Crypto World

China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and PEPE By the End of 2026

Running a well-crafted prompt through Alibaba AI model KIMI can surface some eye-opening 2026 price scenarios for XRP, Shiba Inu, and Pepe.

According to Alibaba’s outlook, all three digital assets could generate substantial returns by New Year, perhaps much sooner than investors expect.

Below is a closer look at the projections and the logic behind them.

XRP ($XRP): Will Ripple’s Payments Solution Hit $8?

In a recent statement, Ripple once again emphasized that XRP ($XRP) sits at the heart of its strategy to position the XRP Ledger as a globally scalable, enterprise-grade payments infrastructure.

Thanks to near-instant transaction settlement and ultra-low fees, XRPL has also gained traction as a preferred blockchain for two of crypto’s fastest-expanding sectors: stablecoins and tokenized real-world assets.

With XRP currently changing hands around $1.41, Alibaba forecasts that the token could reach as high as $8 by the end of 2026, a sixfold increase from today’s levels.

Technical indicators appear to support this scenario. XRP’s recent support and resistance lines for a bullish flag, which could be a precursor to a major rally.

Potential tailwinds include accelerating institutional demand following the approval of U.S.-listed XRP exchange-traded funds, Ripple’s growing roster of enterprise partners, and the possible advancement of the U.S. CLARITY bill later this year.

Shiba Inu (SHIB): Alibaba Think SHIB Will Grow 850% by Christmas

Shiba Inu ($SHIB), launched in 2020 as a lighthearted alternative to Dogecoin, has since matured into a sizable crypto ecosystem with a market cap of $3.6 billion.

Currently trading around $0.000006187, Alibaba’s analysis suggests that a decisive breakout above resistance in the $0.000025 to $0.00003 range could trigger a strong upside move, potentially lifting SHIB to $0.000059 by year-end.

Such a rally would equate to approximately 850% gains from current prices and place SHIB just below its October 2021 ATH of $0.00008616.

Additionally, Shiba Inu has expanded well beyond meme status. Its Layer-2 network, Shibarium, delivers faster transactions, lower fees, added privacy features, and improved developer tools.

Pepe ($PEPE): Alibaba Examines a 2,200% Bull Case

Pepe ($PEPE), which debuted in April 2023, has grown into the largest meme coin outside the doge category, boasting a market capitalization of roughly $1.8 billion.

Drawing inspiration from Matt Furie’s “Boy’s Club” comics, PEPE’s instantly recognizable branding and cultural relevance have kept it highly visible across social media platforms.

Despite fierce competition in the meme coin arena, PEPE’s dedicated community, and the countless imitators it has spawned, have helped it remain a consistent leader within the sector.

Occasional cryptic posts from Elon Musk on X have further fueled speculation that PEPE could sit alongside DOGE and BTC among his personal holdings.

At present, PEPE trades near $0.0000042, roughly 85% below its December 2024 ATH of $0.00002803.

Under Alibaba’s most bullish assumptions, PEPE could surge by as much as 2,233%, climbing to approximately $0.000098 and decisively breaking its previous record.

Maxi Doge: A New Meme Coin Contender Steps Into the Spotlight

Limited by their size, PEPE and SHIB’s potential gains might be substantial, but they’re just short of explosive.

However, Maxi Doge ($MAXI) hasn’t even launched yet and it’s already one of the most talked-about meme coins of 2026, raising $4.6 million in its ongoing presale.

The project revolves around Maxi Doge, a brash, gym-obsessed, unapologetically degen character portrayed as a distant cousin and would-be rival to Dogecoin’s crown, capturing the raw, DGAF energy that defined the 2021 meme coin boom.

MAXI is an ERC-20 token on Ethereum’s proof-of-stake network, giving it a significantly smaller environmental footprint than Dogecoin’s proof-of-work design.

Early presale participants can currently stake MAXI tokens for yields of up to 68% APY, with rewards tapering as more users join the staking pool.

The token is $0.0002804 in the current presale stage, with automatic price increases programmed at each funding milestone. Purchases are supported via MetaMask and Best Wallet.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Maxi Doge Website Here

The post China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and PEPE By the End of 2026 appeared first on Cryptonews.

Crypto World

Vitalik: New Ethereum Design Targets Censorship With FOCIL and EIP-8141

TLDR:

- FOCIL and EIP-8141 allow smart wallet and privacy transactions to reach blocks without wrappers or intermediaries.

