We’re in an age where you can realistically delegate tasks to smart hunks of metal, whether it’s a self-driving car or a robot that can clean on your behalf. Most of us probably won’t be able to afford the helpful sentient humanoids being developed in our lifetimes, but robot vacuums are an affordable way to experience that promised utopia right now.

Business

‘Unprecedented’ leap in business distress as consumer confidence tumbles | Money News

There has been an “unprecedented” rise in the number of businesses on the brink of insolvency, according to a closely watched report.

The latest Red Flag Alert report by Begbies Traynor, an insolvency specialist, showed those in critical financial distress rose by 50% in the three months to December compared to June-August.

It said that 46,583 businesses were clinging on with consumer-facing firms, such as hospitality businesses, bearing the brunt of the deterioration.

Money latest: Top ten most memorable ad slogans revealed

It added that there were “notable” increases in financial stress across 21 of the 22 sectors of the economy that the study covered.

The report pointed to pressures on many fronts from rising energy costs, budget tax measures, high interest rates and weak consumer demand.

The report was published as a key measure of the latter, released once a month by market research company GfK, and showed consumer confidence at its lowest level since December 2023.

All five of the survey’s components, including the outlook for personal finances and the economy, declined.

The findings of both reports chime with a slew of downbeat economic signals since Labour’s election victory, with stagnation taking hold on a quarterly basis.

Chancellor Rachel Reeves warned in late July of a tough budget ahead to plug a £22bn “black hole” in the public finances that a Treasury review was said to have uncovered.

The budget is set to raise taxes on businesses, from April, by £25bn to help increase funding for investment and public services but firms argue the financial hit will just result in lower investment, higher prices, and job losses across the board.

Julie Palmer, partner at Begbies Traynor, said of the Red Flag Alert’s findings: “Across nearly every sector, there has been an unprecedented level of growth in the number of firms who are at serious risk of entering insolvency in the next 12 months.

“The fact that the distress is being felt across almost every corner of the economy highlights how difficult the outlook is for UK businesses right now.

“After a disappointing Christmas, consumer-facing industries, in particular, are feeling the strain, with rising operational costs and higher wages adding to an already difficult situation.

“With many such businesses already operating on thin margins, I fear the current situation will undoubtedly push some over the edge.

“Indeed, at a time when consumer confidence is so volatile and borrowing costs look likely to be structurally higher for the foreseeable future, the situation feels very precarious.

“Sadly, this has only been exacerbated by the tax rises and increase in national minimum wage levied on businesses during the October 2024 UK budget which means the financial strain on businesses will only increase later this year.”

Read more:

UK’s biggest mortgage lender sees three rate cuts this year

Economy faces four years of budget pain, Brewdog co-founder warns

Sainsbury’s to cut over 3,000 jobs

The government has consistently defended the budget, saying it will lay the foundations for growth that the country so badly needs.

Public investment is forecast, by economists, to help output pick up in the second half of the year.

However, many caution that the response by businesses to the budget will also be crucial.

CryptoCurrency

Ivanka Trump Slams Fake Crypto Coin Exploiting Her Name

From Trump to Melania, we now have the Ivanka Trump coin. The crypto industry is going full-throttle on Trump mania, but at least one family member isn’t happy with the latest development, particularly the release of the $IVANKA coin.

Related Reading

In a post on Twitter/X, Ivanka Trump blasted the news of the new crypto project, calling it a “fake crypto coin” currently being promoted without her consent. The presidential daughter stated that she’s not connected with the project and is currently working with her legal team over the unauthorized use of her name in marketing the crypto.

This isn’t the first time a Trump-themed coin became available in the market. Just days before taking office, Trump advertised a meme coin, followed by the launch of the $MELANIA coin.

Ivanka Publicly Denies Any Link With $IVANKA Crypto Project

On Thursday, the presidential daughter publicly denied any links to a new crypto meme coin that’s marketed under her name. In a Twitter/X post that has generated over 1.2 million impressions, Ivanka issued a strong warning and reminder to consumers against this suspicious crypto project.

It has come to my attention that a fake crypto coin called “Ivanka Trump” or “$IVANKA” is being promoted without my consent or approval.

To be clear: I have no involvement with this coin. This fake coin risks deceiving consumers and defrauding them of their hard-earned money,…

— Ivanka Trump (@IvankaTrump) January 23, 2025

Ivanka shared that she had no connection with the project and criticized the developers for using her likeness and name without approval, calling it a violation of her rights. She added that her legal team is taking this issue seriously and plans to sue over misuse of identity.

