CryptoCurrency

Crypto Price Analysis January-24: ETH, XRP, ADA, BNB, and SOL

This week, we examine Ethereum, Ripple, Cardano, Binance Coin, and Solana in greater detail.

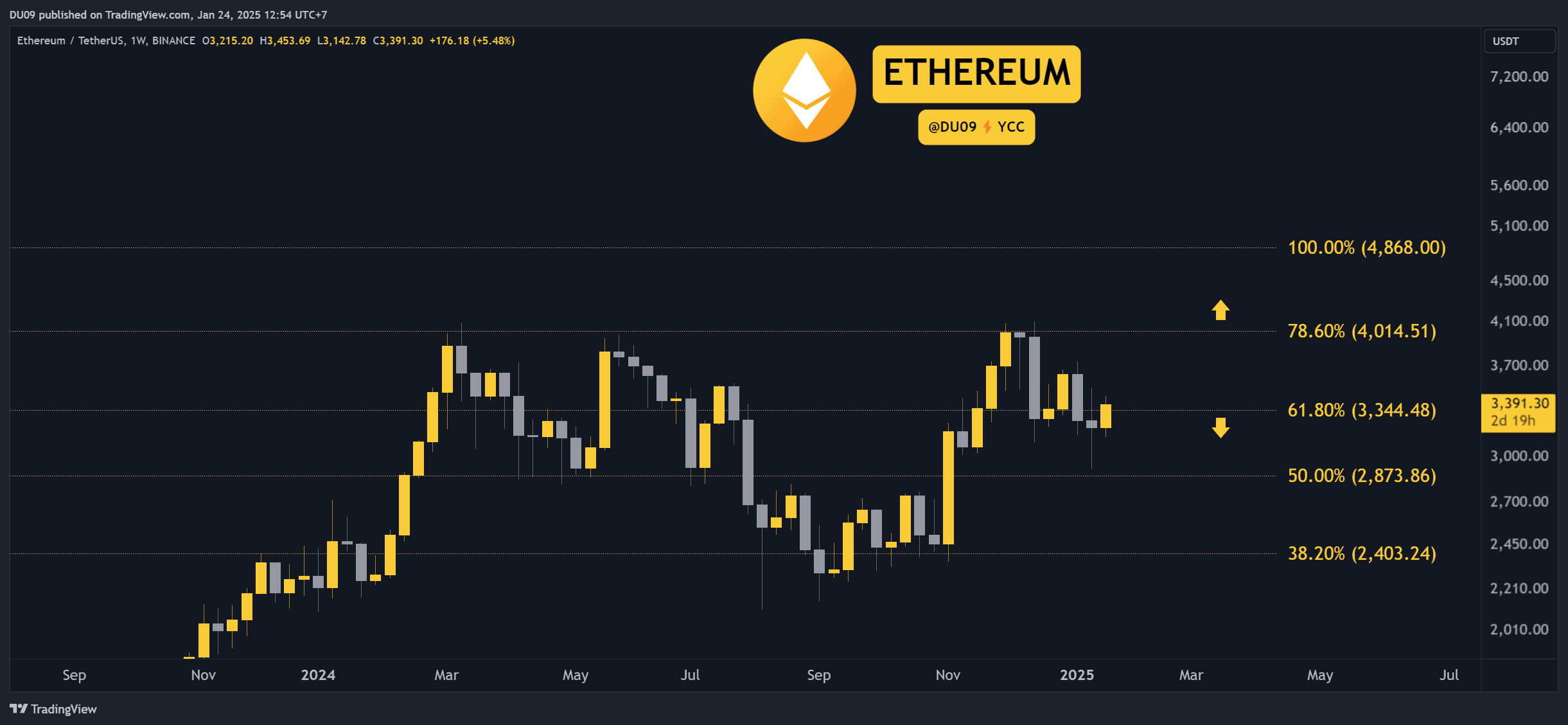

Ethereum (ETH)

Ethereum managed to hold above $3,300 and closed this week with a 1% price increase. While this is not much, it does show that buyers are resilient at this key support level. The longer this happens, the more confidence the market will have in ETH moving higher.

The current price action is also turning positive if we look at the momentum indicators on the daily timeframe. The MACD made a bullish cross recently and the RSI is making higher lows. These are early signals that Ethereum could soon wake up to challenge the resistance levels at $3,600 and $4,000 again.

Looking ahead, Ethereum could surprise the market with a sharp move considering it did not do much in the past month while other altcoins like XRP and Solana made new price records. Eventually, profits will rotate and Ethereum is definitely one of the top candidates for market participants.