- Randomized includers reduce proposer dominance and increase censorship resistance for all Ethereum transactions.

- Rapid inclusion within one or two slots becomes likely even under hostile network behavior.

- Future FOCIL expansion could support most block transactions while preserving MEV auction mechanics.

Ethereum is moving closer to censorship-resistant transaction inclusion after new technical links emerged between FOCIL and EIP-8141.

The update focuses on ensuring that all transaction types reach the blockchain quickly, even under hostile network conditions. It also expands how smart accounts and privacy protocols interact with block production.

The development highlights Ethereum’s push to reduce proposer power while keeping network incentives intact.

How FOCIL and EIP-8141 Enable Direct Transaction Inclusion

According to a post shared by CEO Vitalik Buterin, FOCIL works alongside EIP-8141 to make smart accounts and privacy tools first-class transaction senders.

EIP-8141 builds on account abstraction by allowing smart wallets to submit transactions directly onchain without wrappers or intermediaries. These accounts can support multisignature controls, quantum-resistant keys, and gas sponsorship.

FOCIL then ensures that these transactions gain rapid inclusion through randomly selected includers each slot. In every block, up to 17 actors can include transactions, instead of relying on a single proposer.

Vitalik noted that this structure creates a path for almost guaranteed inclusion within one or two slots. It also allows privacy protocol transactions to enter blocks through the public mempool without relying on broadcasters or relayers.

Why FOCIL and EIP-8141 Weaken Proposer Control

FOCIL currently limits each inclusion list to about 8 kilobytes, keeping the design lightweight in its first phase. However, the roadmap allows these lists to grow and potentially carry most transactions in future blocks.

The approach mirrors some features of multiple concurrent proposer models without removing proposer-builder separation. Instead, it preserves the MEV auction for the final ordering role through ePBS.

Even if all proposer slots were captured by a hostile entity, transactions would still reach blocks through FOCIL includers. This reduces the ability of any single actor to block or discriminate against certain applications.

The design shifts power away from centralized block producers while keeping economic incentives stable. It also protects smart wallet operations and privacy protocol activity from selective exclusion.

Developers say the combination strengthens the base layer against censorship without forcing changes to existing transaction flows. Transactions from smart accounts can move through the public mempool and directly reach includers.

With these changes, ETH positions itself to support a wider range of transaction types under adversarial conditions. The update reinforces ongoing work on account abstraction and block inclusion guarantees.

Crypto World

Payward Acquires Magna to Expand Kraken Token Lifecycle Infrastructure

TLDR:

- Payward’s acquisition of Magna links token vesting and claims infrastructure directly into Kraken’s expanding product ecosystem.

- Magna will continue operating independently while its tools integrate with Kraken’s broader token issuance and distribution roadmap.

- The deal extends Kraken’s reach from trading into fundraising and long-term token lifecycle management services.

- Magna’s platform already supports over 160 projects with peak total value locked of $60 billion in 2025.

Payward has acquired Magna in a move that extends Kraken’s services beyond trading into token lifecycle management. The deal brings vesting, claims, and distribution tools into Kraken’s broader financial infrastructure stack.

Company leaders described the transaction as part of a push toward verticalized crypto services. Terms of the acquisition were not disclosed.

Payward Acquires Magna to Build End-to-End Token Infrastructure

The announcement came through a company blog post and was later echoed in a social update from Dave Ripley. The post confirmed that Magna will continue operating as a standalone platform while integrations progress.

Magna provides tooling for onchain and offchain vesting, token claims, custody workflows, and specialized staking features. These services support teams running complex token distributions and treasury operations.

According to Payward, the acquisition supports its expansion from trading infrastructure into fundraising, issuance, and long-term network management.

The company said Magna already serves teams managing billions of dollars in active token ecosystems.

Arjun Sethi framed the deal as an effort to avoid concentration around distribution and access. He said open, chain-aware infrastructure connects fundraising, liquidity, and distribution into one operating layer.

Kraken Expands Beyond Trading With Magna Integration

Kraken’s on-chain leadership linked the move to a broader strategy around issuer services. Calvin Leyon said the exchange aims to extend trusted infrastructure across the full token lifecycle.

Magna will initially focus on onboarding and security hardening while preserving its existing integrations. Payward said later phases will align the platform with token issuance and global distribution workflows.

