Crypto World

Crypto price prediction as hawkish FOMC minutes sparks market sell-off

The latest Federal Open Market Committee minutes struck a hawkish tone, pressuring risk assets including cryptocurrencies.

Summary

- Policymakers warned inflation progress may be “slower and more uneven,” signaling rate cuts are not imminent and that hikes have not been fully ruled out.

- With Treasury yields rising and easing deemed potentially premature, high-beta assets like Bitcoin, Ethereum and XRP faced renewed selling pressure.

- BTC holds near $66.8K but remains below its 50-day SMA; ETH consolidates near $1,960 with weak inflows; XRP trades under key Bollinger resistance near $1.46.

Policymakers acknowledged that while inflation has cooled from its highs, progress toward the Fed’s 2% target “might be slower and more uneven than generally expected,” and warned that the risk of inflation remaining persistently above target “was meaningful.”

That language reinforced expectations that rate cuts are not imminent and that policymakers remain cautious about declaring victory over price pressures.

The minutes also revealed that several participants would have supported a “two-sided” description of risks, signaling that further rate hikes have not been fully ruled out if inflation reaccelerates. At the same time, officials indicated that additional policy easing “may not be warranted” until there is clear evidence that disinflation is firmly back on track.

While two members dissented in favor of an immediate cut, the broader message emphasized patience and vigilance, a stance that typically tightens financial conditions and weighs on high-beta assets such as crypto.

With Treasury yields climbing and expectations for near-term liquidity fading, digital assets faced renewed selling pressure. This sets the stage for a closer look at how Bitcoin (BTC), Ethereum (ETH) and XRP (XRP) are reacting on the charts.

Crypto price prediction: Bitcoin (BTC)

Bitcoin extended its pullback following the hawkish Fed minutes, briefly dipping toward $65,000 before stabilizing before staging a rebound. It is currently trading around $66,800, but remains well below the 50-day SMA near $82,600, which signals that the broader short-term trend is still bearish.

The RSI is hovering around 34, recovering from near-oversold territory but still below the neutral 50 level, suggesting weak momentum despite the bounce. Immediate support sits near $64,000, followed by the recent low around $60,000.

On the upside, resistance is seen near $70,000, with stronger structural resistance around $75,000–$76,000. Unless BTC reclaims those levels, rallies may continue to face selling pressure.

Ethereum (ETH)

Ethereum saw a sharp sell-off in early February, dropping toward the $1,900 zone before stabilizing. It is now trading around $1,960, consolidating in a tight range amid the Fed-driven volatility.

The Balance of Power indicator has turned slightly positive, hinting at mild buying pressure, but CMF remains marginally negative, suggesting capital inflows are still weak. Immediate support lies at $1,900, with a deeper floor around $1,800.

On the upside, ETH faces resistance near $2,050, followed by $2,200, where prior breakdown levels sit.

XRP

XRP remains under pressure compared to BTC and ETH. After sliding from above $2.00 earlier in the year, it recently bounced from the $1.20–$1.25 area and is currently trading near $1.41.

Price is sitting below the mid-Bollinger Band (around $1.46), while the upper band near $1.65 acts as dynamic resistance.

CMF remains slightly negative, indicating limited buying conviction. Immediate support rests at $1.35, followed by the recent swing low near $1.25. Resistance is seen at $1.46, with a stronger barrier at $1.60–$1.65.

Crypto World

Fed’s Neel Kashkari Says Crypto ‘Utterly Useless’

Neel Kashkari, the president of the US Federal Reserve Bank of Minneapolis, says that crypto is “utterly useless” in comparison to artificial intelligence and took a swipe at stablecoins, saying they don’t have many uses.

Speaking at the 2026 Midwest Economic Outlook summit on Thursday, Kashkari drew comparisons between AI and crypto, saying the latter “has been around for more than a decade, and it’s utterly useless.”

“AI has not been around very long, and people are using it every day,” he added. “This is demonstrating to me that this thing is real and it has real long-term potential for the US economy as opposed to crypto.”

Kashkari said that the way the crypto industry has framed how stablecoins can be used is “a buzzword salad.”

“I always ask people: What can I do with the stablecoin that I can’t do with Venmo today?” he said. “I could send any one of you $5 with Venmo, or PayPal, or Zelle, so what is it that this magical stablecoin can do? Then I get a buzzword salad answer, blah blah blah, tokenized deposits.”

Kashkari took specific aim at the notion of stablecoins being used for remittances, as he highlighted that this mainly serves people outside the US, and argued that its not as cheap as people think.

Related: SEC leaders seek to clarify how tokenized securities interact with existing regulation

He used the example of his father-in-law, based in the Philippines, arguing that while he could receive stablecoins quickly, he still needs to pay fees to convert them into the local currency to actually transact with them.

“If everybody in the world uses the same currency or the same payment platform. All these frictions go away. But all these other countries are not going to abandon their own monetary policy [for stablecoins],” he said.

“When it comes to anything about crypto or stablecoins, ask the most basic questions and don’t settle for word salad nonsense answers,” he said.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Crypto World

Why is the crypto market down today? (Feb. 19)

The crypto market remained in a downtrend on Thursday, dropping nearly 3% to $2.35 trillion due to a confluence of macroeconomic uncertainty and geopolitical tensions that spooked investors.

Summary

- The latest FOMC minutes report has cast uncertainty regarding rate cuts hurting risk-on sentiment.

- Fears of a full-blown US-Iran war have pushed investors to the sidelines.

- Crypto ETFs recorded billions in outflows over the past weeks.