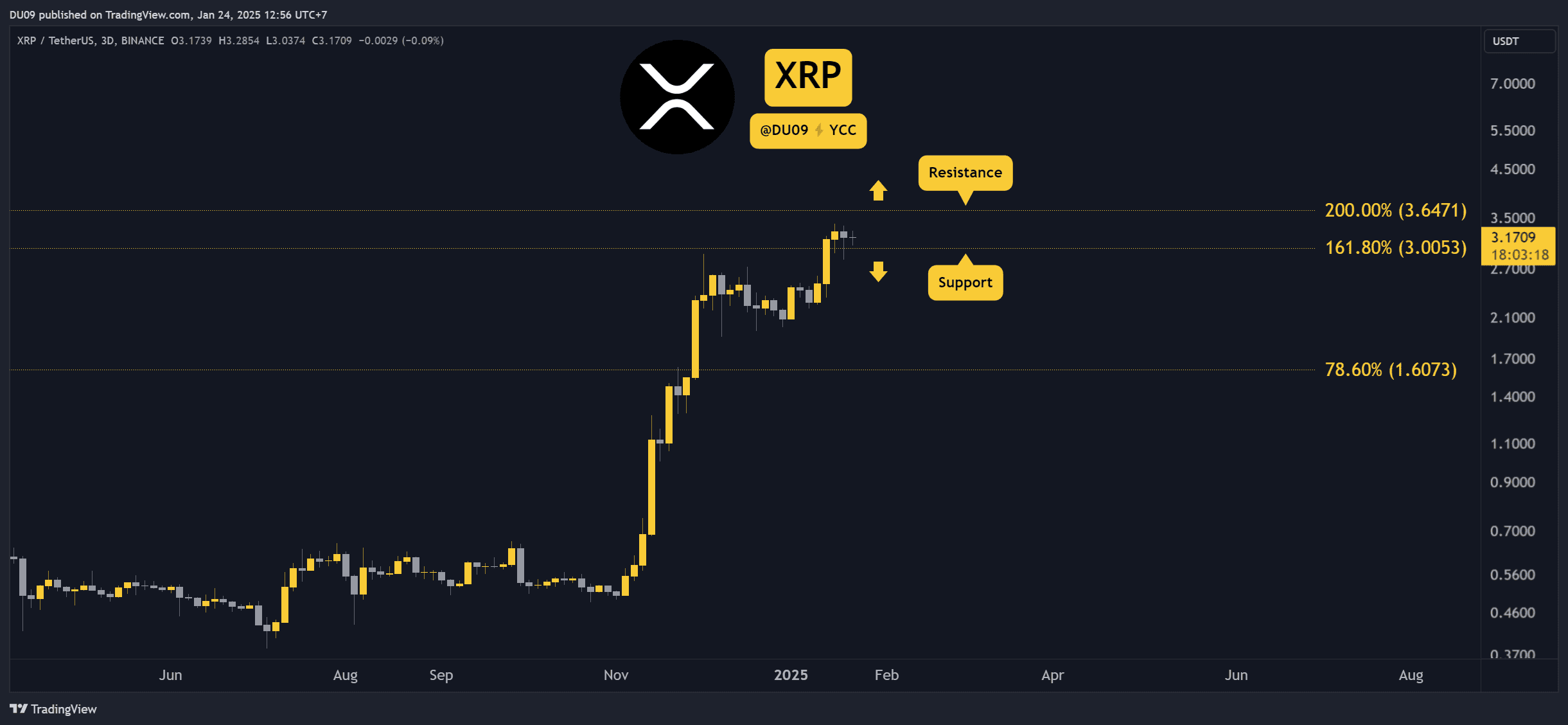

Ripple (XRP)

XRP is down almost 5% on the weekly chart after it failed to rally above $3.4. The price is currently around $3.2 at the time of this writing and buyers seem absent or uninterested. Therefore, the cryptocurrency has been consolidating above the $3 key support level.

As long as XRP stays above $3, there is a good shot at higher levels. But the longer buyers delay a clear breakout above $3.4 the more concerned holders will become. This is why it is critical for XRP to continue its rally.

Looking ahead, the coin seems at a critical junction here. A failure to move higher could soon be interpreted as bearish and see the price break under $3. On the other hand, breaking above $3.4 would quickly see XRP move towards $4 next.

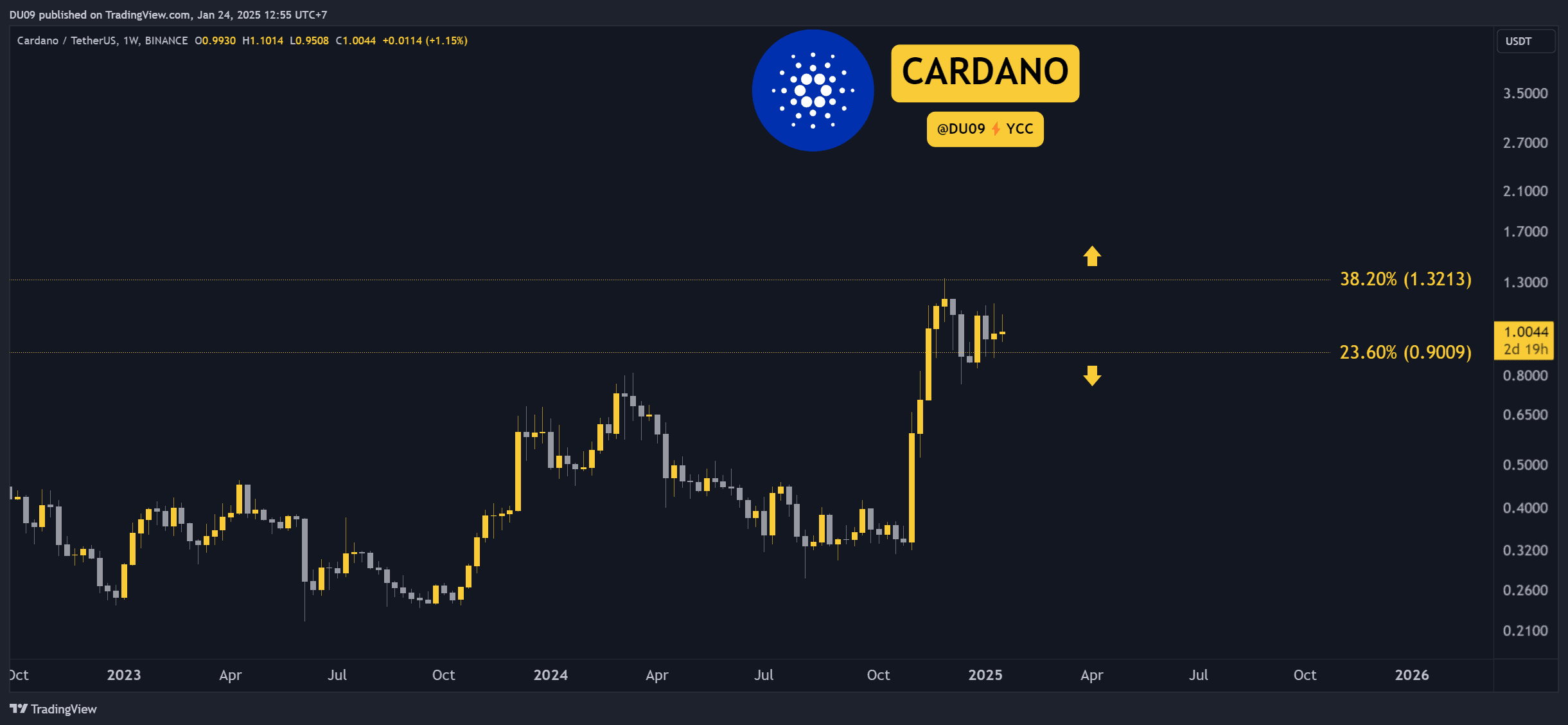

Cardano (ADA)

ADA is down 11% on the weekly chart after sellers pushed the price down from $1.1 to $1 which acts as a key support. So far, buyers managed to keep this cryptocurrency above this level, but momentum is not really on their side.

