Fashion

Statement Coats for Transitional Weather

Staud Jacket, The Row Shirt (old, similar here), Sea NY Sweater (old, similar here and here), Guest In Residence Red Sweater (old, similar here), AYR Jeans, Dior Sunglasses, Loewe Clutch (similar here), Chanel Flats (similar here)

The hero coat right now is the statement one, the layer that carries an outfit as the season shifts. These coats sit comfortably between winter and spring. They have enough structure for cooler days, but feel light and adaptable as dressing begins to open up. When layers simplify, the coat becomes the defining element.

The strongest styles work in multiple ways. Worn clean, they anchor a look on their own. Paired with print, color, or texture, they support more expressive dressing without losing focus. Fabric and construction matter most here. Embroidery, jacquard, suede, and leather give these pieces presence, while clear silhouettes ensure they stay relevant. These are coats to reach for repeatedly now, and as the season moves forward.

Fashion

Debenhams Women’s Sleeve Collection 2026

Elevate your silhouette with the Debenhams Women’s Sleeve Collection. This season, it’s all about the details that frame your look. From the ethereal movement of Angel sleeves to the high-fashion drama of a Cape silhouette, our latest edit focuses on the artistry of the sleeve. Whether you are dressing for a Spring wedding, a formal gala, or a sophisticated garden party, these pieces are designed to provide coverage without compromising on style. Discover how a simple change in sleeve can transform a classic midi into a masterpiece of modern occasion wear.

Cape Sleeve Maxi Dress – Shop Now

Lace Angel Sleeve Midi Dress – Shop Now

Pleated Lace Trim Midi Dress – Shop Now

Linear Sequin Embellished Long Sleeve Maxi Dress – Shop Now

Lace Shirt Dress With Short Sleeves – Shop Now

Navy Floral Kimono Sleeves Dip Hem Wrap Midi Dress – Shop Now

For any questions/feedback regarding the above mentioned products/brands,

please do contact us anytime by clicking here

Fashion

Abby Champion Gets Glam for Tommy Hilfiger Spring 2026

Fashion

9 Long Wavy Hairstyles to Transform Your Look

Fashion

Ice Spice and H&M Capture New York Energy

Fashion

Bridal Lingerie Beyond the Basics for Gowns & Getaways

Fashion

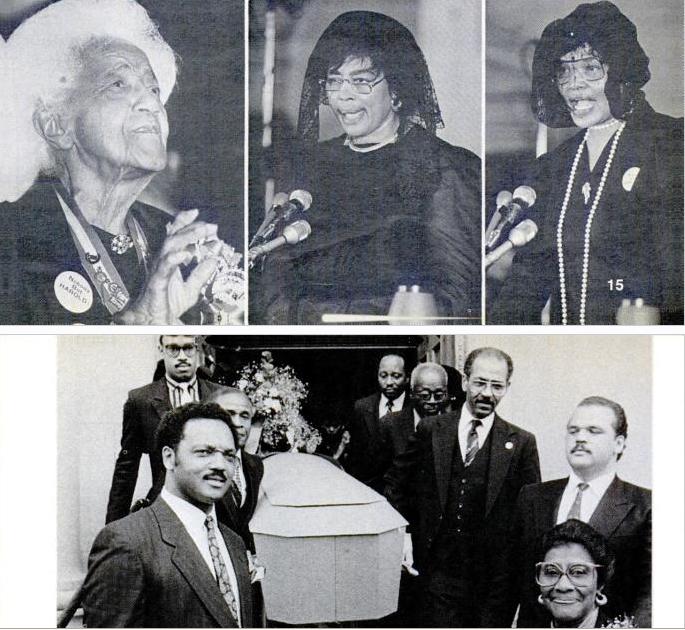

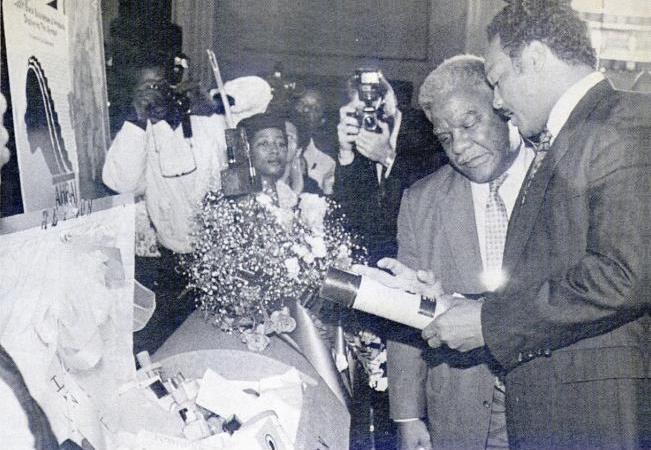

Rev. Jesse Jackson, Civil Rights Leader and Founder of Operation PUSH, Passes Away at 84

