Crypto World

Trader Leaves Crypto Forever After Losing $10,000 in LIBRA

One year has passed since Argentine President Javier Milei backed a project that drove hundreds of thousands of people worldwide to invest in Libra, a meme coin that turned out to be a rug pull.

Alfonso Gamboa Silvestre, a 25-year-old from Chile, was among the many traders who suffered steep losses. The token’s launch and swift demise cost him $10,000. Since that moment, he has left the crypto industry for good.

A Presidential Endorsement That Drove a Buying Frenzy

On Valentine’s Day last year, Gamboa Silvestre was trading on his computer. The day seemed normal until a notification popped up on his phone from one of the many crypto groups he had on Telegram.

He opened the message, which read something along the lines of “Argentina’s president just launched a crypto token.” Gamboa Silvestre ran to X (formerly Twitter) to see whether it was true.

At first, he thought Milei’s account had been hacked. But after carefully reading the president’s verified tweet and the “Viva La Libertad Project” website he included, Gamboa Silvestre ruled out the possibility.

So he bought the token. In total, he invested $5,000.

“I made two purchases. First, a smaller one. When I was totally sure it was [Milei’s] tweet, I made a bigger one,” Gamboa Silvestre told BeInCrypto in an interview in Spanish.

After that, Gamboa Silvestre left the house to go out to dinner with his family, but he couldn’t keep his eyes off his phone. Libra’s price kept dropping, and he didn’t know what to do.

Choosing what looked best on the menu and averting his family’s worried gaze was hard enough, so he locked himself in the restaurant’s bathroom.

“At first I thought the token was going to go down, and then it was going to go back up to infinity,” Gamboa Silvestre said. “But that didn’t happen. I saw that it was going down and down, and my February 14th ended up being a nightmare.”

As investors began withdrawing their money en masse, so did Gamboa Silvestre. He ended up doubling his original investment in losses.

The event also marked his permanent exit from the crypto ecosystem.

From Active Trader To Complete Exit

Gamboa Silvestre first ventured into crypto in 2016, mostly out of curiosity. However, he began to take it seriously in 2022 and became an active trader.

The meme coin sector had treated him well at first.

Gamboa Silvestre was among the first investors in TRUMP and MELANIA, the two tokens launched by US President Donald Trump and First Lady Melania Trump less than 48 hours before Trump assumed the presidency.

He fared well for himself, and he believed that the story would be similar with Libra.

“I thought that, since Milei had been having different meetings with Donald Trump and Elon Musk, I said, well, this is going down the same path, they’re going to do things right, and I’m going to be able to make money with that,” Gamboa Silvestre recalled.

But things didn’t turn out that way. Besides the money he lost, Gamboa Silvestre surrendered something that was even more important to him: his love for crypto.

“After what happened with Libra, I completely stepped away from that world. I stopped doing something that I really liked that had generated me a lot of profitability during that period,” he said. “In the future, I saw myself only living from that. But I lost all confidence.”

Today, the only ties that Gamboa Silvestre has left to the industry are his participation in a class action brought against Milei.

Data Disputes Milei’s Claims

Gamboa Silvestre is one of 212 investors seeking reparation for their losses in a lawsuit pending in Argentina.

Even though Milei has repeatedly dialled down the impact that LIBRA had on investors, the facts tell a different story.

According to data from Ripio, just one centralized exchange operating in the country, 1,329 citizens lost money. These numbers directly contradicted Milei’s previous claims that only a handful of Argentine investors had been affected.

Argentines weren’t the only ones who had lost money. The impact was international, affecting investors anywhere from Bosnia to Lebanon to Australia.

In the United States, a separate class action lawsuit is moving forward against Hayden Davis, the American investor and CEO of Kelsier Ventures, who has been accused of being the mastermind behind the project.

Trust Erodes As Investigation Continues

Despite it being a year since Libra launched, Milei has yet to provide a coherent explanation of his level of involvement in the token project.

According to Agustín Rombolá, one of the lawyers representing the complainants in the class action, Milei’s answers have varied greatly over the past year.

“He first told us it was a casino, that you don’t cry in the casino. Then he told us that he had the right to sell his opinions. And then he told us that he was not working as the president at the moment of the tweet. [After that], he told us he was scammed,” Rombolá told BeInCrypto.

According to Congressman Maximiliano Ferraro, one of the most outspoken critics in the Libra scandal, Milei has yet to address a key issue regarding his role in the case.