Bitcoin (BTC), the world’s largest crypto asset, fell 3.5% to around $65,900 before experiencing a partial recovery back above $66,700 at press time. Ethereum (ETH) was down 1.6% after losing the $2,000 key support level, while other major cryptos such as XRP (XRP), BNB (BNB), Solana (SOL), and Dogecoin (DOGE) were also in the red, posting losses between 1% and 4%.

Some of the top laggards of the day were Provenance Blockchain (HASH), Zcash (ZEC), and Memecore (M).

The latest slide triggered a liquidation wave, with the open interest of the total market falling by 0.71%. Data from SoSoValue show that in the past 24 hours, over $224 million worth of positions were liquidated from the futures market, with roughly $164 million coming from long positions.

At the same time, the crypto fear and greed index, a metric investors use to gauge the general sentiment of the market, remained in the extreme fear thresholds.

The crypto market tanked on Thursday after the FOMC minutes report on Feb. 19, which revealed uncertainty over more rate cuts moving into the coming months. This shifting stance could set the Federal Reserve on a direct collision course with President Donald Trump, who has consistently pressured for aggressive rate cuts. It also complicates the path for Trump’s nominee for Fed chair, Kevin Warsh.

According to market predictions platform Polymarket, the odds of no changes in rate cuts for the next FOMC meeting in March have increased to 93% at the time of writing. Cryptocurrency prices have historically fallen back or remained suppressed when the Fed sets a hawkish tone surrounding interest rate policies.

U.S.-Iran war tensions

Investors also remain wary of a potential full-scale war between the United States and Iran. According to recent reports, the United States and Israel are planning a potential joint campaign to target Iran’s nuclear and missile facilities, which could escalate into a weeks-long conflict. Meanwhile, Iran has vowed to retaliate against any strikes on its territory.

When markets enter a period of geopolitical stress, such as an armed conflict, investors often rotate capital to cash and traditional safe-haven assets and, in turn, dump volatile crypto assets. Bitcoin has so far failed to establish a credible safe-haven narrative as it continues to trade as a high-beta risk asset rather than digital gold.

During this latest escalation, the premier cryptocurrency has mirrored the declines seen in tech stocks, struggling to absorb the stress bid that has instead bolstered physical gold and crude oil prices.

Bitcoin ETFs outflows hit 5-week streak

Another layer eroding retail confidence in the crypto market is the lackluster interest shown by institutional investors towards crypto ETFs, specifically majors like Bitcoin and Ethereum ETFs.

Data from SoSoValue shows that the 12 spot Bitcoin ETFs have recorded 5 straight weeks of outflows so far, with the total tally of these net withdrawals standing at over $3.6 billion within the period. Meanwhile, their Ethereum counterparts have posted outflows of over $1.2 billion.

As investor demand in these investment vehicles continues to be sluggish, it removes a key safety net of consistent institutional buying pressure that has historically stabilized prices during periods of high volatility. Without this reliable influx of capital, the market remains more vulnerable to sudden selloffs and the prevailing negative sentiment.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Bitcoin price outlook as CLARITY Act approval odds hit 90%

Bitcoin traded near $67,000 on Thursday, steadying after a session that coincided with sharp swings in prediction market odds for the CLARITY Act.

Summary

- Bitcoin traded near $67,000 as Polymarket odds for the CLARITY Act swung from 90% to 55%, highlighting regulatory uncertainty.

- The CLARITY Act aims to define oversight between the SEC and CFTC, potentially reducing ambiguity and boosting institutional confidence in crypto markets.

- Technically, BTC is consolidating between $65,000 and $70,000, with weakening bearish momentum but key resistance overhead at $70,000–$75,000.

On Polymarket, approval odds for the CLARITY Act briefly surged to 90% earlier in the day before sharply retracing to around 55% at press time, reflecting uncertainty around the bill’s path forward.

The CLARITY Act is a proposed U.S. crypto market structure bill designed to define regulatory oversight between the SEC and CFTC. The legislation aims to provide clearer rules for digital assets, token classification, and exchange compliance.

If passed, it could reduce regulatory ambiguity, encourage institutional participation, and improve long-term capital inflows into the crypto sector.