Rev. Jesse Jackson, a civil rights leader, Baptist minister, and founder of Operation PUSH and the Rainbow PUSH Coalition, has passed away at 84, his family confirmed.

Born in Greenville, South Carolina, Jackson rose to national prominence during the Civil Rights Movement, marching alongside Dr. Martin Luther King Jr. and advocating for racial equality, voting rights, and economic justice. After King’s assassination in 1968, Jackson continued organizing and mobilizing communities across the country, focusing on expanding opportunities for Black Americans and other marginalized groups.

In 1971, he founded Operation PUSH (People United to Save Humanity), an organization dedicated to improving economic conditions in Black communities through corporate accountability, education initiatives, and voter registration drives. He later established the Rainbow PUSH Coalition, broadening his mission to build a multiracial political movement centered on social and economic justice.

Jackson made history as one of the first Black candidates to mount serious campaigns for the presidency of the United States. He ran in 1984 and 1988, helping to expand the electorate and encouraging greater political participation among minority communities. His campaigns emphasized coalition-building and introduced issues of economic inequality and civil rights into mainstream political discourse.

In recognition of his decades of advocacy and leadership, Jackson received the Presidential Medal of Freedom, one of the nation’s highest civilian honors. Throughout his life, he remained a vocal advocate for peace, voting rights, labor rights, and international human rights causes.

Rev. Jesse Jackson’s legacy is defined by his commitment to justice and his enduring call to “keep hope alive,” a message that resonated across generations and helped shape modern American politics.

He leaves behind a lasting imprint on the fight for equality and a movement that continues in his name.

📸: Courtesy/Archive

Fashion

The Upgrade: Winter Coats – Corporette.com

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

In the past, we’ve gone on a hunt for the best pieces in a wide range of budgets… but today let’s focus on the upgrade — what to buy next once you’re past the basics. So let’s discuss! What are the upgrades on winter coats? I have a few ideas…

(Psst: check out our latest favorites for classic winter coats here…)

Winter Coats: What To Buy Once You’re Past the Basics

Winter Coats Of Varying Lengths

Odds are good your basic winter coat either hits you somewhere between the top of your knee and the bottom of your hip. And that’s exactly right for your first coat — it’s an incredibly versatile length that works well even if you’re wearing a blazer, and often, a dress or skirt.

Still, the first upgrade I would suggest is to get a longer coat — specifically for days where you’re wearing longer skirts or dresses, but also if you’re wearing a longer cardigan or the like. In my mind there are few things that look worse than a sweater or blazer peeking out of the bottom of a coat, and wearing a coat that is drastically shorter than a skirt always reminds me of middle school.

Below knee length, like the pictured one, is great — you may even be able to find opera length coats, intended to be worn with evening gowns and the like.

I’d also consider getting a hip-length coat if you don’t already have one — they look great with pants, don’t get slammed in car doors (oops), and can hang on the back of your chair if you prefer.

Readers, what length is your everyday coat (or your first basic coat)? What other lengths of winter coats have you found useful?

Better Made, Warmer Coats

Another good upgrade: go for quality. I remember reading that although a cashmere coat always sounds amazing, you actually want a cashmere/wool blend for durability as well as warmth.

After you select what fabric you want, you want to look at the details — is the coat fully lined? Are all of the stitches precise? Are the buttons or zippers a good quality? Are there leather, shearling, or other luxe details?

After your purchase, consider taking your coat to a tailor to get it fitted just to you. As we’ve discussed before, the shoulders are one of the hardest parts to tailor, so hopefully those fit well off the rack. The cuffs should end exactly at your wrist, not longer or shorter, and you may want to consider moving the bottom hem to a spot where your leg curves in — that might be just under your knee or just over the knee. You can also have a tailor add interior pockets (or sew up pockets if you don’t like the way they lay!).

