Crypto World

Illicit Stablecoins Reach 5-Year High at $141B in 2025, TRM Labs

New data from blockchain analytics firm TRM Labs shows illicit actors moved roughly $141 billion through stablecoins in 2025—the highest annual tally in five years. The report, issued this week, cautions that the uptick does not signal a broad acceleration in crypto-enabled crime, but rather a deeper reliance on stablecoins for activity where speed, liquidity, and cross-border movement offer clear operational advantages. The analysis highlights sanctions-linked networks and large-money-movement services as the dominant channels for these flows, underscoring how stablecoins have become a preferred rails for moving value outside traditional financial controls.

According to the TRM study, sanctions-related activity accounted for a staggering 86% of all illicit crypto flows in 2025. Of the $141 billion in stablecoin activity, roughly half—about $72 billion—was tied specifically to a ruble-pegged token known as A7A5, whose operations are almost entirely concentrated within sanctioned ecosystems. The institutional emphasis on these tokens points to a striking trend: stablecoins are not merely a tool for everyday commerce but a specialized infrastructure supporting state-linked evasion and enforcement-evading finance.

Beyond the A7A5 concentration, the report notes that Russian-linked networks intersect with other state-backed ecosystems, including actors connected to China, Iran, North Korea, and Venezuela. In TRM’s words, these findings illuminate how stablecoins have evolved into connective infrastructure for sanctioned actors seeking to move value outside conventional financial controls. This interlocking web raises questions for regulators and financial institutions about how to monitor cross-border flows that ride the rails of stablecoins—even when the majority of legitimate activity remains robust and mainstream.

On the demand side, the report draws attention to the way illicit marketplaces deploy stablecoins in perimeter markets. While scams, ransomware, and hacking still occur, those activities tend to stage their crypto use in multiple steps, often beginning with Bitcoin (CRYPTO: BTC) or other crypto assets, before shifting to stablecoins later in the laundering sequence. The research also identifies categories such as illicit goods and services and human trafficking as showing “near-total stablecoin usage,” suggesting operators prioritize payment certainty and liquidity over potential price appreciation. In practical terms, this means stablecoins provide predictable settlement rails that are less sensitive to price volatility, a feature that illicit networks value highly when moving funds across jurisdictions.

Volume in guarantee marketplaces—digital platforms that facilitate risk-sharing or settlement for illicit services—surged to more than $17 billion by late 2025, with most activity denominated in stablecoins. TRM argues that because roughly 99% of this volume is settled in stablecoins, these platforms function more as laundering infrastructure than speculative venues. The implication is that stablecoins have become a preferred vehicle for moving large sums with speed and liquidity, even if much of the activity occurs outside legitimate markets. The report also notes that the role of stablecoins in such ecosystems is not a sign of crypto’s inherent criminality, but rather a signal about the ways illicit actors adapt to enforcement regimes and capital controls.

Corroborating the broader picture, Chainalysis has previously highlighted a rise in crypto flows to suspected human trafficking networks, reporting an 85% year-over-year increase in 2025. In that analysis, international escort services and prostitution networks were noted to operate almost entirely on stablecoins, reflecting demand for payment certainty in illicit networks as well as a preference for cross-border liquidity. These findings reinforce the TRM Labs assessment that stablecoins serve as the backbone of value transfer for several high-risk activities, even as the sector as a whole remains far larger and more diverse than illicit use patterns would suggest.

From the perspective of scale, TRM Labs observed that total stablecoin activity exceeded $1 trillion in monthly transaction volume on multiple occasions in 2025. By extrapolating from these monthly bursts, the study estimates approximately $12 trillion in annual stablecoin activity, implying illicit use accounts for around 1% of the total. That proportion stands alongside global estimates from the United Nations Office on Drugs and Crime, which place money laundering at roughly 2% to 5% of global GDP—an amount roughly in the $800 billion to $2 trillion range. The juxtaposition of these figures underscores a persistent tension: stablecoins are pervasive in legitimate finance while simultaneously enabling sophisticated illicit networks that regulators continue to scrutinize. The findings come amid ongoing policy discussions about how best to balance innovation with robust compliance and risk controls, particularly as sanctions regimes evolve and enforcement benchmarks tighten.

In context, the TRM report adds momentum to a broader industry debate about how to enforce sanctions and combat illicit finance without stifling legitimate use. The intertwining of sanctioned actors with state-linked and non-state networks, as described by TRM, points to the need for enhanced on-chain analytics, cross-border collaboration, and more granular controls on stablecoin issuance and settlement. While the vast majority of stablecoin activity remains legitimate, the visibility of the illicit segment—especially in high-value sanctions-related flows—signals that both policymakers and market participants should pay closer attention to the liquidity and settlement rails that crypto ecosystems have become. The report’s findings are a reminder that, for good or bad, stablecoins occupy a central role in modern finance, shaping how value moves across borders even as regulators adapt to a rapidly evolving digital landscape.

Why it matters

The TRM Labs findings illuminate a nuanced reality for crypto markets and policymakers. Stablecoins have matured into a core settlement layer that supports everyday commerce but also serves as a critical infrastructure for illicit finance during sanctions crises. For cryptocurrency exchanges, wallet providers, and fintechs, the report underscores the importance of implementing robust sanctions screening and address-level risk assessments, especially for counterparties with ties to sanctioned economies or gray-market corridors. The concentration of illicit activity in a handful of stablecoins also highlights the need for precise tagging, traceability, and real-time monitoring to deter misuse while preserving legitimate liquidity and cross-border payments.

For regulators, the data underscore the limits of traditional financial controls when confronted with borderless digital rails. The stability and speed of stablecoins offer undeniable advantages for legitimate commerce, remittances, and cross-border trade, but they also create friction for enforcement. The TRM analysis reinforces calls for clearer stablecoin‑related disclosure, standardized compliance frameworks, and international cooperation to address sanctions evasion without inadvertently curbing innovation. Investors and builders can glean that the risk landscape remains dynamic: reputational and regulatory risk around stablecoins can shift rapidly as enforcement priorities evolve and new tools emerge to monitor on-chain behavior.

