CryptoCurrency

From Concept to Cost Evaluation

Blockchain has moved far beyond pilot programs and proofs-of-concept. What once served as an experimental layer for cryptocurrencies is now becoming a core system for enterprises that need trust, traceability, and automation at scale. Large organizations are no longer asking whether blockchain works. They are asking how to design blockchain development solutions that can operate reliably within real business environments.

The year 2026 marks a turning point for blockchain adoption. Regulatory clarity is improving across major economies, enterprise-grade platforms have matured, and multi-chain architectures are reducing earlier performance and scalability constraints. At the same time, cost scrutiny has intensified. Business leaders now expect a clear blockchain development roadmap that connects technology decisions with measurable outcomes and predictable budgets.

This guide is written for business and technology leaders who are planning or scaling blockchain initiatives in 2026. It explains how to move from concept to deployment with a structured approach that balances strategy, architecture, and cost control. Rather than treating blockchain as an isolated system, the guide frames it as part of a broader enterprise technology stack. Whether you are evaluating vendors, working with a blockchain development company, or building internal capabilities, this roadmap is designed to support informed decisions grounded in real-world enterprise requirements.

Understanding the Blockchain Development Landscape in 2026

The Current Market Landscape

- The global blockchain technology market size which was estimated at approximately USD 33.5 billion in 2025, is expected to reach around USD 1950.3 billion by 2034 at a compound annual growth rate of 57.54% from 2025 to 2034.

- Over 50 percent of Fortune 500 companies have active blockchain initiatives that have moved beyond pilot stages into live or near-production deployments.

- Financial services remain the largest adopters, with more than 60 percent of large banks and financial firms using blockchain for payments, settlements, trade finance, or fraud reduction.

- More than 70 countries are running or supporting blockchain-based programs in areas such as digital identity, land records, and cross-border payments.

- Regulatory bodies are issuing clearer guidance on digital assets, data protection, and permissioned ledgers, reducing uncertainty for enterprise projects.

Why Blockchain Development Looks Different in 2026

Shift from single-chain applications to multi-chain and interoperable ecosystems

- Early enterprise projects relied on a single blockchain network with limited external interaction.

- In 2026, enterprises design systems that operate across multiple chains to support scalability, resilience, and partner connectivity.

- The market for blockchain interoperability tools is expanding rapidly, driven by demand for cross-network data and asset movement.

Shift from static smart contracts to autonomous, AI-assisted protocols

- Traditional smart contracts executed fixed logic with limited awareness of external conditions.

- Modern enterprise systems combine smart contracts with off-chain computation and AI-driven inputs for dynamic decision-making.

- Many new platforms now offer native support for modular contracts, event-driven execution, and advanced automation.

Shift from PoCs and pilots to production-grade enterprise deployments

- Earlier blockchain efforts focused on feasibility testing rather than full operational readiness.

- Enterprises in 2026 prioritize scalability, performance testing, monitoring, and long-term support from the start.

- This change has raised expectations around architecture design, security reviews, and blockchain development cost planning.

