energy Drops Ocean Electrolytes & Minerals for just $45 at Buoy!

Entertainment

ESPN Insider Says Kansas City Chiefs Should ‘Move On’ From Travis Kelce

Travis Kelce still hasn’t announced whether he will play for the Kansas City Chiefs next season, but one insider believes it’s time for the franchise to part ways with the legendary tight end.

“I would move on from Travis Kelce and let me tell you why,” ESPN’s Mike Tannenbaum said in a Wednesday, February 18 appearance on SportsCenter. “When you’re in the front office, you have to project what a player is going to do, not what they’ve done.”

He continued, “I’ve made that mistake countless times in my career and Travis Kelce is a first ballot Hall of Famer. But when you watch him and make an honest and sober evaluation of his 2025 performance, clearly his best days are behind him.”

Kelce, 36, has played all 12 of his NFL seasons with the Chiefs, winning three Super Bowls and being named to 11 Pro Bowls along the way. His 2025 season was the third in a row in which he failed to accumulate 1,000 receiving yards and his 76 receptions were his fewest since 2015.

He still managed 11.2 yards per reception, his best mark since 2022 and played in all 17 Chiefs regular season games.

Kelce mulled retirement after last season, but decided to return after Kansas City’s blowout loss to the Philadelphia Eagles in the Super Bowl. This time, the Chiefs are coming off a shocking losing season and their quarterback, Patrick Mahomes, is recovering from ACL surgery.

“I’ve got so much love for this team, this organization and the people here, so I’ll spend some time with them, go through exit meetings tomorrow and get close to the family and figure things out,” Kelce told reporters after the Chiefs’ season finale against the Las Vegas Raiders in January.

Kelce has made his love for the game no secret, but whether he returns will depend on if he believes he can live up to his own high standards.

“I think if my body can heal up and rest up and I can feel confident that I can go out there and give it another 18, 20, 21-week run, I think I would do it in a heartbeat,” he said on a January episode of his “New Heights” podcast, which he hosts with brother Jason Kelce. “I think right now it’s just finding that answer and seeing how the body feels after this game and when it all settles down.”

While Travis considers his future, a source exclusively told Us Weekly in January that he has options outside of football. The insider said that talks between Travis and Netflix are “well underway” for him to “serve as their exclusive broadcast sports correspondent.”

A second source exclusively told Us that Travis “has had talks with his team about retiring and not playing football next season.” Those talks have been centered around what his next career move would be if he does decide to hang up his cleats.

If Travis does decide to return, he has the support of the Chiefs’ front office. Team owner Clark Hunt told NFL Network’s Good Morning Football in January that “there’s no doubt in my mind that he can still play.”

“We’re trying to be respectful and let him have the time that he needs to make a decision,” he added.

Entertainment

Influencer Kristy Scott Speaks About Life After Divorce

Kristy Scott shocked her millions of fans across social media when she filed for divorce from her soon-to-be ex-husband Desmond Scott in December 2025. As the details of his infidelity were revealed to be the cause, Kristy retreated a bit from the spotlight, but now she’s ready to embrace a new era.

In true fashion, Kristy took to social media to share her life update with her fans, as she transitions from being part of a well-known influencer couple to a single mom.

Article continues below advertisement

Kristy Scott Is ‘Saying Yes More’ And Moving Forward With A Positive Outlook Amid Divorce

In a post on TikTok, Kristy spoke to her followers about how life has been for her lately, including feeling like she’s “building my social life from scratch,” as her social media career has been tied to Desmond for several years due to them being extremely successful couple content creators.

The mom of two sons, Vance, 7, and Westin, 6, admitted in the video that juggling her career and being a mom has been “a little challenging,” but she is making the effort to carve out some “me time.”

One way she aspires to do that is by “saying yes more,” after sharing that she developed social anxiety and often makes excuses to stay inside “laying in bed and binge-watching TV shows,” but she wants to change that.

