Crypto World

Blockdaemon Outlines Solana’s 2026 Path to Institutional Adoption Through Executive Guide and Technical Roadmap

TLDR:

-

- Blockdaemon’s executive guide frames Solana’s 2026 roadmap around the Internet Capital Market vision for institutions.

- Alpenglow and IBRL target predictable sub-second finality, narrowing the gap between blockchain and exchange-style settlement.

- ACE introduces application-level transaction control, reducing MEV exposure and aligning execution with best-execution standards.

- Validator client diversity across Agave, Firedancer, and Rakurai builds network resilience for custody, ETFs, and treasuries.

Blockdaemon has published a comprehensive two-part series on Solana’s 2026 outlook, targeting financial institutions evaluating on-chain infrastructure.

The release includes an executive guide and a technical roadmap, each addressing a different layer of institutional readiness.

The series examines Solana’s shift from a high-throughput retail chain to a network built for predictable finality and execution integrity.

It arrives as institutions move closer to production-grade deployment of tokenized assets and on-chain settlement systems.

Executive Guide Positions Solana Around the Internet Capital Market Vision

Blockdaemon’s executive guide opens with Solana’s broader strategic ambition: becoming an Internet Capital Market.

This concept describes an internet-native environment where listings, trading, and settlement operate entirely on-chain.

For financial institutions, it reframes Solana less as a crypto network and more as specialized financial infrastructure.

“Solana has moved beyond its early reputation as ‘the fast retail chain.’ Its ambition to become an Internet Capital Market reframes it as a potential backbone for next-generation on-chain finance.” — Blockdaemon, Solana in 2026: A Guide for Financial Institutions

The guide outlines four institutional traits that Solana’s 2026 roadmap prioritizes. These are predictable low-latency finality, order-flow privacy, deterministic execution, and application-level control.

Each trait maps directly to operational requirements that traditional trading and treasury teams already work within.

Blockdaemon further notes that Solana’s 2026 upgrades address three critical institutional pillars. On compliance, ACE enables protocol-level identity checks before trade execution takes place.

On liveness risk, validator client diversity, and the Alpenglow upgrade together reduce fault sensitivity across the network.

Technical Roadmap Details Four Pillars of Institutional-Grade Infrastructure

Blockdaemon’s technical roadmap centers on Alpenglow as the foundation for consensus stability. Alpenglow is Solana’s next consensus protocol upgrade, designed to stabilize block production under heavy network conditions.

It reduces uncertainty in transaction ordering and confirmation times, which matter most to funds and market operators.

“Rather than chasing headline TPS, the focus shifts to predictable finality, execution integrity, and redundancy.” — Blockdaemon, Solana in 2026: Technical Roadmap

IBRL, standing for Increase Bandwidth, Reduce Latency covers the broader performance improvement effort. It groups bandwidth, scheduler, and latency upgrades under one coordinated program alongside Alpenglow.

Trading and treasury systems gain more consistent confirmation windows that align with traditional financial service-level expectations.

ACE, or Application Controlled Execution, addresses the MEV problem that has long affected institutional adoption. Without ACE, validators and builders control transaction ordering, creating room for exploitative sequencing.

ACE allows financial applications to define their own sequencing rules, batching logic, and matching behavior for compliance and risk reasons.

Block Building Infrastructure and Validator Diversity Round Out the Roadmap

Blockdaemon’s series covers the full validator client ecosystem currently active on Solana. Clients include Agave, Firedancer, Frankendancer, Jito-Solana, and Rakurai, each operating on independent codebases.

This diversity means no single software failure can bring down the network, which is critical for staking that supports custody, ETFs, or corporate treasuries.

“For leading, network-conscious infrastructure providers like Blockdaemon, client diversity means resilience, performance optimization, and investor confidence.” — Blockdaemon, Solana in 2026: Technical Roadmap

Firedancer, developed by Jump Crypto, is a ground-up reimplementation in C targeting maximum throughput and fault isolation.

Frankendancer provides a hybrid approach, combining Firedancer’s networking stack with Agave’s execution runtime.

Rakurai achieves 5x higher TPS and up to 35% greater block rewards through proprietary scheduling and pipeline optimizations.

On the block building side, Blockdaemon covers JitoBAM and Harmonic as early ACE implementations. JitoBAM operates through Trusted Execution Environments, creating encrypted mempools that keep transactions private until execution.

This reduces sandwich attacks and other exploitative MEV practices that conflict with institutional best-execution standards.