If we zoom out, ADA has been in a range since late November 2024 when it was rejected at $1.3 which also acts as an important resistance. The strongest support is found at 90 cents. As long as the price does not leave this range, the consolidation period continues.

Looking ahead, Cardano seems to be in an impasse which reminds us of XRP’s price action. A clean breakout is required to resume the bullish trend, but until it happens, any delay could test the patience of ADA holders.

-

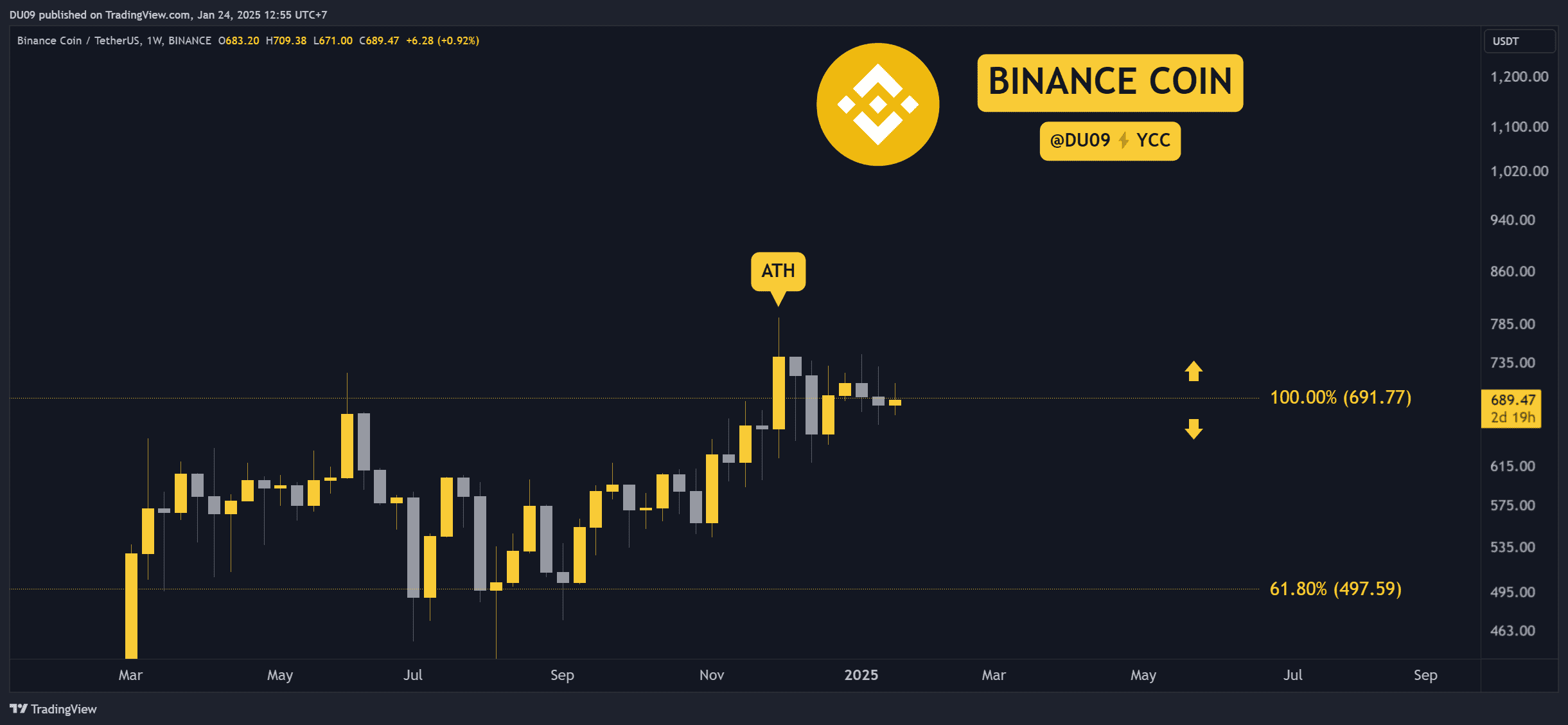

Binance Coin (BNB)

Binance Coin closes the week with a 4% loss after it failed to stay above $700. But sellers don’t seem too interested in taking BNB lower at this time. Hence, the price has been hovering around the key support at $690.

This lack of momentum has turned the action quite flat. What is worrying, however, is that the daily MACD has turned bearish this week. This could lead to additional selling pressure later on.

Looking ahead, BNB could fall to $650 if sellers return or even to $600. These are the next key support levels should $690 break in the next few days. If so, that would likely indicate an overall market correction that could also see ADA and XRP make lower lows.