Magna’s client base includes more than 160 projects, with peak total value locked reaching $60 billion in 2025. The company has positioned itself as a core operational layer for token generation events and ongoing community management.

Bruno Faviero stated that joining Kraken provides resources for deeper liquidity and global reach. He added that Magna will continue supporting teams across multiple chains and custody setups.

Payward confirmed that Magna customers can keep using current products without disruption. Product updates will roll out gradually as foundational integrations advance.

The acquisition strengthens Kraken’s role beyond exchange services into infrastructure for builders and issuers. It also signals growing demand for standardized tools that manage vesting, distribution, and compliance at s

Crypto World

Tom Lee and K3 Capital Increase ETH Accumulation Below $2,000

For some institutional investors, trading ETH below $2,000 represents an opportunity rather than a risk, despite growing concerns about expanding unrealized losses.

ETH has now entered its sixth consecutive month of decline. This marks the longest losing streak since the 2018 downtrend.

Tom Lee and K3 Capital Boost ETH Holdings as Staking Ratio Hits Record High

According to Lookonchain, Tom Lee — founder of Fundstrat and head of Bitmine — executed large ETH purchases during the third week of February.

On February 18 alone, Bitmine acquired an additional 35,000 ETH worth approximately $69.37 million. The purchase included 20,000 ETH, valued at $39.8 million, from BitGo, and 15,000 ETH, valued at $29.57 million, from FalconX.

K3 Capital also made a significant move. Data from OnchainLens shows that a wallet linked to the investment fund purchased 20,000 ETH worth $40.08 million from Binance.

These sizable transactions reflect strong long-term conviction in ETH, even as the asset trades below $2,000.

Data from CryptoRank indicates that long-term investors have increased Ethereum accumulation during the current downturn.

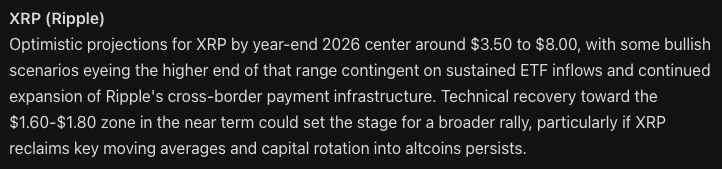

Meanwhile, data from CryptoQuant shows that inflows into ETH accumulation addresses over the past six months have reached the most active period in history. History shows that in 2018, ETH experienced seven consecutive months of decline before recovering.

“The whales and the largest banks are buying and building on ETH. These are the highest inflows into whale‑accumulation wallets we’ve seen. Meanwhile, retail has abandoned it and is calling for its failure. They’re tired and exhausted after watching the price chop inside this massive range for five years.” – Crypto investor Seth commented.

Another key milestone has emerged. For the first time in Ethereum’s 11-year history, more than half of the total ETH supply has been staked.

On-chain data platform Santiment reports that over 50% of the ETH supply now resides in the Proof-of-Stake (PoS) contract.

This contract functions as a one-way vault. Investors deposit ETH into staking to secure the network. Staked coins temporarily leave circulation and cannot be traded.

Staking activity has continued to rise, particularly during bearish cycles. As more ETH becomes locked, the liquid supply declines.

“When over 50% of the supply is locked in staking, liquid supply shrinks. Fewer coins are available for trading. That reduces sell pressure and makes the market more sensitive to new demand.” Validator Everstake stated.

Everstake clarified that 50.18% represents the total ETH held by the Ethereum PoS contract address, while the remaining 30% is active stake.

However, recent analysis by BeInCrypto does not rule out the possibility that ETH could decline further to $1,385 in the short term, amid the most negative market sentiment seen in years.

Even if that scenario unfolds, on-chain data suggests that large investors and institutions continue to position for a long-term recovery.

Crypto World

Expert: Crypto Was Built for Machines, Not Humans, and AI Is Proof

TLDR:

- Crypto built for AI agents treats rigid code as infrastructure instead of a flaw in financial design.

- Legal contracts favor human judgment, while smart contracts favor machine verification and execution.

- AI wallets bypass legacy systems that only recognize humans and registered institutions.

- Self-driving wallets could replace manual interaction with automated on-chain decision systems.

Crypto has long struggled with usability, security risks, and trust gaps for everyday users.