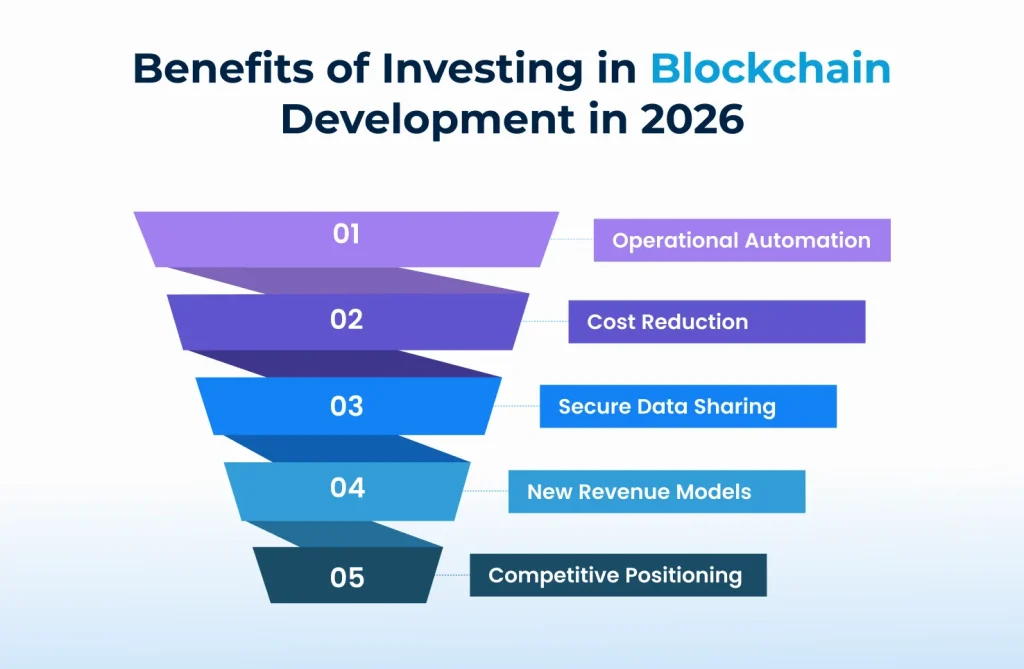

Why Must Enterprises Invest in Blockchain Development in 2026

Enterprises are under pressure to remove manual processes that slow down transactions and increase error rates. Blockchain enables rules-based execution through smart contracts, allowing settlements, approvals, and reconciliations to occur automatically once predefined conditions are met. In live enterprise deployments across finance and supply chain operations, organizations have reported processing time reductions of 30 to 60 percent after shifting to blockchain-driven workflows. This level of automation directly supports faster operations without increasing administrative overhead.

Blockchain reduces dependence on intermediaries by creating a shared and verifiable source of truth between parties that do not fully trust one another. By eliminating repeated validations, reconciliations, and dispute resolution processes, enterprises can lower operational costs over time. Industry surveys indicate that more than 40 percent of enterprises adopt blockchain primarily to reduce costs in areas such as cross-border payments, trade finance, and multi-party settlements. These savings are now a central factor when evaluating blockchain development cost in 2026.

Enterprises operate in ecosystems where data must be shared across vendors, partners, and regulators without compromising integrity. Blockchain enables controlled access to shared records while preserving immutability, making every transaction traceable. This capability supports audit readiness in regulated industries such as banking, healthcare, and energy. As a result, blockchain development solutions are increasingly used to replace fragmented record-keeping systems with tamper-resistant audit trails.

Blockchain is not limited to internal efficiency gains. It allows enterprises to participate in digital ecosystems where assets, data, and services can be exchanged securely. Tokenized assets, shared platforms, and decentralized marketplaces create new revenue opportunities beyond traditional business models. Analysts estimate that tokenization of real-world assets could reach several trillion dollars in value by the end of the decade, making early participation a strategic advantage when assessing blockchain app development cost against future returns.

Early investment in blockchain gives enterprises time to build internal expertise, establish governance structures, and influence ecosystem standards. Organizations that delay adoption risk higher integration costs and reduced flexibility as industry networks mature. In 2026, blockchain is increasingly viewed as foundational infrastructure rather than an optional technology. Partnering with an experienced blockchain development company helps enterprises accelerate adoption while managing technical complexity and long-term cost exposure.

Contact us to invest in blockchain development today

Step-by-Step Guide to Blockchain Solution Development

Step 1: Identifying the Right Business Use Case

Blockchain delivers value only when it addresses a clear business problem related to trust, coordination, or shared data ownership. It is most effective in environments where multiple parties need access to a common record and where manual verification or reconciliation slows operations.

When blockchain is the right fit

- Multi-party processes with limited mutual trust

- Workflows requiring immutable audit trails

- Systems where automation can replace manual approvals

When blockchain may not be suitable

- Single-owner databases with limited data sharing

- Applications with high throughput but low trust requirements

- Processes that can be handled efficiently with traditional databases

High-impact enterprise use cases

- Cross-border payments and settlements

- Asset and securities tokenization

- Supply chain traceability and provenance

- Shared compliance and reporting systems

- Digital identity and credential verification

Before moving forward, enterprises must define measurable business goals. KPIs may include transaction cost reduction, cycle time improvement, dispute reduction, or new revenue generation. ROI expectations should account for initial blockchain app development cost and long-term operational impact to keep the blockchain development roadmap aligned with business priorities.

Step 2: Choosing the Right Blockchain Architecture

Architecture decisions determine how the solution scales, who controls it, and how costs evolve over time.

Network models

- Public blockchains support open participation and transparency, often used for tokenized assets and public ecosystems.

