Fashion

2024 Bestsellers | Hello Fashion

I’m excited to round up my bestsellers from 2024! This list is always so fun to see what you guys loved the most. Everything is still in stock today and they are all items that I still use and LOVE and 10/10 highly recommend!

1. First up is this beautiful wood arched cabinet from Walmart! This cabinet kept selling out for good reason – its such amazing quality and looks so much more expensive than it is…and its under $400!! This specific cabinet comes in 3 colors and it also comes in a few different similar styles too. If you are looking for a cabinet for your living room or kitchen, this is the best find!

2. I did an entry way refresh last year and this console table was the perfect piece!! This ribbed light wood console table is so sturdy and such great quality and you won’t believe the price! I love how the light color brightens up our entry way and that it has storage inside to hide loose ends.

3. This white boucle swivel accent chair continues to be a best seller and I can’t recommend it enough! We bought two of them last year and have had them in our primary bedroom – they make the perfect bedroom accent chairs for reading and watching TV. The chair is oversized enough its like a chair and a half and perfect for curling up and lounging in it.

We recently moved one of the chairs to my living room because I wanted to refresh the space – I am obsessed with how the swivel chair brightened up my living room! It’s so cozy and the boucle material is such great quality – it has held up so well over the last year. The chair is under $300 and I will recommend it over and over again! I was excited to see it now comes in a smaller kids version too that is under $100!

4. This burgundy sleeveless long dress is so beautiful and flattering that I’ve worn it to multiple events over the past year and have it in multiple colors! Its been a staple go to dress for me and some of my favorite and most worn dresses come from this retailer – they are affordable and so gorgeous! This one is under $100!

5. These knee high brown boots were such an amazing find! I was excited that tall boots are back in style and love this brown suede pair – they are super affordable under $100!

6. My shark vacuum carper and upholstery cleaner is something we can never live without now! With four kids and a big dog, I feel like I am always cleaning up carpet stains. I love that this cleaner worked so well on our white couches too. The before and after was mind blowing!

7. You guys know I’m obsessed with Abercrombie and these black pants from there are some of my top favorites! They are the perfect wide leg pant. I love how they can be dressed up more polished for a work pant, or down with sneakers. I like to wear them when I’m traveling on an airplane too because they are so comfy. They are under $100 and they go on sale a lot – and they come in lots of different colors! I love the lighter colors for spring and summer too!

8. This pink crochet swimsuit coverup is something I wore on repeat last year for our beach vacation and over the summer. I love that its flowy and not too short so I’m comfortable chasing around my kids and hanging with the family, but its also so stylish and flattering! I love this pink dress so much that I just ordered the new bright blue color for my beach trip this year! I also love this affordable alternative version– such a great dupe for under $40!

9. I’m such a huge fan of adidas and these burgundy spezial adidas were a most loved pair from this past year! They are such a great, comfy everyday sneaker to wear with jeans or sweats. I love all of the different colors for different seasons!

Fashion

Can You Wear a Bomber Jacket to the Office?

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

Bomber jackets in sophisticated fabrics have been around for a year or two now — can you wear bomber jackets to the office? I’m excited to hear what you guys think, but I of course have a few ideas…

Can Bomber Jackets Replace a Blazer?

For the most part, I don’t think bomber jackets can replace a blazer — they inherently read as more casual. If you swear by the “third piece” rule for dressing, then yes they can absolutely be your third piece — but in my mind they’re more like a trendy cardigan or sweater jacket or other soft, structured layer.

Because it’s more relaxed, it is likely never going to be appropriate for the most conservative moments like court, formal presentations, or your first week at a job. Instead, it’s like a piece of clothing that we would have said was appropriate for dress-down Friday (back when that was a thing) or non-VIP days. Think internal meetings, travel days, conferences, business casual offices in general.

You can dress it up or down with your accessories and other pieces — add structure like tailored trousers or a crisp blouse to dress it up, and make it more casual with something like pants cut like denim (jeans, cords) or more flowy fabrics (linen, satin).

Are Bomber Jackets Outside Jackets or Inside Jackets?

It depends on the bomber jacket, honestly — I think you have to look at the materials. For example, this suede bomber jacket from Anthropologie with prominent hardware and thick ribbing looks more like an outside jacket to me, as does this canvas version from Aritzia. The knit versions are safe, but some of the leather ones (like this version from All Saints) could be worn inside as well, the way you might have worn a leather moto jacket a few years ago — know your office.

There are other differences between office-appropriate bomber jackets and weekend-only bomber jackets — if it’s nylon, oversized, has patches or is reminiscent of a varsity jacket — probably not for work. If, on the flip side, it’s wool, ponte, crepe, or suede or leather with minimal hardware — then it might be appropriate for work.