The presidential daughter added that the crypto project is not just unacceptable but also deceptive and exploitative. Ivanka and her husband, Jared Kushner, held important positions in the first Trump administration. However, the couple seems to enjoy their time on the sidelines.

Controversy Swirls Around The New Coin Releases

Trump-themed meme coins are some of the most popularly traded tokens in the market today. However, their release and marketing were controversial. On January 17th, US President Donald Trump launched the Official Trump token on the Solana blockchain. Then, after two days, the First Lady also announced her coin, the “Melania Coin”, supported by the Solana blockchain.

President Trump used Truth Social to announce his crypto coin, encouraging the community to join the celebration and the special Trump Community. Days after its launch, the Trump token hit an all-time high of $75, pushing the project’s market cap to $15 billion.

However, the enthusiasm on Trump’s coin immediately fizzled, trading at the $37 level, reflecting a 50% drop. Also, the Melania meme coin suffered the same fate, plunging by 80%, and it’s now trading at $2.8.

Related Reading

Trump Continues Pro-Crypto Stance

Before the November elections, Trump indicated his intention to support Bitcoin and crypto projects. He promised a favorable crypto environment and outlined specific plans, including replacing SEC Chair Gary Gensler and supporting a Bitcoin reserve.

On January 23rd, Trump issued his first crypto regulation, banning the creation and issuance of the Central Bank Digital Currency (CBDC).

Featured image from Tobias Hase/Picture Alliance/Getty Images, chart from TradingView

CryptoCurrency

U.S. Congressional Republicans in Hot Pursuit of Biden-Era’s Crypto Debanking

An investigation in the U.S. House of Representatives and a hearing in the Senate will examine whether financial regulators during the administration of former President Joe Biden deliberately cut off crypto industry leaders and others from the banking system in an inappropriate use of authority.

“Debanking is un-American — every legal business deserves to be treated the same regardless of their political beliefs,” said Senate Banking Committee Chair Tim Scott, a South Carolina Republican who took over the gavel earlier this month and has scheduled a February 5 hearing on debanking. “Unfortunately, under Operation Chokepoint 2.0, Biden regulators abused their power and forced financial institutions to cut off services to digital asset firms, political figures, and conservative-aligned businesses and individuals.”

Operation Chokepoint 2.0 is the name Republican lawmakers and the digital assets industry have been using for the systemic severing of crypto insiders from U.S. banks, in reference to an earlier era’s Operation Chokepoint — a government-sanctioned effort to reduce risk in banking by encouraging the lenders to back away from legal but otherwise risky businesses.

Delving into the struggle of crypto executives and businesses to maintain banking relationships, the House Oversight Committee is “investigating whether this debanking practice originates from the financial institutions themselves or from either implicit or explicit pressure from government regulators,” according to a letter the committee chairman, Representative James Comer, sent on Friday to founders and CEOs of several crypto companies and organizations, including Coinbase, Lightswap and Uniswap Labs.

The challenge of pinning the lack of banking options entirely on the government is that some financial institutions may have made decisions based on their own risk appetites or business plans that deliberately steered clear of crypto interests. And banking regulators such as the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency were public in their guidance that regulated banks seeking to do crypto business would face restrictions and additional scrutiny from the agencies.

However, a Coinbase pursuit of private FDIC communications with banks demonstrated that the agency directed them to stop pursuing digital assets services until the regulator had specific rules in place, which it wasn’t developing.

“We are grateful to assist in the thorough investigation of this pernicious practice,” said Kristin Smith, CEO of the Blockchain Association, which also received the House committee’s letter probing the trend.

Meanwhile, congressional Democrats have been focusing their own investigation requests on President Donald Trump’s recently launched meme coin, $TRUMP. He’s been accused of using the presidency to rack up billions of dollars, and they cite the token as a potential risk for dangerous conflicts of interest.

Technology

Here are the best robot vacuum deals right now

Today’s floor cleaners are also more advanced than ever. In addition to vacuuming, many of the best models can now mop, allowing you to tackle both carpet and hardwood flooring. Some can automatically dispense of their trash and dirty water, too, and clean their own components without intervention. Soon, we’ll even have models that can pick up dirty laundry and purify the air in your home, preventing you from having to lift a finger.