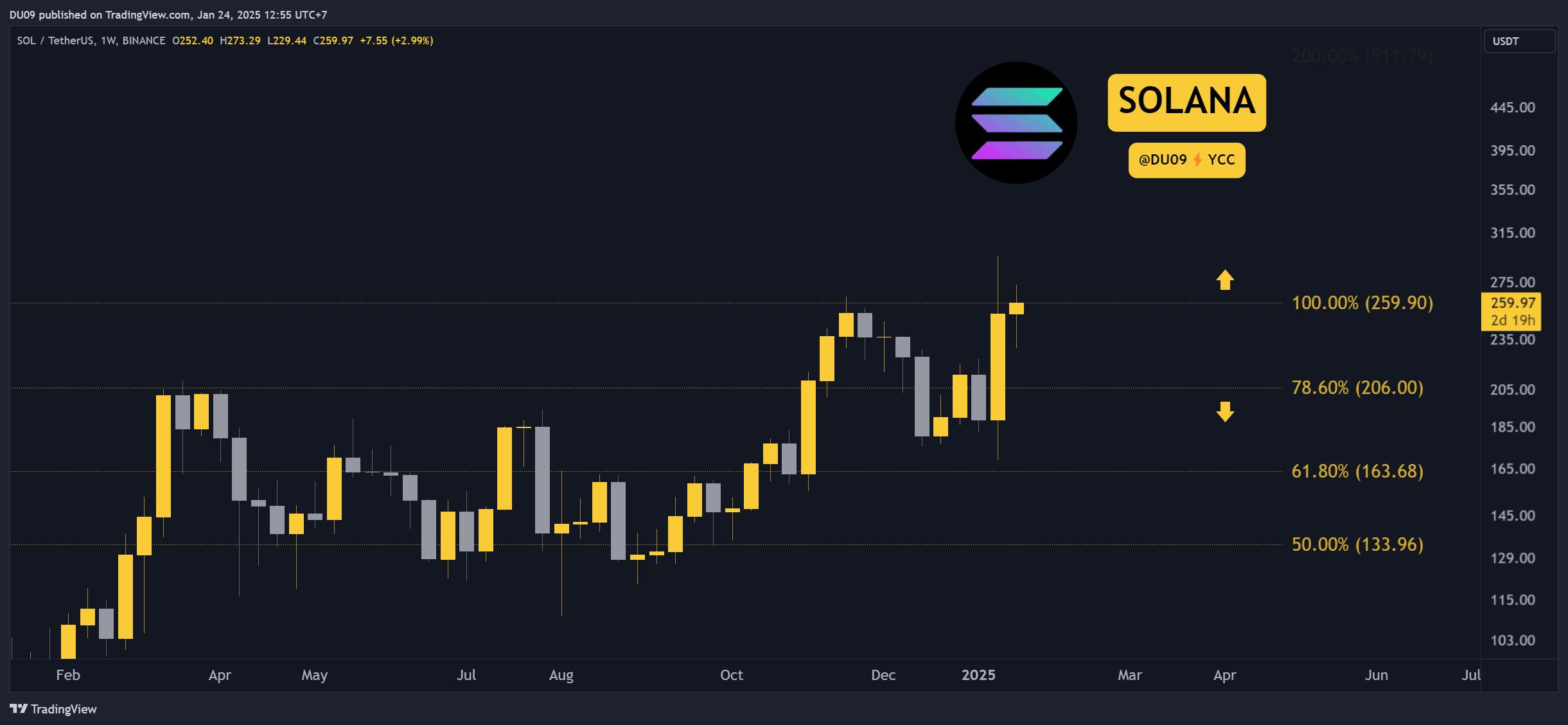

Solana (SOL)

Solana continues to impress with a 22% rally in the past week and a new record price at $295. This is mainly due to the renewed attention to its chain after Trump launched its own meme token on Solana last Saturday. With liquidity fighting to reach Solana from all other competing chains, SOL saw a huge influx of liquidity and demand. This quickly pumped its price.

Since then, the price entered a shallow correction that saw the price briefly drop to $230 before returning to $260 as of today. As long as the meme mania on Solana continues, this will sustain and push SOL’s price higher.

Looking ahead, while the Trump meme FOMO subsided since last week, new meme tokens are being released daily that attract liquidity to Solana. This is bullish for SOL’s price and could see it make new price records in the future that could exceed $300.

The post Crypto Price Analysis January-24: ETH, XRP, ADA, BNB, and SOL appeared first on CryptoPotato.

CryptoCurrency

Oversight committee Republicans launch debanking investigation

While Democrats are calling for an investigation into Donald Trump’s potential conflicts of interest on crypto, House Republicans said they would explore debanking claims.

CryptoCurrency

Raydium targets $10, CATZILLA steals spotlight with high growth potential

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

CATZILLA is stealing the spotlight from Raydium’s $10 target with its high growth potential.

While Raydium sets its sights on a notable target, the real buzz centers around CATZILLA. This emerging contender has investors talking about its potential to surge by high values.

CATZILLA: The meme coin redefining success

CATZILLA is generating a seismic buzz in the crypto world with its growth potential. This emerging meme coin is more than just a flashy newcomer — it’s a bold, community-driven project poised to challenge crypto norms and deliver massive returns.

CATZILLA’s mission is to confront greed, expose scammers, and create a fairer crypto ecosystem. With a rebellious spirit and a fierce drive for innovation, its rallying investors, meme enthusiasts, and DeFi advocates to join its mission of decentralized financial empowerment.

CATZILLA isn’t just another fleeting meme coin. It’s designed with longevity and value at its core, offering early investors an incredible 88% presale discount. Starting at $0.0002, its 14-stage presale gradually increases prices, ensuring those who act early benefit the most.

Triple utility power:

- Governance – Empowering the community to shape CATZILLA’s future.

- Incentives – Rewarding active engagement and contributions.

- Staking – Offering opportunities for passive income by holding and staking CATZILLA tokens.

By blending humor, financial opportunity, and a transparent roadmap, CATZILLA is turning heads as a serious contender in the meme coin arena.

CATZILLA’s strength lies in its passionate community and commitment to inclusivity. It’s a platform where creativity meets innovation, uniting seasoned investors and meme fans in a collective pursuit of financial freedom.

Whether for the laughs, the gains, or the mission, CATZILLA promises a fresh approach to crypto — a space where collaboration thrives and possibilities are endless.

Interested investors can join the CATZILLA movement via presale.

Raydium eyes further growth

Raydium’s recent surge is catching eyes as its price maintains between $5.79 and $8.67. With a 6-month climb of over 227%, the potential for more growth is compelling. The nearest resistance sits at $9.57, signaling a pivotal point. If broken, the path to the second resistance at $13.07 opens, hinting at more than a 50% gain from current levels.

The RSI at 43.34 suggests room to run before overbought levels. The MACD’s positive nature bolsters this bullish sentiment. Recent 1-week and 1-month gains of over 39% and 54% respectively reflect growing momentum. As traders eye these levels, Raydium’s future looks promising in what could be shaping up to be an altcoin season.

Conclusion

While coins like RAY show limited short-term potential, Catzilla stands out as a meme coin aiming to bring financial freedom. With a 700% ROI potential during its presale — starting at $0.0002 and rising to $0.0016 over 14 stages — it offers governance features, rewards for loyalty, and staking options. Catzilla looks to unite enthusiasts to challenge toxic systems and reach new heights.

For more information on Catzilla, visit their website, X, or Telegram News.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Ethereum Achieves 17x Scaling with Layer 2, but Challenges Persist, Says Buterin

Layer 2 protocols have played a critical role in scaling the Ethereum network. The blockchain’s co-founder Vitalik Buterin noted that Layer 2s in 2025 represents a significant evolution from their experimental beginnings in 2019, having achieved certain decentralization milestones, secured billions of dollars in value, and scaled Ethereum’s transaction capacity by 17-fold, all while simultaneously lowering fees.

However, Buterin stated that challenges remain, particularly around scaling and heterogeneity.