For users and the broader market, the message is twofold. First, illicit use represents a relatively small share of overall stablecoin activity, but its visibility matters because it intersects with sanctions policy and macroeconomic stability. Second, the events of 2025 demonstrate how quickly stablecoin liquidity can be redirected toward restricted channels when governance gaps or enforcement actions fail to keep pace with innovation. The ongoing dialogue between analytics firms, policymakers, and industry participants will shape how stablecoins evolve—from mere payment rails to potential risk vectors requiring more rigorous risk management and governance standards.

What to watch next

- Further methodology updates and breakdowns from TRM Labs detailing which stablecoins and sanction-related corridors dominate illicit flows.

- Regulatory responses and enforcement actions tied to sanctioned networks identified in the report, including cross-border cooperation and sanctions-compliance initiatives.

- Monitoring of stablecoin issuance and circulation patterns as policymakers consider stricter controls or new compliance requirements for issuers and custodians.

- Ongoing research from Chainalysis and other firms on the role of stablecoins in human trafficking networks to assess whether new tracking tools reduce illicit activity over time.

- Regulatory developments related to sanctions packages and related crypto-exposure rules in jurisdictions highlighted by the report.

Sources & verification

- TRM Labs, Stablecoins at Scale: Broad Adoption and Highly Concentrated Illicit Networks (official blog)

- Sanctions-related activity accounted for 86% of illicit crypto flows in 2025 (Cointelegraph article)

- Russia-linked networks and the EU sanctions package context (Cointelegraph article)

- Tether challenges report on illicit activity involving USDT (Cointelegraph article)

- Chainalysis report on crypto use in human trafficking networks

- UNODC money laundering overview

Illicit stablecoins: sanctions networks and laundering rails

Illicit actors moved an estimated $141 billion through stablecoins in 2025, reflecting a shift in how sanctioned operations leverage digital rails to bypass traditional financial controls. In the study’s framing, sanctions-related activity dominates the illicit crypto landscape, signaling that enforcement regimes are shaping the channels through which criminal actors move funds. The data show a pronounced concentration around a ruble-pegged stablecoin known as A7A5, with about $72 billion of the total tied to this single asset. This clustering hints at a specialized ecosystem where asset choice aligns with the operational requirements of sanctioned networks, rather than with speculative profit-seeking behavior.

Within this ecosystem, the report highlights networks that blur geographic boundaries—Russia-linked actors intersecting with spheres connected to China, Iran, North Korea, and Venezuela. The analysis underscores how stablecoins have become connective fabric for sanctioned actors seeking to move value beyond conventional controls, reinforcing stability in cross-border transfers while complicating enforcement. In parallel, the data point to a broader pattern: illicit activity in the realm of sanctions and large-scale money movement dominates the illicit use of stablecoins, even as other categories rely increasingly on these digital rails for liquidity and certainty of settlement.

On legitimate terms, stablecoins continue to support a wide range of uses, including remittance and cross-border payments, with total stablecoin activity surpassing $1 trillion in monthly volume on multiple occasions in 2025. If one projects the annual scale, the figure nears $12 trillion, of which the illicit portion—ranging around 1%—belongs to highly regulated, high-risk activity tied to sanctions and related networks. The United Nations Office on Drugs and Crime’s own estimates place global money laundering at 2%–5% of GDP, which aligns with the broader recognition that illicit finance persists at scale despite improvements in detection and policing. These numbers collectively illustrate a crypto environment that is large, interconnected, and continually adjusting to enforcement pressures and policy shifts.

The picture is nuanced: the same rails that power legitimate payments and global commerce also offer resilience and speed that illicit actors have learned to exploit. As policymakers and market participants absorb these insights, the path forward involves targeted improvements in monitoring, reporting, and cross-border information sharing to mitigate risk without stifling the legitimate benefits of stablecoins. The ongoing dialogue among analytics firms, regulators, and the crypto industry will shape the contours of stablecoin adoption in the years ahead, balancing innovation with the imperative of robust AML/CFT controls.

Crypto World

AAVE price defends $120 demand zone as RWA deposits top $1B

AAVE is holding the $120 demand zone as real-world asset deposits on Aave cross $1 billion, indicating rising institutional demand.

Summary

- Aave price is hovering near the mid of its weekly range, up 10% but still down over the past month.

- Real-world asset deposits on Aave Horizon have surpassed $1B.

- $135 remains the key resistance level for a confirmed bullish shift.

Aave (AAVE) was trading at $123 at press time, up 0.6% in the past 24 hours. The token sits near the middle of its weekly range between $110.29 and $131.29.

It has gained 10% over the past week, though it is still down 21% in the last 30 days. The larger trend has been corrective since December highs near $200.

Spot activity cooled slightly. Trading volume reached $280 million in the last 24 hours, down 21% in the last day. In derivatives markets, CoinGlass data shows futures volume down 31% to $274 million, while open interest rose 2.53% to $203 million.

Rising open interest alongside softer volume suggests traders are building positions carefully rather than chasing momentum.

RWA deposits double as institutional interest grows

On Feb. 19, Aave revealed that deposits of real-world assets on its Horizon market surpassed $1 billion. According to posts from Aave and founder Stani Kulechov, deposits have doubled since January. This makes Aave the first lending protocol to cross the $1 billion mark in tokenized real-world assets.

Aave is the first lending protocol with over $1 billion in RWAs deposited. pic.twitter.com/H9d4Nh0Aol

— Aave (@aave) February 19, 2026

Real-world assets include tokenized bonds and treasury-like products. Their rise shows that more institutional players are entering decentralized finance. For Aave, more RWA deposits can mean more borrowing and higher fees.

