Within the realm of digital assets, mCoin has swiftly ascended to prominence, positioning itself as a notable contender through the strategic utilization of Blockchain technology.

The substantial market cap and daily trading volume underscore mCoin’s growing influence in the industry, sparking curiosity and drawing attention from seasoned investors and newcomers alike.

As we explore the factors propelling mCoin’s meteoric rise, a deeper examination of its trajectory and potential gains insight into the intricacies of navigating the ever-evolving landscape of cryptocurrencies.

Unveiling the underlying dynamics behind mCoin’s surge invites a closer look at the implications for both short-term and long-term market behavior, shedding light on the intricate tapestry of opportunities and challenges that define its journey in the digital asset space.

Digital Asset Market Trends

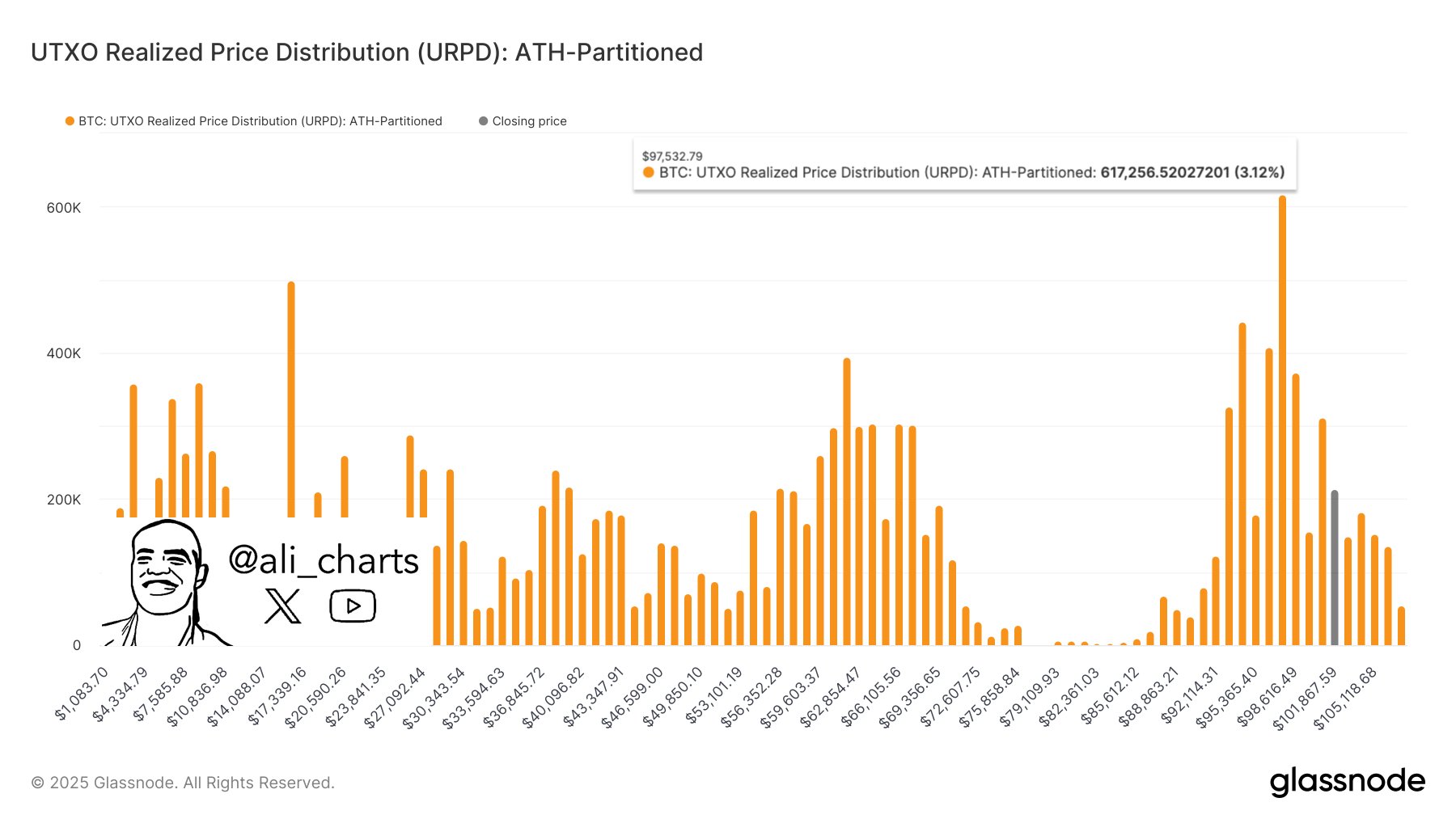

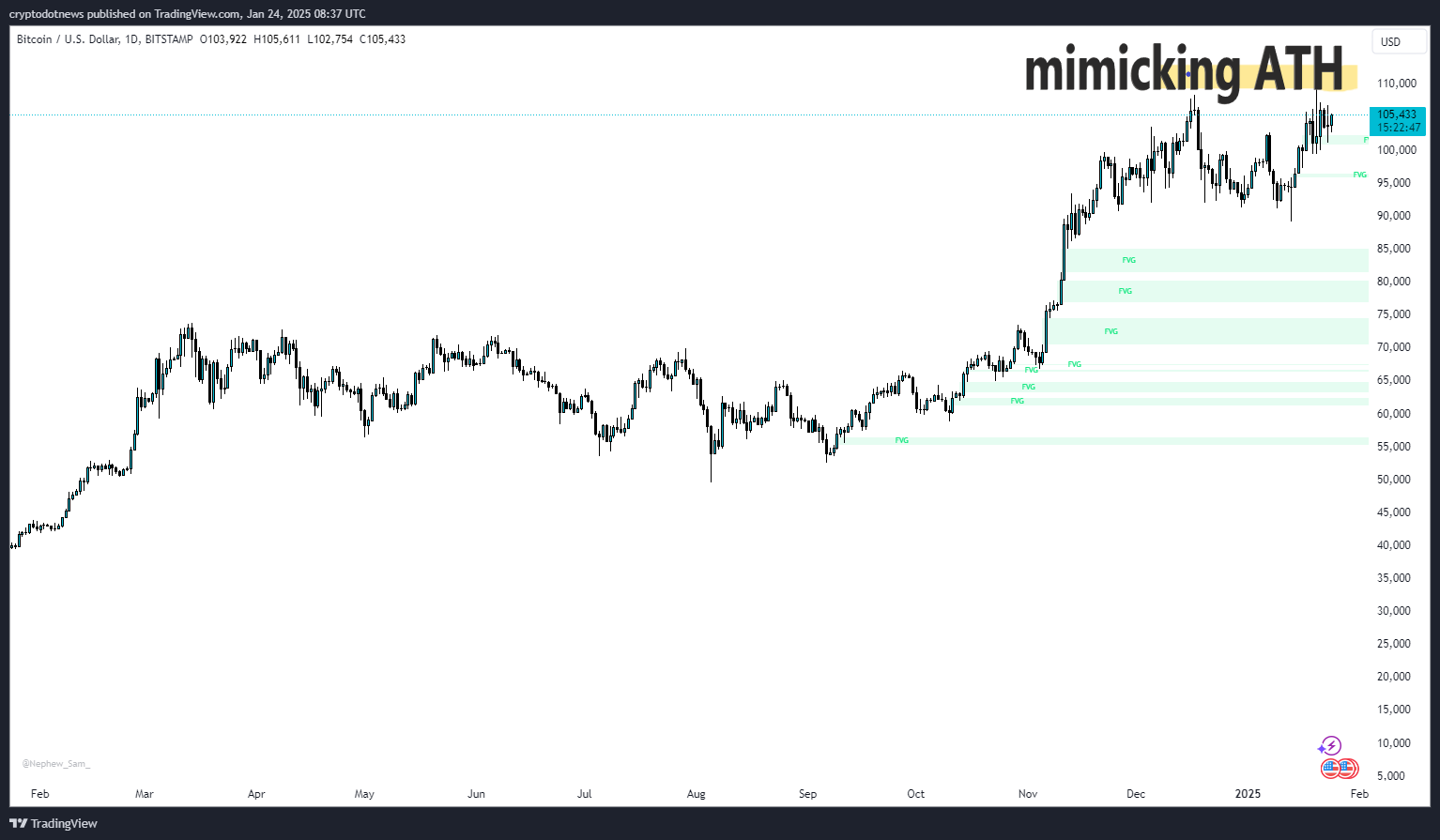

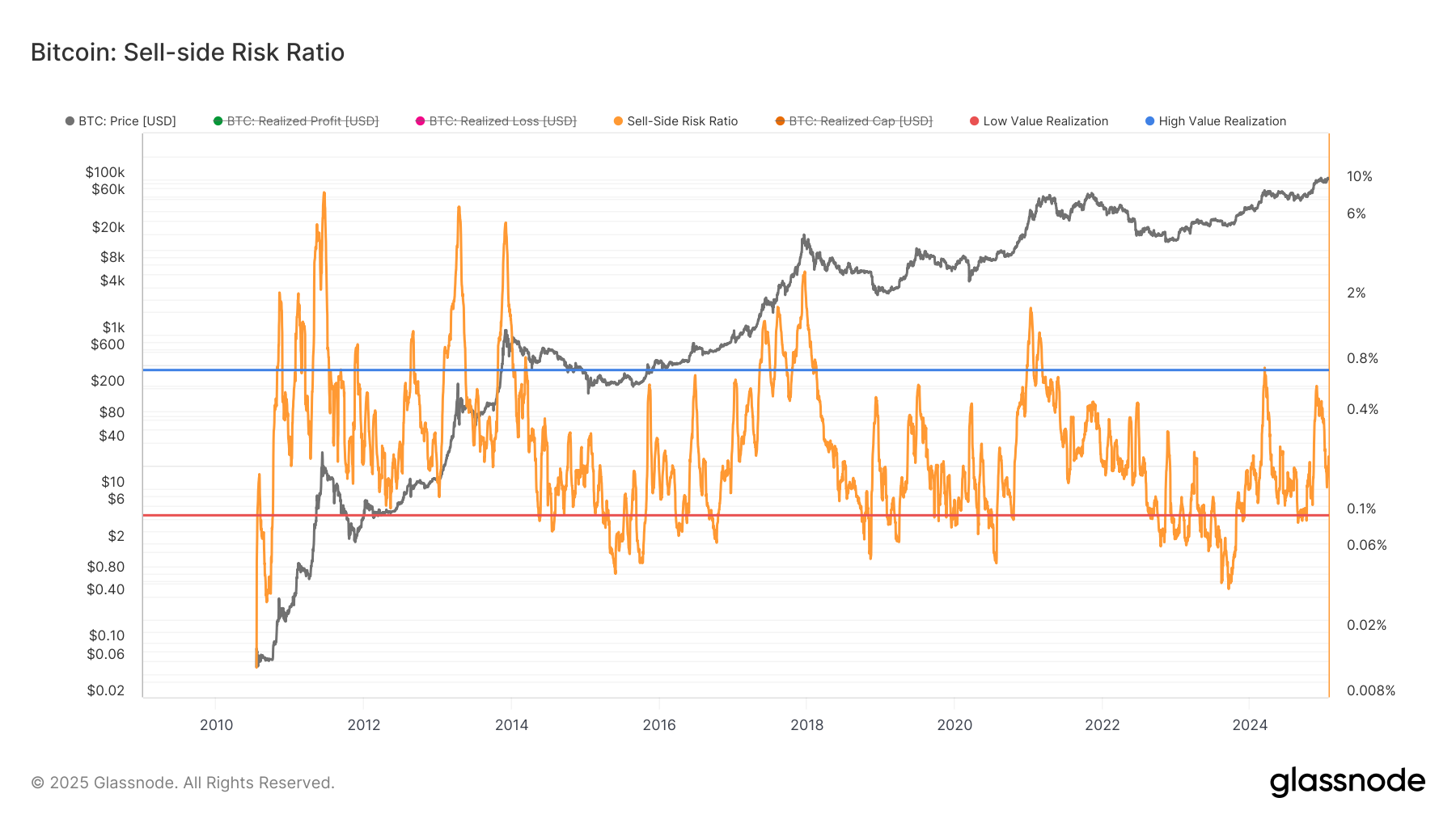

In the ever-evolving landscape of digital assets, market trends play a pivotal role in shaping investment strategies and decisions. Monitoring these trends provides investors with valuable insights into the potential growth or decline of specific assets, enabling them to make informed choices.