But if you need something relatively affordable for daily cleaning, you’d be surprised how little you have to pay for premium features. Below, we’ve listed the best deals currently available on a slate of Verge-approved robot vacuums, whether you prefer a budget entry-level model from Yeedi or top-of-the-line offerings from iRobot, Dreame, and more.

Best robot vacuum deals

iRobot’s Roomba Combo j7 Plus is available from Amazon, Best Buy, and iRobot for around $599 ($600 off), which is an all-time low. The j7 Plus was once our favorite Roomba robovac, and the Combo j7 Plus builds upon the base model with an auto-retractable mop. That means it can lift its mop pads and pick up dirt from your carpets without wetting them and then vacuum / mop hardwood flooring with no mid-cycle management needed.

The mopping performance isn’t the best we’ve seen, though, and you’ll need to frequently change its 210ml water tank and detach and clean the mop pads yourself. Thankfully, it can automatically dispose of dirt using the included auto-empty dock. The Combo j7 Plus isn’t easily tripped up thanks to AI-powered obstacle avoidance, which allows it to navigate toys and pet droppings. You can also direct it to clean specific areas using Amazon Alexa and Google Assistant voice commands.

The Dreame X40 Ultra is another mopping robot, and while it’s on the more expensive side, you can currently pick it up for $1,099.99 ($630 off) from Dreame and Amazon (using an on-page coupon). You’re paying a premium for 12,000Pa of suction power and a pair of removable, self-retracting mop pads, which it can automatically clean and dry on its own using the included base. It can also empty its own bin and refill its own water tank.

The Dreame X40 Ultra features an extendable side brush and mop pads, too, offering better coverage for baseboards, corners, and the underside of your furniture. It uses a combination of AI-powered cameras and “3D-structured light” (presumably based on lidar technology) to map and navigate rooms, with customizable keep-out zones and more functions available in the app. There’s also a dirt detection system that can identify messier spills and adjust its cleaning routine accordingly.

You can get the SwitchBot S10 for an all-time low of $664.99 ($535 off) at Amazon with an on-page coupon or for $699.99 ($500 off) directly from SwitchBot with code BFCM500A. The S10 is one of the most affordable robot vacuum / mop hybrids you can buy that can refill its own tank at a battery-powered base station — with the caveat that it requires hooking into your home’s plumbing. It can also dry its own mop pads and empty its bin at a separate docking bay and offers enough capacity to go up to 90 days without intervention.

Its self-cleaning roller mop is more effective than the typical pads we see in most other units, but the downside is a smaller coverage area. It only has a single roller brush for vacuuming, but its respectable 6,500Pa suction can make up for it. And while it has lidar mapping and AI-powered obstacle avoidance, we found it still has a tendency to get stuck on laundry, bath mats, and other obstacles. The S10 is also one of the few robovacs with Matter support, which effectively enables native control through Apple Home, Google Home, and Alexa (though said platforms don’t yet fully support robot vacuums).

The S10 is a great mopping robot with a battery-powered water refill dock that makes it the most hands-free robovac we’ve tested. A separate auto-empty dock takes care of the dust. It’s big and loud and lacks some features found on high-end robots, but it does a great job of keeping your floors clean.

The big-wheeled Roborock Q5 Pro is down to $159.99 ($270 off) at Roborock’s online storefront and Amazon — if you’re a Prime member — which is only $20 more than its all-time low. Not only is it one of the most affordable robovacs you can buy, but thanks to its dual rubber roller brushes and 5,500Pa of suction power, the entry-level Roborock model remains one of the best we’ve found at dealing with unwanted pet hair.

The lidar-mapping Q5 Pro features voice controls, digital keep-out zones, and mopping pads with an onboard reservoir, but no self-cleaning functions. This particular SKU doesn’t include a self-emptying base, but the 770ml dust bin is one of the largest you’ll find, so you can go a few weeks without touching it. That being said, Roborock sells a version with a self-emptying dock, which is also on sale right now for $329.99 ($270 off).

The Yeedi Cube is currently down to an all-time low of $299.99 ($260 off) at Amazon when you clip the on-page coupon for $190 off. It’s not easy to find a self-emptying / self-cleaning vacuum at this price, as those features are typically only available on robots that cost upward of $600 or more.

With 5,100Pa of suction power, the Cube can tackle most common vacuuming scenarios, though its single hybrid rubber / bristle brush can get easily tangled with pet hair. It mops better than most models in its range, however, namely because its vibrating microfiber pads can actually scrub your floors. The Cube uses lasers for object avoidance, too, though it’s not as effective for navigation as those with lidar and AI smarts. It can avoid large furniture and other objects, but it might need your help rerouting around cables, toys, and laundry. Still, we found it navigates better than most other robots under $300.