“There are still many questions unanswered. Who approached the President, and how did they give him that [smart contract address] that had more than 40 characters and did not have a public status?” Ferraro said in an interview in Spanish.

As the investigation into what happened continues, the financial damage is still being tallied, as is the loss of trust.

For Gamboa Silvestre and thousands of others, Libra was not just a failed investment but a turning point that reshaped their relationship with crypto altogether.

Crypto World

Mike McGlone Adjusts Bitcoin Price Target to $28,000 After Backlash

TLDR

- Mike McGlone adjusted his Bitcoin price forecast from $10,000 to $28,000 following significant backlash on social media.

- McGlone had originally warned that Bitcoin could drop to $10,000 if U.S. equities peaked and a recession followed.

- The revised forecast of $28,000 is based on historical price distribution and fewer negative factors needed to reach that level.

- Analysts like Jason Fernandes criticized McGlone’s initial prediction, calling it alarmist and unrealistic.

- Mati Greenspan acknowledged the possibility of a $28,000 Bitcoin price but remained skeptical of its likelihood in the current market.

Bloomberg Intelligence’s Mike McGlone recently adjusted his bitcoin price forecast, raising his downside target to $28,000. This shift followed criticism after his initial prediction of a potential $10,000 Bitcoin price was widely questioned on social media. McGlone’s revised stance comes after market experts accused him of issuing alarmist forecasts that could negatively impact investor decisions.

McGlone Faces Backlash for $10,000 Bitcoin Call

Earlier this week, McGlone warned that bitcoin could drop to $10,000 if U.S. equities reach their peak and a recession follows. He stated that bitcoin, being a high-beta asset, would suffer in a market breakdown, especially after the collapse of the “buy the dip” mentality. This prediction attracted significant criticism, with market analyst Jason Fernandes challenging the forecast on social media platforms like X and LinkedIn.

The backlash grew when Fernandes called McGlone’s $10,000 forecast unrealistic. He argued that such a dramatic drop would require several negative factors to align. Fernandes, in his critique, noted that the bitcoin price could face risks but stated that $28,000 was a more plausible level, particularly with fewer factors needed to drive that price point.

Bitcoin Price Forecast Revised to $28,000

In a subsequent post, McGlone acknowledged the feedback and adjusted his bitcoin price forecast. He pointed to $28,000 as a more likely scenario, citing historical price distribution as the basis for his updated target. Despite this revision, McGlone still maintained a cautious outlook, advising against investing in bitcoin or other risk assets.

While McGlone’s $28,000 prediction was seen as more reasonable, some market experts like Mati Greenspan remained skeptical. Greenspan suggested that although $28,000 might be possible, the likelihood of it happening was still low. He emphasized the unpredictable nature of markets, stating that while forecasts could be helpful, they should not rule out other possibilities.

Fernandes Challenges McGlone’s Forecast Shift

Fernandes, who had initially criticized McGlone’s $10,000 prediction, continued to voice concerns even after the revision. He highlighted that McGlone’s updated forecast now aligned closer to his own lower-bound estimate of bitcoin’s price range. Fernandes pointed out that a reset in the $40,000 to $50,000 range remained more probable, especially without a systemic liquidity shock.

Despite the change in McGlone’s outlook, the broader discussion highlighted the potential dangers of deterministic predictions in volatile markets like crypto. Analysts warned that alarmist forecasts could influence positioning and potentially lead to unnecessary risks for investors. Fernandes emphasized the need for more balanced approaches when discussing the future of high-risk assets like Bitcoin.

Crypto World

Epstein eyed Coinbase, XRP, XLM, Circle in pre-mainstream crypto era

Epstein’s 2010s emails show Gensler talks, XRP/XLM bets, CBDC and stablecoin funding links.

Summary

- 2018 emails show Epstein sought crypto talks with Gensler and briefed Summers on early digital currency discussions.

- Records cite about $3m into Coinbase plus speculative exposure to XRP, XLM, Circle and early stablecoin structures tied to Brock Pierce.

- Reports mention funding for MIT-linked CBDC pilots and private crypto ventures as crypto policy circles were still nascent.

Newly released documents from the Jeffrey Epstein case contain references to communications involving cryptocurrency policy discussions and Gary Gensler, according to reports published this week.