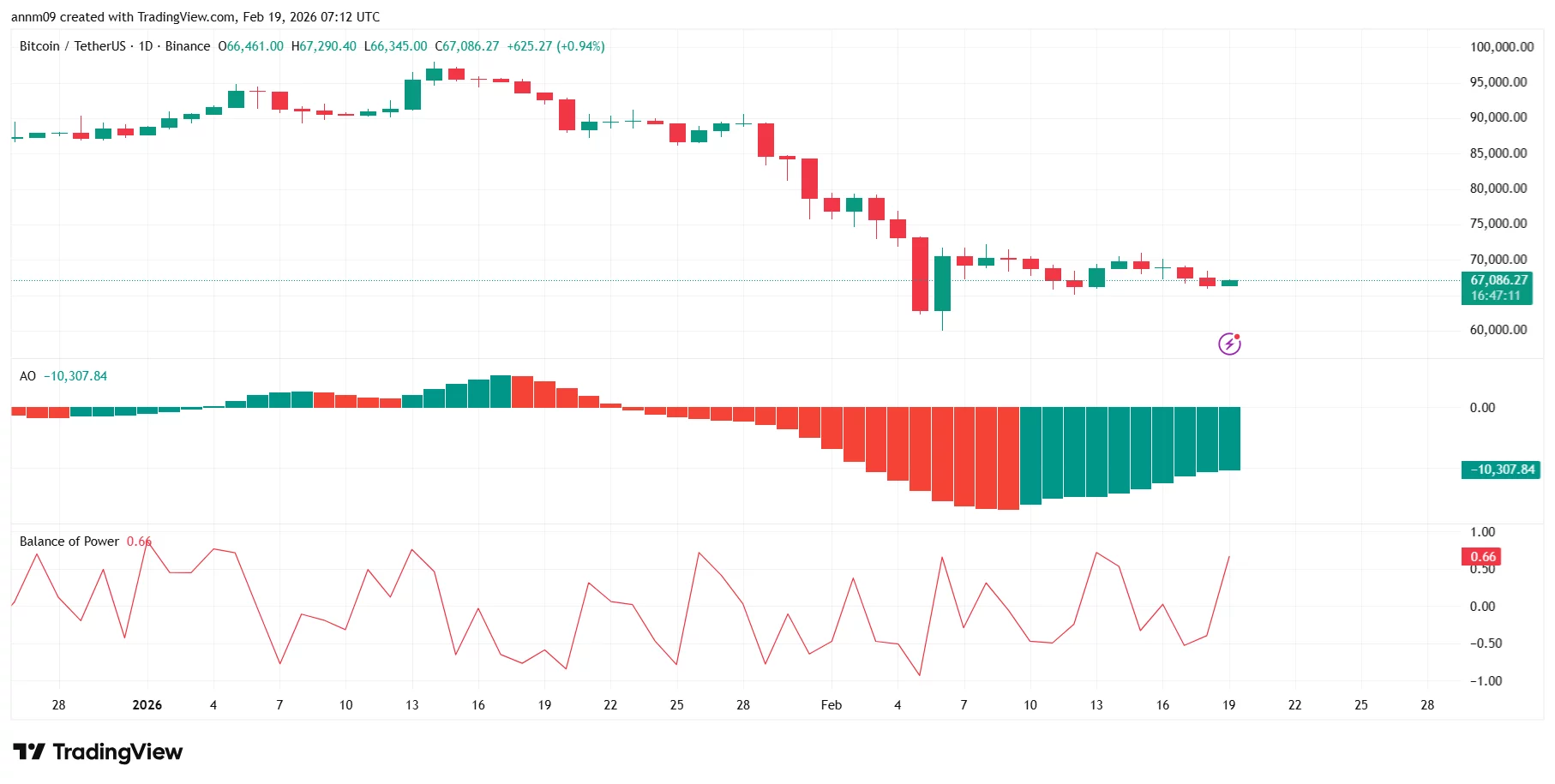

Bitcoin price outlook: Momentum stabilizing after sharp drop

On the daily chart, Bitcoin remains in a broader short-term downtrend following its sharp selloff from the mid-$90,000 region earlier this year. Price action shows a series of lower highs and lower lows before stabilizing around the mid-$60,000 range.

The recent large red candle near $72,000 marked a capitulation-style move, with price briefly dipping toward the low-$60,000s before rebounding. Since then, BTC has been consolidating between roughly $65,000 and $70,000.

The Awesome Oscillator (AO) remains in negative territory but is printing rising green bars, suggesting bearish momentum is weakening. Meanwhile, the Balance of Power (0.66) has turned positive, indicating buyers are attempting to regain short-term control.

Immediate resistance sits near $70,000, followed by a stronger ceiling around $75,000, where prior breakdown occurred. On the downside, key support lies at $65,000, with a deeper level near $60,000 if selling resumes.

For now, Bitcoin appears to be consolidating. A decisive break above $70,000 could open the door for recovery, while failure to hold $65,000 may invite renewed downside pressure.

Crypto World

Sui price eyes $1.20 breakout zone as staking ETFs launch

Sui price is holding the $0.93 support zone as two new U.S. spot staking exchange-traded funds begin trading.

Summary

- SUI trades near support after a prolonged downtrend.

- Two U.S. spot staking ETFs now offer direct exposure with on-chain yield.

- $1.20 remains the key breakout level to confirm a trend shift.

Sui was trading at $0.9364 at press time, down 3.3% in the last 24 hours. Over the past week, the price moved between $0.8991 and $1.04. Buyers have stepped in several times near the $0.90 area.

The wider trend is still weak. Sui (SUI) is down 40% in the last 30 days and about 70% over the past year. Each recovery attempt has stalled below prior highs.

Derivatives show mixed positioning. According to CoinGlass data, futures volume rose 5% to $616.58 million, while open interest fell 2.93% to $493 million. When volume increases but open interest drops, it often points to short-term trades being opened and closed rather than strong conviction in one direction.

First U.S. spot SUI ETFs begin trading

Two spot ETFs tied directly to SUI began trading on Feb. 18.

The Canary Staked SUI ETF (SUIS) from Canary Capital Group began trading on Nasdaq. The fund holds spot SUI and stakes part or all of its holdings on the network. Staking rewards are reflected directly in the ETF’s net asset value.

On the same day, Grayscale Investments launched the Grayscale Sui Staking ETF (GSUI) on NYSE Arca. The fund carries a 0.35% annual sponsor fee, waived for the first three months or until assets reach $1 billion. At launch, 100% of holdings were staked.

Both products are structured as spot ETFs, not futures-based funds. They hold actual SUI tokens and pass staking rewards through to investors via net asset value. With Sui’s staking yield near 7%, the structure offers exposure to both price movement and on-chain yield.

ETF launches for Bitcoin in 2024 and Ethereum in 2025 attracted significant inflows. It is unclear if SUI will experience a comparable level of demand. Further token purchases by the funds could support the price. If participation disappoints, the impact may be limited.

Sui price technical analysis

On the daily chart, $0.93–$0.90 has acted as key support. The price has repeatedly tested this area, with buyers intervening to stabilize price. Short-term downward pressure might lessen if $0.90 holds.

The tightening of the Bollinger Bands indicates compression of volatility. Larger moves are often preceded by such squeezes. Whether or not resistance is recovered will determine the course.