Blob Space and Interoperability Challenges

In his latest blog post, Buterin pointed out that Ethereum’s current blob space – a resource for storing and processing data on the blockchain – barely meets the demands of today’s Layer 2s and their use cases. As such, this limitation could hinder the platform’s ability to accommodate future growth.

Additionally, the heterogeneity of Layer 2s creates challenges when it comes to interoperability, composability, and user experience.

While Ethereum’s initial vision for scaling involved a shard-based system of homogenous blockchains, Buterin noted that Layer 2s have instead evolved into a fragmented ecosystem of chains created by different actors, each with different standards and infrastructure requirements.

To address these challenges, the Ethereum co-founder outlined several key steps. On the Layer 1 side, Ethereum must accelerate scaling blobs and expand the Ethereum Virtual Machine (EVM) and gas limits to handle activities such as proofs, large-scale DeFi, deposits, withdrawals, and mass exit scenarios.

On the Layer 2 front, he stressed the need for improved security, ensuring guarantees such as censorship resistance, light client verifiability, and the absence of trusted parties. Interoperability across Layer 2s and wallets must also be prioritized to enable easy interactions across chains through standardized addresses, message-passing protocols, bridges, and efficient cross-chain payments.

For users, Ethereum should feel like a unified ecosystem rather than a collection of disparate chains, Buterin added.

Strengthening ETH as a Triple-Point Asset

Buterin also stated that Ethereum’s future as a strong triple-point asset – functioning as a store of value, medium of exchange, and unit of account – requires a “multi-pronged” strategy to maximize the value of ETH.

The first step is to cement ETH as the primary asset across the combined Layer 1 and Layer 2 Ethereum economy. This includes prioritizing ETH, the main collateral for decentralized applications and financial ecosystems.

Next comes incentivizing Layer 2s to allocate a portion of their fees toward the broader Ethereum ecosystem, which could generate sustainable funding. This may involve burning part of the fees, staking them, or channeling proceeds into public goods for the Ethereum network.

Third, while rollups offer opportunities for Layer 1 to capture value through MEV, it’s important to maintain flexibility, recognizing that not all rollups can adopt this model due to different application requirements. Finally, Ethereum could explore raising the blob count as a potential revenue stream.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

XRP Forms A Bullish Pattern In 4-Hour Chart – Analyst Expects $4.20 After Breakout

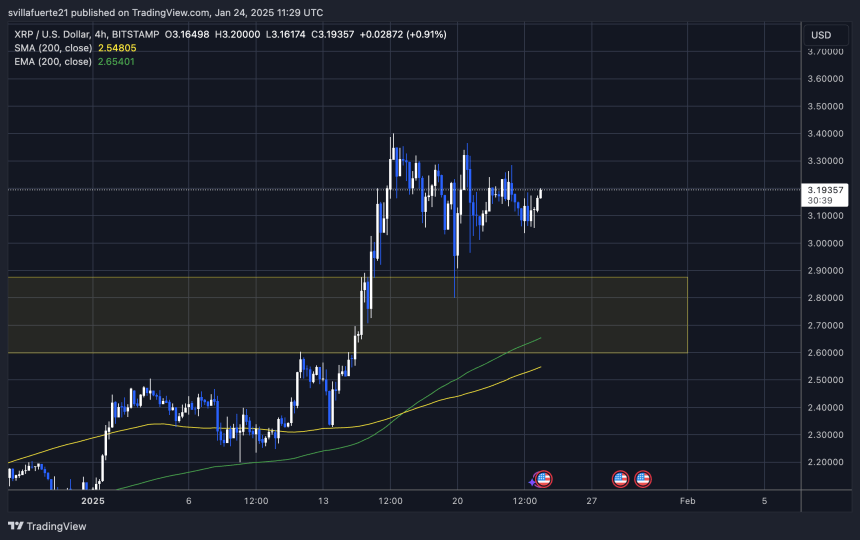

XRP is currently at a critical juncture, trading at a key level after breaking its all-time high just eight days ago. Despite the market’s inherent volatility, price action remains robust, fueling optimism among investors and analysts. As the broader crypto market enters a bullish phase, XRP is gaining attention as a potential leader in the next major rally.

Related Reading

Market sentiment is growing increasingly positive, with analysts predicting a massive move into price discovery. Among them, crypto expert Carl Runefelt has shared an intriguing technical analysis on X, highlighting a bullish setup for XRP. According to Runefelt, the price is forming a bullish pennant pattern on the 4-hour timeframe, a classic indicator of potential upward continuation. This pattern suggests that XRP is consolidating before a significant breakout, which could propel the price into uncharted territory.

As excitement builds, investors are watching closely to see whether XRP can sustain its momentum and capitalize on the bullish market environment. A breakout from the bullish pennant could confirm XRP’s trajectory toward new milestones, reinforcing its position as one of the market’s most dynamic assets.

XRP About To Enter Price Discovery

XRP is on the verge of entering price discovery as the broader crypto market signals a bullish rally. Following a strong pump in early November, XRP’s price action has remained resilient, fueling optimism for substantial gains in the months ahead. As the market flirts with a decisive phase, XRP continues to stand out as a top contender for life-changing returns for investors and traders.

Renowned crypto analyst Carl Runefelt has shared an insightful technical analysis on X, highlighting a bullish setup for XRP. According to Runefelt, the price is forming a bullish pennant pattern on the 4-hour timeframe, a classic indicator of potential upward continuation. Based on this setup, Runefelt has set a price target of $4.20 in the coming weeks, aligning with broader expectations of a market-wide rally.

The bullish pennant suggests that XRP is consolidating before its next major move. If the pattern holds, the breakout could propel XRP into uncharted territory, confirming its position as a leading asset in this market cycle.

Related Reading

As the market gears up for a potentially explosive phase, XRP is well-positioned to capitalize on the momentum. With its strong price action and favorable technical setup, XRP has the potential to deliver significant returns. Investors and traders are closely watching as XRP prepares for its next move, with anticipation building for what could be a pivotal rally.

Price Testing Critical Levels

XRP is currently trading at $3.19, following a massive surge above its previous all-time high last week. The recent price action highlights XRP’s strength as it continues to attract investor interest during this bullish phase. However, the asset has entered a brief consolidation phase, which could signal preparation for its next move.

For bulls to maintain momentum and sustain the uptrend, reclaiming the $3.25 resistance level is critical. Breaking above this mark would likely reignite buying pressure and pave the way for another push toward new all-time highs. Achieving this would reinforce the bullish structure and solidify XRP’s position as one of the market’s top-performing assets.