The documents include emails dated 2018 that reportedly mention conversations between Epstein and individuals connected to policy and academic circles in the cryptocurrency sector. Gensler, who later served as Chair of the Securities and Exchange Commission, appears among the names referenced in the materials.

According to the reports, the files contain correspondence suggesting Epstein discussed arranging a meeting with Gensler regarding cryptocurrency topics. Emails from 2018 indicate Epstein told former U.S. Treasury Secretary Lawrence Summers that Gensler had arrived early for crypto-related discussions, according to the documents. Summers reportedly responded that he knew Gensler and considered him intelligent.

No documents released to date have established a direct connection between Epstein and any specific cryptocurrency decision or project, according to available reports. However, records suggest Epstein invested millions in early cryptocurrency ventures, including approximately $3 million in Coinbase in 2014, reports stated.

Some emails reportedly referenced XRP and Stellar, leading to speculation about possible investments in those projects, though the documents do not provide clear confirmation, according to observers.

Additional claims in the reports suggest Epstein provided funding for U.S. central bank digital currency pilot programs through MIT and certain Federal Reserve Banks. Gensler taught at MIT during that period and worked in academic policy circles before entering government service and participating in the development of U.S. cryptocurrency regulation.

Reports also indicate Epstein explored early stablecoin-related investments, including Circle, through connections associated with Brock Pierce. Pierce reportedly requested Epstein’s assistance in connecting with Lawrence Summers, according to accounts of the correspondence.

The documents suggest Epstein maintained investments in private cryptocurrency ventures while maintaining relationships with academic and policy circles involved in digital currency regulation, according to analysts reviewing the materials. The timing of these connections has drawn attention as they occurred before cryptocurrency markets achieved mainstream adoption.

Crypto World

Tight Bitcoin Bollinger Bands Signal Big Move: Analyst

A key volatility indicator for Bitcoin (BTC) has narrowed to its tightest measurement on record, a pattern that was followed by a multimonth rally in previous bull and bear markets. Will the Bollinger Bands indicator call the market bottom again?

Record Bitcoin Bollinger Band compression hints at volatility

Analyzing the monthly Bitcoin chart, crypto analyst Dorkchicken noted that BTC’s Bollinger Bands are currently at their “tightest” level on record. Such conditions have repeatedly led to bullish breakouts, with the only prior downtrend from similar conditions occurring in 2022, during the drop to $16,000 from $20,000.

Bollinger Bands measure price volatility, and extreme compression often leads to a sharp expansion. The analyst added that there are higher odds of an upside trend once expansion begins.

On the contrary, Bitcoin trader Nunya Bizniz pointed to an approaching 50- and 200-period simple moving average (SMA) death cross on the three-day chart. A death cross occurs when the shorter-term moving average falls below the longer-term average, signaling weak price momentum.

Across the past three instances, the pattern marked drawdowns of about 50% over the following one to six months and aligned closely with final cycle capitulation phases.

A similar path may imply a potential bottom between March and August near $33,000. The trader also said that BTC has spent 110 days below its short-term holder cost basis of $89,800. During previous cycle lows, the price typically remained under that level for nearly 200 days on average.

Market analyst Ardi also noted that the long futures exposure from retail traders has increased on each dip to $68,000 from $88,000. Currently, 72% of tracked retail accounts are long into a descending trendline.

While this reflects early signs of market optimism, each recent surge in long positioning has been followed by a sharp sell-off. With positioning once again elevated, these longs remain vulnerable to liquidation, increasing the risk of a liquidity hunt if the price moves lower.

Related: Bitcoin ‘roadmap to bottom’ says $58.7K Binance cost basis now crucial

BTC’s Sharpe ratio is interesting, but $70,000 remains the level to crack

Crypto analyst MorenoDV said that Bitcoin’s short-term Sharpe ratio has dropped to -38.38, matching levels last seen in 2015, 2019 and late 2022.

The Sharpe ratio measures the risk-adjusted return, and deeply negative readings mark periods of deep drawdown and volatility. Each extremely low ratio signal has aligned closely with the major cycle lows, leading to strong BTC rallies, with the analyst noting that the current price range may be a “generational buy zone.”

Glassnode data calls for confirmation through a stronger BTC demand absorption. Since early February, each move above the $70,000 level has stalled as the net realized profits exceeded $5 million per hour.

Glassnode added that in Q3 2025, profit-taking between $200 million to $350 million per hour did not interrupt the advance to new highs in Q4.