A new framework suggests those flaws reflect a deeper design choice rather than engineering failure. The argument centers on crypto built for AI agents, not for human decision-making. This shift reframes why smart contracts rely on rigid logic instead of legal judgment.

Crypto Built for AI Agents Challenges Human-Centered Finance

The idea gained traction after a commentary shared by Milk Road and attributed to Haseeb Qureshi, managing partner at Dragonfly. He highlighted that even crypto-native firms still rely on traditional legal contracts when making investments.

Despite having engineers capable of auditing smart contracts, Dragonfly continues to use courts and lawyers for enforcement.

Legal systems allow judges to apply context and reason when disputes arise. Code executes instructions without interpretation.

Humans instinctively trust law because it reflects centuries of social and institutional design. Banking infrastructure assumes mistakes, reversals, and mediation will occur. Smart contracts offer none of those safety valves.

For machines, those same traits become advantages.

An AI agent can verify addresses, audit logic, and simulate outcomes in seconds. Deterministic code removes uncertainty that legal frameworks introduce through jurisdiction and precedent.

Crypto Built for AI Agents Aligns With Machine-Only Transactions

The traditional financial system only recognizes humans, companies, and governments as valid participants. It has no category for autonomous software actors. That creates unresolved questions around liability, compliance, and sanctions when AI systems transact.

Crypto avoids those constraints by treating every participant as a wallet controlled by code.

An AI agent can hold funds and execute agreements without legal identity. This structure allows machine-to-machine commerce to operate without regulatory classification barriers.

Supporters of the thesis argue that features humans dislike are optimal for automation.

Long addresses, gas fees, and permissionless access form a strict specification layer. AI systems interpret these rules as predictable infrastructure rather than friction.

This logic underpins the concept of a “self-driving wallet.” Instead of users clicking through decentralized apps, they would issue goals to an agent. The agent would evaluate protocols and construct transactions automatically.

Machine-to-machine transactions already occur in limited forms across on-chain trading bots and automated liquidity strategies. The framework suggests those activities will expand into broader economic coordination. Humans would remain supervisors rather than operators.

The argument does not claim crypto failed its original mission. It proposes that crypto found its natural counterpart in autonomous software. Earlier technologies followed similar paths once complementary tools emerged.

Milk Road framed the thesis as a rethinking of long-standing crypto criticism.

Problems such as complexity and rigidity may reflect optimization for non-human users. In that view, crypto’s future lies in becoming financial infrastructure for artificial agents rather than consumer interfaces.

Crypto World

Crypto.com adds ISO 42001 to its AI, security certifications

Crypto.com gains ISO 42001 AI certification in 2026, expanding its regulated security and AI governance stack.

Summary

- Crypto.com is the first digital asset platform to earn ISO/IEC 42001:2023, the new global Artificial Intelligence Management System (AIMS) standard.

- The exchange already holds ISO 27001, 27701, 22301, PCI:DSS, SOC 2 Type 2, and Tier 4 NIST cyber and privacy assessments, building a layered compliance stack.

- Recent AI moves include partnerships with CoincidenceAI and Doblox plus the $70m ai.com acquisition, positioning Crypto.com to deploy autonomous AI agents under formal governance.

Crypto.com has become the first digital asset platform to secure ISO/IEC 42001:2023 certification, the international standard for Artificial Intelligence Management Systems, the company announced.

The certification places Crypto.com among the earliest companies globally to align its artificial intelligence governance with the newly issued AIMS framework, according to the announcement. The ISO/IEC 42001:2023 standard sets requirements for establishing, implementing, maintaining, and continually improving an Artificial Intelligence Management System within organizations. The International Organisation for Standardisation issues the certifications and defines global requirements under the framework.

Kris Marszalek, co-founder and CEO of Crypto.com, stated the recognition demonstrates the company’s continued focus on safety and security standards and supports efforts to maintain a trusted, secure environment as it expands its use of AI tools and technologies.

The ISO 42001 certification requires companies to manage risks linked to artificial intelligence, including ethical considerations, transparency, accountability, and the broader impact of AI systems on individuals and society. Cryptocurrency platforms are increasingly deploying AI systems for fraud detection, security monitoring, risk modeling, and customer protection, as well as automation tools to improve operational efficiency.