Article continues below advertisement

“I typically would have an excuse or not go, but because I always felt like, ‘Oh, I gotta tackle this, this and that.’ And lately, I’m like, ‘You know what? I need to say yes to things,’” Kristy said.

“Just being able to go out and enjoy myself and forget about a little bit of responsibility for a minute, I’ve been vibing with it,” the influencer with over 2 million followers said, “I say all this to say this is your sign to dive back into your hobbies.”

Article continues below advertisement

Kristy Filed For Divorce From Desmond Scott Due To His Infidelity

After the news that Kristy filed for divorce in late December 2025 began to circulate, rumors swirled as to why the seemingly idyllic couple were parting ways, and shortly after Desmond confirmed it was due to his infidelity.

“I want to begin by apologizing to Kristy, our family, and everyone who has been impacted by the public attention surrounding this situation,” Desmond began in a post on his Instagram Stories. “I know this news has been disappointing for many, and I’m truly sorry for the hurt it has caused. Kristy is the mother of my children, and that will always come first.”

While not explicitly using the word “cheating,” Desmond made it clear that he made “choices” he was “not proud of” when the couple were going through challenges in their marriage.

Article continues below advertisement

“Kristy and I faced challenges and made sincere efforts to work through them,” he revealed. “Toward the end of 2025, I wanted to separate, and I had conversations with Kristy regarding this. During this period, I made choices that I am not proud of. I took responsibility for those actions, I shared this with her directly and personally, and ultimately, we decided to divorce.”

“l ask for privacy and compassion as we navigate this difficult chapter of our lives. Thank you to everyone who has supported us over the years. I’m grateful for that support and will continue sharing my love for cooking and the things that inspire me. I hope you’ll continue that journey with me,” Desmond concluded.

Article continues below advertisement

Kristy Previously Shared Her Anxiety Of Coming Back To Social Media Following The Split

On January 29, Kristy posted an Instagram video out shopping and admitted to being “nervous” talking to her fans after being in the middle of drama-filled headlines.

“I’m literally shaking,” Kristy said at the time. “I’m really nervous making this video, but also my nervous system is, like, shot. It kind of has been for the past month.”

“I don’t wanna get emotional, but I kind of feel like this is gonna force you guys to see a different side of me,” she continued. “Because y’all always see like, my chaotic, humorous side and it’s just not in me to do that at this current moment in time.”

“I’m just gonna share with you guys the raw, the real, the ugly, just like how I’m transitioning,” Kristy added.

She Is Moving Forward With Work Via High-Profile Brand Deals

Late last month, Kristy shared via Instagram, her new campaign for YSL Beauty, as she captioned the post “new beginnings.”

She has a host of high-profile brand deals under her belt, as her influence career has been going strong for a decade.

Article continues below advertisement

Kristy And Desmond Were High School Sweethearts

The former couple met when they were 14 and 15 years old, and before they became a super successful social media couple, they were business partners.

Entertainment

Claressa Shields Shocks Fans After Flexing Her Pre-Fight Glow-Up

Claressa Shields’ new lewk has the internet going OFF! Makeup on fleek, baby hairs laid, and that fresh do is sitting effortlessly. The boxing champion is definitely giving off THAT Girl energy ahead of her big fight, and it’s safe to say fans are all the way here for the vibes.

RELATED: Love Day Lit! Papoose Goes All Out For Claressa Shields With MAJOR Oceanfront Surprise On Valentine’s Day (VIDEO)

Claressa Shields Shakes Up Timelines After Flexing Flawless NEW Look

Listen, Claressa Shields has made it crystal clear that every time she steps out, she’s showing out, period! She served that exact energy when she gave fans a peek at her new hairstyle. The Gwoat sat pretty and flawless with soft makeup, letting her hair do all of the talking. Her jet-black tresses with a touch of brown highlights draped over her shoulders, and layers with a side bang framed her face. Shields was clearly feeling herself, and fans were living for it! She even slid into The Shade Room’s comment section, hyped about her upcoming fight against Franchon Crews-Dezurn on Sunday, February 22, writing, “It’s Fight week baby!!!!!! 🔥🔥🔥❤️❤️❤️”

Social Media Can’t Stop Gushing Over Claressa Shields’ Pre-Fight Glow-Up

After The Shade Room shared a peek of Shields’ new look, the comment section went UP! Roommates immediately flooded it with fire and heart-eye emojis, while others joked that popping out looking like that would definitely have Papoose waiting for her upstairs.