Understanding market dynamics, such as price fluctuations, trading volumes, and investor sentiment, is essential for staying ahead in the highly competitive digital asset industry.

By analyzing historical data and current market conditions, investors can identify opportunities for profit and mitigate risks effectively.

Mcoin’s Blockchain Technology Advancements

Monitoring digital asset market trends is essential for making informed investment decisions. Therefore, examining Mcoin’s Blockchain Technology Advancements sheds light on its innovative strides in this dynamic industry.

Mcoin has made significant advancements in its blockchain technology, enhancing security, scalability, and efficiency.

One notable development is the implementation of smart contracts, enabling automated and secure transactions without third-party interference.

Additionally, Mcoin has focused on improving interoperability with other blockchain networks, fostering seamless integration and enhancing user experience.

These technological upgrades not only showcase Mcoin’s commitment to innovation but also position it as a competitive player in the digital asset space. Investors looking to capitalize on the potential of blockchain technology should closely monitor Mcoin’s advancements as they continue to shape the future of the industry.

Growth Factors Driving Mcoin’s Success

Mcoin’s exponential growth in the digital asset industry can be attributed to its strategic partnerships and innovative technological advancements.

By forming collaborations with key players in the industry, Mcoin has been able to expand its reach and increase adoption among users. These partnerships have not only enhanced Mcoin’s credibility but have also opened up new opportunities for growth and development.

Additionally, Mcoin’s commitment to staying at the forefront of technological advancements has allowed it to offer cutting-edge solutions that cater to the evolving needs of its users.

This dedication to innovation has positioned Mcoin as a leader in the digital asset space, driving its success and solidifying its reputation as a forward-thinking and reliable platform.

Analyzing Mcoin Price Predictions

Amidst the dynamic landscape of the digital asset sector, the trajectory of mCoin’s price predictions unfolds as a focal point for strategic analysis and informed decision-making.

Short-term forecasts for mCoin suggest fluctuations between $0.38 and $0.80 from September to January while as of time of writing priced at $0.60.

Looking further ahead, long-term projections paint a picture of growth, with estimates reaching $12.24 by the end of 2024, $21.02 by 2025, and soaring to $54.71 by 2030. Despite fluctuations, the consensus indicates a positive outlook for mCoin’s value over time.

Investors considering mCoin should weigh these predictions against their investment goals and risk tolerance to make well-informed decisions in this evolving digital asset landscape.

Strategic Investment Insights for Mcoin

In the dynamic realm of digital asset investments, the strategic analysis of mCoin’s price predictions serves as a cornerstone for informed decision-making, particularly when considering long-term growth potential.

Assessing mCoin’s market cap of $107,963,421 and 24-hour trading volume of $2,856,936 provides insights into its current standing in the digital asset landscape.

Understanding these forecasts can aid investors in formulating strategic investment plans aligned with their financial objectives and risk tolerance levels.

Conclusion

In conclusion, mCoin’s rapid ascent in the digital asset industry can be attributed to its innovative use of Blockchain technology, market trends favoring digital assets, and strategic growth factors.

By analyzing price predictions and understanding the potential for long-term growth, investors can make informed decisions about mCoin as a strategic investment opportunity.

As mCoin continues to evolve and adapt within the digital asset landscape, its trajectory and value fluctuations will be closely monitored by industry observers.

Angel Marinov is the Managing Editor at Coinlabz. With extensive knowledge of crypto payments and blockchain use cases, Angel is a trusted source of accurate and timely information

You must be logged in to post a comment Login