- Private blockchains restrict access to a single organization and are suitable for internal enterprise workflows.

- Consortium blockchains enable shared control among trusted partners, common in trade finance and supply chain networks.

Access models

- Permissioned networks offer controlled participation and governance, which is critical for regulated industries.

- Permissionless networks allow open participation but require stronger economic and technical safeguards.

Design approach

- Modular architecture separates execution, data availability, and consensus, allowing upgrades without disrupting the entire system.

- Monolithic architecture bundles components together, simplifying early development but limiting flexibility.

Interoperability should be considered from the start. Enterprises increasingly design systems that can interact with multiple networks to avoid vendor lock-in and support future expansion.

Step 3: Blockchain Platform Comparison and Technology Selection

Platform selection influences performance, security, and blockchain development cost across the solution lifecycle.

Key comparison criteria

- Scalability and transaction throughput

- Security and fault tolerance

- Decentralization and governance controls

- Ecosystem maturity and developer support

- Development and maintenance cost

Enterprise-relevant platforms

- Ethereum and Layer-2 networks are widely adopted for smart contracts and enterprise-grade decentralized applications.

- Solana is used where high throughput and low latency are priorities.

- Hyperledger Fabric is designed for permissioned enterprise networks with fine-grained access control.

- Cosmos and Polkadot support interoperable systems built on multiple connected blockchains.

- Private enterprise blockchains offer full control and customization for internal deployments.

Selecting the right platform requires balancing technical needs with long-term cost and governance considerations.

Step 4: Designing the Blockchain Technology Stack

A complete blockchain solution extends beyond the core ledger.

Core stack components

- Smart contract layer defining business logic

- Backend services and APIs connecting enterprise systems

- Frontend interfaces focused on usability and adoption

- Wallets, identity management, and key custody

- Oracles and off-chain data integrations

- DevOps tooling, monitoring, and infrastructure management

Each component must be designed to work together while meeting enterprise security and performance expectations.

Step 5: Security, Compliance, and Governance Planning

Security and compliance planning must begin before development starts.

Key focus areas

- Smart contract audits and formal verification to prevent vulnerabilities

- Regulatory requirements related to data protection, financial reporting, and identity

- On-chain and off-chain governance models defining decision rights

- Role-based access control and risk management frameworks

Early investment in these areas reduces operational risk and unexpected blockchain development costs later in the project.

Step 6: Deployment, Optimization, and Ongoing Support

Deployment is not the end of the project but the start of live operations.

Post-deployment activities

- Controlled rollout from testnet to mainnet

- Performance monitoring and tuning

- Upgrades, maintenance, and incident response

- Continuous improvement based on real-world usage

Ongoing support ensures the solution remains stable and compliant as usage grows.

Step 7: Future-Proofing Blockchain Solutions Beyond 2026

Enterprise blockchain systems must evolve with changing requirements.

Future-ready design considerations

- Upgradeable and modular smart contracts

- Built-in interoperability for cross-chain interaction

- Scalability planning to support growth

- Convergence of AI and blockchain for adaptive automation

- Long-term ecosystem adaptability to avoid lock-in

Future-proofing protects enterprise investments and supports sustained value from blockchain development solutions.

Develop a Blockchain solution tailored to your business needs

How Much Does It Cost to Build a Blockchain Solution in 2026

The cost of building a blockchain solution in 2026 depends less on the technology itself and more on how the solution is designed, governed, and scaled over time. Enterprises no longer treat blockchain as a one-time build. It is a long-term system that must operate reliably across partners, regulations, and evolving business requirements.

This makes blockchain development cost a strategic consideration rather than a line-item expense. Instead of looking for a single number, enterprises should understand the factors that shape the overall blockchain solution cost breakdown and how different decisions influence long-term spend.