Related: ‘Resilient’ Bitcoin holders defend BTC, but bear floor sits 20% lower: Glassnode

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Quantum Fears Is Not The Reason For Bitcoin’s Decline: Developer

Bitcoin’s recent sell-off isn’t because of quantum computing fear, because if that were the case, Ether would be soaring, says Bitcoin developer Matt Carallo.

“I strongly disagree with the characterization that Bitcoin’s current price is materially, because of some kind of quantum risk,” Carallo told journalist Laura Shin on the Unchained podcast on Thursday.

“If that were true, then Ethereum would be up substantially on Bitcoin,” he added. Ether (ETH) is down 58% since a major crypto market crash in early October, trading at $1,957 at the time of publication.

Carallo’s comments come as several Bitcoiners have argued that fears of quantum computing affecting the blockchain is partly why Bitcoin (BTC) has dropped 46% from its October all-time high of $126,100 to now trade at $67,162, according to CoinMarketCap.

Ethereum zones in on quantum readiness

Some Bitcoin users have accused the blockchain’s developers of not moving quickly enough to make the network quantum-resistant, while the Ethereum Foundation has said it is taking measures to be ready.

In its protocol update on Wednesday, the Ethereum Foundation outlined long-term post-quantum readiness as part of its broader security initiative.

Carallo said that although quantum computing poses long-term risks to Bitcoin, market makers don’t see it as a pressing short-term threat, arguing that the Bitcoin community is just looking for a scapegoat.

“There are a lot of Bitcoiners who want to blame something, blame someone for lackluster performance.”

Carallo said that a more likely reason for Bitcoin’s price decline is that it is now “competing for capital” in a way it never has before against other technologies such as artificial intelligence.

“AI is super capital-intensive,” he said, adding that it is a “massive new investment class that is substantially competing for capital.”

“There’s a lot of interest in value accrual that will happen because of AI in traditional equities,” Carallo said.

Bitcoiners are of the opposite opinion

Not all Bitcoiners agree with Carallo, as Capriole Investments founder Charles Edwards said at Cointelegraph’s LONGITUDE event on Feb. 12, that the risk should be priced into Bitcoin until it becomes quantum-resistant.

“Today, you kind of have to start to discount the value of Bitcoin based on that risk until it’s solved,” Edwards said.

Related: Bitcoin bottom signal that preceded 1,900% rally flashes again

Meanwhile, entrepreneur Kevin O’Leary told Magazine in December that using quantum computing to crack Bitcoin may not be the most efficient use of the resources, and there is more upside in using the technology for areas such as medical research.

In May 2025, the world’s largest asset manager, BlackRock, updated the registration statement for its iShares Bitcoin ETF (IBIT) to warn investors of the potential risks to the integrity of the Bitcoin network posed by quantum computing.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Crypto World

Metaplanet CEO Defends Bitcoin Bet as Shareholder Base Hits Record High

TLDR:

- Metaplanet reports shareholder growth into the hundreds of thousands as its Bitcoin treasury strategy gains global reach.

- The company increased Bitcoin per share by over 500 percent in 2025 through accumulation and derivatives-based income.

- Management confirmed it will never sell Bitcoin and will rely on volatility-driven strategies to grow reserves.

- Executives acknowledged drawdowns but maintained that long-term fundamentals guide every treasury decision.

Metaplanet’s shareholder base has expanded to hundreds of thousands as the company doubles down on its Bitcoin-focused treasury strategy. The firm acknowledged market volatility while confirming that its accumulation plan remains unchanged.

Management pointed to rising global adoption and Bitcoin’s fixed supply as core drivers of confidence. The update comes as digital asset markets continue to test investor patience.

Metaplanet Bitcoin Strategy Centers on Long-Term Accumulation

Simon Gerovich credited the company’s rapid shareholder growth to sustained belief in its Bitcoin-centered model.

He said early support came from only a small group of investors. Today, ownership spans multiple regions, reflecting wider participation in crypto-linked equity strategies.

According to a statement shared on X, the firm increased its Bitcoin per share by more than 500 percent during 2025. The company framed this metric as its primary performance benchmark.

Management said every decision now prioritizes expanding that ratio over short-term price movements.

Gerovich also acknowledged that volatility has created difficult periods for shareholders. He noted that conviction does not remove the pain of drawdowns.

The company stressed that its outlook remains anchored in long-term fundamentals rather than short-term market cycles.

