Money

Major bank offering £50 payments to customers and you’d get cash before Christmas

A HIGH street bank is giving away £50 free to customers who move their savings account to it from elsewhere.

The reward is available to any new or existing customer who switches their Individual Savings Account (Isa) from another provider to the bank.

An Isa is a a type of savings account where you don’t pay tax on any interest earned, and you can save up to £20,000 a year tax-free.

Smaller savings pots don’t usually incur tax, but larger ones can.

For those putting away money for big purchases, like a home deposit, an Isa is worth considering.

The offer from Santander could be withdrawn at any moment – so those eyeing up the extra cash for Christmas should act fast.

Now Santander is offering free cash to those with a nest egg of more than £10,000.

Once the transfer is complete the bank will give customers a £50 e-voucher.

This can be spent at more than 100 restaurants, supermarkets and clothes stores including Argos, B&M and Primark.

Banks often offer incentives to attract new customers, typically for bank accounts, but sometimes for other products like savings accounts too.

Andrew Hagger, personal finance expert at Moneycomms, said: “This is a good incentive – especially for people who may be sitting on some poor performing Isas.”

But it’s important to check that an account is right for you before you switch, instead of moving your money just to get an incentive, and that you’re getting the best rate on offer.

How do I get the deal?

First you need to apply for a Santander Fixed Rate Isa.

You can also upgrade an existing Santander Isa to a Fixed Rate Isa.

Once the account is opened, you must complete a transfer in instruction.

Santander suggests that you do this on the day you open your account or upgrade.

What is an Isa?

Isa stands for Individual Savings Account.

There are four types: cash Isas, stocks and shares Isas, lifetime Isas and innovative finance Isas.

The main benefit of an Isa is that all the money you pay in is tax-free.

This means that you do not need to pay tax on the amount you have saved or any interest you earn.

Every tax year you can save up to £20,000 in one Isa account or split your allowance across multiple accounts.

The tax year runs from April 6 to April 5.

You can open one with most banks and building societies.

Some providers will have restrictions on the minimum amount you can pay in and may require you to deposit a certain amount in order to open an account.

You can do this online or in a branch.

The instruction asks for your non-Santander Isa to be transferred to your new Fixed Rate Isa.

You need to do this within the first 14 days of opening your Isa account.

When you complete the form you will need to ask for a full transfer of your existing non-Santander account, which must have a balance of £10,000 or more.

You must provide an up-to-date email address which the bank can use to email you the code to redeem your e-voucher.

Your account could take up to 30 days to transfer.

You will be sent a code to redeem your e-voucher within 14 days of your transfer completing.

When transferring an ISA you must follow the bank’s correct processes, or you could lose the tax-free status of your cash.

Never withdraw your cash from the account.

Is the Santander deal worth it?

Santander currently has three fixed-rate Isas on offer, with different terms.

A fixed rate means you lock in the interest rate at the start and it won’t change in that time.

Locking away your cash can mean you’re protected if interest rates fall, but you could miss out if they rise.

SAVING ACCOUNT TYPES

THERE are four types of savings accounts fixed, notice, easy access, and regular savers.

Separately, there are ISAs or individual savings accounts which allow individuals to save up to £20,000 a year tax-free.

But we’ve rounded up the main types of conventional savings accounts below.

FIXED-RATE

A fixed-rate savings account or fixed-rate bond offers some of the highest interest rates but comes at the cost of being unable to withdraw your cash within the agreed term.

This means that your money is locked in, so even if interest rates increase you are unable to move your money and switch to a better account.

Some providers give the option to withdraw, but it comes with a hefty fee.

NOTICE

Notice accounts offer slightly lower rates in exchange for more flexibility when accessing your cash.

These accounts don’t lock your cash away for as long as a typical fixed bond account.

You’ll need to give advance notice to your bank – up to 180 days in some cases – before you can make a withdrawal or you’ll lose the interest.

EASY-ACCESS

An easy-access account does what it says on the tin and usually allows unlimited cash withdrawals.

These accounts tend to offer lower returns, but they are a good option if you want the freedom to move your money without being charged a penalty fee.

