CryptoCurrency

Stablecoin Payment Platform Architecture for Merchants

Merchants are not losing money because payments fail. They are losing momentum because settlements are slow, cross-border transfers are inefficient, and existing rails were never designed for always-on digital commerce. Stablecoins are changing that equation, but only for businesses that understand how to implement them correctly. Accepting stablecoins is not about adding a new checkout option or supporting another payment method. It is about building a stablecoin payment platform that can handle merchant volume, compliance obligations, settlement logic, and operational reporting without friction.

If your goal is to support merchant payments at scale, reduce settlement delays, and unlock cross-border efficiency through stablecoin remittance, the architecture choices you make now will define your success later. Let us break down what a merchant-ready stablecoin payment platform really looks like and how to design it for long-term adoption and revenue.

Why Merchants Are Actively Exploring Stablecoin Payments?

Merchants are exploring stablecoins today because adoption, infrastructure, and regulation have all reached a measurable level of maturity. What was once experimental is now supported by verified data and real payment activity. In 2025, stablecoins processed $9 trillion in global payment volume, with peak months reaching $1.25 trillion, reflecting 87% YoY growth. On-chain data shows monthly volumes for leading stablecoins such as USDT and USDC ranging between $700 billion and $1.54 trillion, confirming sustained payment usage at scale. Merchant adoption is equally clear. In 2024, 35.5% of all crypto payment transactions were settled using stablecoins, and by 2025, they accounted for around 30% of total on-chain transaction volume. B2B usage has accelerated sharply, with monthly stablecoin payment flows reaching $3 billion in 2025, representing a 30x increase in two years. These trends show merchants actively using stablecoins for settlement and operational payments.

Institutional support has strengthened this shift.

- Visa launched a large-scale USDC settlement, Mastercard expanded stablecoin settlement across key regions, and major payment processors now actively settle merchant transactions using stablecoins.

- Regulatory clarity from the GENIUS Act in the U.S. and MiCA in the EU has further reduced uncertainty for businesses.

From a performance standpoint, verified data shows lower settlement costs compared to traditional payment rails and near-instant finality on modern networks. By the first half of 2025, 40.9% of merchants accepting crypto preferred stablecoin settlement, underscoring why demand is shifting toward a reliable stablecoin payment platform, designed for scale and cross-border use.

See What a Merchant-Ready Stablecoin Platform Looks Like

What a Merchant-Ready Payment Flow Actually Looks Like

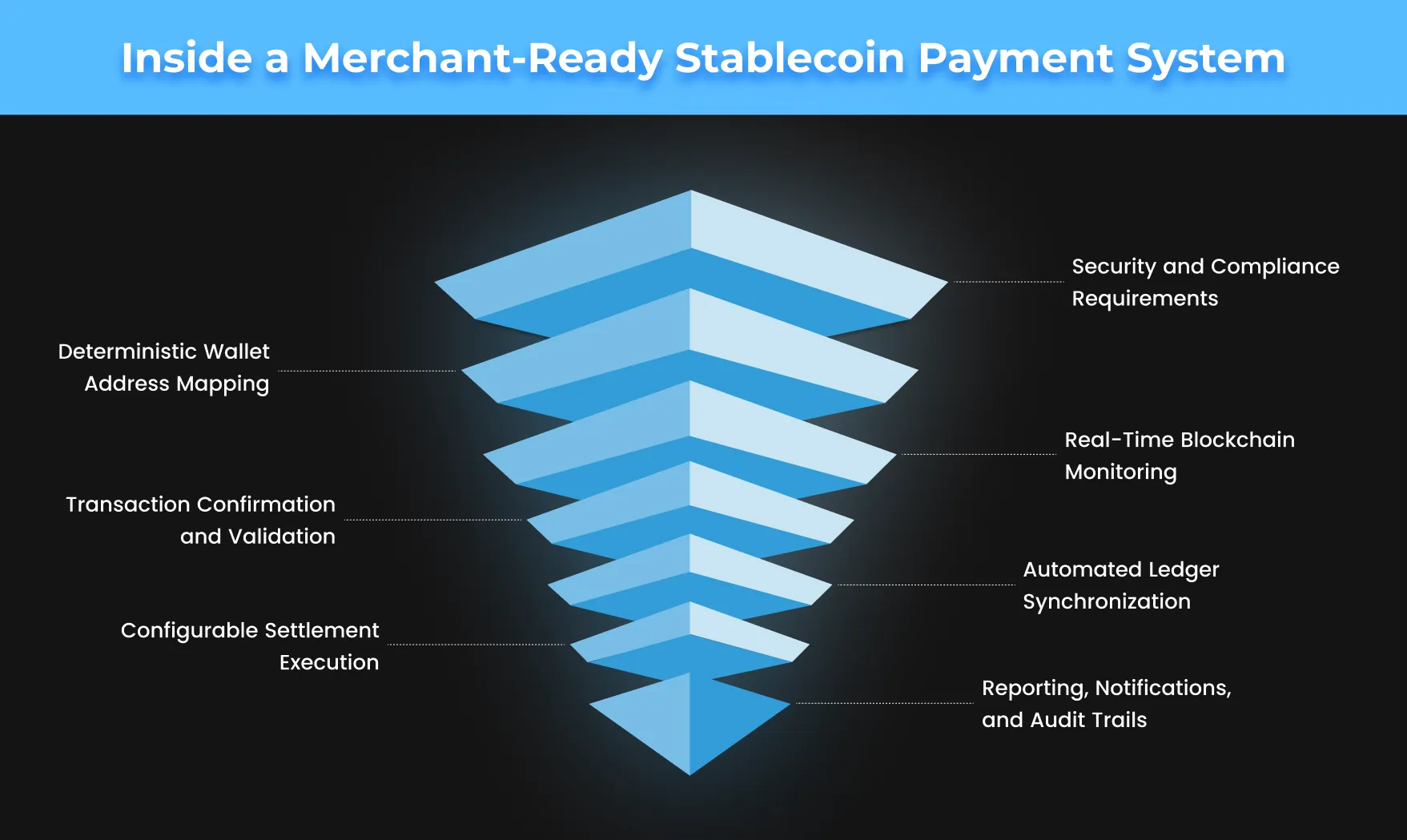

For merchants evaluating a stablecoin payment system, reliability matters more than novelty. A merchant-ready flow is designed to move funds predictably, surface clear status at every stage, and integrate smoothly with existing operations from payment initiation to final settlement. Below are the seven core stages that define a production-grade merchant payment flow.