The executive added that criticism tends to intensify when Bitcoin prices decline. He argued that abandoning strategy during downturns usually leads to weaker long-term outcomes.

The company maintained that discipline matters most during unstable market conditions.

Derivatives and Market Outlook Shape Bitcoin Accumulation Plan

Metaplanet said its derivatives strategy allows it to acquire Bitcoin at more favorable levels than spot purchases alone.

The firm uses structured trading approaches designed to benefit from price swings. Management described this as a risk-managed method that supports consistent accumulation.

The company also highlighted income generation through derivatives as a core operational pillar. This approach aims to strengthen treasury growth without selling existing Bitcoin holdings.

Metaplanet reiterated that it does not plan to liquidate its reserves under any circumstances.

Gerovich shared a personal view that Bitcoin may have found support near the $60,000 level. He emphasized uncertainty and said no one can predict exact price direction.

Despite that view, the company said its strategy would not change regardless of short-term movements.

Metaplanet linked its long-term outlook to Bitcoin’s fixed supply and expanding global use. Management said these features support its belief in higher valuations over time. The firm stated that shareholder trust remains central to every operational decision.

The update was released through Gerovich’s verified social account and echoed the company’s broader messaging on transparency. It signals continued commitment to BTC accumulation amid fluctuating market sentiment.

The firm positioned itself among a growing group of Bitcoin treasury companies pursuing long-term exposure.

Crypto World

Crypto fear index falls to 10 as Strait of Hormuz tensions rise

Crypto fear index fell from 12 to 10 this week as Iran’s Hormuz drills raised oil and energy risk for BTC miners.

Summary

- Crypto fear and greed index dropped from 12 to 10 as Iran’s naval drills briefly closed the Strait of Hormuz, a major oil route.

- Roughly 20–25% of seaborne oil and about 20% of global petroleum consumption move via Hormuz, making closures a direct shock channel to energy prices.

- Higher energy costs can compress BTC mining margins and force some miners to scale back or sell holdings, tightening market liquidity during macro uncertainty.

Cryptocurrency market sentiment declined this week as geopolitical tensions escalated in the Middle East, with Iran conducting military drills that temporarily shut down the Strait of Hormuz, according to market data and reports.

The crypto fear and greed index dropped from 12 points on Monday to 10 points on Tuesday, reflecting subdued market sentiment that coincided with rising tensions between Iran and the United States.

The Strait of Hormuz serves as a critical passage for global oil transport, with approximately 31 percent of all crude oil transported across oceans passing through the waterway. Disruptions to this route typically result in higher oil prices and increased energy costs globally.

Elevated energy costs could impact Bitcoin mining operations, potentially forcing some miners to reduce operations or liquidate cryptocurrency holdings to cover operational expenses, according to market analysts. This represents one mechanism through which geopolitical events affect cryptocurrency valuations and market liquidity.

Iran’s temporary closure of the strait occurred as part of military exercises, though the action came amid heightened tensions with the United States. Iranian and U.S. officials met in Geneva, Switzerland, this week for diplomatic talks, according to reports.

The outcome of those negotiations could determine the trajectory of regional tensions and their impact on global markets. A breakdown in talks could signal escalation, while successful de-escalation might improve market sentiment, analysts noted.

Cryptocurrency trading volumes remained low this week as investors awaited key U.S. economic data releases. The U.S. Federal Reserve was scheduled to release durable goods data mid-week, with Personal Consumption Expenditures (PCE) data expected Friday. Traders typically await such data to establish directional market positions.

Macro factors have influenced cryptocurrency markets in recent months, with risk-on assets including digital currencies showing sensitivity to geopolitical events and global economic conditions, according to market observers.

Crypto World

Vitalik: New Ethereum Design Targets Censorship With FOCIL and EIP-8141

TLDR:

- FOCIL and EIP-8141 allow smart wallet and privacy transactions to reach blocks without wrappers or intermediaries.

- Randomized includers reduce proposer dominance and increase censorship resistance for all Ethereum transactions.

- Rapid inclusion within one or two slots becomes likely even under hostile network behavior.

- Future FOCIL expansion could support most block transactions while preserving MEV auction mechanics.

Ethereum is moving closer to censorship-resistant transaction inclusion after new technical links emerged between FOCIL and EIP-8141.