The relative strength index is currently in the mid-30s after recovering from oversold levels close to 25. A mild bullish divergence has formed, with RSI making a higher low while price retested support. Momentum is improving, though it has not yet turned bullish.

SUI still trades below the 20-day moving average. Lower highs remain intact since the rejection near $2.00. The first sign of structural improvement would be a break above $1.05–$1.10.

The major breakout level sits at $1.15–$1.20. This zone aligns with the prior breakdown structure and horizontal supply. A daily close above $1.20 would break the lower-high pattern and could open room toward $1.45–$1.60.

If $0.93 fails, the next supports lie near $0.85 and $0.75. For now, SUI is compressing near support while ETF catalysts enter the market. Volume expansion on a move above $1.05–$1.20 will likely decide the next trend.

Crypto World

Illicit Stablecoins Reach 5-Year High at $141B in 2025, TRM Labs

New data from blockchain analytics firm TRM Labs shows illicit actors moved roughly $141 billion through stablecoins in 2025—the highest annual tally in five years. The report, issued this week, cautions that the uptick does not signal a broad acceleration in crypto-enabled crime, but rather a deeper reliance on stablecoins for activity where speed, liquidity, and cross-border movement offer clear operational advantages. The analysis highlights sanctions-linked networks and large-money-movement services as the dominant channels for these flows, underscoring how stablecoins have become a preferred rails for moving value outside traditional financial controls.

According to the TRM study, sanctions-related activity accounted for a staggering 86% of all illicit crypto flows in 2025. Of the $141 billion in stablecoin activity, roughly half—about $72 billion—was tied specifically to a ruble-pegged token known as A7A5, whose operations are almost entirely concentrated within sanctioned ecosystems. The institutional emphasis on these tokens points to a striking trend: stablecoins are not merely a tool for everyday commerce but a specialized infrastructure supporting state-linked evasion and enforcement-evading finance.

Beyond the A7A5 concentration, the report notes that Russian-linked networks intersect with other state-backed ecosystems, including actors connected to China, Iran, North Korea, and Venezuela. In TRM’s words, these findings illuminate how stablecoins have evolved into connective infrastructure for sanctioned actors seeking to move value outside conventional financial controls. This interlocking web raises questions for regulators and financial institutions about how to monitor cross-border flows that ride the rails of stablecoins—even when the majority of legitimate activity remains robust and mainstream.

On the demand side, the report draws attention to the way illicit marketplaces deploy stablecoins in perimeter markets. While scams, ransomware, and hacking still occur, those activities tend to stage their crypto use in multiple steps, often beginning with Bitcoin (CRYPTO: BTC) or other crypto assets, before shifting to stablecoins later in the laundering sequence. The research also identifies categories such as illicit goods and services and human trafficking as showing “near-total stablecoin usage,” suggesting operators prioritize payment certainty and liquidity over potential price appreciation. In practical terms, this means stablecoins provide predictable settlement rails that are less sensitive to price volatility, a feature that illicit networks value highly when moving funds across jurisdictions.

Volume in guarantee marketplaces—digital platforms that facilitate risk-sharing or settlement for illicit services—surged to more than $17 billion by late 2025, with most activity denominated in stablecoins. TRM argues that because roughly 99% of this volume is settled in stablecoins, these platforms function more as laundering infrastructure than speculative venues. The implication is that stablecoins have become a preferred vehicle for moving large sums with speed and liquidity, even if much of the activity occurs outside legitimate markets. The report also notes that the role of stablecoins in such ecosystems is not a sign of crypto’s inherent criminality, but rather a signal about the ways illicit actors adapt to enforcement regimes and capital controls.

Corroborating the broader picture, Chainalysis has previously highlighted a rise in crypto flows to suspected human trafficking networks, reporting an 85% year-over-year increase in 2025. In that analysis, international escort services and prostitution networks were noted to operate almost entirely on stablecoins, reflecting demand for payment certainty in illicit networks as well as a preference for cross-border liquidity. These findings reinforce the TRM Labs assessment that stablecoins serve as the backbone of value transfer for several high-risk activities, even as the sector as a whole remains far larger and more diverse than illicit use patterns would suggest.

From the perspective of scale, TRM Labs observed that total stablecoin activity exceeded $1 trillion in monthly transaction volume on multiple occasions in 2025. By extrapolating from these monthly bursts, the study estimates approximately $12 trillion in annual stablecoin activity, implying illicit use accounts for around 1% of the total. That proportion stands alongside global estimates from the United Nations Office on Drugs and Crime, which place money laundering at roughly 2% to 5% of global GDP—an amount roughly in the $800 billion to $2 trillion range. The juxtaposition of these figures underscores a persistent tension: stablecoins are pervasive in legitimate finance while simultaneously enabling sophisticated illicit networks that regulators continue to scrutinize. The findings come amid ongoing policy discussions about how best to balance innovation with robust compliance and risk controls, particularly as sanctions regimes evolve and enforcement benchmarks tighten.

In context, the TRM report adds momentum to a broader industry debate about how to enforce sanctions and combat illicit finance without stifling legitimate use. The intertwining of sanctioned actors with state-linked and non-state networks, as described by TRM, points to the need for enhanced on-chain analytics, cross-border collaboration, and more granular controls on stablecoin issuance and settlement. While the vast majority of stablecoin activity remains legitimate, the visibility of the illicit segment—especially in high-value sanctions-related flows—signals that both policymakers and market participants should pay closer attention to the liquidity and settlement rails that crypto ecosystems have become. The report’s findings are a reminder that, for good or bad, stablecoins occupy a central role in modern finance, shaping how value moves across borders even as regulators adapt to a rapidly evolving digital landscape.