Revenue has grown sharply. In 2025, Aave DAO’s revenue surged to $142 million, exceeding the sum of the last three years prior. With more funds in its treasury, the DAO can invest in development, improve risk controls, and support token holders.

There is also a proposal called “Aave Will Win.” It would send all revenue from Aave-branded products to the DAO treasury. In exchange, Aave Labs would receive funding to build Aave V4 and hand over intellectual property to the community. If approved, the structure could tighten alignment between builders and token holders.

In addition, Grayscale Investments has filed to convert its Aave Trust into an exchange-traded fund listed on NYSE Arca. If approved, the move could expand access to traditional investors.

Aave also handled more than $450 million in liquidations between Jan. 31 and Feb. 5 without creating bad debt. That performance supported confidence in the protocol’s risk controls during volatile market conditions.

Aave price technical analysis

On the daily chart, AAVE is attempting to stabilize above the $115 to $120 demand zone. A recent dip toward $105 was quickly bought, forming a long lower wick. Price then reclaimed $115, which suggests buyers absorbed supply in that area.

The broader structure is still bearish. Lower highs and lower lows remain intact. A confirmed reversal would require a daily close above the $135 to $140 zone, which marks the most recent lower high.

Bollinger Bands show price moving back toward the middle band near $119 to $120 after touching the lower band around $103 to $105. The bands are starting to tighten, often a sign that volatility may expand soon.

The relative strength index dropped to near 30 during the recent selloff, but has recovered to around 45. Momentum has improved, but RSI has not crossed above 50. That level would signal stronger buyer control.

If AAVE holds above $120 and breaks $135, the next targets sit near $150 to $175. If $120 fails, price could revisit $105, with $95 to $100 as the next support area.