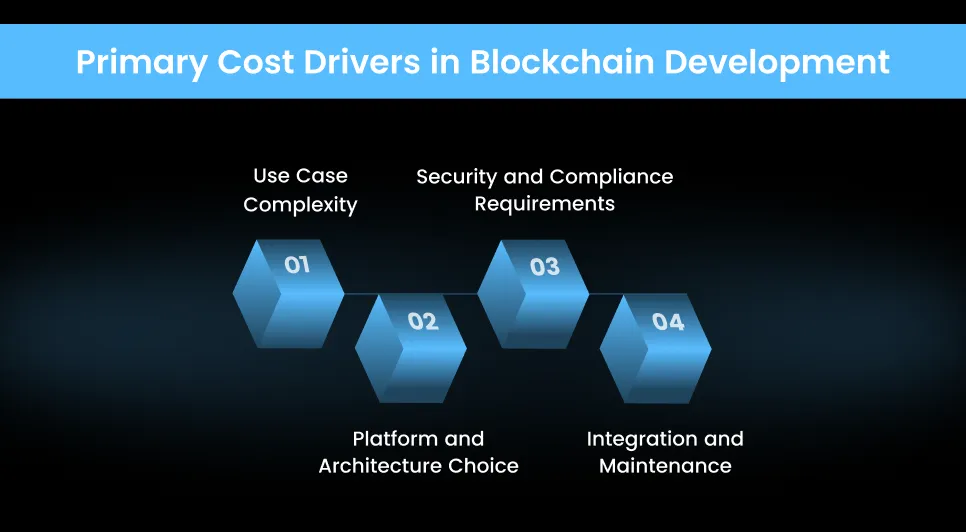

Key Cost Drivers in Blockchain Development

The nature of the business problem is the strongest cost determinant. Simple applications that record transactions or timestamps require limited logic and infrastructure. Enterprise-grade solutions that automate workflows, manage assets, or support multi-party coordination involve complex smart contracts, deeper testing, and extended governance layers. As complexity increases, development timelines expand, and ongoing support becomes more demanding, directly affecting blockchain app development cost.

-

Platform and architecture choice

The selected blockchain platform influences both initial build effort and long-term operating expenses. Public networks often require additional work around gas management, performance planning, and user experience abstraction. Permissioned or consortium networks involve setup, governance design, and infrastructure ownership. Modular architectures designed for future expansion can reduce rework later but may raise early development effort. These trade-offs are central to blockchain development cost planning in 2026.

-

Security and compliance requirements

Security is no longer optional for enterprise deployments. Smart contract audits, threat modeling, and formal verification add necessary effort before launch. Regulated industries also require compliance reviews tied to data protection, financial reporting, and identity controls. While these steps increase upfront cost, skipping them often leads to far higher remediation expenses later. Mature blockchain development solutions account for security and compliance from the start.

-

Integration and maintenance

Most enterprise blockchain systems do not operate in isolation. They connect with ERP systems, payment gateways, identity platforms, and data warehouses. Each integration increases development scope and testing requirements. After launch, ongoing maintenance includes network upgrades, monitoring, incident response, and feature updates. These recurring activities form a significant portion of the total cost to build and operate a blockchain solution.

Cost Models That Enterprises Use

-

Fixed price and time-and-material

Fixed-price models work best when the scope is clearly defined and unlikely to change. They offer budget predictability but limited flexibility. Time-and-material models provide adaptability as requirements evolve, which suits complex blockchain initiatives where architecture and governance mature over time. Many enterprises combine both approaches across different phases of the blockchain development roadmap.

-

In-house, outsourced, and hybrid teams

Building an in-house blockchain team offers control and long-term ownership but involves hiring, training, and retention costs. Outsourcing to a blockchain development company provides faster access to specialized skills and established delivery processes. Hybrid models are increasingly common, where internal teams manage strategy and governance while external partners deliver development and audits. Each model affects both cost structure and delivery speed.

Common Blockchain Development Challenges and How to Overcome Them

Enterprises adopting blockchain in 2026 face a different set of challenges than early adopters. The technology has matured, but expectations around reliability, compliance, and cost control have also increased. Understanding these challenges early helps organizations design blockchain development solutions that scale without disruption or budget shocks.

-

Scalability and performance

Many early blockchain systems struggled with limited throughput and unpredictable latency. Enterprise workloads require consistent performance, especially for transaction-heavy use cases such as payments, supply chain updates, or data synchronization across partners.

This challenge is addressed through careful platform selection, use of Layer-2 networks or permissioned ledgers, and architecture designs that separate execution from data storage. Enterprises increasingly adopt multi-chain approaches to distribute load while maintaining consistency across systems. Performance planning during the design phase reduces the risk of rework later in the blockchain development roadmap.

Smart contracts are immutable once deployed, which means errors can have lasting impact. Vulnerabilities in contract logic, access control, or key management can lead to financial loss or operational failure.