Why it matters

The TRM Labs findings illuminate a nuanced reality for crypto markets and policymakers. Stablecoins have matured into a core settlement layer that supports everyday commerce but also serves as a critical infrastructure for illicit finance during sanctions crises. For cryptocurrency exchanges, wallet providers, and fintechs, the report underscores the importance of implementing robust sanctions screening and address-level risk assessments, especially for counterparties with ties to sanctioned economies or gray-market corridors. The concentration of illicit activity in a handful of stablecoins also highlights the need for precise tagging, traceability, and real-time monitoring to deter misuse while preserving legitimate liquidity and cross-border payments.

For regulators, the data underscore the limits of traditional financial controls when confronted with borderless digital rails. The stability and speed of stablecoins offer undeniable advantages for legitimate commerce, remittances, and cross-border trade, but they also create friction for enforcement. The TRM analysis reinforces calls for clearer stablecoin‑related disclosure, standardized compliance frameworks, and international cooperation to address sanctions evasion without inadvertently curbing innovation. Investors and builders can glean that the risk landscape remains dynamic: reputational and regulatory risk around stablecoins can shift rapidly as enforcement priorities evolve and new tools emerge to monitor on-chain behavior.

For users and the broader market, the message is twofold. First, illicit use represents a relatively small share of overall stablecoin activity, but its visibility matters because it intersects with sanctions policy and macroeconomic stability. Second, the events of 2025 demonstrate how quickly stablecoin liquidity can be redirected toward restricted channels when governance gaps or enforcement actions fail to keep pace with innovation. The ongoing dialogue between analytics firms, policymakers, and industry participants will shape how stablecoins evolve—from mere payment rails to potential risk vectors requiring more rigorous risk management and governance standards.

What to watch next

- Further methodology updates and breakdowns from TRM Labs detailing which stablecoins and sanction-related corridors dominate illicit flows.

- Regulatory responses and enforcement actions tied to sanctioned networks identified in the report, including cross-border cooperation and sanctions-compliance initiatives.

- Monitoring of stablecoin issuance and circulation patterns as policymakers consider stricter controls or new compliance requirements for issuers and custodians.

- Ongoing research from Chainalysis and other firms on the role of stablecoins in human trafficking networks to assess whether new tracking tools reduce illicit activity over time.

- Regulatory developments related to sanctions packages and related crypto-exposure rules in jurisdictions highlighted by the report.

Sources & verification

- TRM Labs, Stablecoins at Scale: Broad Adoption and Highly Concentrated Illicit Networks (official blog)

- Sanctions-related activity accounted for 86% of illicit crypto flows in 2025 (Cointelegraph article)

- Russia-linked networks and the EU sanctions package context (Cointelegraph article)

- Tether challenges report on illicit activity involving USDT (Cointelegraph article)

- Chainalysis report on crypto use in human trafficking networks

- UNODC money laundering overview

Illicit stablecoins: sanctions networks and laundering rails

Illicit actors moved an estimated $141 billion through stablecoins in 2025, reflecting a shift in how sanctioned operations leverage digital rails to bypass traditional financial controls. In the study’s framing, sanctions-related activity dominates the illicit crypto landscape, signaling that enforcement regimes are shaping the channels through which criminal actors move funds. The data show a pronounced concentration around a ruble-pegged stablecoin known as A7A5, with about $72 billion of the total tied to this single asset. This clustering hints at a specialized ecosystem where asset choice aligns with the operational requirements of sanctioned networks, rather than with speculative profit-seeking behavior.

Within this ecosystem, the report highlights networks that blur geographic boundaries—Russia-linked actors intersecting with spheres connected to China, Iran, North Korea, and Venezuela. The analysis underscores how stablecoins have become connective fabric for sanctioned actors seeking to move value beyond conventional controls, reinforcing stability in cross-border transfers while complicating enforcement. In parallel, the data point to a broader pattern: illicit activity in the realm of sanctions and large-scale money movement dominates the illicit use of stablecoins, even as other categories rely increasingly on these digital rails for liquidity and certainty of settlement.

On legitimate terms, stablecoins continue to support a wide range of uses, including remittance and cross-border payments, with total stablecoin activity surpassing $1 trillion in monthly volume on multiple occasions in 2025. If one projects the annual scale, the figure nears $12 trillion, of which the illicit portion—ranging around 1%—belongs to highly regulated, high-risk activity tied to sanctions and related networks. The United Nations Office on Drugs and Crime’s own estimates place global money laundering at 2%–5% of GDP, which aligns with the broader recognition that illicit finance persists at scale despite improvements in detection and policing. These numbers collectively illustrate a crypto environment that is large, interconnected, and continually adjusting to enforcement pressures and policy shifts.

The picture is nuanced: the same rails that power legitimate payments and global commerce also offer resilience and speed that illicit actors have learned to exploit. As policymakers and market participants absorb these insights, the path forward involves targeted improvements in monitoring, reporting, and cross-border information sharing to mitigate risk without stifling the legitimate benefits of stablecoins. The ongoing dialogue among analytics firms, regulators, and the crypto industry will shape the contours of stablecoin adoption in the years ahead, balancing innovation with the imperative of robust AML/CFT controls.

Crypto World

Robinhood chain testnet records 4M transactions in first week, CEO says

Robinhood’s blockchain initiative has hit an early development milestone, with its Robinhood Chain testnet processing more than four million transactions within its first week of launch, Robinhood CEO Vlad Tenev announced on X.

Summary

- Robinhood Chain processed over 4 million transactions in its first week, with CEO Vlad Tenev highlighting growing developer activity on the Ethereum Layer-2 network focused on tokenized real-world assets (RWAs) and on-chain finance.