REGULAR SAVER

These accounts pay some of the best returns as long as you pay in a set amount each month.

You’ll usually need to hold a current account with providers to access the best rates.

However, if you have a lot of money to save, these accounts often come with monthly deposit limits.

You may be charged a penalty for withdrawing cash early, or lose the rate of interest, so if you need access to the cash a fix might not be for you.

You need £500 or more to open one of these accounts, though remember you’ll need to pay in £10,000 to get the bonus.

The one-year fixed-rate Isa gives you 4.01% interest on your nest egg.

If you transferred the minimum £10,000 this would give you a return of £33.42 a month, or £401 over the course of a year.

The 18 month fixed-rate Isa has a slightly lower return, at 3.91%.

On a £10,000 nest egg you would get £32.58 in interest each month, or £391 a year.

The two year fixed-rate Isa has the least generous interest rate of all of the accounts.

How does tax on savings work?

Isas and savings accounts have different rules on whether you need to pay tax on your savings.

All money paid into your Isa is tax-free, so you will never need to pay tax on your nest egg or any interest you earn on it.

But you may be charged interest on your savings depending on how much you have in your account.

All savers have a Personal Savings Allowance, which allows them to earn some interest on their savings tax free.

Any interest made above these allowances will incur a charge.

Basic rate taxpayers can earn up to £1,000 without paying tax.

For higher rate taxpayers this is set at £500.

Additional rate taxpayers do not have any allowance and so pay tax on all of their interest.

Once their allowance is exceeded, savers pay tax on their interest at their rate of income tax.

This would be 20 per cent for a basic rate taxpayer and 40 per cent for higher-rate taxpayers.

It has an interest rate of 3.81%, which would give you £31.75 a month, or £381 a year, on a £10,000 balance.

If you want to withdraw money from the account before its fixed-term has ended then you will need to close your account.

A charge equivalent to 120 days’ interest will be applied.

However there are Isas paying better rates of interest.

Virgin Money has the best one-year fixed-rate cash Isa of all banks and building societies.

It offers a return of 4.61% on your nest egg.

If you had £10,000 in savings this would give you £38.42 a month in interest – £5 more than the best Santander account.

Over the course of a year you would earn £461 in interest, £60 more than with the Santander account.

If you take into account the £50 bonus you would still be £10 better off after a year with the Virgin Money account.

Plus there is no minimum amount you need to open this account, which makes it a good option for savers with smaller pots.

Rachel Springall, finance expert at Moneyfactscompare.co.uk, said: “Savers need to be wary of cash sweeteners if the account itself does not offer the best value compared to other similar accounts.

“Santander’s rates are not market leading and there are a plentiful amount of challenger banks offering much higher rates.”

How do I compare rates?

You can find a full list of the best Isa accounts by using a comparison website such as Compare the Market and Moneyfactscompare.co.uk.

These will help you save you time and show you the best rates on offer.

You can also filter your searches by length or account type.

As a rule of thumb, you only want to consider an account that pays more interest than the current level of inflation, which is 1.7%.

It’s also worth checking regularly as rates can change from one day to the next.

It is a good idea to keep some money in an easy-access savings account which you can use in an emergency.

Once you have found an account you like you should contact the bank or building society you want to move to.

You will need to fill out an Isa transfer form to move your account.

Do not withdraw money from one account to pay into another as you will not be able to reinvest it as part of your tax-free allowance again.

It should not take longer than 15 working days to transfer money between cash Isas.

It can take up to 30 days for other types of transfer.

If your transfer takes longer than it should then contact your Isa provider.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Pubs face widespread closures if they’re hit in next week’s Budget, industry bosses warn

PUBS face widespread closures if hit in the Budget, an industry boss has warned — as many make just 12p profit per pint.

David McDowall has urged Chancellor Rachel Reeves to throw the licensed trade a lifeline next week.

Landlords have had a 75 per cent reduction in business rates since Covid.

But that is due to end in April and losing it would cost them an extra £2.5billion, figures show.