Crypto World

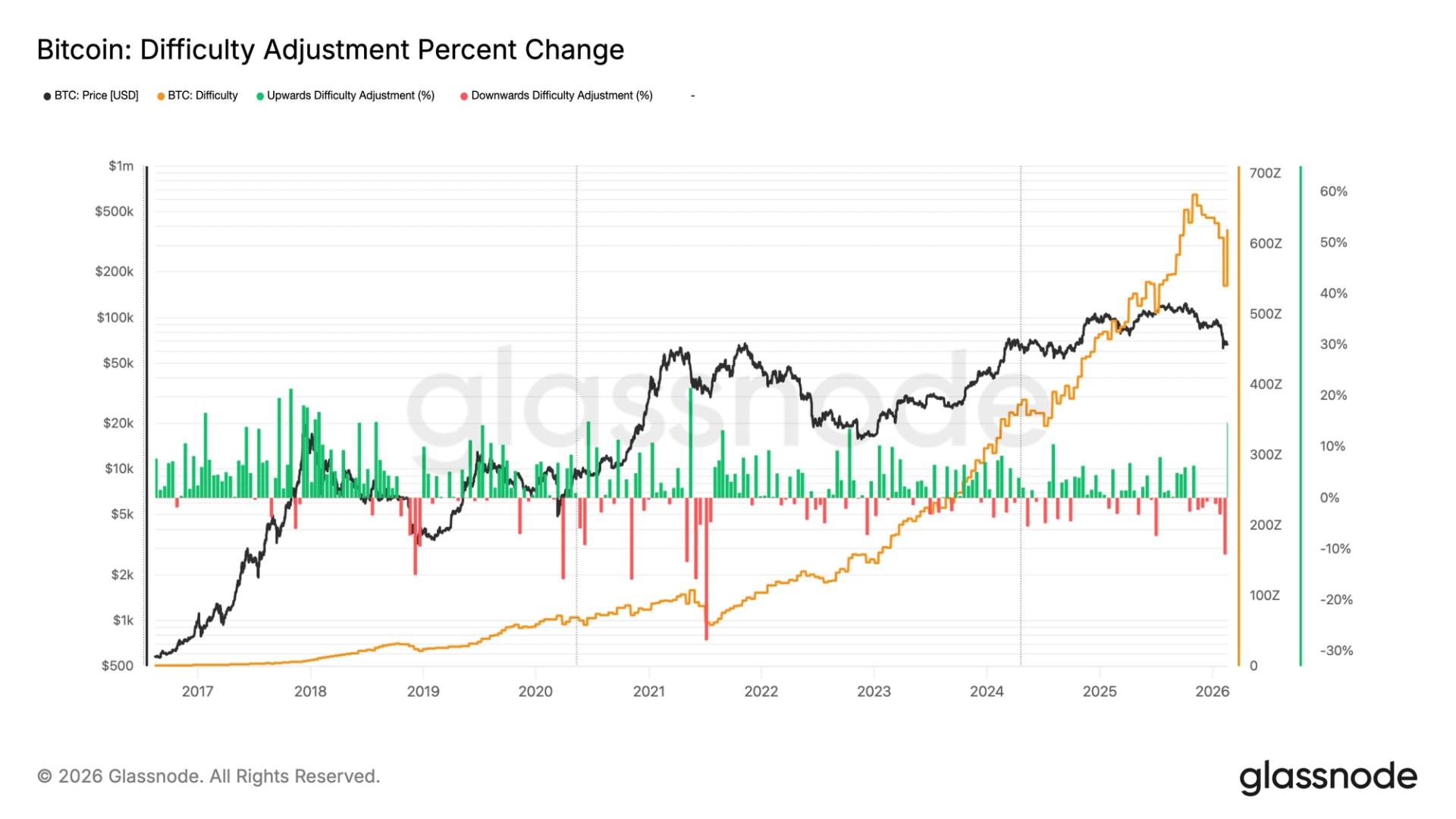

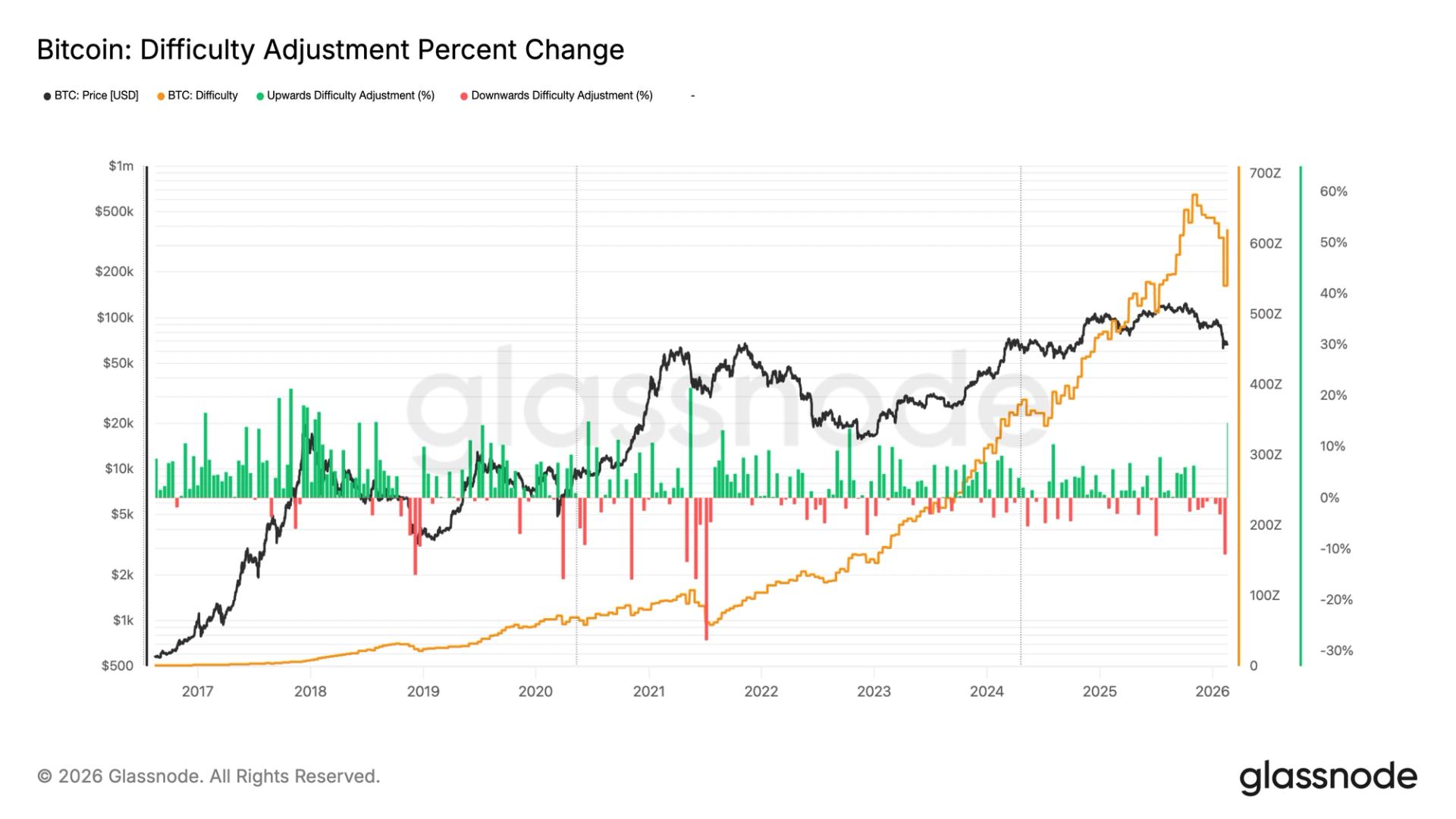

BTC difficulty jumps 15% largest increase since 2021, despite price slump

Bitcoin mining difficulty has climbed to 144.4 trillion (T), up 15%, the largest percentage increase since 2021, when the China mining ban led to a major disruption, which followed a 22% upward adjustment as the network stabilized.

Difficulty adjustments measure how hard it is to mine a new block on the network. It recalibrates every 2,016 blocks, roughly every two weeks, to ensure blocks continue to be produced about every 10 minutes, regardless of changes in the hashrate.

The adjustment follows a 12% decline in difficulty after a drop in the bitcoin hashrate, which is the total computational power securing the network. Mining activity suffered its sharpest setback since late 2021 after a severe winter storm in the United States forced several major operators to scale back operations.

In October, when bitcoin reached an all-time high of around $126,500, the hashrate also peaked at 1.1 zettahash per second (ZH/s). As prices fell to as low as $60,000 in February, the hashrate dropped to 826 exahash per second (EH/s). Since then, the hashrate has recovered to 1 ZH/s while the price has rebounded to around $67,000.

At the same time, hashprice, the estimated daily revenue miners earn per unit of hashrate, remains at multi-year lows ($23.9 PH/s), squeezing profitability.

Despite this profitability pressure, large-scale operators with access to low-cost energy continue to mine aggressively. The United Arab Emirates, for example, is sitting on roughly $344 million in unrealized profit from its mining operations.

Well-capitalized entities that can mine efficiently are helping keep the hashrate elevated and resilient, even amid subdued bitcoin prices.

Crypto World

Parsec Shuts Down Business Amid Crypto Market Volatility

On-chain analytics firm Parsec is closing down after five years, as crypto trader flows and on-chain activity no longer resemble what they once did.

“Parsec is shutting down,” the company said in an X post on Thursday, while its CEO, Will Sheehan, said the “market zigged while we zagged a few too many times.”

Sheehan added that Parsec’s primary focus on decentralized finance and non-fungible tokens (NFTs) fell out of step with where the industry has now headed.