Work Outfit Ideas with Bomber Jackets

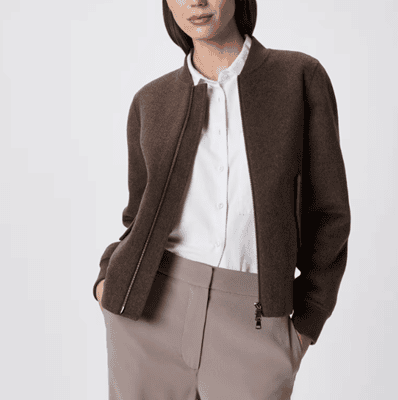

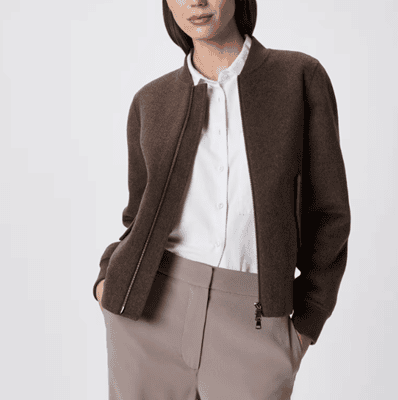

Bomber Jacket + Crisp Blouse + Wide Legged Trousers

This look from Quince is a great example of a work outfit idea — a crisp blouse adds some structure, as well as a nice collar/frame for your face. It hits at the right spot for wide legged pants, and in my opinion the neutral palette in varying shades looks fabulous here.

You can see a similar look at Ann Taylor.

Monotoned & Matchy

You might be saying, SURE, KAT — but where am I going to find matching pieces? But this is one of the trends — for example, Ann Taylor has matching floral knits below (you can also see it here), Aritzia has several options with matching pieces, and All Saints even has a lace bomber jacket.

Failing identical matching pieces, though, just go for the monotone look and match your colors.

Column of Color: Bottom & Top in Matching Colors + Contrasting Bomber Jacket

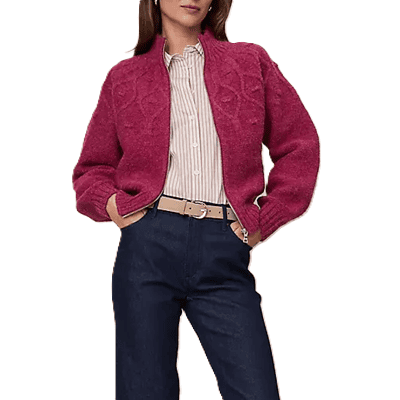

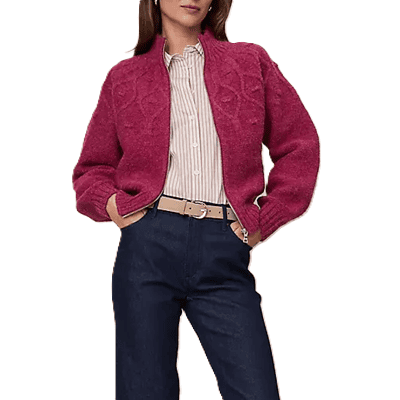

The column of color: always a trusty workwear outfit. Here it looks a bit more sporty because of the five-pocket jeans — if this won’t work for your office, swap it out for white trousers. You can also see it styled with a matching skirt and sweater tee (it’s the third picture here, or you can just see the image here).

You can also see the column of color look with this raspberry knit bomber jacket at Ann Taylor.

Wear it Like You Would a Cardigan

I mean, let’s not overcomplicate things, am I right? If you would have grabbed a cardigan in the past, this is an easy thing to grab to ward off the office A/C or the spring chill.

Fashion

Castor Oil for Hair Thickness: Enhancing Hair Appearance in a Healthy Way

Many people look for natural oils that do more than simply moisturize. They want products that help hair appear thicker and fuller. Over time, hair can look less dense due to breakage, thinning, or general wear from styling. While genetics and overall health play a major role in hair growth, topical care can influence how […]

The post Castor Oil for Hair Thickness: Enhancing Hair Appearance in a Healthy Way appeared first on IFB.

Fashion

Why Hydrolyzed Collagen Powder Is Important for Healthy Aging and Long-Term Structural Strength

As we age, healthy aging becomes less about surface-level changes and more about maintaining strength and resilience from within. Over time, the body gradually produces fewer essential proteins that support elasticity, mobility, and tissue strength. This natural decline affects everything from skin texture and joint flexibility to bone strength and overall stability. Collagen is the […]

The post Why Hydrolyzed Collagen Powder Is Important for Healthy Aging and Long-Term Structural Strength appeared first on IFB.

Fashion

On the Scene at the 2026 American Black Film Festival Honors: Angela Bassett in Black and Gold Falguni Shane Peacock, Vivica Fox in Balmain, and More!

Angela Bassett attended the 2026 American Black Film Festival Honors wearing a black and gold embellished ensemble by Falguni Shane Peacock. Styled by Jennifer Lynn, the look featured a structured black gown layered beneath a coordinating tailored coat adorned with intricate gold appliqué detailing.

The silhouette combined classic tailoring with statement embellishment, as metallic floral accents trailed across the lapels and sleeves of the coat. Bassett completed the look with sleek straight hair, gold earrings, and understated glam that complemented the dramatic texture of the design.

The American Black Film Festival Honors celebrates excellence in film and television, and the red carpet delivered a range of standout fashion moments from some of the industry’s most notable talents.

Scroll for more looks from the African American Black Film Honors.