“ACE’s promise is infrastructure-level fairness, giving institutional applications predictable, auditable control over how trades, payments, or transactions are realized on-chain.” — Blockdaemon, Solana in 2026: Technical Roadmap

Harmonic turns block building into a competitive marketplace by aggregating proposals from multiple independent builders.

Builders include Jito, Temporal, JitoBAM, and Paladin, with validators selecting from their proposals in real time. This model lowers concentration risk and makes order flow more transparent and auditable for regulated institutions.

Blockdaemon also maps the roadmap to concrete strategic use cases for financial institutions. Tokenized money markets benefit from sub-second settlement that removes intraday timing risk.

On-chain FX, derivatives, structured products, and institutional staking all gain from deterministic execution and improved network resilience across the upgraded Solana infrastructure.

Crypto World

Peter Schiff wants you to sell your Bitcoin as he predicts 84% crash

Longtime Bitcoin critic Peter Schiff has reignited debate over the cryptocurrency’s outlook, warning that a break below $50,000 could trigger a steep drop toward $20,000, an 84% decline from its all-time high.

Summary

- Peter Schiff warned that if Bitcoin breaks below $50,000, it could fall to $20,000 — an 84% drop from its all-time high — urging investors to “sell Bitcoin now.”

- Schiff argued that while Bitcoin has suffered similar drawdowns before, the current market carries greater risk due to increased leverage, institutional ownership, and overall market size.

- His comments sparked backlash on X, with users pointing to his long history of bearish calls and defending Bitcoin’s long-term value proposition as a censorship-resistant, globally liquid financial network.

Sell Bitcoin now, says Peter Schiff

In a post on X, Schiff argued that “if Bitcoin breaks $50K, which looks likely, it seems highly likely it will at least test $20K,” adding that such a move would mirror previous drawdowns but unfold under very different market conditions.

“I know Bitcoin has done that before,” he wrote, “but never with so much hype, leverage, institutional ownership, and market cap at stake. Sell Bitcoin now!”

Schiff, a prominent gold advocate and frequent crypto skeptic, has long maintained that Bitcoin’s price cycles resemble speculative bubbles fueled by liquidity and investor enthusiasm. His latest warning comes amid renewed volatility in digital asset markets, where traders are closely watching key technical levels.

An 84% retracement would echo past bear markets. Bitcoin has previously suffered drawdowns exceeding 70% following euphoric rallies, including after its 2017 peak and again following its 2021 high. However, the asset’s structure has evolved significantly, with spot exchange-traded funds, corporate treasuries, and institutional allocators now holding sizable positions.

Schiff’s latest warning quickly drew pushback on X, where critics accused the longtime gold advocate of repeating a decade-old bearish script.

One user claimed investors who followed his past calls on silver were left “stuck in it for 20 years,” referencing the metal’s prolonged stagnation after previous peaks. Others pointed to Schiff’s history of urging investors to sell Bitcoin at far lower levels, noting that he has been issuing similar warnings since the asset traded near $100.

A separate response argued that Bitcoin’s “intrinsic value” lies in its censorship-resistant settlement network, global liquidity, and lack of gatekeepers, framing its volatility not as a flaw but as the market’s process of pricing a new financial system in real time.

The exchange shows the entrenched divide between Schiff and Bitcoin advocates, with critics portraying his latest $20,000 forecast as a continuation of a long-running skepticism that has so far failed to derail the cryptocurrency’s broader upward trajectory.

Still, Schiff’s comments highlight a persistent divide in the investment community: whether Bitcoin’s growing institutional footprint makes it more resilient or more vulnerable in the event of a sharp downturn.