“Post FTX DeFi spot lending leverage never really came back in the same way, it changed, morphed into something we understood less,” he said, adding that on-chain activity changed in a way he never understood.

NFT sales reached about $5.63 billion in 2025, a 37% drawdown from the $8.9 billion recorded in 2024. Average sale prices also declined year over year, falling to $96 from $124, according to CryptoSlam data.

“Quite the ride,” Parsec says

Parsec, which had received investment from major industry players such as Uniswap, Polychain Capital, and Galaxy Digital, launched in early January 2021, just months before Bitcoin (BTC) surged from around $36,000 to $60,000 by April.

The company added in its X post that it is “eternally grateful to those that traversed the ups and downs on-chain.”

“It was quite the ride,” Parsec said.

Alex Svanevik, the CEO of on-chain analytics platform Nansen, said that Parsec “had a great run.”

Crypto industry may be heading for consolidation

It comes just weeks after crypto start-up Entropy announced it is closing down and returning funds to investors, citing scaling issues and a struggle to find product-market fit.

Bullish CEO Tom Farley predicted during an interview with CNBC on Feb. 8 that the industry will see a significant consolidation in the coming months with more projects snapped up by larger companies, which may lead to a much less fragmented sector overall.

Related: Bitcoin ETFs still sit on $53B in net inflows despite recent outflows: Bloomberg

Bitcoin’s price has declined 46% from its October all-time high of $126,100 to $67,246, according to CoinMarketCap.

Google searches for “Bitcoin going to zero” have surged to their highest level since the post‑FTX panic in November 2022, according to Google Trends data for the past five years.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Crypto World

Armstrong and Moreno signal April victory

The path to making America the “crypto capital of the world” appeared to clear significantly on Wednesday as industry leaders and lawmakers announced a truce in the legislative battle over market structure.

Summary

- CLARITY Act, which stalled in early 2026 after Coinbase withdrew support, is now projected to pass by April following intensive “behind-the-scenes” negotiations.

- Senator Moreno emphasized that stablecoin rewards will force traditional banks to pay higher interest to everyday Americans, democratizing the financial system.

- Addressing technical fears, Armstrong confirmed that Coinbase is already preparing for post-quantum cryptography to ensure the long-term safety of digital assets.

CLARITY Act headed for the President’s desk

Appearing together at the World Liberty Forum, Coinbase CEO Brian Armstrong and Senator Bernie Moreno expressed newfound confidence that the CLARITY Act will pass by April 2026.

The optimism follows a rocky January where Coinbase famously “rug-pulled” its support for the bill over provisions that would have banned interest-bearing stablecoins. Armstrong clarified that his opposition wasn’t a “block,” but a call to return to the table.

“There is now a path forward where we can get a win-win-win outcome,” Armstrong said, noting that the smartest banks are now “leaning in” rather than fighting the inevitable.

Stablecoins as a tool for dollar dominance

Senator Moreno, a former crypto entrepreneur himself, argued that the bill’s focus on stablecoin rewards is essential for national security.

By allowing these assets to compete with traditional bank deposits, Moreno claimed the U.S. could effectively “dollarize the world” and reduce treasury borrowing costs by hundreds of billions of dollars.

“Unless you own a bank, you probably shouldn’t care,” Moreno told the audience, framing the debate as a choice between protecting outdated banking models or empowering consumers with faster, high-yield digital cash.

Addressing the “quantum threat”

The conversation also pivoted to technical risks, specifically the concern that quantum computing could “break” the blockchain.

Armstrong was quick to dismiss the threat as a “solvable engineering challenge,” revealing that Coinbase is already coordinating with major networks like Ethereum and Bitcoin to upgrade to post-quantum cryptographic standards.

The duo also cheered recent news from CFTC Chairman Mike Selig, who this week reaffirmed federal jurisdiction over prediction markets. Armstrong, whose “Everything Exchange” now includes these markets, praised the move as a vital check against state-level efforts to classify the sector as illegal gambling.

With the White House and the “Crypto Czar” David Sacks reportedly meeting daily with stakeholders, the “April milestone” has become the primary target for a industry eager to trade regulatory “word salad” for a clear, national standard.

Crypto World

CME Group to launch 24/7 crypto futures and options trading

CME Group, the world’s largest regulated derivatives marketplace, announced plans to begin 24-hour, seven-day-a-week trading of its cryptocurrency futures and options contracts on May 29, 2026, pending regulatory review.

Summary

- Pending regulatory approval, crypto products will move to a 24/7 schedule on the CME Globex platform, with only a brief weekly window for maintenance.

- The shift follows a massive 2025 where CME saw $3 trillion in notional activity, driven by professional traders seeking regulated risk-management tools.

- Beyond Bitcoin and Ether, CME recently broadened its reach by launching futures for Cardano (ADA), Chainlink (LINK), and Stellar (XLM).

CME Group adopts 24/7 crypto trading as competition heats up

The decision marks a significant step in aligning regulated digital-asset derivatives with the continuous nature of global crypto spot markets.

Under the new schedule, CME’s cryptocurrency products will trade continuously on its CME Globex platform, with a brief weekly maintenance window. Any trading conducted from Friday evening through Sunday evening will receive the following business day’s trade date for clearing, settlement and reporting.

CME said that client demand for regulated crypto risk-management tools is at an historic high, driven by record volumes in 2025 when its crypto futures and options saw $3 trillion in notional activity. Average daily volume and open interest have both climbed sharply year-over-year in 2026, underlining robust participation from institutional and professional traders.

The expansion builds on CME’s broader push into digital assets. In early February, the exchange successfully launched futures contracts for Cardano (ADA), Chainlink (LINK) and Stellar (XLM), including both standard and micro sizes, broadening its altcoin derivatives lineup beyond Bitcoin and Ether. Market participants have viewed this as a key step in giving regulated access to a wider range of crypto assets.