- Structured Payment Request Generation

Every transaction begins with a clearly defined payment request linked to an order or invoice. Unique identifiers ensure each payment is traceable across systems, preventing ambiguity from the start.

- Deterministic Wallet Address Mapping

Each payment request is assigned a specific wallet address generated deterministically. This allows incoming funds to be automatically matched to the correct merchant and transaction without manual intervention.

- Real-Time Blockchain Monitoring

The platform continuously monitors blockchain activity once a payment is initiated. Pending states, confirmations, and finality are tracked in real time to keep merchants informed at every step.

- Transaction Confirmation and Validation

Clear confirmation rules define when a payment is considered complete. Amount validation, confirmation thresholds, and network finality checks protect merchants from premature fulfillment and settlement errors.

- Automated Ledger Synchronization

As transactions are confirmed, internal ledgers update instantly. On-chain balances, platform records, and merchant dashboards remain aligned, eliminating reconciliation delays.

- Configurable Settlement Execution

Once funds are received, predefined settlement rules are applied. Merchants can choose when and how funds are settled, turning settlement into a predictable, automated process.

- Reporting, Notifications, and Audit Trails

Merchants receive real-time notifications and access to detailed reports. Every action is logged, creating a transparent audit trail that supports compliance, accounting, and operational clarity.

When these seven stages work together, stablecoin payments stop feeling experimental and start behaving like dependable financial infrastructure. This is what separates basic token acceptance from a merchant-ready stablecoin payment system built for scale and long-term trust.

Explore a Custom Stablecoin Payment Platform

Choosing Between White Label and Custom Stablecoin Payment Platform Architecture

When businesses decide to launch or scale a stablecoin payment platform, one of the most important architectural decisions they face is whether to adopt a white label solution or invest in a fully custom-built system. The right choice depends on speed, control, scalability, and long-term business vision.

| Decision Factor | White Label Platform Architecture | Custom Platform Architecture |

|---|---|---|

| Time to Market | Faster deployment with pre-built modules and ready integrations | Longer development cycle tailored to specific business needs |

| Initial Complexity | Lower technical and operational complexity | Higher complexity with full architectural ownership |

| Customization Level | Limited customization within predefined frameworks | Full control over workflows, features, and system behavior |

| Compliance Flexibility | Standard compliance modules suitable for common use cases | Custom compliance logic aligned with specific jurisdictions and risk models |

| Scalability | Scales within platform limits defined by the provider | Designed to scale based on transaction volume, regions, and future use cases |

| Integration Capability | Supports common APIs and merchant tools | Deep integration with proprietary systems, ERPs, and enterprise stacks |

| Cost Efficiency Over Time | Lower initial investment, recurring platform dependency | Higher upfront effort with long-term operational efficiency |

| Product Differentiation | Minimal differentiation across competing platforms | Strong differentiation through unique architecture and features |

| Control Over Roadmap | Platform updates driven by provider priorities | Full ownership of product roadmap and innovation direction |

| Best Fit For | Startups, fast-moving fintechs, pilot merchant programs | Enterprises, payment providers, and large-scale merchant networks |

Choosing the right architecture is not about which option is better in general. It is about which model aligns with your growth strategy, regulatory exposure, and merchant expectations. A well-chosen architecture ensures that your stablecoin payment platform can evolve confidently as transaction volumes increase, use cases expand, and merchant demands become more sophisticated.

Final Thoughts for Decision Makers

Stablecoin payments have moved beyond experimentation and are now becoming core payment infrastructure. Merchant demand is validated, institutional settlement rails are active, and the opportunity is no longer theoretical. The platforms that will succeed are the ones that recognize stablecoin acceptance as a full-stack responsibility, not a surface feature. A merchant-ready stablecoin payment platform must unify wallet architecture, compliance controls, settlement workflows, and operational reporting into a single reliable system.

If you are evaluating how to build or adopt a scalable stablecoin payment system, the right architectural decisions today will define merchant trust, regulatory readiness, and long-term revenue potential. This is where experience matters. Antier, a renowned stablecoin remittance platform development company, works with enterprises and fintech leaders to design and deploy stablecoin payment platforms built for real merchants and real-world volume. Talk to Antier to build a stablecoin payment platform designed for growth, compliance, and long-term reliability.

Frequently Asked Questions

01. Why are merchants exploring stablecoin payments?

Merchants are exploring stablecoins due to increased adoption, improved infrastructure, and regulatory clarity, which have made stablecoins a viable option for efficient payment processing and settlement.

02. What benefits do stablecoins offer to merchants?

Stablecoins provide benefits such as reduced settlement delays, lower costs compared to traditional payment methods, and enhanced efficiency for cross-border transactions, making them ideal for scaling merchant payments.

03. How can businesses successfully implement stablecoin payment platforms?

Businesses can successfully implement stablecoin payment platforms by focusing on building a robust architecture that accommodates merchant volume, compliance requirements, settlement logic, and operational reporting to ensure long-term adoption and revenue growth.