CryptoCurrency

The Cynics and Idealists of Bitcoin

There is something to the stereotype of naive dreamers and idealists, or cold hard realists and cynics. Stereotypes don’t just come into being baselessly, there is a kernel of truth to them, otherwise they would not have spread virally as an idea in the first place. But they, as well as the worldviews they espouse, are also exaggerated beyond that kernel.

Bitcoin is currently stuck in a game of tug of war between the naive idealists and the jaded cynics.

On one hand, the idealists argue that we already won. We don’t have to do anything, Bitcoin is magically guaranteed success. It’s already going to take over the world, everyone is going to own it, it is the best store of value ever. That’s all it needs to win and succeed. No improvements needed.

On the other hand, the cynics argue that we’ve lost, or are going to. That short of a total overhaul changing Bitcoin drastically, there is no way Bitcoin can succeed in the world. It will become captured and useless. “Who knows where to start?” is the response to asking for what improvements are needed.

Both of these extremes dominating the public dialogue sweeps attention away from two important things, the reality of what can already be done with what we have, and how substantially that reality can be expanded with even very small and simple improvements.

As things stand right now, Bitcoin to have any degree of censorship resistance and privacy for a big portion of the world would depend on custodians. The best we can do in that regard is lots of small and local chaumian ecash mints, but to run an ecash mint requires running a Lightning node.

Lightning is complicated, and screwing up and losing the most recent channel state can lose all of your money. The design allows your counterparty to steal all of your funds if you try to use an old channel state after updating it. CTV + CSFS would give us LN-Symmetry, a type of Lightning channel giving a new way for channels to work. Instead of using an old state allowing the other party to take all your money, LN-Symmetry channels would allow them to just “cut through” all the intermediary states and spend your old state into the most recent one on-chain, ensuring everyone gets the correct amount of money.

That one small change (and that is by no means all CTV + CSFS enables) would radically change the landscape of who would be capable and willing to run a local ecash mint. The risk of losing everyone’s money through incompetence would almost disappear.

This one small new functionality would heavily improve Bitcoin’s odds of staying private and censorship resistant. Does it scale self custody to the whole world? No. Does it drastically improve Bitcoin’s value despite store of value maximalists’ claim improvement isn’t needed or possible? Absolutely.

Bitcoiners need to stop focusing solely on the extremes and poles when it comes to possibility in this space, there is a wide open field mostly unexplored between them. If we really want to know our odds of success, the limits of what we actually can and can’t do with Bitcoin, then we need to explore that field.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Business

Trump’s new economic war

The televised image of Donald Trump towered over delegates in a conference hall in the ski resort of Davos on Thursday, embodying the outsized impact the new president has had just a few days into his second term in the Oval Office.

Prime ministers, business leaders and the president of the European Central Bank had queued up to see him address the World Economic Forum, his first speech to a global audience since returning to the White House. One attendee joked about fetching some popcorn for the show.

Trump did not hold back, provoking nervous laughter as he issued a series of demands and ultimatums to allies and rivals alike.

Saudi Arabia and other producers must cut oil prices, global central banks “immediately” needed to slash interest rates, and foreign companies must ramp up investments in US factories or face tariffs. The EU — which came in for particular opprobrium — must stop hitting big American technology companies with competition fines.

“We are going to be demanding respect from other nations,” the president said. His predecessor had “allowed other nations to take advantage of the US. We can’t allow that to happen any more.”

Trump’s demands came amid a frenetic first week in office in which the president launched a blitzkrieg of executive orders and announcements intended not just to reshape the state but also assert America’s economic and commercial supremacy. Tariffs of up to 25 per cent could be slapped on Canada and Mexico as early as February 1, riding roughshod over the trade deal Trump himself negotiated in his first term.

China could face levies of up to 100 per cent if Beijing failed to agree on a deal to sell at least 50 per cent of the TikTok app to a US company, while the EU was told to purchase more American oil if it wanted to avoid tariffs. Underscoring the new American unilateralism, Trump pulled the US out of the World Health Organization, as well as exiting the Paris climate accord for a second time.

Strikingly, Trump reached for an obscure, 90-year-old provision in the US tax code to threaten a doubling of tax rates for foreign nationals and companies if their home countries were deemed to have imposed “discriminatory” taxes on American multinationals.