However, CME’s push to modernize its markets has faced operational challenges. In November 2025 a cooling-system failure at a CyrusOne data center triggered a major outage that halted futures trading across cryptocurrencies, commodities, equities and FX, highlighting infrastructure risks as trading demand intensifies.

As crypto continues its integration into mainstream finance, round-the-clock regulated trading at CME could help close the gap between always-on digital markets and traditional exchange hours — offering traders more flexibility and risk management options around the clock.

Crypto World

Fed’s Kashkari dismisses crypto as “utterly useless” at 2026 midwest summit

Minneapolis Federal Reserve President Neel Kashkari delivered a blistering critique of the cryptocurrency industry on Thursday, dismissing digital assets as “utterly useless” and characterized by “word salad” marketing rather than functional utility.

Summary

- Kashkari argued that after over a decade, crypto has failed to provide a compelling use case for U.S. consumers, unlike AI tools which have seen rapid, practical adoption.

- He dismissed the “instant” cross-border payment narrative, noting that recipients must still pay high costs to convert crypto into local currency for daily essentials.

- The Fed official asserted that existing domestic tools like Venmo and Zelle already outperform stablecoins, and warned that nations will not abandon independent monetary policies for a unified crypto platform.

Speaking at the 2026 Midwest Economic Outlook Summit, Kashkari challenged the fundamental value proposition of cryptocurrencies and stablecoins.

During a fireside chat, he contrasted the tangible economic impact of Artificial Intelligence with the decade-long history of crypto, which he argues has failed to integrate into the real economy.

Kashkari’s crypto “grocery store” test

Kashkari was particularly skeptical of the claim that crypto excels at cross-border payments. Using a personal example, he described the hurdles of sending money to family in the Philippines. While proponents claim crypto offers “instant” transfers, Kashkari argued the logic falls apart at the point of sale.

“How does [a recipient] buy groceries with it?” Kashkari asked the audience.

“They still have to convert it to the local currency, and that is still expensive. What advocates are really saying is that if everyone in the world used the same platform, friction would disappear, but nations are not going to abandon their own monetary policies.”

Demanding clarity over “buzzwords”

The Fed official urged the public and policymakers to stop settling for vague explanations. He described much of the industry’s rhetoric as a “buzzword salad,” noting that most “innovations” offered by stablecoins are already handled efficiently by existing domestic tools like Venmo or Zelle.

“Ask the most basic questions and don’t settle for nonsense,” Kashkari warned. “Whenever I make people really explain how this thing actually works, there’s just nothing there.”

The remarks highlight a growing divide in 2026 between the central bank’s skepticism and the commercial sector’s expansion, coming just hours after the CME Group announced plans to move toward 24/7 crypto derivatives trading to meet institutional demand.

Crypto World

Will Crypto Markets React to $2B Bitcoin Options Expiring Today?

Another week has ended, and Friday has arrived, which means another batch of Bitcoin options contracts is expiring while spot markets remain sideways.

Around 30,600 Bitcoin options contracts will expire on Friday, Feb. 20, with a notional value of roughly $2 billion. This event is a little smaller than last week’s expiry, so there is unlikely to be any impact on spot markets.

Crypto markets are in bear market territory, but have remained flat over the past week as volume and volatility dry up.

Bitcoin Options Expiry

This week’s batch of Bitcoin options contracts has a put/call ratio of 0.59, meaning that there are more expiring calls (longs) than puts (shorts). Max pain is around $70,000, according to Coinglass, which is above current spot prices, so many will be out of the money on expiry.

Open interest (OI), or the value or number of Bitcoin options contracts yet to expire, remains highest at $60,000 with $1.2 billion and $1 billion at $50,000 strike prices on Deribit as bearish bets increase. Total BTC options OI across all exchanges has been climbing this month and is at $36.5 billion.

“Positioning skews call heavy across both assets, with BTC showing the stronger upside skew,” said Deribit.

Meanwhile, derivatives analyst Laevitas observed that “downside protection remains in demand,” noting 2,140 BTC worth of puts at $58,000 recently bought.

🚨 Options Expiry Alert 🚨

At 08:00 UTC tomorrow, over $2.4B in crypto options are set to expire on Deribit.$BTC: ~$2.0B notional | Put/Call: 0.59 | Max Pain: $70K$ETH: ~$404M notional | Put/Call: 0.75 | Max Pain: $2,050

Positioning skews call heavy across both assets, with… pic.twitter.com/pgl2z4ZGJ6

— Deribit (@DeribitOfficial) February 19, 2026

You may also like:

In addition to today’s batch of Bitcoin options, around 212,000 Ethereum contracts are also expiring, with a notional value of $404 million, max pain at $2,050, and a put/call ratio of 0.75. Total ETH options OI across all exchanges is around $6.8 billion.

This brings the total notional value of crypto options expiries to around $2.4 billion.

Spot Market Outlook

Total market capitalization has been flat for the past 24 hours and since the beginning of the week, hovering around $2.37 trillion, down 46% from its peak. Bitcoin has slowly eroded since Monday, hitting a weekly low of $65,700 in late trading on Thursday before recovering to $67,290 at the time of writing on Friday morning in Asia.

Resistance is forming at $70,000, with support still just above $60,000, and this seems to be the closest target. There has been no movement in Ether prices, which have started to consolidate around $1,950. The rest of the altcoins remain flat at bear market bottoms.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

What next for bitcoin as BTC nears $68,000 on fresh US-Iran tensions

Crypto prices firmed during Asia’s Friday morning session, with bitcoin climbing toward $68,000 after a choppy week that tested nerves across risk markets.

The bounce was broad. XRP, Solana’s SOL, and Cardano’s ADA added upto 2% while ether lagged with a small dip, hovering below $2,000 as traders treated the level as a line that needs defending rather than celebrating.

