CryptoCurrency

Will Silver Price Outperform Gold and Bitcoin In 2026?

Silver emerged as one of the strongest-performing major assets in 2025, sharply outperforming both gold and Bitcoin.

The rally was not driven by speculation alone. Instead, it reflected a rare convergence of macroeconomic shifts, industrial demand, and geopolitical pressure that could extend into 2026.

Silver’s 2025 Performance in Context

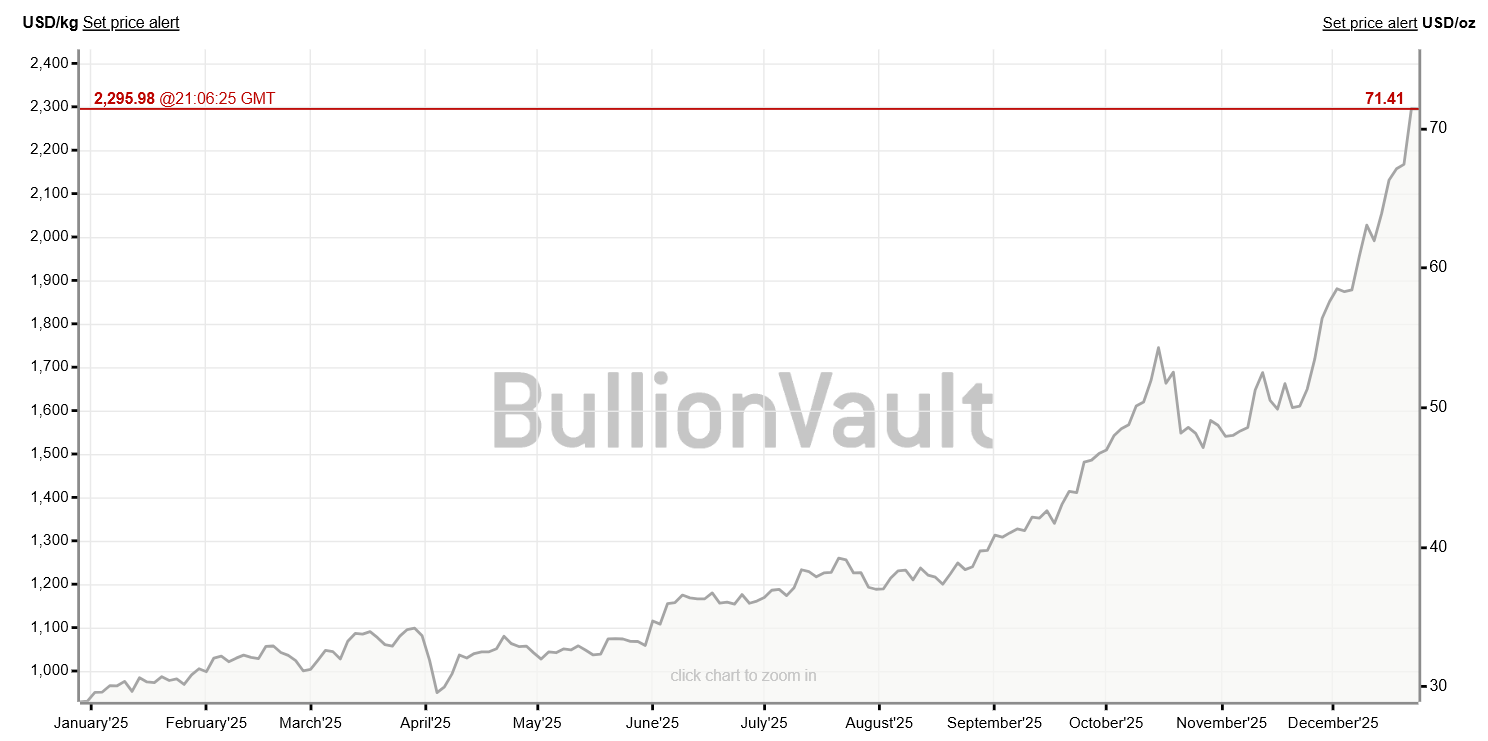

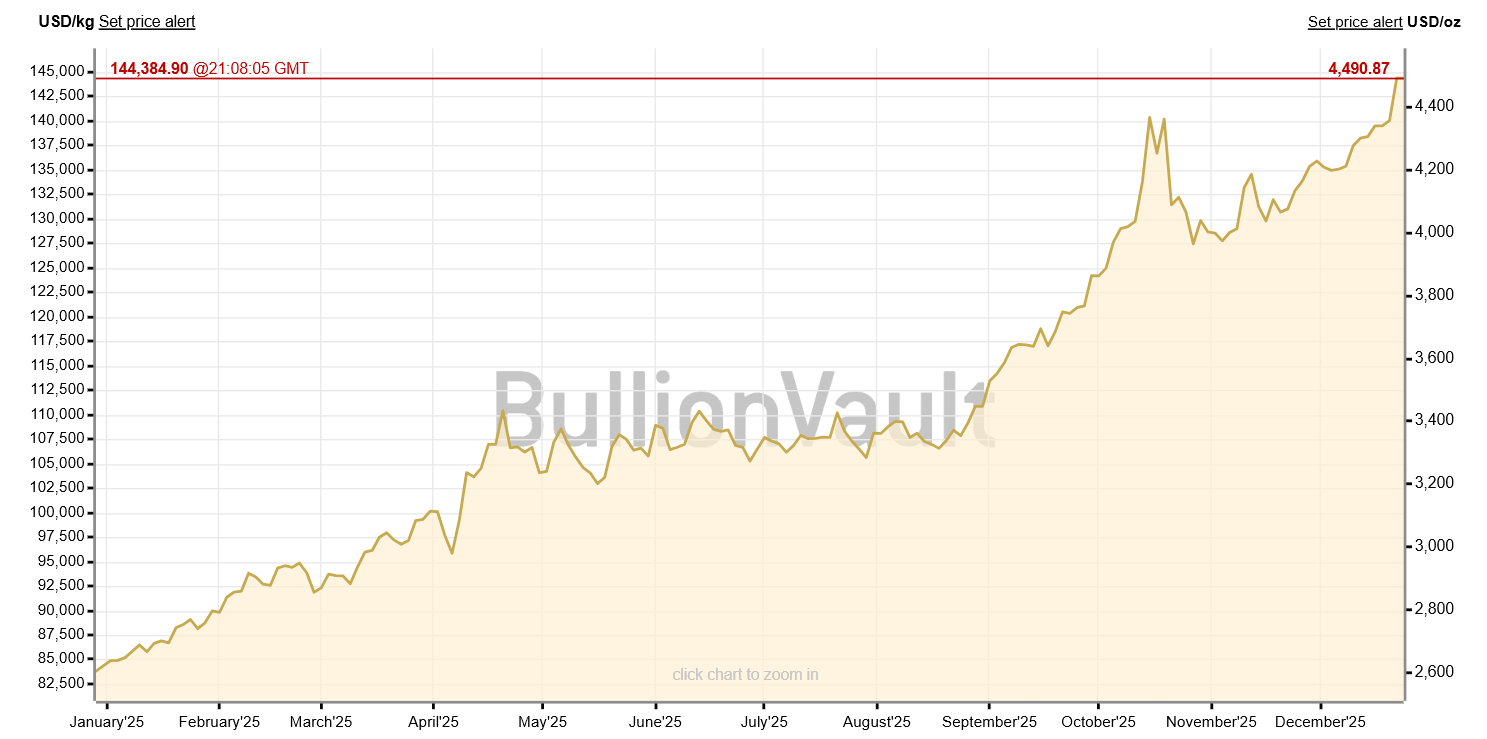

By late December 2025, silver traded near $71 per ounce, up more than 120% year-to-date. Gold rose roughly 60% over the same period, while Bitcoin ended the year slightly lower after a volatile run that peaked in October.