This proposal throws a “hand grenade” at international tax policymaking, says Niels Johannesen, director of the Oxford university Centre for Business Taxation at Saïd Business School. The move suggests a determination to “shape other countries’ tax policy through coercion rather than through co-operation”, he adds.

The plans unveiled this week by the new president raise the spectre of a multi-front economic war as Trump uses the power of America’s resurgent economy to rebalance the international order in his favour.

The key question, say investors and policymakers, is whether this amounts to a more intense version of the transactional, dealmaking approach seen in Trump’s first term, or a shift towards unbridled unilateralism, where a White House unbound by the constraints of international law cajoles and intimidates foreign governments and businesses.

“He’s weaponising everything: trade, tax and energy. I’m worried that finance will get weaponised too,” says the head of one of the world’s largest sovereign wealth funds. “Most people are betting that he cares about the stock market — that’s the only check. That and the fact that he has said he wants to be a peacemaker.”

In Davos, leading US executives were eager to cheer Trump’s agenda — suggesting there is little anxiety within the corporate sector about the US potentially rupturing the global rules-based order.

Tariffs are an “economic tool. That’s it,” said Jamie Dimon, CEO of JPMorgan Chase, in a CNBC interview at Davos this week. “If it’s a little inflationary, but it’s good for national security, so be it. Get over it.”

The US stock market rallied this week as investors digested the prospect of an easing of regulations governing banks and high-technology companies, as well as the announcement of a massive $100bn artificial intelligence infrastructure project launched by OpenAI and SoftBank. By the end of the week (as of late Friday afternoon in New York), the S&P 500 index was up 1.8 per cent.

“Anecdotally, people talk to CEOs and say they all feel super-positive,” says Mahmood Pradhan, head of global macro at Amundi Investment Institute.

“If I ask myself what justifies the animal spirits, the banking deregulation stuff is real and the prospect of lower corporate taxes is real.”

Yet, outside the US, the threat of a widening array of trade barriers and conflicts over tax policies is weighing on the economic outlook. Valdis Dombrovskis, the EU’s economics commissioner, says a fracturing of global trade would be of particular worry to economies like Europe, where trade accounts for more than a fifth of GDP.

He cites IMF estimates showing that extreme geoeconomic fragmentation in trade could wipe out 7 per cent of global GDP over the medium run. “If this global economic fragmentation settles in — and there is a risk of that — it is going to have sizeable negative economic consequences.”

Even while bracing for a tariff onslaught, though, some European policymakers claim to see potential upsides.

“It is a new environment which is definitely less comfortable for Europe, but which also offers a lot of opportunities,” says Alexander de Croo, Belgium’s prime minister. “Europe can show there that we have stability and that you are in a predictable environment where investment can take place.”

European officials also say they could benefit from deeper trade ties with other countries that may be squeezed out of US markets. “Countries are coming to us because they want to diversify away from the US,” says a senior EU official.

“We need to keep on being open but not being naive,” says Spanish economy minister Carlos Cuerpo. “We need to have our companies competing under equal footing, equal conditions and a level playing field with respect to others. That was the case with China. That will need to be the case also with the US.”

While the US and Europe have long railed against Chinese trade practices, Beijing was quick this week to present itself as an upholder of the global, rules-based order rather than its nemesis.

Speaking the day after Trump was inaugurated, Chinese vice-premier Ding Xuexiang insisted that economic globalisation “is not a ‘you lose, I win’, zero-sum game”. The largest countries of the world needed to “lead by example” he said, praising international bodies including the World Trade Organization and UN.

The irony of China presenting itself as a free-trading paragon while Trump seeks to extract concessions from his closest allies by brute economic force was not lost on Davos attendees watching Ding’s performance.

Despite the barrage of measures and statements fired out by the White House this week, most global policymakers are taking a wait-and-see approach to Trump’s aggressive transactionalism, rather than leaping to conclusions about the longer-term ramifications for the global economic system.

“Why put my cards on the table before he has?” says the senior EU official.

Jonathan Reynolds, the UK’s business secretary, acknowledges there remain “lots of questions” about the president’s approach. “Is it about leverage around negotiations? Is it about revenue-raising in terms of tariffs?” The UK, he says, will continue to argue for a “much more open, global trading economy.”

There is little question, however, that Trump is signalling a significant escalation in how he will wield trade as a weapon compared with his first term.