The move had the feel of a relief rally more than a clean turn. After weeks of sharp swings, the market has started reacting in waves. A quick push higher draws in dip buyers, then selling appears as soon as price reaches a level where trapped holders can exit with less pain. The difference this week is that each rebound has looked a little less fragile, suggesting forced selling is easing even if conviction buying has not returned in size.

Macro and geopolitics are doing their part to keep traders cautious. Gold steadied near $5,000 an ounce after two sessions of gains as investors priced rising Middle East risk.

US President Donald Trump said Thursday he would allow 10 to 15 days for talks on a nuclear deal with Iran, while American forces reportedly built up in the region. That mix has supported haven demand and made it harder for risk assets to build momentum.

FxPro chief market analyst Alex Kuptsikevich framed the broader backdrop as bearish.. He said that given the market’s prior dynamics and the more cautious tone in US stocks, the odds increase of a retest of local lows, pointing to levels last seen in the second half of 2024.

On ether, he said the token is sitting on a long running support line that traces back to 2020 and lines up with the $2,000 area, but added that a true breakdown would need confirmation through a drop below recent lows around $1,500.

Under the surface, some indicators hint that big holders may be positioning to sell into strength. CryptoQuant says bitcoin inflows from large holders to Binance have reached record levels, a pattern that can precede heavier spot supply.

Research shop K33 has compared current conditions to the later stages of the 2022 bear market that gave way to a long, grinding consolidation.

The result is a market that can bounce, but struggles to turn rebounds into a trend until spot demand grows louder than the sellers waiting at the next round number.

Crypto World

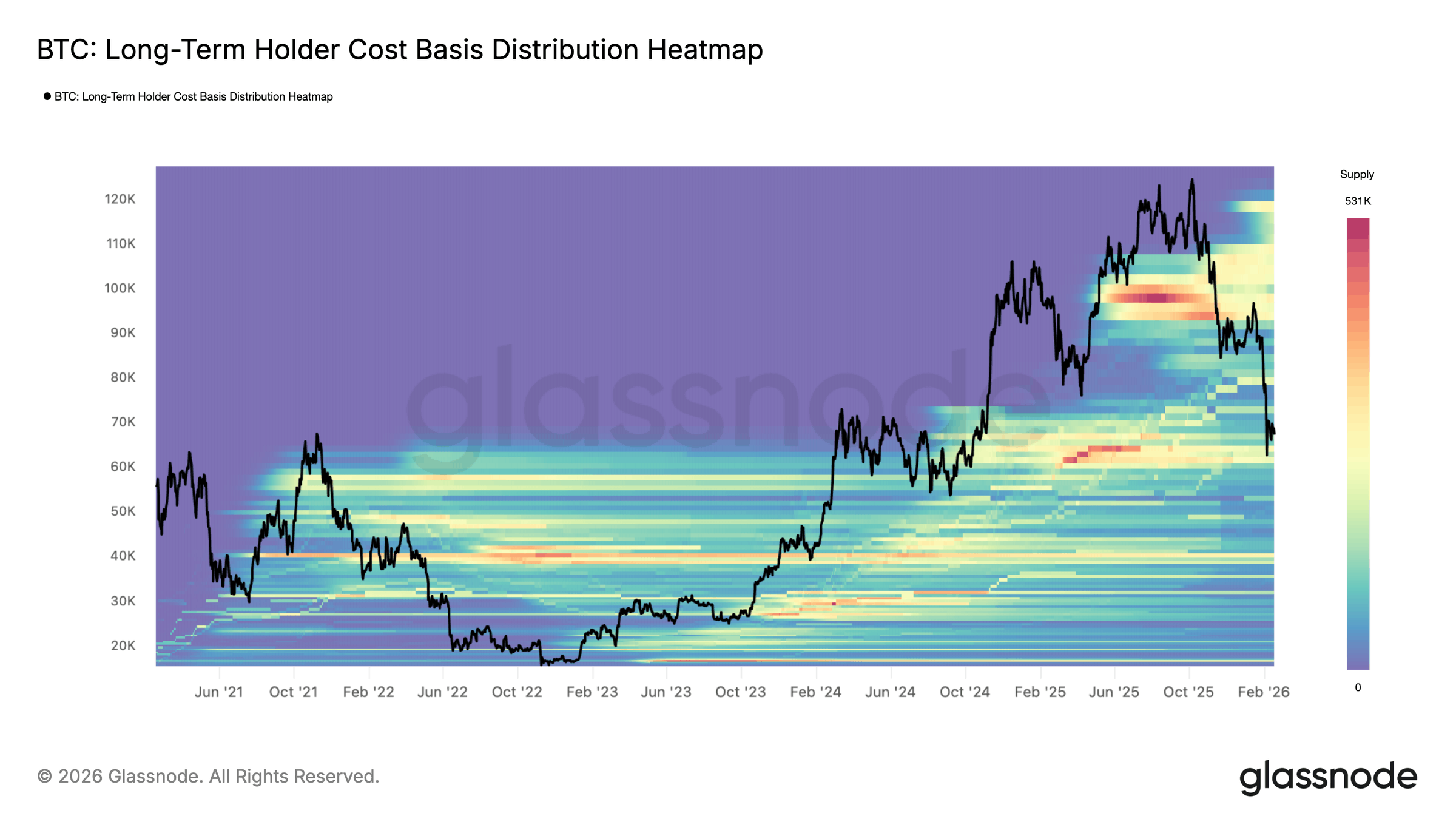

Bitcoin Holders Defend Range as $55K Floor Looms: Glassnode

Bitcoin’s (BTC) market structure shifted into a corrective phase after losing a key onchain valuation level in late January.

Glassnode data shows that BTC’s price is compressing within a 2024-era demand zone as liquidity conditions soften. At the same time, BTC’s supply is steadily shifting into long-term, retail-linked wallets while exchange activity has cooled.