Mr McDowall, chief exec of the Stonegate Group which includes the Slug & Lettuce and Yates’s, said publicans had faced a storm of challenges since the pandemic.

They include high inflation, soaring energy costs and pressure on consumer spending.

He noted the British Beer and Pub Association recently revealed boozers make 12p profit per pint.

Mr McDowall added: “Landlords don’t have any more to give.

“Removing that rate relief would prove very costly for pubs, bars, restaurants and cafes.”

Senior hospitality industry figures have also asked the Chancellor to extend the freeze on alcohol duty — due to end on February 1.

The Treasury said it was pledged to support businesses such as pubs.

Money

Corner shop with over 1,000 locations selling Terry’s Chocolate Orange for just £1 so shoppers can stock up for Xmas

A CORNER shop is selling the beloved Terry’s Chocolate Orange for just £1 – so shoppers can stop up for Christmas.

The deal can be found in One Stop, which has over 1,000 across the country.

Flavours include the classic original, Chocolate Mint, and Chocolate Orange Toffee Crunch.

News of the discount was posted in the Extreme Couponing and Bargains UK Facebook group, garnering 125 reacts and 146 comments.

Users were quick to tag family and friends in the comments, with one saying: “May have to go get some mint ones.”

Another mysteriously wrote: “I will have to grab some for our Christmas pudding project.”

The £1 price tag is a reduction from the usual £1.75 – and will be available until November 5.

Chocoholics can find their local store at www.onestop.co.uk/store-finder/ to shop the deal.

It is the best discount out there for Terry’s lovers, with Chocolate Oranges currently on sale for £1.50-£1.65 at Tesco, £1.50 at Asda, and £1.50 at Ocado down from £2.

It comes just months after Terry’s launched a brand-new flavour of Chocolate Orange – weirdly enough, without the “orange”.

The Chocolate Milk treat, nicknamed “Chocolate No Orange”, hit B&M in August.

One confused customer wrote: “I’m sorry but it’s a Terry’s chocolate orange. It’s in the name lol.”

In other exciting news for chocoholics, a so-called “extinct” chocolate Cadbury’s bar – the Fuse bar – was spotted in miniature form at B&M.

Meanwhile, shoppers raved about a new type of M&M – the Candy Popcorn M&M Minis.

And Nestle added a new chocolate to its Quality Street “Favourites Golden Selection” pouch: the Toffee Penny.

How to save money on chocolate

WE all love a bit of chocolate from now and then, but you don’t have to break the bank buying your favourite bar.

Consumer reporter Sam Walker reveals how to cut costs…

Go own brand – if you’re not too fussed about flavour and just want to supplant your chocolate cravings, you’ll save by going for the supermarket’s own brand bars.

Shop around – if you’ve spotted your favourite variety at the supermarket, make sure you check if it’s cheaper elsewhere.

Websites like Trolley.co.uk let you compare prices on products across all the major chains to see if you’re getting the best deal.

Look out for yellow stickers – supermarket staff put yellow, and sometimes orange and red, stickers on to products to show they’ve been reduced.

They usually do this if the product is coming to the end of its best-before date or the packaging is slightly damaged.

Buy bigger bars – most of the time, but not always, chocolate is cheaper per 100g the larger the bar.

So if you’ve got the appetite, and you were going to buy a hefty amount of chocolate anyway, you might as well go bigger.

Money

What’s next for annuities? Pension experts reveal how to get the best deal for your retirement

PENSION annuity rates and sales are rising and experts say now is a good time to buy one.

But the trick is to find the best deal for your old age.

Ellie Smitherman talks you through it . . .

IS AN ANNUITY RIGHT FOR YOU?

ANNUITIES are retirement plans pensioners can buy to provide them with a fixed regular income for the rest of their life.

Rates are usually shown as how much money you will receive per year for every £100,000 you pay in.

For example, an annuity rate of 5 per cent would mean you get £5,000 for every £100,000 you invest – so if you paid an annuity provider £50,000, you would get £2,500 a year.

If you buy an annuity, you can opt to take a quarter of your pension pot as a tax-free lump sum.

The rest is then converted into a taxable lifetime income.