Instagram user @datssfunntayy wrote, “Okayyy, you know it’s tea wen the two fingers touching 🥰🤏🏾”

Instagram user @thatmodel.silhouette wrote, “Ok now this is cute 😍”

While Instagram user @prettychaoss__ wrote, “Yea pap upstairs with ha tonight 😍😂”

Then Instagram user @jermaine716 wrote, “I know that right, keep giving these bitter females a reason to hate 🔥🔥🔥🔥🔥”

Another Instagram user @therealeazyeconomicz wrote, “Papoose make her feel even prettier as he should ✨🤎”

Instagram user @yelo.k wrote, “She’s always had a very pretty face.😍”

While another Instagram user @therealeazyeconomicz wrote, “You can tell she feel pretty 😍😍”

Finally, Instagram user @peachiesuze2 wrote, “Okaaaay Clarilla Shields 😍😍😍😍 I didn’t even know that was her. It’s giving Big Glo energy.”

Claressa Serves MAJOR Pre-Fight Fashion Energy

Claressa didn’t just flex her new hair — she spun the block and showed up looking fashionably fly in a bright pink fur coat at her press conference for her fight against Franchon. Shields served a serious look in a floor-length coat, knee-high boots, and studded denim jeans. Peep the clips below.

RELATED: Don’t Play With Her! Claressa Shields Gags The TL With Spicy Twerk Session For ‘Liberian Girl’ TikTok Challenge (VIDEO)

What Do You Think Roomies?

Entertainment

Megyn Kelly Under Fire After Leveling Personal Attack Against Chris Cuomo

The former Fox News anchor recently unloaded on Cuomo during a podcast episode, criticizing the former CNN personality’s coverage of the Nancy Guthrie case.

In her fiery rant—which has racked up nearly 100,000 views online—Kelly also leveled several personal digs at Cuomo, even labeling him a “douchebag.”

Article continues below advertisement

Megyn Kelly Pops Off On Chris Cuomo Over Nancy Guthrie Coverage

“Nobody watches his show on NewsNation, and nobody listens to his failed podcast either… Therefore, he gets upset at anybody who does well…”@MegynKelly fires back at “Fredo” Cuomo and brings facts about the sheriff’s past Guthrie family comments.

Watch and subscribe:… pic.twitter.com/YhD8mAvs5d

— The Megyn Kelly Show (@MegynKellyShow) February 17, 2026

Recently, Pima County Sheriff Chris Nanos announced that his department was clearing all immediate family members of the Guthrie family from its investigation as suspects.

Both Kelly and Cuomo have responded to the news of Nancy Guthrie’s disappearance on their respective platforms. During an episode of “The Megyn Kelly Show,” the conservative podcaster refused to hold back as she responded to Cuomo, whom Kelly believed targeted her show during a NewsNation segment.

Article continues below advertisement

“Here’s ‘Fredo’ Cuomo on his little-known show on NewsNation, which has less viewers than I have fingers,” she said. “Let me tell you what Fredo is really upset about. Fredo No-Rato, that’s his real problem. Nobody watches his show on NewsNation… Nobody watches his failed podcast either. Nobody watched his SiriusXM radio show. Nobody watched him on CNN.”

Article continues below advertisement

Kelly Unleashes Claim Against Chris Cuomo Amid Nancy Guthrie Investigation

Kelly didn’t stop there. She accused Cuomo of getting upset when his competitors outperform him. “… like our show, which is always one of the top three conservative podcasts in the nation,” she said. “It’s currently number one on Apple. Fredo doesn’t like that. Because, as I say, Fredo No-Rato. So he gets upset, and he gets jealous.”