Jason Lau, Chief Information Security Officer at Crypto.com, said security and privacy are top priorities for the exchange. The new certification adds to a compliance structure that includes ISO/IEC 27001 for Information Security Management and ISO/CEI 27701 for Privacy Information Management. The company also holds ISO 22301 for Business Continuity Management and PCI:DSS compliance, maintains Service Organisation Control 2 Type 2 compliance, and has completed Tier 4 independent assessments under the NIST Cybersecurity and Privacy Frameworks.

The ISO 42001 certification follows several AI-related partnerships and investments over the past year. In November, the exchange integrated with CoincidenceAI, an AI-powered trading platform. In December, Crypto.com announced a partnership with Doblox, an AI-powered crypto trading assistant that allows eligible users in approved jurisdictions to buy and sell assets directly using insights generated by the platform.

Marszalek purchased the ai.com domain for $70 million in April 2025 in a transaction conducted entirely in cryptocurrency, according to reports. The ai.com platform later developed a consumer platform of autonomous AI agents designed to perform tasks for users, including stock trading, calendaring, and workflow automation. Marszalek described the platform as intended to serve as a “front door to AGI” through a decentralized network.

The certification comes as AI adoption accelerates across financial markets. Morgan Stanley has stated that AI technology capabilities will continue to improve exponentially and that demand will exceed supply of AI computing power. According to Gartner, global AI expenditure in 2025 reached approximately $1.5 trillion. Analysts found that Alphabet, Amazon, Meta, and Microsoft are planning to spend a combined $650 billion on AI infrastructure this year.

Regulators are also advancing the use of AI in oversight. South Korea’s Financial Supervisory Service is considering upgrading its AI-enabled VISTA platform to detect manipulation of the cryptocurrency market in real time, according to reports.

Crypto World

Will Bitcoin Crash to $50K?

Bitcoin traded near $66,400 on February 19, holding steady after days of volatility. However, growing fears of a potential US military strike on Iran are adding fresh uncertainty to global markets, including crypto.

According to confirmed reports from multiple American media, US military officials have told President Donald Trump that strike options against Iran are ready and could be executed as early as this weekend.

US-Iran on the Brink of War as Bitcoin Holds Fragile Support

The Pentagon has already deployed additional aircraft and moved a second carrier strike group toward the Middle East. At the same time, Iran has conducted military exercises and warned it would retaliate if attacked.

These developments follow stalled nuclear talks and rising tensions over Iran’s uranium enrichment and missile programs.

The White House said diplomacy remains the preferred path, but officials also acknowledged that military action is under active consideration. This escalation has increased risk across global markets.

Bitcoin’s recent price action reflects this uncertainty. The asset has fallen sharply from its cycle highs above $100,000 and now trades in the mid-$60,000 range.

Short-term investors are selling at a loss, according to the Short-Term Holder SOPR indicator, which currently sits below 1. This means many recent buyers are exiting their positions under pressure.

At the same time, Bitcoin’s short-term Sharpe ratio has dropped to extremely negative levels. This shows that recent returns have been poor relative to volatility. Historically, such conditions appear during periods of market stress and fear.

If the US launches a strike this weekend, Bitcoin will likely react in two phases.

Bitcoin’s On-Chain Signals Suggest Panic May Trigger Volatility

First, markets may see an immediate sell-off. During sudden geopolitical shocks, investors often move into cash and safer assets. Bitcoin has historically behaved like a risk asset in the early phase of global crises. The SOPR data confirms that short-term holders are already weak and sensitive to fear.

However, the second phase could look different.

The Sharpe ratio suggests Bitcoin is already deeply oversold in the short term. Many weak hands have exited. This reduces the amount of forced selling that can still occur.

As a result, any sharp drop could be short-lived if buyers step in at lower levels.

In addition, geopolitical uncertainty can eventually strengthen Bitcoin’s appeal. Investors often turn to assets outside traditional financial systems when global tensions rise. This shift does not happen instantly, but it tends to develop over time.

For now, Bitcoin sits at a critical point. Fear remains high, and geopolitical risks are rising. But on-chain data suggests much of the damage from the recent correction has already occurred.

The next move will depend heavily on whether tensions escalate into actual military conflict—or ease through diplomacy.

Crypto World

Crypto PAC to spend $1.5m to unseat Rep. Al Green

Pro‑crypto PAC Protect Progress plans $1.5m spend next month against Rep. Al Green over his anti‑crypto voting record.