Exactly how much an individual gets from an annuity depends on their personal circumstances, such as if they are in good health, their life expectancy and how much their pension is worth.

Annuity rates have surged in recent years.

Average annuity rates for a 65-year-old are currently 7.18 per cent, up from 5.11 per cent in January 2022.

The latest data from the annuity comparison tool of financial services firm Hargreaves Lansdown’s shows a 65-year-old with a £100,000 pension pot can get up to £7,146 a year.

This is up 43 per cent on what they would have got just three years ago.

But money paid from an annuity is subject to income tax.

And taking money from a pension in a lump sum can affect your means-tested benefits – they could be reduced or even stopped.

What’s next for rates?

RETIREES are rushing to lock in high rates, says Helen Morrissey, head of retirement analysis at Hargreaves Lansdown.

This is because many think the Bank of England will cut interest rates in the next few months, and this could have a negative impact on annuity rates.

Helen told The Sun: “After years on the sidelines of the retirement income market, annuities are enjoying their time in the sun, as increasing interest rates pushed incomes skyward.”

Emma Watkins of pension provider Scottish Widows added: “While it’s hard to predict the future, many think annuity rates will follow the base rate down over the next few years – while staying well above historic lows.”

But experts urge retirees not to buy too much into the predictions.

Lorna Shah, managing director of Legal & General Retail Retirement, said: “While some commentators are suggesting annuity rates might change, economic and political uncertainties mean annuity rates can be very hard to predict.

“Instead of trying to make a decision based on rates, it’s important for people to think about personal needs and how different products can work together to give them the best result over the long term.”

HOW TO GET THE BEST DEAL

AS you get closer to retirement age, your pension provider will send you information about the value of your pension pot and the options available to you to take money from it.

Some providers can offer you an income directly.

But remember, you don’t have to take an annuity offered by your existing provider.

Buying an annuity is usually an irreversible decision so it’s crucial to consider your options, choose the right type and get the best deal you can.

Research by Hargreaves Lansdown found the difference between different providers’ rates can be worth thousands in retirement.

So shop around for your annuity – it almost always gives you a higher income in retirement.

Use tools such as the Money Helper’s annuity comparison tool, or use annuity brokers to find the best deals currently available on the market and tailored to your circumstances.

You can find a broker online but check reviews and fees.

Only non-advised providers will give you a quote without you taking advice first.

They will simply offer you the best rate they can find on the market.

There may be annuity providers offering higher rates via only a financial adviser.

If you are close to retirement and unsure about annuities or making the most of your pension pot, Pension Wise can help.

It’s a free service from government-backed financial guidance adviser, MoneyHelper.

To find an independent financial adviser, see the Unbiased website, but you will likely need to pay for their advice.

You can also compare annuities yourself on the Annuity Ready website .

If unsure how much to save, the Retirement Living Standards website shows the cost of different retirement lifestyles.

Then use a retirement income calculator to see how much you need to save to reach the level you desire.

Bear in mind there are lots of types of annuities so do your research and get advice to find the best fit for you.

There are pitfalls, too, such as the fact you cannot change your mind – annuities are a lifelong buy so you need to be certain.

This also means if there’s a chance your income needs might change drastically in the future, an annuity might not be the best option for you.

Remember not to automatically accept the annuity rate offered by your pension provider without checking what is on offer across the rest of the market.

THE BEST ALTERNATIVES

IF you want more flexibility over your income you might want to consider a different approach.

Most retirees now opt to leave their pension invested in the stock market, and take income as and when they need it, via “drawdown”.

As with an annuity, you can withdraw a quarter as a tax-free lump sum, with the rest taxed as income.

Drawdown is more flexible than an annuity, and returns may be higher, but savings are exposed to greater volatility.

If there is a stock market crash, the fund value will fall, so your income needs may not be met.

If you are considering a draw-down, seek financial advice.

You are not limited to picking one option. You can mix and match.

So you could use some of your pot to buy an annuity and leave the rest invested to draw an income from it.

FIVE FACTORS KEY TO RATE YOU’LL GET

VARIOUS factors impact exactly how much income you get . . .