Elaborating further, Kelly asserted that Cuomo “can’t take criticism” and suggested the journalist exhibits poor behavior whenever she calls out his ratings or his claims regarding his podcast’s reach.

Article continues below advertisement

Kelly Claims Cuomo Once Tried To Get Her To Stop Speaking About Him

Elsewhere during her rant about Cuomo, Kelly hurled another allegation against Cuomo, the former anchor of “Good Morning America.”

Kelly alleged that her legal team once fielded a phone call from Cuomo, who reportedly “begged” her lawyer to convince her to stop mentioning him.

According to Kelly, “He didn’t want me to attack him, because it hurt his little feelings.”

Article continues below advertisement

Social Media Users React To Kelly’s Statements About Cuomo And Slams Her For Being Too ‘Personal’

Why do you think it is necessary to call him Fredo? That’s rude and makes you look small. You are making $$ off of Nancy so please don’t try to make it sound like you care. You did those stupid videos of you acting like you were on a rocket no different than Cuomo.

— Stop (@Stop26265369) February 18, 2026

Netizens have flooded social media with sharp reactions to Kelly’s comments, and the feedback has been far from kind toward the podcast host.

One user slammed the media pundit for making “everything personal,” while another said Cuomo likely “gets more audience than you.”

Another social media user posted, “It’s all about ratings for you. I get that’s a metric of success, but my god. This is no way to live.”

“Why do you think it is necessary to call him Fredo? That’s rude and makes you look small. You are making $$ off of Nancy so please don’t try to make it sound like you care,” a fourth wrote.

What’s Happening With Nancy Guthrie?

According to several reports from The Blast, the search for Nancy Guthrie—mother of “TODAY” host Savannah Guthrie—remains active as the investigation approaches its fourth week.

Nancy first made headlines on February 1, 2026, when concerned community members reported to Arizona law enforcement officers that she hadn’t been seen since the night before.

A day later, Pima County Sheriff Chris Nanos confirmed that Nancy was forcibly taken from her home and that her Tucson residence had become an official crime scene.

Tips have poured in, according to authorities, and some DNA has been sent off to out-of-state laboratories to see if it can point the investigators in the right direction.

As of now, however, no suspects have been named.

Article continues below advertisement

Three days ago, Savannah shared a saddening video on Instagram, sharing that her family still had “hope” that they’d be reunited with their elderly mother.

She also attempted to share an encouraging message to Nancy’s potential captors, saying, “We are here. We believe. And we believe in the essential goodness of every human being. It’s never too late.”

Entertainment

Which America’s Next Top Model Contestants Spoke Out About Netflix Documentary?

America’s Next Top Model’s most memorable contestants aren’t staying quiet about their experience on TV.

After more than 24 seasons, the reality show is being put under the microscope in a new Netflix docuseries titled Reality Check: Inside America’s Next Top Model.

While host Tyra Banks and judges J. Alexander, Jay Manuel and Nigel Barker are featured in the new project, many viewers are interested in the untold stories by some of the show’s breakout stars.

Since Reality Check premiered on Netflix on February 16, 2026, several contestants have shared their honest and unfiltered reviews of the project. Some are even commenting on Banks’ involvement with the show.

“When I signed on for it, Tyra wasn’t even going to be on the show, so I was kind of surprised that it was more like a judge-focused show,” cycle 10 winner Whitney Thompson said via Instagram on February 17, 2026. “I would want to hear more from the contestants.”

Keep reading to see what cast members are saying about Reality Check and if it’s an accurate representation of their experience on America’s Next Top Model:

Shandi Sullivan

Shandi Sullivan Courtesy of Netflix

America’s Next Top Model cycle 2 finalist Shandi Sullivan claimed that she was sexually assaulted during a group trip to Italy during her time on the show. Now that she’s shared more of her experience, Sullivan is grateful for the support.