The update focuses on ensuring that all transaction types reach the blockchain quickly, even under hostile network conditions. It also expands how smart accounts and privacy protocols interact with block production.

The development highlights Ethereum’s push to reduce proposer power while keeping network incentives intact.

How FOCIL and EIP-8141 Enable Direct Transaction Inclusion

According to a post shared by CEO Vitalik Buterin, FOCIL works alongside EIP-8141 to make smart accounts and privacy tools first-class transaction senders.

EIP-8141 builds on account abstraction by allowing smart wallets to submit transactions directly onchain without wrappers or intermediaries. These accounts can support multisignature controls, quantum-resistant keys, and gas sponsorship.

FOCIL then ensures that these transactions gain rapid inclusion through randomly selected includers each slot. In every block, up to 17 actors can include transactions, instead of relying on a single proposer.

Vitalik noted that this structure creates a path for almost guaranteed inclusion within one or two slots. It also allows privacy protocol transactions to enter blocks through the public mempool without relying on broadcasters or relayers.

Why FOCIL and EIP-8141 Weaken Proposer Control

FOCIL currently limits each inclusion list to about 8 kilobytes, keeping the design lightweight in its first phase. However, the roadmap allows these lists to grow and potentially carry most transactions in future blocks.

The approach mirrors some features of multiple concurrent proposer models without removing proposer-builder separation. Instead, it preserves the MEV auction for the final ordering role through ePBS.

Even if all proposer slots were captured by a hostile entity, transactions would still reach blocks through FOCIL includers. This reduces the ability of any single actor to block or discriminate against certain applications.

The design shifts power away from centralized block producers while keeping economic incentives stable. It also protects smart wallet operations and privacy protocol activity from selective exclusion.

Developers say the combination strengthens the base layer against censorship without forcing changes to existing transaction flows. Transactions from smart accounts can move through the public mempool and directly reach includers.

With these changes, ETH positions itself to support a wider range of transaction types under adversarial conditions. The update reinforces ongoing work on account abstraction and block inclusion guarantees.

Crypto World

Payward Acquires Magna to Expand Kraken Token Lifecycle Infrastructure

TLDR:

- Payward’s acquisition of Magna links token vesting and claims infrastructure directly into Kraken’s expanding product ecosystem.

- Magna will continue operating independently while its tools integrate with Kraken’s broader token issuance and distribution roadmap.

- The deal extends Kraken’s reach from trading into fundraising and long-term token lifecycle management services.

- Magna’s platform already supports over 160 projects with peak total value locked of $60 billion in 2025.

Payward has acquired Magna in a move that extends Kraken’s services beyond trading into token lifecycle management. The deal brings vesting, claims, and distribution tools into Kraken’s broader financial infrastructure stack.

Company leaders described the transaction as part of a push toward verticalized crypto services. Terms of the acquisition were not disclosed.

Payward Acquires Magna to Build End-to-End Token Infrastructure

The announcement came through a company blog post and was later echoed in a social update from Dave Ripley. The post confirmed that Magna will continue operating as a standalone platform while integrations progress.

Magna provides tooling for onchain and offchain vesting, token claims, custody workflows, and specialized staking features. These services support teams running complex token distributions and treasury operations.

According to Payward, the acquisition supports its expansion from trading infrastructure into fundraising, issuance, and long-term network management.

The company said Magna already serves teams managing billions of dollars in active token ecosystems.

Arjun Sethi framed the deal as an effort to avoid concentration around distribution and access. He said open, chain-aware infrastructure connects fundraising, liquidity, and distribution into one operating layer.

Kraken Expands Beyond Trading With Magna Integration

Kraken’s on-chain leadership linked the move to a broader strategy around issuer services. Calvin Leyon said the exchange aims to extend trusted infrastructure across the full token lifecycle.

Magna will initially focus on onboarding and security hardening while preserving its existing integrations. Payward said later phases will align the platform with token issuance and global distribution workflows.

Magna’s client base includes more than 160 projects, with peak total value locked reaching $60 billion in 2025. The company has positioned itself as a core operational layer for token generation events and ongoing community management.

Bruno Faviero stated that joining Kraken provides resources for deeper liquidity and global reach. He added that Magna will continue supporting teams across multiple chains and custody setups.

Payward confirmed that Magna customers can keep using current products without disruption. Product updates will roll out gradually as foundational integrations advance.