- GILT YIELDS: Annuity providers tend to fund them using returns from government bonds called gilts. The Government pays the annuity provider a fixed interest amount, tied to the Bank of England interest base rate. When the base rate rises, gilt yields also increase, subsequently boosting annuity rates, as observed in recent years.

- THE VALUE OF YOUR PENSION: The size of your pot is the primary factor determining your annuity income. The more savings you allocate to buy an annuity, the higher your income will be.

- AGE AND LIFE EXPECTANCY: How long you are expected to live significantly influences the annuity rate you are offered. The more years this is, the lower your rate, as the provider will be paying you for a longer period. For example, a 60-year-old will typically receive a lower income than a 70-year-old.

- YOUR HEALTH: Poor health, smoking or being overweight can lead to a shorter life expectancy, which may qualify you for a better annuity rate. It is crucial to declare any health conditions to your provider.

- YOUR POSTCODE: Annuity providers use your postcode to estimate life expectancy. If you reside in an area with a lower-than-average life expectancy, you may be offered a slightly higher rate.

‘There’s been a cloud over my solar power payments’

Q: I HAVEN’T been paid for my solar panels in almost nine months and I don’t know why.

I got them in 2011 and my energy supplier, Ovo, usually gives me money for energy I generate every three months.

But I haven’t been paid since February this year, covering from December 2023.

I have complained but haven’t had a straight answer as to what’s causing the delay. Can you help?

Leighton Reardon of Blackwood, Caerphilly

A: SOLAR panels can be a great long-term investment, as your energy supplier should reimburse you for any energy you generate yourself and supply back to the grid.

Unfortunately, there are often requirements you have to follow to ensure you keep getting your payments.

In your case, for example, Ovo Energy explained that you need to submit a “meter verification” every two years.

This involves sending a photo of your meter to the firm so it can check your latest reading.

You were supposed to submit your latest photo around July 2023, but Ovo said it didn’t receive it until August this year.

A spokesperson for the firm said it sent you a reminder in February.

But you clearly had not realised this was stopping you receiving your payments, and I’m concerned about why this was not made clear when you repeatedly called to complain.

You said staff on the phone “fobbed you off” and didn’t understand the problem.

I have asked Ovo to investigate, as I feel your problem could have been easily resolved over the phone.

Ovo has now reached out to explain what happened and what you need to do in future.

And a spokesperson said you will now be paid for the full period from December 2023 to September 2024 by early November, which you are happy with.

A spokesperson for Ovo said: “We’re glad to put this right so Mr Reardon can benefit from his panels.

“Our team continues to be on hand to support with any further questions.

“We encourage customers to contact us if they have any questions about their solar panels.”

Premium prizes take a hit

MILLIONS of Premium Bond holders will see their chances of winning cash tumble next month.

National Savings & Investments has slashed the prize fund rates for the second time this year in a blow to savers hoping to score a win.

Ellie Smitherman explains what you need to know . . .

WHAT IS CHANGING? Premium Bonds are a type of savings account that doesn’t offer interest payments like conventional accounts.

Instead, you’re given the chance to win a prize in the draw every month.

The prize fund rates are to be cut to 4.15 per cent from 4.4 per cent from December.

Savers will see their chances of winning in the monthly draw slide from 21,000 to 1 down to 22,000 to 1.

The prize fund was already cut earlier this year, falling from 4.65 per cent in March.

NS&I is also cutting interest rates for Direct Saver and Income Bonds to 3.75 per cent from 4 per cent where it has been since November 2020.

HOW MUCH CAN YOU WIN? There will continue to be two winners of the top £1million prizes from December’s draw.

And the number of the lowest £25 prizes will increase from 1.49m to an estimated 1.5million in December.

But the number of winnings between the biggest and smallest prize will all fall.

Overall, there will be an expected 5,726,438 prizes worth £435,686,300 in December, down from 5,991,306 prizes worth £461,330,525 this month.

Each £1 you put in Premium Bonds is an entry into the monthly prize draw.

All bonds have an equal chance of winning and the more you buy, the greater your chances.