“Welp the documentary is out and now you know more of my story…after all of the years the Top Model girls and what we went through were never forgotten,” Sullivan wrote via Facebook on February 16, 2026. “At the age of 43, I continue to struggle with it; always smiling. That’s why I took this opportunity. Knowing that Tyra didn’t have control over my narrative, that the director and producers here had my back…that’s why I did it. I did it for me. Because I mattered and I still do! The love I have felt today has been immense. Thank you to everyone that heard me.”

Whitney Thompson

Whitney Thompson Courtesy of Netflix

America’s Next Top Model cycle 10 winner Whitney Thompson addressed the criticism Tyra Banks was receiving from the docuseries.

“Hating Tyra is easy, right? I mean, it’s easy to blame her. But the truth is that the industry would not be what it is today if it wasn’t for her putting these things on Top Model back then,” Thompson claimed via Instagram on February 17, 2026. “We would not be gasping at the craziness that she put on TV if she hadn’t done it and shifted our entire mindset. She took queer, Black, trans, different weights, different heights and she put them into the average American’s living room where everyone was together watching these shows, rooting for someone who didn’t necessarily look like them.”

The model continued, “Because of that, it shifted the whole dynamic to where people could actually use people who weren’t identical to them in advertising. That had never happened before.”

Tiffany Richardson

America’s Next Top Model cycle 4 contestant Tiffany Richardson won’t forget the way Tyra Banks yelled at her before being eliminated.

“Hold up @tyrabanks let’s keep it cute … you know how you treated me the whole time off and on camera, YOU WAS A BULLY!!! You treated me like s*** and said the nastiest things about me and my son,” Richardson claimed in a since deleted Instagram post. “That is not how the argument went but YALL EDITED TO MAKE IT LOOK LIKE YOU CARED.”

Banks admitted in the docuseries that she “went too far” while addressing the “tough” moment.

“You know, I lost it. It was probably bigger than her. It was family, friends, society, Black girls, all the challenges that we have,” she explained. “So many people saying that we’re not good enough. I think all that was in that moment. That’s some Black girl stuff that goes real deep inside of me, but I knew I went too far.”

Adrianne Curry

Although America’s Next Top Model cycle 1 winner Adrianne Curry declined to participate in the Netflix doc, she spoke out about the project on social media.

“I was just told one of the Top Model judges admitted they’d advance girls that were not the best models…just good tv,” Curry wrote via X on February 17, 2026. “That was me. I’ve said it for years, I never was the best one. I just had the best sob story. It is nice to have it confirmed.”

Keenyah Hill

America’s Next Top Model cycle 4 contestant Keenyah Hill participated in the Netflix doc with hopes that her story would be shared accurately.

“I’m grateful for the opportunity to lend my voice about my experience on America’s Next Top Model,” Hill wrote via Instagram on February 16, 2026, before watching the finished product. “Sending SO MUCH LOVE to the ANTM Alumni ❤️. I know we all had very different experiences on the show and I feel for everyone who had to heal from the aftermath with half the world watching!! Grateful to have been a part of such a legendary show… Can’t wait to watch 🍿.”

Lisa D’Amato

America’s Next Top Model cycle 17 winner Lisa D’Amato is hopeful that E!’s upcoming project titled Dirty Rotten Scandal will be a more revealing look at the reality TV franchise she was a part of.

“#ANTM #NETFLIX mark your calendars for Dirty Rotten Scandal’s on E! March 11th,” D’Amato wrote via Instagram on February 16, 2026. “The Netflix was still very tame and sugarcoated compared to a lot of us and what happened behind the scenes to US that they kept silenced. We will have the last word. Thank you 🙏 All my love to @miss_jalexander ♥️.”

Eva Marcille

Eva Marcille, who won the third cycle of America’s Next Top Model, revealed she was “gobsmacked” after watching Reality Check: Inside America’s Next Top Model.

“I was in awe … My mouth was wide open,” she said in a February 2026 interview with CBS Mornings. “To be a part of a club, and not know what’s going on in the club is crazy.”