- While some X users called the milestone “seriously impressive,” others cautioned that testnet figures can be vanity metrics and questioned whether activity reflects real external development or internal stress testing.

- The blockchain push comes as Robinhood reported $1.28 billion in Q4 2025 revenue (up 27% YoY), though crypto revenue fell 38% year-over-year amid softer digital asset markets.

4M in a week: Robinhood’s L2 testnet sparks buzz

Tenev highlighted that developers are already building on the protocol’s Ethereum Layer-2 ecosystem, designed for tokenized real-world assets and on-chain financial services, calling it “the next chapter of finance.”

Robinhood Chain is a bespoke Ethereum Layer-2 network built on Arbitrum technology that aims to reduce costs and increase scalability for decentralized applications tied to financial-grade use cases. The public testnet, live since early February, lets developers experiment with tools, network entry points and testnet-only assets such as “stock tokens.”

Reactions on X to the CEO’s tweet were mixed. One user cautioned that “testnet numbers are usually vanity metrics,” but acknowledged that four million transactions in a week suggests “actual curiosity.”

The user questioned whether the activity reflects external developers shipping products or primarily internal stress testing, adding that the real challenge will be moving meaningful RWA volume without complex user experience hurdles.

Others were more optimistic. One commenter described the figure as “seriously impressive,” suggesting that if the mainnet performs similarly under load, it could become a significant retail crypto on-ramp.

Skepticism also surfaced around the proliferation of new blockchains. Another user argued there is “no need to reinvent the wheel,” pointing to Ethereum’s established developer base and long track record, and questioning whether launching additional chains fragments liquidity and adoption.

The announcement comes amid broader shifts in Robinhood’s business performance. In its fourth quarter of 2025, Robinhood reported revenue of $1.28 billion, up 27 % year-over-year, though slightly below Wall Street expectations, as weaker crypto trading revenues weighed on results.

Crypto-related revenue dropped about 38 % compared to the prior year, reflecting broader downturns in digital asset markets, even as equities, options and subscription income supported overall growth.

Crypto World

Mike McGlone Adjusts Bitcoin Price Target to $28,000 After Backlash

TLDR

- Mike McGlone adjusted his Bitcoin price forecast from $10,000 to $28,000 following significant backlash on social media.

- McGlone had originally warned that Bitcoin could drop to $10,000 if U.S. equities peaked and a recession followed.

- The revised forecast of $28,000 is based on historical price distribution and fewer negative factors needed to reach that level.

- Analysts like Jason Fernandes criticized McGlone’s initial prediction, calling it alarmist and unrealistic.

- Mati Greenspan acknowledged the possibility of a $28,000 Bitcoin price but remained skeptical of its likelihood in the current market.

Bloomberg Intelligence’s Mike McGlone recently adjusted his bitcoin price forecast, raising his downside target to $28,000. This shift followed criticism after his initial prediction of a potential $10,000 Bitcoin price was widely questioned on social media. McGlone’s revised stance comes after market experts accused him of issuing alarmist forecasts that could negatively impact investor decisions.

McGlone Faces Backlash for $10,000 Bitcoin Call

Earlier this week, McGlone warned that bitcoin could drop to $10,000 if U.S. equities reach their peak and a recession follows. He stated that bitcoin, being a high-beta asset, would suffer in a market breakdown, especially after the collapse of the “buy the dip” mentality. This prediction attracted significant criticism, with market analyst Jason Fernandes challenging the forecast on social media platforms like X and LinkedIn.

The backlash grew when Fernandes called McGlone’s $10,000 forecast unrealistic. He argued that such a dramatic drop would require several negative factors to align. Fernandes, in his critique, noted that the bitcoin price could face risks but stated that $28,000 was a more plausible level, particularly with fewer factors needed to drive that price point.

Bitcoin Price Forecast Revised to $28,000

In a subsequent post, McGlone acknowledged the feedback and adjusted his bitcoin price forecast. He pointed to $28,000 as a more likely scenario, citing historical price distribution as the basis for his updated target. Despite this revision, McGlone still maintained a cautious outlook, advising against investing in bitcoin or other risk assets.

While McGlone’s $28,000 prediction was seen as more reasonable, some market experts like Mati Greenspan remained skeptical. Greenspan suggested that although $28,000 might be possible, the likelihood of it happening was still low. He emphasized the unpredictable nature of markets, stating that while forecasts could be helpful, they should not rule out other possibilities.

Fernandes Challenges McGlone’s Forecast Shift

Fernandes, who had initially criticized McGlone’s $10,000 prediction, continued to voice concerns even after the revision. He highlighted that McGlone’s updated forecast now aligned closer to his own lower-bound estimate of bitcoin’s price range. Fernandes pointed out that a reset in the $40,000 to $50,000 range remained more probable, especially without a systemic liquidity shock.

Despite the change in McGlone’s outlook, the broader discussion highlighted the potential dangers of deterministic predictions in volatile markets like crypto. Analysts warned that alarmist forecasts could influence positioning and potentially lead to unnecessary risks for investors. Fernandes emphasized the need for more balanced approaches when discussing the future of high-risk assets like Bitcoin.

Crypto World

Epstein eyed Coinbase, XRP, XLM, Circle in pre-mainstream crypto era

Epstein’s 2010s emails show Gensler talks, XRP/XLM bets, CBDC and stablecoin funding links.

Summary

- 2018 emails show Epstein sought crypto talks with Gensler and briefed Summers on early digital currency discussions.

- Records cite about $3m into Coinbase plus speculative exposure to XRP, XLM, Circle and early stablecoin structures tied to Brock Pierce.

- Reports mention funding for MIT-linked CBDC pilots and private crypto ventures as crypto policy circles were still nascent.