SHOULD I CASH IN? Two thirds of Premium Bonds holders have never won, according to recent figures from a Freedom of Information reguest obtained by savings platform AJ Bell.

These savers may have missed out on significant returns in a higher paying cash account or by investing money – particularly if they have held the bonds for a long time.

If you are looking to make a decent and reliable return on your cash, numerous savings accounts pay a better rate.

For example, you can currently earn 5 per cent interest with app-based provider Chip on its easy access account.

It’s worth noting that Premium Bond winnings are tax-free.

Anyone who has used up their annual ISA limit or personal savings allowance could benefit by saving into Premium Bonds.

Premium Bonds are government-backed, meaning your money is safe and there’s no risk of losing it.

But other banks and building societies are protected by the Financial Services Compensation Scheme, which covers up to £85,000 of money per person, per financial institution.

Money

Harvester selling its biggest ever plate as fans hail whopping 3,769-calorie mountain of meat for £50

HARVESTER has launched its biggest plate of food yet – a gut-busting mountain of meat for £50.

The restaurant chain has added the enormous dish to its latest menu and it contains a whopping 3,769 calories.

Greedy diners can feast on half a rotisserie chicken, a half rack of BBQ ribs, a short of beef rib and a massive cheddar and jalapeño sausage.

The giant plate is finished with a heap of salsa, pink pickled onions, corn bread, chips and coleslaw.

If that’s not enough, food fans can still top it off with a bowl of Harvester’s famous self-service salad bar.

The Ultimate Rib Roundup is described as a ‘sharer’ dinner on the menu and comes with a price tag of £49.99.

Harvester, however, has told customers: “Perfectly grilled, packed with flavour and made for sharing (or keeping all to yourself).”

Brenda Gliddon visited her local branch in Kent with her grown-up son to try the Ultimate Rib Roundup.

She said: “My son can out eat anyone I know but even he left some.” Other Harvester fans have also been eyeing up the new calorific dish as a meal for one.

One wrote on the restaurant chain’s Facebook official page: “I love sharing but I’d rather keep this all to myself!”

Another added: “That’s a single portion!”

Tagging in a pal, third commented: “You’ve got to try this. You might get more than 4 ribs on your plate!”

The Ultimate Rib Roundup is available in all 165 UK branches of Harvester.

It has been added as a new addition to the eatery’s Grills and Combos section of the menu.

Listed as a ‘Supreme Flavour Fan Sharer’, the description reads: “A hearty feast for true grill lovers: half of our succulent rotisserie chicken, a half rack of BBQ glazed ribs, a tender short beef rib and a Cheddar & jalapeño sausage paired with charred corn & black bean salsa and pink pickled onions.

“Served with sage & onion seasoned chips, our new hot honey drizzled corn bread and hot slaw.”

How to save money eating out

THERE are a number of ways that you can save money when eating out. Here’s how:

Discount codes – Check sites like Sun Vouchers or VoucherCodes for any discount codes you can use to get money off your order.

Tastecard – This is a members club where you pay to have access to discounts worth up to 50 per cent off at thousands of restaurants. It costs £4.99 a month or £34.99 for the year.

Loyalty schemes – Some restaurants will reward you with discounts or a free meal if you register with their loyalty scheme, such as Nando’s where you can collect a stamp with every visit. Some chains like Pizza Express will send you discounts for special occasions, such as your birthday, if you sign up to their newsletter.

Voucher schemes – Look out for voucher schemes offered by third party firms, such as Meerkat Meals. If you compare and buy a product through CompareTheMarket.com then you’ll be rewarded with access to the discount scheme. You’ll get 2 for 1 meals at certain restaurants through Sunday to Thursday.

Student discounts – If you’re in full-time education or a member of the National Students Union then you may be able to get a discount of up to 15 per cent off the bill. It’s always worth asking before you place your order.

Money

Ultra-rare note error sparks eBay bidding war as £10 sells for 25 times its value – can you spot what’s wrong?

THIS ultra-rare £10 note triggered an intense eBay bidding war – and sold for a whopping £255 – but can you tell what’s wrong?