The acquisition strengthens Kraken’s role beyond exchange services into infrastructure for builders and issuers. It also signals growing demand for standardized tools that manage vesting, distribution, and compliance at s

Crypto World

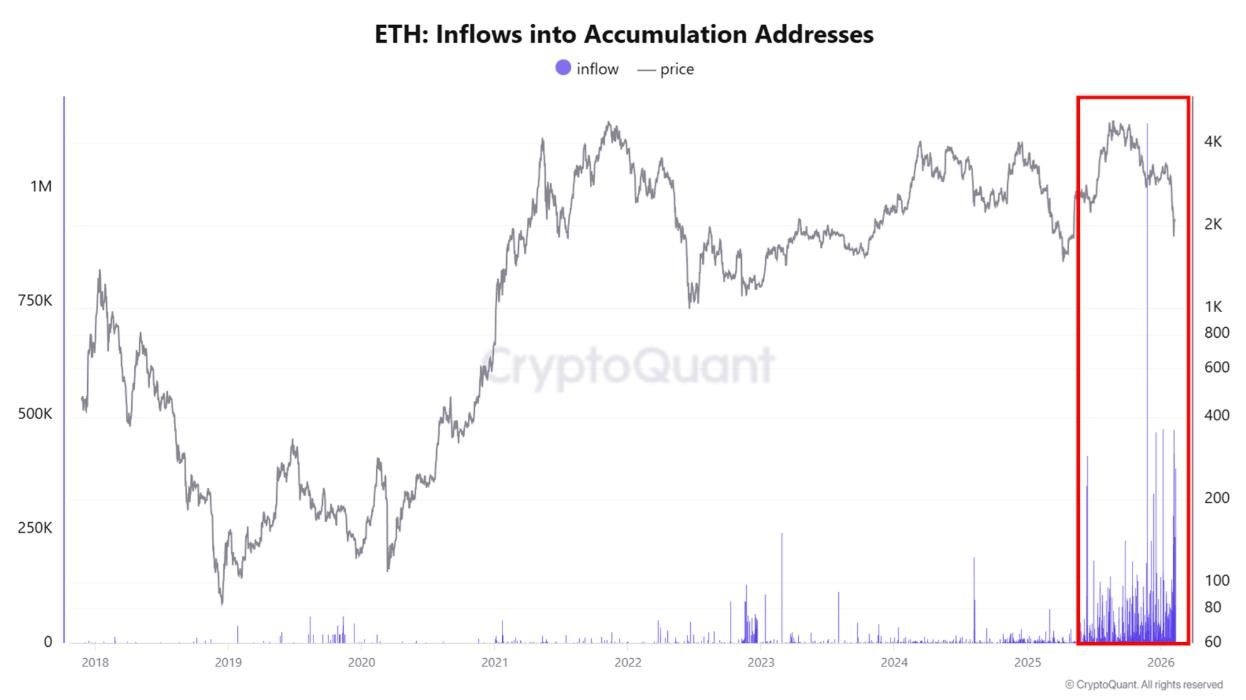

Tom Lee and K3 Capital Increase ETH Accumulation Below $2,000

For some institutional investors, trading ETH below $2,000 represents an opportunity rather than a risk, despite growing concerns about expanding unrealized losses.

ETH has now entered its sixth consecutive month of decline. This marks the longest losing streak since the 2018 downtrend.

Tom Lee and K3 Capital Boost ETH Holdings as Staking Ratio Hits Record High

According to Lookonchain, Tom Lee — founder of Fundstrat and head of Bitmine — executed large ETH purchases during the third week of February.

On February 18 alone, Bitmine acquired an additional 35,000 ETH worth approximately $69.37 million. The purchase included 20,000 ETH, valued at $39.8 million, from BitGo, and 15,000 ETH, valued at $29.57 million, from FalconX.

K3 Capital also made a significant move. Data from OnchainLens shows that a wallet linked to the investment fund purchased 20,000 ETH worth $40.08 million from Binance.

These sizable transactions reflect strong long-term conviction in ETH, even as the asset trades below $2,000.

Data from CryptoRank indicates that long-term investors have increased Ethereum accumulation during the current downturn.

Meanwhile, data from CryptoQuant shows that inflows into ETH accumulation addresses over the past six months have reached the most active period in history. History shows that in 2018, ETH experienced seven consecutive months of decline before recovering.