Conversely, holding above the $3.05 support level is equally important to confirm the ongoing trend. This level has become a key line of defense, and a breakdown below it could signal weakness, potentially leading to a deeper correction and testing lower demand zones.

Related Reading

As XRP consolidates, investors are closely monitoring these crucial levels. A breakout above $3.25 or a strong defense of $3.05 will provide clearer direction for XRP’s next move. The coming days will be pivotal in determining whether XRP can sustain its bullish momentum or face temporary headwinds.

Featured image from Dall-E, chart from TradingView

CryptoCurrency

It’s Easier Than You Think to Build With AI and Web3

Remember those middle-school writing prompts: Describe your favorite cookie.

Your teacher told you to write it as if to an alien, a being who had never encountered a cookie before, which meant touching on each sense – sight, sound, smell, touch, taste. You might not have realized it then, but describing something in a way that allows people to get a clear picture is actually quite hard.

Let me try to describe Matheus Pagani, founder and CEO of Venture Miner. Matheus is a male with light caramel skin and dark brown hair. Even though his hair is cut close, you can tell it’s curly. He’s got a thick dark brown, almost black beard, which connects to a mustache. His eyes are dark brown behind thin wire glasses. His bottom lip sticks out a little further from his top lip, giving him a look of assurance, but not arrogance.

Picturing him yet? How confident are you?

Oh yeah, and he’s Brazilian.

Got it?

Let’s see what Matheus Pagani actually looks like.

Is this what you had come up with in your head from my description? Doubt it. Whenever I told you he was Brazilian, did you accessorize him in bright colors and a feathered headdress? Something like this?

If so, check your bias, but also you’re thinking like an AI. That was what ChatGPT came up with from the prompt “some Brazilians having fun.” Pagani showed this and other examples spit out by our generative AI (Italians have fun by sitting around long tables with multiple generations eating pizza) during the AI2Web3 Bootcamp in NYC in early December.

The bootcamp, run by Pagani and Build City, brought together 59 participants across all skill levels to learn how the two buzziest (and often misunderstood) technologies can be brought together to create useful products and services. Pagani used a version of the middle-school assignment to explain how and why AI made the significant leaps that have kept us all excited and on edge over the past few years. Before there was largely only text data being used to train AIs, and as the exercise highlights, that only goes so far. But mix text information with visual data, and you get a fuller picture.

And understanding this, getting hands on with both AI and blockchain technology to understand its core components is what the bootcamp was all about. For Pagani, these skills are going to be relevant for nearly all people – engineers, tech users, journalists, artists, doctors – real soon.

“We want to join brilliant minds from all backgrounds to come and work with AI and Web3, since the junction of their multiple perspectives can uncover new use cases that we would never envision just with a specialized Web3 or AI mindset alone,” Pagani said. “Nowadays we have tools to easily enable any non-technical enthusiasts to build practically functional applications and systems just with “plain English,” so what matters is bringing passionate people interested in solving problems together with the proper education. When you have this combination, you just need to light the match and watch it burn.”

Mind-Boggling Building

What makes the intersection of these two technologies so exciting is just how much you can build in such a short amount of time without really any prior technical experience.

Not only will AI source whole codebases with the right prompt, but the crypto industry is also building tools to help make developing at the intersection of both more intuitive and accessible.

For instance, Coinbase, who sponsored the bootcamp, launched AgentKit in November. The framework allows developers to build AI agents with their own crypto wallets, enabling the agents to interact autonomously with blockchain networks. This could be used to build a squad of agents that can monitor the markets and execute trades automatically based on predefined rules and guardrails.

“One day, we’ll have AI agents own their own cars and operate their own taxi service that gets paid by customers in crypto and then uses that crypto to purchase repairs,” Lincoln Murr, associate product manager at Coinbase, told the attendees.

Coinbase currently has a grants program ongoing for building with AgentKit. “What you build doesn’t have to be useful; we have a bias towards cool stuff,” Murr told the bootcamp, hoping to inspire projects and applications that no one has yet thought of.

Ora Network also has an interesting model for developers looking to build AI-enabled Web3 applications or vice versa. The network allows developers to utilize current large language models, including Meta’s Llama3 and Stable Diffusion, but it also enables developers to build their own models and offer a so-called initial model offering (IMO) to crowdfund its continued development.

“It’s kind of winner-takes-all right now in AI, but with this model, we’re allowing the crowdfunding of AI building and training, so people can have a share of the models, which is empowering if we think these models will run society in a decade,” Alec James, partnerships and growth lead at Ora, said during the bootcamp. “If that’s the case, we’ll want that development distributed.”

Near, Fleek and Alora were also among the companies that sponsored the bootcamp and presented their various tools and programs for building at the intersection of these two innovative technologies.

Can Devs Do Something?

During the final day of the bootcamp, nine teams presented working prototypes for projects that blended Web3 and AI. These projects ranged from AI assistants meant to help you pick gifts, order delivery or diversify your financial portfolio to applications to help crypto operators pump out memecoins with big virality potential.

Jackie Joya, a participant who had flown in from San Francisco, said the bootcamp has really inspired her to keep building. With a background in animal science, Joya is still new to engineering, but was amazed how much a novice could build with the tools available.

Other participants, across all skill levels, said similar things. Choudhury Imtiaz, a market researcher from Bangladesh, who is in the U.S. on an H-1B1 Visa waiting for a placement, hasn’t heard of Web3 before the bootcamp, but was able to pitch a team project on the last day. And Isayah Culbertson, who has worked as an engineer for both crypto and AI projects separately, was able to learn skills for building with both, which he thinks has the potential to change the world for the better.

“I see the combination accelerating the research and development of so many different fields, while also allowing for a more equitable distribution of wealth generated from that R&D,” he said.

CryptoCurrency

Ethereum (ETH) and MultiversX (EGLD) Predicted Trend Reversal, While Monsta Mash ($MASH) Gains Momentum After Hitting $1M In Presale

Ethereum, once considered Bitcoin’s top competitor, has struggled as Bitcoin and other cryptos surged, partly boosted by President Trump’s endorsement. While Bitcoin experienced a 160% increase last year, Ether only grew by 45%. Meanwhile, the EGLD network is making strides with innovative decentralized applications and developer solutions, raising the question: how high can EGLD soar?Amidst this, the crypto market is buzzing with bullish momentum, shifting investor focus to emerging altcoins like Monsta Mash ($MASH). This viral newcomer is making waves with its explosive presale success and innovative gaming technology with projections of jumping to $3 and beyond. Let’s explore why $MASH might just be the top crypto to pick in the altcoin space!