The note was advertised as having a “rare mint error” that’s related to its printing.

The £10 is certainly rare, sporting a completely blank side that left bidders baffled.

Sold in September, the tenner attracted a whopping 27 bids from those desperate to get their hands on the bizarre note.

The poster even manage to nab themselves an extra £12.95 just for delivery, all the way from Denmark.

A blank note of this kind is practically impossible to find elsewhere.

From our research, the only other £10 blank note we could find appeared to sell for £156.11 on eBay.

It comes as a rare 50p coin sold for 200 its usual value because it was missing a tiny “mark”.

The King Charles Atlantic Salmon 50p was advertised as having “no privy mark” on eBay.

It later sold for a whopping £102 following 23 bids from eager collectors.

A privy mark is a tiny crown symbol stamped onto some coins on the “heads” or “obverse” side – or on the rim.

In the case of the King Charles Atlantic Salmon 50p, first minted in 2023 in celebration of Charles‘ ascension of the throne, the privy mark is a small Tudor crown.

It can be spotted just behind the King’s head.

How to spot rare coins and banknotes

Rare coins and notes hiding down the back of your sofa could sell for hundreds of pounds.

If you are lucky enough to find a rare £10 note you might be able to sell it for multiple times its face value.

You can spot rare notes by keeping an eye out for the serial numbers.

These numbers can be found on the side with the Monarch’s face, just under the value £10 in the corner of the note.

Also if you have a serial number on your note that is quite quirky you could cash in thousands.

For example, one seller bagged £3,600 after spotting a specific serial number relating to the year Jane Austen was born on one of their notes.

You can check if your notes are worth anything on eBay, just tick “completed and sold items” and filter by the highest value.

It will give you an idea of what people are willing to pay for some notes.

But do bear in mind that yours is only worth what someone else is willing to pay for it.

This is also the case for coins, you can determine how rare your coin is by looking a the latest scarcity index.

The next step is to take a look at what has been recently sold on eBay.

Experts from Change Checker recommend looking at “sold listings” to be sure that the coin has sold for the specified amount rather than just been listed.

What are the most rare and valuable coins?

Money

I won £200k on People’s Postcode Lottery and lost half a stone – I’ve had sleepless nights & still think it’ll disappear

A WINNING Postcode Lottery player bagged an eye-watering £200,000 and lost half a stone.

Alison and Tim Browne, from Breaston, Derbyshire, were gobsmacked when they discovered the lucrative jackpot.

The couple were one of three households who scooped the windfall in the Postcode Lottery Millionaire Street draw last week.

Mum-of-two Alison said their jackpot has seen her drop half a stone within a week due to lack of sleep.

“But it’s good! You have dreams that you have won lots of money, but then you wake up and think, ‘Damn, it’s a dream’,” she said.

“This is how I felt every night this week when I managed to get to sleep at 3am. Then I woke up and thought, ‘No, it’s not a dream!’

“Never in my wildest dreams did I think we would win this much.”

Tim admitted he didn’t even enter the competition – but his wife unknowingly had.

He said: “I can’t believe it. I’m just glad she didn’t phone to tell me the amount when I was driving!

“I didn’t even know she was doing People’s Postcode Lottery, to be honest.”

An overjoyed Alison added: “It’s a fantastic feeling and I can’t stop smiling. But we’re going to have a big, big party on the street.

“It’s wonderful. We’ve known George and Paul for over 30 years and we get on really, really well.

“It’s a lovely street, lovely neighbours, and a lovely place to live.

“I don’t know what to think. This is life-changing, it really is.”

The pair are plan to splurge the cash on a lavish holiday to celebrate their 40th anniversary.

And, they will finally be able to tick riding on the iconic Orient Express off their bucket-list.

Tim said: “It means everything. We always wanted to do the train trip across the Rockies in Canada and also the Orient Express.

“There’s lots of trips that we’ve never done and have never been able to do. And now we’ll be able to do them and that’s fantastic.”

Alison, a freelance school music exam coordinator, said: “We’ve been married 43 years now, but our 40-year anniversary fell during lockdown so we weren’t able to celebrate properly. Now we can do that.”