Crypto World

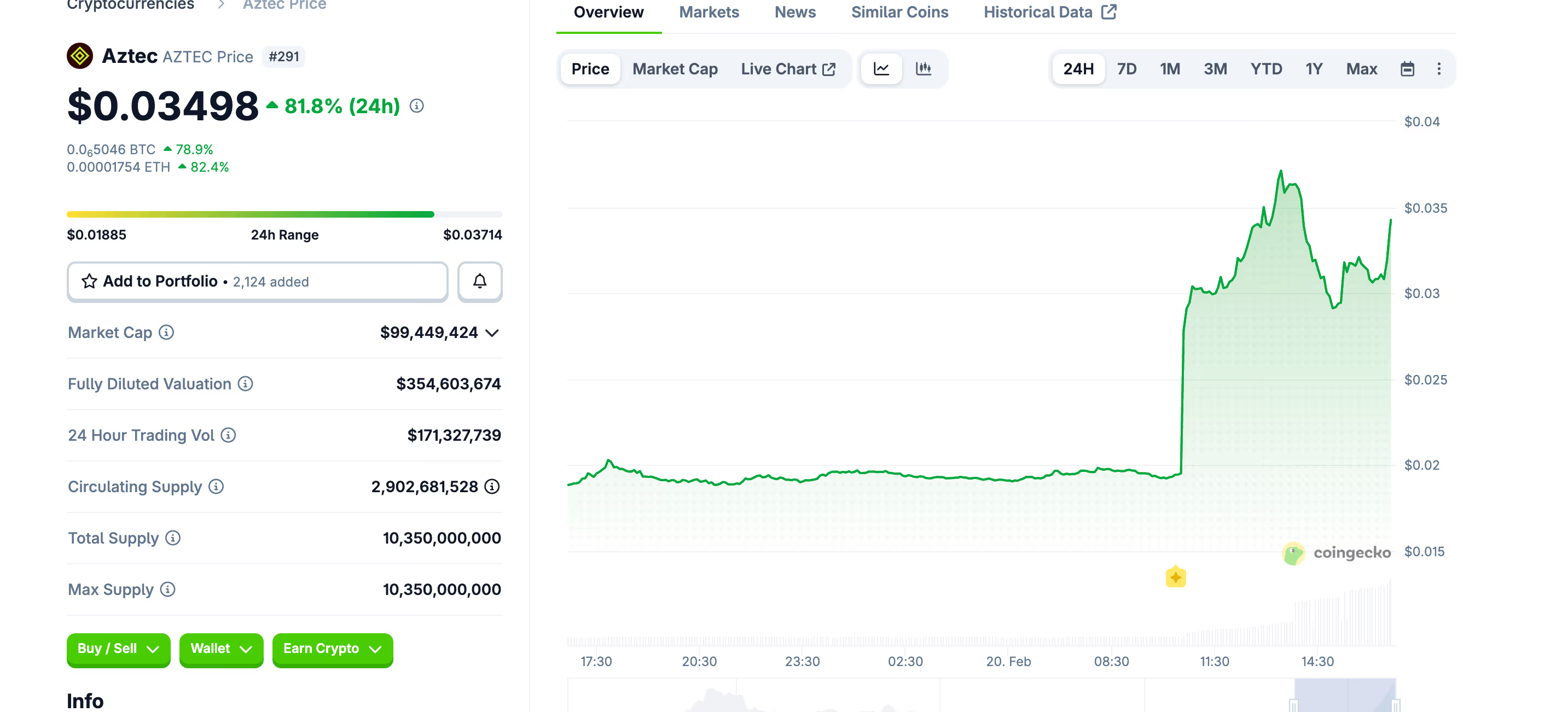

Dual South Korean listings send Ethereum layer-2 token AZTEC surging 82%

Aztec (AZTEC) surged about 82% in 24 hours to around $0.035 after South Korean exchanges Upbit and Bithumb both moved to list the token with local currency pairs, triggering a wave of KRW-denominated buying into a thinly traded market.

Korean listings still matter because they flip a token from being crypto-only to something a huge retail base can buy directly with local currency.

South Korea consistently ranks among the top three countries by crypto trading volume relative to population, and Upbit alone regularly matches or exceeds Coinbase in daily spot turnover during active sessions.

A KRW pair cuts out the extra hop through USDT, plugs into Korea’s unusually active spot trading culture, and puts the token on the screens people in the region actually watch. And that kind of exposure can be transformative for smaller-cap tokens like AZTEC.

Traders often treat new Upbit and Bithumb listings as momentum events, rushing in before liquidity deepens and before the initial premium fades. The pattern has played out repeatedly — tokens like VIRTUAL have printed double-digit moves on Korean listing announcements alone, regardless of what the underlying project was doing at the time.

In thin books, that dynamic creates the kind of vertical candle AZTEC printed. Once prices gap higher locally, arbitrageurs step in, buying on global venues and selling into the Korean bid, which helps drag prices up across the board. The so-called “kimchi premium” — the persistent spread between Korean and international prices — tends to widen sharply during these episodes before narrowing as arb flow catches up.

Aztec itself is pitched as an Ethereum-based, privacy-focused layer 2 that uses zero-knowledge proofs to enable encrypted transactions on a public chain. That gives the token a narrative beyond the listing event.

The premium had narrowed slightly by the Asian evening session as arbitrage flow caught up and the surge showed signs of exhaustion.