📸/🎥: Kingsmen Media Group

Fashion

Mariah The Scientist Performed in DC in a Teal Green $1,478 KNWLS ‘Neo’ Coat and Custom Laura Andraschko Riding Boots

Mariah The Scientist hit the stage Saturday night at The Anthem in DC for her Hearts Sold Separately Tour, where she delivered heartfelt vocals in an incredible teal green $1,479 ‘KNWLS’ outfit.

The Atlanta native who first broke out on the scene with her EP “To Die For” in 2018 is now performing to sold out concerts with hit songs like “Burning Blue.”

For those of you who are wondering where “The Scientist” part of Mariah’s stage name comes from, in an interview with BigBoyTV she explains that she went to St John University stating, “I had a scholarship there for Biology and I dropped out in the third year, and I would like to finish.“

Staying on visual theme with her “Hearts Sold Separately” album cover that showcases her in a custom green SEKS.LLC “toy soldier” look, Mariah’s KNWLS Coat was strikingly on brand.

With structural sleeves, her leather coat featured a zipper centered and was belted at her waist. Her custom riding boots by Laura Andraschko couldn’t have been more of a perfect color match for her monochromatic ensemble.

When it came down to Mariah’s glam, her auburn hair added warmth and richness against her teal coat. Her team really thought this look through. From her matching green shadow to her bedazzle green mic, Mariah’s DC tour look was very strong and cohesive.

What say you? Hot! or Hmm…?

Photo Credit: IG/Reproduction- @Domflickedthat

Video Credit: @Cheyennefrieze

Fashion

Philip Jones Jewellery Trending Collection 2026

Step into 2026 with the radiant beauty of the Philip Jones Jewellery trending collection. Specializing in high-quality, accessible luxury, Philip Jones continues to be the UK’s go-to destination for pieces that deliver a refined, premium look without the high-end price tag. From the brilliant fire of Zircondia® Crystals to the delicate meaning behind the Birth Flower series, this collection is designed for everyday elegance and thoughtful gifting. Whether you’re layering paperclip chains or searching for the perfect “Best Friend” keepsake, discover why thousands of women trust Philip Jones for their signature sparkle.

Sterling Silver Inside Outside Hoop Earrings Created with Zircondia® Crystals – Shop Now

18k Gold Plated Paperclip Link Bracelet Created with Zircondia® Crystals – Shop Now

January Birth Flower Snowdrop Necklace with Card – Shop Now

Silver Plated Daisy Bracelet – Shop Now

Best Friend Charm Bracelet Created with Zircondia® Crystals – Shop Now

Silver Plated Adjustable Heart Band Ring – Shop Now

Amethyst Heart Stud Earrings – Shop Now

18k Gold Plated Teardrop Bangle – Shop Now

For any questions/feedback regarding the above mentioned products/brands,

please do contact us anytime by clicking here

Fashion

Save up to 20% with the Allies of Skin UK Combo Offer

Whether you’re in need of a routine shake-up or building your very first regimen, the Allies of Skin UK combo offer is your gateway to high-performance results. Designed specifically for the modern woman who demands efficiency and efficacy, this customizable experience allows you to target your key concerns—from deep hydration to advanced lifting – while saving up to 20%. These aren’t just duos; they are synergistic pairings crafted to maximize active ingredients, ensuring every step of your routine works harder for your skin.

Advanced Lifting & Repair Duo – Shop Now

Ultimate Lifting Duo – Shop Now

Smooth + Firm Eyes Duo – Shop Now

Renew Skin + Lips Duo – Shop Now

Hydrate + Lift Duo – Shop Now

Overnight Firming Duo – Shop Now

Firm + Lift Duo – Shop Now

For any questions/feedback regarding the above mentioned products/brands,

please do contact us anytime by clicking here

Fashion

Debenhams Women’s Sleeve Collection 2026

Elevate your silhouette with the Debenhams Women’s Sleeve Collection. This season, it’s all about the details that frame your look. From the ethereal movement of Angel sleeves to the high-fashion drama of a Cape silhouette, our latest edit focuses on the artistry of the sleeve. Whether you are dressing for a Spring wedding, a formal gala, or a sophisticated garden party, these pieces are designed to provide coverage without compromising on style. Discover how a simple change in sleeve can transform a classic midi into a masterpiece of modern occasion wear.

Cape Sleeve Maxi Dress – Shop Now

Lace Angel Sleeve Midi Dress – Shop Now

Pleated Lace Trim Midi Dress – Shop Now

Linear Sequin Embellished Long Sleeve Maxi Dress – Shop Now

Lace Shirt Dress With Short Sleeves – Shop Now

Navy Floral Kimono Sleeves Dip Hem Wrap Midi Dress – Shop Now

For any questions/feedback regarding the above mentioned products/brands,

please do contact us anytime by clicking here

Fashion

Abby Champion Gets Glam for Tommy Hilfiger Spring 2026

Fashion

9 Long Wavy Hairstyles to Transform Your Look

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports24 hours ago

Sports24 hours agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World11 hours ago

Crypto World11 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World5 days ago

Crypto World5 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market