This mix of technical and onchain data, along with the current capital rotation, may shape the next steps for Bitcoin price.

Bitcoin lost its active supply cost price, but holders defend $60,000

In its weekly “The Week On-chain” report, Glassnode said that BTC’s recent price dip accelerated due to breaking below its true market mean near $79,000 in January, which is the cost basis of the tracked active supply.

Since then, the price has stabilized inside a dense $60,000 to $69,000 range, which is being defended by medium-term holders. One of the reasons this zone has been a strong support is because of the age of coins within this range for the majority of 2024.

Coins accumulated in that range have aged more than a year, placing a large cohort close to breakeven. This supply may be acting as a backstop on the current sell pressure.

Market analyst Ardi pointed to a similar dynamic, writing on X:

“We’re trading inside the same $53-73K range that took 245 days to build last year. Think about how much volume went through this zone. This is the most contested zone on BTC’s entire chart right now.”

Glassnode also highlighted that, in past cycles, deeper bear phases have gravitated toward the realized price, which now stands near $54,900. The metric estimates the average acquisition cost of all circulating coins.

Bitcoin’s liquidity conditions also remain compressed. The 90-day realized profit/loss ratio has declined back into the 1–2 range, a level associated with limited capital rotation. A sustained move below 1 has aligned with stressed bear environments.

Related: Google searches for ‘Bitcoin going to zero’ at highest since 2022

BTC accumulation rises even as activity slows down

CryptoQuant data shows that the balances held by accumulating address cohorts have continued rising into early 2026. Total BTC held by these cohorts has expanded to over 4 million BTC, up from roughly 2 million BTC in early 2024, which reflects a steady supply absorption.

The retail-linked accumulation addresses have increased their holdings by 850,000 BTC, while the accumulating pattern wallets, addresses that steadily add BTC in recurring intervals with minimal outflows, increased their size to 1.27 million BTC. This expansion occurred even as the price dropped in 2026.

In contrast, the inflows from centralized-exchange addresses and highly active addresses have moderated. Compared with the 2023 to 2024 expansion phases, where inflow spikes frequently exceeded 1.2 million to 1.5 million BTC, the recent activity has remained significantly lower, averaging 300,000 BTC to 400,000 BTC.

The divergence shows that more BTC is being absorbed into long-term wallets while fewer coins are rotating through major exchanges. That reduces the liquid supply and slows down short-term trading activity.

Related: Bitcoin’s consolidation nears ‘turning point’ as $70K comes in focus: Analyst

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Metaplanet CEO Fires Back at Anonymous Critics Over Bitcoin Strategy Claims

TLDR:

- Metaplanet CEO Simon Gerovich rejects anonymous claims of hidden Bitcoin buys and poor disclosure practices.

- Four September Bitcoin purchases were each disclosed promptly via the company’s live public dashboard.

- Selling put options lowers Bitcoin acquisition costs below spot, not a directional price bet.

- Metaplanet’s Bitcoin-per-share KPI surged over 500% in 2025 despite stock price volatility.

Metaplanet’s CEO has gone on the offensive. Simon Gerovich addressed a wave of anonymous allegations targeting the Japanese Bitcoin treasury firm.

The criticism questioned the company’s disclosure practices, options trading approach, and September Bitcoin purchases. Gerovich pushed back point by point, calling several claims factually inaccurate.

Metaplanet CEO Challenges Claims Over Bitcoin Purchases and Disclosure Practices

The September Bitcoin purchases drew particular scrutiny. Critics alleged the company bought near a local price peak and stayed quiet about it.

Gerovich acknowledged the timing but rejected the narrative entirely. He confirmed four separate purchases were made that month, each disclosed promptly through the company’s public dashboard.

Metaplanet publishes all Bitcoin wallet addresses openly. Shareholders can verify holdings in real time through a live dashboard the firm maintains.

Gerovich cited this as evidence the company operates with unusual transparency for a listed entity. He described it as one of the most open corporate structures in the market.

The company’s accumulation approach is systematic, not speculative. Gerovich emphasized that Metaplanet does not attempt to time Bitcoin’s price.

Every purchase gets disclosed regardless of prevailing market conditions. That policy has remained consistent throughout the firm’s accumulation period.

Gerovich took direct aim at anonymous accounts spreading the allegations. He stated he would not tolerate the distribution of false information to shareholders navigating a volatile market.

He also noted his personal financial exposure as a major shareholder, having invested his own capital into the company.

Options Trading Strategy and Financial Metrics Addressed Directly

The criticism around options trading reflected a misreading of strategy, according to Gerovich.

Selling put options is not a directional bet on Bitcoin rising. It is a method to acquire Bitcoin below the spot price by collecting option premiums upfront. He walked through a specific example to illustrate the mechanics.

In his post, Gerovich described a scenario where spot Bitcoin trades at $80,000.

Selling a put at that strike and collecting a $10,000 premium brings the effective acquisition cost to $70,000. The strategy exploits elevated volatility to lower average entry prices. In Q4, he said, the approach meaningfully reduced Metaplanet’s effective Bitcoin costs.

On financials, Gerovich challenged the use of net profit as an evaluation metric. He pointed to 6.2 billion yen in operating profit, representing 1,694% year-over-year growth.

Ordinary losses stem from unrealized valuation changes on long-term Bitcoin holdings the company has no plans to sell. He called drawing negative conclusions from that line item a misreading of the statements.

Bitcoin per share, the company’s primary KPI, rose over 500% in 2025. The hotel business generated 437 million yen in sales revenue and 169 million yen in operating profit. Borrowing arrangements were disclosed three times across facility establishment and two drawdowns.

Specific lender details and interest rates were withheld at the counterparty’s request, Gerovich said.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Video4 hours ago

Video4 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World9 hours ago

Crypto World9 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market