“Those around Trump have had time to build up a systematic, methodological approach for protectionist trade policy and it shows,” says former UK trade department official Allie Renison, now at consultancy SEC Newgate. The approach will be to build up a case file of “evidence” against countries, she says, and then use it to extract concessions in areas of both economic and foreign policy.

The question remains how far Trump is willing to go. The danger of trampling on the rules-based order, says Jeromin Zettelmeyer, head of the Bruegel think-tank, is a complete breakdown in the diplomatic and legal channels for settling international disputes.

If Trump were to pull out of a wider range of international frameworks, such as the WTO or the IMF, he warns, then the arrangements that help govern the global economy could get “substantively destroyed”.

The extreme case, he adds, is that “they really do a Putin” — namely by violating the sanctity of international borders. Taking control of Greenland or the Panama Canal by force, as Trump has threatened, would amount to “the reintroduction of the law of the jungle”.

Michael Strain, director of Economic Policy Studies at the American Enterprise Institute think-tank, questions whether Trump will reverse the “fundamental forces” that drive global economic integration — and whether the president even wants to do so. But regardless, he says, the uncertainty about his true intentions “makes it hard for business to plan, creates a chilling effect on investment, and creates tensions with our allies.”

Some caution against being awestruck by Trump’s threats or his espousal of capitalism without limits, because his agenda was so incoherent.

“What we are seeing is huge doses of American hubris,” says Arancha González, dean of the Paris School of International Affairs at Sciences Po. “We are blinded by the intensity of all the issues put on the table and by Trump’s conviction. But we are not looking at the contradictions. It’s like we are all on an orange drug.”

Additional reporting by Harriet Agnew in Davos and Peter Foster in London

Data visualisation by Keith Fray

Technology

ElevenLabs has raised a new round at $3B+ valuation led by ICONIQ Growth, sources say

Companies that want to build AI voice into their products are rushing to work with ElevenLabs, the startup that develops synthetic voice technology like voice cloning and dubbing tools. Now ElevenLabs is turning up the volume on its business with a huge series C raise, just a year after a sizable series B.

The New York startup has closed a Series C of $250 million at a valuation of between $3 billion and $3.3 billion, multiple sources tell TechCrunch. The round is being led by ICONIQ Growth, several people said. Andreessen Horowitz, one of the lead investors in the company’s $80 million Series B in January, 2024, was another name mentioned as a potential investor in this round. ElevenLabs, ICONIQ Growth and Andreessen Horowitz did not respond to our request for comment.

For months, investors have been scrambling to invest in ElevenLabs after a blockbuster period of growth for the company, with its AI audio technology getting used everywhere, TechCrunch was the first to report in October.

On the back of a strong funnel of business, sources tell us that ElevenLabs was initially looking for funding at a $4 billion valuation. But a $3 billion valuation is still triple the unicorn valuation that the company landed with that year-ago Series B. One source said the company has been preparing to announce the round this month so official confirmation may come any day now.

ElevenLabs’ fundraise comes after a strong few years both for the company and the wider industry. The company was founded in 2022 by Mati Staniszewski and Piotr Dabkowski who respectively previously worked at Palantir and Google. Childhood friends from Poland, the pair were inspired by the poor quality of dubbing in the American videos they watched growing up, and they saw an opportunity to use AI to develop something better.

Their idea was a clear example of right idea-right time. As generative AI services have become more advanced, multimedia has come to the fore, and there has been a growing interest in building applications that include sound and video alongside GenAI text services.

ElevenLabs released its first beta product in January 2023, and by the time it had raised its Series A of $19 million in June 2023, it had gone viral.

Some of that growth has not been without controversy, with stories of fake news being created with its tech. But as ElevenLabs has developed a raft of detection tools and other safeguards to prevent misuse, it has emerged as a key partner for enabling speech-based services for an increasingly high-profile number of businesses.

Its technology, usable via an API and priced at a number of usage tiers, covers a wide range of use cases: translating text to speech (in multiple languages), cloning voices, changing voices in an audio track, creating entirely new voices; alongside other voice editing tools.

Customers include other technology platforms such as Syntheisa, the text-to-video startup that works with businesses and itself announced a fundraise of $180 million earlier this month; publishing giants like Washington Post, Harper Collins and Bertelsmann, which says 36 businesses are using ElevenLabs’ tech in their content creation; and gaming companies, among others.