Crypto World

IP Strategy Announces Share Repurchase Program of Up To 1 Million Shares

[PRESS RELEASE – GIG HARBOR, Washington, February 20th, 2026]

IP Strategy Holdings, Inc. (Nasdaq: IPST) (the “Company” or “IP Strategy”), the first company to adopt a treasury reserve policy centered on the $IP token, today announced the board of directors has authorized a share repurchase program whereby the Company may buy back up to 1 million shares of its outstanding shares of common stock through December 31, 2026.

As of February 18, 2026, IP Strategy had 10,259,226 shares of its common stock outstanding. Assuming the full execution of buying back 1 million shares, this would constitute a nearly 10% reduction in the number of outstanding shares of the Company. The Company may acquire shares through open market purchases or privately negotiated transactions, including through a Rule 10b5-1 plan, at the discretion of management and on terms that management determines to be advisable.

IP Strategy is the largest independent owner of $IP tokens – the native token of the Story Layer 1 blockchain – with a current holding of 53.2 million tokens. The Company also recently began the transition from self-custodied validator work to third-party custodied validator work, a move which is expected to effectively double its related yield to 10% or more annually for 2026.

“The Board’s decision to authorize a share repurchase program reflects its belief that the market does not currently take into account the inherent value of our 53.2 million $IP tokens, nor the growth in higher-margin recurring revenue anticipated in 2026 from the transition to third-party custodied validator services,” said Justin Stiefel, Chief Executive Officer of IP Strategy. “When combined with the previously-announced streamlining and cost reduction plans for 2026, the implementation of a share repurchase program at this time reflects a very high degree of confidence in our long-term strategy and growth potential.”

About IP Strategy

IP Strategy Holdings, Inc. (Nasdaq: IPST) is the first Nasdaq-listed company to hold $IP tokens as a primary reserve asset and operate a validator for the Story Protocol. The Company provides public market investors broad exposure to the $80 trillion programmable intellectual property economy in a regulated equity format. IP Strategy’s treasury reserve of $IP tokens provides direct participation in the Story ecosystem, which enables on-chain registration, licensing, and monetization of intellectual property.

About Story

Story is the AI-native blockchain network powering the $IP token and making intellectual property programmable, traceable, and monetizable in real time. Backed by $136 million from a16z crypto, Polychain Capital, and Samsung Ventures, Story launched its mainnet in February 2025 and has rapidly become a leading infrastructure for tokenized intellectual property. Story allows creators and enterprises to turn media, data, and AI-generated content into legally enforceable digital assets with embedded rights, enabling automated licensing and new markets for intellectual property across AI and entertainment.

Forward-Looking Statements

This press release contains forward-looking statements, including statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “aims,” “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “plans,” “possible,” “potential,” “seeks,” “will,” and variations of these words or similar expressions that are intended to identify forward-looking statements. Any such statements in this press release that are not statements of historical fact may be deemed to be forward-looking statements. These forward-looking statements include, but are not limited to, the Company’s adoption of a share repurchase program and the number and percentage of outstanding shares it may repurchase, the timing of the implementation of the Company’s share repurchase program, the shift to third-party custody of its $IP tokens, the expected increased yield from the Company’s validator operations, and the effectiveness of the Company’s proposed cost-saving measures.

Any forward-looking statements in this press release are based on IP Strategy’s current expectations, estimates and projections only as of the date of this release and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, risks related to the volatility of the Company’s common stock and any correlation between the Company’s stock price and the price of $IP tokens, the legal, commercial, regulatory and technical uncertainty regarding digital assets generally, and expectations with respect to future performance and growth. These and other risks concerning IP Strategy’s programs and operations are described in additional detail in its registration statement on Form S-1 initially filed with the Securities and Exchange Commission (“SEC”) on August 26, 2025, as amended by Amendment No. 1 filed on October 16, 2025, Amendment No. 2 filed on December 12, 2025 and Amendment No. 3 filed on December 19, 2025, its latest annual report on Form 10-K, subsequent quarterly reports on Form 10-Q, and any other subsequent filings with the SEC. IP Strategy explicitly disclaims any obligation to update any forward-looking statements except to the extent required by law.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

ZKsync and Phylax Launch Bank Stack: A Full-Scale Institutional Architecture Built on Ethereum

TLDR:

- Bank Stack operates across three integrated planes: blockchain platform, money and assets, and services and governance layer.

- Prividium enables institutions to run private, compliant transactions while inheriting Ethereum’s security and global settlement guarantees.

- Phylax adds pre-committed assertions and circuit breakers that block unsafe transactions before execution, not after settlement occurs.