Summary

- Protect Progress, aligned with Fairshake, will pour $1.5m into ads and outreach in Texas’ Democratic primary to defeat Green.

- The PAC cites Green’s opposition to FIT 21, the Digital Asset Market Clarity Act, the GENIUS stablecoin bill, and his support for SAB 121 bank‑custody limits.

- Fairshake and affiliates control about $193m in cash from donors including Ripple, Coinbase and a16z, signaling deeper crypto lobbying in 2026 races.

A cryptocurrency-aligned super PAC announced plans to spend $1.5 million opposing Rep. Al Green in the Texas Democratic primary next month, according to a statement released by the organization.

Protect Progress, a federal super PAC affiliated with Fairshake, said the funds will support advertising and voter outreach aimed at unseating Green, a longtime member of the House Financial Services Committee who has voted against several major crypto-related bills.

The group cited Green’s opposition to measures including the Financial Innovation and Technology for the 21st Century Act, the Digital Asset Market Clarity Act currently under consideration, and the GENIUS stablecoin bill that passed earlier this year. The organization also pointed to his support for maintaining the SEC’s Staff Accounting Bulletin 121, which limited how banks custody digital assets.

“As a member of the Financial Services Committee, Representative Al Green has decided to try and stop American innovation in its tracks,” Fairshake spokesperson Josh Vlasto said in a statement.

Green, who has served in Congress since 2005, has voiced skepticism about cryptocurrency, warning of potential risks to the U.S. dollar’s global role and raising concerns about the sector’s economic and environmental impact, according to public statements. During a House hearing last year, he dismissed claims that regulators pressured banks to cut ties with crypto firms, calling “Operation Choke Point 2.0” a “made-up statement.”

Green is running in a reshaped Houston-area district following Texas redistricting and faces Democratic challenger Christian Menefee, who has received favorable assessments from crypto advocacy groups.

Fairshake and affiliated committees reported holding approximately $193 million in cash earlier this year, following fundraising from major industry players including Coinbase, Ripple and Andreessen Horowitz, according to federal filings. The spending reflects how crypto-backed political groups plan to engage in the 2026 election cycle, backing candidates supportive of digital asset regulation while opposing lawmakers viewed as hostile to the industry.

Crypto World

How Will Nvidia Stock React to $30 Billion OpenAI Deal?

Nvidia is close to finalizing a $30 billion investment in OpenAI, replacing an earlier plan for a massive $100 billion multi-year partnership.

According to Financial Times, the deal would be part of OpenAI’s latest funding round, which could value the company at roughly $830 billion. OpenAI is expected to reinvest much of that capital into AI infrastructure, including Nvidia’s GPUs.

The shift from a $100 billion commitment to a smaller $30 billion equity investment changes the financial risk profile.

Instead of funding massive infrastructure directly, Nvidia gains ownership exposure while still securing demand for its hardware. This restructuring has drawn close attention from investors already watching Nvidia’s volatile stock movements.

From Six-Week Lows to Strategic Rebound: Nvidia’s Volatile Month

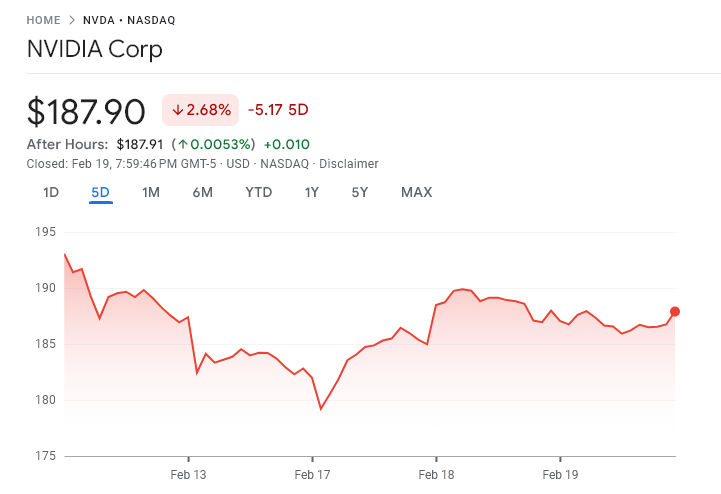

Nvidia’s stock has moved sharply over the past several weeks. In early February, shares fell to around $177, marking a six-week low.