Usage has led to a rapid rise in sales. In October, sources told us that ElevenLabs’ annualized recurring revenue (ARR) had grown from $25 million in 2023 to $80 million. Two people in November estimated that its ARR was likely closer to $90 million. If the latter figure is accurate, a $4 billion valuation would have put its valuation multiple at 44 times ARR; in the end it seems the deal has been done at a slightly more moderate multiple of 37 times ARR.

For some context on that number, these are not the most exuberant valuations at the moment: investors appear willing to pay as much as 50 times ARR for the fastest-growing generative AI companies.

Anysphere, the maker of a popular AI-coding assistant Cursor, has received multiple unsolicited offers valuing the company at about $2.5 billion, which translates to about 52 times ARR, TechCrunch reported in November. The company has seen its revenue grow from $4 million annualized recurring revenue (ARR) in April to $4 million a month as of last month. (ARR is commonly calculated by multiplying the latest monthly revenue by 12.) However, by the time the deal, which was led by Thrive at a valuation of $2.5 billion, was announced earlier this month, Anysphere had reached $100 million in ARR, The New York Times reported. That implies that the company was valued at 25 times ARR.

ElevenLabs’ more temperate multiple may be a function of the company’s competitors, which include a plethora of startups but also giants like Google and OpenAI.

Other past backers of the company have included Sequoia, Credo Ventures, Concept Ventures, Salesforce Ventures, Disney, and nearly two dozen high-profile angel investors.

CryptoCurrency

This Ripple (XRP) Rival Has Gone Viral In The Past Week Surging Past $5.8M Raised In Its ICO's First Month

Ripple (XRP) is currently trading at $3.08 and has experienced a slight decline of 5% over the past 24 hours. Despite its established presence in the cross-border payments sector, Ripple (XRP) is encountering fresh challenges from emerging competitors. Remittix (RTX) in particular is stealing some of Ripple’s spotlight away with a modern offering in the global payments space. This powerful PayFi solution promises to address long standing issues in this lucrative market, as it gears up to dominate PayFi in 2025. So what key features are drawing so many to Remittix (RTX)?

Ripple (XRP) Price Declines Following Mid January Surge

Ripple (XRP) has been wobbling significantly in January, having risen by 40% in just a few days but ending the week up by a net 2.47%. Based on on-chain analytics, Ripple has a market capitalization of about $181.2 billion and a circulating supply of 57,564,441,898 XRP tokens. The Relative Strength Index (RSI) sits at 52 suggesting a neutral market sentiment. The Moving Average Convergence Divergence (MACD) points at a possible consolidation phase without clear momentum in either direction. It appears that Ripple’s most recent surge has come to an end but what’s next is unclear for the moment.

Remittix Disrupts the PayFi Space

Remittix is leveling up the cross-border payments market. The hefty fees and transaction times that come with traditional payment systems have long bothered both individuals and businesses. Now, Remittix wants to end those problems for good.

Through the platform, users can change more than 40 cryptocurrencies to fiat currency and transfer funds worldwide. Transactions are completed within 24 hours and flat-rate pricing eliminates hidden fees typical of legacy systems.

Another key draw for businesses is the Remittix Pay API, which enables companies to accept cryptocurrency payments while seamlessly settling in fiat currencies. With support for over 30 fiat currencies and 50 cryptocurrency pairs, this API simplifies financial operations for organizations operating across borders.

Remittix (RTX) is also designed with privacy and security in mind. Transactions are processed as standard bank transfers, concealing their cryptocurrency origins and making the platform accessible for both seasoned blockchain users and newcomers. This approach ensures that businesses and individuals can integrate digital assets into their workflows without unnecessary complexity.

Remittix is also focused on advancing financial inclusion. By offering its solutions 24/7 without reliance on traditional banking infrastructure, Remittix provides vital access to underbanked populations. This initiative helps bridge the gap in global finance, empowering users who might otherwise be excluded from the modern economy.

Remitix Presale Continues To Boom, Surpassing $5.8 Million

Remittix is soaring in presale, having raised over $5.8 million already with tokens priced at $0.0297. Analysts are forecasting an 800% price surge during the presale with even more substantial growth expected post-launch. As it continues to disrupt the PayFi space, Remittixis becoming one of the most promising crypto projects for 2025.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Ripple seeks deadline for cross-appeal brief in SEC case

Ripple Labs has requested a due date for its cross-appeal brief in its ongoing legal battle against the US SEC.