- Platforms like Fireblocks already integrate with Prividium, letting banks reuse existing policy stacks for new institutional networks.

Bank Stack is emerging as a new institutional architecture for on-chain finance. ZKsync and Phylax have jointly introduced this framework, anchored on Ethereum and powered by Prividium.

The architecture is designed to address fragmented payment rails, rising compliance costs, and security risks. Financial institutions are no longer debating whether blockchain matters.

They are now choosing which architecture will run their settlement, liquidity, and balance sheet operations.

A Three-Layer Architecture Built for Institutions

Bank Stack operates across three integrated planes. The blockchain platform layer combines Ethereum with Prividium for private execution, compliance primitives, and interoperability.

Above that sits the money and assets layer, which covers tokenized deposits, stablecoins, and real-world assets. The third plane handles services and governance, including identity, custody, policy enforcement, and reporting.

Prividium serves as the institutional transaction layer at the foundation. It is a private, compliant, ZK-powered blockchain that remains anchored to Ethereum.

Institutions run confidential transaction environments while inheriting Ethereum’s security and global interoperability. Execution and data stay private, while ZK proofs posted to Ethereum provide integrity and finality.

ZKsync’s L1 interoperability solution connects any ZK Chain to Ethereum natively. Institutions no longer need to sacrifice governance, privacy, or execution environments for access to public market liquidity.

Prividiums become the first architecture where both can coexist. This removes one of the largest structural barriers to institutional blockchain adoption.

Compliance is built into the infrastructure surface rather than added on top. Prividiums embed permissioned participation, KYC/AML enforcement, and auditability directly into the system.

This shifts compliance from an operational burden to an architectural guarantee. Policy becomes enforceable in production, not just observable.

Circuit Breakers and Onchain Money Primitives

ZKsync shared via its official channel: “The Bank Stack is not a product. It is an institutional architecture for on-chain finance.” Phylax adds execution-time controls through pre-committed assertions and invariant enforcement during block building.

Transactions that violate safety conditions are excluded before execution. This prevents catastrophic states rather than detecting them after settlement.

Phylax also supports on-premises deployment, colocated with block production. There is no critical-path SaaS dependency and no custody of keys or funds.

Private assertions keep internal controls confidential inside an institution. Risk teams, underwriters, and regulators can use verifiable evidence for governance and coverage workflows.

The monetary foundation of Bank Stack includes tokenized deposits, fiat-backed stablecoins, and tokenized cash equivalents. These primitives compose with identity and policy controls.

Real-world assets such as tokenized securities, funds, and collateralized instruments are also supported. Platforms like Fireblocks already integrate with Prividium, allowing banks to reuse existing policy stacks.

Together, Ethereum provides global settlement, Prividium provides private execution, and Phylax provides deterministic operational controls.

Crypto World

Phemex integrates Ondo tokenized stocks and ETFs for 10m users.

Phemex integrates Ondo tokenized equities, giving 10m users onchain access to 14 major stocks and ETFs.

Summary

- Phemex completed integration with Ondo Finance’s full tokenized equity suite, listing 14 real‑world assets including NVDA, TSLA, AAPL, AMZN, QQQ, and SPY‑style ETFs.

- The exchange says the move is part of a broader push into RWA tokenization, allowing clients to hold tokenized stocks and ETFs while preserving digital asset liquidity.

- Founded in 2019, Phemex now serves more than 10m traders with spot, derivatives, copy trading, and yield products as it positions itself between TradFi and DeFi.

Cryptocurrency exchange Phemex announced the completion of its integration with Ondo Finance’s full suite of tokenized equities, according to a statement released by the company.

The integration provides the platform’s 10 million users access to 14 tokenized traditional assets, including shares of technology companies and exchange-traded funds, the company stated.

The tokenized equity offerings include shares of NVIDIA, Tesla, Apple, and Amazon, as well as the Nasdaq 100 ETF and the SPDR S&P 500 ETF, according to the announcement.

The platform describes the integration as part of its expansion into real-world asset (RWA) tokenization, allowing users to access traditional financial instruments through blockchain technology while maintaining digital asset liquidity.

Phemex stated the initiative represents part of its strategy to bridge traditional finance and decentralized finance platforms.

Founded in 2019, Phemex operates as a cryptocurrency exchange offering spot trading, derivatives trading, copy trading, and wealth management products, according to company information. The platform reports serving more than 10 million traders globally.

Crypto World

XRP ‘Coiling’ for a Breakout? Liquidity Patterns Mirror Previous Explosive Rallies

Historical data depicts XRP rallies followed periods of tight liquidity, though sustained moves required expanding USD market depth.