Unlock Exponential Growth with Monsta Mash ($MASH) Presale

Analysts highlight $MASH’s appeal lies in its low entry price and potential for up to 1000x gains.Currently priced at $0.00365 in Phase 3 of its presale, $MASH is projected to surge to $0.00671 in the next phase. This promising trajectory is drawing significant attention from crypto whales, who are keen to capitalize on the anticipated growth. As excitement builds, $MASH continues to solidify its place as one of the top crypto to pick in the market.

Picture this: a $5,000 stake in $MASH at the presale price of $0.00365 bags you approximately $1,369,863 tokens. If $MASH climbs to $5 by 2026, your investment could skyrocket to an incredible $6,849,315. Sounds impressive, right?

Don’t miss out, secure your spot in the $MASH revolution today!

Maximize Your Investment with Exclusive 50% Bonus Offer on $MASH

Monsta Mash ($MASH) is setting the standard for presale excitement with irresistible bonuses. For the next 5 days only, grab a 50% bonus on your $MASH purchase using code MONSTA50; an unmissable chance to maximize your investment!

But the perks don’t stop there. Earn unlimited referral rewards by inviting others to join the movement, and stake your tokens on Mash Yield to enjoy impressive annual returns ranging from 8.5% to 19.3%.

With exclusive bonuses and unmatched rewards, $MASH is more than just a presale it’s your gateway to exponential growth. Secure your stake now in the top crypto pick and position yourself for incredible returns.

MultiversX and Ethereum: The Race for Recovery

MultiversX (EGLD) is trading at $31.25, reflecting a -1.13% drop in the past 24 hours and a 94.36% decline from its ATH. The token’s 24-hour trading volume is -26.60% down, with a market cap of $862.31M. Over the past week, EGLD has fallen -12.50%, underperforming the global crypto market (+1.80%) and Smart Contract Platform tokens (+1.30%). EGLD is predicted to surge to $39.52 by February 22, 2025

CoinPedia’s 2025 forecast suggests EGLD could reach $67.93, with a downside potential of $21.14, averaging around $49.

ETH has declined 0.48% over the past week, underperforming compared to the global crypto market. Currently priced at $3,240.48, ETH’s 24-hour trading volume stands at $24.53B, reflecting a 1.24% dip in the last 24 hours. However, ETH’s trading volume has risen by 6.50% compared to the previous day, pointing to an uptick in market engagement. Ethereum is projected to jump by 52.72%, potentially reaching $4,887.04 by February 22, 2025. Moreover Ash Crypto reports that Trump’s World Liberty Finance acquired over $58 million in ETH recently, signaling a potential price surge. Poseidon also predicts Ethereum could reach $5 by February.

Final reflections

Monsta Mash ($MASH) emerges as the leading new crypto opportunity, proving its resilience in volatile markets with rapid sales and exceptional rewards, including an engaging T2E game. Powered by an innovative GameFi framework and robust fundamentals, $MASH is poised for explosive growth, surpassing the performance of ETH and EGLD this year. Unlike the recent dips and sluggish momentum of ETH and EGLD, $MASH is on track to hit beyond $4 by 2026, delivering an impressive 300x+ ROI.

Get ready to level up! Download the Monsta Mash beta app NOW from the Google Play Store and Apple App Store.

Unlock your potential with $MASH;

-

50% Bonus Code: MONSTA50

-

Website: Monsta Mash Official Site

-

Buy Now: Secure Your $MASH Tokens

-

Telegram: Join the Community Chat

-

LinkTree: All Links in One Place

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

DePIN needs a more cohesive narrative for mass adoption — Web3 exec

According to data from CoinMarketCap, the decentralized physical infrastructure network sector has a market capitalization of over $27 billion.

CryptoCurrency

LINK and SUI losing ground

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

BeerBear, a new meme coin, is emerging as a potential rival to altcoin titans like Chainlink and Sui.

The crypto world is buzzing with speculation and profit-hunting, but not all coins are equal when it comes to massive gains. Altcoin titans like SUI and LINK may have solid reputations, but they’re losing steam. Meanwhile, a hidden gem called BeerBear is capturing the attention of speculators with its growth potential.

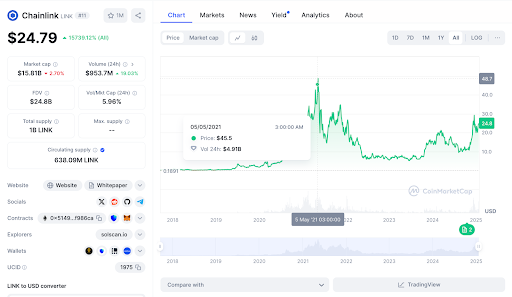

Chainlink

Chainlink has long been a favorite among altcoin fans, but its glory days appear to be fading.

The Chainlink chart reveals a history of volatility in recent years. Despite occasional recoveries, the asset has failed to maintain higher levels, indicating weak long-term momentum. LINK’s recent growth appears more like short-term speculation rather than a foundation for future gains. The chart lacks clear signals of stability or the potential for significant growth.

It’s hard to get excited about a coin that keeps teasing gains but fails to deliver. The LINK army is starting to dwindle, and the market sentiment is shifting toward other opportunities.

SUI

SUI entered the market with promise but its hype is wearing thin. The price has stagnated, and many experts are finding it hard to argue for any substantial upward movement. With trading volume declining and whales exiting the scene, SUI looks more like a fading star than a new powerhouse.

BeerBear

BeerBear aims to be a golden ticket to rapid gains and an adrenaline-charged crypto experience. While others are waiting and watching, smart investors are locking in.

BeerBear’s presale is heating up, with Stage 3 live at $0.0003 per token. The journey started at $0.0001, and every stage pushes the price higher, ultimately reaching $0.0020. This will offer early buyers the potential for a 1,900% ROI.

BeerBear is engineered for quick, massive growth, powered by features such as:

- The “Bar Brawl” Beat ‘Em Up Game: A genre-defining, action-packed experience. Think Final Fight, but for crypto – and every level-up means more rewards.

