Business

Shares of local oil explorers surge on supply disruption fears

Brent crude futures rose over 1% to $71.11 per barrel.

“Elevated brent crude prices are supportive for upstream players such as ONGC and Oil India, as higher realisations strengthen margins and cash flows,” said Ankit Garg, head of Equity Investments, Wealthy Nivesh PMS.

Agencies

AgenciesHigh Brent prices support upstream companies like ONGC & Oil India; Shares of marketing firms fall

For oil marketing companies, an increase in crude prices leads to margin pressure because input costs move up immediately. And if these companies are unable to pass on the costs entirely, it impacts their profitability.

The pressure on oil prices stemmed from developments involving Iran, where joint naval drills with Russia in the Sea of Oman and the northern Indian Ocean heightened supply concerns.

Iran temporarily shut parts of the Strait of Hormuz as a security precaution during military exercises. Given that the route is one of the world’s most critical oil shipping routes, any disruption tends to amplify volatility in crude markets.

Impact on operating performance will be a function of the duration for which crude oil prices stay elevated, said Sunny Agrawal, head of Fundamental Research at SBI Securities. “We believe, in the longer run, crude oil prices may remain subdued, as demand is muted and, hence, any spike in stock prices of oil exploration companies should be seen as an opportunity to trim the weights in the portfolio,” he said. Analysts said charts are pointing to a 5% upmove in Oil India and a near 10% gain in ONGC from Thursday’s closing.

“Oil India has managed to hold its 50 DEMA (Double Exponential Moving Average) with a surge in trading volumes, which suggests more upside from the current level towards the ₹500 zones with immediate support at ₹460 levels,” said Chandan Taparia, head of derivatives and technical research at Motilal Oswal Financial Services

In the case of ONGC, the stock could move to ₹290-300. “The stock has been finding sustained buying interest near ₹262-265 zones in the last 10 sessions and a small follow-up could lead to the next leg of rally,” said Taparia.

Business

Shawn Soderberg, Bloom Energy chief legal officer, sells $465k in shares

Shawn Soderberg, Bloom Energy chief legal officer, sells $465k in shares

Business

Negative Breakout: These 10 stocks cross below their 200 DMAs

In the Nifty500 pack, the closing prices of 18 stocks fell below their 200-day moving averages (DMA) on February 19, according to StockEdge.com’s technical scan data. Of these, we have highlighted 10 stocks that slipped more than 2%. Trading below the 200 DMA is considered a negative signal because it indicates that the stock’s price is below its long-term trend line. The 200 DMA is used as a key indicator by traders for determining the overall trend in a particular stock. Take a look:

Business

Alien files incoming: Trump orders government release of UFO records

Alien files incoming: Trump orders government release of UFO records

Business

Sika faces scrutiny on 2026 outlook after soft Americas finish to 2025

Sika faces scrutiny on 2026 outlook after soft Americas finish to 2025

Business

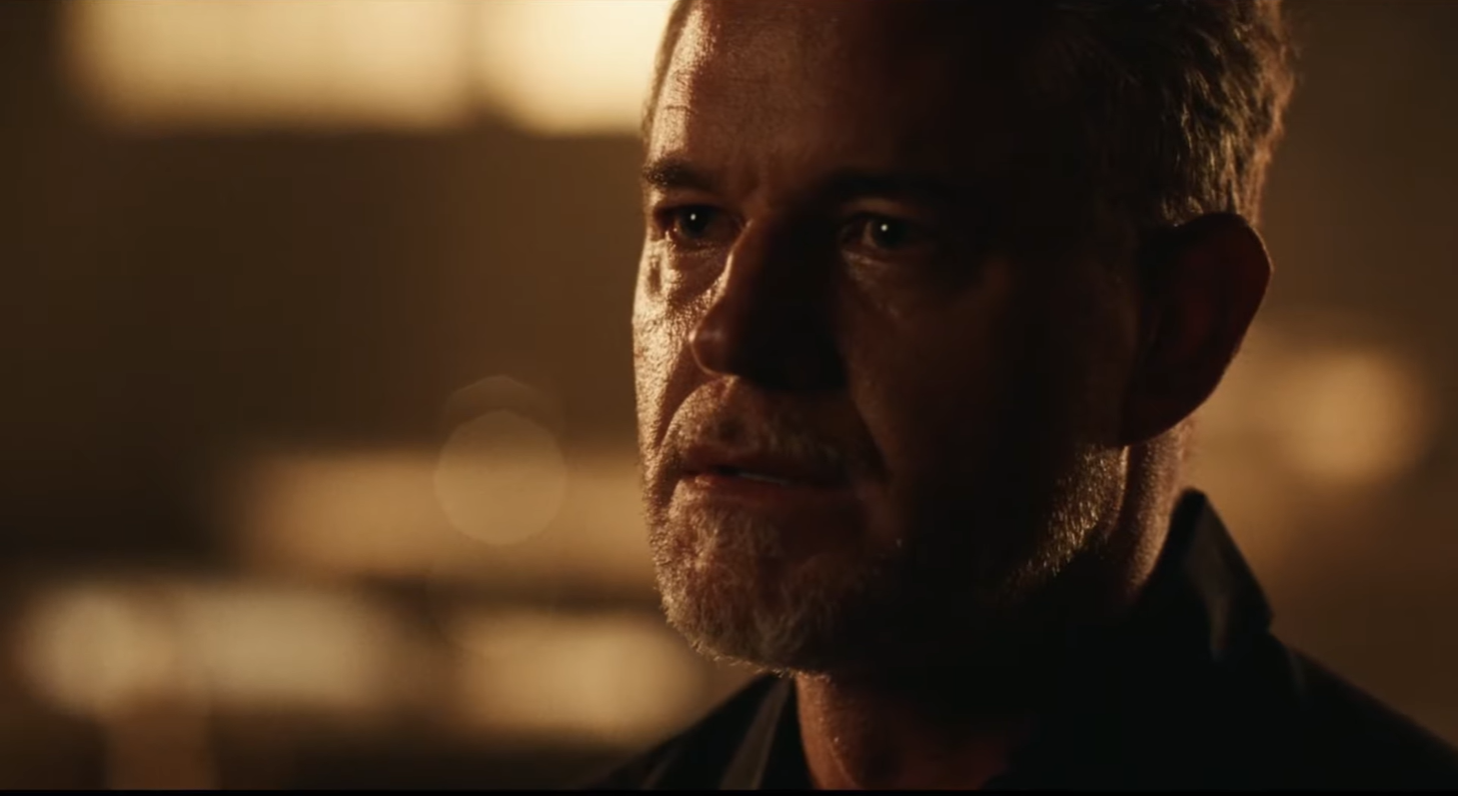

Eric Dane Has Passed Away at 53 Following a Courageous Battle With ALS

“Grey’s Anatomy” star Eric Dane has passed away. He was 53 years old.

His passing comes just 10 months after he announced his amyotrophic lateral sclerosis (ALS) diagnosis.

Eric Dane Passes Away

Dane, who passed away on Thursday, was surrounded by his family and friends in his final days, according to a statement released to PEOPLE.

“With heavy hearts, we share that Eric Dane passed on Thursday afternoon following a courageous battle with ALS,” his family said in the statement. “He spent his final days surrounded by dear friends, his devoted wife, and his two beautiful daughters, Billie and Georgia, who were the center of his world.”

The family touched on his ALS diagnosis, saying “Throughout his journey with ALS, Eric became a passionate advocate for awareness and research, determined to make a difference for others facing the same fight. He will be deeply missed and lovingly remembered always.”

“Eric adored his fans and is forever grateful for the outpouring of love and support he’s received,” the statement adds. “The family has asked for privacy as they navigate this impossible time.”

What is ALS?

Otherwise known as Lou Gehrig’s Disease, amyotrophic lateral sclerosis is defined by Cleveland Clinic as “a neurodegenerative condition that affects how nerve cells communicate with your muscles.”

Symptoms of ALS include the following:

- Muscle weakness, particularly in the arms, legs, and neck

- Muscle cramps

- Twitching in your hands, feet, shoulders and/or tongue

- Stiff muscles (spasticity)

- Speech challenges (slurring words, trouble forming words)

- Drooling

- Unintentional emotional expressions (like laughing or crying)

- Fatigue

- Trouble swallowing (dysphagia)

As of writing, it still not known what causes ALS. There is also no treatment that can reverse the damage caused by this disease.