XRP’s market structure is showing signs of renewed liquidity compression, as evidenced by exchange flows and on-chain liquidity conditions aligning in a way that has historically preceded increased volatility.

Data tracking Binance exchange inflows revealed that large deposits previously surged ahead of a major XRP rally, a pattern often associated with rising volatility rather than immediate selling.

Fragile Market Setup

CryptoQuant explained that while exchange inflows are commonly interpreted as potential sell-side pressure, past behavior indicates that they can also mark positioning phases before sharp price expansions. During the earlier rally period, USD liquidity, which represents the depth of capital supporting XRP markets, expanded significantly. This allowed prices to support upward momentum despite high volatility.

Current conditions, however, differ, as USD liquidity has been declining. Such a setting points to thinner market depth compared with prior expansion phases. Reduced depth typically increases sensitivity to flows and amplifies price reactions.

On the supply side, the amount of XRP actively available for trading dropped sharply ahead of the previous breakout, a period that marked the start of the rally. That same pattern is beginning to reappear, as XRP liquidity is trending lower once again. In past cycles, similar setups, where exchange inflows spiked while overall liquidity tightened, were followed by sharp increases in price volatility.

Whether those moves turned into steady trends depended largely on how much capital entered the market. Right now, exchange inflows remain relatively contained, but liquidity on both the USD and XRP side is shrinking. This points to a thinner market than during earlier expansion phases, where even modest changes in buying or selling pressure can have an outsized impact on price.

With less liquidity to absorb trades, XRP’s price may react more quickly if activity picks up, which makes market conditions even more fragile than they appear on the surface.

You may also like:

XRP Most Talked-About Asset After Bitcoin

Even against this backdrop, investor interest in the asset has not faded. As recently reported by CryptoPotato, XRP has emerged as the second-most talked-about digital asset after Bitcoin, as per Grayscale. The asset manager observed that the crypto continues to attract significant attention due to steady interest from its user base and investors, even as market sentiment remains cautious.

Speaking during Ripple Community Day, Grayscale’s Head of Product and Research, Rayhaneh Sharif-Askary, described XRP as having a large and committed community, and added that client inquiries about the token remain consistently high. Advisors at Grayscale have reported that the token frequently ranks just behind Bitcoin in terms of discussion volume.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ripple CEO Garlinghouse Predicts CLARITY Bill Has 90% Chance of Approval Soon

His remarks came after the most recent meeting in the White House.

Ripple chief executive Brad Garlinghouse said he now sees a 90% chance that the CLARITY Act will become law by April 2026. He described the outlook as stronger than before, citing steady legislative progress in Washington.

According to the CEO, the improved odds reflect recent engagement between lawmakers, the White House, crypto firms, and banking representatives. He noted that discussions have shifted from broad disagreements to resolving specific policy details.

Legislative Momentum Builds in Washington

Garlinghouse shared his updated view during an appearance on Fox Business, pointing to growing bipartisan interest in market structure legislation. He said recent meetings helped narrow differences that had previously slowed progress.

That momentum follows the CLARITY Act’s passage in the House of Representatives in 2025 with bipartisan support. Senate consideration has taken longer, though observers say the current pace signals renewed urgency.

To maintain progress, officials involved in the talks reportedly aim to settle remaining policy disputes by March 1, 2026. Supporters see the timeline as critical, given that legislative schedules often tighten ahead of midterm elections.

Stablecoins and Regulatory Clarity at the Center

The CLARITY Act, formally known as the Digital Asset Market Clarity Act, seeks to establish a unified federal framework for digital assets. It would define oversight roles by assigning assets that resemble securities to the securities regulator and commodity-like assets to the Commodity Futures Trading Commission.

Supporters argue that clearer boundaries would reduce legal uncertainty and provide consistent guidance for firms operating in the United States. They say this could lower compliance risks and support broader participation from established financial institutions.

You may also like:

Despite this support, stablecoins remain a central issue in negotiations, particularly whether issuers can offer yield-style features on reserve-backed holdings. Banking groups warn such practices could affect deposits, while crypto firms argue restrictions may push activity to other jurisdictions.

Against that backdrop, Garlinghouse said prolonged uncertainty has limited innovation, citing Ripple’s legal experience as partial but incomplete progress. He stressed that individual court outcomes cannot replace clear, industry-wide rules.

Market expectations have also shifted, with prediction platforms such as Polymarket showing rising confidence in passage within the proposed timeframe. Analysts view the coming months as a key window before political dynamics complicate the process further.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Is Blue Owl Redemption Halt an Early Alarm for Crypto Markets?