Newly released documents from the Jeffrey Epstein case contain references to communications involving cryptocurrency policy discussions and Gary Gensler, according to reports published this week.

The documents include emails dated 2018 that reportedly mention conversations between Epstein and individuals connected to policy and academic circles in the cryptocurrency sector. Gensler, who later served as Chair of the Securities and Exchange Commission, appears among the names referenced in the materials.

According to the reports, the files contain correspondence suggesting Epstein discussed arranging a meeting with Gensler regarding cryptocurrency topics. Emails from 2018 indicate Epstein told former U.S. Treasury Secretary Lawrence Summers that Gensler had arrived early for crypto-related discussions, according to the documents. Summers reportedly responded that he knew Gensler and considered him intelligent.

No documents released to date have established a direct connection between Epstein and any specific cryptocurrency decision or project, according to available reports. However, records suggest Epstein invested millions in early cryptocurrency ventures, including approximately $3 million in Coinbase in 2014, reports stated.

Some emails reportedly referenced XRP and Stellar, leading to speculation about possible investments in those projects, though the documents do not provide clear confirmation, according to observers.

Additional claims in the reports suggest Epstein provided funding for U.S. central bank digital currency pilot programs through MIT and certain Federal Reserve Banks. Gensler taught at MIT during that period and worked in academic policy circles before entering government service and participating in the development of U.S. cryptocurrency regulation.

Reports also indicate Epstein explored early stablecoin-related investments, including Circle, through connections associated with Brock Pierce. Pierce reportedly requested Epstein’s assistance in connecting with Lawrence Summers, according to accounts of the correspondence.

The documents suggest Epstein maintained investments in private cryptocurrency ventures while maintaining relationships with academic and policy circles involved in digital currency regulation, according to analysts reviewing the materials. The timing of these connections has drawn attention as they occurred before cryptocurrency markets achieved mainstream adoption.

Crypto World

Tight Bitcoin Bollinger Bands Signal Big Move: Analyst

A key volatility indicator for Bitcoin (BTC) has narrowed to its tightest measurement on record, a pattern that was followed by a multimonth rally in previous bull and bear markets. Will the Bollinger Bands indicator call the market bottom again?

Record Bitcoin Bollinger Band compression hints at volatility

Analyzing the monthly Bitcoin chart, crypto analyst Dorkchicken noted that BTC’s Bollinger Bands are currently at their “tightest” level on record. Such conditions have repeatedly led to bullish breakouts, with the only prior downtrend from similar conditions occurring in 2022, during the drop to $16,000 from $20,000.

Bollinger Bands measure price volatility, and extreme compression often leads to a sharp expansion. The analyst added that there are higher odds of an upside trend once expansion begins.

On the contrary, Bitcoin trader Nunya Bizniz pointed to an approaching 50- and 200-period simple moving average (SMA) death cross on the three-day chart. A death cross occurs when the shorter-term moving average falls below the longer-term average, signaling weak price momentum.

Across the past three instances, the pattern marked drawdowns of about 50% over the following one to six months and aligned closely with final cycle capitulation phases.

A similar path may imply a potential bottom between March and August near $33,000. The trader also said that BTC has spent 110 days below its short-term holder cost basis of $89,800. During previous cycle lows, the price typically remained under that level for nearly 200 days on average.

Market analyst Ardi also noted that the long futures exposure from retail traders has increased on each dip to $68,000 from $88,000. Currently, 72% of tracked retail accounts are long into a descending trendline.

While this reflects early signs of market optimism, each recent surge in long positioning has been followed by a sharp sell-off. With positioning once again elevated, these longs remain vulnerable to liquidation, increasing the risk of a liquidity hunt if the price moves lower.

Related: Bitcoin ‘roadmap to bottom’ says $58.7K Binance cost basis now crucial

BTC’s Sharpe ratio is interesting, but $70,000 remains the level to crack

Crypto analyst MorenoDV said that Bitcoin’s short-term Sharpe ratio has dropped to -38.38, matching levels last seen in 2015, 2019 and late 2022.

The Sharpe ratio measures the risk-adjusted return, and deeply negative readings mark periods of deep drawdown and volatility. Each extremely low ratio signal has aligned closely with the major cycle lows, leading to strong BTC rallies, with the analyst noting that the current price range may be a “generational buy zone.”

Glassnode data calls for confirmation through a stronger BTC demand absorption. Since early February, each move above the $70,000 level has stalled as the net realized profits exceeded $5 million per hour.

Glassnode added that in Q3 2025, profit-taking between $200 million to $350 million per hour did not interrupt the advance to new highs in Q4.

Related: ‘Resilient’ Bitcoin holders defend BTC, but bear floor sits 20% lower: Glassnode