The decline followed uncertainty over the original $100 billion OpenAI deal, concerns over US export restrictions on AI chips to China, and broader investor worries about the sustainability of AI spending.

However, the stock rebounded after Nvidia announced a smaller investment commitment, new partnerships, and major chip supply deals.

A multi-year agreement to supply millions of AI chips to Meta also helped restore confidence. By mid-February, Nvidia shares recovered toward the high-$180 range.

Still, volatility persisted. Investors remained cautious about regulatory risks, high valuation levels, and whether AI infrastructure spending could deliver sustained returns.

Nvidia Commits to a Much Smaller Deal With OpenAI, But it Has a Bigger Signal

The latest $30 billion investment is widely seen as strategically bullish for Nvidia. First, it removes the financial burden of the original $100 billion plan, which could have strained Nvidia’s balance sheet.

Second, it strengthens Nvidia’s position as OpenAI’s primary hardware partner.

This means Nvidia benefits in two ways. It gains equity exposure to one of the world’s most valuable AI companies while continuing to sell the chips powering OpenAI’s models.

However, short-term reactions may remain mixed. Large investments always carry risk, and some investors prefer Nvidia to focus purely on chip sales.

Still, the deal reinforces a key point: AI infrastructure spending continues to accelerate.

Ultimately, the investment strengthens Nvidia’s long-term outlook. It confirms that Nvidia remains at the center of the global AI boom, even as markets navigate short-term uncertainty.

Crypto World

ETH Whales Are Quietly Buying the Dip: On-Chain Data Reveals What’s Really Happening

TLDR:

- ETH-accumulating whales increased their balance as the realized price dropped, confirming active buying at lower levels.

- The realized cap for accumulating whale addresses rose, ruling out any selling activity within this cohort.

- ETH is currently trading at $1,949, with a 1.80% price gain recorded over the past seven-day period.

- Trader Daan Crypto warns that a drop below $1,900 could push ETH toward its February lows fairly quickly.

ETH continues to draw attention from large investors even as its price shows signs of pressure. On-chain data reveals that accumulating whale addresses are not selling their holdings.

Instead, these whales are buying at lower price levels. The realized price metric for this cohort has bent downward, which may seem alarming at first glance.

However, a closer look at balance and realized cap data tells a more complete story about what these large holders are actually doing.

What the Realized Price Drop Really Means for ETH

The realized price of accumulating whale addresses has turned downward for the first time. This kind of movement can point to two separate scenarios in the market.

Either a whale with a higher cost basis sold their ETH, pulling the average down. Or new buying occurred at lower prices, which also pulls the realized price downward.

To determine which case applies, analysts cross-referenced balance data and realized cap figures. In the same period where the realized price dropped, the balance of accumulating whales went up. At the same time, their realized cap also rose, not fell.

These two data points together confirm that no selling took place among this cohort. On the contrary, whales added more ETH to their holdings at reduced price levels. This buying behavior is what caused the realized price to bend downward, not distribution.

CryptoMe, a well-followed Cryptoquant on-chain analytics analyst, stated that accumulating whales’ trust in ETH still looks strong based on this data set.

Price Levels and What Traders Are Watching Closely

Even with whale accumulation continuing, the broader price action remains uncertain. ETH is currently trading at $1,949.06, with a 24-hour volume of over $18.8 billion. The asset posted a 0.23% gain in the past 24 hours and a 1.80% rise over the past seven days.

Crypto trader Daan Crypto Trades pointed out that liquidity levels are clear in this range. According to Daan, a move above $2,150 would mark a new local high and likely push prices further up. However, a drop to $1,900 or below opens the door to revisiting February lows.

That caution is worth noting, especially since the accumulating whale data only covers one segment of the market. Other investor groups and broader macro conditions can still move the ETH price independently.

The on-chain data does not account for retail behavior, derivatives activity, or sentiment shifts.

Therefore, while whale accumulation is a constructive sign, it does not guarantee price direction in the short or medium term.

Traders and investors are advised to monitor multiple data sources before concluding where ETH heads next.

Crypto World

Community Banks Saw $78M Net Outflows to Coinbase, KlariVis Study Finds

New analysis from banking data company KlariVis found that 90% of community banks in its sample had customers transacting with Coinbase. Across 53 banks where transaction direction could be determined, $2.77 flowed to the crypto exchange for every $1.00 returning, resulting in a net $78.3 million deposit shift over 13 months.