Private capital firm Blue Owl Capital, with over $307 billion in assets under management, has permanently halted investor redemptions at a retail-focused private debt fund.

The suspension has triggered concerns among economists. Furthermore, it has raised a key question about whether the private credit market could impact the broader crypto market.

Everything to Know About Blue Owl’s Redemption Changes

According to Bloomberg, the private credit firm has seen a rise in withdrawal requests in recent months. This was partly driven by investor concerns over its exposure to software companies amid the artificial intelligence surge.

FT noted that Blue Owl Capital Corp II (OBDC II) has been closed to redemptions since November. The firm had previously indicated it might reopen withdrawals later this quarter, but it has now abandoned that plan.

Earlier this week, the company revealed that quarterly redemptions would no longer be available to OBDC II investors. Instead, the firm plans to distribute cash through periodic payments tied to asset sales.

“We’re not halting redemptions, we are simply changing the method by which we’re providing redemptions,” Blue Owl co-President Craig Packer told analysts on a conference call Thursday, as per Reuters.

According to Packer, payouts to fund holders are expected to be roughly 30% of the fund’s value, up from the prior 5% cap.

“We are returning six times as much capital and returning it to all shareholders over the next 45 days. In the coming quarters we will continue to pursue this plan to return capital to OBDC II investors,” Blue Owl commented on its latest plan.

Blue Owl also moved to sell approximately $1.4 billion in assets from three of its credit funds. Bloomberg revealed that Chicago-based insurer Kuvare, the California Public Employees’ Retirement System, Ontario Municipal Employees Retirement System, and British Columbia Investment Management Corp. purchased the debt, according to people familiar with the matter. Blue Owl added that the loans were sold at 99.7% of par value.

Private Credit Market Faces Growing Strain

Market analyst Crypto Rover suggested that Blue Owl’s redemption freeze reflects mounting pressures across the $3 trillion private credit sector. He outlined several warning signs.

First, about 40% of direct lending firms now report negative free operating cash flow. Default rates among middle-market borrowers have climbed to 4.55% and continue to rise.

Notably, 30% of firms with debt due before 2027 show negative EBITDA, making refinancing challenging. Meanwhile, credit downgrades have outpaced upgrades for seven straight quarters.

“If the stress continues in the private credit market, it’ll first impact the small businesses for whom the private credit market is a critical funding source. Additionally, it’ll cause refinancing costs to go up and will result in more defaults, which will create a vicious cycle. The only way to stop this is by lowering interest rates and providing liquidity,” the analyst added.

Economist Mohamed A. El-Erian questioned whether the situation could represent an early warning signal similar to those seen in 2007 before the 2008 global financial crisis.

Implications for Crypto Markets

Stress in the private credit market does not automatically translate into direct contagion for crypto, but indirect linkages deserve attention. A recent analysis from BeInCrypto indicates Bitcoin has closely tracked US software equities.

A meaningful share of private credit is allocated to software companies, linking these markets through shared growth-risk exposure. If lending conditions tighten or refinancing risks rise, valuations in the software sector could come under pressure.

Rising defaults, widening credit spreads, and constrained capital access would likely weigh on growth stocks. Given Bitcoin’s correlation with high-growth equities during tightening cycles, sustained weakness in software could spill over into crypto markets.

That said, this remains a second-order macro effect rather than direct structural exposure. The critical variable is the broader financial response. If stress leads to tighter financial conditions, Bitcoin could face downside alongside tech.

If it triggers monetary easing or renewed liquidity support, crypto may ultimately benefit. For now, the risk is cyclical and liquidity-driven, not systemic to digital assets themselves.

Crypto World

Silver Supply Shock? Binance Hits $70B as CME Goes 24/7

While silver inventories on COMEX continue to decline, Binance’s newly launched gold and silver perpetual futures have already surpassed $70 billion in trading volume within weeks.

The sharp convergence across metals and crypto derivatives markets signals surging demand for 24/7 synthetic exposure to precious metals.

Binance recorded over $70 billion in trading volume across its XAU/USDT and XAG/USDT perpetual contracts.

It points to a strong appetite for always-on, on-chain access to gold and silver price movements. The milestone highlights how traders are increasingly turning to crypto-native platforms to gain exposure to metals without traditional market-hour constraints.

At the same time, physical silver dynamics are tightening. Silver backing futures keep falling, with the March-to-May contract roll reaching 30 million ounces per day. This pace could clear the current open interest.