Silver price entered 2025 near $29 per ounce and climbed steadily through the year. Gains accelerated in the second half as supply deficits widened and industrial demand surprised to the upside.

Sponsored

Sponsored

Gold also rallied strongly, moving from roughly $2,800 to above $4,400 per ounce, supported by falling real yields and central-bank demand.

However, silver outpaced gold by a wide margin, consistent with its historical tendency to amplify precious-metal cycles.

Bitcoin followed a different path. It surged to a record near $126,000 in early October before reversing sharply, ending December near $87,000.

Unlike metals, Bitcoin failed to hold safe-haven inflows during late-year risk-off moves.

Macro Conditions Favored Hard Assets

Several macroeconomic forces supported silver in 2025. Most importantly, global monetary policy shifted toward easing. The US Federal Reserve delivered multiple rate cuts by year-end, pushing real yields lower and weakening the dollar.

At the same time, inflation concerns remained unresolved. That combination historically favors tangible assets, particularly those with monetary and industrial value.

Unlike gold, silver benefits directly from economic expansion. In 2025, that dual role proved decisive.

Sponsored

Sponsored

Industrial Demand Became the Core Driver

Silver’s rally was increasingly anchored in physical demand rather than investment flows. Industrial usage accounts for roughly half of total silver consumption, and that share continues to grow.

The energy transition played a central role. Solar power remained the single largest source of new demand, while electrification across transport and infrastructure added further pressure to already tight supply.

Global silver markets recorded a fifth consecutive annual deficit in 2025. Supply struggled to respond, as most silver production comes as a byproduct of base-metal mining rather than primary silver projects.

Electric Vehicles Added Structural Demand

Electric vehicles significantly increased silver consumption in 2025. Each EV uses 25 to 50 grams of silver, roughly 70% more than an internal-combustion vehicle.

With global EV sales rising at double-digit rates, automotive silver demand climbed into the tens of millions of ounces annually.

Charging infrastructure amplified the trend. High-power fast chargers use kilograms of silver in power electronics and connectors.

Unlike cyclical investment demand, EV-related silver consumption is structural. Production growth directly translates into sustained physical offtake.

Sponsored

Sponsored

Defense Spending Quietly Tightened Supply

Military demand became a less visible but increasingly important factor. Modern weapons systems rely heavily on silver for guidance electronics, radar, secure communications, and drones.

A single cruise missile can contain hundreds of ounces of silver, all of which is destroyed upon use. That makes defense demand non-recyclable.

Global military spending reached record highs in 2024 and continued rising in 2025 amid wars in Ukraine and the Middle East.

Europe, the United States, and Asia all expanded procurement of advanced munitions, quietly absorbing physical silver.

Geopolitical Shocks Reinforced the Trend

Geopolitical tensions further strengthened silver’s case. Prolonged conflicts increased defense stockpiling, while trade fragmentation raised concerns about supply security for critical materials.

Unlike gold, silver sits at the intersection of national security and industrial policy. Several governments moved to classify silver as a strategic material, reflecting its role in both civilian and military technologies.

Sponsored

Sponsored

This dynamic created a rare feedback loop: geopolitical risk boosted both safe-haven investment demand and real industrial consumption.

Why 2026 Could Extend the Outperformance

Looking ahead, most of the drivers that powered silver price in 2025 remain in place. EV adoption continues to accelerate. Grid expansion and renewable investment remain policy priorities. Defense budgets show no signs of retreat.

At the same time, silver supply remains constrained. New mining projects face long lead times, and recycling cannot offset growing industrial losses from military use.

Gold may continue to perform well if real yields stay low. Bitcoin may recover if risk appetite improves. But neither combines monetary protection with direct exposure to global electrification and defense spending.

That combination explains why many analysts see silver as uniquely positioned for 2026.

Silver’s 2025 rally was not a one-off speculative spike. It reflected deep structural changes in how the global economy consumes the metal.

If current trends persist, silver’s dual role as a monetary hedge and industrial necessity could allow it to outperform both gold and Bitcoin again in 2026.