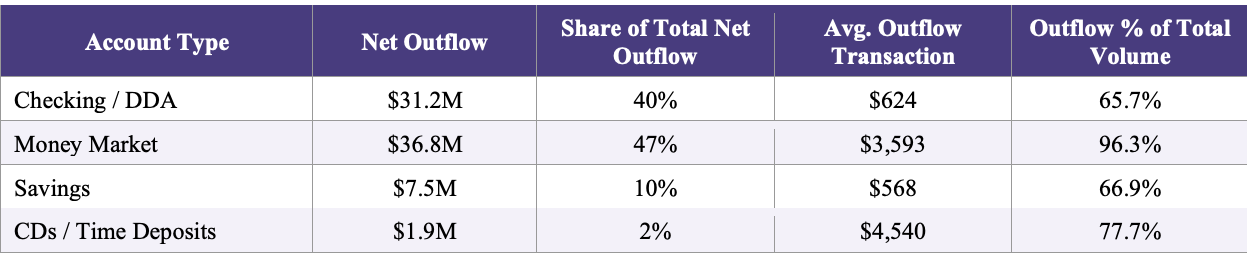

The study reviewed 225,577 Coinbase-related transactions across 92 community banks and found that transfers were heavily concentrated in money market accounts, where 96.3% of identifiable transaction volume represented funds leaving banks for the exchange.

“In general, community banks can be defined as those owned by organizations with less than $10 billion in assets,” the Federal Reserve says on its website.

KlariVis said that if the patterns observed in the sample hold nationally, more than 3,500 of the country’s roughly 3,950 community banks could have similar customer activity tied to Coinbase transfers.

The size of the 53 banks with directional data ranged from $185 million to $4.5 billion in deposits, with smaller institutions showing higher relative exposure. At banks with less than $1 billion in deposits, 82% to 84% of Coinbase-related transactions represented funds moving out, compared with about 66% to 67% at banks above $1 billion.

Across those banks, total outflows reached $122.4 million compared with $44.2 million in inflows. The average outbound transfer was $851, while inbound transfers averaged $2,999 but occurred far less frequently.

Money market accounts accounted for $36.8 million of the net outflow, with average transfers of $3,593, significantly higher than checking account movements.

Community banks hold about $4.9 trillion in deposits and fund about 60% of small business loans under $1 million and 80% of agricultural lending, according to the report, which argues sustained deposit migration could affect local credit availability.

Using academic estimates that small banks reduce lending by about $0.39 for every $1 decline in deposits, KlariVis said the $78.3 million net outflow could translate into about $30.5 million in reduced lending capacity.

Related: Coinbase’s Base transitions to its own architecture with eye on streamlining

CLARITY Act stalled by debate over stablecoin yield

The study comes as the US Congress, banks and crypto-native companies debate the CLARITY Act, which aims to define the regulatory framework for digital asset markets and determine whether crypto exchanges and stablecoin intermediaries can offer yield on customer holdings.

While the GENIUS Act, passed in July 2025, bars stablecoin issuers from paying interest, it does not prohibit third-party intermediaries such as Coinbase from offering yield on stablecoin balances, which has become a major point of contention between financial institutions and crypto companies.

In August, Banking groups, led by the Bank Policy Institute, urged lawmakers to address what they describe as a “loophole” in the law, warning that allowing exchanges to offer indirect yield could accelerate deposit outflows, disrupt credit flows and shift up to $6.6 trillion from the traditional banking system.

Last month, Bank of America CEO Brian Moynihan echoed that sentiment, saying interest-bearing stablecoins could draw up to $6 trillion from the US banking system, citing US Treasury-backed research suggesting deposits could migrate if issuers are allowed to pay yield.

Meanwhile, Coinbase CEO Brian Armstrong has pushed back against restrictions on stablecoin rewards. In January, he withdrew support for a version of the bill, writing on X: “We’d rather have no bill than a bad bill.” He raised several concerns about the draft, one of which was that it would eliminate stablecoin yield and protect banks from competition.

Despite ongoing tensions between banks and crypto companies, US Senator Bernie Moreno said on Wednesday he thinks the CLARITY Act could advance through Congress by April. Prediction marketplace Polymarket currently shows an 83% chance that the legislation will be signed into law this year.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports23 hours ago

Sports23 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 hours ago

Crypto World5 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show