Enterprises mitigate this risk by treating security as part of development, not a final checkpoint. Code reviews, third-party audits, and formal verification are becoming standard practices. Secure key custody, role-based access, and incident response planning further reduce exposure. Investing in security early often lowers overall blockchain development cost by preventing expensive fixes after deployment.

Blockchain projects often operate across jurisdictions with differing rules around data protection, financial reporting, and digital assets. Unclear or changing regulations create hesitation at the executive level and can stall deployments.

This risk is managed by designing compliance into the system architecture. Permissioned access models, configurable data visibility, and audit-ready transaction records allow enterprises to adapt to regulatory requirements without rebuilding the solution. Close coordination between legal, compliance, and technical teams is now a core part of enterprise blockchain development.

-

Legacy system integration

Most enterprises rely on established systems such as ERP platforms, payment rails, and identity providers. Integrating blockchain with these systems can be complex and time-consuming.

Successful projects use middleware and APIs to connect blockchain networks with existing infrastructure without disrupting operations. Clear data ownership models and synchronization rules help avoid inconsistencies. Planning integration early prevents delays and unexpected increases in blockchain app development cost.

-

Cost overruns and scope creep

Blockchain projects often expand beyond their original scope as stakeholders identify new use cases or features. Without clear boundaries, timelines extend, and costs escalate.

Enterprises control this risk by defining measurable goals, prioritizing features, and delivering solutions in phases. Breaking development into milestones allows teams to validate value before expanding functionality. This disciplined approach keeps blockchain development costs aligned with business outcomes.

-

User adoption and experience

Complex interfaces, wallet management, and unfamiliar workflows can slow adoption among internal users and external partners. Even technically sound systems fail if users find them difficult to operate.

Enterprises address this challenge by abstracting blockchain complexity behind familiar interfaces. Clear onboarding, role-based access, and thoughtful UX design reduce friction. Focusing on usability from the start improves adoption rates and protects the long-term value of blockchain development solutions.

Why Enterprises Must Choose a Blockchain Development Company

Enterprise blockchain projects demand skills that go beyond general software development. Smart contract engineering, consensus design, security audits, and governance planning require experience that most internal teams do not possess at scale. A blockchain development partner brings hands-on exposure to multiple platforms, architectures, and industry use cases, reducing trial-and-error during critical stages of the blockchain development roadmap.

Time-to-market matters when blockchain initiatives support payments, asset flows, or shared industry networks. Building internal capability often involves long hiring cycles and steep learning curves. A partner with established blockchain development services can accelerate delivery by applying proven frameworks, reusable components, and structured development processes. This allows enterprises to move from concept to production with fewer delays.

Blockchain projects operate in environments where security, compliance, and governance are tightly linked. Development partners help identify risks early, from smart contract flaws to regulatory exposure. By embedding audits, access controls, and compliance considerations into the design phase, partners reduce the likelihood of post-launch failures. This proactive approach protects both operational continuity and blockchain development cost.

Enterprise blockchain initiatives rarely remain static. Use cases expand, transaction volumes grow, and new participants join the network. A capable partner supports scalable delivery models that adapt to changing requirements without rebuilding the system. This flexibility helps enterprises manage growth while keeping blockchain app development costs predictable.

Blockchain systems require continuous monitoring, upgrades, and adaptation as platforms evolve and regulations change. Long-term partnerships provide continuity across development, deployment, and post-launch phases. Strategic support helps enterprises refine governance models, improve performance, and extend functionality over time. This sustained engagement is a key reason enterprises rely on a blockchain development company rather than treating blockchain as a one-off project.

Understand the Blockchain app development cost

Schedule a free demo

Conclusion

Enterprises now approach blockchain not as a standalone project but as an integral part of digital infrastructure that supports automation, secure data sharing, and new revenue models. Understanding the drivers of blockchain development cost, evaluating platform and architecture choices, and anticipating security, compliance, and integration requirements help organizations make informed decisions.

For enterprises ready to harness blockchain effectively, partnering with an experienced blockchain development company is crucial. Antier brings end-to-end blockchain development services, combining technical expertise, strategic guidance, and hands-on experience to help businesses implement scalable, secure, and future-ready blockchain solutions.

Take the next step in your blockchain journey with Antier and build solutions that are ready for 2026 and beyond.