Business

BorgWarner at Barclays Conference: Strategic Growth and Market Expansion

BorgWarner at Barclays Conference: Strategic Growth and Market Expansion

Business

Aveanna healthcare CCO Cunningham sells $363k in AVAH stock

Aveanna healthcare CCO Cunningham sells $363k in AVAH stock

Business

Epstein eyed record label investment to access women, files suggest

His associate said the music industry was “related to P”, a way Epstein apparently often referred to women.

Business

Amazon layoffs reportedly hit hundreds of New York employees

Payne Capital Management President Ryan Payne explains why tech earnings remain strong despite a recent dip and how AI hiring could help offset a wave of baby boomer retirements on ‘Mornings with Maria’.

Amazon’s latest wave of layoffs has reportedly hit New York, with hundreds of employees losing their jobs.

Roughly 135 corporate employees at Amazon’s 1440 Broadway office in Manhattan were laid off in January, according to the New York Post, citing a filing submitted to the New York State Department of Labor.

More than 100 other New York-based employees were also let go, the outlet reported, citing a source who said additional filings are expected to surface in state records in the coming weeks.

AMAZON VAN GETS STUCK IN ‘DANGEROUS’ MUDFLATS AFTER DRIVER FOLLOWS GPS ROUTE

The Amazon logo is displayed on the side of Amazon Germany’s headquarters in Parkstadt Schwabing, Munich, Bavaria, Jan. 27, 2026. (Matthias Balk/picture alliance via Getty Images / Getty Images)

The reductions are part of Amazon’s sweeping restructuring effort, the New York Post reported.

Last month, Amazon announced plans to eliminate about 16,000 roles across the company as part of an organizational overhaul aimed at “reducing layers, increasing ownership, and removing bureaucracy,” while continuing to invest heavily in areas such as artificial intelligence.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMZN | AMAZON.COM INC. | 204.86 | +0.07 | +0.03% |

“Some of you might ask if this is the beginning of a new rhythm where we announce broad reductions every few months. That’s not our plan,” human resources executive Beth Galetti said at the time.

AMAZON PHARMACY TO EXPAND SAME-DAY PRESCRIPTION DELIVERY TO 4,500 US CITIES

An Amazon Prime delivery person is pictured in a van sorting packages in Queens, N.Y. (Lindsey Nicholson/UCG/Universal Images Group via Getty Images / Getty Images)

The company previously slashed about 14,000 corporate positions in October during another reorganization. In total, the recent reductions bring Amazon’s job cuts to approximately 30,000.

While that figure represents a small fraction of Amazon’s 1.58 million global employees, the majority of whom work in warehouses and fulfillment centers, it amounts to nearly 10% of the company’s corporate workforce, according to Reuters.

The downsizing marks the largest workforce reduction in Amazon’s 30-year history, surpassing the 27,000 jobs eliminated between late 2022 and early 2023, Reuters reported.

AMAZON PRIME AIR DRONE CRASHES INTO TEXAS APARTMENT BUILDING

Andy Jassy, CEO of Amazon.com Inc., speaks during an event in New York Feb. 26, 2025. (Michael Nagle/Bloomberg via Getty Images / Getty Images)

CEO Andy Jassy said last year that while new technology may create new roles, it will also streamline operations and reduce staffing needs in certain areas, the New York Post reported.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“We will need fewer people doing some of the jobs that are being done today,” Jassy said in June. “In the next few years, we expect that [AI] will reduce our total corporate workforce as we get efficiency gains from using AI extensively across the company.”

Amazon did not immediately respond to FOX Business’ request for comment.

FOX Business’ Ashley Carnahan, Bonny Chu and Pilar Arias contributed to this report.

Business

Meet Hazel, the AI Tool That Sparked a Stock Market Selloff

Meet Hazel, the AI Tool That Sparked a Stock Market Selloff

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports23 hours ago

Sports23 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Video1 hour ago

Video1 hour agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World6 hours ago

Crypto World6 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market