If you’re looking for quality, some of the brands I’ve heard most over the years include Mackage, Fleurette, Cinzia Rocca, Max Mara, The Row, and Akris — readers, what would you add?

Statement Coats

As someone who wears a lot of black, I love a colorful or loud statement coat — and it tends to be a bit of a status symbol as well because you need the closet space to store the coats. I’ve always loved that they can complement your personality and your outfit.

(The gray Mackage above also comes in lovely hot pink!)

Some of our favorite stores and brands to check for statement coats for winter in 2026 include Mackage, Soia & Kyo, COS, J.Crew, and Cuyana.

Readers, do you have any statement coats in your closet? Which ones do you love to wear, and why?

Fashion

Coffee Break: Stack Starter No. 2

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

I love these minimal rings from Catbird, where they’re bestsellers — maybe I’ve just missed it, but I hvaen’t seen the “necklace chain as ring” before, and never as delicately done as it is here. Lovely.

The set contains two rings: their Hundred Summers Ring (top, the one that looks more like a chain) and “Threadbare Ring, Yellow Gold” (bottom, the super thin gold ring). Both are made with 100% recycled 14K gold.

The set was $136, but is now marked to $115.6.

Sales of note for 2/20:

Fashion

EGO UK Women’s Boots Most Demanded Collection

Walk like the world is your runway. The EGO UK Women’s Boots most demanded collection has officially reached “viral status” for Spring 2026. From the TikTok-famous I-Am-The-One wedge to the “Mob Wife” aesthetic of the Guilty slouch boot, these silhouettes are currently dominating street-style feeds from London to New York. Whether you’re leaning into the hardware-heavy biker trend or looking for a razor-sharp stiletto to elevate your night-out fit, this collection delivers high-end drama without the designer price tag.

Guilty Peep Toe Slouched Stiletto Heel Knee High Boot In Black Faux Suede – Shop Now

Tarsier Pointed Toe Knee High Long Heeled Boot In Black Faux Leather – Shop Now

Doll Lock Layered Detail Chunky Sole Knee High Biker Boot In Black Faux Leather – Shop Now

I-Am-The-One Padlock Detail Wedge Heel Knee High Long Boot In Black Faux Leather – Shop Now

For any questions/feedback regarding the above mentioned products/brands,

please do contact us anytime by clicking here

Fashion

On the Scene at the BAFTA Awards: Teyana Taylor in a Plum Colored Burberry Look, Emma Stone in a Black Louis Vuitton Dress, Wunmi Mosaku in a Cobalt Blue Ahluwalia Gown + More

Some of Hollywoods brightest actors and actresses made their way to London to attend the 2026 BAFTA awards held at the Royal Festival Hall.

Teyana Taylor, who has been dominating red carpets left-and-right, was on the scene in a plum colored Burberry gown designed by Daniel Lee. Her long sleeve gown had a dramatic collar that shaped her face, and highlighted her highly sought-after pixie haircut.

Perhaps it’s time that we learn more about her mother Nikki Taylor because it’s evident she raised a powerhouse. Hopefully BET, VH1 or The Aunties Production will consider a documentary.

In addition to Taylor, Emma Stone and Chase Infiniti looked exquisite in their Louis Vuitton dresses that show how interchangeable the brand is.

Emma looked classy and timeless in her black LV dress that had an oval cutout centered. While Chase radiated in a maroon colored strapless dress that featured a dramatic peplum hem.

Sinners actress Wunmi Mosaku took home the BAFTA for Best Supporting Actress for her performance as Annie. With a pregnancy glow that enhanced her beautiful melanated complexion, she glistened from head to toe like a star in the midnight sky. She opted for deep cobalt blue gown by British designer Priya Ahluwalia that featured fringe perfectly draped across the body. Think Herver Leger with a twist.

We thought each of these ladies owned the red-carpet in their beautiful ensembles at the BAFTA awards.

What say you? Hot! or Hmmm….?

Photo Credit: Getty Images

-

Video4 days ago

Video4 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics2 days ago

Politics2 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports19 hours ago

Sports19 hours agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics20 hours ago

Politics20 hours agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports5 days ago

Sports5 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World6 hours ago

Crypto World6 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World5 days ago

Crypto World5 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market