“The whales and the largest banks are buying and building on ETH. These are the highest inflows into whale‑accumulation wallets we’ve seen. Meanwhile, retail has abandoned it and is calling for its failure. They’re tired and exhausted after watching the price chop inside this massive range for five years.” – Crypto investor Seth commented.

Another key milestone has emerged. For the first time in Ethereum’s 11-year history, more than half of the total ETH supply has been staked.

On-chain data platform Santiment reports that over 50% of the ETH supply now resides in the Proof-of-Stake (PoS) contract.

This contract functions as a one-way vault. Investors deposit ETH into staking to secure the network. Staked coins temporarily leave circulation and cannot be traded.

Staking activity has continued to rise, particularly during bearish cycles. As more ETH becomes locked, the liquid supply declines.

“When over 50% of the supply is locked in staking, liquid supply shrinks. Fewer coins are available for trading. That reduces sell pressure and makes the market more sensitive to new demand.” Validator Everstake stated.

Everstake clarified that 50.18% represents the total ETH held by the Ethereum PoS contract address, while the remaining 30% is active stake.

However, recent analysis by BeInCrypto does not rule out the possibility that ETH could decline further to $1,385 in the short term, amid the most negative market sentiment seen in years.

Even if that scenario unfolds, on-chain data suggests that large investors and institutions continue to position for a long-term recovery.

Crypto World

Expert: Crypto Was Built for Machines, Not Humans, and AI Is Proof

TLDR:

- Crypto built for AI agents treats rigid code as infrastructure instead of a flaw in financial design.

- Legal contracts favor human judgment, while smart contracts favor machine verification and execution.

- AI wallets bypass legacy systems that only recognize humans and registered institutions.

- Self-driving wallets could replace manual interaction with automated on-chain decision systems.

Crypto has long struggled with usability, security risks, and trust gaps for everyday users.

A new framework suggests those flaws reflect a deeper design choice rather than engineering failure. The argument centers on crypto built for AI agents, not for human decision-making. This shift reframes why smart contracts rely on rigid logic instead of legal judgment.

Crypto Built for AI Agents Challenges Human-Centered Finance

The idea gained traction after a commentary shared by Milk Road and attributed to Haseeb Qureshi, managing partner at Dragonfly. He highlighted that even crypto-native firms still rely on traditional legal contracts when making investments.

Despite having engineers capable of auditing smart contracts, Dragonfly continues to use courts and lawyers for enforcement.

Legal systems allow judges to apply context and reason when disputes arise. Code executes instructions without interpretation.

Humans instinctively trust law because it reflects centuries of social and institutional design. Banking infrastructure assumes mistakes, reversals, and mediation will occur. Smart contracts offer none of those safety valves.

For machines, those same traits become advantages.

An AI agent can verify addresses, audit logic, and simulate outcomes in seconds. Deterministic code removes uncertainty that legal frameworks introduce through jurisdiction and precedent.

Crypto Built for AI Agents Aligns With Machine-Only Transactions

The traditional financial system only recognizes humans, companies, and governments as valid participants. It has no category for autonomous software actors. That creates unresolved questions around liability, compliance, and sanctions when AI systems transact.

Crypto avoids those constraints by treating every participant as a wallet controlled by code.

An AI agent can hold funds and execute agreements without legal identity. This structure allows machine-to-machine commerce to operate without regulatory classification barriers.

Supporters of the thesis argue that features humans dislike are optimal for automation.

Long addresses, gas fees, and permissionless access form a strict specification layer. AI systems interpret these rules as predictable infrastructure rather than friction.

This logic underpins the concept of a “self-driving wallet.” Instead of users clicking through decentralized apps, they would issue goals to an agent. The agent would evaluate protocols and construct transactions automatically.

Machine-to-machine transactions already occur in limited forms across on-chain trading bots and automated liquidity strategies. The framework suggests those activities will expand into broader economic coordination. Humans would remain supervisors rather than operators.

The argument does not claim crypto failed its original mission. It proposes that crypto found its natural counterpart in autonomous software. Earlier technologies followed similar paths once complementary tools emerged.

Milk Road framed the thesis as a rethinking of long-standing crypto criticism.

Problems such as complexity and rigidity may reflect optimization for non-human users. In that view, crypto’s future lies in becoming financial infrastructure for artificial agents rather than consumer interfaces.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Video1 hour ago

Video1 hour agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports23 hours ago

Sports23 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World6 hours ago

Crypto World6 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market