Marcille, who was not approached to be in the doc, added that she was horrified to hear some of the stories mentioned in the Netflix documentary.

“I’ve lived my experience. I’ve walked in my shoes. And though there is a level of relatability one would assume, someone having walked in the same shoes, I had no idea. Absolutely no idea. I have been asked about Tyra for 21 years,” she explained. “No matter what project I’m doing, what I’m involved in, somehow Top Model finds its way in my interview.”

Entertainment

Brian Kelley Teases Florida Georgia Line Future With Tyler Hubbard

Brian Kelley and Tyler Hubbard are prioritizing their friendship before releasing any new Florida Georgia Line music.

“Right now, I think just working on our brotherhood is kind of top tier, most important for us,” Kelley, 40, said on the Wednesday, February 18, episode of the “Country Outdoors” podcast. “Lord willing, the brotherhood will lead its way home, so we’ll see.”

Hubbard, 39, and Kelley cofounded Florida Georgia Line in 2010, going onto release four studio albums together. The two musicians announced a hiatus from FGL in 2022, each pursuing solo projects.

“I think we’re both focused on the friendship and working on our own stuff still,” Kelley said on Wednesday. “I think time will tell, and I’m excited about what God can do, and I think the options are endless right now. It’s cool to see what time can do, as well. You plan one thing and God and other things happen and things shift and cycles come back.”

He continued, “I think, over the past couple of years, we’ve really even more so tried to allow God to move and open those doors or close those doors, whatever it may be in life and really not have it our way. I think [any] time we get set on something, if it changes, you get frustrated. We’re just a piece of sand in this world and just trying to say, ‘God, take the wheel.’”

Kelly further teased that a potential FGL reunion “does excite” him without revealing an exact timeline for musically coming back together with Hubbard.

Months earlier, Hubbard teased that he also hoped the duo could mend fences.

“I hadn’t spoken to BK a lot in the last couple years, but we’re going on a hike next week,” Hubbard said on the “Human School” podcast in December 2025. “The way I see it is I have a desire for that friendship. I miss the guy that I was partners with for 10 years. I miss my old roommate, my best man [at] my wedding.”

According to Hubbard, their friendship didn’t “have to be what it was” during their band heyday.

“It doesn’t have to equal FGL doing anything, but we need to repair and spend some time together face to face and just walk and talk, hang and go fishing or get a guitar out,” he said. “Enough time has gone by. What’s happened has happened, but there hasn’t been any real repair at all. What I’m hungry for is, let me get my friend back.”

Hubbard further shut down rumors about what led to their friendship breakup.

“There’s not a good guy, bad guy in this equation. There’s not a right or a wrong,” he said late last year. “BK stuck to his convictions and led with his gut and decided to make a decision based on his passion. I set a boundary that I wasn’t willing to cross and it is what it is. We both accepted it way before the internet accepted it.”

Hubbard also claimed that Kelley was eager to work on solo projects over FGL ones.

“We had a really good conversation for, like, an hour. I was able to be really honest. He was able to be really honest,” Hubbard recalled on the 2025 podcast. “He just basically said, ‘Man, I’m really feeling called, like, this is the time for me to do this and I really need your support and want your support.’ [I said] ‘whatever you ultimately want to do, I want you to be happy and I want you to follow your gut and your heart and if that means not doing this, so be it. But I beg you to reconsider.’ That was not the path I wanted.”

Kelley dropped his solo record, Sunshine State Of Mind, in 2021, while Hubbard released his self-titled debut in 2023 and Strong in 2024.

Entertainment

Donald Trump worries Melania is a 'big movie star' following doc: 'It's not good'

:max_bytes(150000):strip_icc():format(jpeg)/donald-and-melania-trump349-012926-a094d69c118c488b80259567368fe6bd.jpg)

The president said there’s only room for one movie star in the family.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports23 hours ago

Sports23 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 hours ago

Crypto World5 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show