- Beer Points = bigger airdrops: Earn points with every token purchase and turn them into exclusive bonuses, NFTs, and premium game content.

Beer points reward system

Earn 6%-12% Beer Points based on the size of the token purchase:

- Small contributions ($10 – $250) earn 6% in Beer Points.

- Medium contributions ($1,000 – $2,500) earn 9% in Beer Points.

- Large contributions ($10,000+) unlock the maximum reward of 12% in Beer Points.

Example: A $700 purchase during Stage 2 earns 5,600 Beer Points, amplifying bonuses and rewards in the BeerBear ecosystem.

USDT-BSC multi-level referral program

- Earn big: Get up to 9% for direct referrals, plus additional bonuses for referrals made referees.

- Fast weekly payouts: No delays — rewards are paid out weekly to keep the profits flowing.

- Scale the network: Start small and go big, building a network that generates consistent and growing income.

Conclusion

SUI and LINK could be running out of steam but BeerBear is gearing up for a massive takeoff. For those tired of watching stagnant charts and chasing overhyped altcoins, BeerBear could be a ticket to substantial gains.

For more information on BeerBear, visit their website, X, or Telegram.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Historic Week for the Crypto Industry as Trump Steps into Office: Your Crypto Recap

It’s been a historic week in the cryptocurrency market! Even though the prices don’t exactly reflect it on a seven-day scale, a lot has happened on the macro level that could pave the way for a longer-term progress that was much-desired. That said, the total crypto market cap currently sits at around $3.8 trillion, but let’s take it one step at a time.

The very first thing that happened at the beginning of the week was Donald Trump taking the oath of office and stepping into his position as the 47th president of the United States of America. This unchained a series of events that could provide for a long-lasting impact on the industry.

Right off the get-go, Trump signed an executive order, which, among other things, established a working group on Digital Asset Markets with the purpose of exploring the merits of creating a strategic national cryptocurrency stockpile. Now, some clarifications are in order. Many expected Trump to focus on Bitcoin and to actually mandate the government to consider buying it for its national reserves. Whereas in reality, the order only talked about not selling the crypto that the country has confiscated.

Nonetheless, the order in question also aims to prohibit the creation and further usage of central bank digital currencies to prevent a potential dispute to the dollar’s hegemony. Also, the document outlines the necessity for for easy access for individuals and crypto companies to the country’s banking system, effectively putting a halt on operation Chokepoint 2.0.

That said, Trump also appointed an interim Chairman to the Securities and Exchange Commission – Mark Uyeda. They also established a task force headed by Commissioner Hester Peirce (a.k.a Crypto Mom) to work on creating a fair and transparent framework for digital assets.

All in all, it was a very good week in terms of crypto fundamentals, not so much as for the price as most of the coins are charting losses with the exception of BTC, which is up by around 2%.

Market Data

Market Cap: $3.801T | 24H Vol: $213B | BTC Dominance: 55.3%

BTC: $106,100 (+2%) | ETH: $3,397 (-0.7% ) | XRP: $3.16 (-1.3%)

This Week’s Crypto Headlines You Can’t Miss

Trump Signs Executive Order To Consider National Digital Asset Stockpile: Report. Arguably, the biggest news in the cryptocurrency space this week came on Thursday night when the new US President signed an executive order to review the creation of a ‘National Digital Asset Stockpile.’ This, alongside Senator Cynthia Lummis’ election to chair the Senate Banking Subcommittee on Digita Assets, prompted Changpeng Zhao to claim that the BTC reserve is ‘pretty much confirmed.’

Donald Trump Pardons Silk Road Creator Ross Ulbricht. President Trump seems to be keeping up his promises, at least for now, as he officially pardoned Ross Ulbricht, the controversial founder of the notorious Silk Road. The developer spent roughly a decade behind bars as he was convicted in May 2015 on seven charges and received two life sentences plus 40 years without the possibility of parole.

SEC Revokes SAB 121, Paving the Way for Banks to Hold Crypto. More favorable news from the new US administration toward crypto came with a substantial change within the Securities and Exchange Commission. A new policy, called SAB 122, overturned the controversial SAB 121, which essentially blocked banks from holding crypto assets.

Trump Names Uyeda and Pham as Interim SEC and CFTC Leaders. The changes within the two top US financial watchdogs – CFTC and SEC – began with the appointment of Mark Uyeda as the latter’s interim Chair and Caroline Pham to spearhead the former until permanent leaders are voted in.

Trump Downplays Meme Coin Profits in First Statement After Launch. The crypto space was rocked in the past week by the launch of two official meme coins by the US President and the First Lady. The consecutive token releases during the weekend sent shockwaves throughout the market, but Trump downplayed the profits when he finally addressed the assets publicly.

Here’s What CryptoQuant’s IBCI Signals for Bitcoin’s Next Move. Bitcoin went on a wild ride this week, from a brief slip below $100,000 to a new all-time high above $109,000 on inauguration day. Since then, the asset has calmed and stands a few grand from that peak. However, there are some warning signs that this bull run could come to an end soon or at least be paused for a while.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Binance Coin, and Solana – click here for the complete price analysis.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

CryptoCurrency

Nasdaq Files for In-Kind Redemptions for BlackRock Spot BTC ETF (IBIT): SEC Filing

Nasdaq has filed a proposed rule change to allow in-kind creation and redemption for the BlackRock iShares Bitcoin Trust (IBIT), according to a Friday filing to the U.S. Securities and Exchange Commission (SEC).

The process allows large institutional investors, called authorized participants (APs), to buy and redeem shares of the fund directly to bitcoin (BTC).

It is considered to be more efficient as it allows APs closely monitor the demand for the ETF and to act fast by buying or selling shares of the fund without cash being involved in the process. Retail investors are not eligible to participate.

When the SEC first approved spot bitcoin ETFs including IBIT last January, the agency allowed to launch the funds with cash redemption, instead of bitcoin.

“It should have been approved in the first place but Gensler/Crenshaw didn’t want to allow it for a whole host of reasons they gave,” Bloomberg Intelligence ETF analyst James Seyffart wrote on X. “Mainly [they] didn’t want brokers touching actual Bitcoin.”

BlackRock’s IBIT is the largest spot BTC ETF on the market, attracting nearly $40 billion of inflows in its first year, making it the most successful ETF debut ever.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login