“At that pace, COMEX is out of silver by February 27,” wrote investment specialist Karel Mercx, adding that from April onward, the market risks a physical shortage unless meaningful inflows arrive in the coming weeks.

The structure of the futures curve adds to the urgency. When adjusting for financing costs such as SOFR (Secured Overnight Financing Rate) and storage, the March–May spread is approaching backwardation. This condition effectively signals immediate demand for physical metal over future delivery.

In carry-adjusted terms, backwardation signals that physical silver is more valuable now than later.

Rising futures prices can intensify this dynamic, as higher forward pricing encourages speculative buying. It also prompts producers and holders to retain physical supply in anticipation of further appreciation, pulling additional metal out of the market.

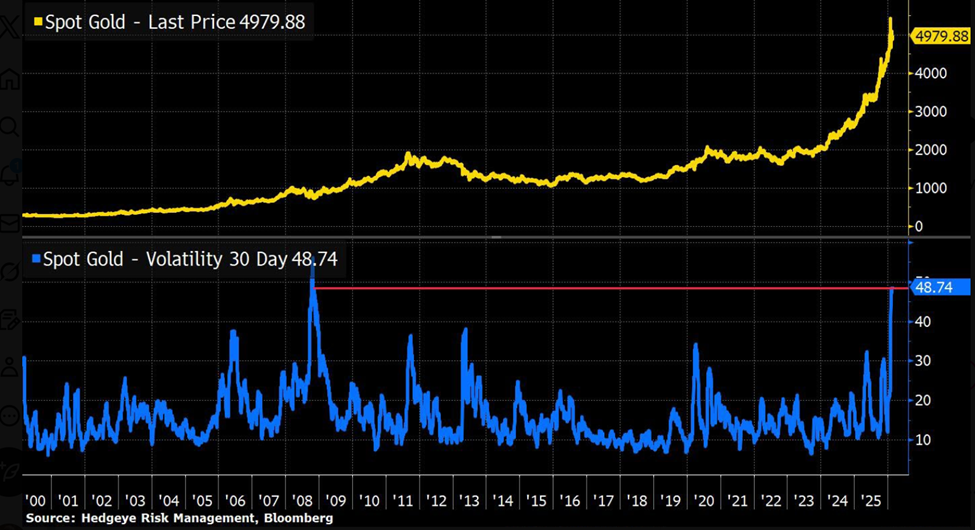

Meanwhile, gold volatility has surged, with its 30-day volatility at its highest level since 2008. The surge reflects heightened macro uncertainty and rapid shifts in positioning across derivatives markets.

The structural shift toward round-the-clock trading is not limited to crypto exchanges. CME Group announced that beginning May 29, crypto futures and options will trade 24 hours a day, seven days a week on CME Globex, pending regulatory review.

CME reported a record $3 trillion in notional volume across crypto futures and options in 2025, citing record-high demand for digital asset risk management.

Year-to-date 2026 data show average daily volume up 46% year-over-year and futures ADV up 47%, reinforcing sustained institutional participation.

The development may also reduce the risk of weekend price gaps. This would allow markets to respond instantly to geopolitical or macro shocks. Notably, the feature is already native to crypto exchanges like Binance.

Taken together, the surge in derivatives activity, accelerating silver inventory drawdowns, elevated gold volatility, and the normalization of 24/7 trading suggest markets are entering a structurally different phase.

As physical supply tightens and financial access expands, traders are positioning for potential scarcity in both metals vaults and digital order books.

Crypto World

Silver Price Breaks February Resistance Line

As seen on the XAG/USD chart, silver has today breached the upper boundary of the descending channel formed by February’s lower highs and lows.

Bullish sentiment is supported by heightened geopolitical tensions and rising demand for safe-haven assets. According to media reports:

→ On Thursday, US President Donald Trump warned Iran that it must reach an agreement on its nuclear programme, or “really bad things” would happen, setting a 10–15 day deadline.

→ In response, Tehran threatened retaliatory strikes on US bases in the region if attacked.

On 11 February, analysing the XAG/USD chart, we noted that silver was consolidating between two key levels:

→ resistance around $87.5–95

→ support near $70

Today’s bullish breakout of the channel’s upper boundary – which acted as resistance in February – can be interpreted as a move towards the $87.5–95 zone.

Confidence for bulls is further reinforced by an inverted head and shoulders (SHS) pattern. If buyers are determined, this should be confirmed by XAG/USD holding above:

→ the channel breakout level near $79

→ the psychological $80 mark.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video10 hours ago

Video10 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World14 hours ago

Crypto World14 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show