Business

Novo Experimental Weight Loss Shot Shows 22% Weight Loss

Novo Nordisk A/S rose the most since August 2023 after its experimental shot delivered as much as 22% weight loss in an early-stage trial. Madison Muller has more on Bloomberg Television.

CryptoCurrency

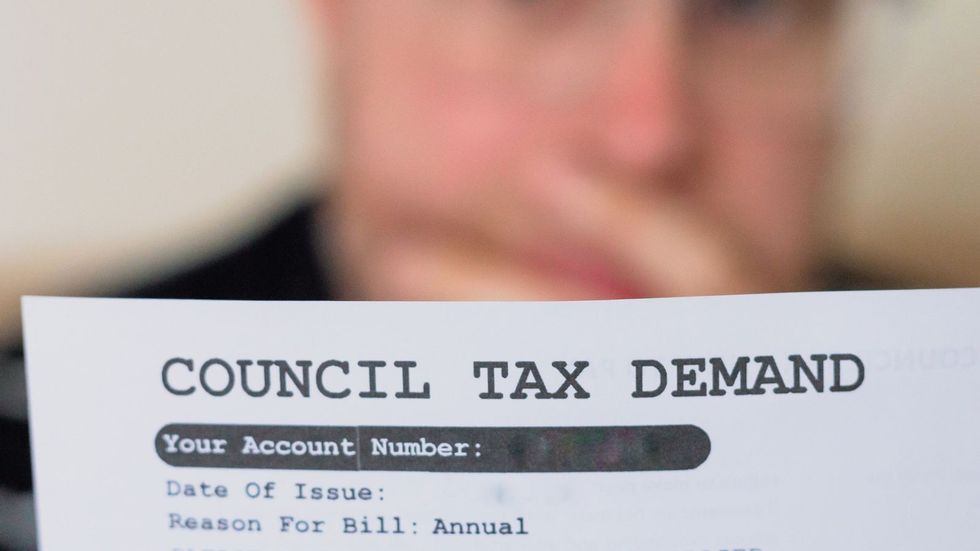

Council tax alert: Oxford set to hit second home owners with 200% charge

The council of one of Britain’s most famous cities is drawing up plans to charge residents a 200 per cent council tax bill in effort to generate more revenue for the local authority.

Oxford City Council has approved plans to double council tax charges on second homes in a move aimed at making the city “a fairer place to live” in a move than will impact hundreds of households.

An estimated 668 properties within the city council’s boundary will be affected by the new premium charge of 100 per cent.

The measure, which will require second homeowners to pay twice their standard council tax rate, is set to take effect from April 2025.

Earlier this week, the decision was finalised following approval from the authority’s audit and governance committee.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Oxford City Council is preparing to hike council tax on second homes

GETTY

The council had initially planned to implement the charge from April 2024, following its initial approval in February 2023.

However, these plans faced a setback in late December 2023 when council officers received guidance from the Government.

This delay came after officials were informed they needed to provide affected homeowners with 12 months’ notice following the legislation’s royal assent.

As a result, this requirement pushed the implementation date back to April 2025, as the legislation did not receive royal assent until October 2023.

Council tax bills are expected to go up this year

GETTY

Speaking after the committee’s approval, Oxford City Council’s deputy leader Ed Turner emphasised the fairness aspect of the new measure.

“We really want to make Oxford a fairer place to live,” he said. Turner added: “If people have a second home in Oxford, it’s only right that they make an appropriate contribution for local services.”

The deputy leader also highlighted the council’s eagerness to implement the charges, stating: “We need this money, and I think we will be charging from the first moment that we legally can.”

Oxford is not the only local authority floating raising council taxes on specific types of property owners.

Wandsworth Borough Council, where residents are known for paying the lowest council tax in the country, are preparing to target foreign investors who are buying London properties and leaving them vacant.

As of April 1, the Labour-run council will charge a 100 per cent council tax premium on homes which have not been lived in for 12 months.

LATEST DEVELOPMENTS:

Wandsworth is one of the wealthier boroughs in London but is looking to raise more council tax revenue

GETTY

Property owners who do not reside in the property for five years will have to pay 200 per cent more, while those who not live in the home for five years will be charged a 300 per cent penalty.

Those who are second home owners, who have furnished their property despite it not being their primary residence, will be hit with a double council tax bill.

Under previous tax rules, a property in Wandsworth needed to be empty for two years before being hit with a 100 per cent council tax rate.

GB News has contacted Oxford City Council for comment.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login