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

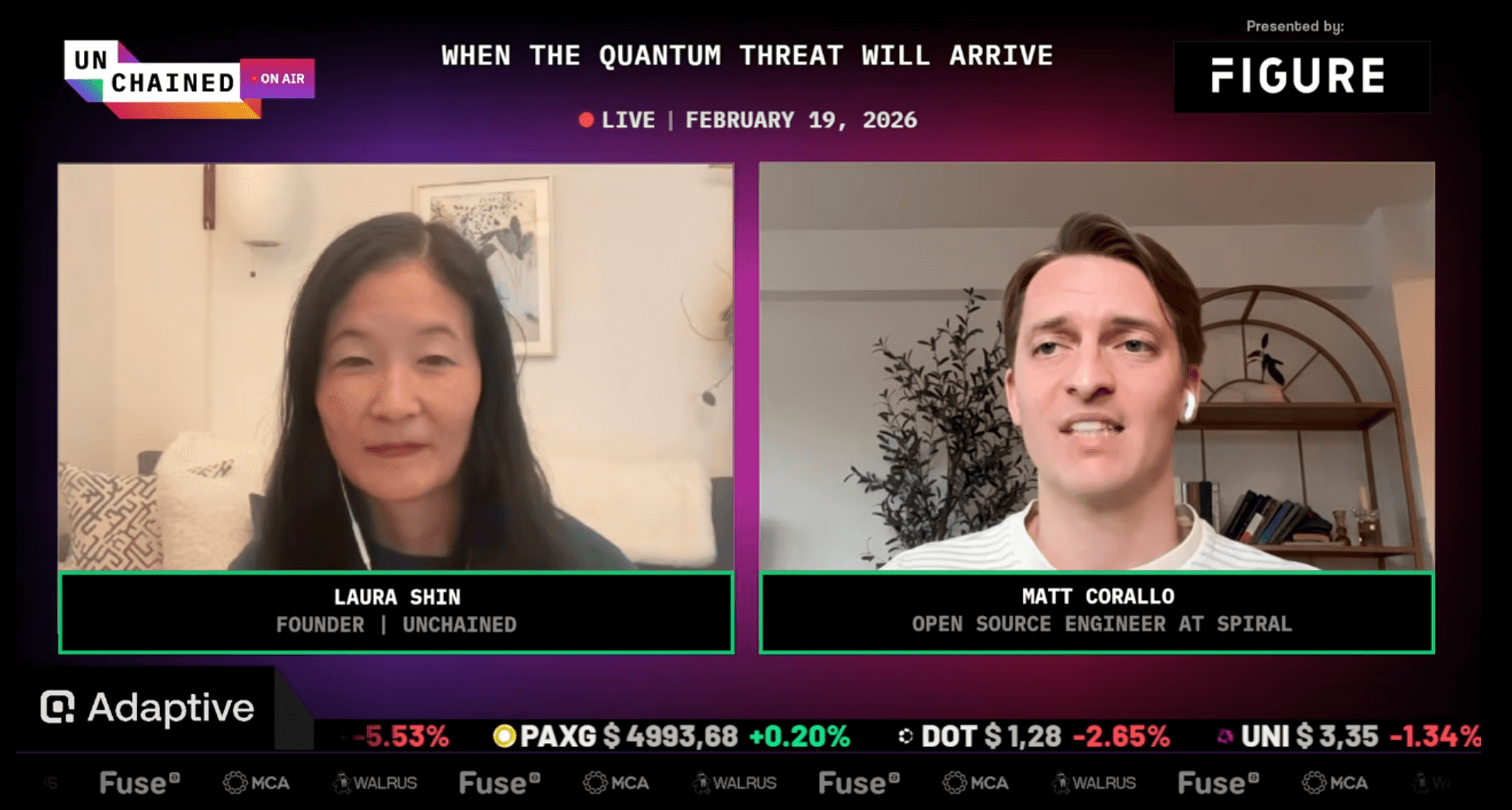

Quantum Fears Is Not The Reason For Bitcoin’s Decline: Developer

Bitcoin’s recent sell-off isn’t because of quantum computing fear, because if that were the case, Ether would be soaring, says Bitcoin developer Matt Carallo.

“I strongly disagree with the characterization that Bitcoin’s current price is materially, because of some kind of quantum risk,” Carallo told journalist Laura Shin on the Unchained podcast on Thursday.

“If that were true, then Ethereum would be up substantially on Bitcoin,” he added. Ether (ETH) is down 58% since a major crypto market crash in early October, trading at $1,957 at the time of publication.

Carallo’s comments come as several Bitcoiners have argued that fears of quantum computing affecting the blockchain is partly why Bitcoin (BTC) has dropped 46% from its October all-time high of $126,100 to now trade at $67,162, according to CoinMarketCap.

Ethereum zones in on quantum readiness

Some Bitcoin users have accused the blockchain’s developers of not moving quickly enough to make the network quantum-resistant, while the Ethereum Foundation has said it is taking measures to be ready.

In its protocol update on Wednesday, the Ethereum Foundation outlined long-term post-quantum readiness as part of its broader security initiative.

Carallo said that although quantum computing poses long-term risks to Bitcoin, market makers don’t see it as a pressing short-term threat, arguing that the Bitcoin community is just looking for a scapegoat.

“There are a lot of Bitcoiners who want to blame something, blame someone for lackluster performance.”

Carallo said that a more likely reason for Bitcoin’s price decline is that it is now “competing for capital” in a way it never has before against other technologies such as artificial intelligence.

“AI is super capital-intensive,” he said, adding that it is a “massive new investment class that is substantially competing for capital.”

“There’s a lot of interest in value accrual that will happen because of AI in traditional equities,” Carallo said.

Bitcoiners are of the opposite opinion

Not all Bitcoiners agree with Carallo, as Capriole Investments founder Charles Edwards said at Cointelegraph’s LONGITUDE event on Feb. 12, that the risk should be priced into Bitcoin until it becomes quantum-resistant.

“Today, you kind of have to start to discount the value of Bitcoin based on that risk until it’s solved,” Edwards said.

Related: Bitcoin bottom signal that preceded 1,900% rally flashes again

Meanwhile, entrepreneur Kevin O’Leary told Magazine in December that using quantum computing to crack Bitcoin may not be the most efficient use of the resources, and there is more upside in using the technology for areas such as medical research.

In May 2025, the world’s largest asset manager, BlackRock, updated the registration statement for its iShares Bitcoin ETF (IBIT) to warn investors of the potential risks to the integrity of the Bitcoin network posed by quantum computing.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Video2 hours ago

Video2 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World7 hours ago

Crypto World7 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market