The couple share a son Matthew, who is autistic, and hailed the win for “the security this will bring him”.

Meanwhile, older son James, joked: “I’ll be happy with a pint in Spoons. It’s £6 a pint!”

Tim revealed he also dreams of welcoming a new puppy into the family to keep Pointer Finlay company.

The musician told how a new Gore-Tex waterproof jacket wouldn’t go a miss either.

Alison laughed: “If we get another dog we’ll need a house with a bigger garden.

“My son and daughter-in-law don’t want us to get another dog because they have to look after them if we go away.

“We’re all going away to Wales on holiday together next week so we can celebrate there.”

It comes as another lucky player who scooped a life-changing Postcode Lottery prize refused to believe she had won – until a key sign revealed it was fate.

Meanwhile, another punter doubled their £200,000 Postcode Lottery win by using a clever trick – make sure you don’t miss out.

Jo Deighton from Shoreham, West Sussex, was gobsmacked when she scooped nearly an eye-watering quarter of a million pounds.

Elsewhere, one Brit who bagged a £410,000 jackpot told how no one believed her – not even her husband.

Leyla Eaton’s jaw dropped after discovering she’d scooped the eye-watering prize.

The mum-of-two entered when she was struck by a “strong feeling” a huge windfall was coming her way.

How to play the People’s Postcode Lottery?

For just £12 a month, players can sign up through the official website to have a chance of winning millions of pounds.

Once signed up, players are automatically entered into every draw and prizes are announced every day of each month.

Tickets play for the Daily Prize, worth £1000 and revealed every single day.

Tickets could also win a jackpot of £30,000 for Saturday and Sunday’s Street Prize draws.

People’s Postcode Lottery also offers a £3million Postcode Millions draw each month – where your ticket plays for a share of the cash prize fund.

Winners are notified by email, text, post, or phone call, depending on the prize they win.

Jackpot winners are visited by the lottery team in person.

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment1 month ago

Science & Environment1 month agoX-rays reveal half-billion-year-old insect ancestor

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Technology4 weeks ago

Technology4 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

MMA3 weeks ago

MMA3 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Technology4 weeks ago

Technology4 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Football3 weeks ago

Football3 weeks agoWhy does Prince William support Aston Villa?

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Technology4 weeks ago

Technology4 weeks agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Technology3 weeks ago

Technology3 weeks agoGmail gets redesigned summary cards with more data & features

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Technology1 month ago

Technology1 month agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

Sport3 weeks ago

Sport3 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Sport4 weeks ago

Sport4 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

MMA3 weeks ago

MMA3 weeks ago‘I was fighting on automatic pilot’ at UFC 306

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

News3 weeks ago

News3 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Politics3 weeks ago

Rosie Duffield’s savage departure raises difficult questions for Keir Starmer. He’d be foolish to ignore them | Gaby Hinsliff

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Money3 weeks ago

Money3 weeks agoPub selling Britain’s ‘CHEAPEST’ pints for just £2.60 – but you’ll have to follow super-strict rules to get in

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

News3 weeks ago

News3 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

TV3 weeks ago

TV3 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

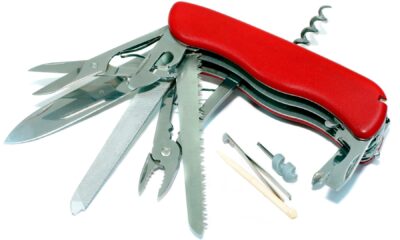

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

Technology3 weeks ago

Technology3 weeks agoIf you’ve ever considered smart glasses, this Amazon deal is for you

-

Technology3 weeks ago

Technology3 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

-

Technology3 weeks ago

Technology3 weeks agoHow to disable Google Assistant on your Pixel Watch 3

-

News3 weeks ago

News3 weeks agoReach CEO Jim Mullen: If government advertises with us, we’ll employ more reporters

-

Business3 weeks ago

Maurice Terzini’s insider guide to Sydney

You must be logged in to post a comment Login